chestephens1

@t_chestephens1

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

chestephens1

Possible Inauguration XRP pump to $4.20

Possible scenario for #XRP outbreak to new ATH of $4.20 during US Presidential Inauguration Ceremony or shortly after. The CEO of RIPPLE has met numerous times with the US President in the last 90 days post election.tested 1st buyzone of $3.29-3.30 but did not sustain enough volume to push further to upside. XRP still potentially adhearing to my downward trend and could whip again sub $3 to $2.80s.

chestephens1

XAUUSD PRE NFP ANALYSIS RED or BLUE

red = nfp MISS blue= nfp BEAT 176K is the number to beat #gold #xauusd #spotgold IAUPrecision.

chestephens1

BTC Q2-2024 short to retest 60K volume area

Q1 was a beauty for cryptos in general. #BTC grew almost 36K in price in last 90 day cycle. We have now rejected the 71K and looking for lower regions to attack. Getting paper hand traders and 73K buyers shaken out of the market. What goes up MUST come down and retrace and Q2 we will see a correction on BTC before its path to 100K. Tested 73K and retraced to 60K Q1 74K highs - 1/2 Q1 grow volume (35/ 2 = 17.5) = 56.5K a 60K buy option will present itself in Q2 if NOT a full 56K area (liquid will inject quickly down here) I am shorting from sub 70K and looking for a 10K retrace to 60K volume area before a new injection of liquidity is presented to the market. 1:6 Risk:reward ratio for TP at 61K 1:10 Risk: reward ratio for TP at 57K ZONE 1: Blue= 65.6-64.6 slight bounce area ZONE 2: Orange= 61.8- 60.7 1st Zone of liquidity (previous Q1 liquidity zone) ZONE 3. Green= 58.3- 57.4 Golden pocket to catch possibly best entry (Q1 breakout zone + old 2021 zone) This is not financial advice simply an analysis of market structure. Current Price at posting :$68,875We have entered the blue zone and a bounce DID occur here. If we reject 67K we can look for lower regions.We bounced from the blue zone and failed to reject the 67k zone. Some resistance at the entry level of 69K and went back to test ATH. Trade has been closed. Will monitor for re entryLast 72 Hrs moved the market to tap BOTH the BLUE and ORANGE zones. Now trending down back towards the Orange zone in prep for 4/20 halving. Hoping to buy in at this 55-57k region

chestephens1

BTC selloff to 38k-35.5k for Q1 JANUARY 2024

With the Top for 2023 confirmed we can begin to dump. $44.7k is TOP for BTC 2023. We opened 2023 at 16K levels so we are bound for a retrace in Q1 2024. (34K is 61.8 level on fib retracement for 2023) BlackRocks Bitcoin ETF will seek approval by January 10, 2024. With BR injecting their footprint into bitcoin i anticipate a drop to retest sub 40k region to 38.6k being TOP of box and 37.5k being BOTTOM of box. It could continue down to 35.8k as alot of supply lies at this area. Today provided the first drop in the sequence. Once we break 40K it should nose dive. Entry at 41.8K SL: 43K flat 1:3 Risk:Reward ratio **The large move is to 29k levels but it will not be fluid** This is my personal thesis and not financial advice.

chestephens1

XRP to breakout to 0.87 for XMAS 12.25.2023 XRP/usd

Not sure why there is such low volume on XRP but the sentiment is still the same IMO. The Crypto winter is HERE I think XRP is potentially being manipulated by the alphabet boys SEC. BTC is in an upward channel to test 50K ETH has broken out to test 2500 Why is XRP so stagnant??? We have taken out the sub .60 lows, and tested .70 2x in NOV The confluences are aligning and its only a matter of time before the impulsive bull run. .81-.87 is the target which is is 1:5 Risk:Reward ratio as posted. LOAD THE BUS we going NORTH! *This is not Financial advice, simply my own analysis and opinion DYR* #XRPtotheMOONAn Impulsive drawdown retest has occurred. The Short was among all cryptos equally. Shaking out weak buyers and SL. Liquid dip to test .60 did not hold and is back up to .616 This is why we have a large SL! Best entry is still .623 im still holding #XRPtotheMOONAnother flash liquidity dip to test .60 but once again could not hold under .60 pushed back to .62 FOMC news is over so now we just wait for the push upside #XRPtotheMOONToday ALMOST stopped me out of this trade LOL another liquid dip to test NOV lows but we zapped back up to just leave a wick. Need to move upward towards .63 and maintain above .61 for bullish outlook #XRPtotheMOONWe are still above our entry of .62 but volume did not permit a .70 test and beyond. This current target date of 12/25 for breakout was not achieved. I will still keep this running and update you throughout as i am a believer. January 10th 2024 is a crucial date for all crypto movement as that is the date Blackrock ETF will be spoken on for approval. Another update in early 2024. #XRPtotheMOON

chestephens1

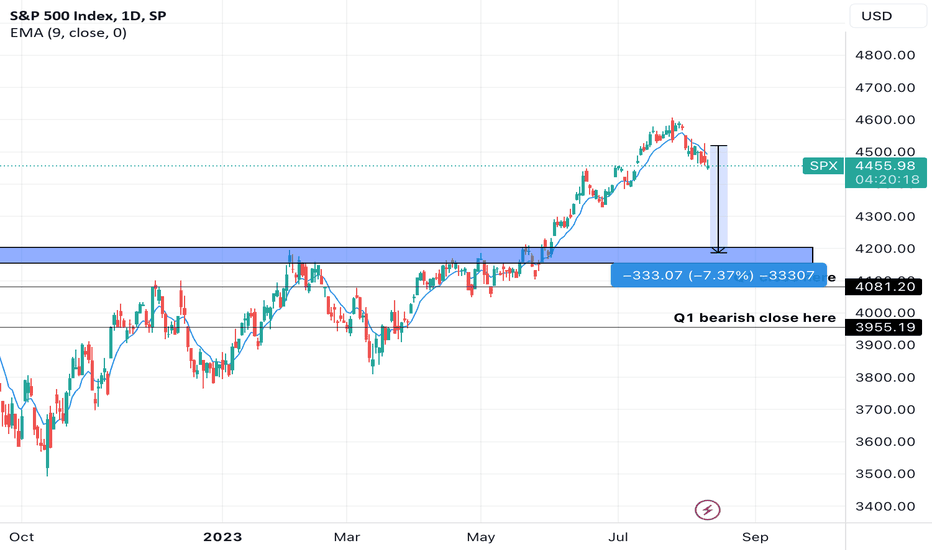

$spx reset for Q4 incoming! 4200 levels

Notice how we have tapped 4600 which an extreme overbought level. SPX must retest a lower level of 4380-4330 and if it does not hold it should freefall to 4200 in prep for Q4. SPX has been in a bullish outbreak since march 2023 with only a slight dip in june 2023. a correction is due. I am using SPXS as the inverse of this play. I do have a sentiment which is: when the Dollar is up, stocks are down and VICE versa. We are noticing incoming strength from DXY which is causing a shorting of SPX and other index + stocks. Trade wisely

chestephens1

XRP to test .50-.81 for Q2-2023 bull run! $xrpusd

XRP has been on a consolidation path for 60+ days before this breakout from .37 This initial breakout attempted to test .49 and failed from the .37 breakout. we retraced back to .42 to gain some liquidity and fuel for a second bullish test of .49 we are now in a new liquidity range of .452-.456 (.448 super liquid dip) Once we breakout of .456 and can make a new support level of .46 we will be on our way to .49 and my target of .81 by late June 2023 We could dip once again to .42 before we rocket to .49 XRP and RIPPLE's SEC case is coming to a close during the q2 2023 timeframe. It may be pushed up to the Supreme Court for additional oversight. Coinbase being dragged into a SEC probe can fuel more pressure for this bullish outbreak. Research ISO2022 XRP will be the new standard of crypto for payments worldwide. Once this gov case is closed this will provide more clarity on the newfoundland of digital currency Patience. Consistency. Discipline. ****NOT FINANCIAL ADVICE****Broke out to test .49 BUT once again it failed. Looking for a mini retrace .460-.449 zone. Monthly close on friday 3/31 will give major insight on where the bottom can be priced in. Hopefully looking to close 3/31 at or above .46

chestephens1

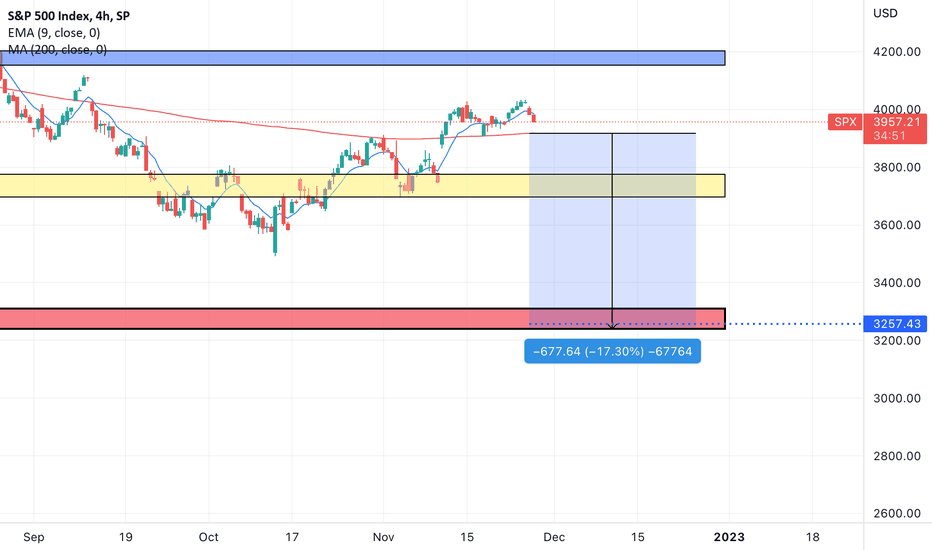

SPX500 sell off 3600s! BIG TIME SHORT

I was given some information today that has concluded me to short SPX for the remainder of the year. Turmoil and scandal in the US has caused a turn in SPX bearish. The US is going bankrupt. I cannot say anymore than that. consolidation may occur at 3850 levels then further dip to yellow supply POTENTIAL 700 Point swing! 3:1 RR from MA200 (red) to the yellow supply box 1. 8:1 RR from MA200 (red) to the red supply box 2. 3257 levels indicate the impulse bounce (TA backed by A.K)dipped into the 3800 level but found support. Now At the 4000 resistance sector. Looking to suck in Q1 buyers then continue the bearish cycle. if 4100 is taken out this will invalidate the bearish cycle.

chestephens1

$XRP retest .45-.50 by EOY 2022

XRP super bull here! 'IT is our time to shine now! The Downturn of BTC and the other major cryptos due to the unexpected closure of a major exchange has caused a slight squeeze on XRP. In my opinion it seems as of recent BTC and XRP have been moving in inverse. We have major support at .31-33 levels with a common breakout level of .38. Recently we have not been able to close full body over .50 for more than 72 hrs (10.09.2022) My 9EMA just crossed over my. 200MA signaling a bullish outbreak. I have created a supply box from .41-.48 that xrp often finds itself (9.23-11.8) THIS SUPPLY BOX EXPIRES 12.31.2022 ALL CRYPTOS TANKED DURING ELECTION WEEK FYI. This is the buy back in prep for the SEC verdict coming Q1 2023 buy buy buy

chestephens1

BTC SHORT 16K BY ELECTION TIME NOV.2022

THE SELL IS IN. We cannot get a solid close over 24.6k to push for a 30k test which alludes me to a dive down to the impulse at 15-17K. The interest rate hikes in the past 6 months have just been another driver in KILLING the price of BTC and majority of cryptos. The banks are broke and are liquidating their initial positions for a possible lower buy in. The US gov is also looking for crypto regulation which would further dampen the price as this is not what crypto was created for. They will speak towards this in the NOV elections as well. The US GOV wants to us USDC/ USDT We tested 20K today 9/27/22 but it could not hold over. BTC wants low LOW. It is in the bottom depths of consolidation towards a cheaper price. 19K flat is a safe buy in zone but you can look for a high 19.5K test to enter. This will not be a fluid drop but a choppy drop. Anything lower than 16K = 12K SOS SL: 20.1K TP: 16K RR: 1:2.540 Days later + the FTX collapse and we have hit the target! Patience is key.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.