ScopeMarkets

@t_ScopeMarkets

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ScopeMarkets

GOLD: Bears await clear exit from flag pattern

GOLD has seen its downward pressure pause as it prints a bearish flag pattern in the 1-hour time frame. Before now, the yellow metal has shed over 500 points as the US dollar enjoyed risk flows due to solid economic reports from the US. GOLD sellers will have to wait for a clear break out from the bearish flag pattern for further confirmation of the downside which could see the price exit the $2000 price level.

ScopeMarkets

Gold advance stalls around trendline

GOLD investors are currently facing a challenge as the commodity's price has hit a descending trendline that has been keeping the bears in control since December 28th, 2023. Meanwhile, the US dollar is performing well, recovering some of its losses from the end of 2023. Investors are now waiting for the US inflation report, which could potentially boost the price of gold if inflation figures drop and revive rate-cut sentiments. However, if the report shows a surprise reading, we could see GOLD prices continue their decline from the descending trendline as the report will dampen expectations of early rate cuts by the Fed

ScopeMarkets

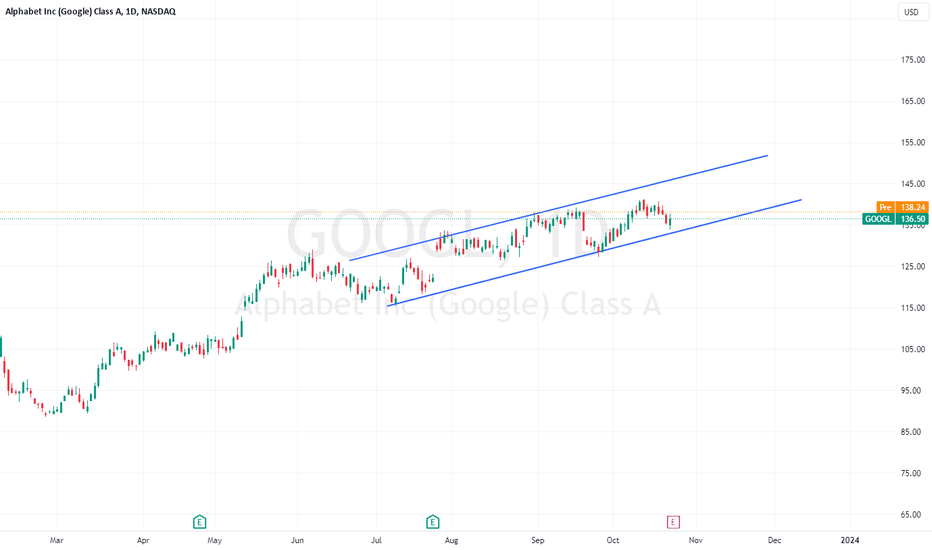

Google turns the corner as investors await earnings

GOOGL parent company Alphabet is set to report its Q3 earnings with analysts expecting an upbeat report from the tech company. The internet search giant is expected to see its EPS jump by 37% to $1.46 while gross earnings for Q3 are expected to rise by 10% to $ 76 billion. Analysts are forecasting a rebound in the Ad business revenue with YouTube advertising set to rake in about $ 7.82 billion, indicating a 10% rise with upbeat reports also expected in its cloud computing services. Investors will be eager to hear about the company’s progress on Google’s artificial intelligence project as it prepares to launch a new language model called Gemini which is expected to compete with OpenAI’s GPT-4. A glance at the chart shows that the correction phase of the bullish trend might have ended as the price made a rebound close to the support area of the ascending channel around $133.00. GOOGL has benefitted from the AI revolution this year which has seen its stock rise about +54.71% as it competes with other tech giants for superiority.

ScopeMarkets

Safe-haven inflow pushes Gold Further away from channel

There has been a surge in the demand for GOLD due to the renewed tension in the Middle East. As investors seek a haven for their assets, the price of the yellow metal has increased by over 1% leading up to the New York trading session. With a clear break away from a descending channel, the bulls will feed on further geopolitical tension to override the strong resistance around 1948.13 and 1953.55.

ScopeMarkets

Gold: Bulls could swing in around techincal level

Gold prices may have the potential for a final surge, with bids potentially lingering around the 1805.00 price level, which was the low of February. The value of the yellow metal has been on a decline as the US dollar, supported by strong economic data, continues to attract investors. Despite the Federal Reserve's restrictive monetary policy approach, the JOLTS job opening report has recently risen unexpectedly, indicating that the US economy continues to surprise analysts. Moving on, the market awaits strong economic data (ADP Non-Farm Employment and ISM Services PMI) from the US, and Gold prices could see some action later in the day. The technical levels for Gold remain clear, with the primary support at 1805.00 and resistance at 1857.53. However, the general bias remains bearish as long as the Federal Reserve adheres to its "higher for longer" narrative.

ScopeMarkets

Gold reverses at trendline after Fed decision

GOLD prices turned south after the Federal Reserve kept its interest rate unchanged at 5.50% with the intent of keeping rates higher for longer. Prior to the event, Gold took advantage of the US dollar with the price rising toward $1946 as rate pause sentiments filtered into the market. However, the bears swung into action, forcing the price to close below the descending trendline that has subdued the bullish advancement from April after the Fed maintained its hawkish position on economic projections. The central bank noted that it will keep rates higher for longer and is looking at hiking rates one more time before the end of the year. The Technical Outlook on Gold gives bears the upper hand as a shooting star (Bearish reversal Candlestick) is spotted at the resistance of the descending trendline. With the price looking ready to drop further, the focus has shifted to the unemployment claims data which could heap more pressure on Gold should the report come out better than expected.

ScopeMarkets

Bitcoin surges as court ruling boosts ETF hopes

Bitcoin surges as court ruling boosts ETF hopes Bitcoin is moving sharply higher after a US appeals court found in favour of Greyscale, who has looked to push back after the SEC rejected their application to convert their Grayscale Bitcoin Trust into a spot Bitcoin ETF. Today's ruling has helped lift sentiment across cryptos, while bitcoin mining stocks and brokers are also sharply higher in early trade. The instruction that the SEC should "vacate" its rejection paves the way for a potential future approval, boosts hopes of an ETF product that will widen the net in terms of accessibility for the crypto posterchild. In terms of the chart, this appears to set the stage for a bullish period, following a collapse towards the $24,737 swing-low. Until that level is broken, the bullish trend remains in play here. That view remains despite the decline through trendline support this month. The wider market outlook remains key, with any risk-off move driving dollar strength and BTCUSD weakness. Nonetheless, with today's news bringing a welcome boost for bitcoin bulls, heightening the chances of a bullish phase for BTCUSD.

ScopeMarkets

Bitcoin breaks resistance, as ETF prospects lift sentiment

Bitcoin breaks resistance, as ETF prospects lift sentiment Bitcoin has seen its ups and down over the course of the year thus far, with HODLers looking to benefit after riding protracted periods of weakness. The past two months have provided yet another period of downside, with prices being hit as Coinbase and Binance draw the ire of the US regulators. However, one of the factors derived from those SEC charges has centered around the question of what is a commodity or a security. Bitcoin’s classification as a commodity does bring the benefit of lower oversight compared to some of the smaller coins. However, that pessimistic tone appears to be shifting as traditional financial players look to enter the space in a big way. ETF filings from Invesco and Wisdomtree follow on from a similar request from Blackrock, with traditional money clearly entering the space. Meanwhile, Deutsche Bank filed for a crypto custody license in Germany. With the world’s largest Crypto platforms under great scrutiny and traditional finance firms moving into the space, there is a hope that we will see improved business practices in the crypto arena. Meanwhile, questions around which altcoins will be classified as commodities will likely shift alt-coin funds toward Bitcoin. With that in mind, it comes as no surprise to see the bulls back in charge, with the price of BTCUSD popping through $28493 resistance. Coming off the back of a 50% retracement, we look set for a potential push through $31036 resistance to form a fresh one-year high. A decline through the recent lows of $24,770 would be required to signal a wider pullback coming into play. Until then, there is a good chance we are set for a period of Bitcoin strength.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.