Soul_Investments

@t_Soul_Investments

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Soul_Investments

The BTC graph shows on the monthly graph that the price has broken out already from an inverted head & shoulders pattern. It follows the same flow as the Total Market cap graphs incl. and excl. BTC and ETH. Only is BTC front running and the rest of the market is lacking behind. But this does not mean that it's over or that this is bad thing. On the short term, based on the inverted head & shoulders, BTC has the potential to increase up to $ 123.000 and the BTC.dominance can increase up to 72%. If this happens, Altcoins will go up as well. It only means that at that moment there could potentially be more interest in BTC. So it's not over yet. Not for BTC and not for Altcoins. It's important to zoom out and what the bigger patterns on the monthly and weekly graphs to be able to understand where the cryptomarkt is heading to.

Soul_Investments

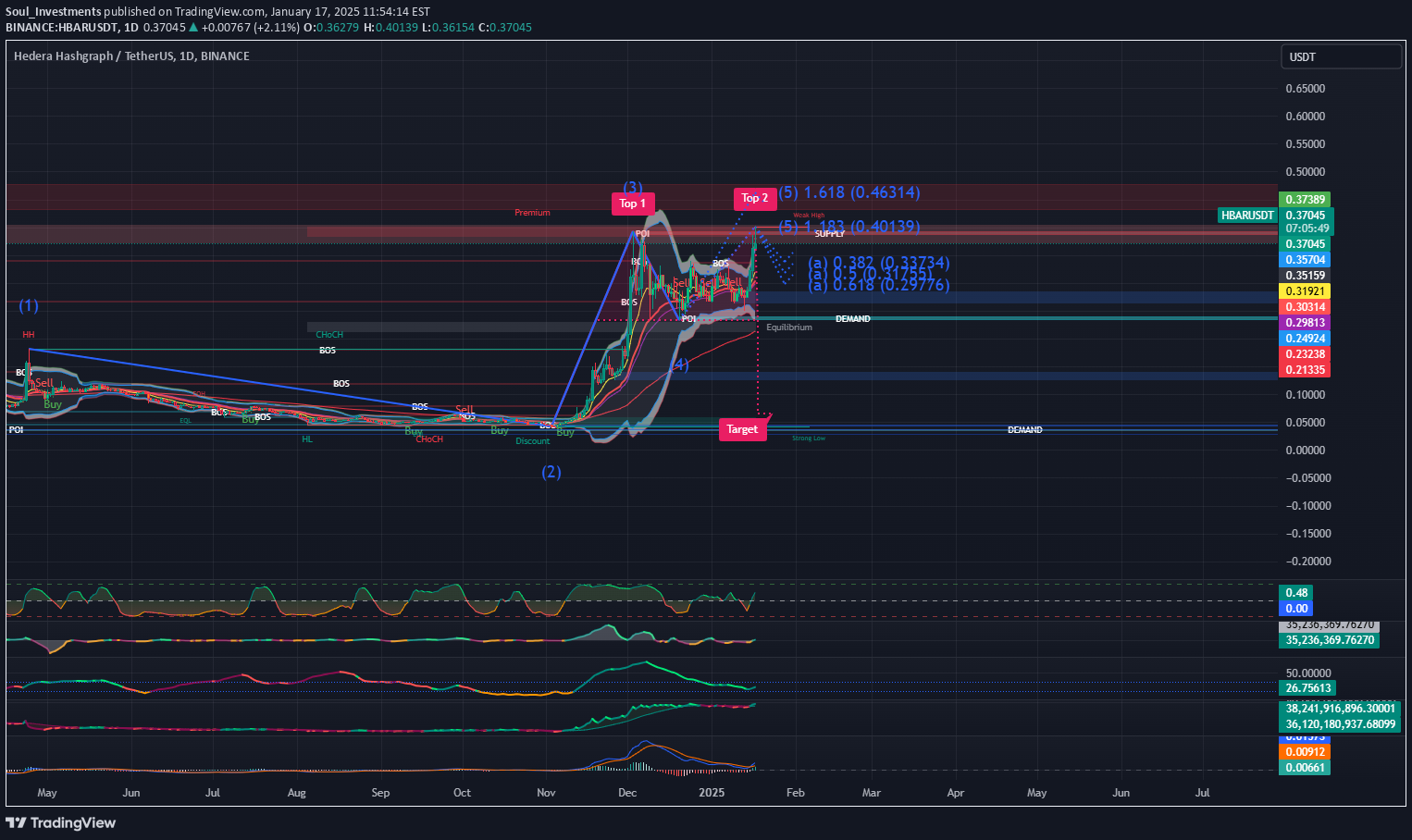

HBAR shows signs on the 4H and 1D timeframe of a potential risk of -80% price decline due to a double top formation. BTC price goes down (see my other chart) HBAR will probably will go down too. I see many crypto's on my watchlist showing signs of a potential big price decline. In stead off all the positive messages in the media. So be carefull. Really strong bullish trends are not confirmed yet for none of the crypto's on my watchlist.

Soul_Investments

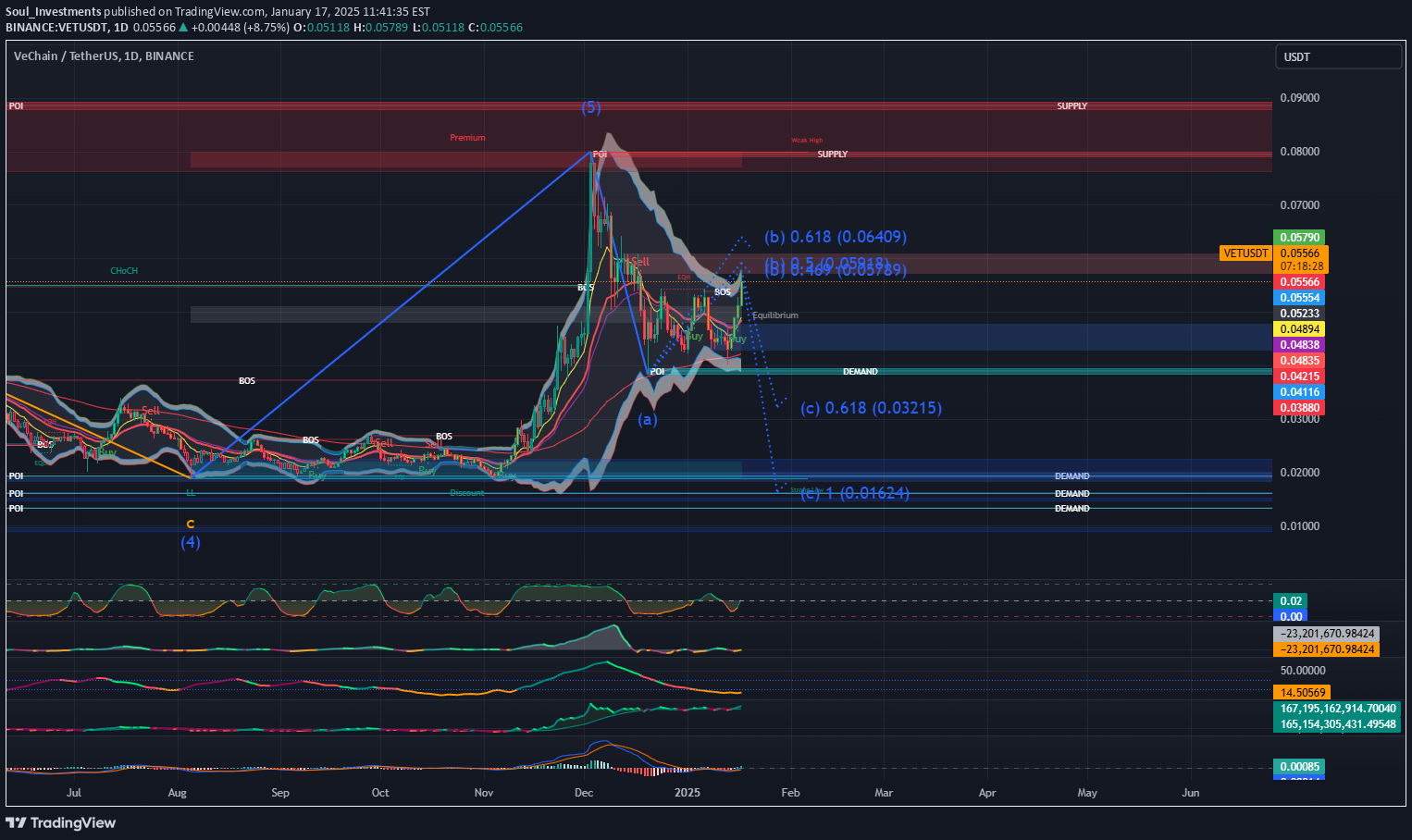

I am curious if more people are noticing similar patterns by multiple crypto's whereby the prices are moving probably in a corrective Elliot abc phase. Whereby in this case VET has a risk of a potential decline of -60%. BTC is not looking good either (see my BTC chart for further context). And see my charts for ETH, ADA and SOL. They are all showing the same patterns.

Soul_Investments

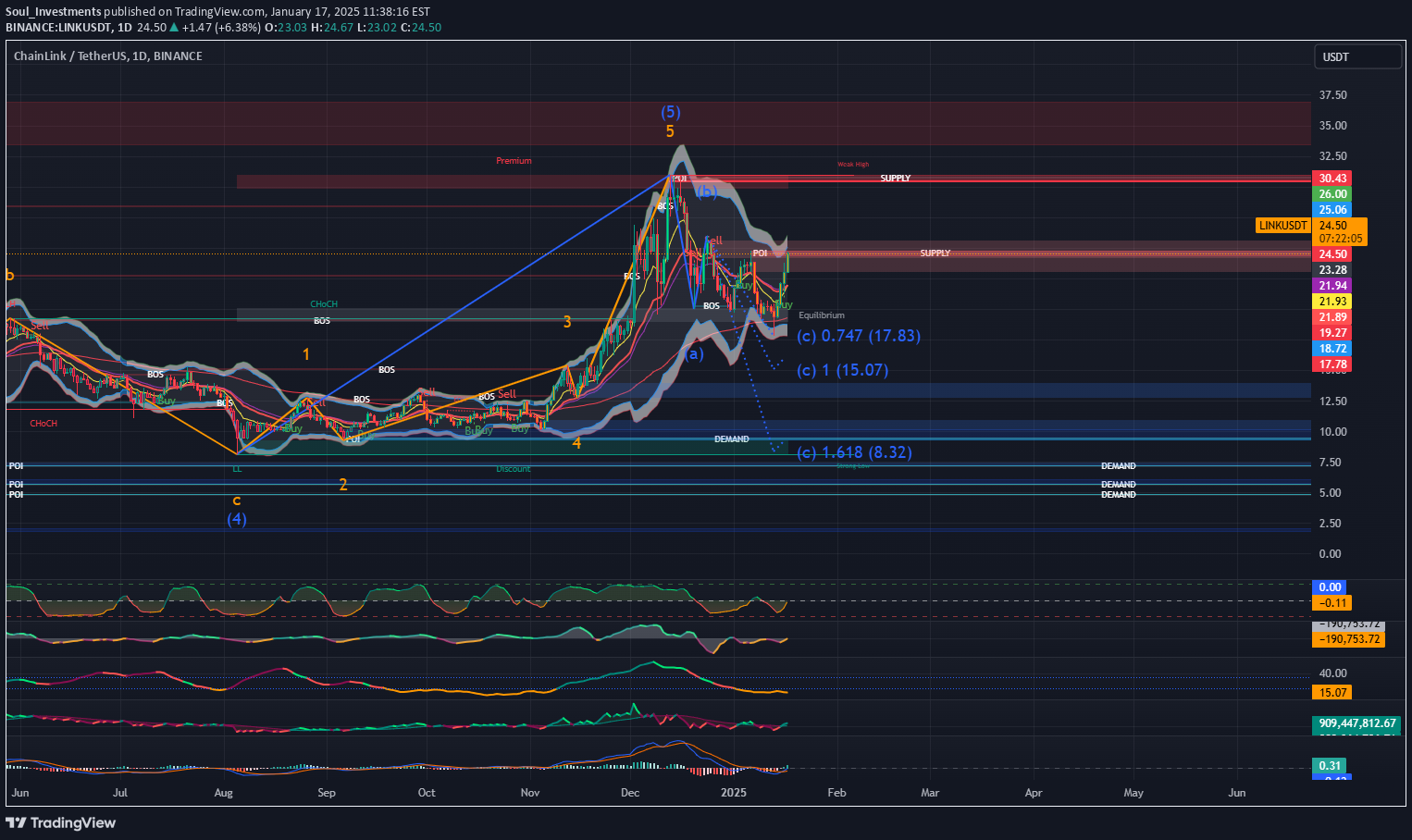

I am curious if more people are noticing similar patterns by multiple crypto's whereby the prices are moving probably in a corrective Elliot abc phase. Whereby in this case LINK has a risk of a potential decline of -60%. BTC is not looking good either (see my BTC chart for further context).

Soul_Investments

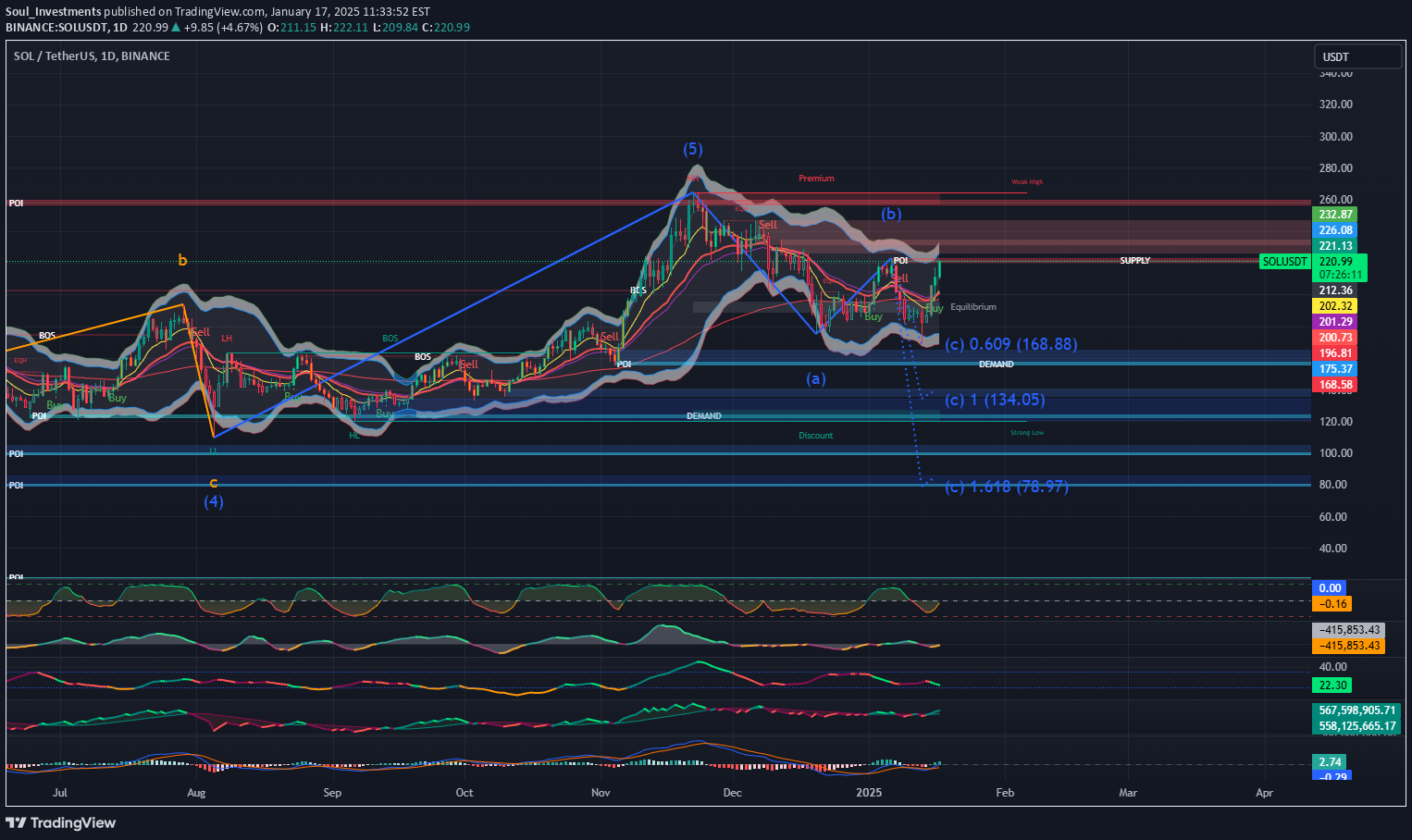

I am curious if more people are noticing similar patterns by multiple crypto's whereby the prices are moving probably in a corrective Elliot abc phase. Whereby in this case SOL has a risk of a potential decline of -60%. BTC is not looking good either (see my BTC chart for further context).

Soul_Investments

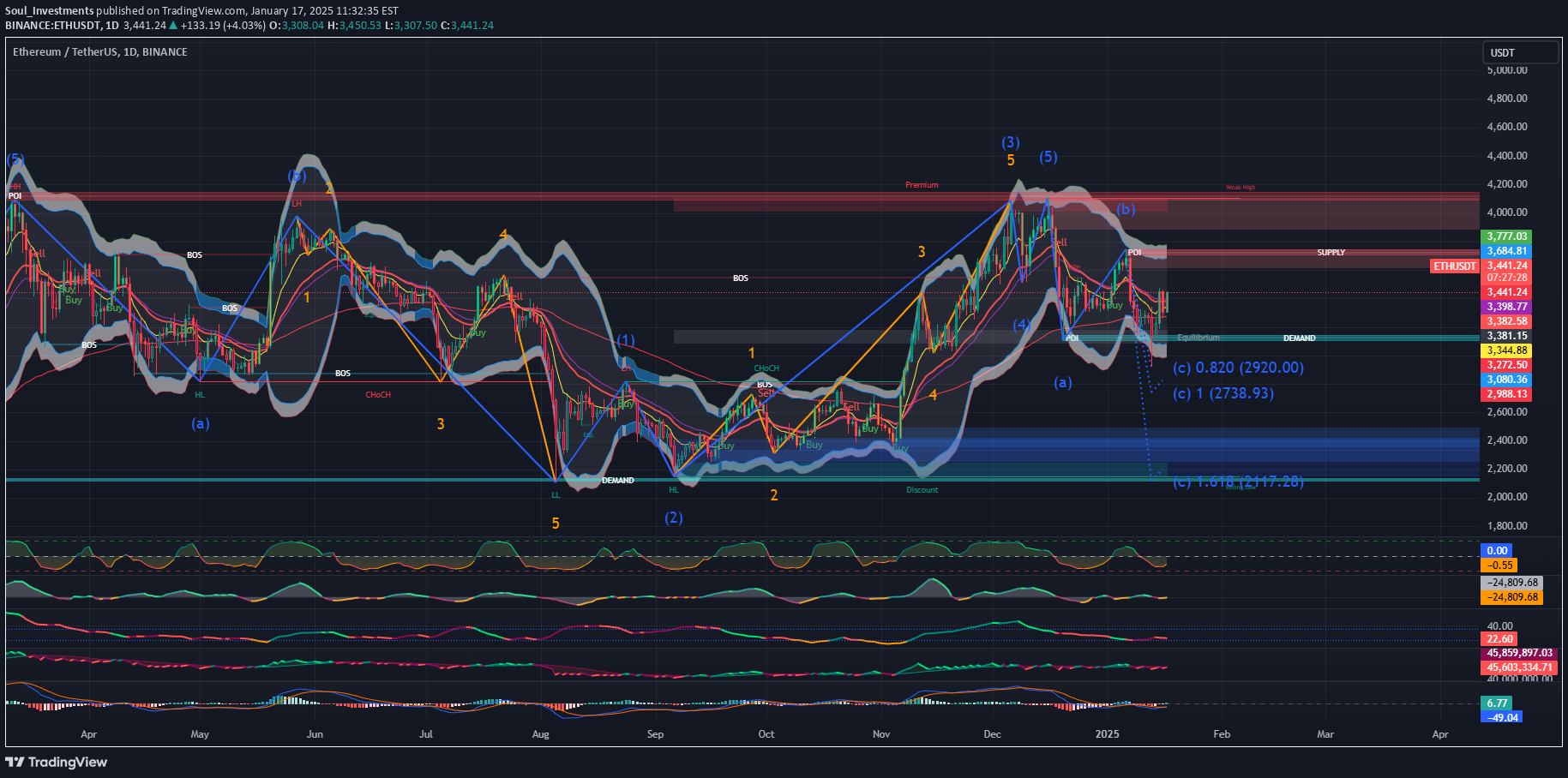

I am curious if more people are noticing similar patterns by multiple crypto's whereby the prices are moving probably in a corrective Elliot abc phase. Whereby in this case ETH has a risk of a potential decline of -35%. BTC is not looking good either (see my BTC chart for further context).

Soul_Investments

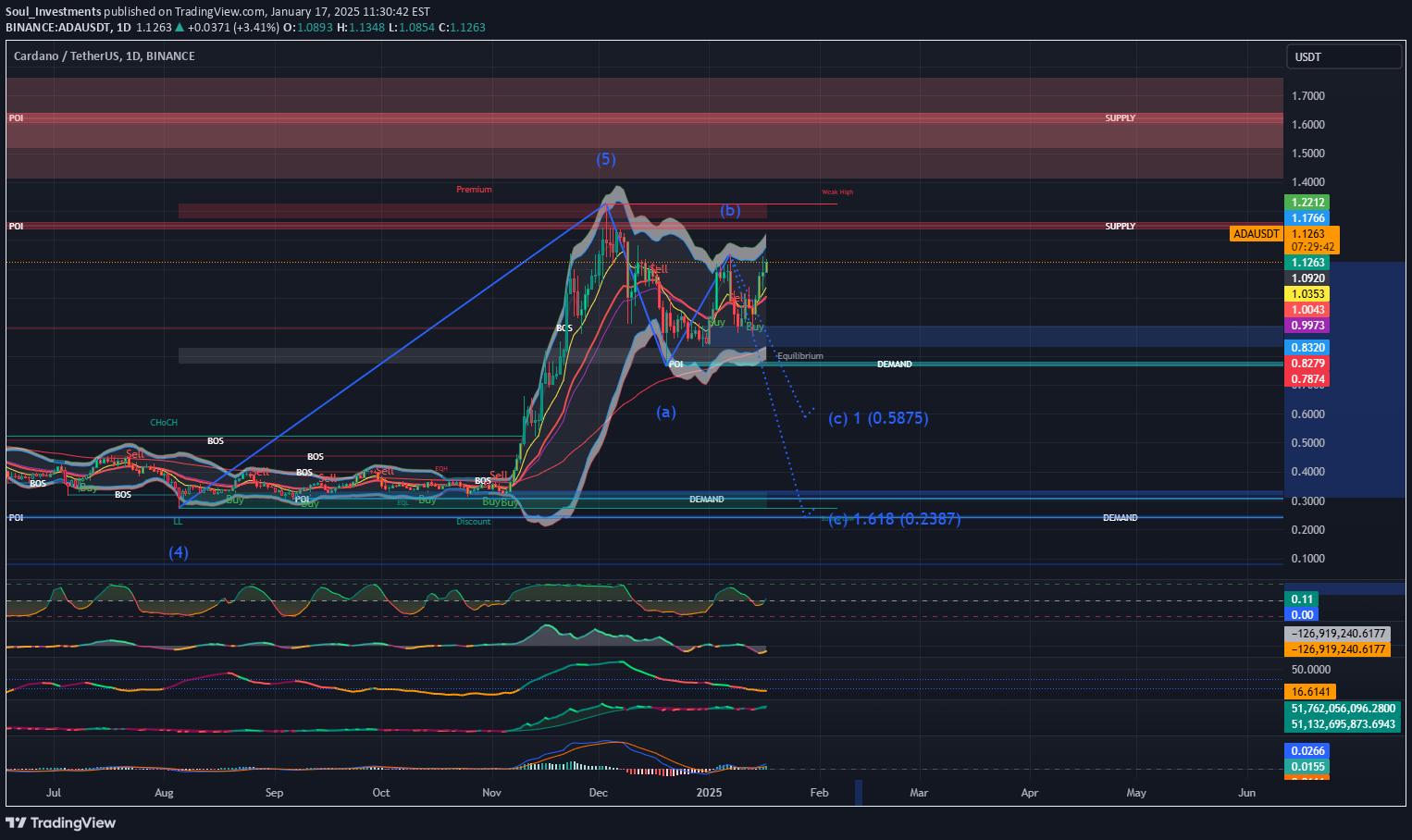

I am curious if more people are noticing similar patterns by multiple crypto's whereby the prices are moving probably in a corrective Elliot abc phase. Whereby in this case ADA has a risk of a potential decline of -70%. BTC is not looking good either (see my BTC chart for further context).

Soul_Investments

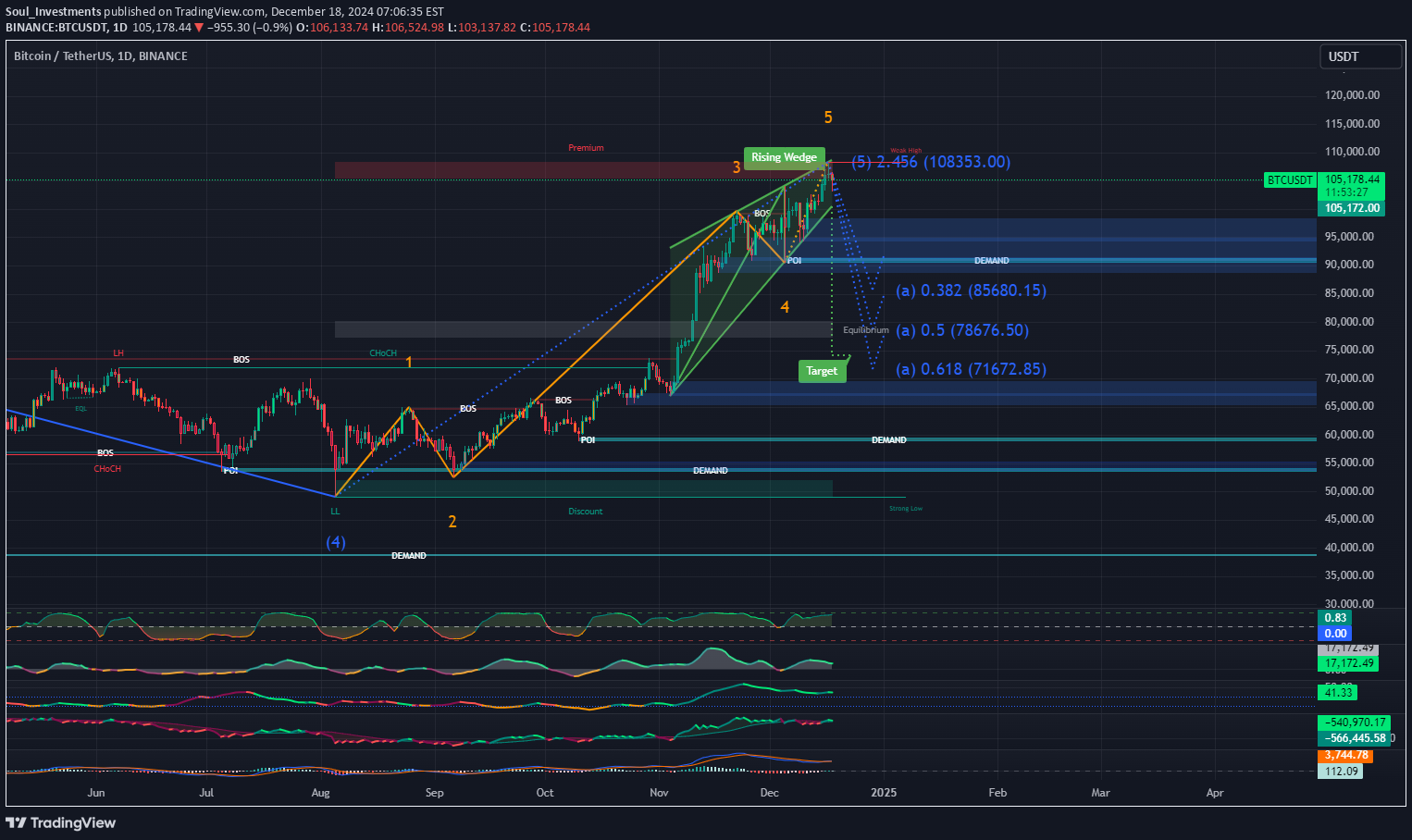

According to the indicators that I am using I see completely different signals than that many others are sharing in the media. BTC is not looking so good at all. At the moment BTC is moving in an corrective Elliot wave ending probably wave b soon which means a bigger correction can be expected. The equilibrium zone is in the same area as were the current CME gap is and it is expected that this gap must be filled, before any BTC upward continuation is possible. There are more than $200 million liquidation positions open around latest high. For sure those positions are going to be liquidated due to market makers and that can probably cause a quick trend downwards. The ADX inidcator (3rd one below the graph) is not showing any bullish strenght at the moment. Rather a neutral trend which can go either bullish or bearish. The price is trying to break through for the fourth time now and it's not showing much strength. If BTC goes down on the daily graph to the equilibrium zone, it is possible that a further downtrend may be triggerd, because on the weekly timeframe BTC is starting to move in a corrective Elliot wave phase as well. Everyone is refering to charts and patterns from the past, but that is not a guarantee this time that it will happen again. The repeated patterns were possible because BTC was moving in an bullish Elliot phase of 3 bullish upward waves. So yes.. ofcourse it happened three times already in the past. But BTC is at the end of a Elliot wave 5 so that means a downward must happen first, before BTC is technical able to make a big move up.

Soul_Investments

Hello dear followers. While the media is trying to FOMO people about BTC price getting higher and higher and that Altcoins season has started. I see different signals in the graphs. Both BTC and altcoins are heading towards a price correction of -30%. BTC is currently at the end of an Elliot wave 5 which is usually followed by a corrective abc wave. First wave a could be a correction of -30%. Always around Christmas and New Year there is a price correction also during bull markets this type of corrections are common. For the Long term BTC is moving in a cup and handle with a price target of $120.000, but on the 1H, 4H and 1D grapsh I see BTC price moving in a bearish rising wedge which is usually followed by a correction all the way back to where the price increase started. So please be carefull and don't FOMO into crypto right now.

Soul_Investments

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.