farisalraisi

@t_farisalraisi

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

farisalraisi

Long BTC

BTC been going through a correction for few months now. My prediction is that we might see an end for the correction soon. If BTC break below the 0.786 fib level of the last wave, we might find strong support at around 56k and rally from there. My hypothesis is based on 2 trendlines as shown on the chart. Good luck everyone!

farisalraisi

ICP Bullish momentum

Buy opportunity if price falls to $11.6 and $10.7 ICP Fibonacci support levels keep holding and price action is forming a diagonal which might break out to the upside as long as the chart keeps behaving this way and support level hold.

farisalraisi

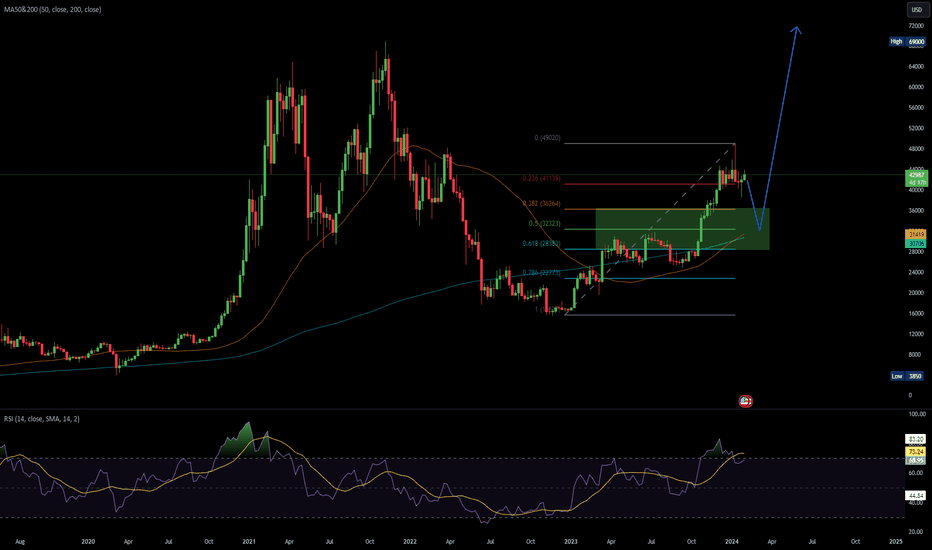

Double top, major resistance, and inverse H&S

Once again, Bitcoin takes us on a roller coaster of mixed signals. In this amazing uptrend, the bullish sentiment will keep building up the longer price remains close to 48-50k resistance level. On the daily time frame, an inverse H&S is formed, which gives a bullish bias. However, the first top close to 49k a month ago, left us with a huge weekly bearish reverse candle. For me personally, that candle can't be ignored and the pull back to around 38.5K wasn't big enough for it. In my opinion, once we have the next big bull wave, we might never see the 30ks range again. Does it feel like we are there yet? Well, off course your and my feeling don't really matter, but there is a lot of hype going on and high expectations which is always worrisome. I personally don't believe we are there yet. Given the large market cap on BTC, in order to reach all-time highs, we will need much more capital coming in, which is most likely only available at major support levels which we never went back to (but barely and swiftly once; recently) since breaking 32k. I am not saying that we are going back to 32k, although it is possible. I think a target of 36k is more realistic.

farisalraisi

farisalraisi

Chainlink hitting major resistence

Short opportunity as Link hits resistance. Clear stop-loss level and take-profit zone with very attractive ratio. Good stop loss in my opinions would be somewhere a little bit above 20$ while take-profit somewhere close to 10$. Good luck everyone. I predict this will be the last fall in the market before the next bull wave.

farisalraisi

no words needed. What is the sentiment?

What do you guys expect happening before and until the halving? Stock market is hitting all times high, crypto will probably do too at some point. The question is when and how. Are you guys expecting a pull back to 32-38k ?

farisalraisi

Polygon Matic Long

Buying opportunity for the next bull run. Retracement to Fibonacci 0.618 is met. Moving Average 200 is retested to confirm upward trend. trendline level is respected over and over throughout the years. I still think that BTC is going lower towards 36-35k which will create another buy opportunity.

farisalraisi

Strong topping tale forming on BTC.

Support levels as shown. Crazy what's happening, BTC is the future. Fiat will eventually be doomed with the dollar devaluation. Good luck everyone!

farisalraisi

Descending Broadening Wedge

A clear descending broadening wedge pattern is playing out. This is a bullish trend (at least on the micro level), with confirmation already triggered through an upward breakout of trend. Now price is at consolidation (recharging) stage with resistance level already broken once. Same trend is going on with BTC.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.