Technical analysis by RealMacro about Symbol PAXG on 10/8/2025

حباب ابرقهرمان طلا و نفت: هشداری برای سرمایهگذاران سهام!

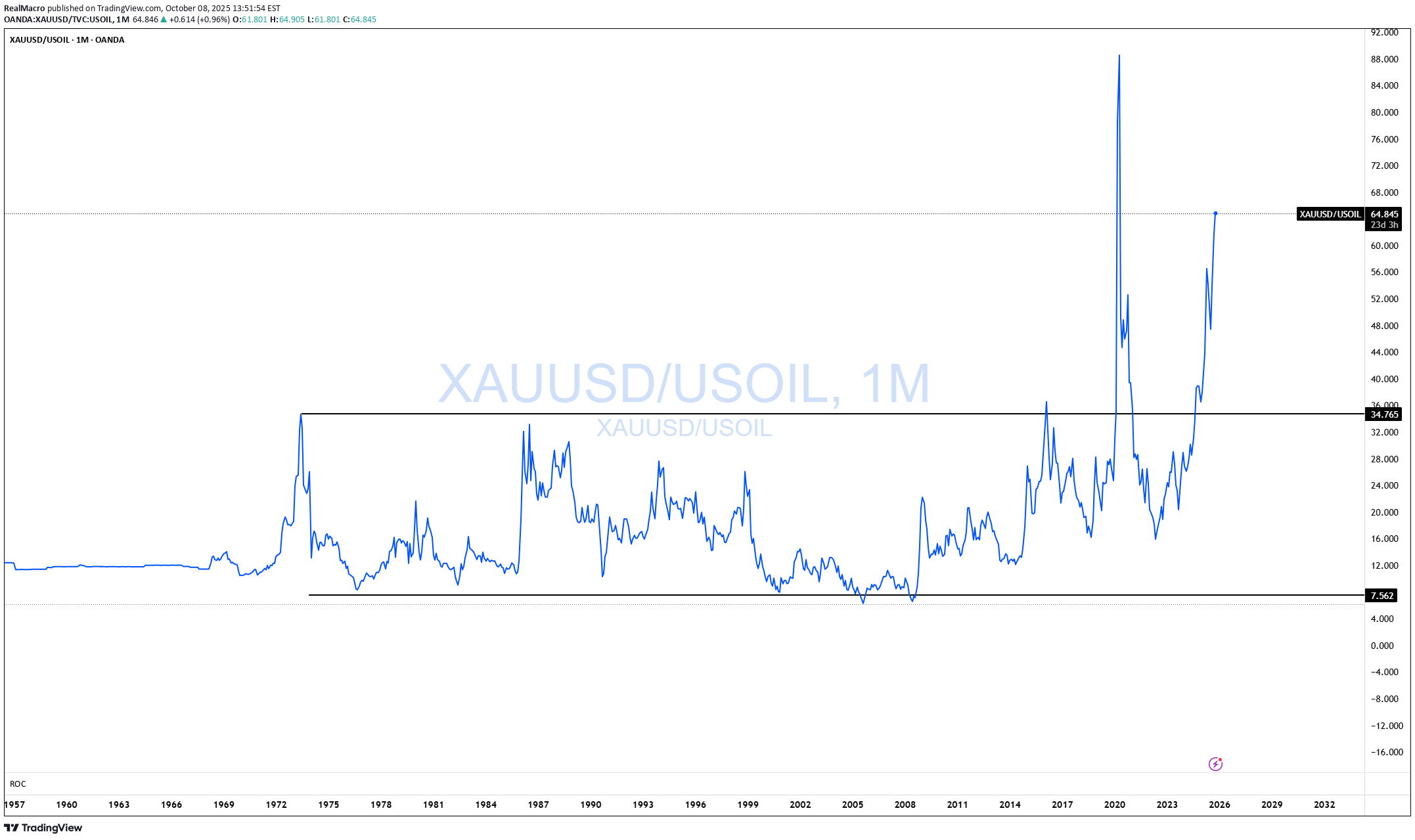

Gold = Fear Oil = how strong the economy is. Except for COVID we have never seen such an extreme reading. Yet people are buying up stocks like we will never again be able to produce another stock again as long as we live! Tulips! Here are just a few of the factors to consider that make this indicator important. Why This Indicator Matters: Key Factors at a Glance Gold’s Surge Signals a Shift Gold has soared nearly 60% year-to-date, adding a staggering $10 trillion in market capitalization. This rally effectively erases all the stock market gains made since May 2021, including those driven by AI enthusiasm and speculative tech runs. USD Can Only Be Measured Against Gold As the world’s reserve currency, the U.S. dollar’s real value is best gauged in terms of gold. This is a critical point—because when gold rises this dramatically, it reflects monetary inflation. A large part of the stock market rally has been driven by an expanding money supply, not true value creation. Curiously, this inflation hasn’t shown up in oil prices, which have collapsed, despite geopolitical risks. More on that below. The Dollar’s Worst Year in Decades 2025 marks one of the most significant declines for the U.S. dollar in recent history. Its role as the world reserve currency (WRC) has diminished—from 85% in the 1970s to just 50% today. Trade wars and tariffs are only accelerating this trend. Monetary Inflation Drives Stock Prices Stock markets are being lifted by monetary inflation, not organic growth. Stocks can be created endlessly—unlike gold. That makes gold a true inflation benchmark. The stock market’s rise is, in large part, a mirage, reflecting debased currency, not real productivity. Oil Isn’t Behaving as Expected—Why? Typically, when the dollar weakens, oil prices rise—because more dollars are needed to buy the same barrel of oil. But right now, oil prices are soft. Why? Global demand is weak, outpaced by supply. Even the Russia-Ukraine war hasn’t changed that dynamic. In fact, Russia is now importing gasoline, as Ukrainian forces continue to target and disable refining capacity. Here’s why this matters: when oil wells are opened, they can't just be turned off. If the refiners are destroyed and the oil has nowhere to go—it’s wasted. That’s a strategic win for Ukraine. The Disconnect Between Stock Prices and Profits While inflation has pushed stock prices higher, it hasn’t translated into equivalent profit growth. Example: If a stock goes from $10 to $20 due to inflation, you'd expect earnings to go from $1 to $2 to maintain the same P/E ratio. Instead, the earnings yield is just 3.2%—a historical low. That’s a major red flag. As pilots would say: WTF, over? Here’s the likely explanation: The money hasn’t reached consumers—it's concentrated in the hands of wealthy savers and leveraged investors, who are buying more stocks to sell to the next buyer willing to lever up even more. It’s a classic feedback loop—and a superbubble reminiscent of the tulip mania era. The Smart Money Knows What's Coming As this imbalance grows more obvious, central banks and institutional investors are quietly increasing their gold holdings—well above the pace of supply growth. So when Gold/Oil (two important commodities) completely disconnect like this, and Gold explodes up like this, you'd better take notice! Lastly, it takes 100 ounces to buy a new home. Last time this occurred was in 1978 ish, 2011, and now! Debt to GDP in 76 was 33%, 2011 was 99% and today 126% It is not the same animal as the past. GTFO & STFO! No matter where the prices for stocks go! CAUTION!!!Gold: No signs of stopping. 🛢️ Oil Glut Fears Are Back — and It’s Not Just Noise Global demand just isn’t there. Period. Everyone’s cheering for cheap gas, but here’s the trade-off no one wants to talk about: To hit $2 gas, oil needs to sit around $50/barrel. That crushes producers, kills new investment, and sets up future supply shocks. Meanwhile, the U.S. keeps pumping like there’s no tomorrow — classic setup for an oversupply crash. We’ve seen this movie before: 2020-style collapse, where they literally paid you to take oil. If the economy keeps slowing and US production doesn’t ease, we could be lining up for the sequel. Pain in both directions.