SergioRichi

@t_SergioRichi

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

SergioRichi

آیا زمان جهش سولانا (XRP) فرا رسیده است؟ پیشبینی شگفتانگیز قیمت!

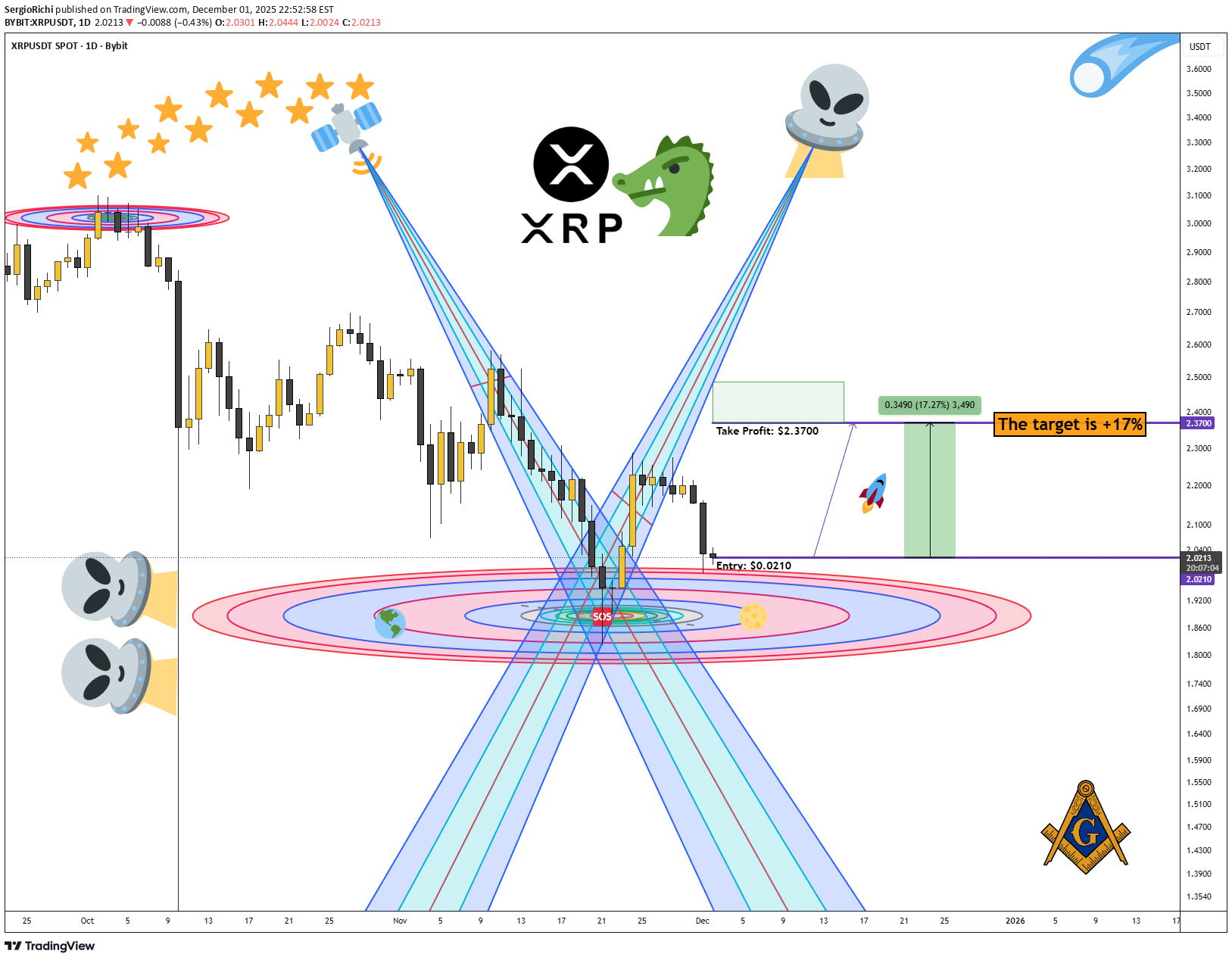

XRP ➖ Time for XRP? I checked CoinMarketCap and saw the coin is currently ranked 6th in searches, so I got curious about what's going on with it. Like every other coin, it dropped hard together with the market on Monday and triggered a ton of trader stop losses. Looking at the liquidation heatmap, there is still room for upside along with Bitcoin. Basically this will just be a corrective bounce before we head even lower. We'll wipe out the shorts first and then drill a new bottom. ➖ Entry around $2.0210 with a target of $2.3700, good for roughly +17%. Unless aliens and reptilians don't step in and mess with this little XRP bounce of course 🦖👽.Better safe than sorry. I'm closing the XRP idea at breakeven. Especially considering what might happen with Ethereum: t.me/SergioRichi/614

SergioRichi

آیا زمان خرید PUMPUSDT فرا رسیده است؟ فرصت سود 150 درصدی!

🐸 PUMP #PumpFun ➖ Time to buy? Chart (PUMPUSDT): PUMP is down 72% from its all-time high. Looking at the liquidation map, this looks like a solid entry point to grab some PUMP for part of the portfolio with around +150% upside potential. Take-profit target is $0.007 ➖ right where the biggest cluster of short liquidations sits.I don't like what's happening right now. Closing the trade at +2.98% with an exit price of $0.002902. It looks like the correction in BTC, ETH, PUMP, and other assets could keep going and form a new local bottom.

SergioRichi

بیت کوین در آستانه کجاست؟ سطح حیاتی ۹۴,۶۴۰ دلاری و پیشبینی قله ۲۰۲۶!

BTC #Bitcoin — Bitcoin is approaching a key level at $94,640. The correction in the crypto market continues, and it's now starting in the US stock market. Bitcoin is nearing an important level on the 5-day timeframe—specifically $94,640. That's where market makers and big players have placed limit buy orders, and I think we'll see some major trader liquidations there too. For those who trade Bitcoin exclusively, I've marked a buy level. • Buy limit: $94,640. • Take Profit 1: $130,000 • Take Profit 2: $150,000 The range for wrapping up Bitcoin's cycle is pretty wide, since there are large orders set up there for taking profits. It's tough to pinpoint exactly where the price peak will be—we can only go by the data we can see. • Coinbase: $130,000, $150,000, and possibly $200,000. • Binance: $130,000, $150,000, and likewise, it's unlikely but possible to climb to $200,000. Based on Elliott waves, we're finishing the 5th upward wave, and I figure the peak will hit in 2026, followed by a straight drop. Indicator for Bitcoin miners: The cycle indicator on Bitcoin shows the peak hasn't been reached yet: Samuel Benner's Cycle and the 2026 Peak The "200-year farmer chart," often referred to as Samuel Benner's Cycle Chart, is a historical economic forecasting tool created in 1875 by Ohio farmer and self-taught economist Samuel Benner. It's credited with a "90% success rate" in broad sentiment prediction, and modern applications extend to stocks, crypto, and even solar cycles correlating with recessions. It's best used as a sentiment gauge, not a precise timer. Implications for 2026 The chart marks 2026 as a "B" year—a cycle peak in "Good Times," signaling high prices and a time to sell before transitioning to panic and hard times from 2026-2032. This suggests a potential bull run peak, followed by downturn risks amid global debt, inflation, and geopolitics. As of late 2025, we're in a growth phase approaching this apex, per the model's extensions. Dear friends, it looks like 2026 will mark the end of the growth cycle for Bitcoin and altcoins, so we'll need to find exit points, bail out of the crypto market, stock up on supplies for 3-5 years, and get busy building bunkers 😀🔥.Bitcoin has reached the $94,640 mark. Godspeed.How's the mood? Drop a comment with your take on whether Bitcoin will head up or keep dropping from the current price of $96,000. Curious to hear your opinions. 🤔🤔🤔The Crypto Fear and Greed Index is at an extreme fear level of 11. Chats and the X platform are buzzing with panic over Bitcoin's drop. • The last time we saw numbers this low was February 26, 2025. These are the times when the ideal entry point into Bitcoin takes shape—right when tons of folks are waiting for it to sink even lower or straight-up declaring that the bear market has kicked off and it's time to bail. With Bitcoin, it's straightforward: now's the prime time to jump in. But what about altcoins? • I dug through the data on Coinbase and Binance and spotted that market makers and big players have set limit orders down below—some at -10%, others at -30% from current prices. • This could mean Bitcoin's about to rally, its dominance will climb too, and they'll basically suck liquidity out of altcoins, pouring it right back into Bitcoin 😀🔥.🚨 BREAKING The sentiment on Bitcoin is way too bearish right now. Bitwise put together some intriguing stats on the average Bitcoin returns after the fear level drops below 20 points. After: ➖ 1 week: +5.2% ➖ 2 weeks: +9.3% ➖ 1 month: +19.9% ➖ 2 months: +44.2% ➖ 3 months: +62.4% ➖ 6 months: +48.5% Today, the reading is at 9 points, which means we're in the final phase of Bitcoin's correction, and we could see a god candle in the near future.BTC — Current Bitcoin outlook As of November 19, 2025, there are massive buy orders queued up on Coinbase and Binance at $85,000 and $80,000. Looks like we're gearing up for one last corrective dip across the crypto market and the S&P 500 index. MSTR and COIN stocks are riding that correction wave too. ➖ The Crypto Fear & Greed Index is currently sitting at 16 points. Snapshots:🪙 BTC #Bitcoin — It's time Hey everyone. Targets hit on Bitcoin, and I bet the panic level is through the roof. ➖ Even my brother—who couldn't care less about crypto—texted me saying Bitcoin's down to $80,000, what's going on? 😀🔥 ➖ That's like an extra confirmation that the bottom might be in, or damn close to it. The correction targets from the last update got nailed at • $80,000 and • $85,000. If you're a Bitcoin-only trader, now's the time to think about adding it to your portfolio. • Next stop: $96,000, where we'll see $10 billion in short liquidations. • Medium-to-long term, we're eyeing $125,000 to $150,000; honestly, $200k still feels like a stretch right now—better to cash out at 125k-150k and then hunt for gains on altcoins as liquidity shifts over from Bitcoin. Charts: 👉 If you sign up on a crypto exchange through my link, I'll kick back up to 50% of the trading commissions from your activity every week—pure win-win.BTC #Bitcoin ➖ It's almost time to start closing out Bitcoin positions. The correction's getting more tangled up. Hey everyone. In my last Telegram post from November 21, 2025, I said it was the perfect moment to buy Bitcoin, right when the negativity on social media was peaking: t.me/SergioRichi/576 ➖ Now Bitcoin's rebounded up to $90,700, so it's time to tweak the plans. 😀🔥 ➖ Back in that post, shorts were massively overweight, and it made sense to liquidate traders around $96k–$97k. Now the balance has flipped toward longs, and I'm seeing orders lined up for liquidations on Binance and Coinbase. This just goes to show again that the market mostly hunts through those trader liquidation zones ✂️. • The plan is to close Bitcoin positions at $96,000–$97,000 and wait for a dump to build up long-term long positions from the $75,000–$80,000 range, aiming for further targets at 125k, 150k, and maybe even 200k. 👉 If you sign up on a crypto exchange through my link, I'll kick back up to 50% of the trading commissions from your activity every week—pure win-win.We’re scrapping that idea. Now we’ll wait for Bitcoin at $75,000 and a bit lower. From there we’ll make a decision.

SergioRichi

تحلیل فوری سولانا (۱ آذر ۱۴۰۴): سقوط زیر خط روند و انتظار ورود در محدوده ۶۰ تا ۷۰ دلار!

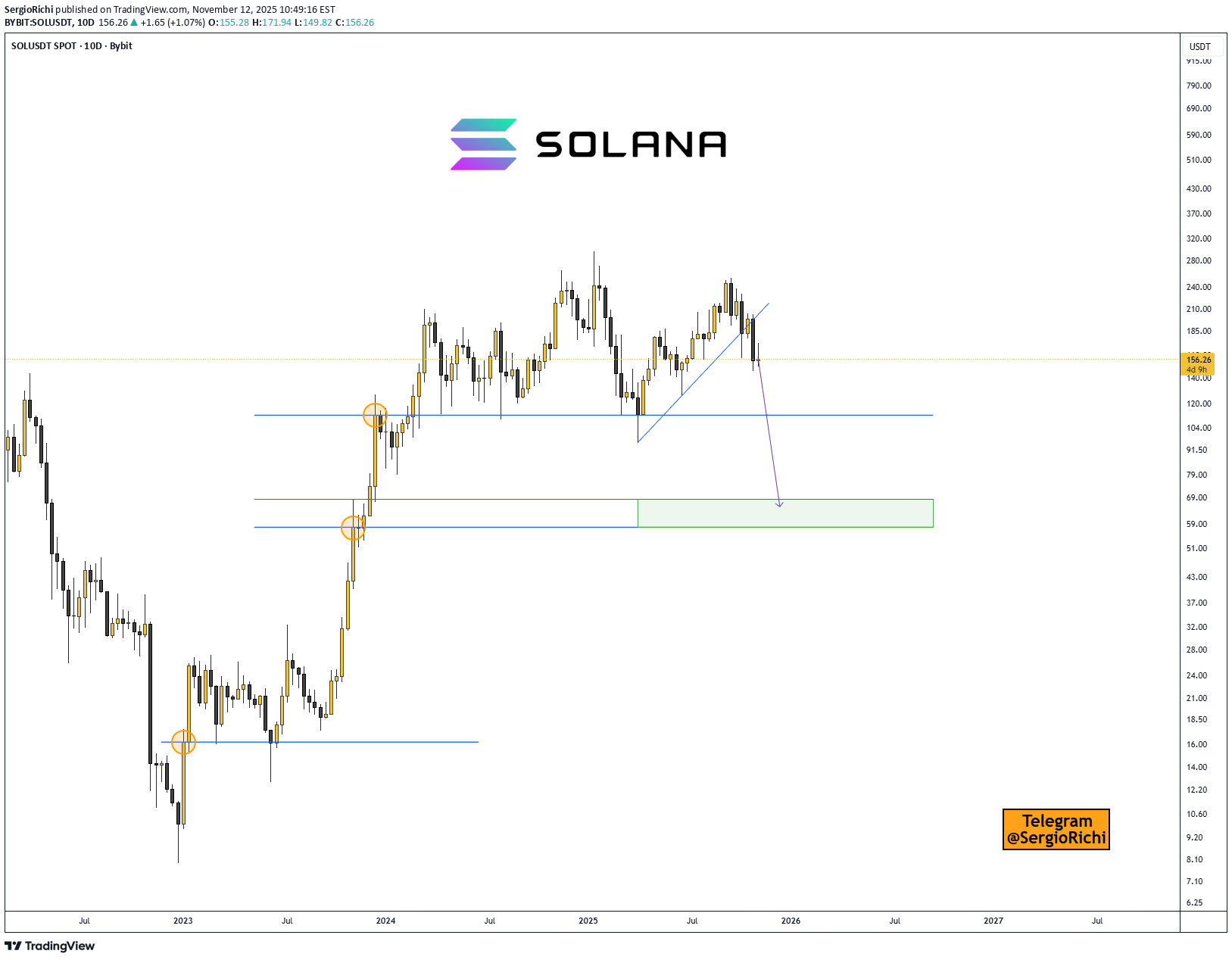

SOL / #Solana Quick overview for Solana (Nov 12, 2025) We've broken the trendline and are now trading below it on the 10-day timeframe. No price rebound in sight, so the priority is to wait for a correction with the nearest targets at $60–$70, where we can look for entry points. Coinglass is sneaky—they won't let you view data beyond a 3-month chart 😡. ➖ Essentially, there's a large order on Coinbase at $52 and on Binance at $79. ➖ We'll focus on $60–$70 and make decisions from there. Charts:SOL #Solana ➖ Soon... time for sell Solana. The nearest short trader liquidations are sitting at ➡️ $145-$148, and you've also got limit sell orders on Binance for 9,175 SOL and 14,045 SOL. ➖ There's still a short upward push left for Bitcoin up to $96,000-$97,000 and for Ethereum to $3,250-$3,300. • After that, I'll be watching for the correction to keep rolling on Solana, sticking to the main plan with level testing on the 10-day timeframe. • Plus, if we drop below $100, we'll slide into sideways accumulation between $55-$100, which is a solid spot to start building up a spot position. At those levels, I figure everyone'll capitulate and start posting that crypto's a total scam and we're in for a three-year bear market. ➖ Market makers and the big players have nailed their objectives, knocking a ton of folks out of the game. ➖ Those trading futures saw their deposits go up in smoke back on October 10, 2025. ➖ Right now, it's all about shaking out the spot holders. 👉 If you sign up on a crypto exchange through my link, I'll kick back up to 50% of the trading commissions from your activity every week = pure win-win.

SergioRichi

بهترین فرصت خرید اسپات اتریوم: نقاط ورود جدید بر اساس سفارشات نهنگها (نوفمبر ۲۰۲۵)

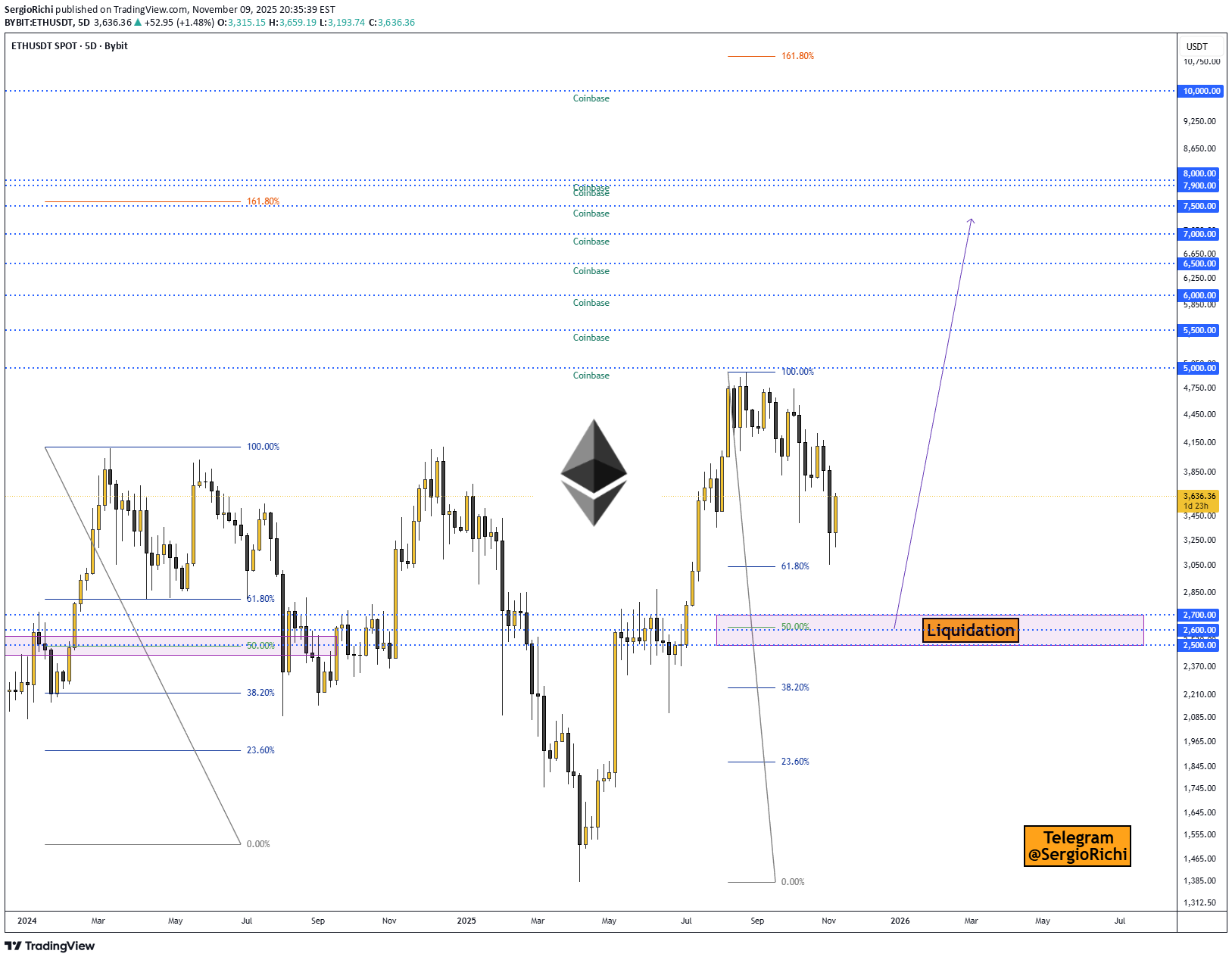

ETH / #Ethereum Spot idea for Ethereum (Nov 9, 2025) On October 29, 2025, I posted an update saying it's worth waiting for Ethereum to drop into the $3,100 - $3,400 range, since that's where the nearest long trader liquidations are sitting, along with some big limit orders on exchanges like Binance and Coinbase. We've hit those levels now. Update: So, it's time for a new update aimed at traders hunting for a better entry point on Spot (no leverage involved). There are fresh large limit orders set by market makers and major whales. ➖ On Binance: $3,055, $3,000, $2,900, $2,800, $2,700, $2,500. ➖ On Coinbase: $3,000, $2,500. If you check the Liquidation Heatmap on the Bybit crypto exchange through the Coinglass platform, the biggest pain point for traders is around $2,500 - $2,700, where big players will scoop up Ethereum more cheaply after those liquidations hit. To sum it up: The crypto market and the US stock market are both in correction mode right now, so you need to be extra cautious when looking for entry points and try to avoid using leverage on futures positions—otherwise, you could wipe out your trading deposit. I think it's smart to hold off a bit longer and enter positions right where the big players are waiting, and where those trader liquidations are clustered. That way, you'll have an edge on your entry and can hold the trade through Ethereum's distribution zone all the way up to $10,000. Charts: Looks like 2026–2027 could hit peak cycle vibes, right alongside the highs for stocks and crypto. Altseason on deck?ETH 🔹 It's time for buy Ethereum. Ethereum's correction targets have been nailed at $2,600–$2,700. Could it dip lower? You bet—if you're building out a spot portfolio, though, this is a killer entry point right now. ➖ Next up, profit-taking targets based on those Coinbase orders. It's a broad range from $5,000 to $10,000. I've marked them on the chart and attached screenshots.

SergioRichi

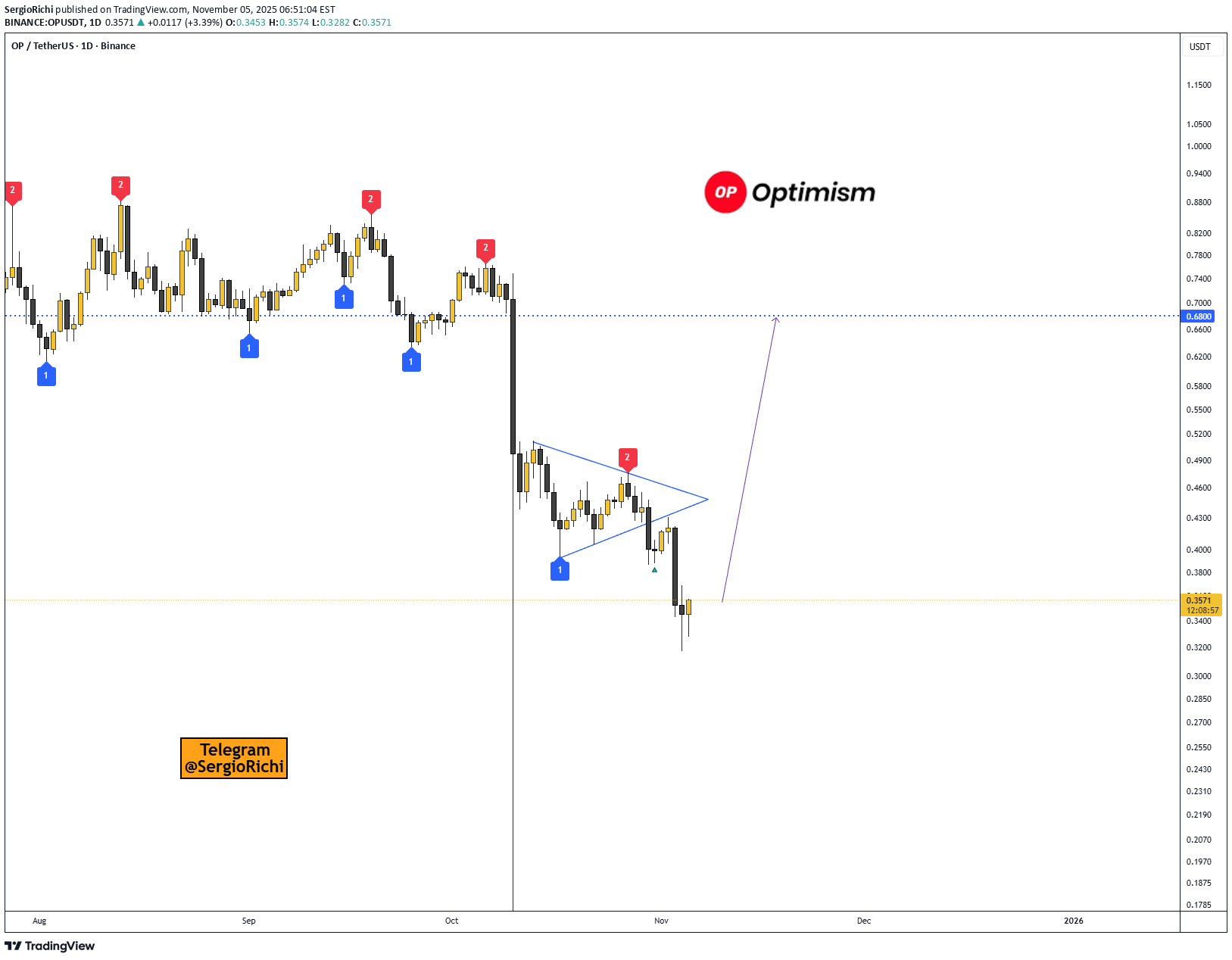

بیتکوین ترکاند! فرصت طلایی ورود مجدد به OP با سود 1:8 (تحلیل و سیگنال)

BTC just smashed through $100K, and ETH's hovering right around $3K. Might be time to dip back into OP—looks like the liq map shows they flushed out every last long trader. Entry: $0.3547 Take Profit: $0.6800 Stop Loss: $0.3098 Playing it with a 1:8 RR. If this one gets stopped out, I'll eye the next entry around $0.26 +/- straight into the spot bag. All that prime liquidity's piled up overhead.OP #Optimism Closed out my OP, didn't wanna hang on any longer. Gonna wait for signals from BTC and the S&P 500 before jumping in on spot, then ride out till altseason hits. Closed: $0.4294

SergioRichi

نقطه ورود جذاب در آپتیمیزم: ترید با پاداش ۱ به ۵!

There's also an interesting entry point on OP #Optimism. The trade is almost 1 to 5. Entry: $0.4059 Take Profit: $0.5015 Stop Loss: $0.3849 It looks a lot like a false breakdown downward and growth along with Bitcoin and Ethereum is quite possible. Short traders' liquidity has already accumulated. #Crypto #Trading #DayTrading

SergioRichi

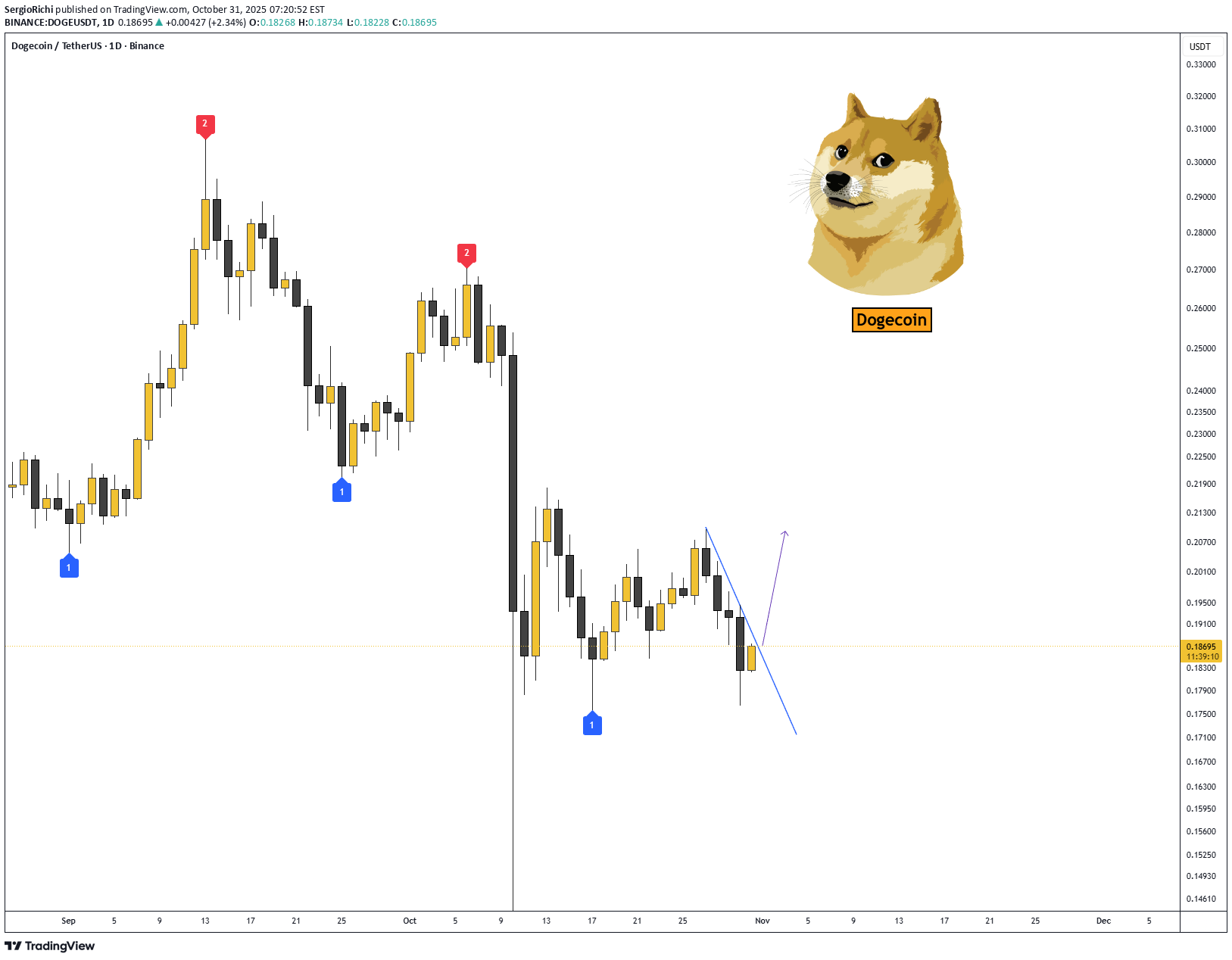

پیشنهاد ورود به معامله ارز دوج کوین (DOGE) با سود 2 برابری: تحلیل و نقاط ورود/خروج

SergioRichi

احتمال کاهش نرخ بهره فدرال: بیت کوین تا ۱۰۰ هزار دلار سقوط میکند؛ بهترین فرصت خرید قبل از جهش بزرگ!

BTC / #Bitcoin 🪙 Fed Rate Cut Looms: BTC Dip to 95K-100K = Prime Entry Before Moonshot? (October 29, 2025 ) I've been away from the market for a good long while. In essence, nothing much happened during that time. We're just hanging out in a sideways range, waiting for the big events: 1. Fed Interest Rate Decision 2. FOMC Press Conference 3. Trump and Xi In just a couple of hours, we'll see that 0.25% interest rate cut. And there'll be a key speech from Jerome Powell. For today, trader sentiment looks mostly positive, from what I can tell. But I've got this gut feeling the market's gonna dip again. The sweet spot for entry on Bitcoin should be 95k to 100k. They'll sweep the long liquidity once more, and then we'll head higher. That's how I see this event shaking out. Charts: ➖ On the 5-day timeframe, that key level around 95k is still holding. Once it's tested, it'll clear the way for a push up to 145k to 200k (the final leg up). ➖ Chart from Coinglass Legend, which shows long trader liquidations stacking up below from $93k to $98k on the Bybit exchange. I figure they'll clear out that liquidity first before we rally. ➖ Big cluster of orders right nearby on the Coinbase crypto exchange at 93k and 100k, which backs up this zone as a hot spot. Whale money's piling in, partly by scooping up those trader liquidations. As you know, messing with leveraged trades is a risky game. The smart play is limit orders, and stick to spot only 😀🔥. #Crypto #Trading #Coinbase #FED #FOMC #STOCK

SergioRichi

Growth ahead of the Trump-Xi Jinping meeting in South Korea.

ETH / #Ethereum 🔹 Donald Trump and Xi Jinping (October 19, 2025) A positive outlook is shaping up for Ethereum, and it sure looks like a classic W reversal is in the works. There's a ton of negativity swirling right now, with a lot of folks expecting prices to dip even lower (I was bracing for that final flush-out myself, but it looks like they scooped up the dip and are busy forming this reversal setup). During that Ethereum drop on October 10-11, BitMine Immersion Technologies beefed up its reserves with 104,336 ETH worth $417 million. As of this writing, the company's sitting on 3.03 million ETH valued at $12.18 billion, making it the biggest corporate whale holding Ethereum. Whales and public companies are aggressively snapping up Ethereum and stacking their bags. All that's left is to speculate where Ethereum's gonna top out and where they'll start dumping all this volume 8k? 10k? I've pulled together some screenshots that back up the bullish signal: 1️⃣ Liquidations on the Hyperliquid exchange: As you can see on the chart above, once we break $5,000, a massive wave of short traders are gonna get wrecked that could spark another leg up in price momentum. 2️⃣ Coinbase order book: Check it out—above $5,000, there are limit orders lined up for profit-taking, so Ethereum might follow a similar path straight up to $8,000. 3️⃣ Current big orders on Binance and Coinbase exchanges. 4️⃣ OKX ETH/USDC liquidation heatmap. Wrapping it up: On the daily chart, we're seeing a reversal pattern forming as a W (I call it the "pirate reversal" myself), and keep in mind that after the chaos on October 10-11, more than 1.6 million traders got absolutely rekt. I doubt everyone's gonna pile back in buying or flipping to long positions anytime soon that plays right into the hands of the big market puppeteers and market makers. They'll pump the price higher, whip up the hype, and offload their Ethereum stacks at the top. Snapshot:ETH / #Ethereum 🔹 Ethereum is entering a correction before further growth (October 29, 2025) We're awaiting the current major events: ➖ Fed Interest Rate Decision ➖ FOMC Press Conference ➖ Trump and Xi Regarding Ethereum, there aren't big changes; it seems the correction will drag on and it's more likely they'll collect liquidity from long traders, and only after that we'll head into growth. Chart: 1. Marked on the 5-day chart the liquidation levels $3100-$3400 from where an Ethereum reversal could occur. 2. On the Coinbase exchange, whales have placed a grid of orders all the way down to $3000. 3. On the Binance exchange, large orders at 3000, 3100, 3200, 3300, 3400, 3450, 3500. Let's see how everything plays out today and tomorrow. Volatility will be high. 🤔🔥

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.