Robi_Nitu

@t_Robi_Nitu

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Robi_Nitu

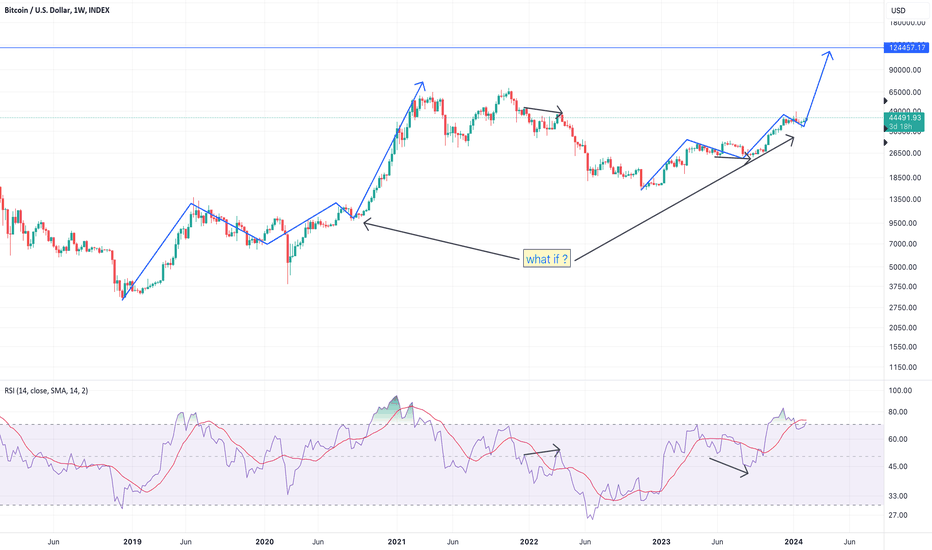

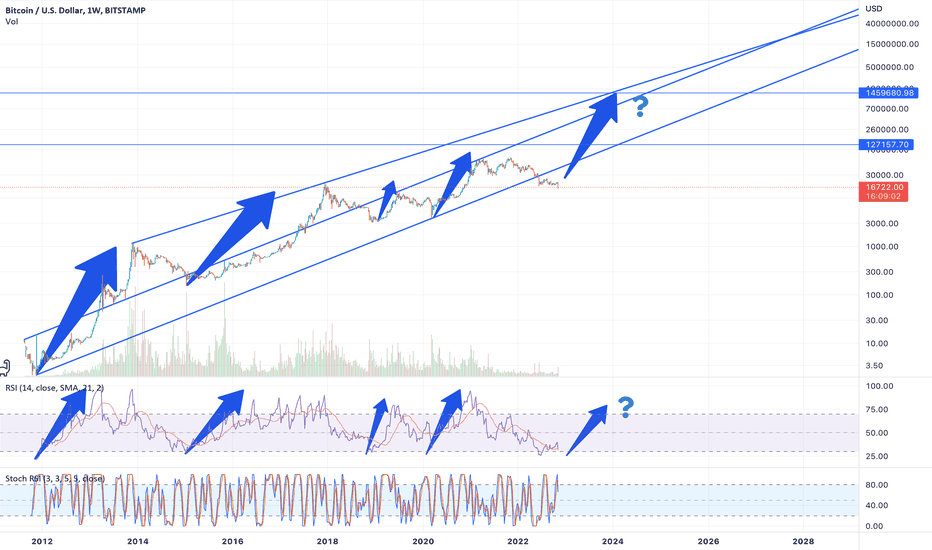

Hi guys, Found some similarities with the past cycle. If this is a good idea we should see 6-8 weeks of growth from here. Tell me what you think, is this in any way valid ? Trade safe !

Robi_Nitu

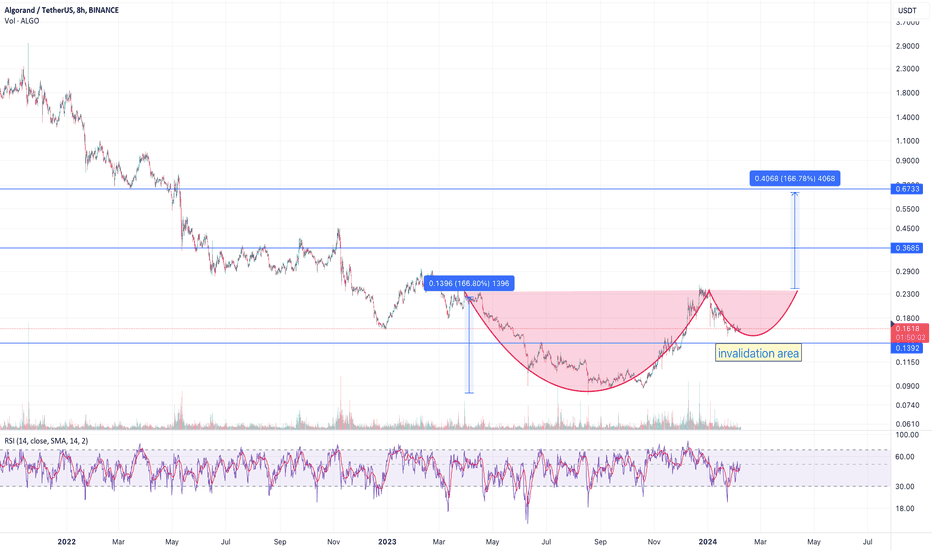

Hi guys, Spotted this setup on ALGO, the target of the cup & handle is situated in the 0,67$ area. As a "safe" trading setup we still need to wait for a breakout and retest of the 0,23$ area before taking action. Always take risk management measures while trading ( set stops, maintain risk under 2% etc.). I hope we all make it !Managed to get over the 0,23$ area. If it holds ... we're on.0.28$ just hit, seems it was a good idea, set SL in profit and let it rideAlmost there, trading at the 0,54$ levels currently, it took a lot more time than expected, but ... it's getting there.

Robi_Nitu

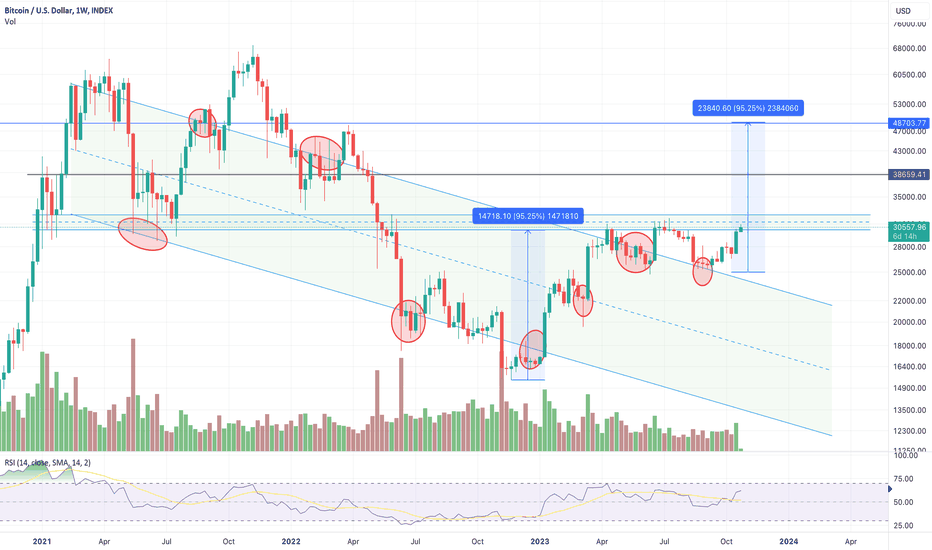

BTC bullish chart October 2023 Hi guys, I noticed a few boolish aspects of this year's TA and I wanted to make some updates from previous chart : 1. The descending channel seems to have been broken out of and price is attempting to hold the 30k area. 2. I marked with a red bubble every confirmation of the descending channel going down, it should also confirm the "going up" part of the process. 3. The measured move from the bottom applied to the end of the current correction suggests we might still have a chance at 48k this year. Let's trade better, together !

Robi_Nitu

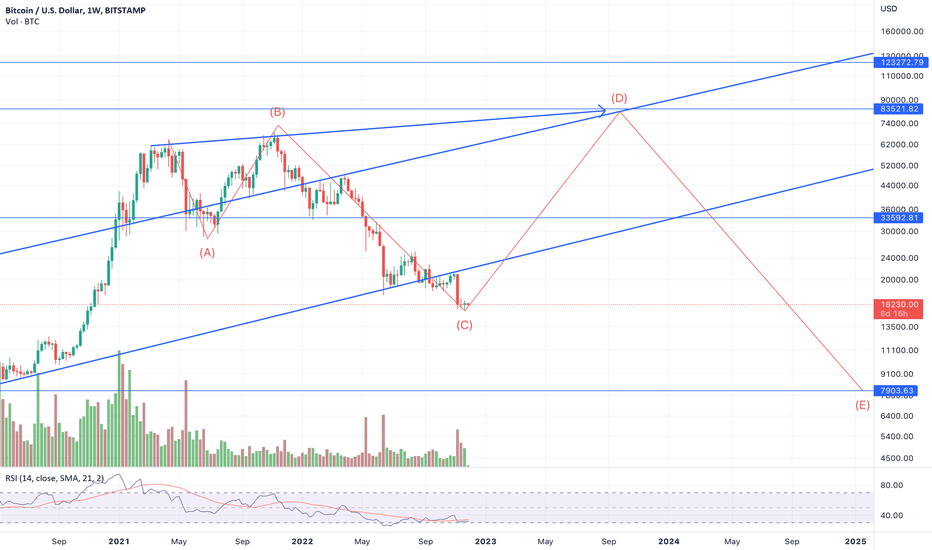

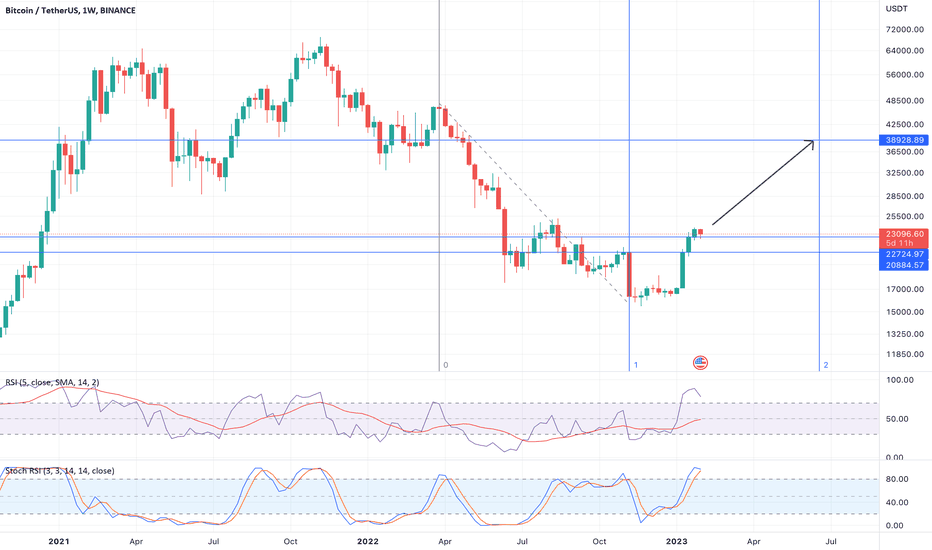

BTC bull(ish) chart 28th of November 2022 Hi guys, This is my latest BTC chart with the price projection going into next year. I reviewed my previous ones, always seem to get the price levels right (tops/bottoms), but rarely the time needed for the moves. So take the time period with a grain of salt. In my opinion the C wave of the correction is at the bottom. We should be seeing price move up in the following weeks. I had an initial calculation that suggested the 23rd of March as Ann important date, seems that after the FTX debacle it's going to stretch longer into the summer of 2023. The price target for the next move up sits in the 84k area. I will be updating this chart upon further development. RSI weekly potential bull div, Stoch RSI "almost" oversold, EW count - 5 waves, Fibo 0.9 retracement from previous 2020 breakout. Invalidation : weekly close under 13.800$ Happy hunting !Trade active: over the 17k mark, let's see if the bulls stick to the plan.Trade active: over the 18.800$ levels, a daily close over 20.700$ confirms bull market breakoutTrade active: We got to 26.7k and rejection followed. It sure seems at this point that my bottom blue trend line is being challenged. If we manage to get inside the blue outlined channel I think this scenario is confirmed 90%.Trade active: looks like 33.5k is the next major resistance, when it breaks 40k will come fast

Robi_Nitu

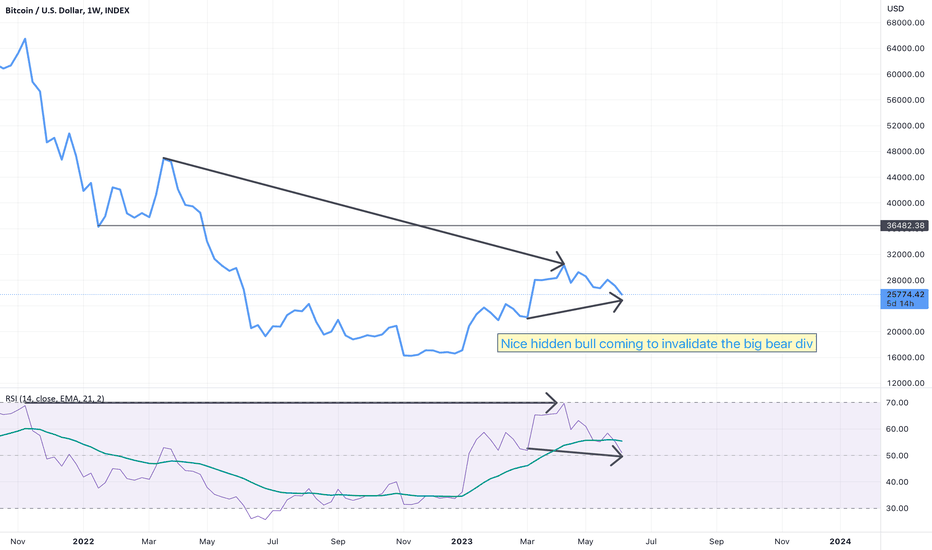

BTC weekly divs June 2023 Hi guys, Yesterday's correction came as no surprise for anyone. Price is currently trying to form a hidden bull div on the weekly, this would invalide the previous larger timeframe bearish divergence if it plays out. Maybe 36k is next. Happy hunting !

Robi_Nitu

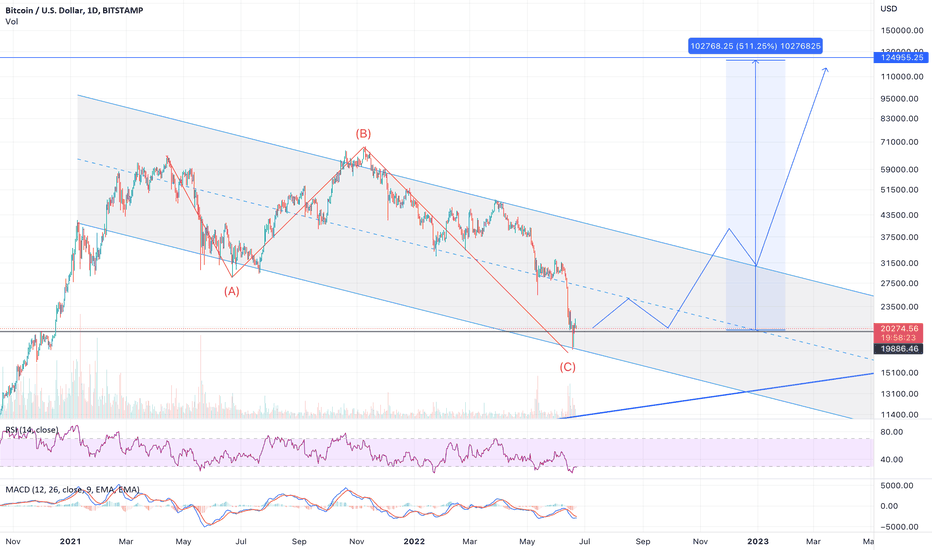

BTC bull scenario 22nd of June 2022 Hi guys, BTC went lower than I was expecting on my previous analysis ( under 19.300$ ) but recovered and is currently trading over the 20k $ levels. As long as we manage to keep this level we are still on our way to surpass 100k in the next 6 to 8 months. Invalidation level remains a weekly close under 19.300$. Happy hunting !Trade active: on our way, 22k todayTrade active: scenario still validTrade active: over 22kTrade active: over 23kTrade active: 5 waves leading diagonal & ABC that puts the price at 20.700$, it’s the make it or break it moment, counting on make it. Happy hunting guys, it’s now or neverTrade active: finding support over the 22.500$ on the correction, if we see the breakout here, next is 29k regionTrade active: following the path, the 24k levels look like a big resistance, patience is keyTrade active: We have reached the median part of the channel as per our previously made plan. It's highly probable to maybe see a breakout try. If we get rejected most likely a final visit under 20k is in play. Afterwards we're targeting the upper side of the channel. Same if we manage to establish support over on the upper side of the channel.Trade active: as previously calculated, rejection at the median part of the channel, let's see if we get another 20.700$Trade active: As I was saying 3 days ago, we got the expected correction with a short visit to the 20.800$ area ( was thinking 20.700$, came close). Now the reset should be over. Excited for the next leg up (if the plan works out entirely). Next stop 29.900$Trade active: support at 20.800$ seems to hold, we can expect a fakedown but opening longs here, will double if it goes lower.Trade active: got the takedown to 19.300$, doubled longs, currently at 20.700$ let's gooooo !!!Trade active: We're seeing a push to 22.400$ area and a normal slight retracement. At this moment in time and price I consider that going back under 20k is not probable anymore. Will continue updating.Trade active: Went lower than 20k again, touched briefly 18.200$. Still holding my long position open, I want to seen a green close on the weekly (over 19.600$).Trade active: hi guys, tomorrow we will find out for sure if this plan is sustainable or not. Bitcoin did a full fibs 1.236 correction and should be bouncing here. The only other type of correction would be an expanded one to 1.618 fibs that would put it back in the 4000$ area. Because there are no other scenarios I believe the bottom to be in (since June actually - now we are seeing a higher low on the weekly ). It's make it or break it time. Go bulls !Trade active: We got the breakout we were waiting for. Now we should see a retest of the 19.800$ area. If it holds it's game on.Trade active: 19.800$ held, currently at 20.800$, moved stops to 19.600$Trade closed: stop reached: got stopped at SL, will do a new chart, looking for a bounce from the lower side of the channelTrade active: I'm back in this, seems FTX crash was a black swan event that pushed the timeframe by 3 months, we're back on support now, let's see if we get the full extensionTrade active: 23kTrade active: 25kTrade active: 29k after a short visit to 31.200$

Robi_Nitu

Hi guys, I had another Fibo timezones projection that said 23rd of March would be a nice top for BTC. I did the last one in September 2022 before the FTX drama. It's invalid now.This is the updated one. Share your thoughts.Happy hunting !

Robi_Nitu

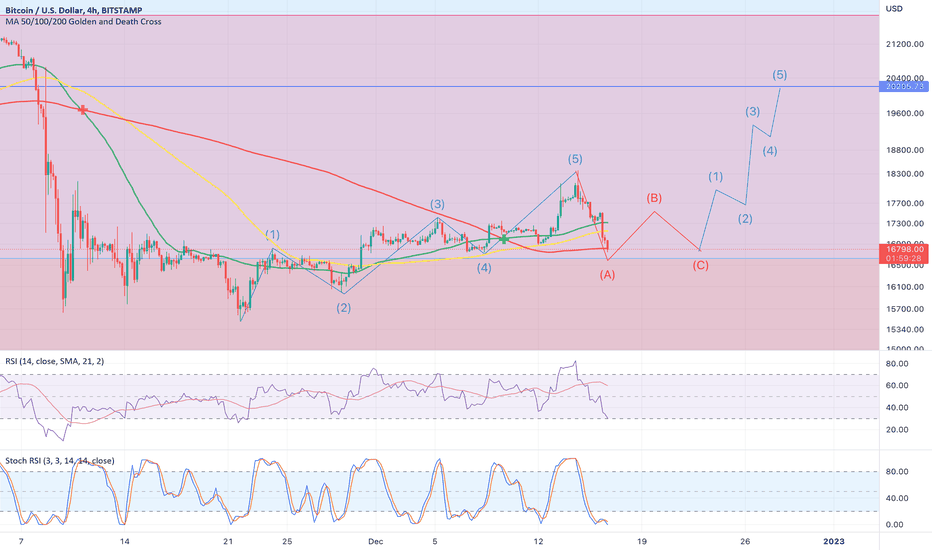

Hi guys, this is my trade setup for today, a breakout seems to be in the cards for BTC, I'm targeting the level marked on chart.Happy hunting !invalidation under 16.450$invalidation point reached and bounced of, still considering this valid even if it takes longer to play outlooks better today, let's see if we manage to get a 4h close over 18.075$, will keep updating, currently at 17.150$looking good, currently retesting the first target from 18.090$next target 18.800$hit 21.5, got out at 19.3, waiting for a retrace, will publish next idea soon, keep close.

Robi_Nitu

Hi guys,if indeed we're seeing a leading diagonal we should get an ABC correction and another impulsive to 20.400$.Short term trade.Happy hunting !

Robi_Nitu

Hi guys,BTC is again in the RSI zone from where it previously ripped to the upside.If we maintain the proportions we spot a target over 1 mil/BTC in the next 7-10 years.Happy hunting !first macro target @127.000$

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.