Truck14

@t_Truck14

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Truck14

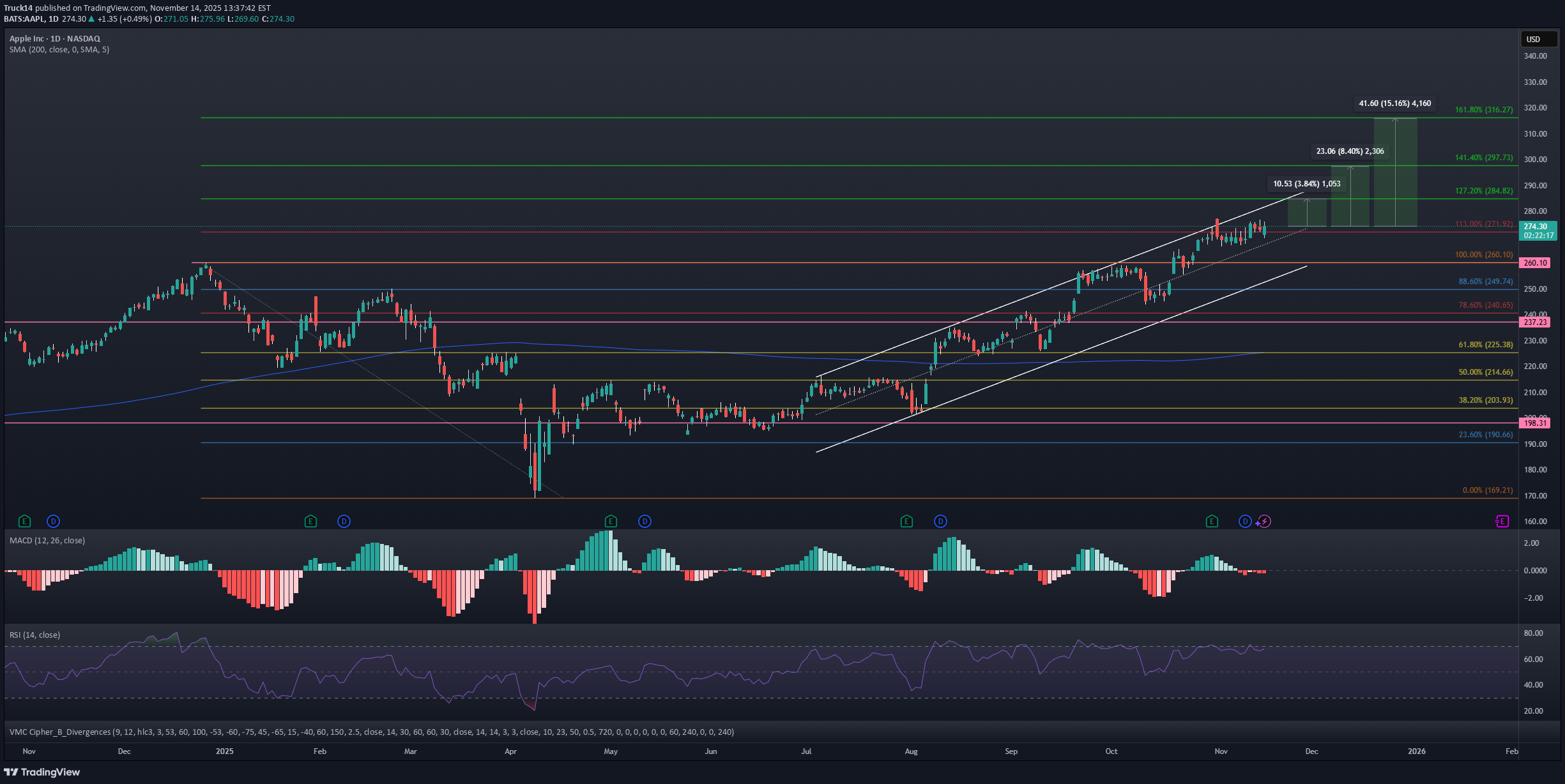

آینده درخشان اپل (AAPL): آیا قیمت به ۲۸۵ تا ۳۱۶ دلار خواهد رسید؟

AAPL. Looks like more upside is in store for AAPL as it is on the cusp of price discovery. The daily RSI is primed at 68 right now. Additionally, if it plays catch-up to Nvidia and Google (which have hit 161.8% retraces from their December 2024 high to April 2025 lows), then one would think that $285/$300/$316 would be on deck for price targets in the relatively near future. It is also notable that Apple hasn't sold off really at all on these recent pullbacks this week. Let's see what happens.

Truck14

تحلیل تکنیکال SUI: آیا این ارز دیجیتال به زودی اوج میگیرد؟

SUI Long idea. Interesting if they break ~$2.175. There is also a potential dragon here with classic bullish divergence on the oscillators.

Truck14

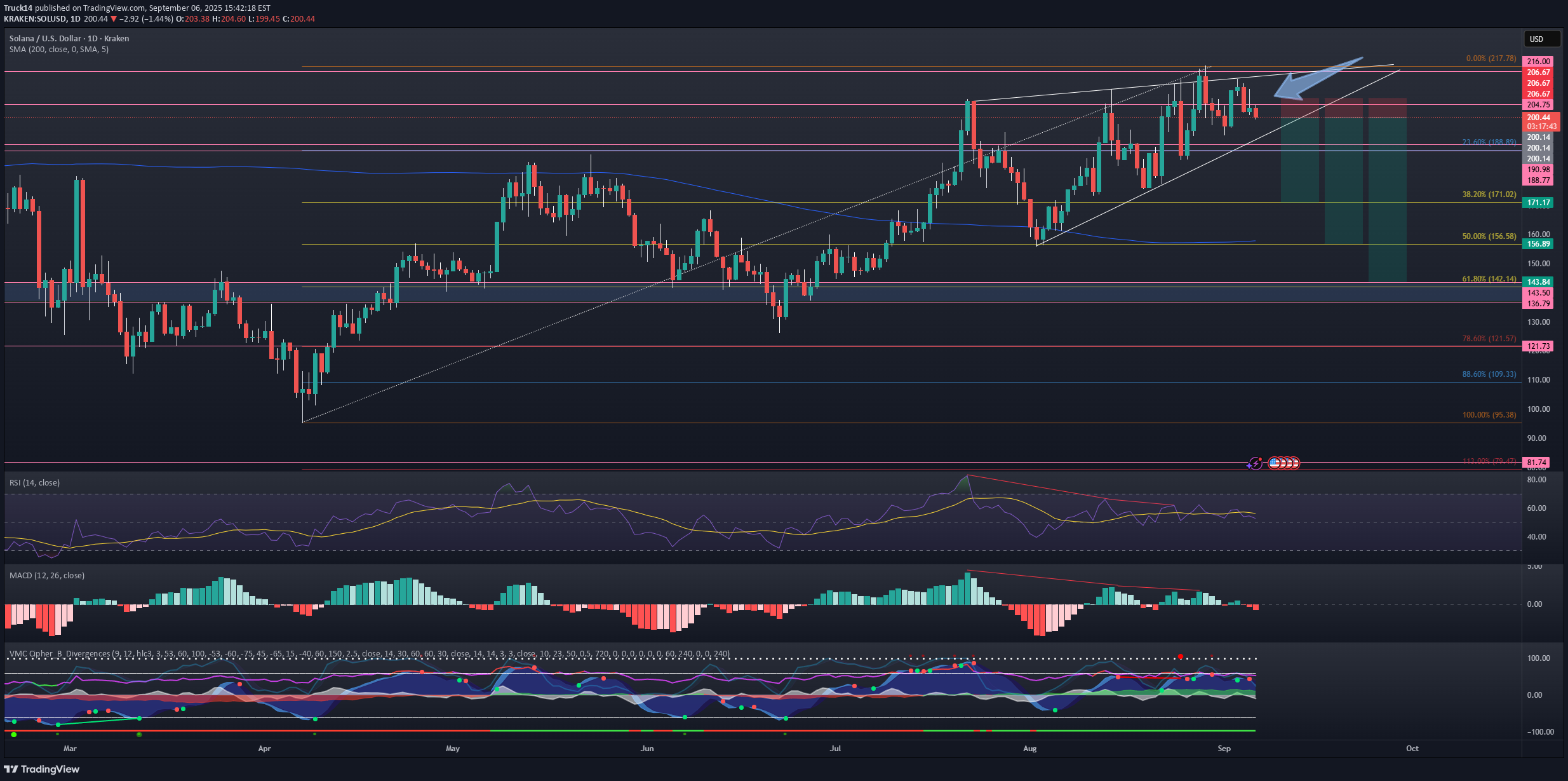

خستگی فروشندگان OP: آیا وقت صعود است؟ (تحلیل تکنیکال با RSI)

OPUSD has an imperfect potential Bullish Crab Harmonic pattern down here in the dumpster at the June 2022 lows there on the left. The RSI is showing some classic bullish divergence. It seems like there could be at least some kind of exhaustion rally soon even if it just manifests into another lower high. Performance on these alt coins has been abysmal, but maybe some bids can come in. Let's see what happens.

Truck14

الگوی هارمونیک گاوی در آستانه انفجار: سیگنال خرید قدرتمند در قیمت ۱۸.۹ سنت!

Algo is showing a potential Gartley/Bat Bullish Harmonic Pattern at a key level (18.9 cents, which was a swing low in September 2019. There is also some Classic Bullish Divergence on the MacD on the daily time frame. Some on the RSI as well. Price has also been contained within a nice falling wedge structure locally. Let's see what happens. Easy to strategize an entry, stop loss, and take profit levels here where you can take on minimal losses if it fails. kangs.

Truck14

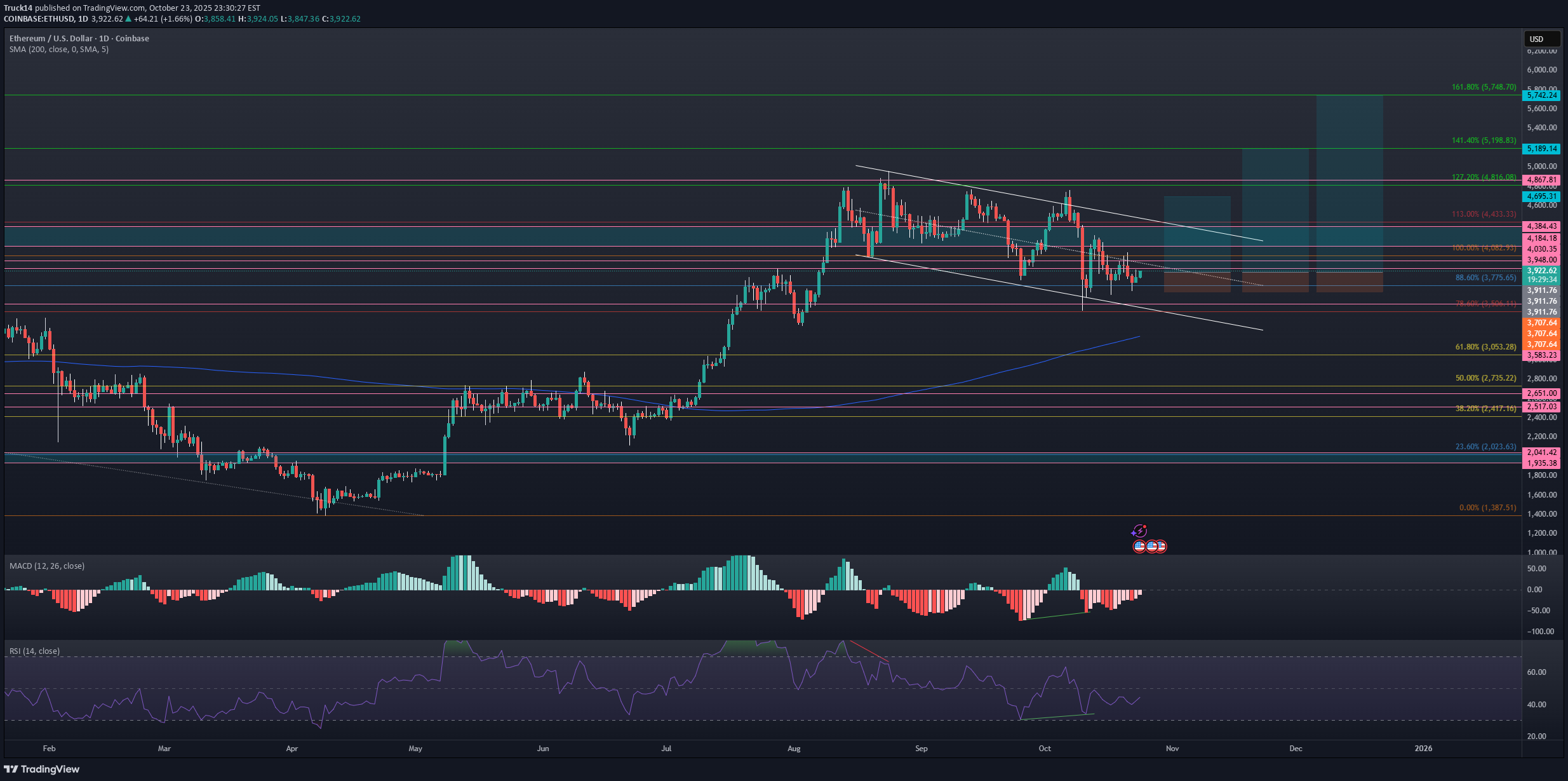

احتمال جهش بزرگ اتریوم: کلید ورود به سود با این دو شاخص حیاتی!

Eth bullish continuation idea. Buyers must recapture $3950 first and foremost. Eth is showing potential classic bullish divergence on both the MacD and RSI here on the daily time frame. It is in a well-established uptrend (not considering the most recent price action, where it has been consolidating for some time up here in the high $3k's - low $4k's). Let's see what happens. Easy to strategize an entry, stop loss, take profit(s) where you can take on minimal losses if it fails. kangz.

Truck14

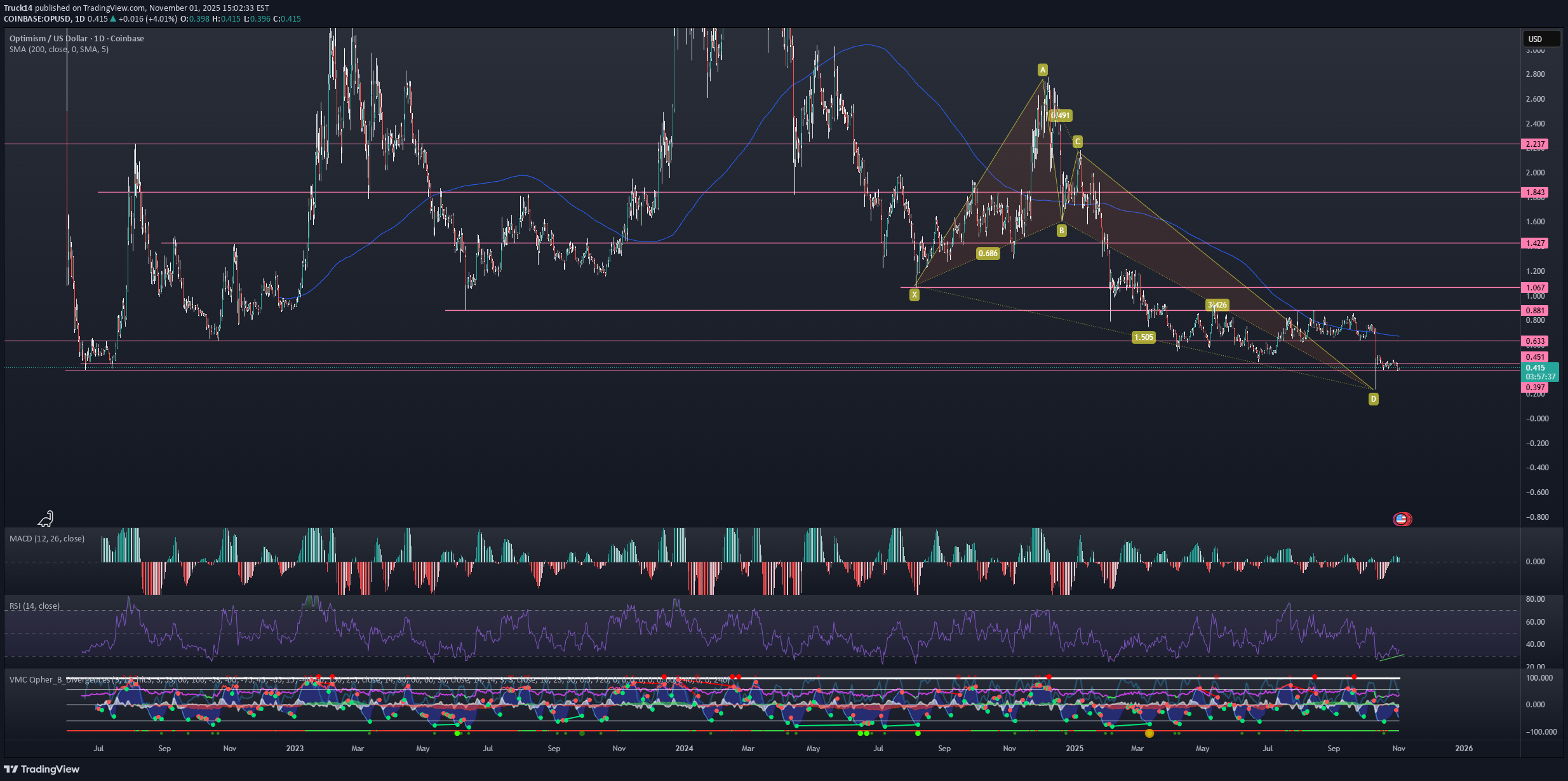

آینده OP: آیا الگوی پروانهای گاوی نجاتدهنده است؟ فرصت خرید در کف قیمتی!

OP is still at/near the pattern completion zone of the potential Bullish Butterfly Harmonic Pattern. It's not perfect, but there is definitely an "M-shape" there and sellers are failing to push the price below .63 cents now for multiple months, which is a key level that goes all the way back to 2022. However, market participants are unable to create any local higher highs, which is somewhat concerning. Overall, it is probably more of a neutral likelihood of up vs. down here, but there is a lot of upside if market participants can keep the price above 63 cents long enough. Something to keep an eye on. Let's see what happens. It will be dependent on BTC not dumping here soon.

Truck14

APTUSD Long Idea

Aptos is looking interesting down here for a long. Very easy to manage your risk. Sellers have failed to push the price lower and now you can see these subtle higher lows locally. Additionally, there is Class "B" or Class "C" Bullish divergence on both the RSI and MacD here on the daily time frame, and it looks like a downsloping supply line was broken recently. Once/if $4.70 breaks, it should be a quick ride to $5.43 minimum. Targets derived from inflection points looking left, which also happen to line up with common retracement target fibonacci levels. Let's see what happens.

Truck14

Pepe Long Idea.

Pepe. Breaking a supply line after regarding .00001 as support and putting in a confirmation low it looks like. Based on historical price action, when this level truly holds, the targets on the chart are .000014 and .000016 approx., respectively. Let's see what happens. Kangs

Truck14

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.