TopgOptions

@t_TopgOptions

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

TopgOptions

Bitcoin Could Fade Into Irrelevance in the Next Bear Market

If you haven`t sold BTC recently: Now you need to know that Bitcoin (BTC) has been trading in a corrective phase after failing to sustain above $100,000 earlier this year. Strategy (formerly MicroStrategy), led by Michael Saylor, holds over 671,000 BTC – acquired at an average cost basis of approximately $74,972 per BTC. The company's aggressive accumulation has been funded through a combination of convertible debt, equity issuance, and at-the-market offerings, creating significant leverage.While Saylor frames this as "Bitcoin yield," it amplifies downside risk. A sustained drop below the ~$75K average cost basis would flip unrealized gains into losses, potentially triggering margin pressures on debt covenants, forced dilution to raise capital, or – in a worst-case spiral – partial liquidations to service obligations. MSTR stock already trades as a highly correlated, leveraged proxy to Bitcoin (historical beta often 1.5x–2x). A BTC breakdown below $74K could compress MSTR's premium to NAV dramatically, sparking retail and institutional selling. This, in turn, would pressure Bitcoin further if Strategy is forced to slow purchases or (unlikely but possible in extreme scenarios) sell holdings. This setup creates a classic self-fulfilling prophecy: bearish sentiment drives price lower → crosses key psychological/technical level at $74K → leverage unwind in the largest corporate holder → accelerated selling → deeper correction. Technical Outlook: Path to Sub-$74KFrom a chart perspective: BTC has rejected the $100K–$126K highs and is forming lower highs. Key support cluster sits around $80K–$82K (prior resistance turned support). A break below $80K opens the door to $74K retest – aligning perfectly with Strategy's average cost. Further downside targets: $70K (38.2% Fibonacci retracement of the 2024–2025 rally) and the $62K–$72K zone, a major demand area from mid-2025 consolidation. Bear Case Target: Sub-$74K, potentially triggering the leverage feedback loop described above. Buy Area: If we see capitulation, the $62K–$72K zone represents strong historical support and a potential accumulation range for long-term holders. This area coincides with prior cycle highs and significant on-chain volume.

TopgOptions

ریزش سنگین انویدیا (NVDA) به ۱۷۰ دلار؟ خروج پولهای بزرگ و زنگ خطر حباب هوش مصنوعی

I f you haven`t bought NVDA before the previous earnings: Now you need to know that NVIDIA has dominated 2023–2025, becoming the face of the global AI boom. But the higher the climb, the harder the fall. While NVDA is still seen as “untouchable,” several major signals suggest the stock could revisit levels near $170 — a healthy correction of 10–15% from here. 1. Major Investors Are Exiting — SoftBank Dumped Everything SoftBank, one of Nvidia’s earliest and most influential institutional backers, sold its entire stake in late 2025, worth roughly $5.8 billion. Smart-money exits near all-time highs should never be ignored. SoftBank rarely sells unless it believes: - the sector is overheated - the valuation has run too far - risk/reward becomes asymmetric This mirrors their strategy in 2021–2022 when they unloaded overvalued tech before the correction. SoftBank’s full exit is a red flag for anyone ignoring the possibility of an AI bubble. 2. Michael Burry Bought Massive Puts — A Direct Bet Against the AI Mania Michael Burry — famous for predicting the 2008 crisis — has quietly increased his put positions on NVIDIA and other AI names. Why does this matter? Because Burry doesn’t short “normal” overvaluations. He shorts bubbles. His AI thesis: - expectations are unrealistic - revenue growth is priced as infinite - companies are spending billions on AI with no short-term monetization - chip demand could normalize faster than markets expect When a contrarian with Burry’s track record bets against a trend, it’s worth paying attention. 3. NVIDIA’s Valuation Is Stretched Even for a Hyper-Growth Company Even bulls agree: NVDA’s multiples are once again aggressively priced. Key issues: • Price-to-Sales historically elevated NVDA is trading at a P/S ratio that would be insane for any company approaching a $5 trillion market cap. • Revenue growth expectations assume perfect long-term AI adoption If AI monetization slows or plateaus even slightly, NVDA’s valuation collapses fast. 4. Are We in an AI Bubble? Many Indicators Say Yes Top analysts, academics, and even bullish investors admit: AI has bubble-like behavior. Evidence of a bubble: - Stock prices rising faster than actual earnings growth - Companies buying GPUs “because everyone else is doing it” - Zero clarity on monetization for many AI firms - AI startups valued at billions with no revenue - Media hype similar to 1999 dot-com sentiment Harvard Business Review, Wired, and Investopedia already discuss the “AI bubble thesis.” If AI expectations don’t materialize fast enough, NVDA becomes the single most vulnerable stock on the market.

TopgOptions

خرید آپشنهای اپل (AAPL) قبل از گزارش درآمد: استراتژی طلایی با قیمت $255!

If you haven`t bought the dip on AAPL: Now analyzing the options chain and the chart patterns of AAPL Apple prior to the earnings report this week, I would consider purchasing the 255usd strike price Calls with an expiration date of 2025-11-21, for a premium of approximately $18.65. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TopgOptions

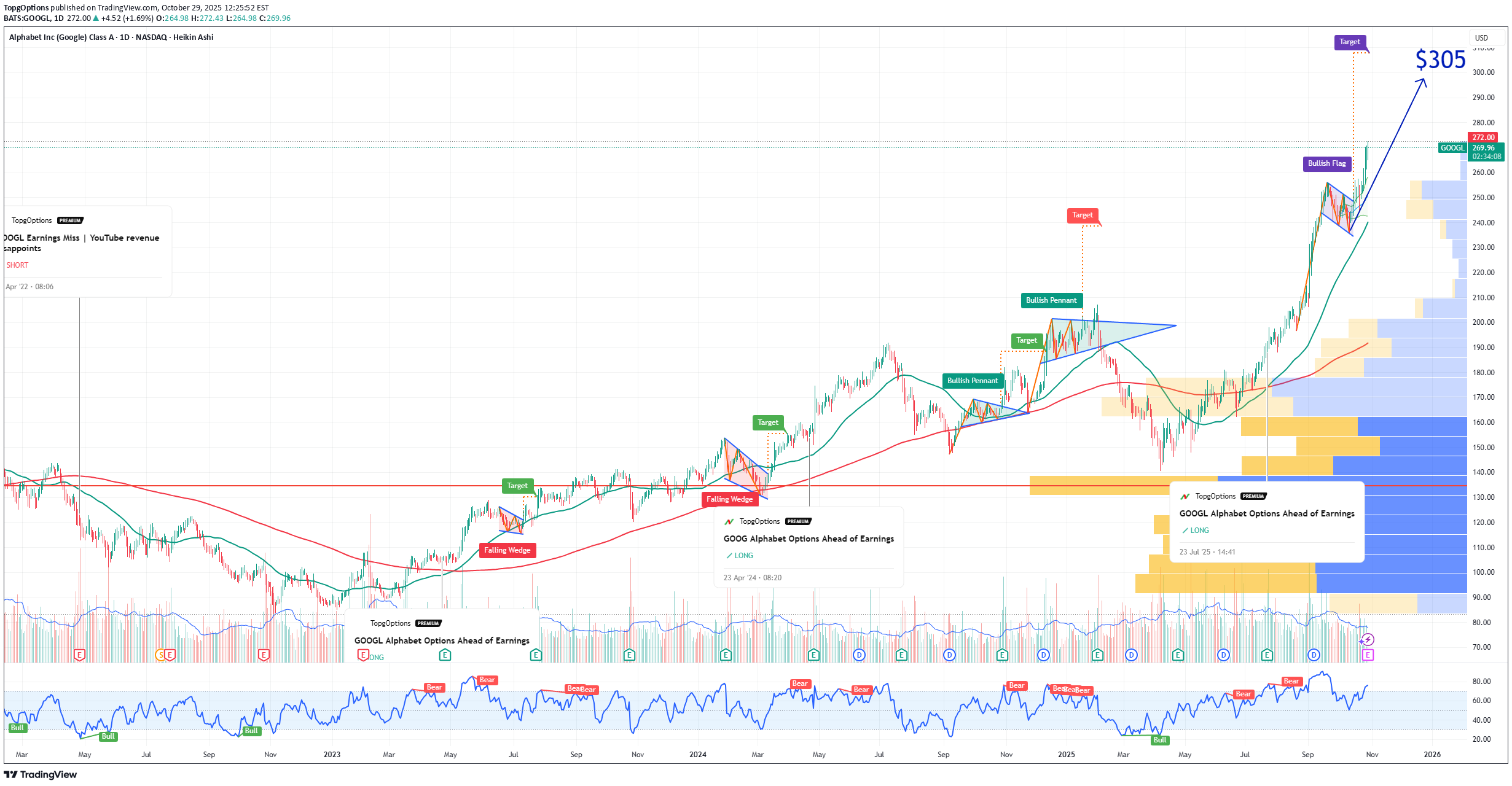

خرید کال اپشن GOOGL قبل از گزارش درآمد: استراتژی انفجاری با سوددهی زودهنگام!

If you haven`t bought GOOGL before the rally: Now analyzing the options chain and the chart patterns of GOOGL Alphabet prior to the earnings report this week, I would consider purchasing the 305usd strike price Calls with an expiration date of 2026-1-16, for a premium of approximately $8.30. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TopgOptions

انتخاب هوشمندانه آپشنهای متا: استراتژی خرید کال قبل از گزارش درآمد!

If you haven`t bought META before the rally: Now analyzing the options chain and the chart patterns of META Platforms prior to the earnings report this week, I would consider purchasing the 720usd strike price Calls with an expiration date of 2025-11-21, for a premium of approximately $51.75. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TopgOptions

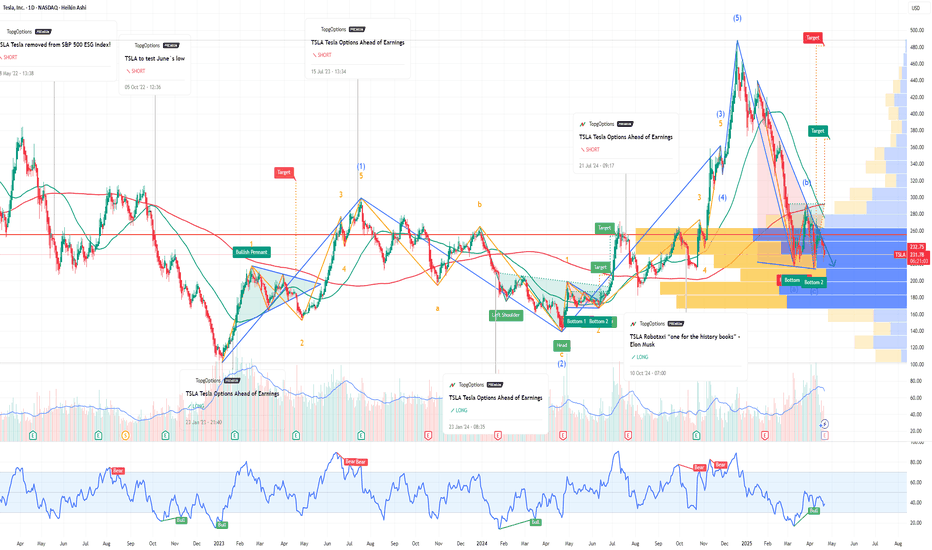

پیشبینی انفجاری تسلا قبل از گزارش درآمد: استراتژی خرید آپشن 800 دلاری!

If you haven`t bought the dip on TSLA: Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week, I would consider purchasing the 800usd strike price Calls with an expiration date of 2027-1-15, for a premium of approximately $40.30. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TopgOptions

سقوط دوم بیت کوین در راه است؟ هشدار بزرگ برای بازار ارز دیجیتال

If you haven`t bought BTC before the rally: The cryptocurrency market is still reeling from the brutal sell-off on Friday, October 10, 2025, triggered by U.S. President Donald Trump's announcement of 100% tariffs on Chinese imports. Bitcoin plummeted below $105,000, Ethereum dropped over 16% to under $3,700, and the broader market saw liquidations exceeding $19 billion—the largest single-day wipeout in crypto history, nine times bigger than February 2025's crash. While Monday and Tuesday brought some recovery, with Bitcoin climbing back above $115,000 and the total market cap topping $4 trillion, underlying issues like inflated trading volumes, massive altcoin losses, and a prominent whale re-entering a short position suggest this might just be a dead-cat bounce. This article explores why a second leg down could be imminent, incorporating technical analysis for TradingView users eyeing volatility plays. The Friday Flash Crash: A Perfect Storm Amplified by Fake Volumes The October 10 crash unfolded rapidly, with Bitcoin shedding nearly 10% in hours and over $200 billion erased from the market cap. But what made the drop so severe, especially for altcoins? A key culprit: fake trading volumes driven by wash trading. Wash trading, where traders buy and sell the same asset to themselves to inflate volumes, creates the illusion of liquidity and interest without real economic activity. Estimates suggest that up to 87-88% of crypto volumes are fake, often used in pump-and-dump schemes or to lure retail investors. In thin markets like crypto, these artificial volumes mask true liquidity. When real selling pressure hit—amplified by leveraged positions and the tariff news—exchanges like Binance saw cascading liquidations due to flawed margin systems. This "flash crash" wiped out $600–900 million in longs alone, but the fake volumes meant the market couldn't absorb the shock, leading to exaggerated drops. Analysts note that such illusions persist in 2025, with AI tools now exposing them, but regulators lag behind. If volumes remain overstated, any renewed catalyst could trigger another liquidity vacuum, setting up a second leg down. Altcoin Bloodbath: 50–90% Drops Expose Vulnerabilities While Bitcoin and Ethereum recovered somewhat, altcoins bore the brunt of the carnage. An index tracking altcoins (excluding BTC, ETH, and stablecoins) cratered about 33% in just 25 minutes, with some tokens plunging 50–90%. Tokens like Solana, XRP, and Dogecoin lost 20–60%, but lesser-known altcoins saw even steeper declines, highlighting the sector's over-leveraged and illiquid nature. This disproportionate pain stems from altcoins' reliance on hype and speculative inflows, often propped up by those same fake volumes. In a risk-off environment, capital flees to safer assets like Bitcoin, whose dominance spiked during the crash. Altseason indicators are now cooling (76–78 previously). Bitcoin dominance dropped below 59% post-crash. If earnings season in traditional markets reveals economic weakness, spilling over to crypto, altcoins could lead the next sell-off wave, potentially dropping another 20–50% if support levels break. The Whale Factor: $192M Profit, Then Re-Entry Signals Bearish Conviction Adding fuel to the fire is a mysterious crypto whale who timed the crash impeccably. Just 30 minutes before Trump's tariff announcement, this entity opened a massive short position on Bitcoin, pocketing $192 million in profits as the market tanked. Speculation abounds: Was it insider knowledge, or just savvy trading? Either way, the whale didn't stop there—they've re-entered with another short, increasing their position to $340 million, and even opened a fresh $163 million bearish bet. Other whales have followed suit, including: A Satoshi-era entity shorting $1.1 billion before the news An OG whale opening a $392 million short These moves suggest high conviction in further declines, possibly tied to ongoing trade tensions or macroeconomic risks. In a market where whales can move prices, this re-entry could catalyze the second leg, especially if it triggers more liquidations. My price target for Bitcoin is $95KPrice Target reached!

TopgOptions

Why ETH Ethereum Could Surpass BTC Bitcoin’s Market Cap

If you haven`t sold the previous top on ETH: Now why Ethereum Could Surpass Bitcoin’s Market Cap: 1. Ethereum’s Network Upgrades Drive Value Ethereum has undergone significant upgrades, most notably the Merge, transitioning the network from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This dramatically reduced ETH’s issuance rate and energy consumption, positioning Ethereum as a more sustainable and “deflationary” asset. With upcoming upgrades like Sharding, Ethereum is set to become faster, cheaper, and more scalable—critical factors for adoption in decentralized finance (DeFi) and Web3 applications. 2. DeFi and Smart Contract Dominance Ethereum hosts the majority of DeFi protocols, NFT marketplaces, and decentralized applications (dApps). The network effect is strong: developers and users are deeply entrenched in Ethereum, creating high demand for ETH for transaction fees (gas) and staking. As DeFi continues to grow, ETH’s utility and demand could rise exponentially, putting upward pressure on price. 3. Institutional Interest and Adoption Institutional interest in Ethereum has increased substantially. Products like ETH ETFs and staking services are attracting large-scale capital inflows. Unlike Bitcoin, which is often treated as digital gold, Ethereum has a dual narrative: store of value and programmable money. This unique proposition makes it appealing not only to investors but also to corporations exploring blockchain solutions. 4. Scarcity and Deflationary Pressure Post-Merge, Ethereum implemented EIP-1559, which burns a portion of transaction fees, effectively reducing ETH supply over time. During periods of high network activity, ETH becomes increasingly deflationary. This contrasts with Bitcoin, whose fixed supply doesn’t adjust dynamically to network usage, giving Ethereum a potential advantage in a high-demand scenario. 5. Macro Trends and Crypto Evolution As crypto matures, utility and adoption increasingly dictate valuation. Ethereum’s ecosystem—spanning DeFi, NFTs, DAOs, and enterprise solutions—is far more versatile than Bitcoin’s. This could make ETH the go-to platform for digital finance, giving it an edge in both market capitalization and long-term relevance.

TopgOptions

TSLA Tesla Options Ahead of Earnings

If you haven`t bought TSLA before the recent rally: Now analyzing the options chain and the chart patterns of LMT Lockheed Martin Corporation prior to the earnings report this week, I would consider purchasing the 230usd strike price Puts with an expiration date of 2025-4-25, for a premium of approximately $10.70. If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TopgOptions

SEI Poised for a Breakout After Bold 23andMe Acquisition Bid !

Sei (SEI), the innovative layer-1 blockchain designed for high-speed trading and decentralized finance (DeFi), is flashing strong bullish signals both fundamentally and technically. The recent news that the Sei Foundation is exploring the acquisition of 23andMe, the leading personal genomics company, has sparked excitement in the market. If successful, this strategic move could position Sei at the forefront of the multi-billion-dollar genomic data industry — combining blockchain’s security and transparency with the rapidly growing demand for data privacy.Why This Is Huge23andMe recently filed for Chapter 11 bankruptcy protection, opening the door for a potential buyout. The Sei Foundation’s plan to migrate genetic data onto the blockchain would give individuals direct control over their data, allowing them to decide how it’s used and even monetize it. This taps into a massive and underserved market where data security and privacy are becoming critical issues.Bullish Chart SetupFrom a technical perspective, Sei’s chart is showing signs of a major breakout:✅ Double Bottom: SEI has recently formed a clear double bottom pattern, signaling a strong reversal from recent lows. This is a classic bullish pattern that suggests the selling pressure has been exhausted and buyers are stepping in.✅ Falling Wedge: SEI is also breaking out of a falling wedge, a high-probability bullish formation. Falling wedges typically lead to strong upside moves as downward momentum fades and buying pressure builds up.✅ Volume Increasing: Recent spikes in volume confirm that smart money could be accumulating in anticipation of a breakout.Perfect Storm for a RallyWith a bullish technical setup aligning with a game-changing fundamental catalyst, Sei could be on the verge of a major breakout. A successful acquisition of 23andMe would not only give Sei real-world utility in the health data sector but also drive increased adoption and network activity. If SEI clears key resistance levels, this combination of technical strength and strategic growth could send the token to new highs.Sei isn’t just another DeFi project — it's positioning itself to be a leader at the intersection of blockchain, health data, and privacy. This could be the beginning of a powerful new trend for SEI. 🚀

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.