ganndailypips

@t_ganndailypips

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

🔄 When Time Speaks, Price Listens #TimeAnalysis | #Cardano | #ADAUSDT | #SmartTrading In my previous ADA/USDT analysis, the mistake wasn’t in the price structure—it was in the timing. The price didn’t reverse where expected, not because the setup was wrong, but because I ignored one critical factor: The time cycle must align with the price cycle. 📌 Here's what really happened: From July 2 to July 7, price moved sideways in a clear accumulation range. Then came an explosive expansion wave (Wave 3) from 0.573 to 0.75, lasting 113 hourly candles. This was followed by a correction wave (Wave 6) of 130 candles. Currently, price is in a distribution wave (Wave 9), ongoing for over 90 candles. 📉 My error? Misalignment between time and price. 📆 After applying my fixed monthly time cycle model, based on the rule that 9 marks the end of every cycle, it became obvious that the price waves were following exact temporal intervals: ➡️ Monthly cycle anchor points: (8 Jan, 7 Feb, 6 Mar, ..., 9 Sep, 8 Oct...) Each month is divided into 3 major time zones, and each zone into two sub-zones. This creates a clean framework where waves naturally unfold: 🔹 3 = Expansion 🔹 6 = Correction 🔹 9 = Distribution 💡 Key Takeaways: Don’t trade predictions. Trade the wave. Every price move is governed by time. Ignoring time leads to premature entries—even with solid technical analysis. 🧠 Want to learn how to read these time-price cycles? Let’s discuss in the comments.

🔍 Still analyzing the markets based on price only? Markets don't move randomly. They follow precise time-based cycles that repeat with uncanny accuracy. In this analysis, I focused on: 🔁 Time segmentation using the 3-6-9 cycle ⏳ Key reversal points calculated with Time Cycle Lines 📉 Smart price action based on real Order Blocks and liquidity 🧠 A core belief that “Time is more important than Price”, inspired by Gann and modern cycle theory. --- ✅ Now the real question is: Do you see how the major shift happened exactly at a timed zone, not just a price level? 🗣️ Let me hear your thoughts: Do you use time tools in your strategy? Would you like to learn how I project these reversal zones in advance? 👇👇 💬 Drop your insights in the comments 🔁 Share with traders who think beyond indicators ➕ Follow me if you want to explore how Time-based analysis can give you a real edge. #TradingView #Forex #MarketCycles #GannTheory #SmartMoneyConcepts #ForexStrategy #DigitalAnalysis #TimeAnalysis #PriceAction #DrGemy

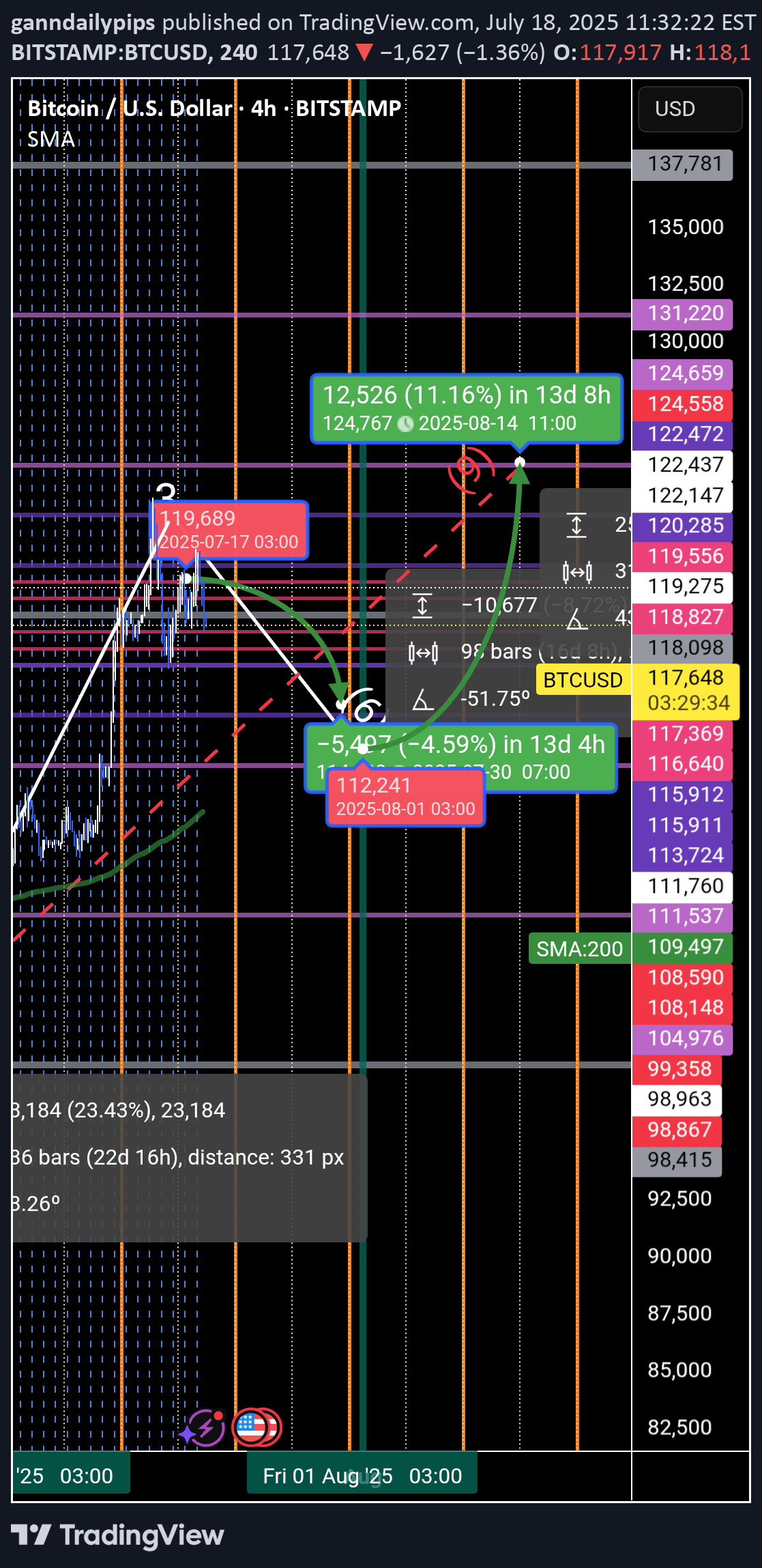

🔁 I use a unique time-based cycle method built around the universal law of 3-6-9: 3 = Impulse wave 6 = Correction 9 = Cycle end we are at the higher time frame cycle 9 each cycle of the 3, 6 ,9 contain a smaller one 3 ,6 , 9 This isn’t just about charts — the number 9 governs all natural cycles: Pregnancy, learning, lunar cycles, economic growth, etc. --- 🗓️ These are the key monthly turning points I track every year: > Jan 8 – Feb 7 – Mar 6 – Apr 5 – May 5 – Jun 4 – Jul 2 – Aug 1 – Aug 31 – Oct 30 – Nov 29 – Dec 6 📍 This month, July 2nd was a critical time pivot. From there, Bitcoin entered a new time cycle. 📌 Time Is More Powerful Than Price Most traders focus on price action, waves, or indicators… But the reality? Time is the real market driver. ⏳ Entry signals based on time outperform those based on price. Why? Because price is a reaction — time is the cause.

After sweep the liquidity above 118098. the price goes down for the correction . I expect it will reach the one hr order block at 115911. Entry : 118098- 117500 St : 118200 tp: 116000

After sweep the liquidity above 118098. the price will correct may be to 115911 or more ... for the next 8 hrs I expect it will reach the 1 hr order block at 115911. entry : 118098- 117000 tk: 115911 or end of time cycle of 8hr St: 118198

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.