TraderDusk

@t_TraderDusk

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Bitcoin and the Historic 8-Year Trendline: A Pivotal Moment

Hello, I'm full-time trader Dusk.If this analysis helps you, please consider following and boosting this post. Thank you!Today, I'm writing with anticipation and excitement as Bitcoin once again approaches an 8-year-long historical trendline.It has been quite a journey, with Bitcoin reaching a high of $19,000 in 2017, soaring to $69,000 in 2021, and touching $109K in 2025On January 20 of this year, Bitcoin tested its 8-year trendline but failed to break above it, subsequently dropping sharply to $74,500 (-32%) by April 4. Since then, Bitcoin has steadily recovered and continued its upward momentum.Currently, Bitcoin is at $104,000, with the next key target being $113,000.I've outlined four possible scenarios:① Immediate rejection and decline from current priceProbability: ★★★☆☆ (Medium)② Reaching $113K, then decliningProbability: ★★★☆☆ (Medium)③ Direct breakout above $113KProbability: ★★☆☆☆ (Moderate)④ Touching $113K, consolidating, then continuing upwardsProbability: ★★★★☆ (High)Personally, I find scenarios ② and ④ to be the most likely, though I’m hoping for scenario ③—a powerful breakout beyond $113K.However, the region between $105K and $113K currently presents significant selling pressure. It remains uncertain whether Bitcoin can swiftly break through this resistance and maintain momentum despite substantial selling volume.That said, the current market dynamics differ significantly from the past. BlackRock now holds approximately 600,000 BTC, MicroStrategy around 550,000 BTC, and various U.S. states and countries are increasingly recognizing Bitcoin as a strategic asset.Today's news highlights Galaxy Digital's Nasdaq listing and discussions with the SEC regarding tokenizing Nasdaq-listed U.S. stocks.With increased institutional and governmental adoption and now discussions around stock tokenization, Bitcoin stands on the threshold of mainstream institutional acceptance.Let's closely monitor how Bitcoin responds at this historic trendline, and together witness the potential unfolding of a new financial era.I hope this isn't just wishful thinking!

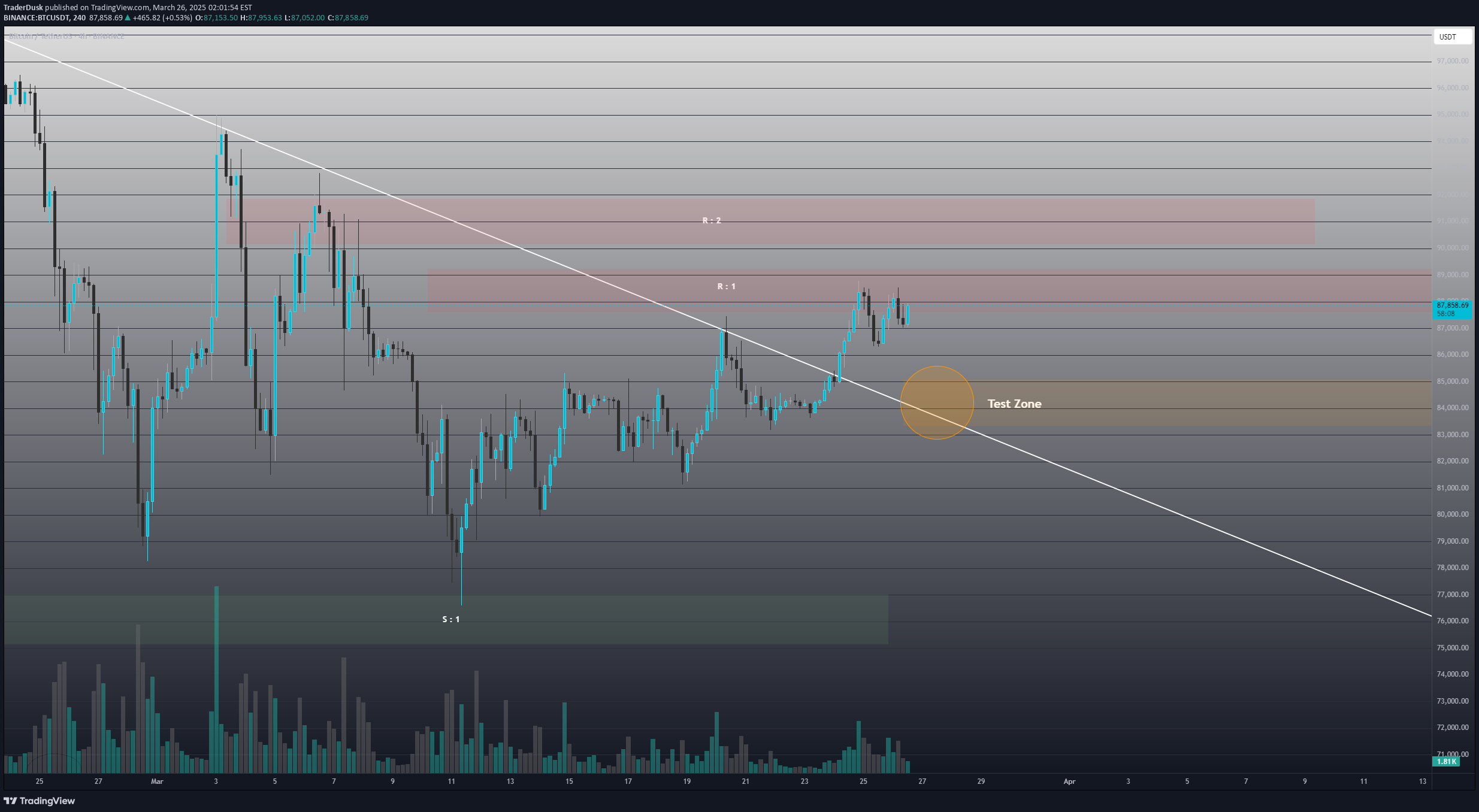

Bitcoin Short-Term: Double Top Formation & Market Direction

Hello, I'm Dusk, a full time trader.If you find this helpful, please "Follow" and "Boost".BTCUSD Bitcoin: Movement Analysis After Double Top FormationBitcoin recently dropped to S:1 ($76,600) due to gold strength and tariff concerns, before bouncing back toward R:1 ($88,600) as outlined in my previous idea.Currently, we are seeing a mild pullback on the 4H chart.📌 Previous idea:Since price broke above the trendline highlighted earlier, a retest toward the Test Zone ($83,400–$85,000) is likely.This area will be critical for gauging direction, especially when watching for price reaction and volume behavior.A direct move toward R:2 ($90,000) is possible, but due to a double top pattern on the daily chart, the following two scenarios seem more probable:A retest of the Test ZoneSideways consolidation to relieve downward pressureTrading PerspectiveBTC/USDT on the 4H chart still looks constructive.However, the daily chart shows declining volume despite rising price, suggesting caution against chasing longs.📈 Chart snapshot:Will keep you updated as things develop.We have now reached the Test Zone predicted in my analysis.To be honest, I set this zone quite wide, perhaps unreasonably so.However, the key point is to never enter with 100% of your position size in such zones.While some traders do manage to find precise entry points with minimal error margins, this approach can be risky for long-term trading strategies.When trading in the current Test Zone, I would recommend splitting your position using ratios like 1:2:3 or 2:2:4 for staged entries.If you believe this is the bottom, you can add 20-25% to your position as the price moves upward.This way, you only lose what you've invested when things go wrong, but when things go right, you gain more than your initial position size.Conversely, if you expect the bottom of the Test Zone to break, you should aim to get your average entry price as low as possible, then cut losses if the zone is breached.Remember, the market might briefly break below the zone before quickly forming a tail and bouncing back.This is why staggered entries with divided position sizes give you more flexibility to navigate such scenarios.Bitcoin has touched $83,600 and is now taking a brief respite around $84,000.The decline has been faster and steeper than expected, with even the reliable Nasdaq showing disappointing performance.Currently, Bitcoin shows little strength at support levels, and downward pressure continues to be felt.If you've entered positions in stages within the Test Zone and are experiencing unrealized losses, I recommend reducing some of your position near your average entry price to manage risk against further potential declines.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.