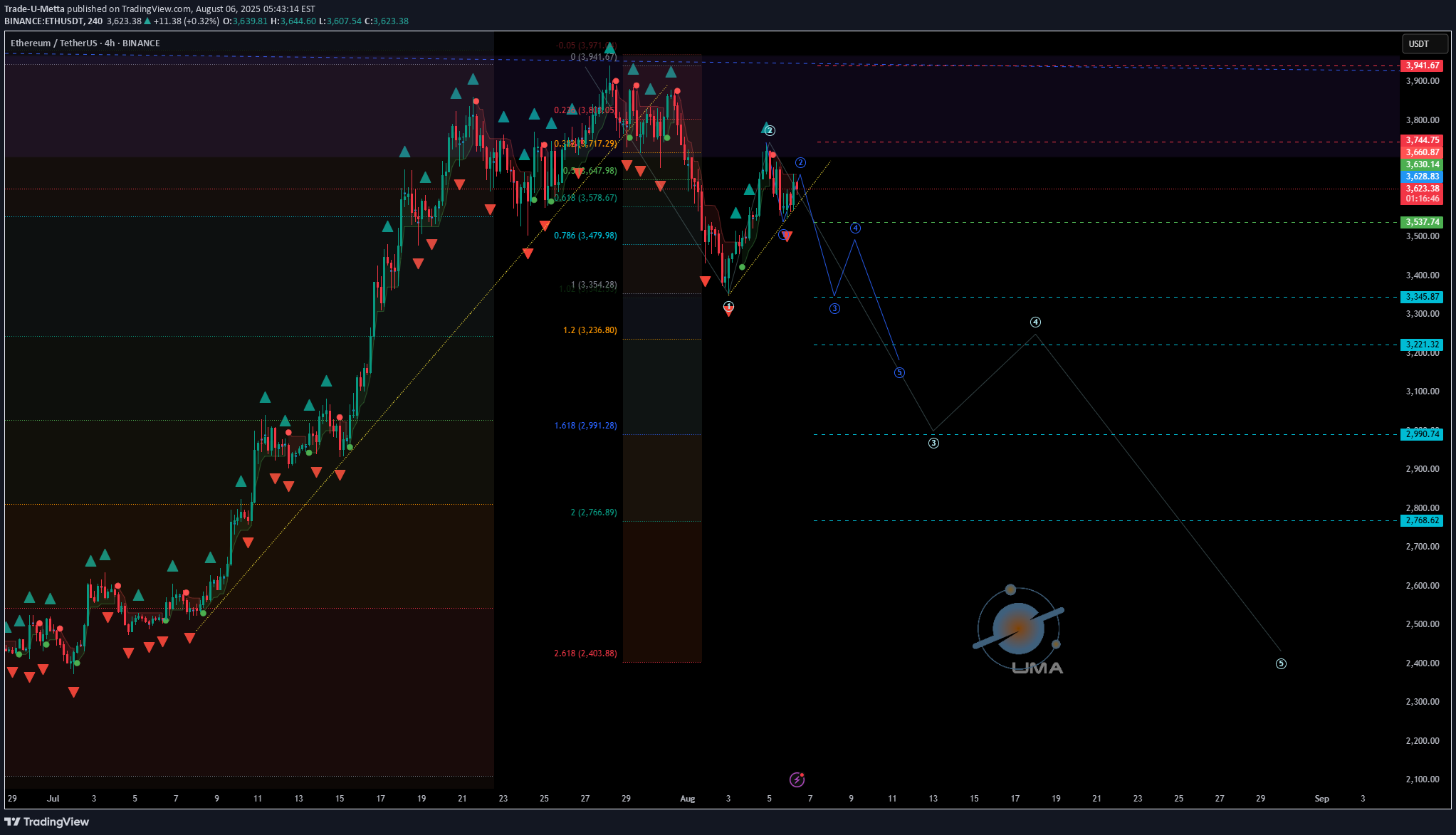

Technical analysis by Trade-U-Metta about Symbol ETH: Sell recommendation (8/6/2025)

Trade-U-Metta

ETHUSDT - UniverseMetta - Analysis

#ETHUSDT - UniverseMetta - Analysis Potential reversal & correction setup in progress 📆 W1 – Weekly Timeframe 🔹 Price is testing a major monthly resistance zone, from which price has previously rejected toward the lower edge of a large triangle structure 🔹 According to the 3-wave structure, ETH has reached 161% of Wave 1 and closed above the 200% Fibo level 🔹 If the price fails to make a new high this week, a top fractal may form — a possible signal for a medium-term correction 📉 D1 – Daily Timeframe 🔹 A double top pattern is forming, along with a potential retest of the trendline 🔹 If confirmed, this could trigger a 3-wave correction structure downward 🔹 A downward fractal is already printed — adding confluence to the bearish scenario 🎯 Correction targets: • $3,242 • $2,546 ⏳ H4 – 4H Timeframe 🔹 Current price action suggests a correction from the recent impulse 🔹 A 3rd wave may initiate upon trendline breakout 🔹 Entry confirmation may come from breakout + retest, or via confirmed double top structure 🔹 Stop should be placed above the high of Wave 1 (H4) 🎯 Trade Setup: Entry: 0.64930 TP: 0.65404 - 0.65700 - 0.66164 - 0.66676 Stop: 0.64482 ‼️ Risk should not exceed 1–3% of your portfolio This signal/idea is not financial advice 📌 Key Fundamental Triggers to Watch: 🔹 Federal Reserve expectations – a dovish shift could support ETH short-term, but failure to materialize may drive a pullback 🔹 ETH ETF news – updates on applications, approvals, and volume flows can significantly impact sentiment 🔹 Correlation with NASDAQ/S&P500 – weakness in equities could drag crypto lower 🔹 On-chain activity – declining gas usage or demand may indicate lower network utility and bearish pressure 🔹 Weekly overbought condition – many technical indicators (RSI, MACD) point to overextension