Trade-U-Metta

@t_Trade-U-Metta

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Trade-U-Metta

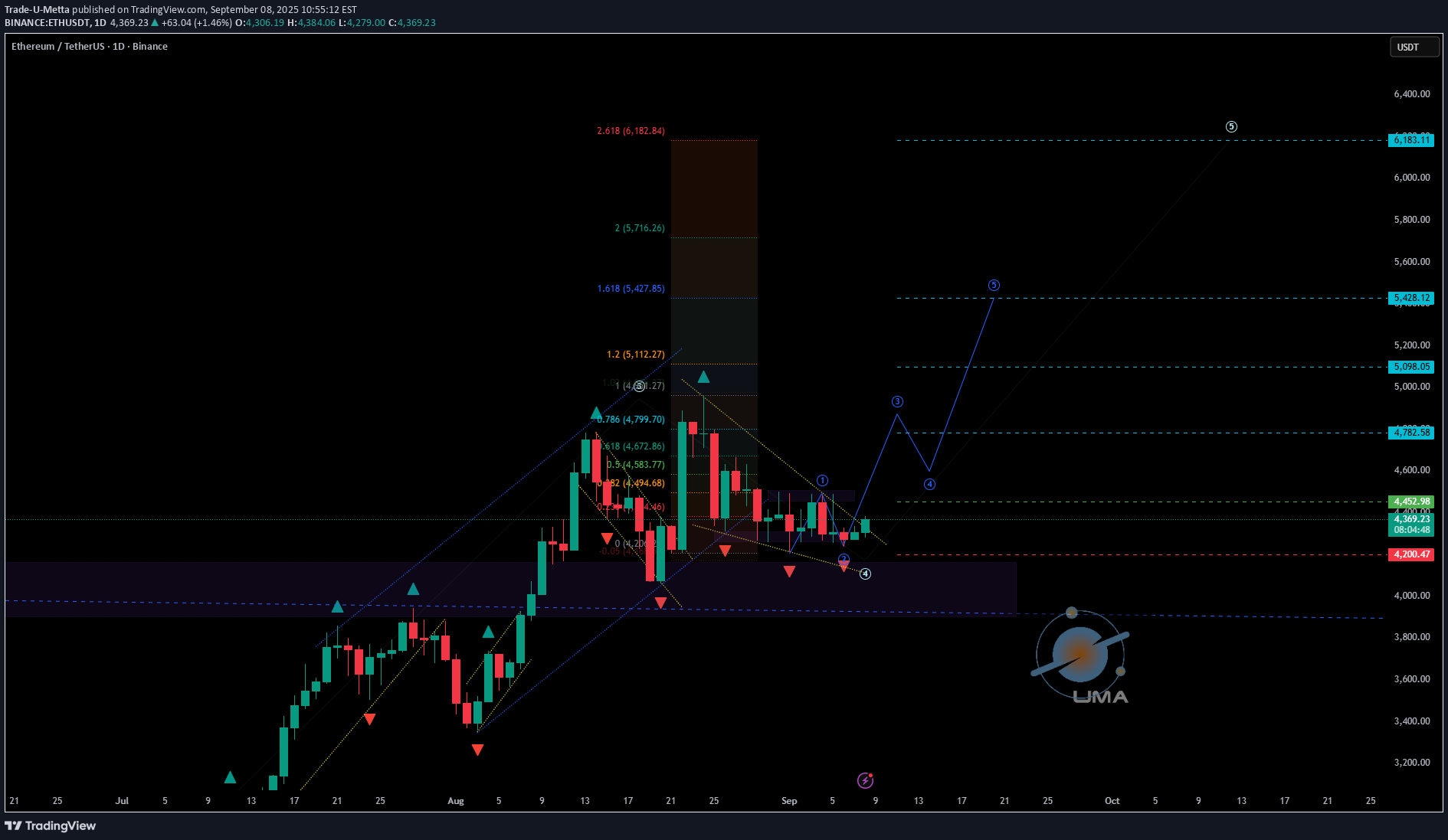

ETHUSDT - UniverseMetta - Analysis

#ETHUSDT - UniverseMetta - Analysis Potential trend continuation – focus on Wave 5 📆 W1 – Weekly Timeframe 🔹 Price has broken above and confirmed support at a key level 🔹 A retest of the breakout level may precede the launch of a new Wave 5 in the uptrend 🔹 Alternatively, a deeper ABC correction could develop before continuation 📉 D1 – Daily Timeframe 🔹 A symmetrical triangle has formed and price has broken above the trendline 🔹 This may mark the beginning of a new impulse within an ABC structure 🎯 Short-term upside targets for a breakout: • $4,782 • $4,964 ⏳ H4 – 4H Timeframe 🔹 A potential Wave 3 to the upside is forming 🔹 Entry confirmation comes after price breaks above the 1st wave high and holds above the trendline 🔹 Stop-loss placed below the low of Wave 1 🎯 Trade Setup: #ETHUSDT #BUY Entry: 4,452.98 Take Profits (TP): • 4,782.58 • 5,098.05 • 5,428.12 • 6,183.11 Stop Loss: 4,200.47 ‼️ Total risk should not exceed 1–3% of your portfolio This signal/idea is not investment advice Always conduct your own analysis before entering the market

Trade-U-Metta

#XRPUSDT - UniverseMetta - Signal

#XRPUSDT - UniverseMetta - Signal D1 - Formation of ABC structure in continuation of the trend. H4 - Formation of the 3rd wave + breakout of the trend line. Stop behind the minimum of the 1st wave. Entry: 2.9004 TP: 3.2410 - 3.6414 - 4.0671 - 4.4997 Stop: 2.6697

Trade-U-Metta

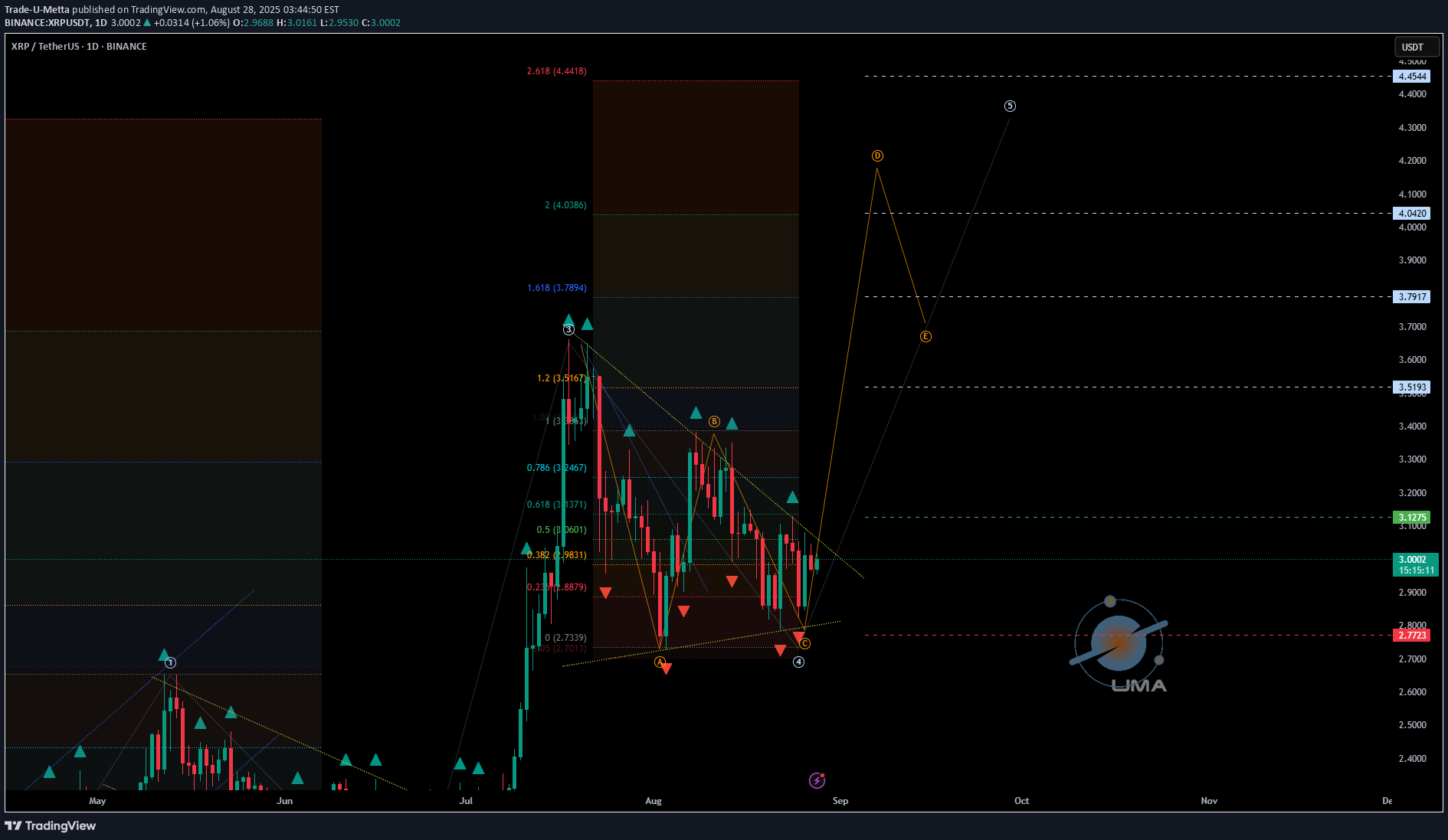

#XRPUSDT - UniverseMetta - Analysis

#XRPUSDT - UniverseMetta - Analysis Setup for potential wave 5 continuation 📆 W1 – Weekly Timeframe 🔹 Price has spent over a month in a corrective structure following the completion of wave 3 🔹 A continuation of the 5th wave in the broader uptrend is possible — if price breaks and closes above the trendline 🔹 A down fractal may serve as a key trigger for the next bullish impulse 🎯 Medium-term structure target: $4.32 (Wave 5 — 2.618 Fib from Wave 1) 📉 D1 – Daily Timeframe 🔹 Price has formed a triangle consolidation — signaling potential breakout soon 🔹 Breakout of the upper trendline could lead to a strong upward continuation 🔹 If the move extends as part of a broader correction, we may see targets up to $5.17 (2.618 Fibonacci extension) 🎯 Key resistance zones: • $4.32 • $5.17 🎯 Trade Idea: #XRPUSDT #BUY Entry: 3.1275 Take Profits (TP): • 3.5193 • 3.7917 • 4.0420 • 4.4544 • *5.1642 Stop Loss: 2.7723 ‼️ Risk exposure should not exceed 1–3% of your portfolio This signal/idea is not financial advice

Trade-U-Metta

TSLA - UniverseMetta - Signal

Trade-U-Metta

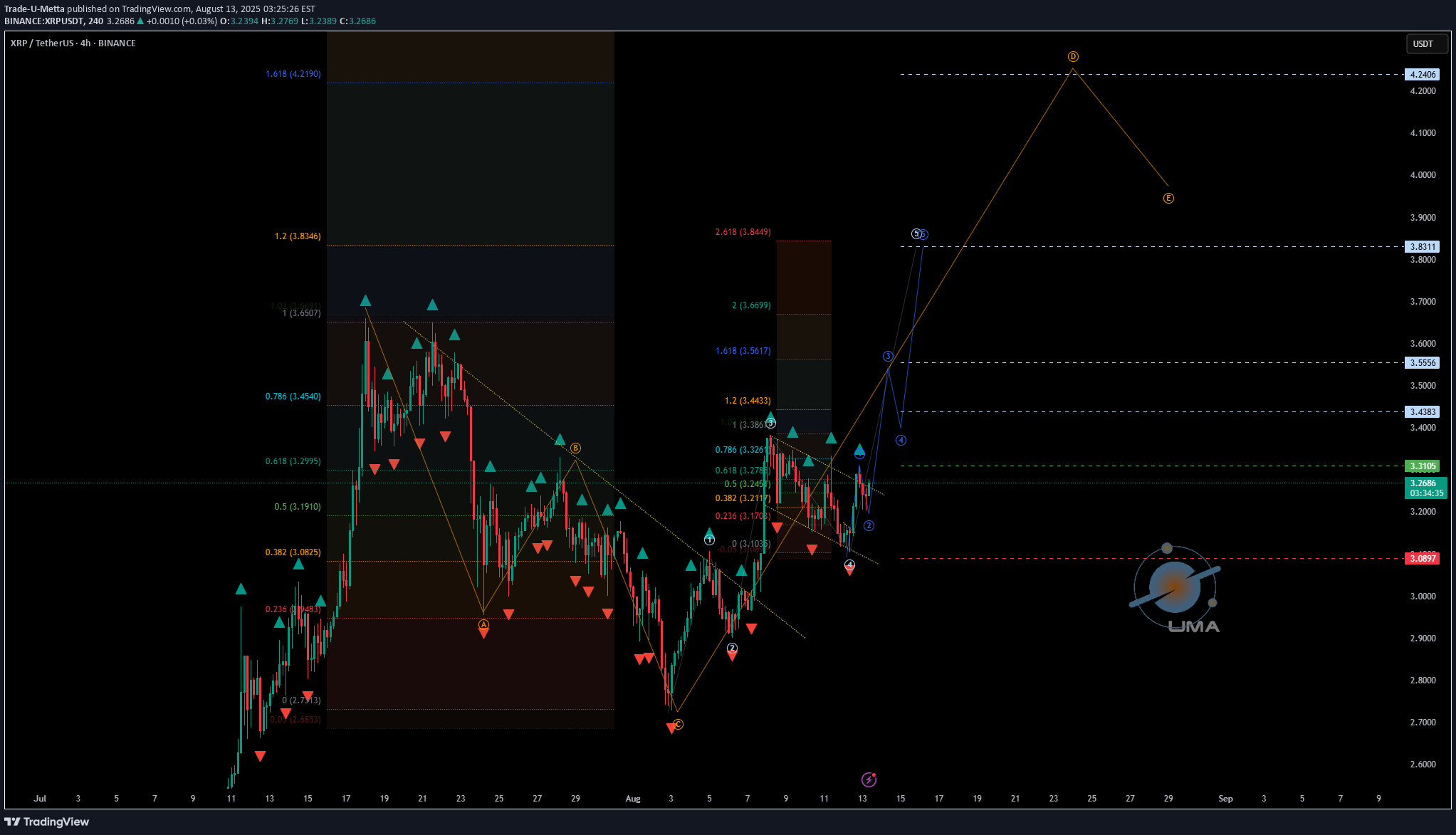

XRPUSDT - UniverseMetta - Analysis

#XRPUSDT - UniverseMetta - Analysis Potential continuation of the bullish trend 🗓 W1 — Weekly Timeframe 🔹 XRP is currently within a potential 5th wave of the broader uptrend 🔹 A down fractal has formed — a key signal indicating a possible end of correction 🔹 If the bullish structure continues to develop: 🎯 Long-term target (W1): $4.36 📉 D1 — Daily Timeframe 🔹 The correction appears to have completed as an ABC structure 🔹 Price broke above the trendline and is now retesting it 🔹 This retest could serve as the launch point for a new impulse upward 🎯 Potential extended target: $5.13 ⌛ H4 — 4H Timeframe 🔹 Price is moving within a descending corrective channel 🔹 For confirmation of bullish continuation, we need a breakout above the channel 🔹 Ideal entry scenario: formation of a 3rd wave to the upside 🎯 Local targets: ▫️ $3.43 ▫️ $3.55 ⚠️ If price falls back inside the channel — the idea is invalidated. Stop-loss should be placed below recent key lows. 🎯 Trade Setup: #XRPUSDT #BUY Entry: 3.3105 Take Profits (TP): ▫️ 3.4383 ▫️ 3.5556 ▫️ 3.8311 ▫️ 4.2406 Stop Loss: 3.0897 ‼️ Total risk should not exceed 1–3% of your portfolio This signal/idea is not investment advice

Trade-U-Metta

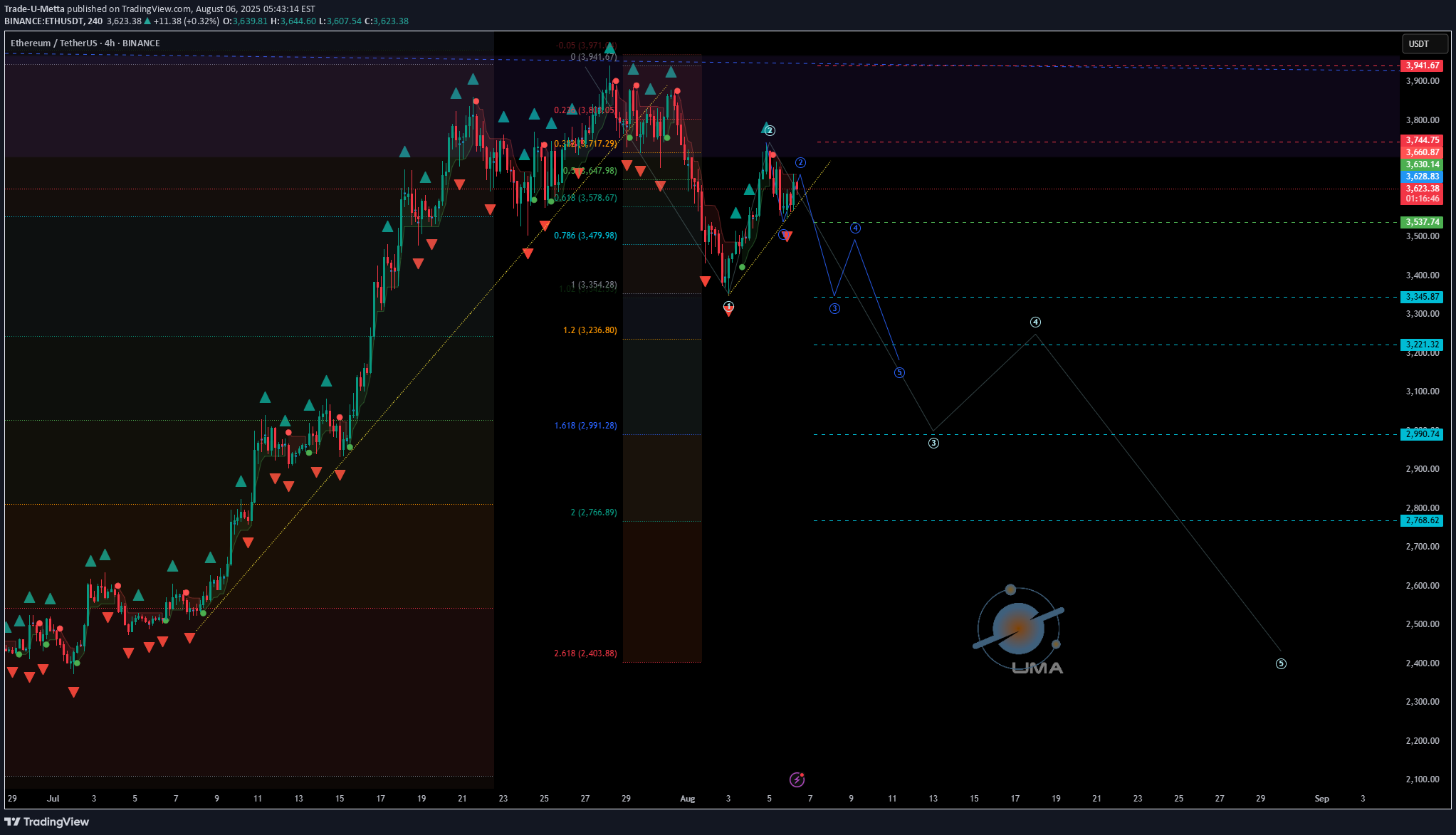

ETHUSDT - UniverseMetta - Analysis

#ETHUSDT - UniverseMetta - Analysis Potential reversal & correction setup in progress 📆 W1 – Weekly Timeframe 🔹 Price is testing a major monthly resistance zone, from which price has previously rejected toward the lower edge of a large triangle structure 🔹 According to the 3-wave structure, ETH has reached 161% of Wave 1 and closed above the 200% Fibo level 🔹 If the price fails to make a new high this week, a top fractal may form — a possible signal for a medium-term correction 📉 D1 – Daily Timeframe 🔹 A double top pattern is forming, along with a potential retest of the trendline 🔹 If confirmed, this could trigger a 3-wave correction structure downward 🔹 A downward fractal is already printed — adding confluence to the bearish scenario 🎯 Correction targets: • $3,242 • $2,546 ⏳ H4 – 4H Timeframe 🔹 Current price action suggests a correction from the recent impulse 🔹 A 3rd wave may initiate upon trendline breakout 🔹 Entry confirmation may come from breakout + retest, or via confirmed double top structure 🔹 Stop should be placed above the high of Wave 1 (H4) 🎯 Trade Setup: Entry: 0.64930 TP: 0.65404 - 0.65700 - 0.66164 - 0.66676 Stop: 0.64482 ‼️ Risk should not exceed 1–3% of your portfolio This signal/idea is not financial advice 📌 Key Fundamental Triggers to Watch: 🔹 Federal Reserve expectations – a dovish shift could support ETH short-term, but failure to materialize may drive a pullback 🔹 ETH ETF news – updates on applications, approvals, and volume flows can significantly impact sentiment 🔹 Correlation with NASDAQ/S&P500 – weakness in equities could drag crypto lower 🔹 On-chain activity – declining gas usage or demand may indicate lower network utility and bearish pressure 🔹 Weekly overbought condition – many technical indicators (RSI, MACD) point to overextension

Trade-U-Metta

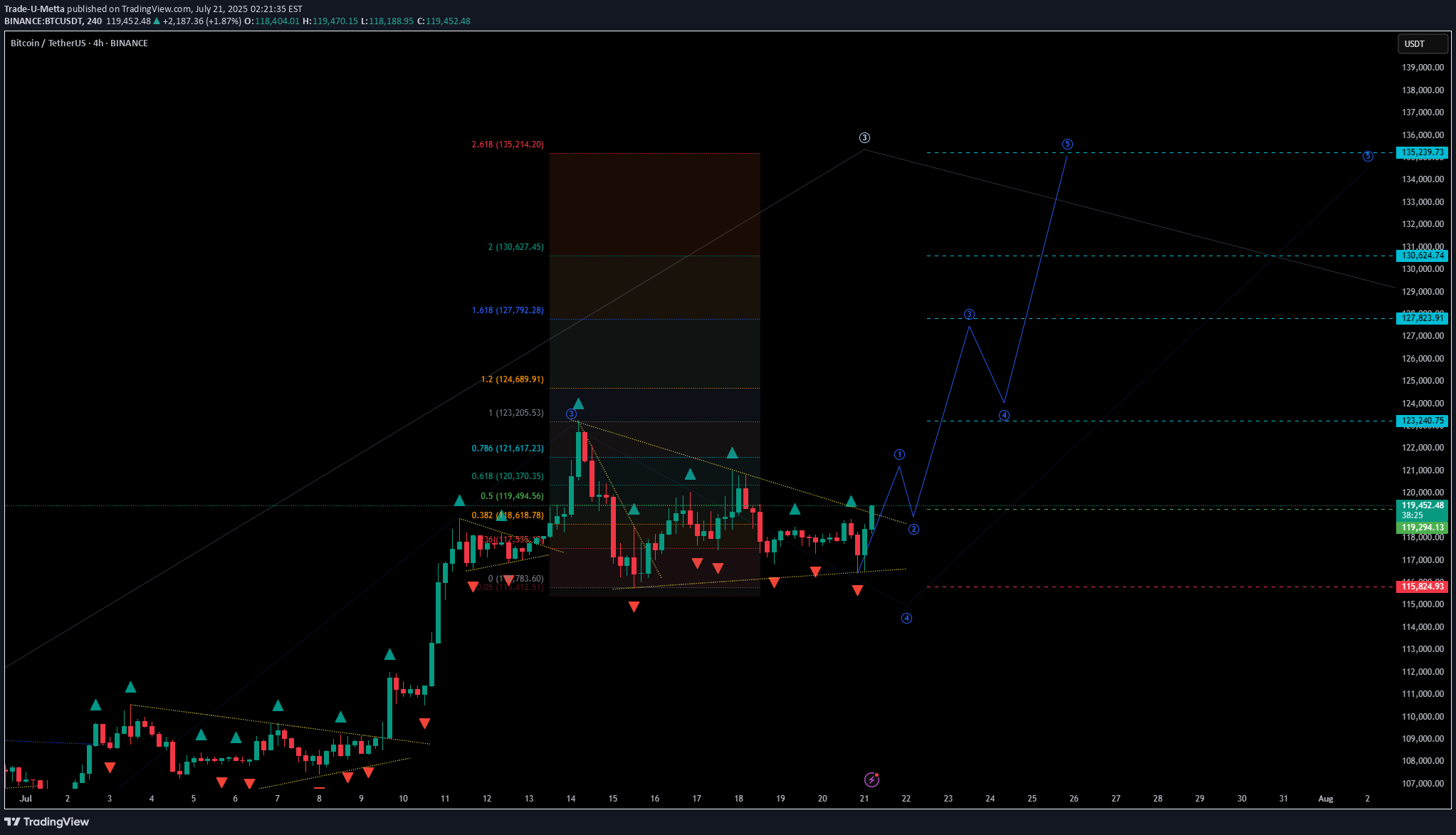

BTCUSDT - UniverseMetta - Signal

#BTCUSDT - UniverseMetta - Signal H4 - Formation of the 3rd wave from the lower border of the channel. Stop behind the minimum of the 1st wave. Entry: 115776.79 TP: 120784.05 - 125355.20 - 130353.86 - 134629.03 Stop: 111641.76

Trade-U-Metta

BTCUSDT - UniverseMetta - Signal

#BTCUSDT - UniverseMetta - Signal D1 - Formation of potential 3rd wave from the level in continuation of the 5th wave on W1. Stop behind the maximum of the 2nd wave. Entry: 119823.70 TP: 123162.36 - 128518.11 - 131787.21 - 137038.63 Stop: 116693.72

Trade-U-Metta

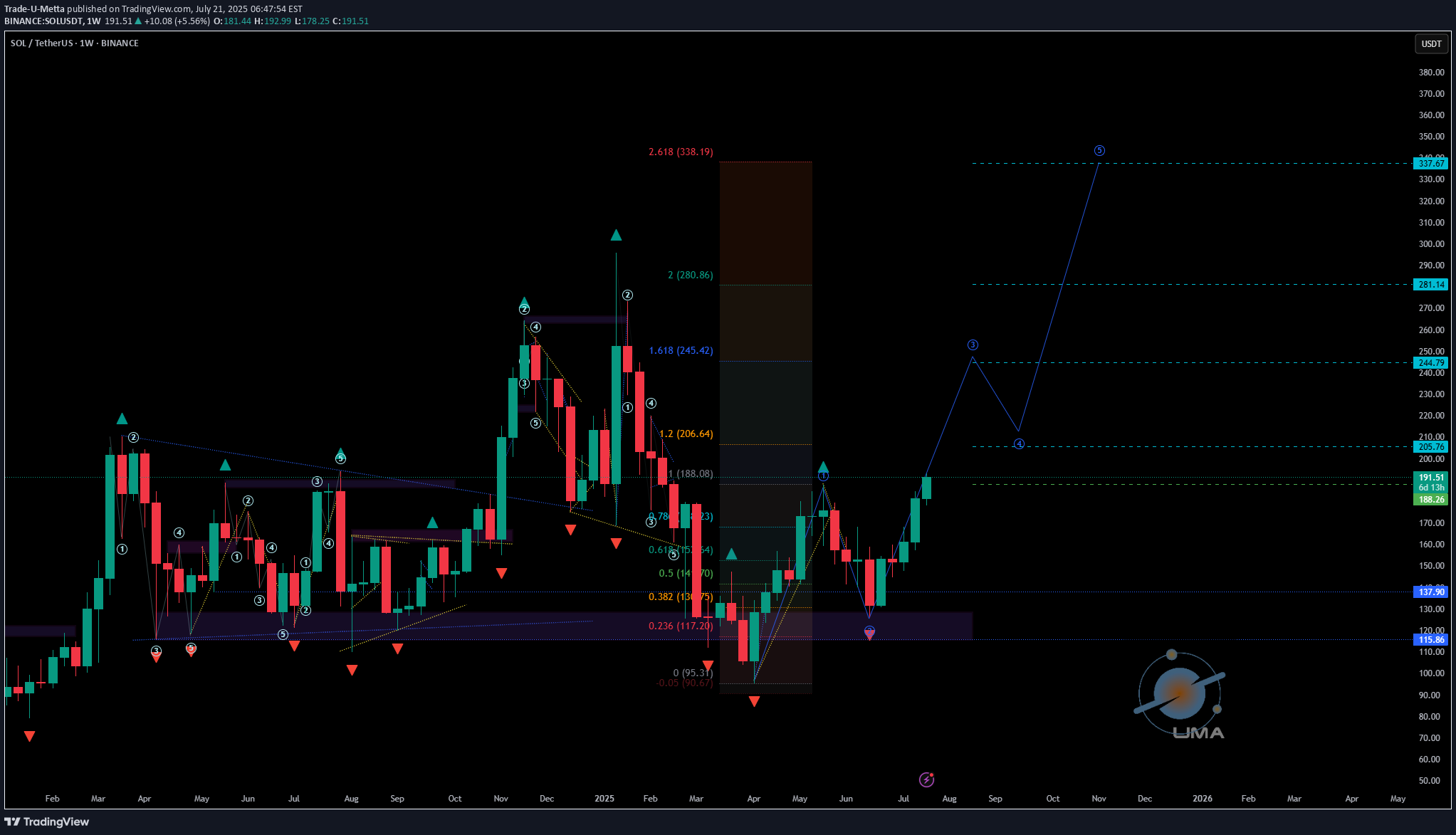

SOLUSDT - UniverseMetta - Analysis

#SOLUSDT - UniverseMetta - Analysis The price on W1 formed a double 3-wave structure. It is also worth considering the previous development for 2-3 months to reach all levels and update ATH. Against the background of the growth of all other assets, and the possibility of the beginning of the altseason, this pattern can be considered for a set of positions in the portfolio. The nearest targets will be at the level of 206 - 245. When the entire structure is realized, we can see a price of 338 per asset. Observe the risks. Target: 206 - 338

Trade-U-Metta

BTCUSDT - UniverseMetta - Signal

#BTCUSDT - UniverseMetta - Signal H4 - Formation of a triangular formation in continuation of the trend, for a more confident entry you can wait for a retest and formation of the 3rd wave. Stop behind the minimum of the 1st wave. Entry: 119294.13 TP: 123240.75 - 127823.91 - 130624.74 - 135239.73 Stop: 115824.93

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.