Tradius_Trades

@t_Tradius_Trades

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Tradius_Trades

Bitcoin: The Tides are Shifting BULLISH Based on Price Action

Based on price action analysis utilizing market structure and a variety of trend change confirmation tools, I am looking to long dips in Bitcoin.

Tradius_Trades

Tradius_Trades

Tradius_Trades

Unlocking the Matrix: Master Bitcoin Trading with the MAC

Embrace the Bullish Path: Unveiling the Moving Average Channel Strategy In the world of trading, clarity is a privilege bestowed upon the disciplined. Like Neo in the Matrix, you stand at a pivotal crossroads, where your financial reality can be reshaped. Today, we delve into the depths of our Moving Average Channel (MAC) strategy—a powerful tool for navigating the cryptic waters of Bitcoin (BTC) trading that demands strict adherence. The Monthly MAC: A Firmly Bullish Beacon Gaze upon the Monthly MAC, a radiant indicator of bullish potential. It shines brightly, urging you to remain vigilant. Should the price pull back to $57,000 or below, it reveals a critical juncture for Daily entry triggers. Yet, heed this: do not rush in. Instead, cultivate patience and wait for the market to signal its readiness. The Weekly MAC: The Path to Higher Gains Turn your focus to the Weekly MAC, where bullish momentum persists. A descent to $61,100 or lower marks a sacred threshold for H6 entry triggers. Here, discipline reigns supreme; your task is to let the market come to you, aligning your actions with its rhythm. The Daily MAC: Riding the Wave Now, as we explore the Daily MAC, bullish sentiment continues to echo. Currently positioned below the MAC low, we must seek out H1 entry triggers. Set your sights on the target of $71,500 (the Daily MAC High). This journey requires discipline—wait for the right conditions, and consider leaving some positions open to capture any further upward expansions. The Red Pill: A Privilege of Insight This information is your red pill moment—a glimpse into the deeper truths of the market. You are among the few privileged enough to unlock the potential of disciplined trading. It’s not just about what you know, but how you choose to act on it. The Call to Action Will you embrace this disciplined path? Follow Tradius Trades, where insight meets structured action. --- As you absorb this knowledge, remember: reality is a construct, and the choice to follow the path of discipline is yours. Will you be the one to shape your fate with unwavering commitment? Join us, and let’s trade the truth together.

Tradius_Trades

ETHEREUM EXPOSED Monthly Charts Say BUY While Weekly Charts Sell

🎯 ETHEREUM EXPOSED: Monthly Charts Say BUY While Weekly Charts Scream SELL (Here's What To Do) Monthly vs Weekly: The Battle of Timeframes Currently, Ethereum's showing an interesting timeframe divergence that's creating perfect opportunities for different trading styles. Monthly Timeframe: The Bull Case - Bullish trend intact - Currently below Monthly MAC (prime buying zone) - Clear targets: - Mid-MAC: $3,000 - High-MAC: $3,422 - Perfect place to buy for position builders and long-term investors Weekly Timeframe: The Bear Case - Bearish MAC trend signals active - Key resistance: $2,636.73 - Valid short entries on H6 timeframe when price reaches this level and above How to Play Both Sides Here's the secret most traders miss: These "conflicting" signals aren't a problem - they're an opportunity. Pick your timeframe, stick to your strategy, and ignore the noise. Ducks in a Barrel Strategy: Almost Perfect Setup Current conditions show: ✅ Uptrending 39 & 52 Week MAs ✅ Undervalued vs gold & treasuries ⏳ Waiting for: Oversold stochastic When that third checkmark hits, we're looking at a prime entry setup. Ready to Master Market Analysis? While this analysis gives you the blueprint, successful trading requires more than just knowing the levels. I've spent years mastering these patterns and developing foolproof systems for market analysis. Want to learn how to: - Spot these setups before the crowd - Execute with perfect timing - Manage risk like a pro - Trade multiple timeframes confidently - Utilize Commitment of Traders to know how the Commercials (the smartest guys in the business aka Smart Money), are positioning, and how to ride the wave with these guys. I'm accepting a small group of serious traders into my inner circle. You'll get: - Weekly market analysis calls - Rules Based and Non Discretionary Trading Strategies - Education to greatly improve your analysis and trading DM me now if you're ready to level up your trading game. Serious inquiries only. Trading Disclaimer TRADING CRYPTOCURRENCIES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. Past performance is not indicative of future results. The information provided in this analysis is for educational purposes only and should not be considered financial advice. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change without notice. I am not a licensed financial advisor. All trading decisions and consequences are your responsibility.

Tradius_Trades

Why Smart Money is BEGGING for a Bitcoin Dip (Technical Analysis

📈 Why Smart Money is BEGGING for a Bitcoin Dip (Technical Analysis)MAC Strategy: Your Dip-Buying BlueprintMonthly and weekly Moving Average Channel indicators are bullish. Here's your shopping list:- Weekly MAC support: $59,234- Monthly MAC support: $55,943These aren't dips - they're gifts. When Bitcoin touches these levels, smart money moves fast.Ducks in a Barrel Strategy Says "Load Up"Weekly timeframe say we want to buy the dip. :- 39 & 52 week MAs trending up and pulling away from each other (bullish momentum)- Strong uptrend intact in spite of the several months of consolidation..Perfect storm setup for Ducks in a Barrel:1. Bitcoin undervalued vs gold/treasuries2. Stochastic hits oversold at the same timeIf you see a Bitcoin dip, REMEMBER: Dips are Gifts.Stop Missing These SetupsI'll be honest - finding and catching these dips isn't rocket science, but timing is everything. Ready to level up?- Learn how to implement rules based & non-discretionary trading to become profitable- Learn to interpret the Commitment of Traders data to gain a major edge in the markets- Join live market analysis sessions- Learn my exact entry triggers- Master risk managementDM me for more information. Serious traders only.Trading DisclaimerTRADING CRYPTOCURRENCIES INVOLVES SUBSTANTIAL RISK OF LOSS AND IS NOT SUITABLE FOR ALL INVESTORS. Past performance is not indicative of future results. The information provided in this analysis is for educational purposes only and should not be considered financial advice. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change without notice. I am not a licensed financial advisor. All trading decisions and consequences are your responsibility.

Tradius_Trades

ETH - The Bullish & Bearish Case

Today we take a look at ETH and lay out a variety of trade ideas.MONTHLY: From the Monthly perspective, ETH remains very Bullish. Essentially, going long ETH anywhere at or below the low of the Monthly MAC is a legitimate spot to buy. The target based on the Monthly chart is around 3,400 (approximately 30% above current price level). From an investment perspective, this is a great area to go long ETH.WEEKLY: From the Weekly perspective, ETH remains Bearish, as we have not had a confirmed bullish trend change. Right now, ETH is trading at the Weekly MAC high, which is a legitimate place to look for new short entries, or to take profits from any longs taken at recent weekly lows. There is currently H6 bearish divergence setup, but not triggered. If it triggers, I will be shorting ETH to a target of the Weekly MAC low (2,337).DAILY: From the Daily perspective, ETH remains Bearish. However, we are getting a potential bullish trend change (but not triggered/confirmed). There is H1 bearish divergence setting up right now, and if it triggers, the short trade target would be the Daily MAC low at 2,421.As you can see, if you are an investor, the current price levels are reasonable areas to load up to the long side. However, the Weekly and Daily are still bearish until bullish confirmation. Daily is in the process of confirming bullish, but not yet. Day trades and shorter term swing trades to the short side are still valid.Have a great week.

Tradius_Trades

Overall, I remain bullish on Bitcoin. The Monthly & Weekly MAC strategy is still supportive of looking for buy triggers on pullbacks into the Monthly/Weekly MAC lows. I will be looking for entry triggers on entry timeframes if Bitcoin pulls back into the 56K to $57,500 price range, and would consider still hunting entries if it trades below these levels.The Daily remains bullish, but there is a MAC selling setup (not confirmed until Williams AD closes below its 57 period MA). Have a great weekend.

Tradius_Trades

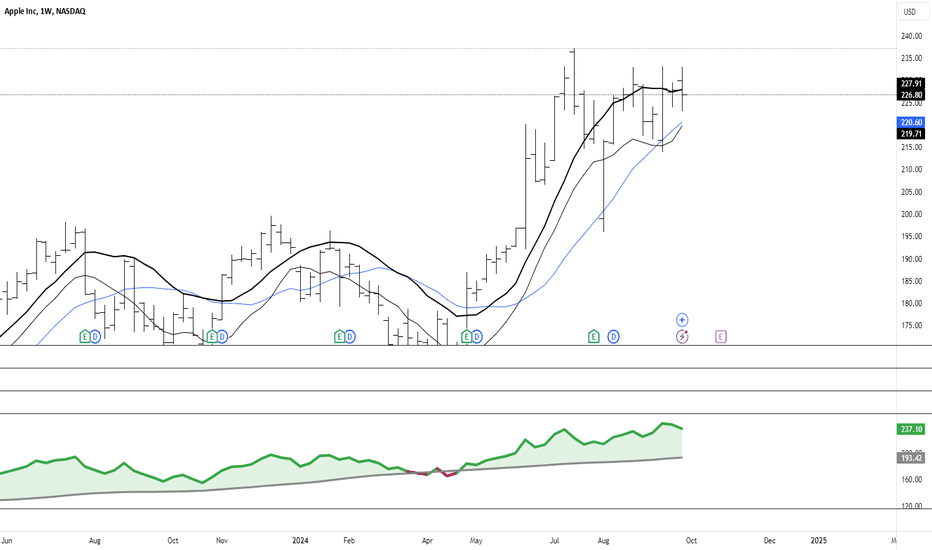

Apple - How I'm Looking to Trade Apple This Week

Monthly & Weekly MAC strategy suggests dips into the Weekly &/or Monthly MAC low are good setup areas for going long. Essentially, I'm looking to buy the dip if we get a price move into the levels noted in the video. I would not just be buying the MAC lows. I would be looking for entry triggers on my entry timeframes in those areas. I also point out that there are some Monthly/Quarterly bearish divergences forming, but nowhere near confirmation, so bulls need not worry. In short, I'm looking to buy the dip on Apple. Have a great weekend.

Tradius_Trades

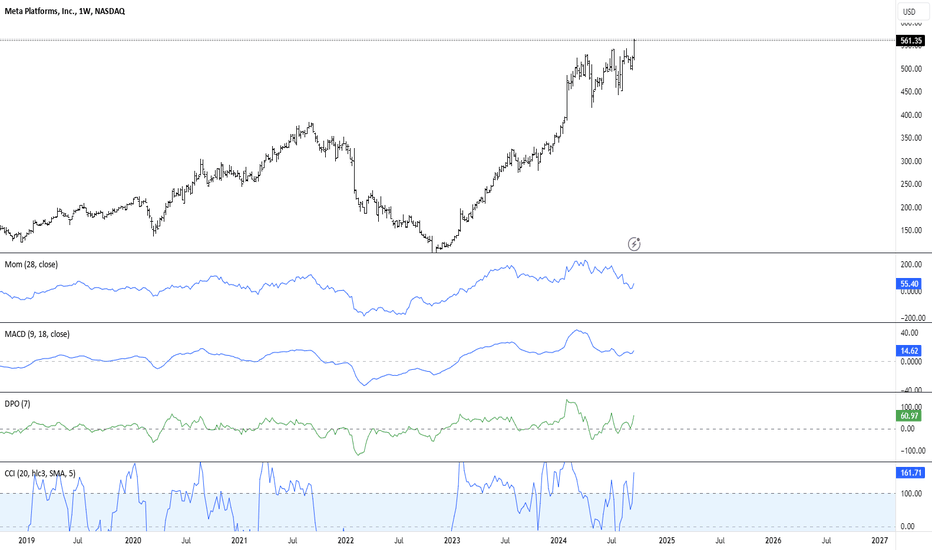

META - Still Bullish, But Major Sell Signal Looming

Here is what I am watching on META. -Like many of the other high flying stocks in the US, the Quarterly, Monthly & Weekly charts are flashing divergence sell setups. Bulls need not be too worried yet, as these divergence sell setups have not yet confirmed. However, the astute trader must be aware that these setups are looming, because if they confirm, they imply a minimum 15% move to the downside for Meta. -We are bullish on any pullbacks into the 446 to 495 range (Monthly & Weekly MAC lows). These are considered Buying opportunities and valid areas to look for entry triggers on entry timeframes. -Cycles suggest a cyclical high right around now, heading into a significant cyclical low in early to mid October (possibly into November). I'd like to see this cycle play out to have price trade down into the Monthly/Weekly MAC lows, where we will be ready to hunt entry triggers to the long side.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.