SmartFlowsI

@t_SmartFlowsI

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SmartFlowsI

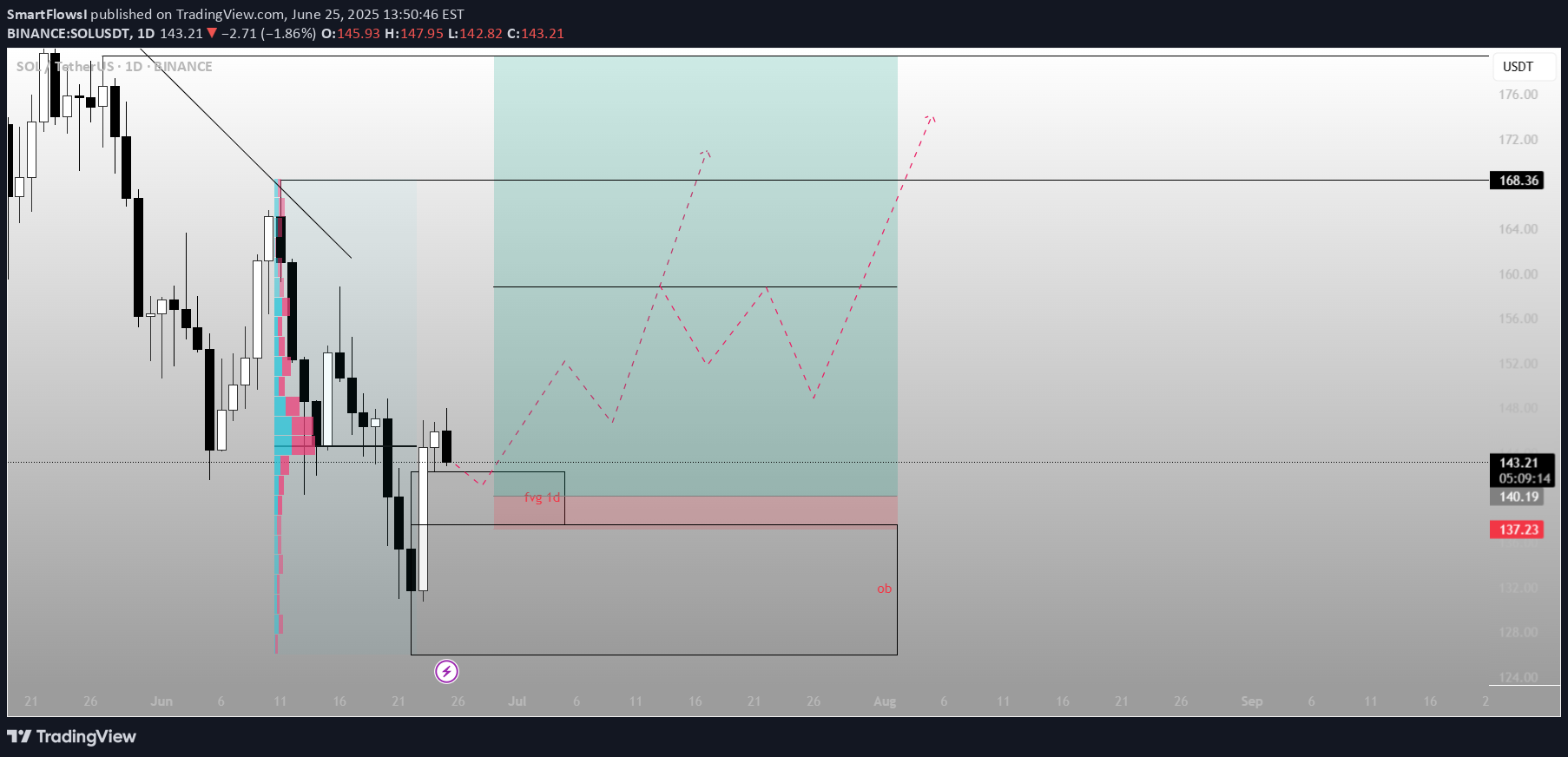

Most see rejection. I see a launchpad

What looks like a failed breakout is actually SOL setting up for a higher timeframe reversal, right at a refined zone of inefficiency and Smart Money interest. The narrative isn’t over — it’s just beginning.Technical Breakdown:Current Price: ~$143.30Context:Price tagged the Fair Value Gap (FVG) on the daily and showed reaction — a sign of algorithmic awarenessVolume profile suggests thin liquidity above, ripe for expansion if momentum kicks inKey Levels:FVG (1D) zone: just under current price (~140.19)Order Block (OB): ultimate demand zone near 137.23 — strong structural supportDowntrend Line: recently broken, retest in motionMajor Upside Target: 168.36 — a clean liquidity magnetStrategic Thesis:Price dipped into FVG but held above the OB — a classic Smart Money accumulation setupThe dashed projection shows potential higher lows forming, giving fuel for a push through prior highsFVG + OB form the discount zone, where risk/reward is maximized before the next impulse moveExecution Plan:Entry zone: $140.00–137.50→ Expect small shakeouts before confirmationInvalidation: Daily close below $136 kills the bullish caseTarget:Primary: $168.36Stretch Goal: $172–176 if momentum is sustained into August

SmartFlowsI

Everyone sees consolidation. I see positioning

ETH is holding just above a key fib cluster, showing signs of controlled distribution, not weakness. Smart Money doesn’t chase — they build positions while the crowd second-guesses.The Structure:Current Price: ~2,419Local High (Premium): 2,482.09Fib Retracements:0.236 → 2,394.72 (mild correction)0.382 → 2,340.68 (initial re-entry zone)0.5 → 2,296.99 (ideal discount)0.618 → 2,253.31 (deep entry, high confluence)0.786 → 2,191.11 (structure last line)Key Zones:FVG already filled during the move up — imbalance mitigatedOrder block (OB) at 2,191.11: high-probability reaction zoneStrategy Outlook:Scenario A (Shallow pullback):ETH tests 2,394 → 2,340, then continues the push to 2,482→ Aggressive buyers step in earlyScenario B (Deeper sweep):A drop to 2,296 → 2,253 opens the door for reaccumulation→ Classic Smart Money trap before the next rallyInvalidation:A break below 2,191 (and OB failure) kills this bullish narrativeExecution Logic:Accumulation Zones:Light: 2,340–2,296Strong: 2,253–2,191 (discount reload)Target:2,482Extension optional if momentum builds above recent highs

SmartFlowsI

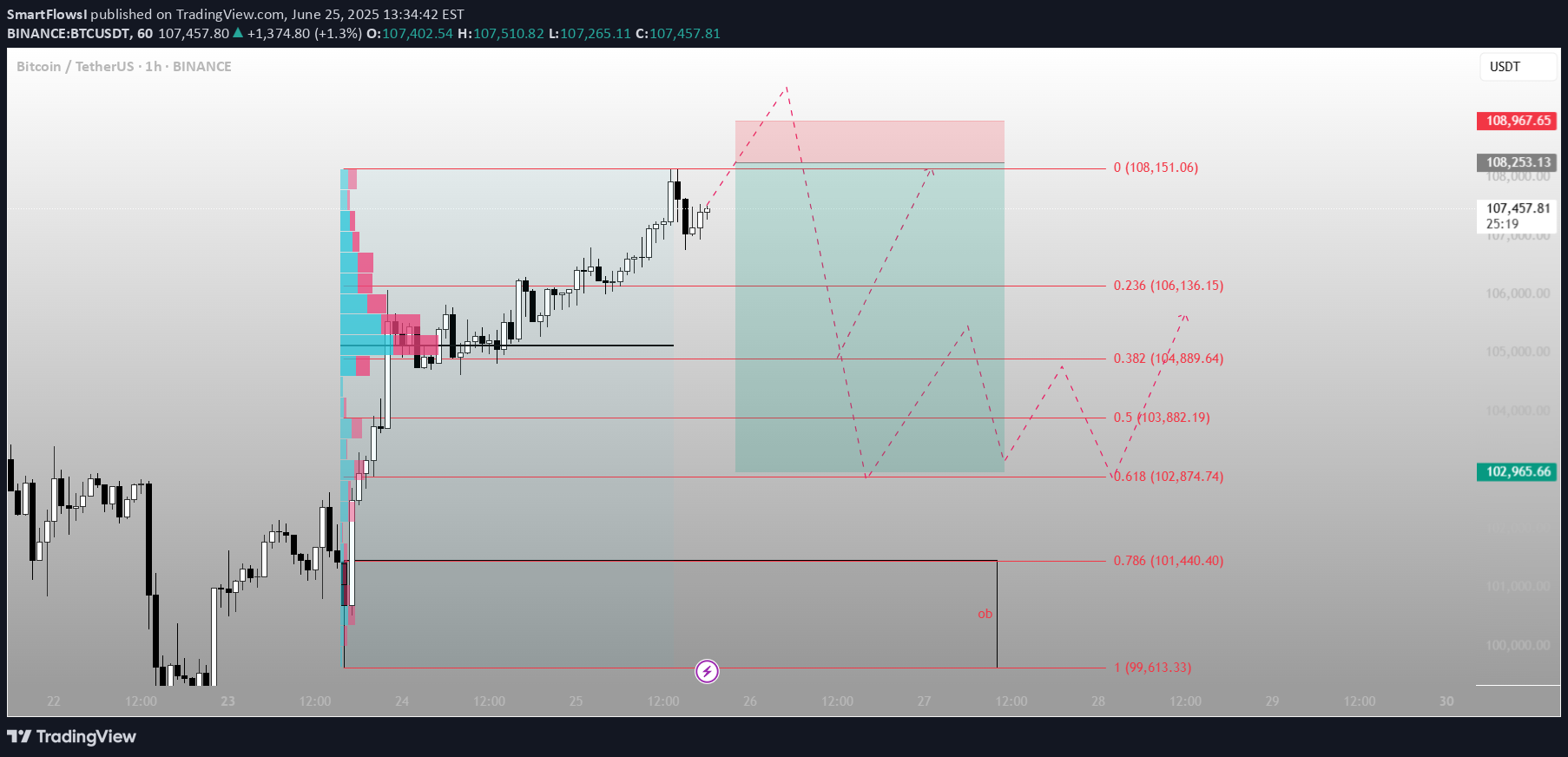

Premium zone tagged — now we watch how the Smart Money reacts

Bitcoin just tapped into the 108,151 level — the top of a measured premium range and a likely area where profit-taking begins and fresh distribution footprints form.This run-up wasn’t random. Price surged from inefficiency, cleanly filled the fair value gap (FVG), and is now flirting with a key liquidity pocket.Here's what the structure says:Premium reached: 108,151 (0% fib)If rejection holds, Smart Money looks to discount entries:0.236: 106,1360.382: 104,8890.5: 103,882Deep retracement zone: 0.618 at 102,874Final defense for bulls? The unmitigated FVG block between 101,440 → 99,613Possible Playbook Scenarios:Quick retrace → higher high:Bounce off 104,889 or 103,882 before attacking 108,967+Deeper sweep:Into 102,874 (0.618) before Smart Money steps in againInvalidation:Break below 99,613 closes this bullish narrative and confirms a structural breakTL;DR Execution Logic:Wait for retracement into 0.5–0.618 fibsLook for bullish reaction (engulfing or SFP)Upside targets:108,151 (retest)108,967 (liquidity sweep)Further upside if momentum sustains

SmartFlowsI

ETH didn’t rally — it cleared inefficiency and paused

This isn’t the move. This is the setup for the move.ETH tagged 2658.22 — premium — and stalled right where Smart Money pauses before redistributing or rotating.Here’s how this lines up:Price swept into the 0 fib (2658.22), then hesitated — that’s not weakness, that’s precisionJust below sits a clean FVG at 2594–2575, right between the 0.382–0.5 fibsBelow that: OB near 2527–2492 — last line of defense before momentum flipsRight now, ETH is offering a reactive pullback opportunity. If bulls hold 2594–2575 with a bounce, we rotate higher again. But if they don’t — 2527 becomes the decision zone.Execution lens:Ideal re-entry zone: 2594–2575Invalidation: sustained close below 2555 = expect OB tapIf FVG holds, expect revisit of 2658 → extension toward 2680sThis setup isn’t done. It’s developing. Wait for price to speak — not hope.For more plays built like this — mapped in advance, not after the fact — check the profile description

SmartFlowsI

Impulse without purpose? Not in Smart Money terms

SOL didn’t just break structure — it filled inefficiency and positioned above. Now price is sitting in the upper FVG, where decisions are made — not guesses.What just happened:Price rallied from the OB below and left an IFVG in its wakeCurrent price is hovering at the edge of a higher FVG, right where liquidity rests from trapped shortsThe move is complete — now it’s about what price does next in this zone of intentFrom here, two paths:Sweep into FVG, reject, and rotate back down toward the 154–147.4 rangeReact bullishly from mid-FVG, reclaim structure → break to new internal high and keep runningThe OB down at 145 is still valid if price unwinds — that’s where Smart Money bids.Execution view:Rejection from 158–159 = short bias down to 147–145Clean invalidation above FVG highIf price consolidates at 154 and reclaims → setup flips bullishThe setup isn’t about what price did — it’s about what it’s preparing for.You want more trades like this — precision zones, mapped logic — check the profile description.

SmartFlowsI

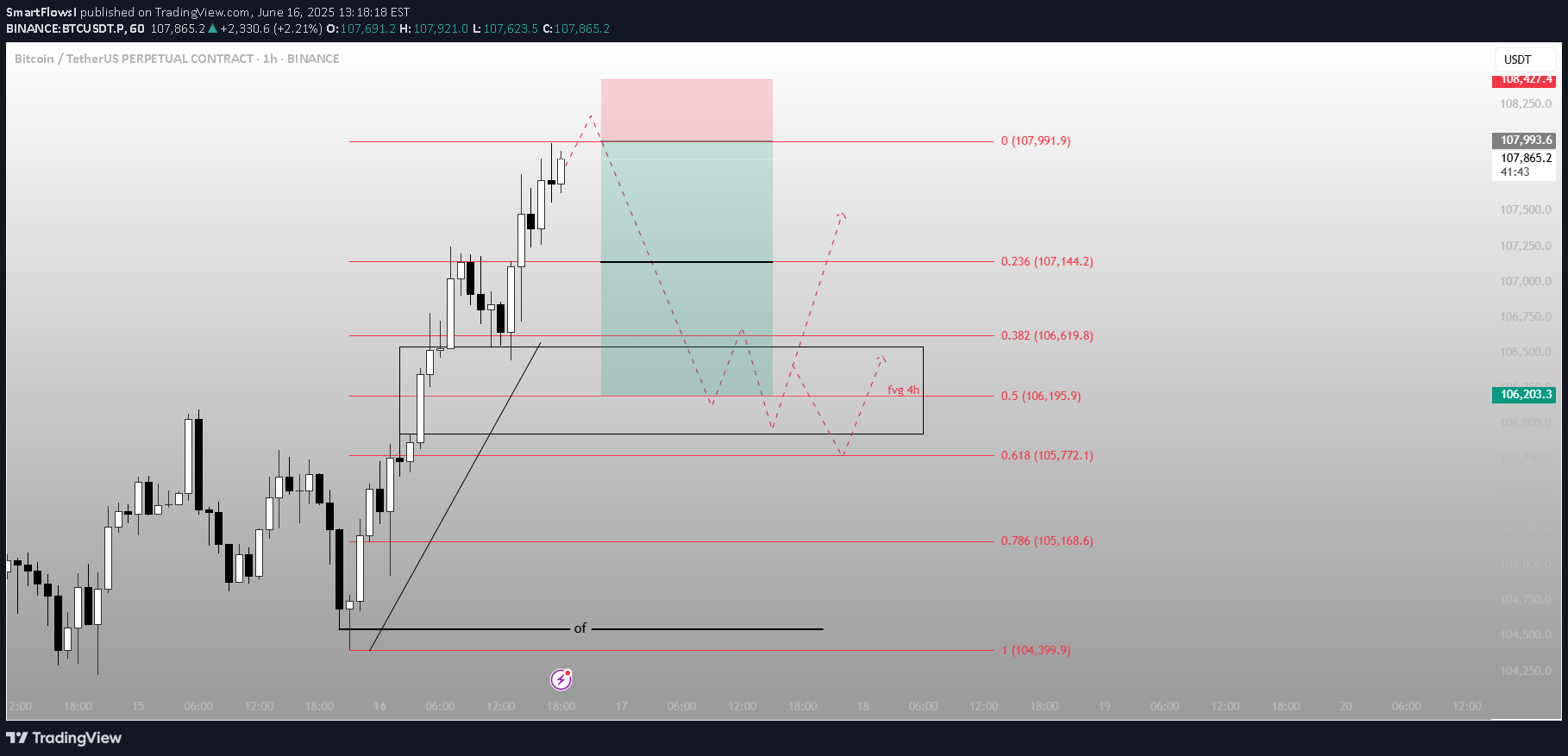

That wasn’t a breakout. That was the stop run

BTC swept the high into 107,991 — precision tap of the premium fib. Now the delivery shifts. Price has already done its job: take liquidity, trigger late longs, and set up the real move.Here’s the execution breakdown:Price tagged the 0 level of the fib extension — 107,991 — and rejectedA clean 4H FVG sits just below around 106,195.9 (0.5), aligned with 0.382 and 0.618 fib levels (106,619.8 to 105,772.1)This is the re-entry zone for Smart Money — not the top chasersExpectations from here:→ Rebalance into the 106.6–105.7k region→ If that zone holds and price shifts structure bullish again, we retest 107.1 → 107.9 → break higher→ If we lose 105.7 cleanly, I’m watching 104,399.9 — the deeper inefficiency magnetThis isn’t about confirmation. It’s about preparation.More trades like this — clean, controlled, conviction-based — live in the profile description.

SmartFlowsI

I didn’t chase the high. I waited for the reclaim.

WIF ran the 1.048 liquidity, reversed, and now it's offering the kind of structure I don’t second-guess. This isn’t about trend — this is about reclaiming control.Here’s the map: Price retraced cleanly into the BPR zone between 0.944 and 0.920 — right in the middle of the fib rebalancing zone 0.618 fib sits at 0.920, which makes this entire region a Smart Money entry block Below that is the 1H OB at 0.840 — a worst-case sweep zone if liquidity gets runCurrent structure suggests a tight range building beneath the previous high — a classic setup before a displacement move into 0.999 → 1.048Hold above BPR and reclaim 0.969? That’s your greenlight.Execution plan: Entry: 0.944–0.920 TP1: 0.969 TP2: 1.048 Invalid below: 0.885 — or full re-entry from the 1H OB near 0.840The move already happened. This is the retest. You either planned for it — or you're reacting late.Precision like this lives in the profile. Setup-first. Noise-free.

SmartFlowsI

Sweep. Reaction. Shift. That’s not noise — that’s the model in

SUIUSDT just tapped the lower boundary of its STB 5M, and the market responded instantly.This wasn’t support. This was engineered liquidity — and it triggered precisely where Smart Money waits.Here’s the structure: Price ran the range low and tagged the STB, aligning with 0.618 at 3.1833 This reaction builds into a reclaim of the 1H OB — the same inefficiency that broke structure last time Next draw is the 0.382 retracement at 3.2631, then 3.3124 — both short-term targets If volume and structure align, the full reprice to 3.3922 becomes the higher-timeframe objectiveAnything below 3.1265 breaks the current long bias — invalidation is clear.Execution map: Longs are valid as long as price holds above 3.183 TP1: 3.2631 TP2: 3.3124 Full target: 3.3922 Invalidation: Close below 3.1265Price isn’t turning because of hope. It’s rotating because it fulfilled its algorithmic sweep.More setups like this — clean, intentional, and early — are in the profile description.

SmartFlowsI

Price respected the level. The rest is execution.

SOLUSDT just tapped the 1H OB near 155.75 — a zone defined by structure, not emotion. If you’ve been following the narrative, this isn’t a dip. It’s reaccumulation before displacement.Here’s the setup: Price tagged the OB at 155.75, perfectly aligning with the 0.618 fib — the algorithm’s comfort zone Below this lies 153.95 — the invalidation level for the long idea First upside target sits at 158.27 → then 159.83 → then a full rotation into 164.46, where we meet a 1H OB stacked with prior inefficienciesThe volume profile shows clear acceptance in this range. If we hold and rotate back above 157.01 with strength, expect continuation. If we sweep below 153.95 and fail to reclaim, the idea flips.Execution clarity: Longs from 155.75–155.00, invalidation below 153.95 First reaction target: 158.27 Full structure target: 164.46 Below 151.67 = deeper reprice scenario into weekly inefficienciesNo noise. No hype. Just structure. The chart is clean — the plan is already in motion.Want more setups like this before they move? Profile description has them.

SmartFlowsI

This isn’t distribution. It’s preparation.

XRP has spent the last sessions consolidating just under a 15M OB — not failing, just gathering energy. Most traders confuse rejection for weakness. Smart Money sees opportunity.What matters: We’ve got stacked 15M OBs above 2.2544 and 2.2805 — liquidity zones that will either break or sweep Price just tapped the local low while holding above volume cluster support If we reclaim the midrange and hold above 2.2400, the setup for expansion into 2.2805 is in play Lose 2.2348? Expect a deeper rotation to the 2.1862 demand zoneThere’s no need to predict here. Just follow structure. Volume confirms intent, and the reaction around these OBs will dictate the next leg.Execution: Reclaim 2.2544 → long toward 2.2805 Clean breakdown? Step aside and re-evaluate near 2.19 Bias is bullish unless 2.2348 gets invalidated with convictionYou don’t need more signals. You need fewer distractions. The chart is already speaking.More like this? Setup-first, noise-free — check the profile description.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.