Strateg_

@t_Strateg_

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Strateg_

رشد فصلی ارزها: بیت کوین به کجا برمیگردد؟ (تحلیل بازار)

To date, we have reached another bifurcation point in the market and it's time for another review. So far, there is a share of positivity in the market situation. As I wrote earlier, there is strong medium-term support for BTC in the 85-90k zone, from which a rollback is likely. Unfortunately, last month we broke through the 85k level, which is a signal for a possible test of 75k in the spring. However, the probability of a rollback from 85k to 90-100 still prevails. The broadcast opened the month ambiguously. According to Asian time, the opening is in the negative zone below 3000, higher in the neutral zone at GMT. I think the market will move this month based on the bullish BTC signal, and the coins will continue to move in different directions. The seasonal growth period in the first half of December is also a positive signal. Once again, I would like to draw attention to the background trigger used by the United States to manipulate the market - brent oil. At the last bifurcation point, prices still collapsed, despite the positive data on US stocks, to which ETH immediately reacted with a consolidation below 3k, as I warned in the review. The current monthly candle opened above the interim support of $ 62.5, against which there is a signal for growth in the first half of the month at least. As a result, we have signals for new growth waves for individual altcoins that have reached supports and have high growth goals, as part of seasonal growth, attempts to rollback BTC with oil and rollback according to the annual schedule. However, most of the alcoins, especially those with high capitalization or upcoming aggressive issuance, will not have time to show significant growth in this short period and will continue the medium-term bearish trend. Be careful with new purchases in the next couple of weeks. Today - tomorrow is the time when coins draw a shadow down the new monthly candle, but starting tomorrow evening or Wednesday, the probability of a reversal for individual coins will increase. If positive oil data is released in the middle of the week, then the growth of the crypt is likely to accelerate steadily by the end of the week, with a continuation in the next weekly candle. Next, the opening zone of the second half of the month will be of great importance. For altcoins, in the event of a reversal attempt, the minimum target will be to overshoot the last monthly candle. For work today, I am considering the TURTLE NTRN ENSO VIC MITO BMT HOOK first of all. These tools were recently listed on binance, which reduces the threat of delisting hanging over projects from 20-22. The issue of these instruments is also smooth, which reduces the likelihood of further large drawdowns. Given today's circulating supply, these instruments are already in an oversold position and the likelihood of a reversal to growth at the slightest provocation from the market prevails. They also previously provided strong technical signals for growth up to 300%+, which will be worked out in the medium term. Secondly, I am considering CHESS UTK COS DATA QUICK FIO for scalping, which can give new growth waves of up to 40-50% at least, but I recommend using a smaller position size for them. CHESS has been assigned the monitoring tag, but there are strong technical signals for a 0.1 retest, which is why a large exit pump is likely. After that, I will no longer consider using the token.

Strateg_

BMT: راز رشد 400 درصدی و تحلیل تکنیکال کلیدی قیمت!

In this review, I will consider in detail the BMT, which I previously took into account. First of all, it is worth noting the issue of this token. At the moment, 50% of tokens have already been unlocked and further issuance is slowing down, which will not put significant pressure on the price. For the next year, the 0.0250 level will remain the main support from which attempts will be made to gain a foothold above 0.05. A very important signal is the opening of the half-year above 0.125, which may lead to a sharp reversal of the half-year candle up to this level. If low volatility persists, the range of 0.100-125 will remain a medium-term target for retest and will be worked out, but with a possible pullback. On a smaller scale, the second half of the quarter opened above 0.0250, which is a signal for a test of 0.050-75. As a result, there is a fairly high probability of an attempt to close the current monthly candle above 0.05, with the trend continuing in the new month. After a local break in the 0.075-90 region, there is a high probability of a rollback to a 0.05 retest followed by an attempt to resume growth. TURTLE MITO VIC NTRN ENSO CHESS HOOK has a similar growth potential today.

Strateg_

افشای پتانسیل انفجاری NTRN: سود 200 درصدی در انتظار است!

I hired NTRN today. For this token, the second half of the quarter opened above the 0.035 support, which gives a clear signal for growth. The first large investments have been made in recent days, but a stable trend can be expected by the end of the year with an attempt to consolidate in the range of 0.0750-1000. The main resistance is the 0.050-55 range. So far, it has not been taken against the background of a bearish trend that has gained a foothold on the indicators. Starting next week, the indicators will allow stable growth. If a new monthly candle opens above 0.05, further purchases will not be long in coming. The token has fallen to an extremely oversold position due to binance's speculation with the issue data. The actual number of tokens in circulation is still significantly lower, which gives great growth potential. I'm also considering TURTLE CHESS HOOK VIC BMT MITO for work.

Strateg_

فرصتهای انفجاری رشد کریپتو در پایان سال: منتظر چه اتفاقی باشیم؟

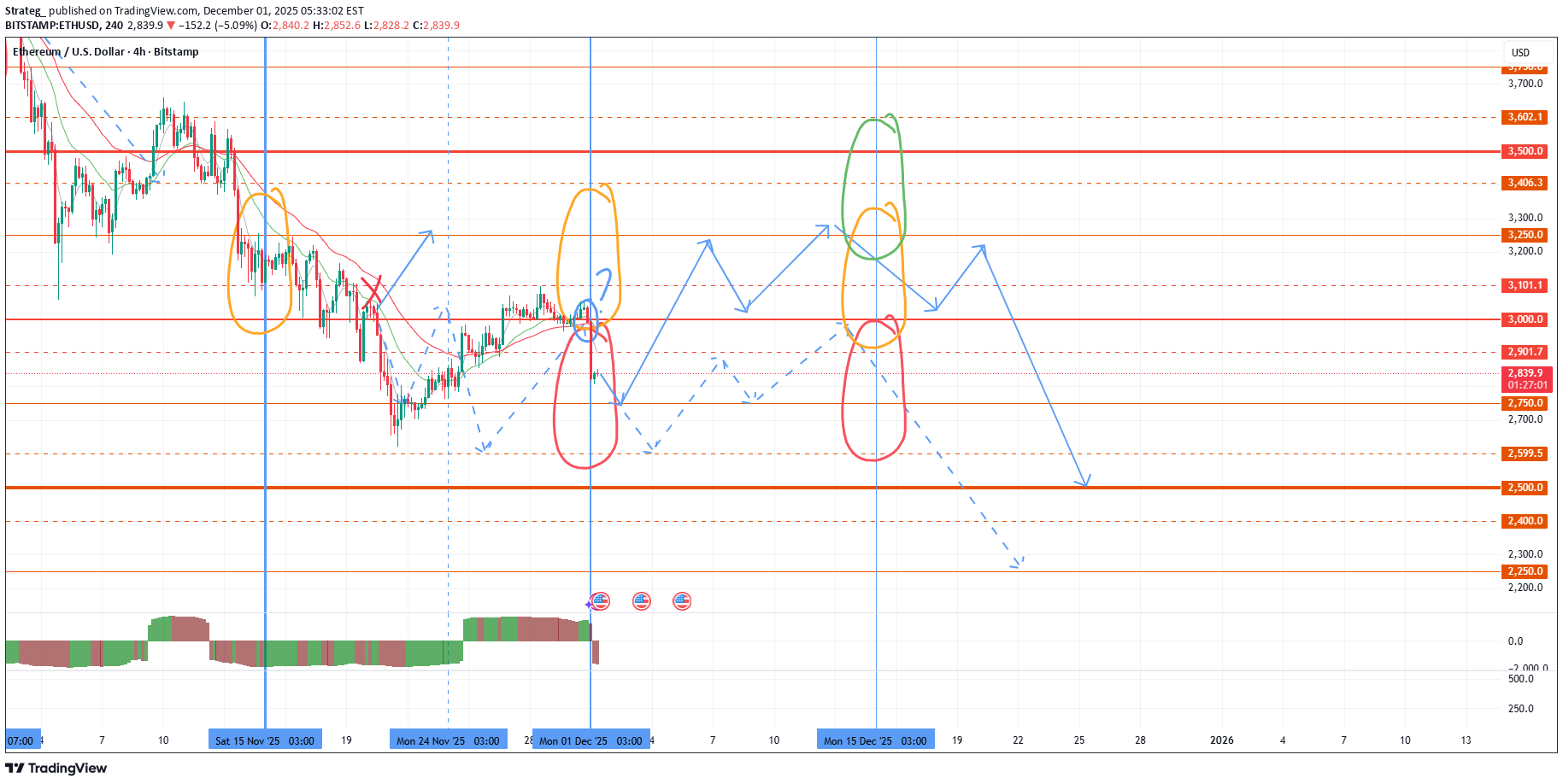

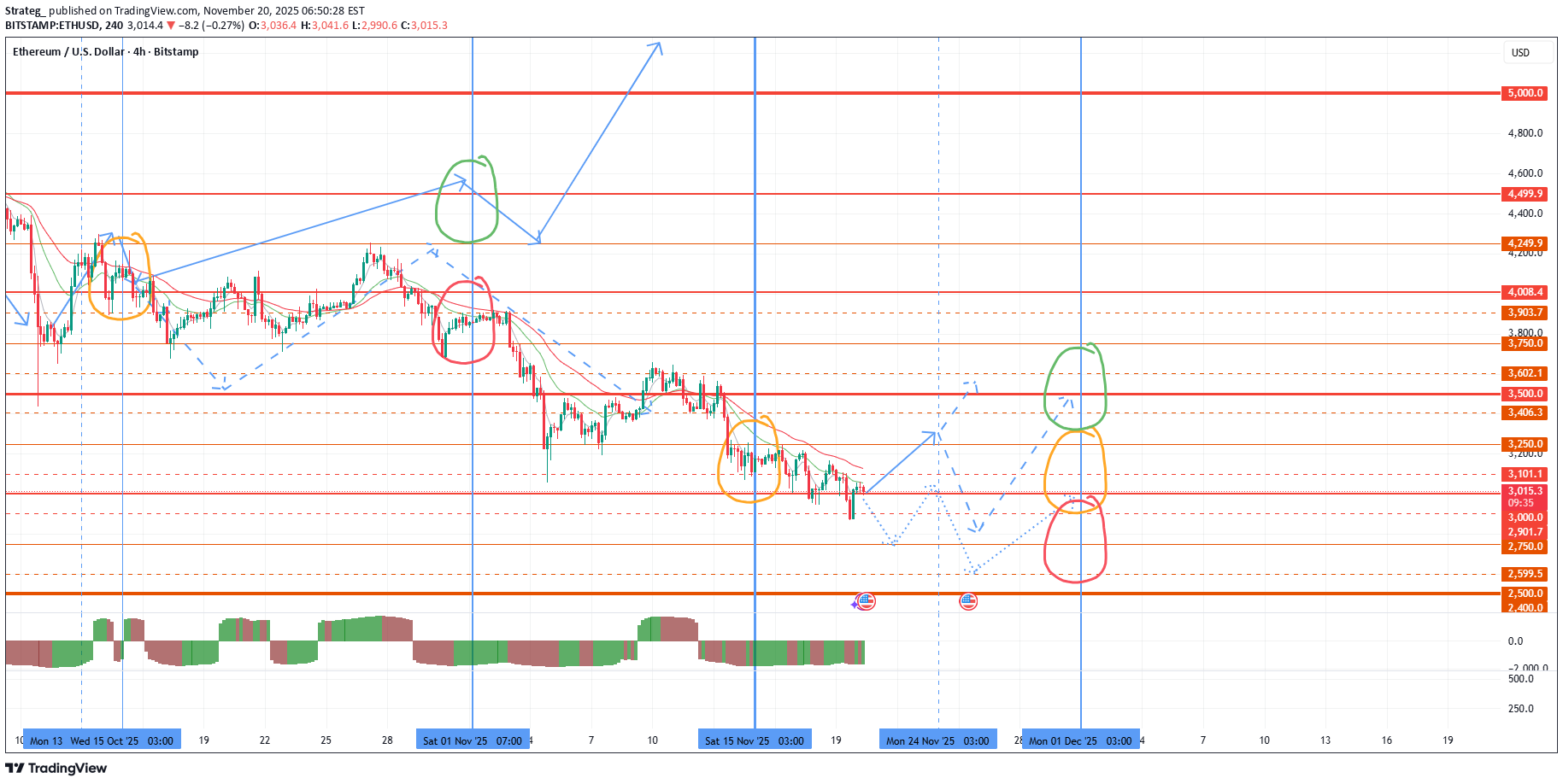

Today we have reached a new major bifurcation point in the middle of the quarter, which I have focused on. For individual coins, starting in the middle of this week, the probability of a bullish quarterly candle reversal with large growth waves will increase, similar to RESOLV and TNSR. Such reversals will be facilitated by a slowdown in the fall of ETH with attempts to change the trend before the end of the year. So far, the bearish influence has prevailed in the market, with the opening of most major periods below key resistances and stable sales until the middle of the quarter to consolidate below 3,500, which I will indicate in the latest review. The ultimate goal of the bears in this quarter is to test the range of 2500-2750, with an attempt to close the annual candle in it under a negative scenario, and against the background of consolidation below 3500, this goal is still relevant. By the end of the month, we may still see new sales impulses to break through 2750, but with increasing buying activity at the end of each week, against which individual coins will try to grow. The second half of the quarter for ETH opened below 3,250, which gives a signal for sales below 3,000 up to 2,500, but an opening above 3,100 is a technical signal for growth up to 3,500-4,100. The attempt to reverse the quarterly candle is also facilitated by its opening above 4,100. And so, under an optimistic scenario and a stable transition to a reversal of the quarterly candle in the second half of the week, purchases can be expected until the end of the week, with the aim of opening a new week above 3250, which will ensure continued growth until the end of the month and the possibility of opening a new month with a growth signal before the end of the year. With less volatility, there is a chance of opening a new week below 3,100, which could lead to a reversal next week. As I wrote in a review at the beginning of October, BTC opened the quarter negatively, with a pullback signal down to 90-100 k, which the bears successfully worked out. There is a large medium-term support in the 85-90k zone, from which a pullback is likely. In addition to the growth of the altcoin index and the growth of ETH/BTC, which I expect at the turn of the quarter, the slowdown in the decline of BTC will also cease to put pressure on the market and allow individual coins to show major reversals. Brent may once again have quite a big impact on the markets. If today and tomorrow the price fixes above $ 64 and, moreover, above $ 65, then the probability of growth of the crypt will prevail until the close of the week. In the event of US manipulation and a sudden new wave of brent sales below $62.5 today or tomorrow, there will be a chance for an ETH reversal before the weekend. Given the released data on stocks in the United States, the probability of a positive scenario prevails. All markets are connected, and no matter how absurd it may seem at first glance, it was the background manipulation of the commodity price that allowed the bears to break through key supports on ETH more than once, both on October 10 at 4,100, and at the subsequent 3,500, 3,250 and 3,100. By superimposing the dynamics of brent in the second half of the week on the dynamics of ETH by the weekend, you can see a chain reaction. That is why by the second half of October, I predicted a drop down to 3,500 by the end of the week, in the event of a drawdown of brent to $ 60. Against the background of a slowdown in the fall of ETH and attempts to reverse the quarter, it is possible to make regular toppings for individual coins. First of all, it is worth paying attention to TURTLE and MITO, which have strong technical signals for growth up to 0.21-25 in the medium term. So the potential is the ground for dynamics similar to RESOLV. VIC BMT HOOK CHESS also has slightly weaker technical signals for growth, which I am also considering working with in the first place. On an attempt to reverse the quarter, there is a high probability of their growth to 50-70%, at least with the aim of breaking the last monthly candle. In the case of a stable ETH reversal, growth impulses of up to 200%+ can be expected. Similarly, growth waves of up to 40-50% may show weaker instruments that do not have obvious signals, but are in an extremely oversold zone, such as QUICK COS FIO DATA. In my opinion, these tools are candidates for the assignment of the monitoring tag, given the dynamics, and therefore I recommend using a small position when working with them. In addition to the positive note towards the end of the year that has appeared at the moment, I would like to focus on the overall negative dynamics of the market, which may continue at the beginning of the year. The current likely pullback on the quarterly and annual candles is still a temporary phenomenon and gives opportunities to coins that have technical growth signals left earlier. Most of the market, after attempts to roll back the tops at the turn of the year, is likely to continue falling until the second quarter. That is, coins without obvious growth signals, especially those with large capitalization, may remain flat until January or February without significant purchases followed by a major break.

Strateg_

تحلیل تکنیکال بازار: پیشبینی هفته و ماه پیش رو (سطوح حیاتی خرید و فروش)

To date, the market has fully fulfilled its targets at the 3500 retest against the background of brent leaving below 64. Further, until the second half of Sunday, the probability of purchases up to the 4500 retest prevails. An important guideline for further dynamics will be the opening level of the new week and the second half of the month. If these periods open at least above 4,100, the probability of a flat and maintaining the market with the possibility of a breakout next month will remain. With weak purchase dynamics, there is a chance of opening the second half of the month below 4,100. In this case, in any case, we will see purchases before the end of the month for a pullback on the monthly candle, but then the market will consolidate around 3500. The available technical signals currently outweigh the bullish scenario. In this case, individual coins will turn the current month into a bullish one with significant interruptions. The main contenders for this month's move are MITO VIC BMT HOOK, which are highly unlikely to be contenders for the monitoring tag and are more suitable for medium-term investments. It is also possible to consider scalping in the short term CHESS FIO COS QUICK DATA, which have reached supports and can show a deeper drawdown only when the ether falls below 3500. A signal has been left for a move to the ADX, however, there is a possibility of a deeper drawdown to 0.075-85 before the reversal.

Strateg_

فرصت بعدی بعد از PIVX: رمز ارز HOOK آماده انفجار قیمتی!

As I have already written, you should not try to jump on the departed train on pivx, which I recommended for purchase for more than a month, it is better to consider the options where the X's are just being prepared. First of all, they include CHESS HOOK BMT MITO VIC. Consider the position of the HOOK. After listing on binance, the token left several strong technical signals for a retest up to 0-50-75, which is highly likely to lead to a major growth wave. The growth momentum last week was only the first investment in the upcoming trend. An uptrend line has been formed and there is a high probability of an attempt to consolidate above it before the end of this month. The quarter opened in a mixed zone, an opening above 0.09 gives a signal for growth up to 0.15, however, an opening below 0.1 is likely to give pullbacks in the event of a sharp increase. The main long-term support for the current issue is the 0.0750-850 range, from which there was a rebound after a long-term rebidding. A hike below this range is likely only with an additional significant drawdown of ETH. The most likely target is an attempt to close the current monthly candle above 0.21-21 in order to continue the trend in the new month. With negative overall market dynamics, there is a possibility of a pullback from 0.21-25. In this case, in the new month, we can expect a new attempt to return to the trend line from 0.110-125, which will provide an additional opportunity for scalping.

Strateg_

فانتوم توکنهای ورزشی در آستانه انفجار؟ سیگنالهای صعودی قوی برای ATM، CITY و JUV

As I mentioned in the last market review, the probability of sales for most coins and disruptions of ETH remains predominant. Against this background, the oversold ATM CITY ACM JUV fantokens are extremely interesting for speculators. The quarter opened above the supports, which gives a strong bullish signal. Quite large purchases are immediately observed against this background. When selling on ETH, there is an opportunity to shadow on CHZ to a retest of 0.041-425, which so far prevents x on fantokens. This can create new favorable prices for scalping. In particular, for ATM, there is a possibility of a pullback to a retest of the 1.25-35 range, which is the main support in this monthly candle. Next, you can have a new stable bullish reversal of the monthly candle from the middle of the month and consolidate the formed trend line. In the absence of a drawdown on ETH and CHZ, continued growth is possible from the middle of the week. CITY JUV and ACM did not give significant impulses to retest the resistances, which is why the probability of growth from current levels is slightly higher for them.

Strateg_

شروع قدرتمند CHESS در فصل جدید: آیا قیمت به ۰.۲۵ خواهد رسید؟

Today I want to pay special attention to CHESS. Against the background of the growth of STO, CELO and KERNEL, there is a possibility of purchases of other DEFI group coins, among which CHESS is the most oversold. The quarter for this token opened above the long-term strong support of 0.05, which is a confident bullish signal in the medium term. This week opened above the intermediate resistance of 0.06, which gives a signal for the start of the trend and an attempt to work out an inverted head and shoulders pattern with an attempt to test the next strong long-term level of 0.1, consolidation above which makes it possible to increase the scale of price movement up to 0.25. For this token, very large volumes of purchases were left on the market for a retest of 0.25. If the market breaks down, there is a possibility of new tests of 0.05, but given the medium-term bullish mood, you can keep a constant position from current levels and scalp in case of lower impulses. The overall picture of the market this week also contributes to the maintenance of the crypt. ETH opened the week below the strong resistance of 4500, which gives rise to the failure of new attempts to storm 4750, but oil opened the week with a strong bullish gap, which supports the currency market and still leaves room for retests of 4750 on ETH, as I wrote in the last review. Taking advantage of this flat in the market, CHESS has every chance of successfully consolidating above 0.1 before a possible fall in ETH.

Strateg_

پیشبینی سقوط یا صعود بازار: سطوح حیاتی اتریوم و شانس فانتوکنها برای رشد انفجاری

September ended, a month of seasonal sales and 4 weeks of sluggish market decline, which I predicted in the last review. October and December are the months of seasonal growth in the 4th quarter, but the bears continue to hold the market. The quarter opened neutrally on the ETH. An opening above 4100 provides an opportunity for retests of 4750-5000, however, an opening below 4250 is a slightly stronger signal for a stable consolidation below 4k and an attempt to retest 3500. The current market growth is still only a retest of the 4500-4750 range before the likely continuation of sales. It will be possible to talk about the continuation of medium-term growth only with a repeated breakdown of 4750, in which case active purchases of altcoins will begin. With the current market, the probability of a further flat and a slow fall for most coins prevails. Bitcoin opened the quarter below 115k, which further increases the likelihood of a market drop with sales up to a 90-100 k retest. The oil price also continues to fall, which negatively affects the markets. If there is a rebound in brent to $67.5-$69 in the new week, then the probability of a breakdown of $ 4750 in ether will begin to prevail. If brent falls below 64, there will be a chance of a hike to 3900 on the ETH by the end of next week. Today, the opening level of the new week on the ETH is of great importance. When opening above 4500, the probability of a breakdown of 4750 will increase significantly and we will not see sales below 4250-350. When opening below 4500, a breakdown of 4750 will be possible only against the background of weighty arguments, extremely negative statistics on the United States or oil growth. With the current negative market and the prevailing probability of further altcoin decline, I am still cautiously considering coins for operation. The only oversold group with the probability of growth from its current position is still the fantokens. Among them, I am considering atm city juv acm for work. These tokens do not have binance futures, which reduces the opportunities for large speculators to sell and insures against a pattern similar to alpine and asr. These tokens also have extremely high undeveloped targets on large timeframes up to 5-7 x. ATM opened the quarter above 1.5, which is a very positive signal. After drawing the shadow on a new monthly candle with a retest of 1.35, there is a high probability of a bullish reversal of the current monthly candle with a stable approach to the 2.1-2.5 test at least. In the event of a breakdown of 2.5, further growth towards 5-7.5 will be very active. With a negative market and ether falling to 3500, there is a possibility of a delay and flat ATM with a rebound from 2.1 and growth from the second half of the quarter. According to CITY, there is also a good quarter opening above 1.0, which can lead to stable growth on the 2.1-2.5 test this month with a further trend. For ACM and JUV, there is also a good opening of the quarter above the supports, but the candlestick pattern on large timeframes is more negative, and therefore growth may be more sluggish after the breakouts of ATM and CITY. Among other altcoins, so far I am considering only chess pivx and fio, which can give an increase of up to 50-70% from current levels against the background of the lack of assignment of the monitoring tag in the first week of the new month. However, the opening of the quarter for them is quite negative, which is likely to lead to new price drawdowns, especially in the event of a drop in ether. In work, it is worth keeping a moderate position with the expectation of possible drawdowns to 0.100-115 for pivx, 0.05 for chess and 0.0125-150 for fio. Topping up can be confidently done from these levels, a hike below is possible only if the monitoring tag is assigned in the following months, or there is a strong drop in ether up to 2500. I will consider other coins to work only after the breakdown of 4750 on ether.Today, due to the lack of tag assignment, monitoring gave a pivx reaction with a test of the target range of 0.20-25, however, the opening of the quarter is negative for it, as well as for fio, as I wrote in the last review, which will lead to a significant pullback and a likely retest of loyalties. So far, chess looks more promising with a likely 0.1 retest, at least due to a good opening of the quarter. Adx and koma, which I recommended earlier, also showed good dynamics with the take test. Both left a signal for an attempt to move, but after the current impulse, it may take a considerable amount of time to accumulate. According to adx, the opening of the quarter is also higher than support, which increases the likelihood of new growth waves in the future. Ether approached the intermediate support near the range of 4000-4250. Further, there is a high probability of waves of purchases in an attempt to keep the monthly candle from turning into a bearish one, against the background of the breakdown of 4750 at the beginning of the week, which is a strong signal for the resumption of the bullish trend by the end of the year. In an optimistic scenario, there may be no sales below 4,100 this month. Attempts to grow ether will give rise to breakouts for individual altcoins. With the current market drawdown, fresh projects have shown themselves to be more confident. In this regard, in the medium term, I am taking the most oversold listed coins in the last two years, MITO BMT HOOK VIC. Among the older coins, chess adx with good quarter opening levels and atm acm city juv fantokens are still the most interesting due to strong oversold and speculative interest. Growth waves of up to 40-50% can also result from the current levels of fio cos and data.

Strateg_

Up to 100%+ on PIVX

To date, sales in the altcoin market continue within the framework of seasonal dynamics, which are likely to last at least until the middle of the month. Binance continues to exert pressure by delaying the announcement of the assignment of the monitoring tag to new coins, under the threat of which investors are wary of further purchases. The first week of the month ends today and once again there is no announcement. The probability has increased that the tag will not be assigned this month. In this regard, I am trying to take into account the most oversold coins relative to the current market position, which can break through against seasonal sales. Pivx looks the most interesting, which has already made a profit several times this year. The July momentum broke through one of the downtrend lines, starting a smooth trend change from strong long-term support at 0.125. This month opened above the level, as did the quarter, which could lead to a powerful growth momentum before the end of the quarter with an attempt to consolidate above 0.21-25 and profit up to 100%+. Due to the likely absence of the assignment of the monitoring tag this month, growth may begin as early as tomorrow. In this case, the trend can be quite stable. If the breakdown occurs on working days and against the background of a general drawdown of the market, then there is a high probability of a rebound from 0.21-25 with a stable trend from the second half of the month. In the new week, it is worth keeping short stops in the morning, as binance may deviate from its own rules and assign a monitoring tag in the second week of the month. Also, fantokens are still safe this month, without entering the delisting and monitoring announcement. However, seasonal sales had a strong impact on them in the summer, and they are likely to smooth out the dynamics now. In this regard, I'm trying to take only the most oversold atm and acm. Due to the lack of a monitoring announcement, waves of growth up to 30-40% above current levels may also result from fio chess cos, however, if seasonal sales accelerate in the new week, there is a possibility of an additional drop in prices to 20-25%. Against the background of the general market decline, highly oversold but also dangerous coins with the bsw fis voxel bifi flm rei monitoring tag with possible growth impulses of up to 50% may be interesting for speculators. However, it should be borne in mind that if there is no growth, they may be delisted in the new month.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.