RealMacro

@t_RealMacro

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

AAPL CRACK!

AAPL just flashed its first CRACK! of this structure. AAPL has moved from the upper trendline to the bottom more through time than price. In my BKC (Bare Knuckle Charting) read, the real tell isn’t the crack… It’s the miss. The previous high couldn’t even tag the upper trendline. That’s subtle, but it’s a big signal of weakening momentum. Then came the CRACK! at the bottom, confirming it. Lastly, we have a mini Head & Shoulders formed at the top. APPL is growing revenues at a rate of 1–2% per quarter, while the stock has been growing at a rate of 5–6% per quarter. That extra 3–4% per quarter is pure multiple & narrative expansion — which is exactly why cracks in charts start to appear. I urge CAUTION to Bulls! THANK YOU for getting me to 5,000 followers! 🙏🔥 Let’s keep climbing. If you enjoy the work: 👉 Drop a solid comment Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

هشدار بزرگ: بیت کوین سقوط کرد! بازار خرسی رسماً آغاز شد و حالا چه باید کرد؟

⚠️ BTC CRACKS — Officially in a Bear Market (-24%) Bitcoin has now broken below $97,000, down 24% from its highs, officially entering bear-market territory. I’ve been warning about this setup for months — not because I enjoy being bearish, but because the structure was screaming caution. This isn’t a “buy-the-dip” moment or a garden-variety correction. We’ve hit a major technical and psychological level that could decide the next phase for the entire crypto space. If this level fails, expect a chain reaction across risk assets — leverage, liquidity, and sentiment all roll over together. It could be years before you see another uptrend. Note: This is not a short-term trade. Stay sharp. The real test for crypto starts now. Thank you ALL FOR getting me up to 5,000 followers!! )) Click boost, follow, comment nicely for more authentic, no BS, raw analysis. Let's get to 6,000 followers. ))

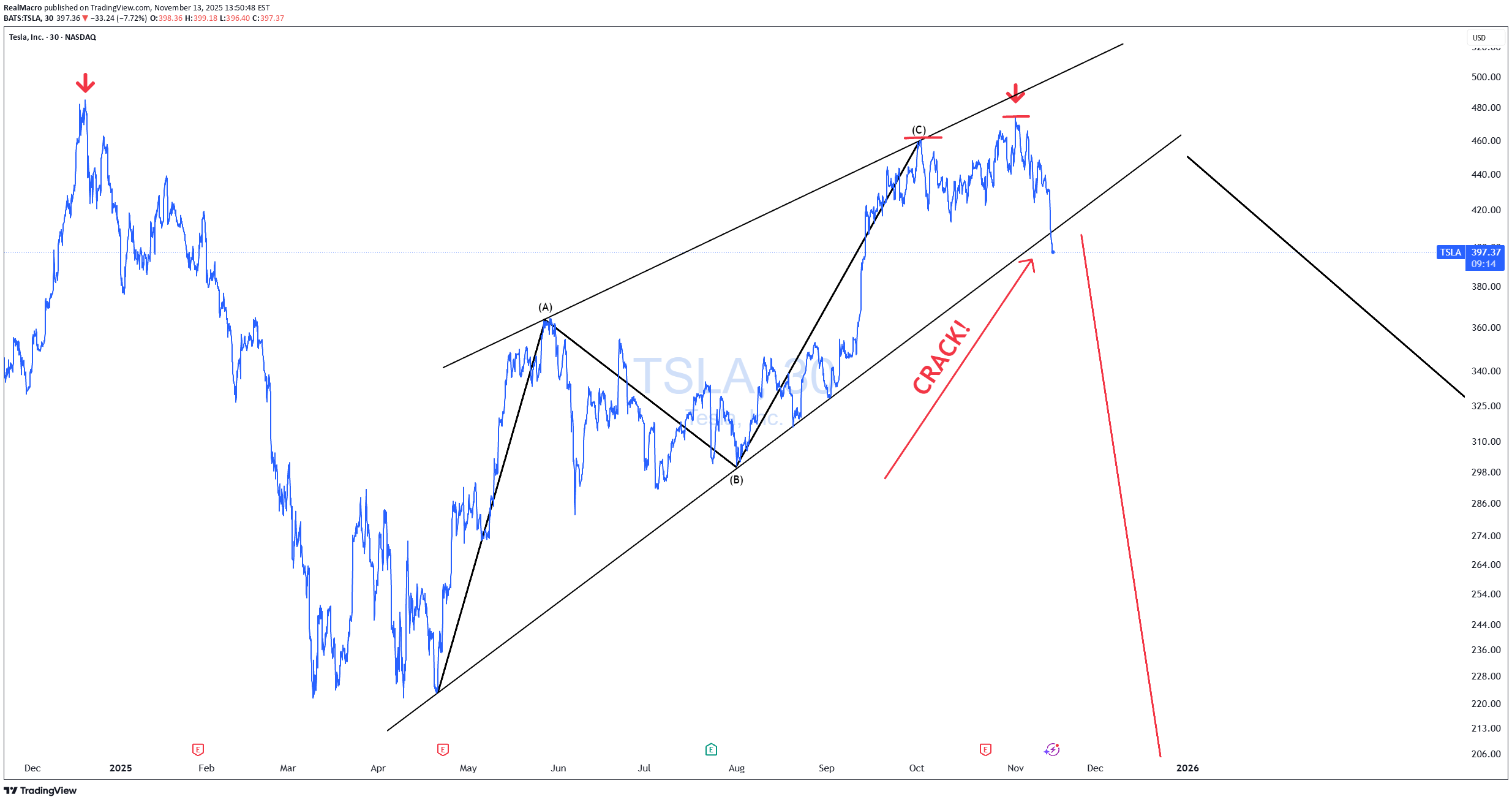

هشدار جدی: چرا نباید الان سهام تسلا (TSLA) داشته باشید؟ (تحلیل فنی و بنیادی سقوط قریبالوقوع)

🚫 Why No One Should Be Holding TSLA Right Now Charting: Triple Top! Rising wedge fully formed 3-wave rising wedge structure that has hooked and broken! mini double top. I’ve been saying this for a while — no one should be long TSLA. The stock has done nothing since 2021, yet the hype machine for the boy band keeps spinning. Ask yourself honestly: Where does Tesla actually lead anymore? Not in EVs Not in autonomy Not in robots Not in AI Not in tech innovation It’s become a stock story with no story left. And when leadership is built on hype, not execution, it always ends the same way. Never invest in toxic leadership or cult narratives. TSLA is a real company, sure — but in fundamental terms, it’s an $8 stock wearing a $450 costume. If you agree and sell, and it's wrong. Guess what? You will have a bunch of cash waiting to buy it. If you disagree, you won't have a bunch of cash waiting to buy lower BC YOU NEVER SOLD! You can't "BUY THE DIP" Ubless you first SELL THE RIP! It's 2nd-grade math that the boy band who will come in here hating on my call again cannot do. They will give me colorful charts, tell me about cup and handles while riding it all the way down! They are always buying but NEVER selling. That's the trick with paper money, you can never run out of it. hahah! Click boost, follow, comment nicely for more authentic, no BS, raw analysis. Let's get to 6,000 followers. ))

سقف ۴۰۰۰ دلار؛ چرا اتریوم شکست خورد و چه اتفاقی در انتظار قیمت ETH است؟

As a macro investor and chartist examining structures, I have not been fond of cryptocurrencies for a while now. Since 2021, ETH has shown no trend. Just wild, reactive emotional moves all over the place. One thing is for sure, it does not like prices above $4,000 Yet another uptrend broken, being rejected out of $4,000 range again! This chart needs a deep pullback and to start fresh! Bottom line: Nothing moves lower without a lower low. Keep an eye on it.And there is the CRACK! So we have a series of lower highs and lower lows. All the basics of a reversal of trend. As silly and basic as this is, most overlook this (in both directions) and then wonder why their trade failed. So let's recap Double top Price hates $4000 Broken steep uptrend! Multiple uptrend failures in a sideways market. (With Big Ars one at the start of the year.) And we have lower highs and lows. What else do you really need? You want to be a bull? Great Buy the Breakout if and when it occurs. Thats the easiest safeset move you can do in a choppy market. Get away from all the noise. Don't be a dick for tick and try to squeeze profits and get whipsawed down!

بیت کوین در نقطه انفجار: منتظر سقوط بزرگ یا جهش سرنوشتساز؟

After months of repeated warnings throughout the year about crypto's vulnerability, we’ve now arrived at a critical inflection point. If Bitcoin breaks down here, it could trigger a waterfall decline — potentially into a bidless market. This is a major level. What happens next could define the next phase for the entire crypto space. Stay alert. It's better to be out of the market wishing you were in than out of the market wishing you were out! No one is forcing you to be in the market! Click boost, like, and subscribe! Let's get to 5,000 followers! ))Nothing moves lower can occur without a lower low. Keep an eye on it.Nothing moves lower without a lower low. Keep an eye on it.CRACK!! As I have been warning for a while now. MAGIC!

هشدار سقوط سنگین تسلا: الگو "سقف سهگانه" چه زنگ خطری برای TSLA است؟

Triple tops = market drop! As soon as the market tanks, TSLA is in major trouble! For 5 long years, people have been trying to pump this stock with no good results. Instead, they got a -75% decline and a -66% decline for their efforts. This stock will fall bidless! All hype with no substance. The question is, will the market stay up long enough to push it up one more time and sucker in the last fools before the kiss of death? We shall see! It's now or never! I am proudly shorting it! As I have successfully done twice before with huge gains. I am telling you, fanboys, point-blank before I get all the hate posts. ))*TESLA 3Q REV. $28.10B, EST. $26.36B *TESLA 3Q ADJ EPS 50C, EST. 54C *TESLA 3Q GROSS MARGIN 18%, EST. 17.2% *TESLA 3Q OPER INCOME $1.62B, EST. $1.65B This is what people expect from a trillion dollar company? @@Why would anyone in their right mind want to buy this chart? SMH! How can anyone possibly look at this chart and find VALUE! The simplest of things are usually the hardest to teach,

BTC to Gold Cracking Lower! CAUTION!

This could end up turning into a significant crack! for BTC relative to Gold. We have a fight on our hands between Speculation (BTC) and a Safe asset (Gold) For over 4 years, speculation has not been able to outperform safety, and it is now starting to break lower. CAUTION! is in order! Click boost, follow, for more authentic, no BS, raw analysis. Let's get to 5,000 followers. ))Cracks everywhere! Now look for a new low! Stick to the very basics of charting and drop the fancy stuff

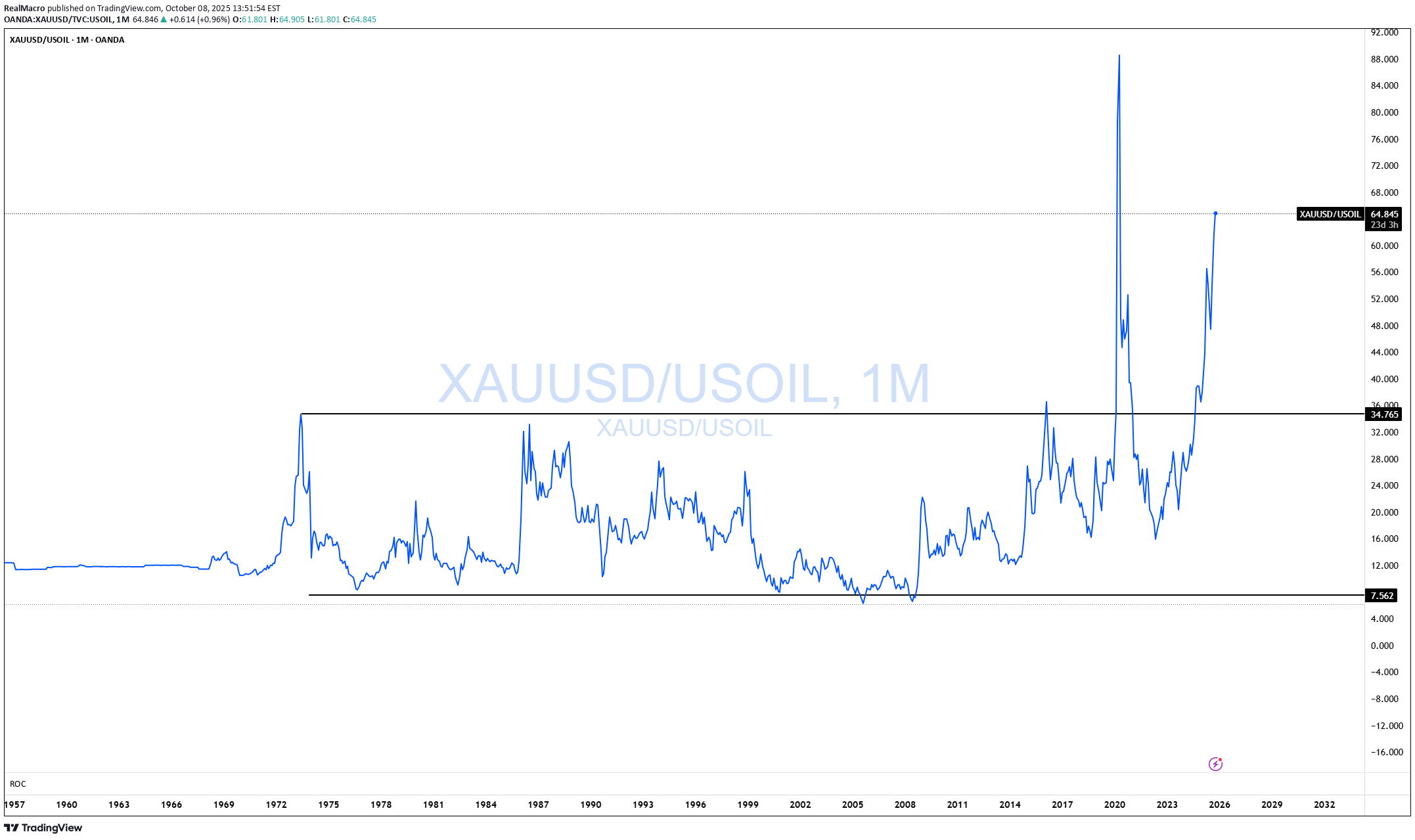

حباب ابرقهرمان طلا و نفت: هشداری برای سرمایهگذاران سهام!

Gold = Fear Oil = how strong the economy is. Except for COVID we have never seen such an extreme reading. Yet people are buying up stocks like we will never again be able to produce another stock again as long as we live! Tulips! Here are just a few of the factors to consider that make this indicator important. Why This Indicator Matters: Key Factors at a Glance Gold’s Surge Signals a Shift Gold has soared nearly 60% year-to-date, adding a staggering $10 trillion in market capitalization. This rally effectively erases all the stock market gains made since May 2021, including those driven by AI enthusiasm and speculative tech runs. USD Can Only Be Measured Against Gold As the world’s reserve currency, the U.S. dollar’s real value is best gauged in terms of gold. This is a critical point—because when gold rises this dramatically, it reflects monetary inflation. A large part of the stock market rally has been driven by an expanding money supply, not true value creation. Curiously, this inflation hasn’t shown up in oil prices, which have collapsed, despite geopolitical risks. More on that below. The Dollar’s Worst Year in Decades 2025 marks one of the most significant declines for the U.S. dollar in recent history. Its role as the world reserve currency (WRC) has diminished—from 85% in the 1970s to just 50% today. Trade wars and tariffs are only accelerating this trend. Monetary Inflation Drives Stock Prices Stock markets are being lifted by monetary inflation, not organic growth. Stocks can be created endlessly—unlike gold. That makes gold a true inflation benchmark. The stock market’s rise is, in large part, a mirage, reflecting debased currency, not real productivity. Oil Isn’t Behaving as Expected—Why? Typically, when the dollar weakens, oil prices rise—because more dollars are needed to buy the same barrel of oil. But right now, oil prices are soft. Why? Global demand is weak, outpaced by supply. Even the Russia-Ukraine war hasn’t changed that dynamic. In fact, Russia is now importing gasoline, as Ukrainian forces continue to target and disable refining capacity. Here’s why this matters: when oil wells are opened, they can't just be turned off. If the refiners are destroyed and the oil has nowhere to go—it’s wasted. That’s a strategic win for Ukraine. The Disconnect Between Stock Prices and Profits While inflation has pushed stock prices higher, it hasn’t translated into equivalent profit growth. Example: If a stock goes from $10 to $20 due to inflation, you'd expect earnings to go from $1 to $2 to maintain the same P/E ratio. Instead, the earnings yield is just 3.2%—a historical low. That’s a major red flag. As pilots would say: WTF, over? Here’s the likely explanation: The money hasn’t reached consumers—it's concentrated in the hands of wealthy savers and leveraged investors, who are buying more stocks to sell to the next buyer willing to lever up even more. It’s a classic feedback loop—and a superbubble reminiscent of the tulip mania era. The Smart Money Knows What's Coming As this imbalance grows more obvious, central banks and institutional investors are quietly increasing their gold holdings—well above the pace of supply growth. So when Gold/Oil (two important commodities) completely disconnect like this, and Gold explodes up like this, you'd better take notice! Lastly, it takes 100 ounces to buy a new home. Last time this occurred was in 1978 ish, 2011, and now! Debt to GDP in 76 was 33%, 2011 was 99% and today 126% It is not the same animal as the past. GTFO & STFO! No matter where the prices for stocks go! CAUTION!!!Gold: No signs of stopping. 🛢️ Oil Glut Fears Are Back — and It’s Not Just Noise Global demand just isn’t there. Period. Everyone’s cheering for cheap gas, but here’s the trade-off no one wants to talk about: To hit $2 gas, oil needs to sit around $50/barrel. That crushes producers, kills new investment, and sets up future supply shocks. Meanwhile, the U.S. keeps pumping like there’s no tomorrow — classic setup for an oversupply crash. We’ve seen this movie before: 2020-style collapse, where they literally paid you to take oil. If the economy keeps slowing and US production doesn’t ease, we could be lining up for the sequel. Pain in both directions.

طلای جادویی: راز صعود و الگوی برج ایفل در بازار!

As stated back in June, there is still more upside in gold. MAGIC! However, we remain in the Eiffel Tower pattern.

NVDA HAGIA SOPHIA!

The Hagia Sophia pattern has now fully formed; it just needs the crack! and the Hook! No matter what your vague hunches and feelings are about AI, the charts will always win. You can't "buy the dip" unless you know when to "Sell the Rip"! If you can't see this resistance area, I don't know what to tell you. Everyone is bullish at the top of a bubbliotious market without exception! Click boost, Like, Subscribe! Let's get to 5,000 followers. ))Much easier to understand now that it has filled in, what the 'Hagia Sophia' Pattern means. Not so easy to see when it is happening on a white canvas and no data. As expected! tradingview.com/chart/Pob4EZsL/

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.