UnbieX

@t_UnbieX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

UnbieX

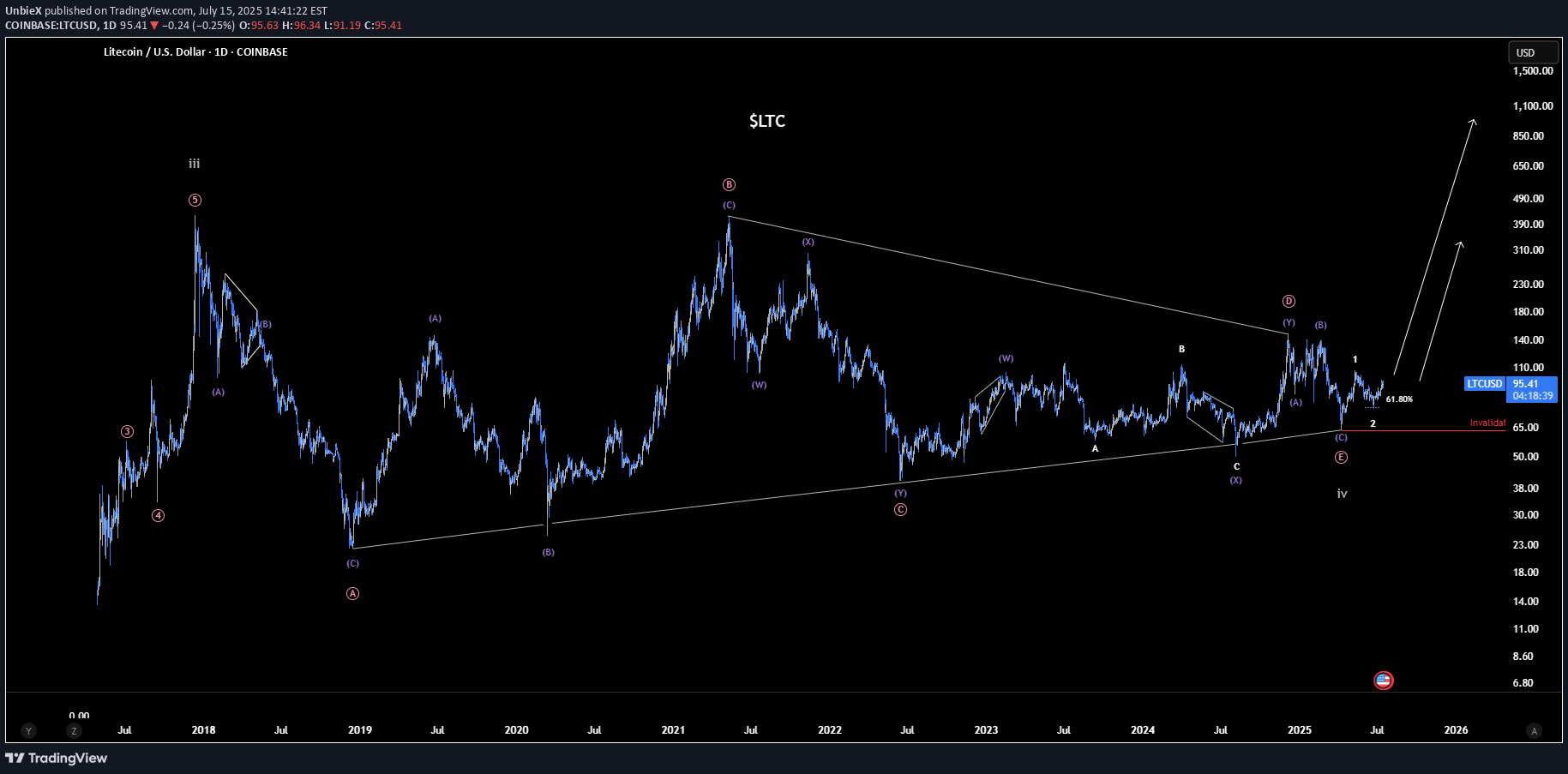

Litecoin may be on the verge of a breakout following nearly four years of accumulation. From a technical standpoint, this could lead to a powerful rally toward targets in the $600–$1000 range. However, the timing of this Wave 4 consolidation don’t align particularly well with a typical, healthy correction. A break below the red line would invalidate the current count and shift focus to my secondary outlook.

UnbieX

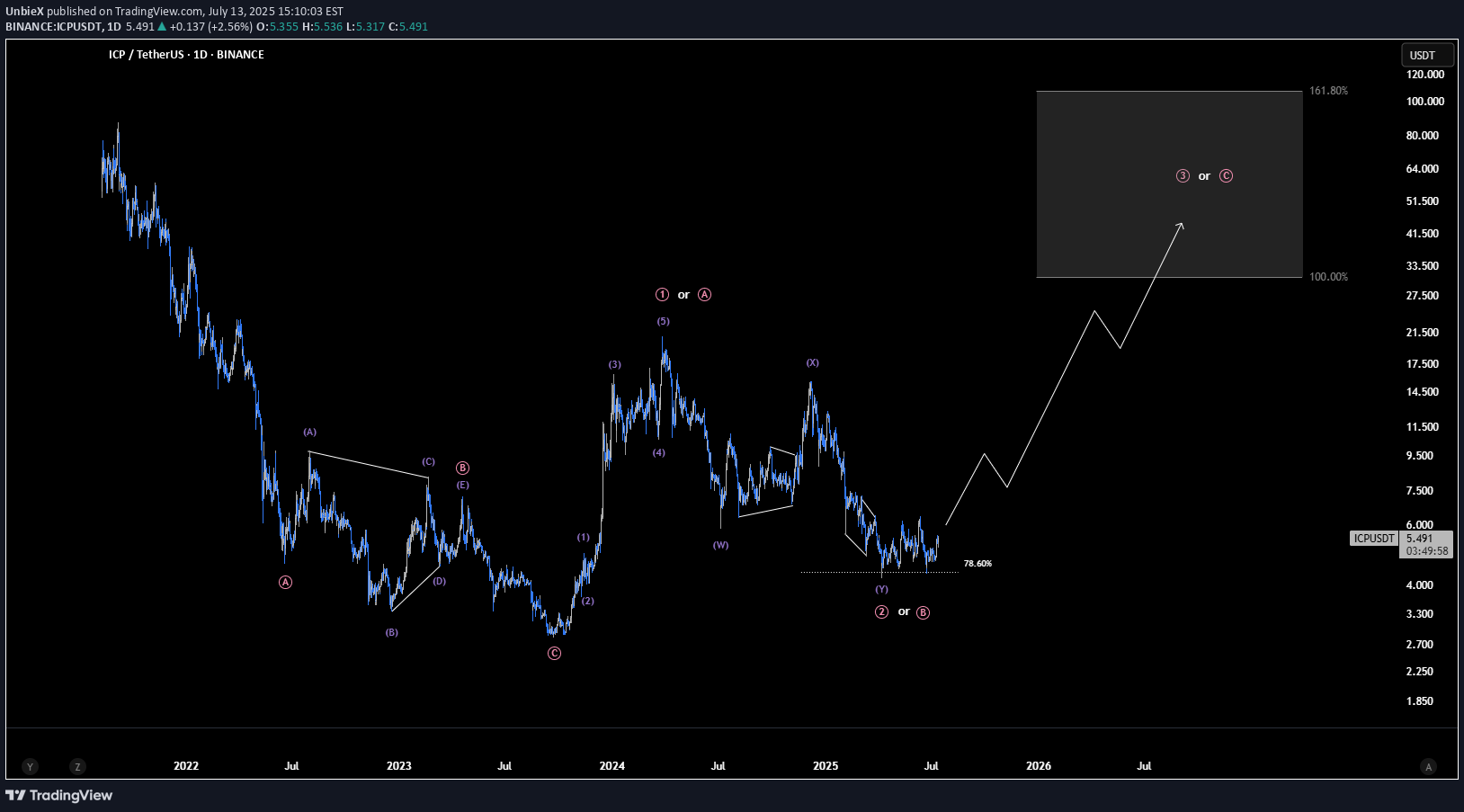

This is the current outlook for ICP. I anticipate a significant impulse to the upside, with technical projections suggesting a potential move toward the $30 to $100 range, representing gains of over 700%. However, as is often the case with altcoins, caution is warranted as any break to a new low would invalidate this scenario. As long as the low holds, the focus remains on the upside, with 30 dollars as a reasonable initial target.

UnbieX

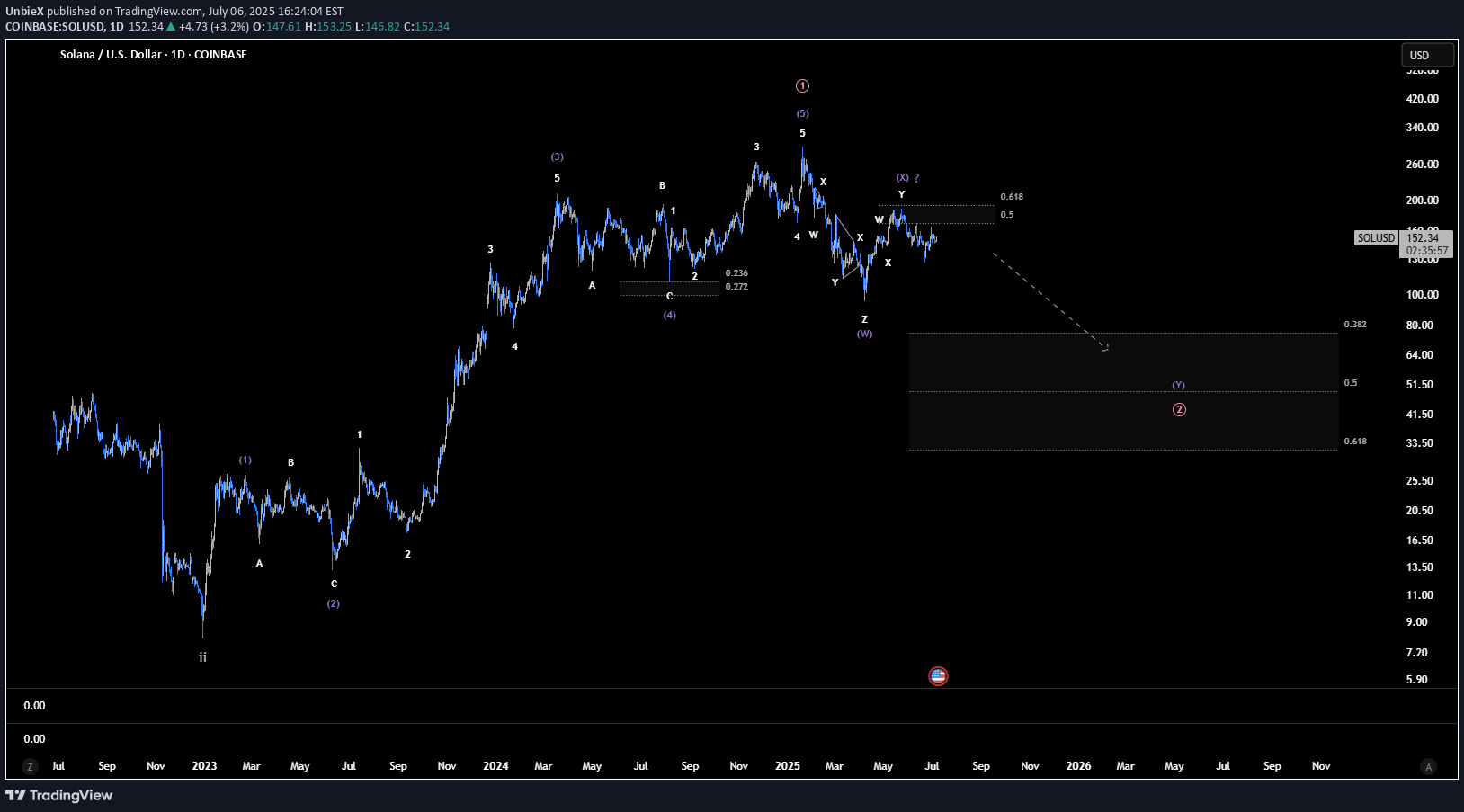

From an Elliott Wave standpoint, the structure appears highly promising. The current formation allows for two plausible interpretations: either the early stages of a strong impulsive wave, or a more measured diagonal unfolding at the cycle degree. A break below the red level would decisively invalidate this count

UnbieX

#SOLThis is my preferred and most bullish scenario for Solana. We're currently in a higher-degree Wave 2 correction following a completed Wave 1. The micro count remains unclear for now, further price action should bring more clarity. It’s possible the X-wave has already completed, suggesting additional downside ahead. The only problem I see with this scenario is that, unlike Solana, other coins like XRP and BTC do not appear to be undergoing a larger corrective phase.Disclaimer: This analysis is for informational and educational purposes only and should not be considered financial or investment advice. All trading involves risk, and you should perform your own due diligence before making any trading decisions. The author is not responsible for any losses that may arise from reliance on this content. Always trade at your own risk.

UnbieX

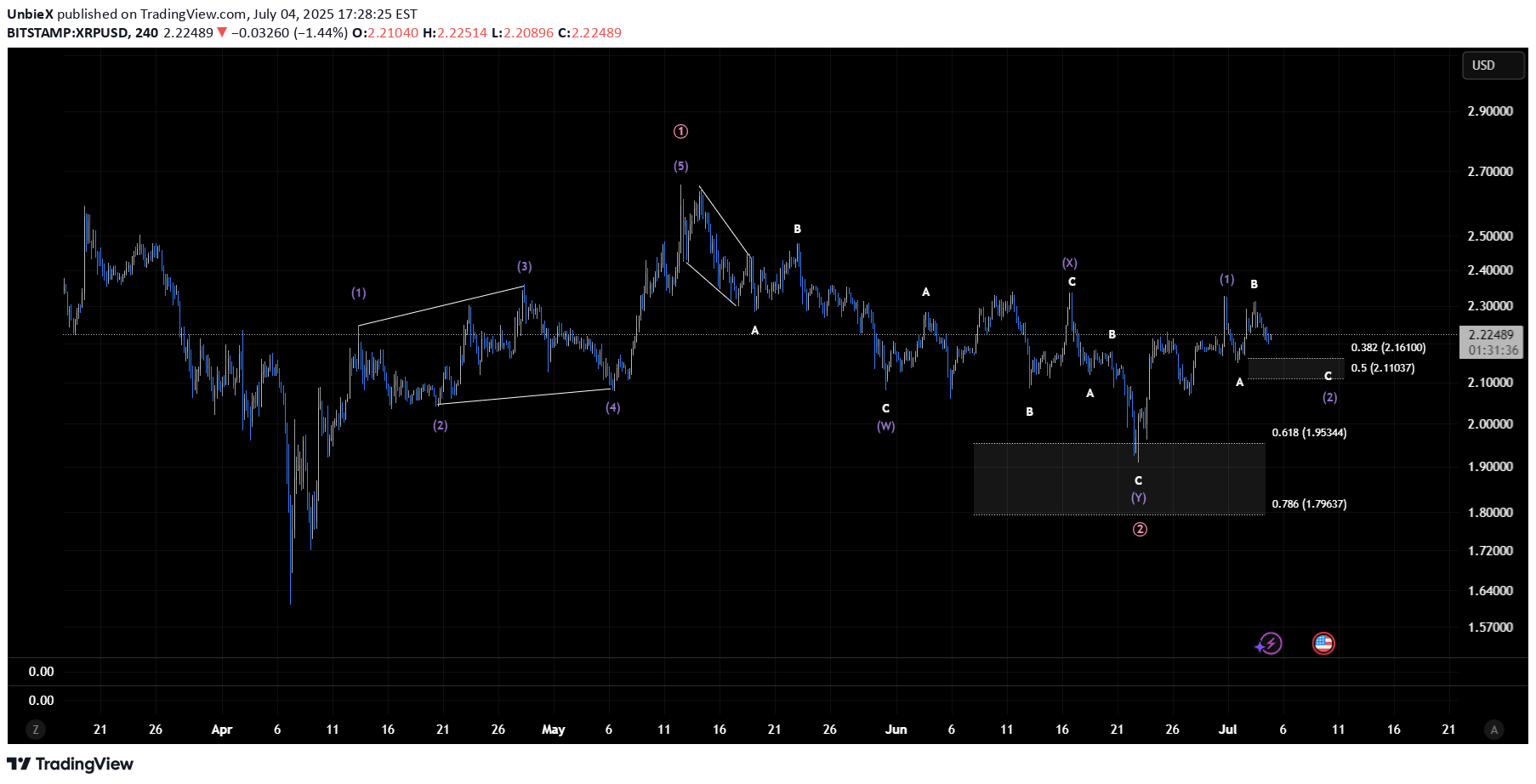

Here's one of my 2 micro timeframe counts for XRP. As you can see, Wave 2 (Pink) has already reacted nicely to the 0.618 Fibonacci level,(the golden ratio), and it looks like we're currently forming a lower-degree Wave 1/2 before potentially launching into an impulsive Wave 3.That said, the recent move up from the Wave 2 (Pink) low looks quite corrective, which is why I’m still considering the possibility that Wave 2 isn’t fully complete and may be forming an ABC within Wave Y. Price action will be the ultimate guide here.Disclaimer: This analysis is for informational and educational purposes only and should not be considered financial or investment advice. All trading involves risk, and you should perform your own due diligence before making any trading decisions. The author is not responsible for any losses that may arise from reliance on this content. Always trade at your own risk.

UnbieX

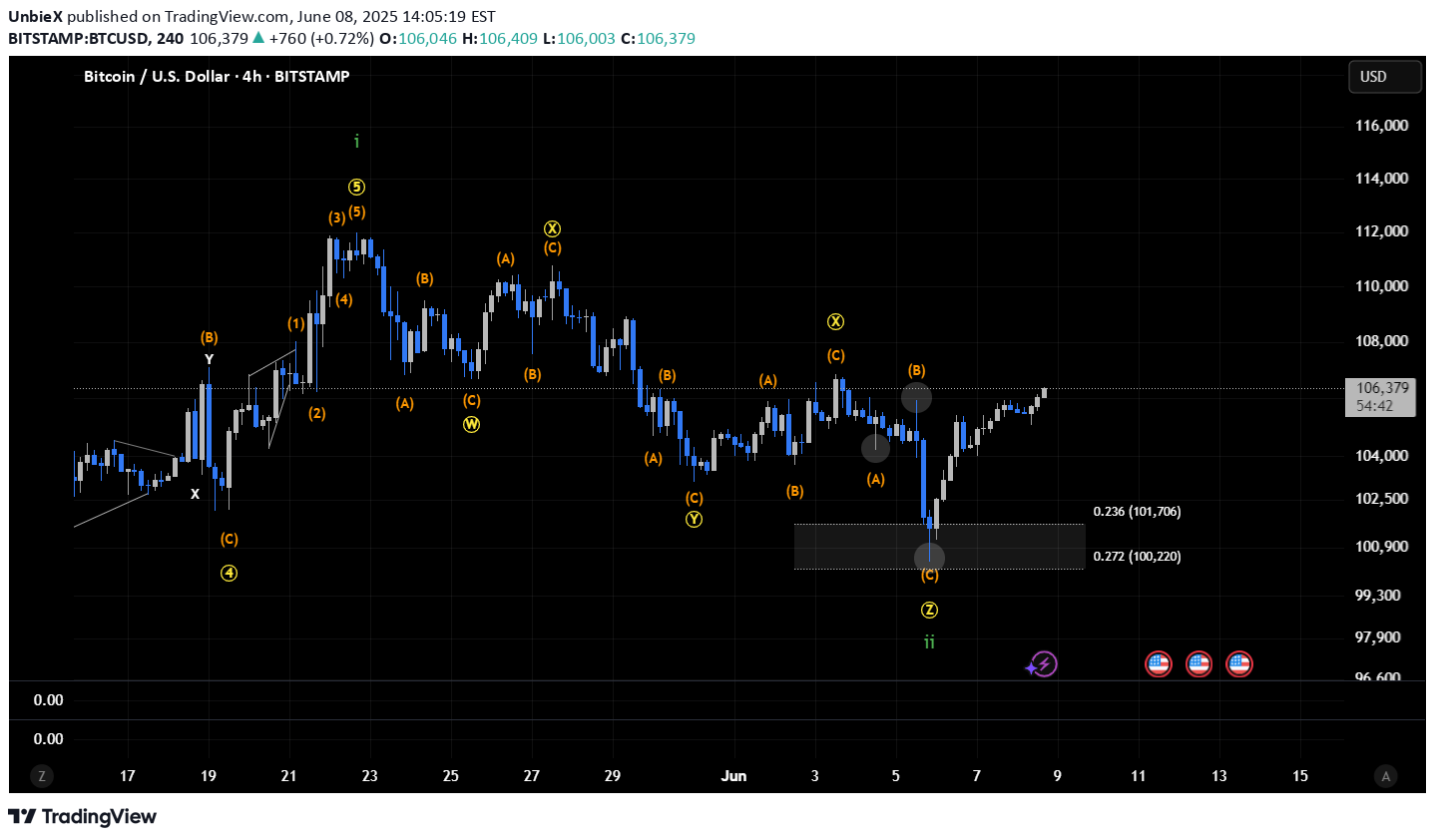

The price reacted to the 0.236–0.272 Fibonacci level, effectively marking the end of the WXYXZ correction. However, for a Wave 2, this represents a relatively shallow retracement implying that alternative scenarios must remain on the table. This could still be an unfolding flat structure (3-3-5), with Wave A forming as a triple zigzag though this is less likely. A more probable outcome is a zigzag (5-3-5), which would require a sharper corrective move. Another possible structure is a double zigzag (WXY).

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.