cybernetwork

@t_cybernetwork

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

cybernetwork

اوج طلای زرد: آیا کریپتوها منتظرند؟

Gold double top on the 4 hrly + broken down through the green 50 SMA line. Rotation into crypto next?

cybernetwork

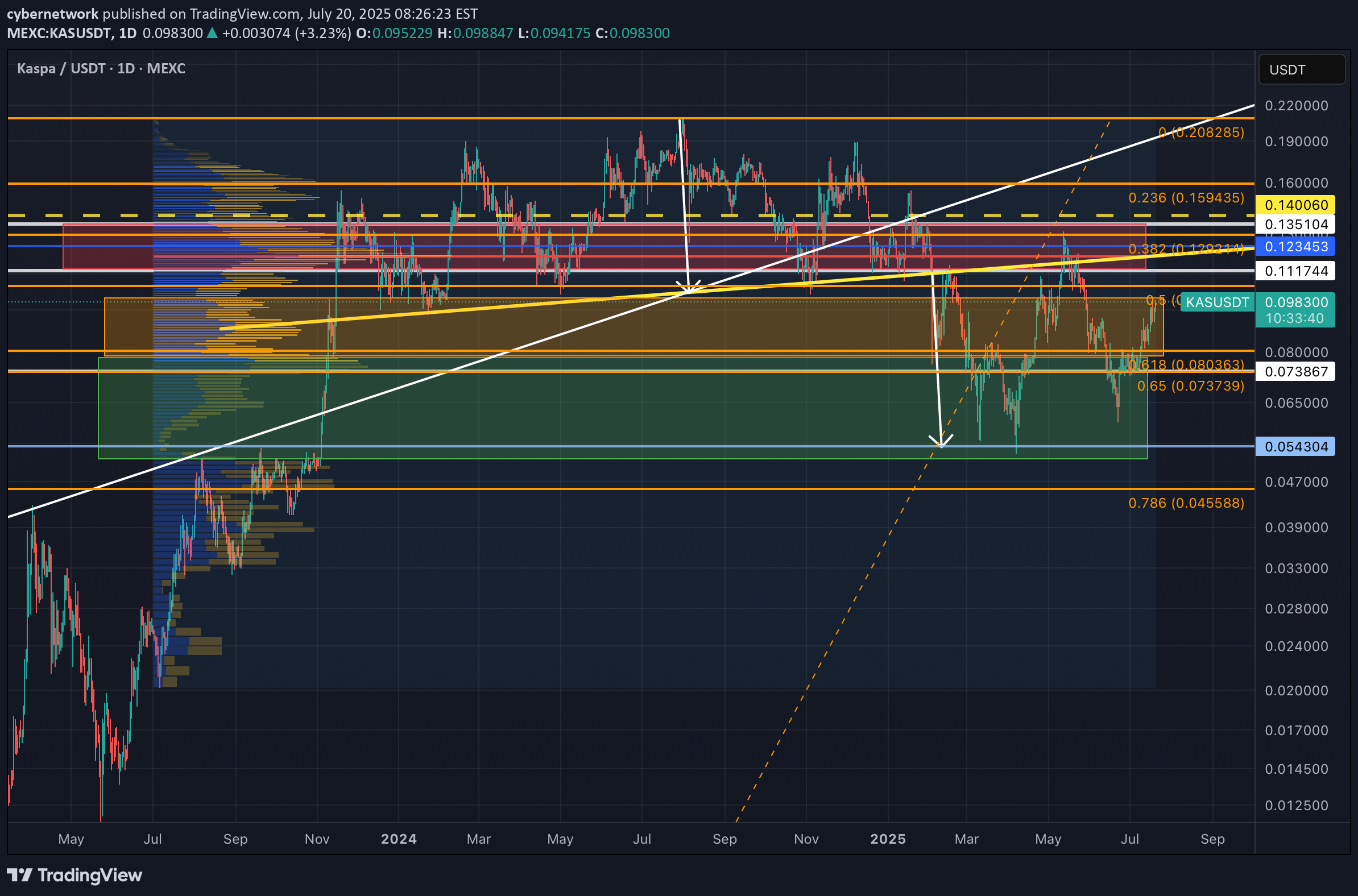

کاسپا (KAS): شکست مهم 21 EMA در نمودار 4 ساعته؛ آیا قیمت اوج میگیرد؟

KASUSD #Kaspa breaking out on the 4hrly above the dashed-white resistance line as well as the red 21 EMA. Waiting for current candle close above the red 21 EMA for confirmation. Continuing to DCA during the fear and uncertainty (US-Gov Shutdown, PRC +100% Tarifs, QE looming, etc.) to accumulate in anticipation of FUD eventually being resolved. Managed to buy a lot more KASUSD with BTC at ca. 3 cents and still DCAing atm. Got caught off guard by the +100% PRC tariff triggered mass liquidation induced dump. But only the price has changed, fundamentals kept on improving. If 10 cents was a good buy. 3 cents and now 5 cents+ is a way better accumulation level, while the market remains fearful and bleeding red. FusionGap Histogram has also flipped bullish on the 3hrly (an early signal to the 4hrly if price holds above 21 EMA).Successful retest on the 3 hrly:Will need to wait for the green 50 SMA to be breached next..Broke down below 21 EMA. Waiting for consolidation and opportunity to reaccumulate.

cybernetwork

Kaspa has finally broken out with confirmation.

Measured move at 12 cents. FG histogram turned green again. Attempting to support above the orange 200 SMA line right now.

cybernetwork

Last chance to reaccumulate Kaspa while it is below 10 cents?

Second chance to accumulate KAS at below 10 cents after its correction down to 5 cents from its 20 cents ATH is coming to an end? Previously, technicals looked great for KAS (and other ALTs too) with a breakout from a cup-&-handle pattern in July/Aug2024, but market says otherwise with gloomy economic report. >> For the small portion of capital assigned to trading crypto: I got stopped out from my (manually adjusted) trailing stoploss, with an approx. 6.8%avg loss from my BTC and ETH DCA spot injections into KAS from 10 cents all the way to 20 cents ATH. For my long-term investment hold, I had bought from 2 cents all the way to almost ATH (at ~15 cents) and still holding and adding to it now as long as KAS is below. 10 cents. Had started accumulating aggressively again within the green zone, and probably gonna stop soon once KAS leaves the orange zone. Last cycle, my main Altcoin investment focus was in ADA (POS and UTXO based chain based on academic research and peer-reviewed design), eventually selling most of other ALTs into ADA. This cycle, my personal investment focus is in Kaspa — and probably holding 15%(?) through the bear market correction after blow-off-top into the next cycle together with BTC and some ETH as well. Fingers crossed with regards to price; although the technology, decentralization ethos, and general fundamentals behind it is IMO extremely sound, and has a high probability (though not certain) to eventually establish itself to become one of the (if not THE) top L1s into the future. ——————————————— My reply re. the past YTD price performance of KAS , which I feel might be worth sharing here. "For Kaspa, on the YTD timeframe, it has corrected ~50% down, after a ~10x rise from about 2 cents (when I first got in, in 2023) all the way to 20 cents. It is still an early tech about 3 years old and still not widely know; hence as an investment, it is definitely risky and high volatility is to be expected (not listed in high liquidity Tier1 exchanges yet), just like BTC in 2017 where I first bought at ~3kUSD, and a lot more significantly at 5k, and all the way to its ATH at 20kUSD, and stupidly held when it dropped all the way to 3kUSD, and kept on buying with a long-term view. I view Kaspa in the same light as BTC (different from other cryptos), the only two that I will probably still hold a small but significant portion of, after the blow off top of this cycle due to its fundamentals that I am personally drawn towards -- e.g. POW but 6000x faster than BTC in bps, and ultimately will be 60000x faster once the DAGKnight protocol is implemented in 2026 (trilemma solved); protocol are based on peer-reviewed published research; fair-launched with no-VCs pre-allocation nor pre-mine; no central controlling figure; no DAG/Chain bloating due to implementation of pruning and where 0% TX-archival nodes are needed to maintain the security of mining, and are only necessary for explorers and institutions that intends to track TXs; (soon to come in Q4) Two Layer 2 implementations that will eventually be "Based-Zkrollups" (something that Ethereum planned to implement but was not feasible due to speed and cost issues, even after its POS-fork) -- where L2 TXs are instantly settled onto L1 without security compromising batching of TXs and delayed settlement that Eth-L2s currently does, and more. But KAS is just a crypto project that I am personally interest in; and I am certainly not recommending anyone to buy as an investment, well unless they see something interesting in it too as I do. ;)"

cybernetwork

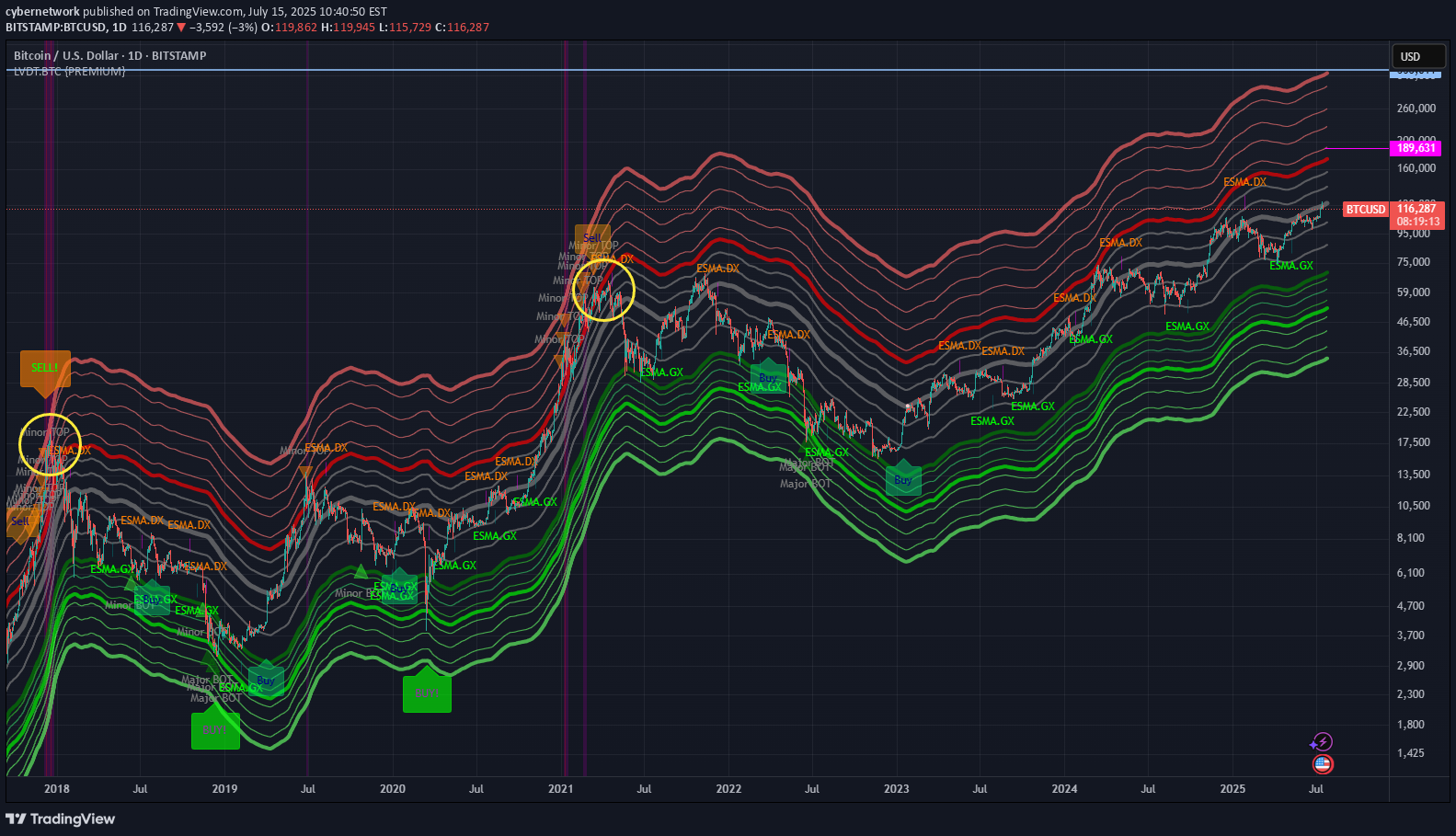

$300k+: LVDT estimated BTC ATH target this cycle.

According to my old LVDT indicator, BTC should reach $300k or even higher at ATH this cycle. The real parabolic (banana zone) run will only start when BTC touches the thick red line again. Time to gradually DCA sell every time BTC pierces significantly above the thick red line (signaling a potential point of Blow-off-Top). I plan to be updating this tread from time to time as the chart progresses until the absolute "Sell" signal is triggered.Weekly chart view, with price ranges from the breakout from the thick-red-line on the Daily Chart to the subsequent ATH marked, as well as an estimated/speculated range for this cycle (at ~US$350). The actual real time evolution of the BTCUSD price along this channel will be monitored and the speculated ATH price target will be updated accordingly.

cybernetwork

Bullish confirmation today on both the daily and 4hrly.

Bullish confirmation today on both the daily and 4hrly. 4hrly Chart:Caught the dip?

cybernetwork

Kaspa looking ready for the next leg up.

Successful retest of breakout level.Next target at 12 cents.10 BPS incoming.IGRA smart contract layer incoming.

cybernetwork

FG-Histogram turned green and into the positive zone, as well as Bullish Divergence established on the daily.Previously, a bearish divergence with the FG-Histogram subsequently turning orange marked the start of the dump in September 2024.Have been slowly DCAing more into KAS from ETH within the golden pocket again, while setting stop limit below the 65% retrace level.Stopped out below 65% Fib retracement level, out below the golden pocket range. More pain ahead. Will wait for even more favorable buy opportunities.

cybernetwork

KASPA: Soon to switch to being greedy again.

Back into the green zone. Stepping up DCA-accumulation into a more aggressive mode soon, expecting KAS to fall to as low as ~5.4 cents.FG oscillator is still orange (bearish) on the weekly.10 bps upgrade and activation incoming. 4 smart contract layers being developed. Tier1 exchange listings to look forward to. KII (Kaspa industrial initiative), and so on.

cybernetwork

KASPA has broken up above inv-H&S pattern at 18 cents.

Breakout above 18 cents (blue line) from the inverse head-and-shoulder, with a measured move target at 32 cents. Presently establishing support. Need to successfully hold above the blue 18 cents line and close on the daily above to confirm.Setting stoploss sufficiently below blue line, accounting for volatility (not exposing where I place my stops).This chart follows on from my previous analysis:The crypto market historically tends to move in cycles/phases, with BTC first pumping followed by higher market cap OG tokens, before the capital flows to the midcaps (i.e. KAS) and eventually the microcaps and meme coins (which then marks the time to sell). Just need to be patient and remind yourself of the fundamentals of Kaspa, being the only properly (POW) decentralized crypto that is truly scalable.Stopped out at 16.98 cents.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.