TheArabianWhale

@t_TheArabianWhale

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

TheArabianWhale

Market Update 📊: Bullish Crypto and Extremely Bullish ETHEthereum (ETH) is projected to reach $6,000 by the end of the year or possibly sooner.ETH ETF Trade:- ETFs have the potential to accumulate over 1 million ETH.- Currently, 3.3% of ETH’s circulating supply is held in investment vehicles globally.Trend Analysis:- ETH investment vehicle flows have been declining steadily since November 2021.- This decline mirrored Bitcoin (BTC) flows until the U.S. spot ETF hype began.- Investment flows have remained stagnant for the past 2.5 years.- A significant trend shift is anticipated following the launch of U.S. spot ETH ETFs.Forecast for U.S. Spot ETFs:- Expected Net Inflows: $4 billion in the first five months.- Basis of Estimate: - Relative global ETH AUM market share compared to BTC: 28%. - Comparison between CME’s ETH Open Interest (OI) and BTC: ETH currently at 23%. - Benchmarking against cumulative spot BTC ETF inflows of $13.8 billion.Projected Inflows:- Estimated Net ETH Inflows: $3.1 billion to $4.8 billion.- Equivalent to: 750,000 to 1,000,000 ETH.- Represents: 0.65-0.85% of ETH’s circulating supply.Market Dynamics and OutlookEstimated inflows of $4 billion to ETH and approximately $3 billion of sell-side pressure in BTC (due to Mt. Gox releases) favor ETH/BTC strength over the summer. While ETH/BTC has been on a linear downtrend for the past two years, the imminent positive catalyst for ETH and corresponding negative catalyst for BTC suggest a potential breakout.Periods of ETH outperformance tend to be short-lived but very strong. In 2021, ETH's significant outperformance against BTC occurred in a seven-week period from late March to mid-May. Given the current setup, ETH is positioned for summer strength. With the ETH/BTC ratio at 0.054, taking a long position on ETH versus BTC is considered advantageous.

TheArabianWhale

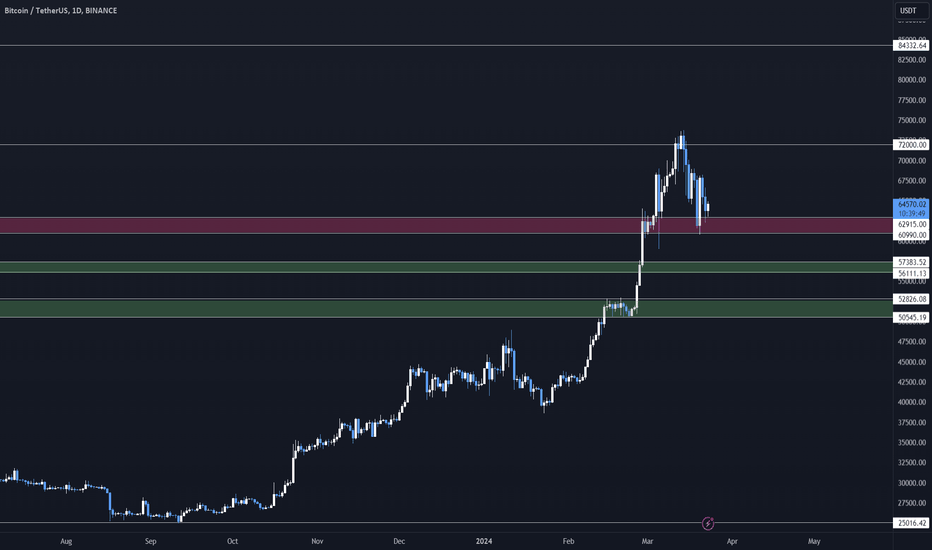

The market situation is straightforward: if we maintain levels above 60K, we're likely to see further upward movement. Conversely, if the market dips below 60K, we might test support at 58K, and holding above 54K indicates stability. Any drop below 54K could lead to a significant downturn, although such a scenario isn't anticipated in the near future.Overall, the market sentiment remains bullish, but there are some concerning signs, such as Genesis selling while BlackRock is not buying activity may not be sufficient to sustain prices.During bullish periods, it's advisable to focus on identifying opportunities for long positions rather than short ones.Quote of the day: "Profit isn't profit until it's realized."

TheArabianWhale

The current market is highly active and somewhat risky. Recently, there's been a spike of interest, with many individuals borrowing more money to invest in hopes that Bitcoin will reach its highest value ever, similar to its peak in 2021.However, it's crucial to consider the potential consequences if the market sentiment suddenly shifts. If everyone is betting on the price going up and it unexpectedly starts to drop, it could trigger a domino effect, squeezing the long leveraged personnel, which forces the position to be sold at a lower price leading to a rapid decline in prices. This pattern has occurred before with Bitcoin, where it experiences temporary dips before soaring to new highs. Therefore, it's wise to avoid borrowing excessive amounts of money for investment purposes.Despite the inherent risks, traders on the CME, remain optimistic about continuing profits. The prices for Options, which are essentially bets on Bitcoin's future price movements, have also risen, indicating widespread belief in Bitcoin's potential for success.Bitcoin's value is further boosted by investment funds that have been actively purchasing it. This is a big deal and shows that these funds play a big part in determining Bitcoin's price.Regarding Grayscale, although they've been selling some of their Bitcoin holdings to repay debts, it's not expected to have a substantial negative impact on the market. The proceeds from these sales are typically reinvested in Bitcoin, helping to maintain balance.In essence, the market is buzzing with activity, but it's also somewhat unpredictable, with many individuals banking on Bitcoin's rise. While significant investment moves are contributing to its upward momentum, it's essential to exercise caution, especially given the potential for significant price fluctuations. Avoiding excessive leverage is advisable to mitigate risks associated with borrowing for investments.

TheArabianWhale

Bitcoin futures trading on CME has been buzzing with activity, indicating a keen interest from institutional investors. Trading volume has hit a new high, with many traders betting that prices will rise, as seen from futures contract prices being higher than the spot price.Ethereum futures have also gained traction recently. They've become more popular compared to Bitcoin futures in recent weeks, with more people betting on Ethereum's price going up.Bitcoin miners are holding onto more of their bitcoins instead of selling them. They're doing this because they expect to earn less from mining new bitcoins after the next halving event. This usually leads to an increase in Bitcoin's price.Historically, Bitcoin's price tends to rise before a halving event and then stabilizes afterward. With the next halving expected soon, there's a possibility that prices might increase based on past patterns.Bitcoin ETFs have attracted significant investments, although the pace has slowed compared to the previous week.In summary, the current trends in cryptocurrency markets, especially for Bitcoin and Ethereum, indicate a growing interest and investment, particularly from institutional investors.TLDR:- Bitcoin is doing well.- Altcoins are a bit shaky, so be cautious if Bitcoin takes a dip.- Meme season could be a sign of a market peak, but this time might be different (though it's doubtful).- Will Bitcoin break its all-time high? YES.- We're still early in the bull cycle, which means prices could go higher.

TheArabianWhale

📈 Market Update🚀Flows to Bitcoin ETFs have remained massive over the past week, with Bitcoin ETPs globally witnessing a net inflow of 83,500 BTC in the last 30 days. This inflow is equivalent to six months of miner rewards following the upcoming April halving. CME open interest is nearing an all-time high, reflecting a positive market sentiment as annualized futures premiums hold strong at 15%. ETH maintains a slight discount to BTC.BTC's reaction to the CPI surprise was notably strong compared to its typical response to macroeconomic data in the second half of 2023. This suggests that macro factors could become relevant price drivers once again, although ETF flows continue to dominate the market.Despite some red flags such as significant miner outflows to OTCs and indications of high leverage in offshore markets which is a recipe for a typical sell-off, there's no indication of a market "flush" yet. Bitfinex has a significant sell wall around 53-54K, constituting a high timeframe resistance from a monthly level.The risk-reward ratio for ETH relative to BTC appears favorable due to the upcoming spot ETF in May, which marks the final deadline, along with the Ethereum Dencun upgrade next month. Moreover, Celsius is nearing the unwinding of their ETH position.**TL;DR:**- Neutral view with a bias towards long positions.- Super bullish outlook for ETH.- Red flag: Strong ask supply from Bitfinex and miner outflows.Stay tuned for more updates as the market evolves! 📊💡 #MarketUpdate #Bitcoin #Ethereum #CryptoAnalysis #ETFs #BTC #ETH

TheArabianWhale

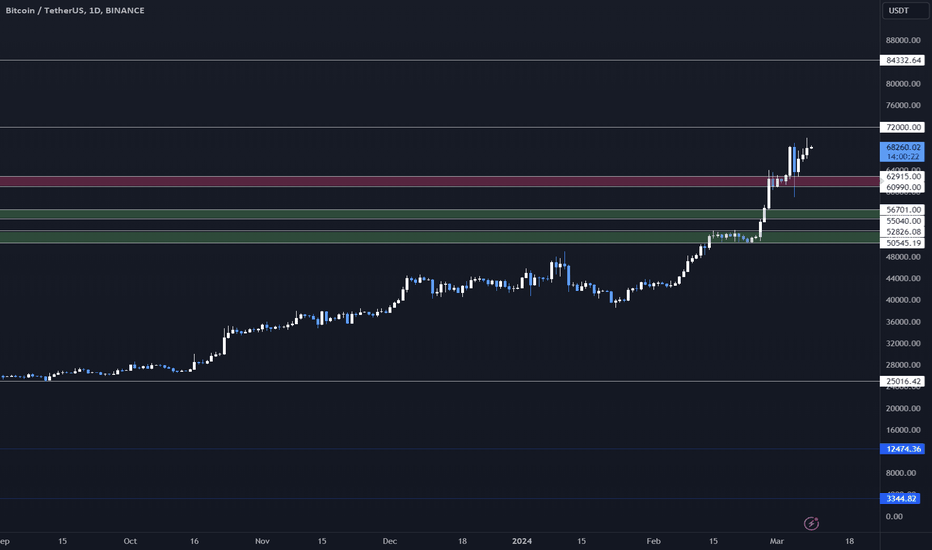

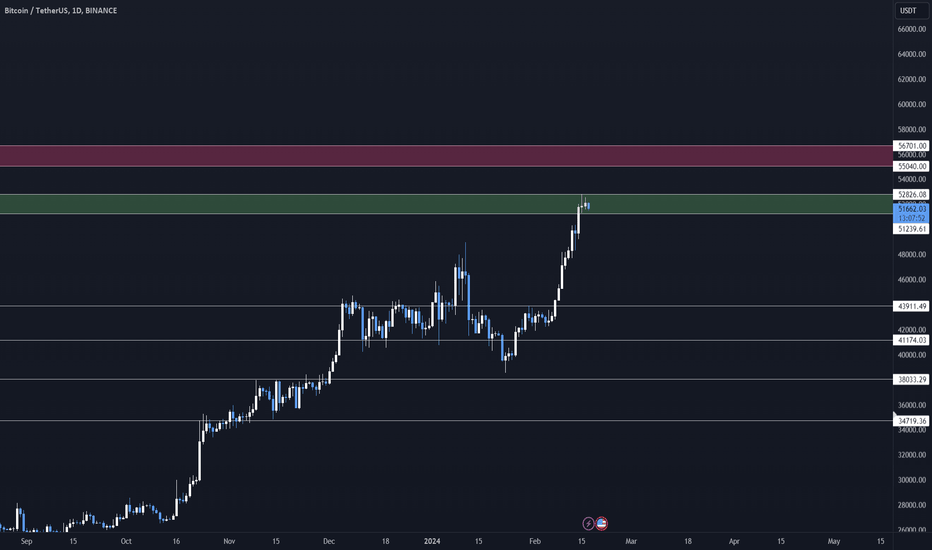

📈 Market Update: 17th February 🌐The biggest resistance in the current market is around $59,000. While there may be some debate about resistance at $52,000, my focus lies on the major changes, and I don't foresee significant developments in that range. The key weekly level to monitor is between $41,000 and $44,000; staying above this range signifies a robust upward trend.A drop below the $41,000-$44,000 range could signal significant negative momentum. However, if the market maintains its current stance, it remains strong on a weekly basis. The most favorable opportunities for significant price movement lie near the $60,000 resistance or the $30,000 support levels. While there might be some action around the $40,000 range, its significance is expected to be relatively lower.This week, we've witnessed an extraordinary addition of over $2.2 billion to the market, indicating a removal of 43,000 Bitcoins from circulation in just five days. To put this in meaningful words, only 900 Bitcoins are currently mined each day, with this number set to halve to 450 in less than two months. Since the start of ETF trading, there's been a net inflow of $4.9 billion.In terms of price action, stabilization is observed presently, which could be a positive sign. We may anticipate a rise to $55,000 next week, followed by another period of stabilization.TLDR: Larry Fink's approach is like Michael Saylor but on steroids, with consistent buying and increasing capital, coupled with the impending halving. This scenario translates to fewer dips and more upside potential, making it challenging to find substantial downturns. While dips are expected, they are not anticipated to be significant. Being bullish in this market seems more favorable than adopting a bearish stance—it's a BULL MARKET. 🚀💰 #MarketUpdate #Bitcoin #BullMarket #CryptoAnalysis #ETFTrading

TheArabianWhale

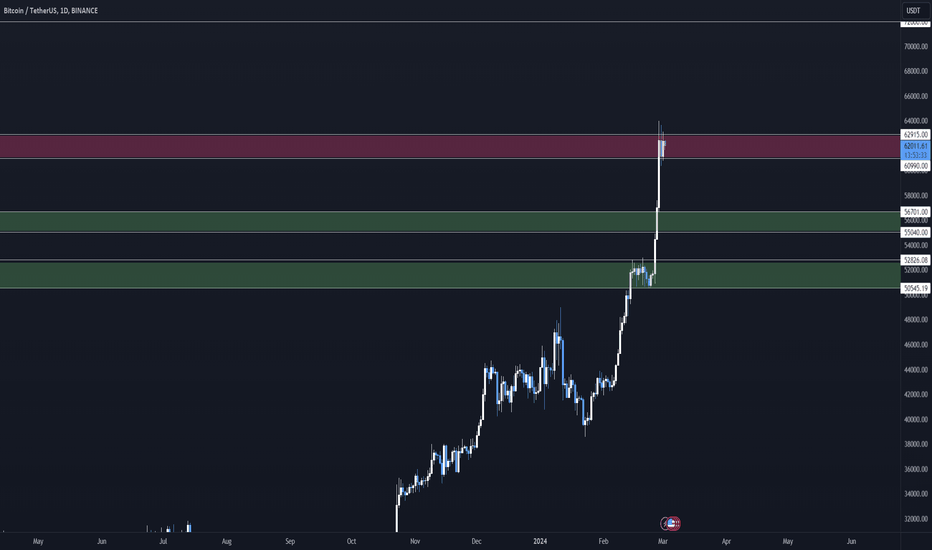

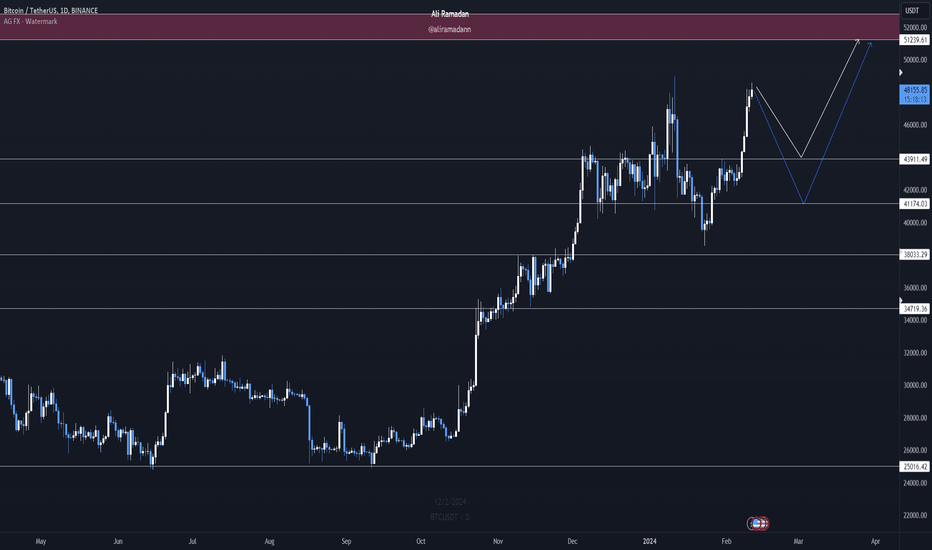

After a period of minimal volatility, Bitcoin is currently trading above its recent highs on both the weekly and daily charts. It has surpassed the $43,800 resistance level on the weekly chart, pending confirmation at the close of the week. Similarly, on the daily chart, it has breached the $44,200 resistance level.If these breakout attempts hold until the weekly close, it would indicate a positive trend. The market has undergone a period of stabilization, absorbing significant sell-offs from GBTC, resulting in a notable breakout from an eight-week range. This development provides a strong case for the continuation of the upward trend.Given the prolonged consolidation period and the presence of long wicks at both ends of the range, the most prudent approach appears to be waiting for a break in the weekly consolidation. This cautious strategy aims to capitalize on breakout momentum. Historically, low volatility periods have preceded higher volatility phases, suggesting potential for future movements.However, if the breakout fails or if the market's range collapses, it could signal unpredictable conditions. In such a scenario, a breakdown from the eight-week range would indicate bearish tendencies, potentially leading to a pullback to deeper support levels. In summary, the outlook remains favorable unless the breakout attempt fails, prompting a reassessment of the market's direction.

TheArabianWhale

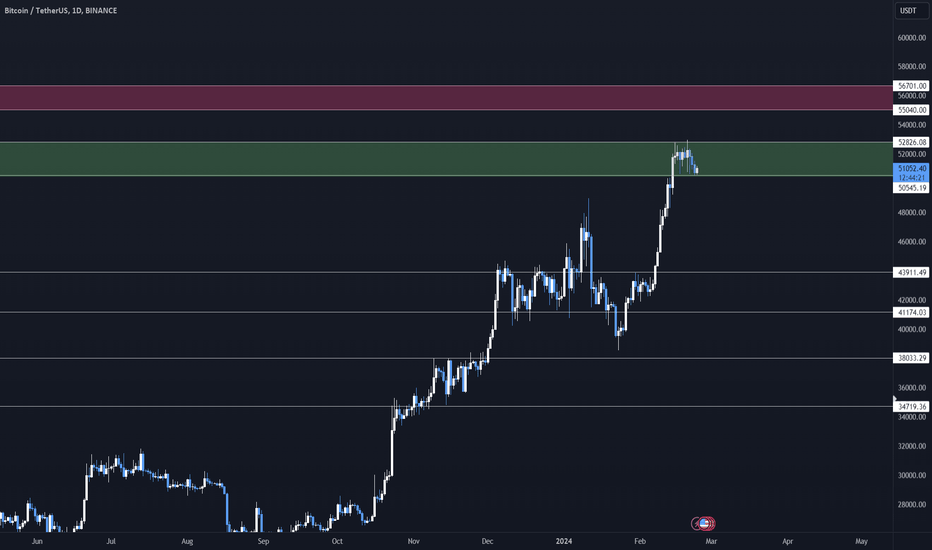

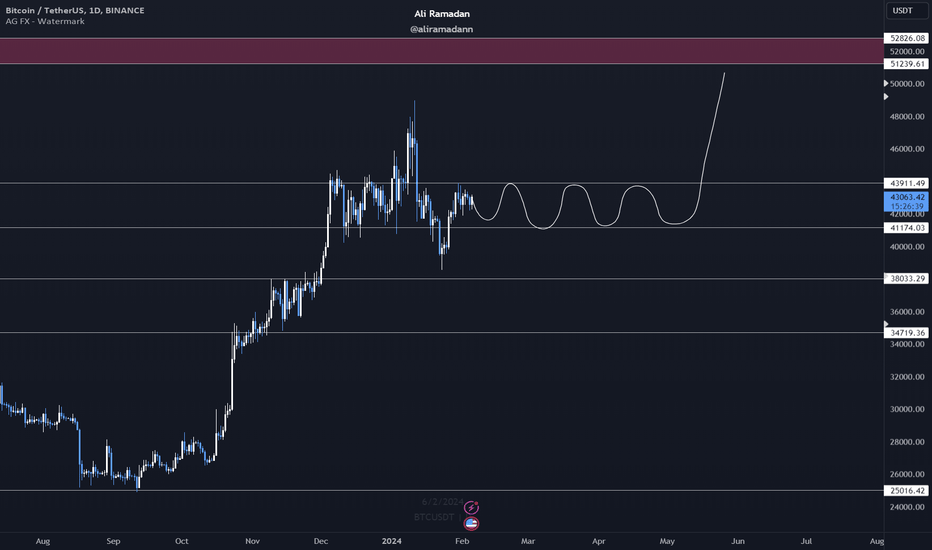

In the latest analysis post, I've closely examined the performance of Grayscale Bitcoin Trust (GBTC) with a particular focus on recent liquidity movements. Over the past week, spanning five trading sessions, a noticeable deceleration in the rate of daily outflows from the trust has been observed. Specifically, the average daily outflow rate has contracted by +20%, indicating a substantial reduction in the volume of withdrawals.Since its inception, Grayscale's Bitcoin exposure has significantly diminished, registering a reduction of 127,000 BTC, equivalent to a 20.5% decrease in its holdings. This contraction can be attributed to various factors, including the liquidation of positions by discount buyers, the unwinding of assets by the FTX estate, and a notable shift by investors towards more cost-effective ETF options available in the market.Regarding Bitcoin's market direction, my analysis suggests a period of consolidation before any potential upward momentum. Currently, there are no discernible indicators hinting at an imminent downturn in Bitcoin's value; the market conditions appear stable and ready to grow. This stability holds significance for the crypto market, as historical patterns indicate that an increase in Bitcoin's price often precedes similar uptrends across the broader altcoin market. In essence, when Bitcoin's price rises, it tends to have a ripple effect, elevating the value of other coins.The intricate interplay between Bitcoin's liquidity movements and its price dynamics, coupled with the subsequent impact on the altcoin market, underscores the complexity of the cryptocurrency investment landscape. Having a long exposure in the consolidation range is considered a favorable entry point, especially for portfolios without existing long exposure.

TheArabianWhale

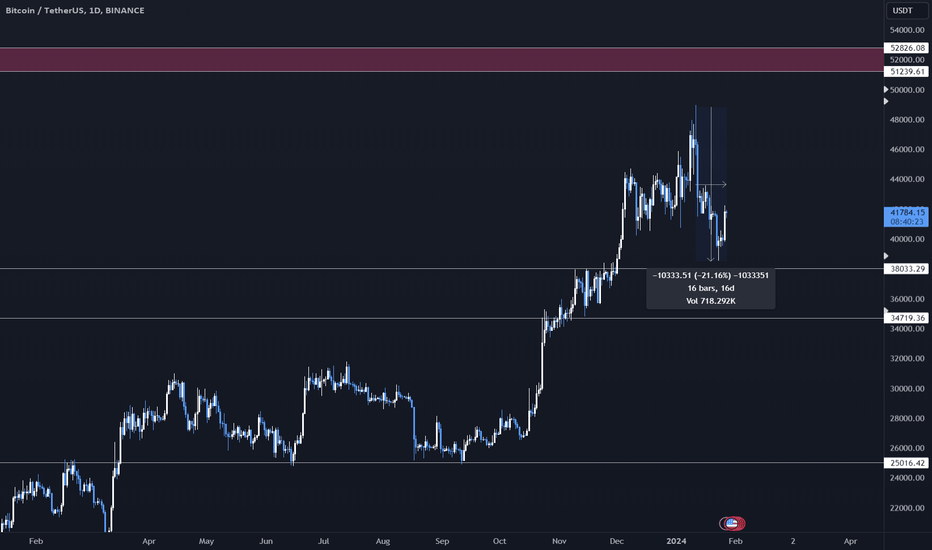

Bitcoin has recently exited its ETF trading range after five weeks of consolidation, experiencing a downward shift. The current focus of the market is primarily on the movements of Grayscale Bitcoin Trust (GBTC), creating a complex scenario.A notable aspect is the lag in the impact of Grayscale's Bitcoin outflows moving to Coinbase. Additionally, not all outflows represent redemptions; some are transfers to more cost-effective ETF providers. This, coupled with the reduction of long positions on the CME, complicates the situation by increasing selling pressure.Reports suggest that significant selling pressure originated from the FTX estate liquidating its GBTC holdings. If this results in a decrease in outflows, particularly direct redemptions from Grayscale to other ETFs, there might be a reduction in selling pressure. Traders are actively monitoring signs of slowing outflows or selling, as they could indicate an opportunity for a rebound to the mean.Looking at the broader perspective, ETFs have seen notable volume and inflows. However, the market price has been negatively affected by Grayscale's selling activities and the risk reduction from pre-ETF long positions, along with some liquidations. Once these temporary sources of supply diminish, the market is expected to show some improvement.From a technical analysis standpoint, the weekly trading range has broken down, and there's a short-term downtrend on the daily chart. The immediate support level is around $38,000, with more significant levels ranging from $32,000 to $35,000. Signs of market strength, aside from flow considerations, would include reclaiming the $41,000 breakdown level, or more conservatively, a rise above the previous range high of $44,000.Despite the current challenges, the overall picture suggests that we are still in a bull market. The factors contributing to a strong year for crypto include the upcoming halving, the introduction of the Spot ETF, and a general risk-on sentiment. As expressed by Zhusu, "Bears will build and pay for the buy walls of the future."

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.