YavuzOZ_23

@t_YavuzOZ_23

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

YavuzOZ_23

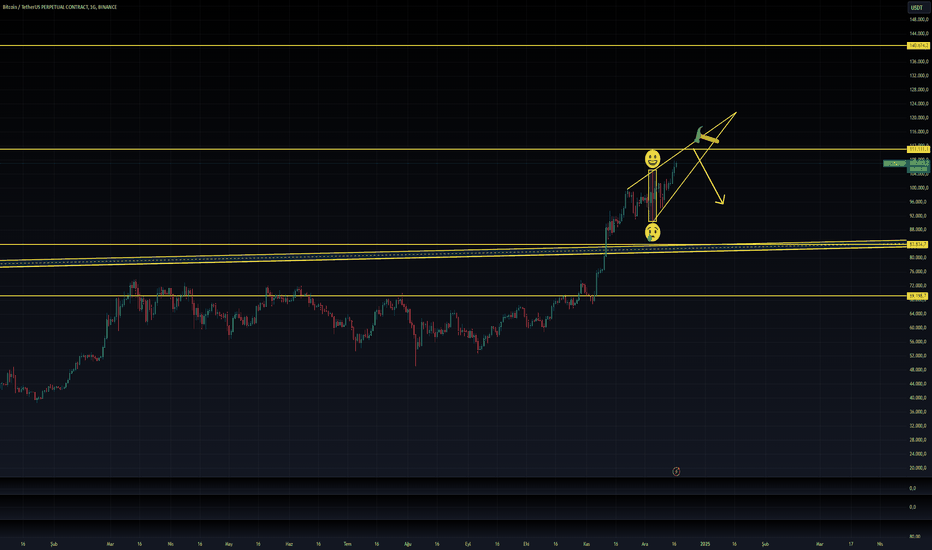

#bitcoin

Donald Trump has promised to make the US the "crypto capital of the planet and Bitcoin superpower" and announced that he will make Bitcoin a strategic reserve. With these statements, Bitcoin rose to unprecedented levels, up to $100K. However, tomorrow's FED meeting will be followed with great attention in the markets. A 25 basis point reduction in interest rates has almost certainly been priced in. However, recent strong inflation data and the resilient structure of the US economy indicate that the FED may approach interest rate cuts for 2025 more cautiously. In addition, the inflationary impact of Trump's potential economic policies may lead the FED to take a more careful stance. If the FED revises its inflation estimates upwards in its projections and makes statements that interest rate cuts will be postponed, there may be a sharp sell-off in the markets, especially in Bitcoin. Although the markets have the potential to rise thinking that the interest rate cut is certain, downward movements can be expected after such statements.

YavuzOZ_23

EIGEN

alt As I get closer to the bullish side every day, my $19 target coin... It can go to good places if the market allows it.

YavuzOZ_23

PNUT

This COIN monopolized by a whale can seek new peaks with its greed... The ground is suitable for this, my action plan is like this, saying never without a stop... These graphs are made to remain as a memory in my notebook. It is not investment advice. Do not give investment advice to anyone, then there will be trouble...

YavuzOZ_23

YavuzOZ_23

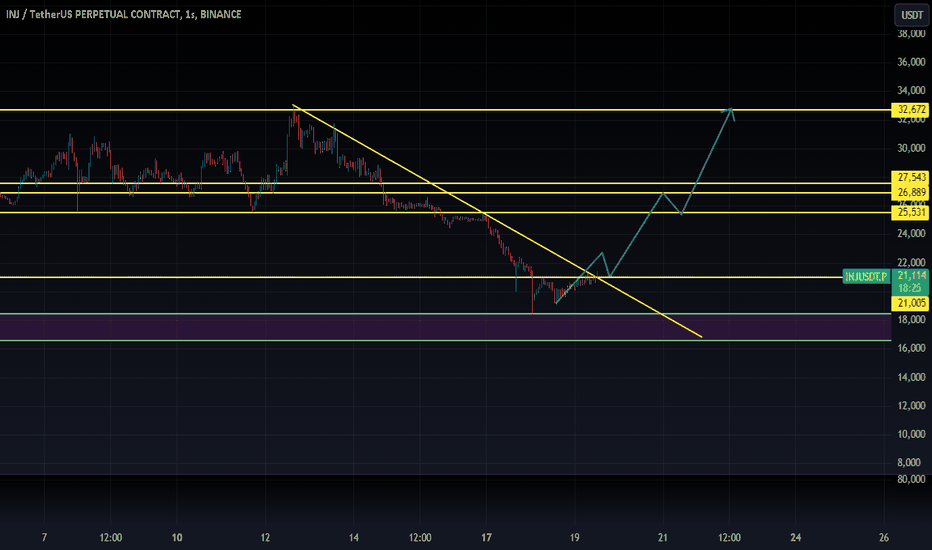

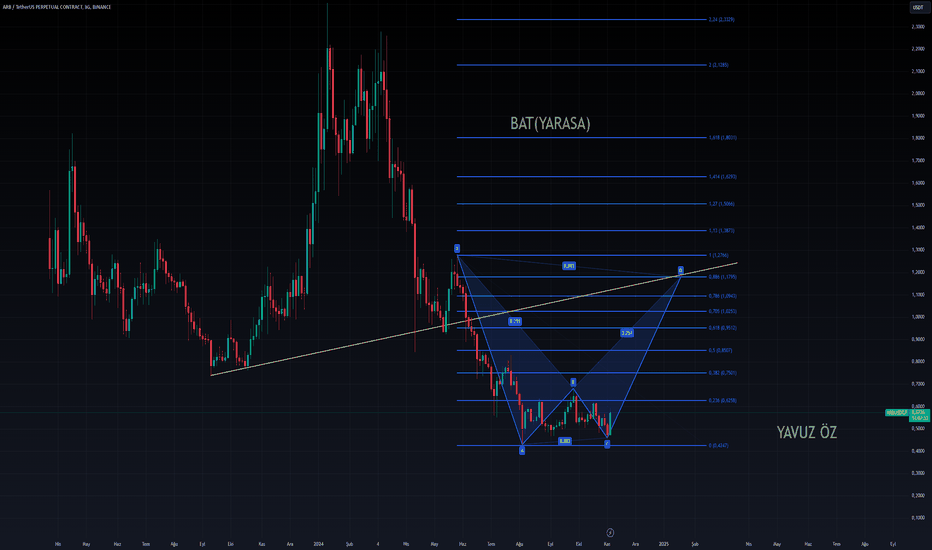

ARB

If BTC, which gained momentum with TRUMP becoming both US and crypto president, continues its movement horizontally for now and FED Chairman Powell speaks less hawkishly today, ARB may launch the attack that many people are waiting for...

YavuzOZ_23

BTC

The FED's September interest rate cut was priced in the markets as 98%. After the pricing, especially financial institutions published reports that the FED should be more cautious about interest rate cuts. On the other hand, while the fact that wage inflation continues to remain lively continues to confuse people, BTC transfers to the accounts of Mt. Gox creditors continue....

YavuzOZ_23

BTC

The FED's interest rate cut in September was priced at 98% in the markets. After pricing, financial institutions in particular published reports about the FED being more cautious about interest rate cuts. On the other hand, the fact that wage inflation remains alive continues to confuse Mt. BTC transfers to Gox creditors' accounts continue....

YavuzOZ_23

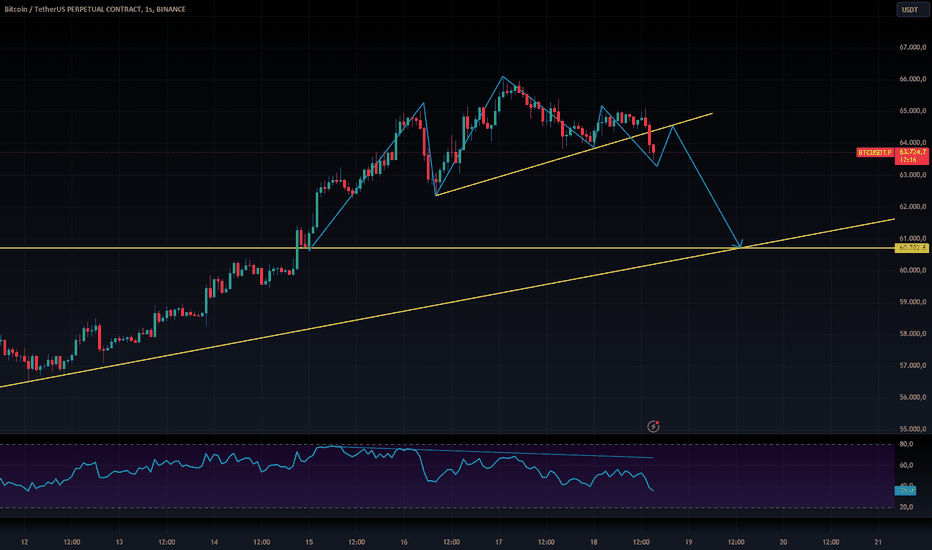

BTC

Today, JOLTS data, which is one of the employment data from the USA, will be released. I think the data will come close to or slightly above expectations. After the data arrives, the market may move downwards sharply at first. However, I think there will be a serious increase afterwards. As for the reason, even if the data is good, the thought that a contraction in employment continues may come to the fore. In this case, the possibility of the FED making two interest rate cuts may increase. I think this situation will bring about an increase for BTC.

YavuzOZ_23

YavuzOZ_23

BTC

BTC rebounded on Tuesday as weaker-than-expected US retail sales data bolstered chances that the Fed will soon have to cut interest rates. Although the latest inflation data supports the rise, both the ETF outflows and the fact that the FED signals an interest rate cut by the end of the year in its projections CAUSED PRESSURE ON BTC. We may see fluctuating, but upward attacks in the market, from unemployment rights to injury application data tomorrow.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.