RSI-Guy

@t_RSI-Guy

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

RSI-Guy

We've seen two head fakes on this daily falling wedge so far, but looking at the MACD, we could see an actual reversal play out sometime over the next few weeks. With the US passing positive stablecoin regulation, Circle looks well positioned (in my unprofessional opinion) to capitalize on this important policy change. NFA, DYOR

RSI-Guy

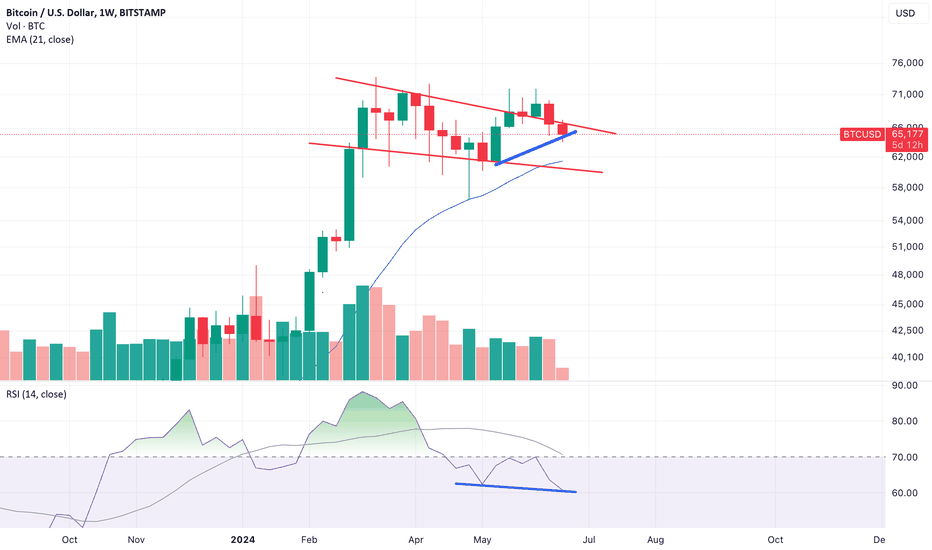

Full disclosure, I'm not a huge fan of fractals, especially those resulting from black swan events over 4 years ago. That being said, the BTC/USD weekly chart is starting to look worryingly similar to the 2021 top, as I'm sure many other analysts have also spotted. The strong bearish RSI divergence is also cause for concern, as BTC heads down to retest its long-standing support level (white line). Do I personally think history will repeat/rhyme this time? Mmm, I don't think so. Yes, we should anticipate further downside in the short-term. It is Summer after all. But with potential rate cuts due in September, war peace talks underway, and plenty of headroom left above in this cycle (according to the current MVRV score and Pi Cycle indicator), we could potentially see renewed optimism return end of September (NFA). For the immediate term, a lot hangs in the balance of the upcoming Jackson Hole conference.

RSI-Guy

RSI-Guy

Pretty self-explanatory. We can see how the earlier hidden RSI div broke out post BTC ETF announcement. Now we've flushed out all the downside liquidity, it seems to me like there's really only one direction BTC prices can go. This new hidden RSI div is even deeper, most likely due to Germany's aggressive selling earlier this month. Currently testing the former ATH weekly close ~$65K. If we break this, the next resistance sits just under the $70K level. After that, it's blue skies and price discovery shortly thereafter. If you've survived this long, chances are the darkest days are now behind you. Sit back and enjoy the run up. Should be a great next 7 months. Let's get that bread.

RSI-Guy

Promising looking hidden RSI divergence on BTC's weekly chart following the recent dip back into the wedge pattern. Suggests we may see a strong breakout here soon (next few weeks or so). If you want to see how these can play out, check out the recent Terawulf breakout (ticker: WULF). Similar hidden RSI divergence on the weekly right before the surging breakout above $4. Let's see what happens!

RSI-Guy

There's a strong hidden RSI divergence on the weekly BTC/USD chart. From this, I think it's really just a matter of time before we see a strong breakout. We've seen two traps (circles) so far, as people got caught out trying to time the market too closely. Imo, better to wait for a weekly candle to close above the resistance line. Until then, I'm expecting prices to chop inside the bullish pennant and continue shaking people out.We have a confirmed breakout on the weekly above the trend line. I'm personally ignoring the daily chop and continuing to pay attention to the weekly closes. That's where the real market intent is. CPI data came in above expectations, FOMC meeting next. M2 taps are back on, rate cut could be on the horizon soon. Things seem to be lining up pretty good right now

RSI-Guy

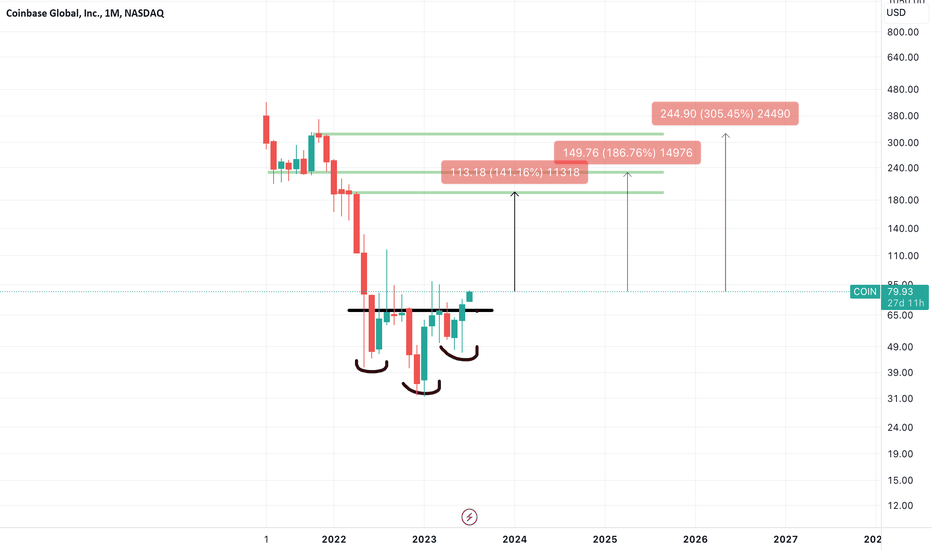

Interestingly, COIN is showing both a bearish regular RSI divergence AND a hidden bullish divergence on the weekly. Seeing as the latter has formed more recently, I tend to think we might see a rebound here rather than a bearish continuation, but it could all hang in the balance of the upcoming SEC Ethereum ETF decisions. Coinbase and ETH remain closely tied. If all ETF submissions get rejected then we may see Coinbase fall briefly in tandem. But, if by some miracle, Gensler decides to approve them, I think we could see COIN rally up toward $350. Keen to watch and see how this plays out.

RSI-Guy

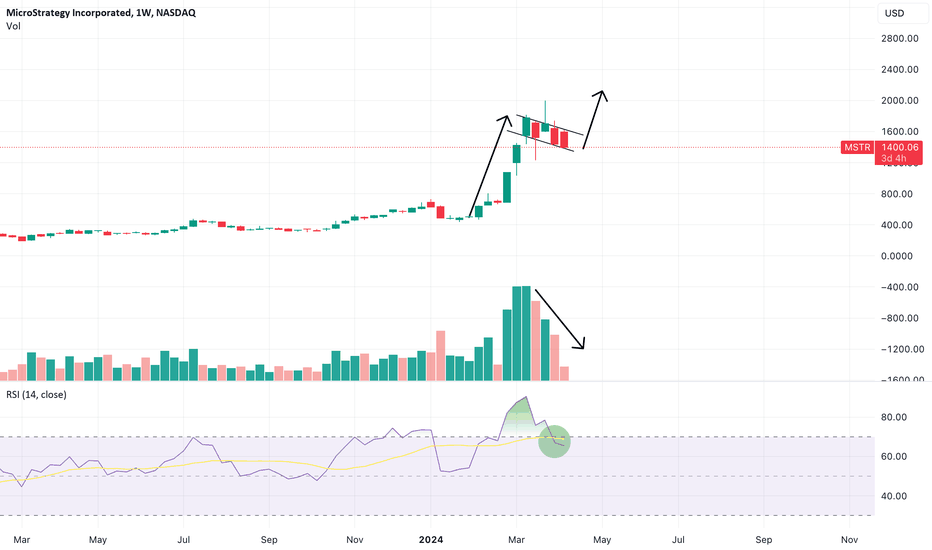

Looks like the early beginnings of an inverse H&S on the MSTR chart. Neckline around $1340. Will be watching for the breakout to confirm this pattern. Early targets: - $1480 - $1670 RSI trending up. Looks even better on the daily chart. With BTC prices gaining strength and excitement building from Roaring Kitty's return on X, I'm hopeful for this to play out.We have a breakout, but will we close out the day above the neckline?Breakout confirmed. First target achieved. Eyes on $1,680 nextTarget 2 achieved. All eyes on the weekly chart now and whether we can close above the current high of $1780

RSI-Guy

When you zoom out, it's hard to ignore the bull flag pattern that's forming on the weekly. $1400 seems to be acting as the current support. I feel like a convincing close beneath this level will invalidate the flag, but if we get a bounce here, we might be on a new leg up. Price target? Not sure. $2K makes sense as the most obvious psychological resistance level, and the previous failed test area. If we get a strong rebound and maybe a decent volume of liquidated shorts, maybe we push on stronger toward $2200 in the short-term. Definitely one to watch!Forgot to add - Volume's dropping off which could hint at a consolidation, and the price action has now returned from the overbought region (not that I think this latter detail is especially important, but it's an additional point to consider).

RSI-Guy

Seems like another decent inverse H&S breakout on the monthly. Not a lot standing in the way as resistance until ~ $140. Supporting fundamentals: BlackRock and other institutions have named Coinbase as their prospective ETF custodian. Crypto market seems to be flipping bullish = more business and revenue for Coinbase.Still holding. Awesome entry and everything playing out as expected

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.