fugutrader

@t_fugutrader

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CELRUSD - Bearish rejection

CELRUSD has rejected a previous pivot high and is testing previous pivot high support. A possible retracement trade.

FILUSDT - Parabolic Exhaustion

Filecoin is showing signs of consolidation after a bullish parabolic runup. Profit-taking may occur, causing a bearish retracement.Sell activity being absorbed, but not aggressively.

طلا در آستانه انفجار: نوسانات شدید در انتظار خبرهای مهم!

Gold is finding support on the 200EMA with volatility contracting in a triangle pattern as a large number of news releases approach. Fundamentals are displaying a bearish sentiment but the market could already have factored that in with the recent price drop so prepare for some fake breaks and reversals before any sustained breakouts in the final direction. Institutional traders watch the higher timeframe 200 MAs closely, so observe how price responds to the 1 and 4 hour levels before confirming a trade direction.

بیت کوین در نقطه حساس: آیا صلیب مرگ 50/200 به زودی رقم میخورد؟

Bitcoin is testing critical support trend lines with increases in volume indicating indecision by the bulls and bears. The 50MA crossing under the 200MA can either present a buying opportunity on a dip if support holds, or a capitulation if price breaks through it to target the next lower support zone.

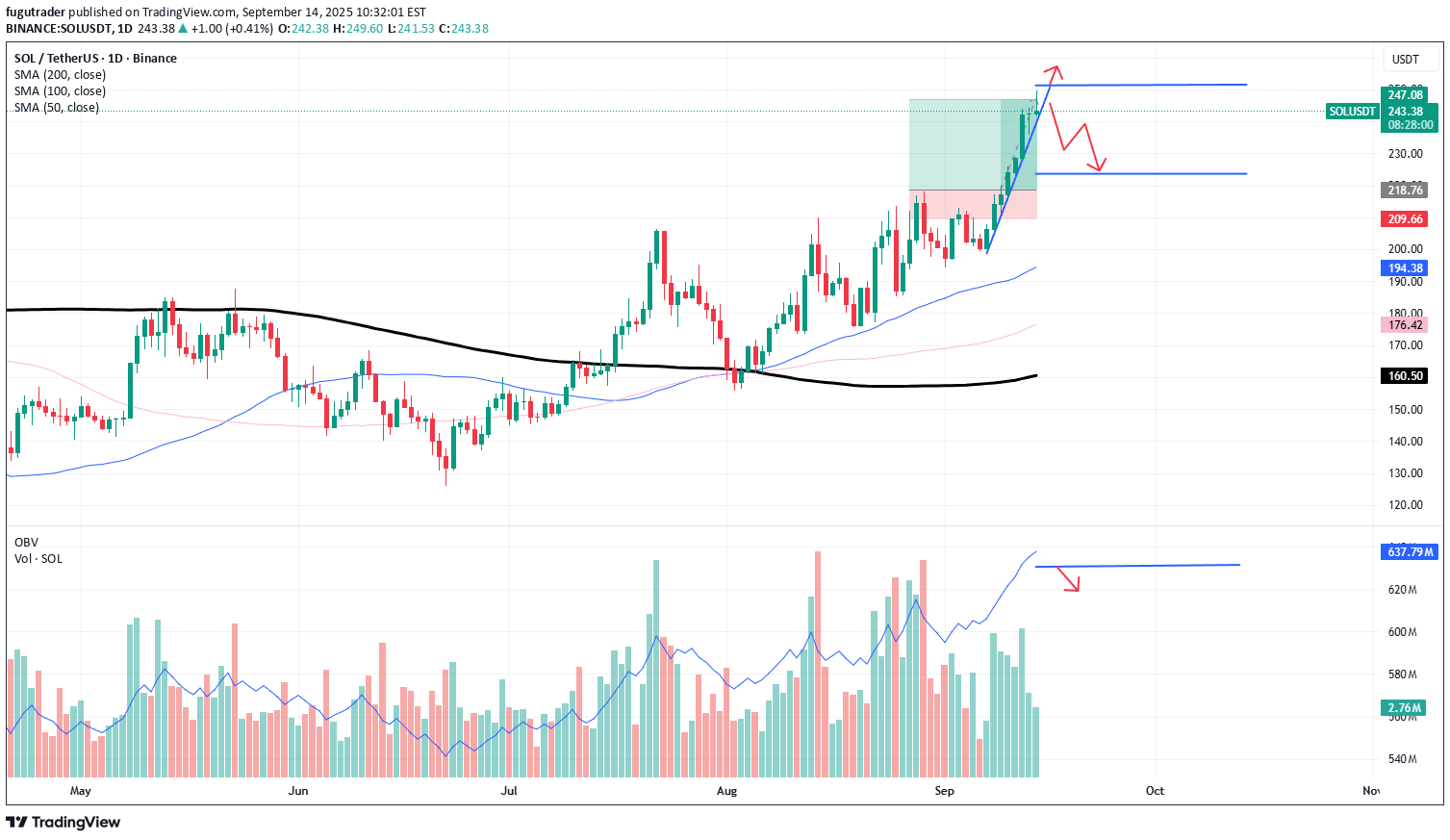

SOLANA - Bearish Doji reversal or break of $250 round number?

Solana has been receiving a lot of positive press (largely from the institutions holding long positions). Whether this will become a self-fulfilling prophecy, will largely depend on the buy-in from retail traders. Watch the volume indicators to ensure that there is convergence, not divergence, between it and price.

Solana - Possible breakout on higher Volume

Volatility across Cryptos likely high with upcoming Bitcoin options expiries on Friday 29. On the Daily charts a Rising Wedge is forming which is traditionally bearish. If price declines on declining volume towards the lower boundary, watch for an increase in volume to signal a potential price drop through and below the pattern.Price stalling/consolidating at resistance around symbolic round number of $250. A possible bearish retracement to test support or a strong continuation once it gets to the upside of that round number. Continue observing volume.

Bitcoin to revisit the 200 Moving Average?

It has previously exhibited a tendency to revisit the Mean, then consolidating around it before moving to new pivot highs. These have been at approximately equally spaced price intervals. There is currently evidence of large investors rotating out of BTC into ETH and/or Alt coins.Bounce or Break? Bitcoin is testing an important structural support level as well as likely being drawn towards the psychological 100k round number. Watch volume. Be aware that price can fall on low volume but needs more volume to rise.

Bitcoin - Breakout from consolidation pattern

Bitcoin volatility has contracted and is currently exhibiting an Ascending Triangle / Pennant pattern. The longer price remains within the boundaries of the pattern, the stronger the breakout from it will likely be.

BTC - Rising Wedge testing previous Channel high

BTC has made a strong recent runup and is now testing the high side of a recent consolidation channel. A Rising Wedge making higher highs and higher lows is pushing BTC into overbought territory and if the attempts at the previous channel high fails, with price falling through the lower wedge support line, there could be a period of bearish exhaustion to previous support zones.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.