TheAlchemist888

@t_TheAlchemist888

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

TheAlchemist888

ETHUSDT - Multi-year Symmetrical Triangle

ETH has formed a massive symmetrical triangle since the 2021 top (~$4,800). This triangle has been tightening since 2022 with: - Lower highs from $4,800 → ~$4,000 - Higher lows from ~$850 → $1,370 → $1,850+ We now close to the apex, meaning a major breakout or breakdown is imminent in the coming weeks/months. Price Action ETH is pressing against the upper resistance of the triangle (~$3,850–3,950). A monthly close above $4,000 would be the first breakout in over 2 years. Volume Volume has decreased over time, typical for a symmetrical triangle. We are looking for volume increase on breakout to confirm it’s on the right track. Momentum (Laguerre RSI: 0.67) Momentum is rising, supportive of a bullish breakout. RSI is not yet overbought, so there’s room for continuation. Scenarios Bullish Breakout Scenario: Trigger: Monthly close above $4,000–4,200 Target: ~$7,000–7,500 Timeline: Could play out over 3–6 months Bearish Breakdown Scenario Trigger: Monthly close below $2,500 Target Zone: $1,850 → $1,300 (last major supports) Would invalidate the higher low structure I am bullish but it is hard to not to be cautious given its crypto and this is a pretty tough resistance. Do your own research and make responsible decisions all. Peace out.We are breaking out!!!

TheAlchemist888

BTC eyeing for higher

Looking at the weekly chart. If the price manages to break above the current resistance around 109k, we could see the next leg up all the way to the major resistance of the trend which is around 180k. Close below 85-86k is dangerous. So we continue to asses the chart as it goes along.

TheAlchemist888

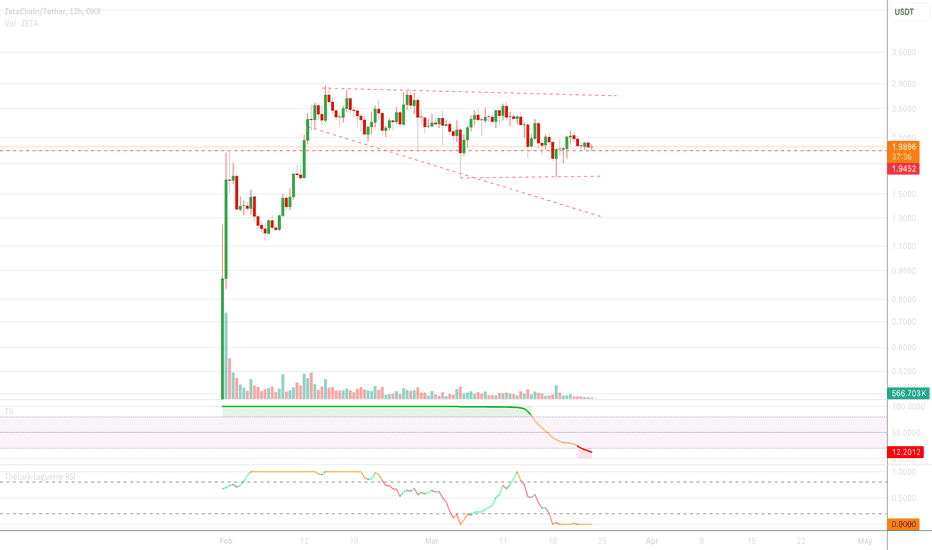

Z for ZETA - Breakout - Reversal

Ascending Triangle, bottomed out and reversal in motion of downtrend breakout. The chart is pretty self explanatory. Careful with risk management.After the breakout, the price retested the triangle and found support 2 times. Now there is only the major horizontal resistance left to start its move towards the target.Zeta keeps on disappointing. I am guessing this is something to do with the unlock schedule of the token vesting. I probably wont be buying anymore vested coins as they tend the get heavy selling pressure as we experienced here with Zeta. Narrative is good, brand is great, chart looks great, did its retest even after breakout but kept on getting sold. Not a good look.

TheAlchemist888

PHA - Under the radar potential

The good looking chart shows us breakout and retest confirmation on the weekly very clearly. This is an AI focused coin PHA. I have followed their recent updates and seems like they have a very unique business model when it comes to utilizing AI agents. I think the coin has a good use case and a good inflation model to be sustainable. I will hop on this one. Lets ride the AI train. Let me know of your thoughts.Massive pump arrived, a bit late but better then never. Sold position fully to find other opportunities.

TheAlchemist888

Zeta - New kid on the block - Broadening Wedge (Descending)

Caught my attention with OKX jumpstart and the moves they have made after such as quickly listing on Coinbase (no announcement?), Binance futures (no spot?) and more others. Their listing strategy is different to other projects in the market and its refreshing to see. Has cool tech, cross chain interoperability is the only way for the future, and these guys do it natively. Tested out the tech myself with some of their ecosystem partners (Can be found on Zeta Hub), works without a hitch so far. On the chart, I see a descending broadening wedge with a potential double bottom. Please correct me if you think I am wrong. This is usually a bullish formation. However, of course this is a super new coin, they are generally much more unpredictable. Currently sitting at 450-500m USD Market Cap, I believe with its cool tech, good design, good communication strategy; we should see Zeta chain in top 50 projects on CMC. That would be 5x from here. Do your own research please, this analysis is purely for my own records, not to be taken as financial advice.Still in range. Touched the support for the third time and bounced. Keep following for a breakout. If closes below support, I will take a stop loss.I got stopped out below the support but re-entered again. Realizing my first broadening wedge was pretty much on point then I got sidetracked by the horizontal support that was building. This time it should work.Good bounce, help up pretty well even after the war news. I am in for the long haul for this one.Holding. Keep on following.The market is a bit shaky but Zeta is doing wonders with the wedge. If it breaks out, I will be very happy. And you should too =))

TheAlchemist888

AVAX short term triangle - long opportunity

A short term long opportunity seems to be in the books. Invalidation under the support trend.Invalidation occured. Stop loss.

TheAlchemist888

OKB looking bullish

Everything about OKB is looking bullish. Keeps on forming a bullish pennant recently. Also the OKX company decided to launch their own blockchain with OKB being used for gas. I expect them to come up with ground breaking products to amplify their new blockchain. They also keep on burning OKB, so far 70m has been burned. If OKX is to compete with Binance, they will need to step up their game and their market cap. I think we could easily see 3-5x from OKB in the next year or so. Please let me know if you agree or disagree. Lets go!This is quiet ridiculous. Dissapointing to see such an illiquid coin for a "top 3" crypto exchange. Stopped out, probably hunted. Bitter loss but will look for better opportunities.

TheAlchemist888

LTCUSD - Huge Long Opportunity

This is a pretty straight-forward chart, LTC seems to have bottomed and sitting on a 5 years long support. LTC hasnt been talked about much lately but it seems to be actually still being used for payments and more than we all think; according to a report by Bitpay, LTC was the most used cryptocurrency to make payments on Bitpay, with 34% of the payments being done through them, and apperently it wasnt the first time. The second crypto is Bitcoin, if you were wondering. Lets look at some data; - There are 7.8m LTC addresses with a balance. - approx. 800k daily active addresses. - On December 18 2023, there was an ATH of 980k txs and averaged a 700k txs per day for over a week. Looking at the previous ATHs, there was always a surge in price during these times. The above data is super bullish for a coin that only has 4.8bn market cap with incredible tract record and traction. Considering there is no centralised management for this coin, just like BTC, I wouldn't rule out a surprise ETF application for LTC as well, of course after BTC ETF narrative. The fundamentals are just right, the chart looks great. Worth taking a risk here. Let me know if you agree or disagree with this idea in the comments. I would love to see some other ideas that prove or disprove this analysis.Come on LTC, show us the money =))LTC should be popping soon. Show us the money! =)Finally broke out of the down-trend and hit a major horizontal resistance, I expect it to find support above the down-trend line and continue its movement.388 is the ultimate target. Lets ride this bull!

TheAlchemist888

Avax Bullish pennant

Trying out this new chart patterns indicator, making our life much easier. Seems like it caught a pretty accurate bullish pennant on the 12h chart and also showing the target. Technical indicators also support bullish momentum. Lets go AVAX!Trade active: Happy to take profits here and just leave a smaller percentage to keep riding this bull.

TheAlchemist888

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.