ProjectSyndicate

@t_ProjectSyndicate

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

ProjectSyndicate

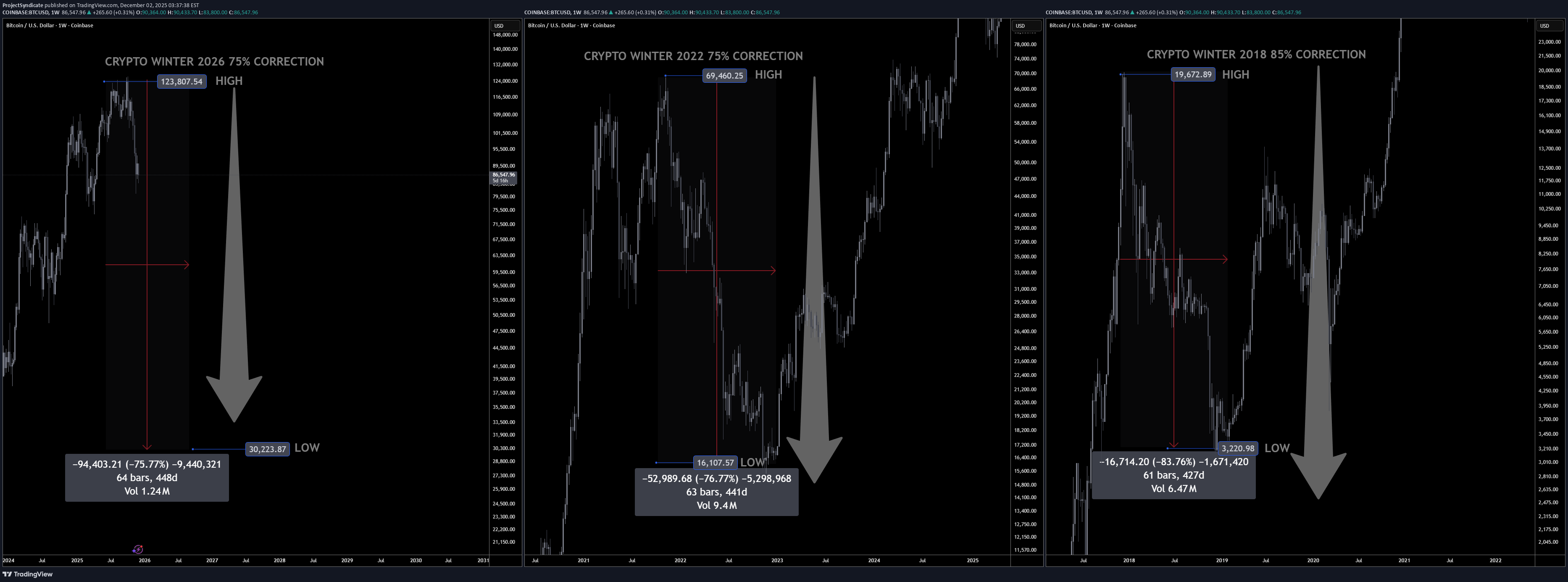

فروپاشی بزرگ بیت کوین در ۲۰۲۶: آیا BTC تا ۳۰,۰۰۰ دلار سقوط میکند؟

Investment Memo: Anticipating a 2026 Bitcoin Crypto Winter By ProjectSyndicate ________________________________________ 1. Executive Summary ❄️ Summary view: This memo treats 2026 as the high-probability crypto winter year for Bitcoin following the 2024 halving, with a working top around 123,000 USD and an expected cycle low near 30,000 USD, implying roughly a 75–76% drawdown from the peak. This is fully consistent with historical Bitcoin bear markets, which have typically seen 75–85% corrections from all-time highs. ❄️ Contrarian hook: While mainstream narratives still focus on ETFs, institutional adoption, and “crypto as macro asset,” the explosion of leverage (Aster DEX up to 1001x), CZ-backed perps, and BNB-chain meme-coin mania are treated here as late-cycle excess—classic topping signals rather than sustainable foundations. ________________________________________ 2. Thesis & Target Range 📊 Cycle top assumption: cycle high of ~123,000 USD per BTC. That is well within the band implied by recent ATH prints ~125–126k in mid-2025 and aligns with a typical “blow-off” overshoot above the prior psychological milestone at 100k. 📊 Cycle low assumption: 30,000 USD downside target represents a drawdown of ~75.6% from 123,000 USD—slightly shallower than the 2018 crash (~84%) and broadly in line with the 2021–22 bear (~77% from 69k to ~15–16k). That keeps this winter brutal but not apocalyptic, consistent with a maturing asset still capable of deep mean reversion. 🧮 Math check on prior winters •2017–18: 19k → 3k ≈ 84% drawdown •2021–22: 69k → 16k ≈ 77% drawdown •2025–26 (your base case): 123k → 30k ≈ 76% drawdown This places scenario squarely inside the historical corridor of 75–85% post-peak corrections. ________________________________________ 3. Historical Pattern: Why Large Drawdowns Are the Base Case 📉 Structural volatility: Bitcoin’s entire price history is punctuated by massive post-parabolic drawdowns—early cycles saw 86–93% collapses, later ones 75–80%. Each halving-to-peak run has ended in a violent crash once marginal buyers are exhausted and leverage saturates. 📉 Time dimension: Historically, the “winter” phase has lasted 9–18 months from peak to capitulation and then a long grinding accumulation. The 2017 peak to 2018–19 bottom spanned roughly a year; the 2021 peak to 2022–23 nadir similarly took about a year, with a further period of sideways chop. 📉 Drawdown normalization: Traditional asset allocators increasingly frame Bitcoin as an alternative macro asset, but the statistical reality is unchanged: drawdowns of 70%+ are not outliers—they are typical. An assumption of only shallow corrections is the non-consensus view; a 75% winter is actually the boringly normal scenario from a historical distribution standpoint. ________________________________________ 4. Where We Are in the Current Cycle ⏳ Post-halving positioning: The fourth Bitcoin halving occurred in April 2024, cutting block rewards to 3.125 BTC and effectively tightening supply. Historically, the major blow-off tops occur 12–18 months after halving, as reduced supply + narrative momentum pulls in late-stage retail and leverage. ⏳ Evidence of late-cycle behavior: By mid-2025, Bitcoin had already pushed to new ATHs above 100k and then into the ~120–126k region, with growing signs of ETF saturation, institutional FOMO, and leverage-driven upside. From a purely cyclical lens, we are more likely in the “euphoria / distribution” band than in early bull territory. ________________________________________ 5. Aster DEX & Meme-Coin Mania as Contrarian Top Signals 🚨 Aster DEX as the “Hyperliquid of BNB Chain”: Aster DEX, emerging from APX Finance and Astherus and explicitly leveraging Binance’s network, is marketed as a high-performance perp DEX with MEV-resistant trading and leverage up to 1001x, backed by CZ/affiliate ventures. From a contrarian perspective, this is textbook late-cycle: maximum leverage offered to the broadest possible audience at or near cycle highs. 🚨 BNB meme-coin carnival: Simultaneously, BNB-chain meme coins and speculative listings (Maxi Doge, PEPENODE, various new BNB meme projects) are being pushed as high-beta “next 100x” plays. Historically, similar episodes—2017 ICOs, 2021 dog-coin and NFT mania—have coincided with or slightly lagged Bitcoin’s macro top rather than signal early-cycle value. 🎭 Narrative pattern recognition: In prior cycles, the market’s center of gravity shifted from Bitcoin to highly speculative edges (ICOs, NFTs, obscure DeFi, meme coins) at the very end of the bull. Late-cycle liquidity rotates into lottery tickets while BTC quietly transitions from “must own” to “source of funds.” The current Aster + BNB meme complex rhymes strongly with that historical script. ________________________________________ 6. Why a 75% Drawdown to 30,000 USD is Plausible 🧊 From 123k to 30k mechanically: A move from 123k to 30k doesn’t require structural failure; it merely requires a reversion to historical drawdown. That kind of move can be achieved by: •ETF inflows slowing or turning to mild outflows •Derivatives funding turning negative as carry trades unwind •A moderate macro risk-off (equities correction, higher real yields) 🧊 Maturing, not invincible: As adoption broadens—spot ETFs, institutional mandates, integration into macro portfolios—Bitcoin’s upside may gradually compress, but liquidity cycles and leverage cycles haven’t vanished. Even if each cycle’s drawdown edges slightly lower from ~85% to ~77%, there’s no reason to assume sub-50% drawdowns are the new regime. A respectable winter at 30k is almost conservative relative to earlier -80%+ events. ________________________________________ 7. Why the Floor Might Hold Above Prior Lows 🛡️ On-chain + macro floor logic: Without pinning to proprietary on-chain models, two simple supports for a 30k floor are: •Institutional cost basis: A growing chunk of supply is held via ETFs and treasuries accumulated in the 40–70k band. Many of these players may defend positions with hedging or incremental buying in the high-20k / low-30k region rather than panic-sell at -70–80%. •Realized price ratcheting higher: Across cycles, Bitcoin’s long-term realized price average on-chain cost basis tends to step up structurally. Past winters have bottomed not far below that long-term average; as the realized base rises, so does the likely bear-market floor. 🛡️ Regime shift vs. previous cycles: In 2018 and 2022, Bitcoin was still climbing the wall of institutional skepticism. By the mid-2020s, you have: •Spot ETFs •Corporate treasuries •Sovereign/FI experimentation These players typically do not capitulate to zero; they reduce risk, but they also accumulate in stress. That supports the idea of a shallower floor (30k) instead of a full 85–90% purge. ________________________________________ 8. Timing the 2026 Winter 🧭 Halving + 18-month lag template: Using the standard halving cycle template, major tops often occur 12–18 months post-halving, and winters then dominate the following year. With the fourth halving in April 2024, a 2025 ATH and a 2026 winter are exactly what the simple cycle model would project. 🧭 Scenario sketch •2025: Distribution at elevated levels (80–120k+), persistent Bitcoin as digital gold narrative, alt & meme blow-off, over-issuance of high-leverage products (Aster, other perps). •2026: Liquidity withdrawal + ETF fatigue + regulatory flare-ups → a stair-step decline through 80k, 60k, 45k, culminating in capitulation wicks into the 30–35k zone before a multi-month bottoming process. ________________________________________ 9. Market Structure Stress Points in a Winter Scenario 🧱 Leverage cascade risk: Perp DEXs offering hundreds to 1000x leverage attract the most price-insensitive flow at the worst time. When BTC breaks key levels (e.g., 80k → 60k → 50k), auto-deleveraging and forced liquidations can accelerate downside far beyond spot selling. Aster-style platforms, while innovative, mechanically create risk of cascading liquidations in a volatility spike. 🧱 Alt & meme vaporization: BNB meme coins and other speculative assets that rode the late-cycle pump will likely see 90–99% drawdowns, as in previous winters where smaller alts dramatically underperformed BTC. In your framework, BTC at 30k is actually the “high-quality survivor” outcome; the majority of late-cycle tokens may never reclaim their peaks. 🧱 Mining and infrastructure: With halved rewards and a much lower BTC price, marginal miners will be forced offline, just as in prior winters. That tends to deepen the short-term pain but ultimately improves the cost curve (strong miners consolidate, inefficient ones exit), laying groundwork for the next cycle. ________________________________________🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀🚨🚨🚨 2026 CRYPTO WINTER PLAYBOOK – CONTRARIAN BTC OUTLOOK 🥶 Bitcoin cycle top penciled in around $123K, with a projected winter low near $30K (≈-75%). ❄️ Previous winters: 2018 -84%, 2022 -77% – a -75% drawdown is actually “normal” for BTC. 🌨️ 2024 halving → 2025 blow-off → 2026 winter fits the classic 12–18 month post-halving boom-and-bust pattern. 🧊 Aster DEX 1000x leverage + BNB meme coin mania = classic late-cycle euphoria, not the start of a new bull. 🌬️ Spot ETF + institutional FOMO can’t delete BTC’s historical 70–80% crash DNA – they just shift where the floor is. 🌨️ $30K acts as a plausible new floor, supported by higher institutional cost basis and long-term realized price. 🧊 Expect alt & meme coins to nuke 90–99%, while BTC “only” does -75% and survives to lead the next cycle. ❄️ Smart money sells euphoria near 6-figure BTC, builds dry powder, and targets gradual entries 40–35–30K. 🥶 Leverage is the enemy: perps and 1000x casinos likely accelerate the crash via liquidation cascades. 🌨️ Not financial advice – it’s a cycle-based contrarian framework for a statistically “normal” 2026 Bitcoin winter.final DEATH BOUNCE incoming shortly in December/January. then lights out.

ProjectSyndicate

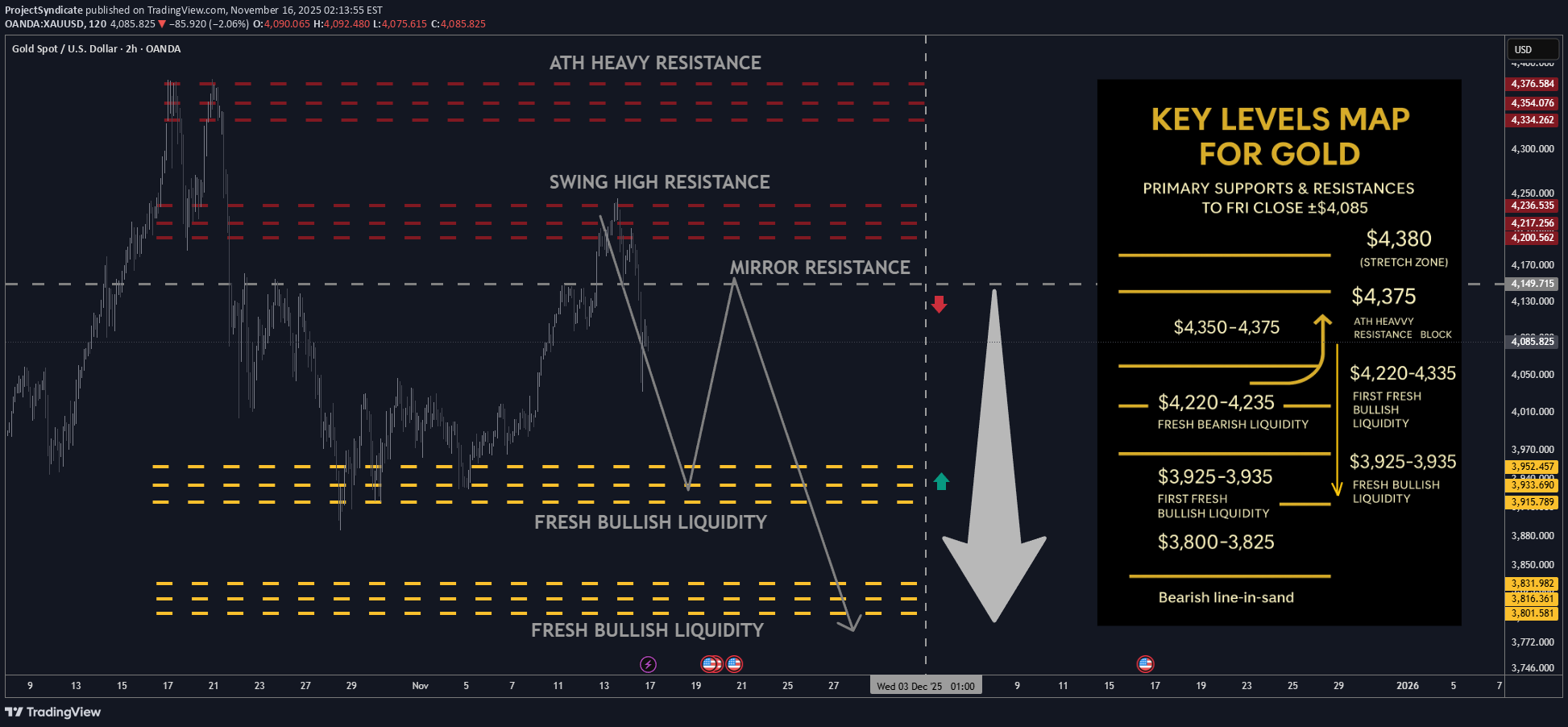

طلا هفته آینده: سطوح حیاتی حمایت و مقاومت و پیشبینی تریدرها

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: ~$4,244 → ~$4,085 — buyers punched through $4.20k but sellers defended the $4,220–4,250 band; weekly close is soft but still comfortably above $4k and mid-range. 📈 Trend: Bullish but in corrective / two-way mode ; treating current tape as range-trade while below the $4,350–4,375 ATH supply block. 🛡 Supports: $3,925–3,935 fresh bullish liquidity → $3,800–3,825 deeper demand pocket— key shelves where dip-buying is expected. 🚧 Resistances: $4,220–4,230 short-term fade zone → $4,350–4,375 (ATH heavy resistance block). 🧭 Bias next week: Preference to fade strength into $4,220–4,230, targeting a rotation back into $3,925–3,935. Alternative is to buy dips into $3,925–3,935 and ride the range back toward $4,220–4,230. Invalidation on sustained acceptance above $4,350–4,375; loss of $3,800–3,825 risks deeper mean reversion. ________________________________________ ________________________________________ 🔝 Key Resistance Zones •$4,220–4,230 — immediate weekly ceiling; aligns with your noted resistance block, attractive area to initiate shorts on first tests. •$4,350–4,375 — prior ATH / “heavy resistance block”; any spike here is a fade candidate unless price accepts above it on strong volume. 🛡 Support Zones •$3,925–3,935 — fresh bullish liquidity; preferred first take-profit for shorts and primary dip-buy zone. •$3,800–3,825 — deeper fresh liquidity; failure here would signal a more meaningful correction, not just a pullback in an uptrend. ________________________________________ ⚖️ Base Case Scenario Range/consolidation between roughly $3,800–$4,230: •First pushes into $4,220–4,230 are sellable for rotations toward $3,925–3,935. •As long as weekly closes keep rejecting the ATH block $4,350–4,375, bias stays “sell strength, buy clean liquidity dips.” 🚀 Breakout / Breakdown Triggers •Bull trigger: Sustained acceptance above $4,350–4,375 multiple sessions holding above and using that band as support would shift tone back to full-on trend and reopen the path toward and beyond prior extremes (~$4,400+). •Bear trigger: A decisive daily close below $3,800 turns the current “healthy pullback” into a deeper correction, opening room toward prior lower shelves sub-$3,750 and likely volatility expansion. ________________________________________ 💡 Market Drivers to Watch •Fed & real yields: Odds of a December cut have ramped up again; any hawkish pushback or hotter data could cap rallies near resistance. •U.S. fiscal/political risk: Shutdown and fiscal brinkmanship are still in the background; resolution headlines could briefly pressure gold, while renewed instability supports the bid. •Flows & positioning: ETF and central-bank demand remain supportive, but after a 60% YTD run, fast money is quick to take profits into strength. •Cross-asset behavior: Watch that equity–gold correlation; if risk-off hits and gold still sells with stocks, dips could run further before strategic buyers step in. ________________________________________ 🔓 Bull / Bear Trigger Lines •Bullish above: $4,350–$4,375 (sustained acceptance; ATH block reclaimed as support). •Bearish below: $3,800 (opens risk of deeper liquidation below the current liquidity shelves). ________________________________________ 🧭 Strategy for this week Primary plan – short from resistance (your core idea): •Entry zone: Scale into shorts around $4,220–4,230 front edge of the resistance block. •TP #1: $3,925–3,935 fresh bullish liquidity; consider closing most size here. •Runner / extension: If momentum extends lower, watch $3,800–3,825 for final profit-taking; below here the profile shifts into deeper correction mode. •Risk: Hard invalidation if price accepts above $4,350–4,375 daily closes holding above and successful retests. Alternative plan – buy the dip into liquidity: •Entry zone: Stagger bids around $3,925–3,935 and, for more aggressive positioning, into $3,800–3,825. •Exit zone: First target back into $4,220–4,230; consider de-risking heavily as you approach that resistance band. •Risk: Cut or reduce if price fails to hold above $3,800 on a daily closing basis or if selling accelerates on high volume through that shelf.🔱 GOLD WEEKLY SUMMARY 💰 High/Close: 4,244 → 4,085 — sellers defended 4,220–4,250. 📊 Trend: Bullish but corrective; range-trade while < 4,350–4,375. 🏰 Resistance: 4,220–4,230 (fade zone) → 4,350–4,375 (ATH block). 🛡 Support: 3,925–3,935 (fresh liquidity) → 3,800–3,825 (deep demand). 🎯 Bias: Sell strength → 4,220/4,230 → target 3,925/3,935. 🏹 Alt Plan: Buy dips at 3,925/3,935 toward 4,220/4,230. 🚀 Bull Trigger: Break & hold above 4,350–4,375. ⚠️ Bear Trigger: Daily close < 3,800. 🌐 Drivers: Fed cuts, USD/yields, fiscal risk, ETF/CB flows. ⚒️ Risk: Invalidate shorts on acceptance above 4,350–4,375.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀

ProjectSyndicate

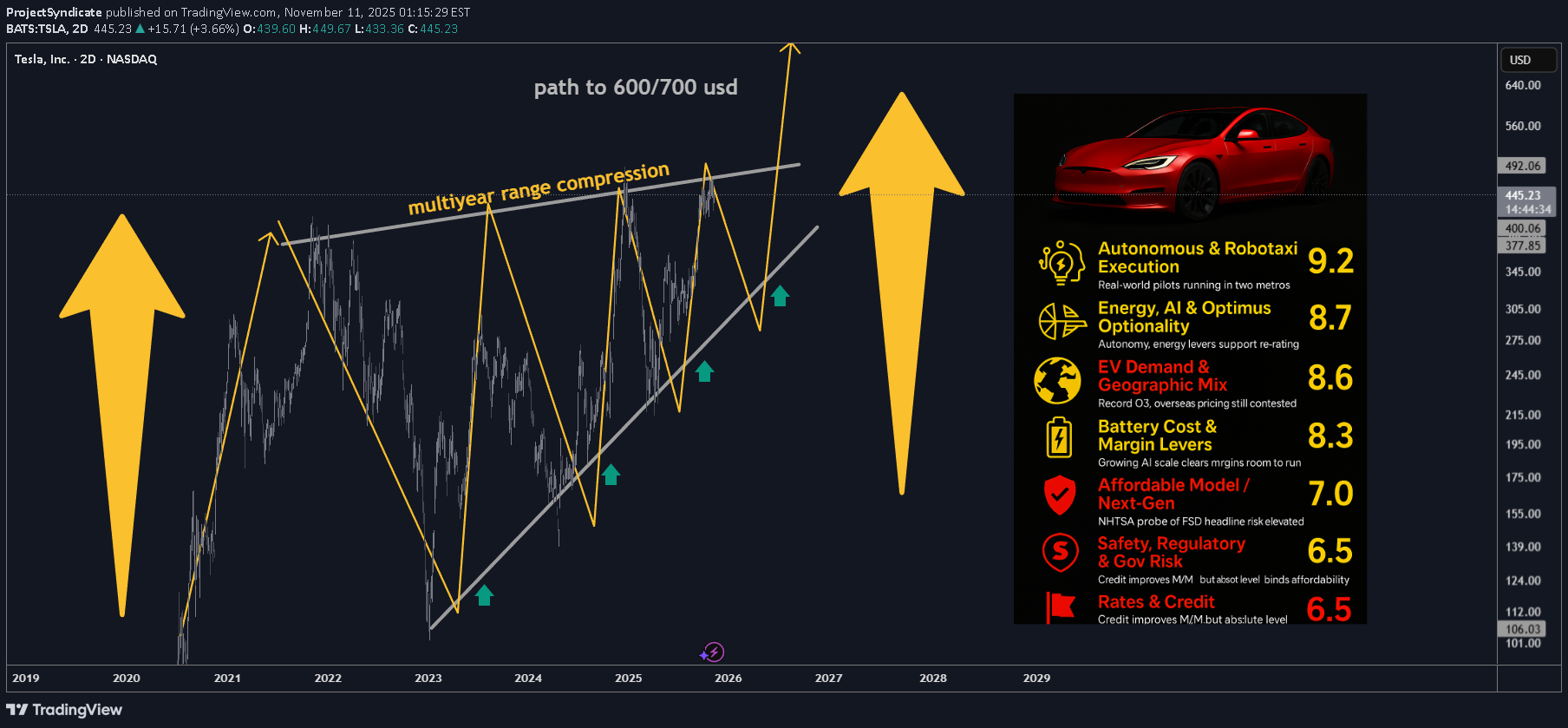

پیشبینی تسلا ۲۰۲۶: رتبهبندی کاتالیزورها و هدف قیمتی ۶۰۰ دلاری

________________________________________ TSLA: Updated Outlook (Nov-2025) Here's an updated/revised outlook for TSLA including all the primary catalyst ranking and analyst ratings and overview of latest developments this was updated for Q1 2026 with all the viable market data. ________________________________________ 🤖 1) Autonomous & Robotaxi Execution — 9.2/10 (↑) •What changed: Tesla’s invite-only Austin robotaxi pilot kept running through the summer; Tesla also says it launched a Bay Area ride-hailing service using Robotaxi tech (Q3 deck). FSD v14 (Supervised) began rolling out in Oct with broader model upgrades; Tesla claims billions of supervised miles and AI training capacity lifted to ~81k H100-equivalents. •Offsetting risk: NHTSA opened a fresh probe (Oct-2025) into ~2.9M Teslas over traffic-safety violations when using FSD; investigation cites 58 reports incl. crashes/injuries. •Why the bump: Real pilots in two metros + visible AI scale-up keep autonomy the center of the bull case—even with elevated regulatory risk. ________________________________________ 🌍 2) EV Demand & Geographic Mix — 8.6/10 (↘ ) •What changed: Q3-25 delivered record vehicles and record energy storage deployments, with record revenue and near-record free cash flow. Still, we’re past the U.S. tax-credit pull-forward and China/Europe pricing remains competitive. •Read-through: Momentum into Q4 looks better than 1H-25, but regional price discipline and mix will matter. ________________________________________ 💸 3) U.S. EV Tax Credits & Incentives — 6.0/10 (↘) •What changed: Federal new/used EV credits ended for vehicles acquired after Sept 30, 2025 under OBBB. Buyers can still qualify if a binding contract + payment was made by 9/30 and the car is placed in service later (“time-of-sale” reporting). This creates a limited after-deadline tail into late ’25/early ’26 but the program has sunset for new acquisitions. •Implication: Pull-forward demand helped Q3; near-term becomes tougher without the credit. ________________________________________ 📉 4) Rates & Credit Conditions — 6.5/10 (↔) •Rate-cut expectations have eased financing costs M/M, but absolute affordability still binds EV uptake. (Macro-sensitive; no single decisive print.) ________________________________________ 🎯 5) Affordable Model / Next-Gen Platform — 8.0/10 (↔) •Q3 deck emphasized Model 3/Y “Standard” variants to expand entry price points; true next-gen remains staged, with execution risk. ________________________________________ 🔋 6) Battery Cost & Margin Levers — 8.3/10 (↑) •What changed: Q3 total GAAP GM improved vs 1H; energy revenue +44% YoY; free cash flow ~$4.0B. Scale/learning and supply-chain localization called out. ________________________________________ ⚡ 7) Energy, AI & Optimus Optionality — 8.7/10 (↑) •Record storage deployments, Megapack 3 / Megablock unveiled; expanding AI inference/training and a U.S. semi-conductor deal noted. This is the clearest re-rating vector beyond autos. ________________________________________ 🛡️ 8) Safety, Regulatory & Governance Risk — 7.5/10 (risk) (↑ risk) •New NHTSA probe into FSD reporting/behavior escalates headline risk; audit scrutiny persists. Interpret higher score here as more material risk to multiple. ________________________________________ 🚩 9) Competition & Global Share — 6.2/10 (↔) •Competitive intensity in China/EU remains high; Q3 execution improved but pricing power still contested. ________________________________________ 🌐 10) Macro & Trade/Policy — 6.5/10 (↑) •Policy shifts (e.g., OBBB tax-credit sunset; tariff/trade uncertainty) remain a swing factor for cost & demand corridors. ________________________________________ ✅ 11) Commodities/Inputs — 5.5/10 (↔) •Mixed moves across lithium/nickel; no single driver eclipses execution/AI narrative near term. ________________________________________ Updated Catalyst Scorecard (ranked by impact) 1.Autonomous & Robotaxi Execution — 9.2 2.Energy, AI & Optimus Optionality — 8.7 3.EV Demand & Geographic Mix — 8.6 4.Battery Cost & Margin Levers — 8.3 5.Affordable Model / Next-Gen — 8.0 6.U.S. EV Incentives — 6.0 7.Rates & Credit — 6.5 8.Macro/Trade — 6.5 9.Competition/Share — 6.2 10.Safety/Reg/Gov Risk — 7.5 (risk flag) 11.Commodities — 5.5 (Key Q3 facts from Tesla’s deck; probe/tax-credit items from NHTSA/IRS reporting.) ________________________________________ 📊 Analyst Rankings & Price Targets •Street consensus (near-term 12-mo): ~$391 average target; consensus rating: Hold across ~46 firms. •Bull camp: Wedbush (Dan Ives) $600 PT (reiterated Nov-5; Street-high; thesis = embodied-AI/robotics optionality + robotaxi). Benchmark $475 Buy (post-Q3). •Cautious/negative: UBS $247 Sell (raised from $215 but still bearish on deliveries/margins). •Tape-check from Tesla: Q3-25 revenue $28.1B, non-GAAP EPS $0.50, record FCF, record deliveries & storage. (EPS miss vs some expectations; revenue beat.) ________________________________________ 🔍 Headlines that moved the needle •NHTSA opens new FSD probe (scope ~2.9M vehicles). •FSD v14 (Supervised) broad rollout; AI capacity to ~81k H100-eq; Bay Area robotaxi ride-hailing noted (Q3 deck). •OBBB EV tax credits sunset 9/30/25; binding-contract/time-of-sale guidance enables limited post-deadline claims. •Q3 print: record deliveries, record energy storage, record FCF; EPS light vs some models but narrative shifts to AI/energy. ________________________________________ 🧭 Technicals: Levels & Structure (weekly focus) Primary structure: since late-2022, TSLA’s traded inside a contracting wedge, with noteworthy compression into 2H-2025—typical of late-stage accumulation before a decisive break. Momentum divergences are improving on weekly frames even as price consolidates. ________________________________________ Key levels (spot-agnostic): •Support: $360–$370 (prior breakdown area/weekly shelf); $330–$345 (multi-touch base/pivot); $310–$320 (cycle risk zone). •Resistance: $405–$420 (range top & supply), $450–$475 (post-robotaxi pop zone / analyst PT cluster), $500 (psych), then $600–$650 (LT measured target band). •Roadmap Expect one more downside probe into $310–$320 in Q1-2026 to complete the wedge, then trend break and resume bull leg toward $600/$650 over the subsequent cycle (≈ ~100% off the projected low). •Risk markers: sustained weekly closes < $305 would postpone the “final low” timing and force a re-mark to the 200-week MA cluster; weekly closes > $475 accelerate the upside timing toward the $500/$600 handles. ________________________________________ Cases unchanged framework •Bull: Robotaxi expands to more metros, regulators settle into a supervised-AV regime, energy/AI scale continues; market re-rates to $475–$600 (Benchmark/Wedbush anchors). •Base: Solid execution across autos + energy, FCF stays healthy, autonomy rolls out cautiously under oversight; stock tracks Street $350–$400 band. •Bear: Delivery softness post-credit-sunset, tougher pricing in China/EU, or adverse NHTSA actions; retest of $300–$330 zone before trend resolution. ________________________________________ What to watch next (60–90 days) 1.NHTSA probe path and any software/recall remedies. 2.Robotaxi geographic expansion cadence and any shift from safety-monitor to remote-assist ops. 3.Energy bookings & Megapack 3/Megablock ramp against utility RFP calendars. 4.Delivery run-rate post-credit sunset and mix of Standard trims. ________________________________________🚗 TSLA Catalysts Ranking: Q1 2026 Outlook PT 600 USD 🤖 Autonomy Surge: Robotaxi pilots live in Austin & Bay Area; FSD v14 expanding fast. ⚡ Energy & AI Lift: Record storage deployments + AI training scale hitting 80k H100 eq. 🌍 EV Demand: Q3 deliveries & FCF at record highs, though EU/China pricing still tight. 🔋 Margins Recovering: Cost cuts & energy growth push GM ↑, strong cash generation. 💰 Tax Credit Fade: U.S. EV credits ended 9/30; only pre-deadline contracts still qualify. 📉 Rates & Macro: Fed easing helps affordability, but demand gap post-credits to watch. 🦾 Optimus & AI Story: Embodied-AI optionality now key to long-term re-rating. 🚨 Reg Risk: NHTSA probes ~2.9 M FSD cars—headline volatility risk persists. 🏁 Tech Map: Wedge compression since ’22 = accumulation; possible final low $310–$320 Q1-26. 🚀 LT Target: Bull cycle toward $600–$650, ≈ +100% from projected base.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Ferrari (RACE) Catalyst Scorecard AND 2026 Outlook

ProjectSyndicate

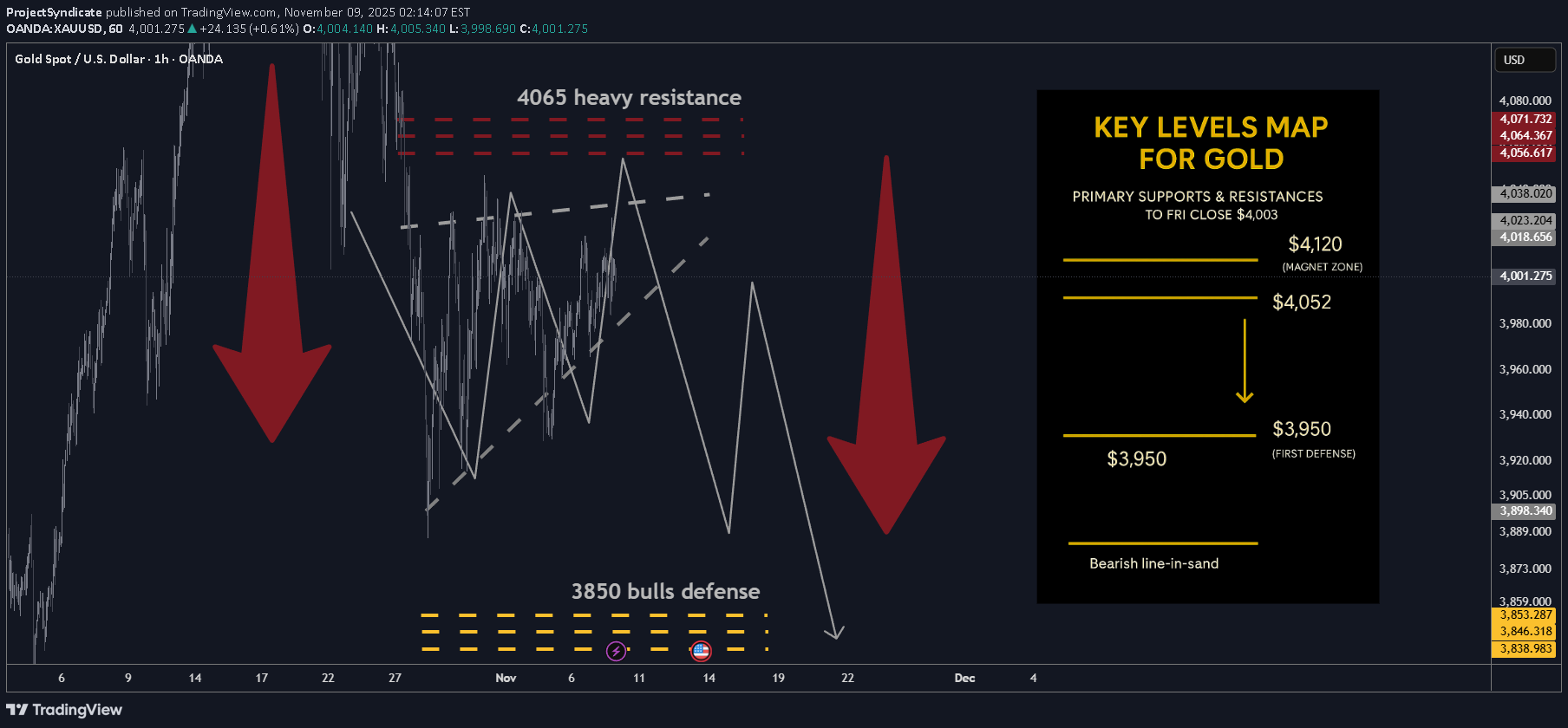

تحلیل طلای هفته آینده: سطوح حیاتی حمایت و مقاومت برای معاملهگران

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,024.9 → ~$4,003 — sellers faded upticks; weekly close soft but back above the round $4k. 📈 Trend: Neutral / mild correction inside range; not expecting immediate new highs while <$4,080–4,120. 🛡 Supports: $3,950 → $3,900 → $3,850 — pivotal shelves for bears’ take-profit and control. 🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply zones; first taps favored for fades. 🧭 Bias next week: Short sells into $4,040–$4,120; TP $3,950 then $3,850 (your plan). Invalidation on sustained reclaim > $4,120–$4,175; loss of $3,850 risks extension lower. 🌍 Macro tailwinds/headwinds (this week’s tape): •Narrative tone: Kitco flagged “razor’s edge” near $4,000 with mixed views (bubble vs. consolidation), while another Kitco piece framed the stall as a “healthy pause.” •WSJ flow: Headlines oscillated between “slips below $4,000” and modest up-days; net read is consolidation around $4k with quick two-way trade. •Levels: Spot finished the week essentially on $4k; intrawEEK high couldn’t clear early-week $4.02–4.03k cap. 🎯 Street view: After last month’s print above $4,000 (first ever), WSJ tone shifted to digestion; rallies still attract supply until a decisive reclaim of upper resistance. ________________________________________ 🔝 Key Resistance Zones •$4,040 — immediate ceiling; weekly high proximity, likely to cap first tests. •$4,080 — secondary supply ledge from recent failures. •$4,120 — upper band; acceptance above here starts to neutralize the correction. 🛡 Support Zones •$3,950 — first defense / first TP. •$3,900 — round-number shelf; loss invites momentum probes. •$3,850 — critical structural base and second TP; break risks downside acceleration. ________________________________________ ⚖️ Base Case Scenario Compression within a rising-wedge-like structure, ranging $3,850–$4,120. First pushes into $4,040–$4,120 are sellable for rotations toward $3,950 → $3,850 while the market respects weekly lower highs. 🚀 Breakout / Breakdown Triggers •Bull trigger: Sustained acceptance > ~$4,120–$4,175 turns the tone constructive again and reopens $4,200+. •Bear trigger: Daily close < $3,900 increases odds of full $3,850 test; failure of $3,850 risks momentum spill. 💡 Market Drivers to watch •Fed path / real yields (rate-cut odds vs. sticky inflation narrative in WSJ copy). •USD swings (no broad USD weakness → upside attempts stall). •ETF/CB flows (Kitco interviews highlight split sentiment; dip-buyers active, momentum players cautious). •Event risk (headline sensitivity remains high; quick squeezes into resistance possible). 🔓 Bull / Bear Trigger Lines •Bullish above: $4,120–$4,175 (sustained). •Bearish below: $3,900 → $3,850 (risk expands under $3,850). 🧭 Strategy for this week Short from resistance: Scale in around $4,040 → $4,080 → $4,120; TP #1: $3,950; TP #2: $3,850; Risk: Hard stop on a daily close above $4,120 (or intraday breach that holds on retest). Consider trimming if a news-driven squeeze tags $4,175 and fails.🏆 GOLD WEEKLY OUTLOOK — RANGE COMPRESSION PLAY 💰 $4,024 → $4,003 — Weekly close steady above $4k; sellers capped upside. ⚖️ Trend: Neutral / corrective; range-bound under $4,080–$4,120. 🏗 Structure: Rising wedge compression — momentum fading. 🎯 Strategy: Short $4,040–$4,120; targets $3,950 → $3,850. 🧱 Supports: $3,950 / $3,900 / $3,850 — bears’ take-profit zones. 🚧 Resistances: $4,040 / $4,080 / $4,120 — repeated supply caps. 🌍 Macro tone: WSJ & Kitco — “consolidation near $4k,” real yields firm, USD mixed. 🔥 Bear trigger: Daily close < $3,900 → opens $3,850 test. 🚀 Bull trigger: Sustained > $4,120–$4,175 → reversal risk. 🧭 Bias: Sell strength, stay nimble; rising wedge = fade rallies, book profits on dips.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Gold Bull Market Update and Outlook Q4 2025 / Q1 2026

ProjectSyndicate

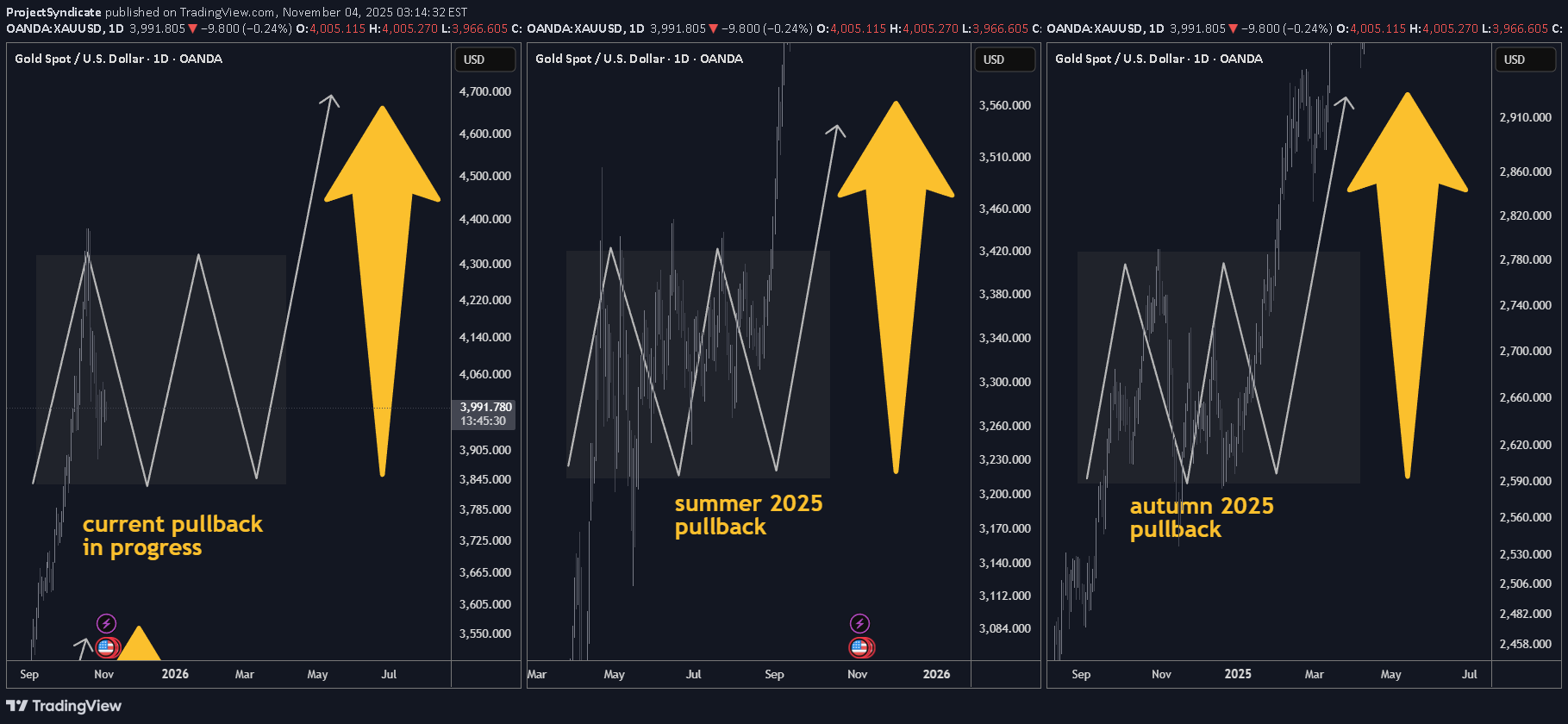

پیشبینی طلای ۲۰۲۶: آیا اصلاح فعلی فرصت خرید نهایی قبل از صعود است؟

📌 Executive Summary •Base case (60%): The current pullback is a normal retracement within the primary bull trend. We expect consolidation through late Q4-2025 and potentially into January 2026, followed by a resumption of the uptrend in Q1/Q2-2026. •Drivers remain intact: Persistent central-bank accumulation, reserve-diversification dynamics, and episodic macro/geopolitical risk keep the structural bid under gold. •Positioning stance: Maintain core long exposure, add tactically on weakness into the $3.8k–$4.0k zone spot equivalent with tight risk controls, and ladder call spreads into Q2-2026. •Risk skew: Near-term pullback risk persists position shakeouts, macro data surprises. Structural bearish risks are low unless central-bank demand materially softens. ________________________________________ 🧭 Market Context & Recent Price Action •Gold printed successive record highs into mid-October; front-month futures traded above $4,170/oz before easing. Headlines framed the rally as policy and safe-haven led, with year-to-date gains exceptionally strong. •Central-bank demand continues to underpin the move: WGC and sell-side coverage highlight accelerating official-sector buying and diversification away from FX reserves; banks forecast higher prices into 2026. •The current setback aligns with prior bull-market pauses (e.g., Apr–Jul 2025 and Sep 2024–Dec 2024 pullbacks), consistent with the user-stated pattern of multi-month consolidations before trend resumption. What’s new in headlines late Oct–Nov 2025: •Pullback is “technical and temporary,” with buy-the-dip framing from UBS; next tactical target cited around $4,200. •Official-sector flows: Korea & Madagascar exploring reserve increases; PBoC extended buying streak into September. •WSJ coverage stresses gold’s role in erosion of trust in fiat/central banks and the reserve-diversification theme. ________________________________________ 🔑 Structural Bull Case 2025-2026 1.Official-Sector Accumulation: oMulti-year build in central-bank gold holdings (EM-led) as a sanctions-resilient reserve asset; this remains the single most important marginal buyer narrative. 2.Reserve Diversification & Financial Geopolitics: oEvidence that gold’s share of global reserves has risen while some institutions reassess currency composition. 3.Macro Volatility & Policy Trajectory: oPeriodic growth scares, policy pivots, and real-rate uncertainty sustain hedging demand. Street targets for late-2026 (e.g., ~$4,900 GS) anchor upside convexity. 4.Market Microstructure: oThin above prior highs and crowded shorts on pullbacks can fuel sharp upside re-accelerations when macro catalysts hit data, geopolitics, policy hints. ________________________________________ 📊 Technical Map Top-Down •Primary trend: Up. The sequence of higher highs/higher lows since 2024 remains intact; current move is a trend-within-trend consolidation. •Pullback anatomy: Prior bull pauses (Apr–Jul 2025; Sep–Dec 2024) lasted 2–4 months, with troughs forming on volatility compression and momentum washouts—a template for now. •Key tactical zones spot-equiv.: o$3,800–$4,000: First reload area prior breakout shelf / 50–61.8% of the last leg. o$4,200–$4,250: First resistance / re-acceleration trigger retests of breakdown pivots. o$4,350–$4,400: High congestion; decisive weekly close above here re-opens ATH extension. ________________________________________ 🗓️ Scenario Pathing Q4-2025 → Q2-2026 •Base Case 60% — “Consolidate then resume”: oSideways-to-lower into late Q4/Jan 2026 as positioning resets; range $3.8k–$4.2k. oBreakout resumption in Q1/Q2-2026 as macro and official flows re-assert. •Bullish Extension 25% — “Shallow dip, quick reclaim”: oSofter real yields / risk flare trigger swift recapture of $4.2k–$4.4k and new highs earlier in Q1-2026. oCatalysts: heavier central-bank prints, geopolitical shock, or earlier policy-easing rhetoric. •Bear-Risk 15% — “Deeper flush, trend intact”: oHawkish macro surprise or forced deleveraging drives $3.6k–$3.7k probes; structure holds unless official-sector demand meaningfully fades ________________________________________ 🧪 What to Watch High-Signal Indicators •Official-Sector Data: Monthly updates from WGC, IMF COFER clues, and PBoC reserve disclosures. Continuation of EM purchases = green light for the bull. •Rates & Liquidity: Real-rate direction and dollar liquidity conditions around data and policy communications. •Microstructure: CFTC positioning inflections, ETF out/in-flows a lagging but useful confirmation when they finally turn. •Asia Physical/Policy: China/Japan retail and wholesale dynamics; policy/tax headlines can create short-term volatility. ________________________________________ 🎯 Strategy & Implementation 1) Core: •Maintain strategic long allocation consistent with mandate e.g., 3–5% risk budget; avoid pro-cyclical reductions during orderly pullbacks. 2) Tactical Adds •Scale-in buy program within $3.8k–$4.0k •Optionality: Buy Q2-2026 call spreads (e.g., 4.2/4.8) on dips; fund via selling Q1-2026 downside put spreads around $3.6k–$3.7k where comfortable with assignment. 3) Risk Controls 🛡️: •Hard-stop any tactical adds on weekly close < ~$3.6k or if credible evidence emerges of official-sector demand reversal.🥇 Base Case: Normal pullback inside primary bull trend — consolidation likely till Jan ’26, rally resumes Q1/Q2 ’26. 💰 Drivers Intact: Central-bank buying, reserve diversification, & macro/geopolitical hedging sustain long-term bid. 🏦 CB Demand: PBoC, Korea, Madagascar add reserves; official-sector flows remain the key pillar. 📉 Current Pullback: Mirroring Apr–Jul ’25 & Sep–Dec ’24 pauses — 2-4 month digestion phase. 🪙 Tech Zones: Buy zone $3.8k–$4.0k | Resistance $4.2k | ATH trigger $4.35k–$4.4k. 📊 Scenario Path: 60% → Consolidate → Resume bull 25% → Quick reclaim > $4.2k 15% → Deeper flush $3.6k–$3.7k (trend intact). 🔔 Watch: WGC/PBoC data, real-rate trends, CFTC & ETF flows, Asia policy headlines. 🎯 Strategy: Maintain core long (3-5% risk); scale-in $3.8–$4.0k; add Q2-26 call spreads 4.2/4.8; hedge via Q1-26 put spreads. 🛡️ Risk Control: Cut if < $3.6k or CB demand fades — otherwise, stay gold & buy the dip.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Gold Bull Market Outlook And Targets: 5000 USD/7500 USD

ProjectSyndicate

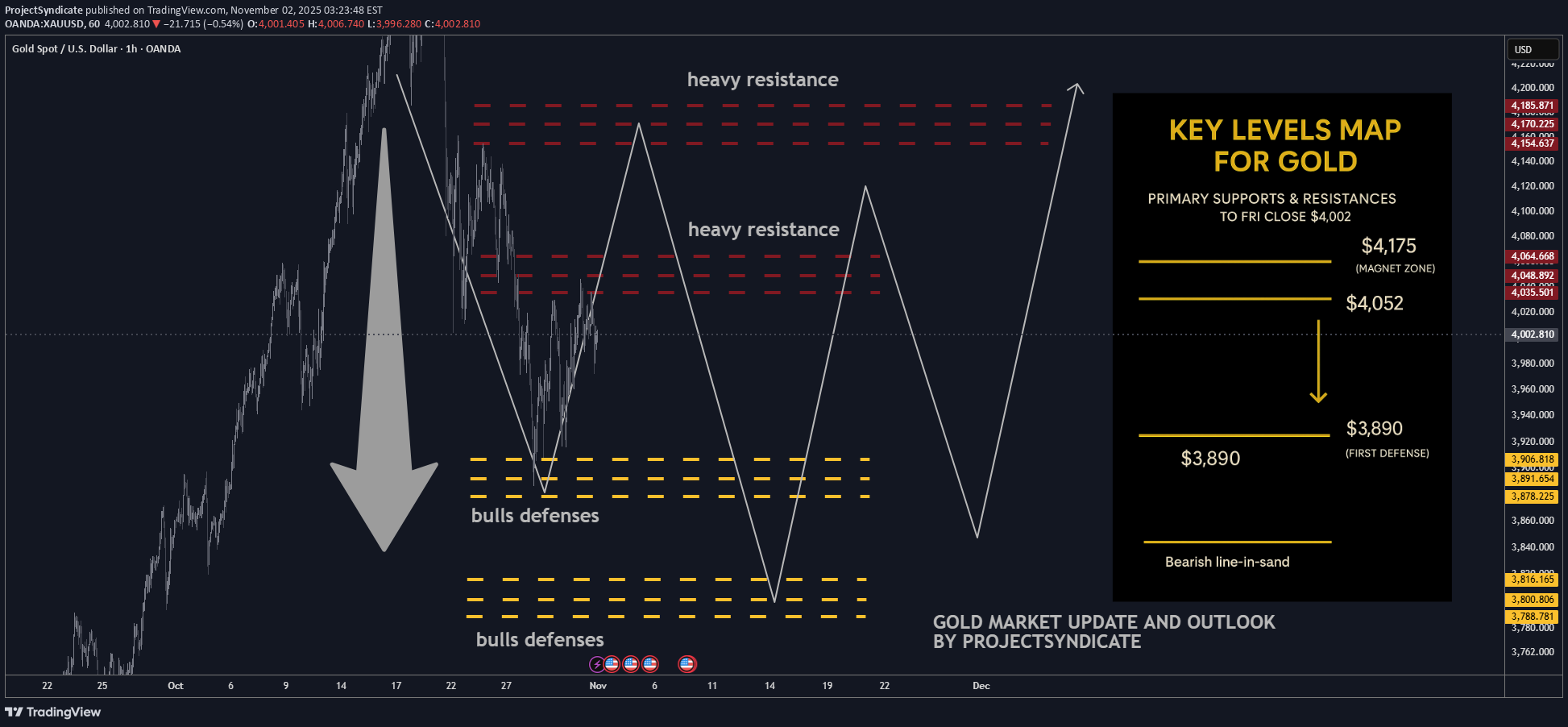

تحلیل طلا هفته آینده: سطوح حیاتی حمایت و مقاومت و پیشبینی معاملهگران

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,108 → ~$4,002 — sellers defended overhead; weekly close soft within range. 📈 Trend: Neutral / correction mode still ON; not expecting new highs near term. 🛡 Supports: $3,890 → $3,800 — pivotal shelves for downside containment. 🚧 Resistances: $4,052 / $4,175 — magnet zones for supply / fade attempts. 🧭 Bias next week: Prefer short sells into $4,052–$4,175 with take-profit toward $3,890 → $3,800. Invalidation on sustained reclaim > $4,175; failure of $3,800 risks extension lower. 🌍 Macro tailwinds/headwinds : • Rates: Real yields stable-to-firm keep upside contained; any dovish surprise could spark squeezes into resistance. • FX: DXY mixed—lack of broad USD weakness limits impulse follow-through. • Flows: CB/ETF demand supportive on deep dips but tepid near highs. • Geopolitics: Event risk provides intermittent bids; not a trend driver this week. 🎯 Street view: Medium-term bullish narratives reserve diversification, policy easing into 2026 remain, but near-term tape favors mean-reversion lower under resistance. ________________________________________ 🔝 Key Resistance Zones • $4,052 — immediate ceiling; prior supply pivot likely to cap first tests • $4,175 — upper resistance; acceptance above flips tone from corrective to constructive 🛡 Support Zones • $3,890 — first defense; loss invites momentum probes • $3,800 — critical structural base; break risks downside acceleration ________________________________________ ⚖️ Base Case Scenario Range-to-soft trade within $3,800–$4,175. Rallies into $4,052–$4,175 are sellable; expect rotations back toward $3,890 with scope to $3,800 if sellers press. 🚀 Breakout Trigger Only a sustained acceptance > ~$4,175 negates the correction and opens $4,200+ pathing; conversely, firm rejection at $4,052 with a daily close < $3,890 increases odds of a $3,800 test. 💡 Market Drivers • Fed path & real-yield drift • USD index swings • ETF/CB flow tone on dips vs. rips • Risk sentiment headlines (geopolitics/trade) 🔓 Bull / Bear Trigger Lines • Bullish above: $4,175 correction phase likely over if held • Bearish below: $3,890 → risk expands under $3,800 🧭 Strategy Short-sell from overhead resistances ($4,052 → $4,175). Scale profits into $3,890 then $3,800; keep stops tight above trigger levels. Stand aside on fresh longs until sustained reclaim above $4,175 reasserts momentum.🔥 GOLD WEEKLY SNAPSHOT — PROJECTSYNDICATE 🏆 High/Close: $4,108 → $4,002 — soft finish; sellers capped upside. 📈 Trend: Neutral / correction mode still ON — no new highs expected. 🛡 Supports: $3,890 → $3,800 — key downside floors. 🚧 Resistances: $4,052 / $4,175 — strong overhead supply zones. 🧭 Bias: Short-sell into $4,052–$4,175 → targets $3,890–$3,800. 💣 Invalidation: Reclaim > $4,175 flips tone bullish; below $3,800 = deeper risk. 🌍 Macro: Stable yields & firm USD cap upside; dips supported by CB/ETF flows. ⚖️ Range View: Trade remains $3,800–$4,175 — rallies likely to fade. 🚀 Trigger: Sustained > $4,175 = breakout; < $3,890 = renewed weakness. 🎯 Strategy: Sell resistance, take profit near supports; avoid longs for now.let me know your thoughts on the above in the comments section 🔥🏧🚀🎁Please hit the like button and 🎁Leave a comment to support our team!

ProjectSyndicate

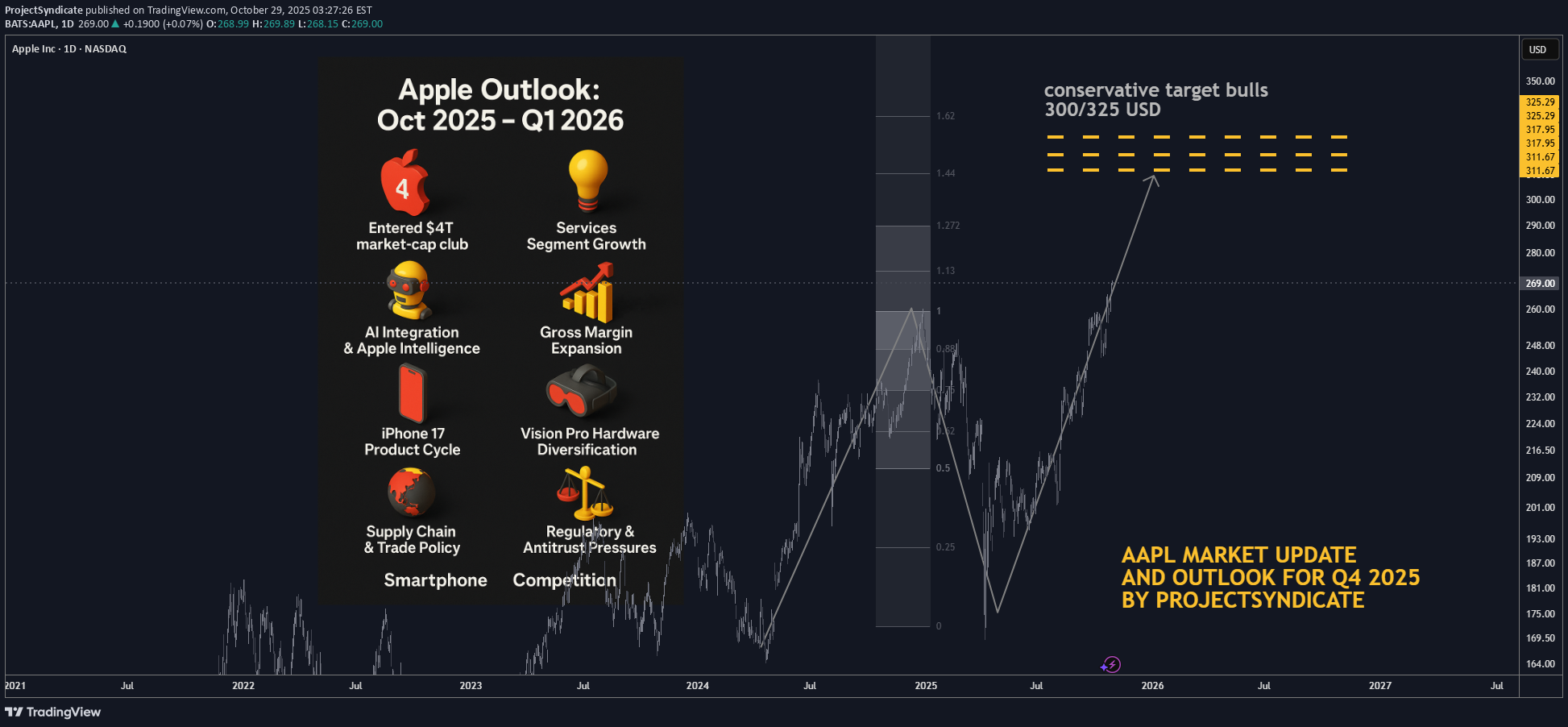

اپل در مسیر ۴ تریلیون دلاری: پیشبینی Q1 2026 و کاتالیزورهای کلیدی هوش مصنوعی

🍏 Apple Outlook: Oct 2025 – Q1 2026 🧠 Status and Tape Read. Apple (AAPL) has entered the $4 T market-cap club on Oct 28–29 2025, propelled by strong iPhone 17 sell-through and Services momentum. Shares pushed toward the $270 area intraday before easing, marking a powerful reversal from mid-year consolidation. Near-term, positioning is elevated into Thursday’s print; options imply ~±4% move on earnings. 📈 Path into Q1’26. Our base case shifts from a prolonged correction to a higher-low / buy-the-dip regime: dips toward the mid-$240s–$250s should attract sponsorship unless Services rolls over or China iPhone demand fades. A constructive tape through Q1’26 hinges on (1) Apple Intelligence engagement metrics, (2) iPhone 17 replacement/Android switcher rates, and (3) regulatory overhang. 📰 What’s New and recent headlines 🏆 Apple hits $4 T market value for the first time, joining Nvidia and Microsoft. Drivers: iPhone 17 traction and Services strength; stock up sharply since spring. 🗓️ Earnings set for Thu, Oct 30 (after-close); Street looking for growth in revenue/EPS; Services eyed >$100 B annual run-rate. 🔼 Loop Capital upgraded AAPL to Buy with $315 PT ahead of the move, citing iPhone cycle acceleration. 🧾 “Who Bought 8 Million Shares?” 🧺 JPMorgan Large Cap Growth Fund (SEEGX) increased its Apple position by ~8.15 million shares to ~32.9 million shares, per latest fund tracking. ⚙️ Catalysts Shaping Apple’s Stock Price in 2025–26 🤖 AI Integration & Apple Intelligence — Strength: 9/10 Rollout of on-device Apple Intelligence and upgraded Siri remains the core narrative into 2026. Look for user engagement datapoints and third-party app integrations at/after earnings. A positive read-through would validate the iPhone super-cycle argument. 💡 Services Segment Growth — Strength: 8.5/10 Consensus expects Services to push past a $100 B annual clip; durability watched versus regulatory pressure (DMA in EU, global app store scrutiny). A sustained >13% YoY growth print keeps multiple support intact. 📊 Gross Margin Expansion & Cost Efficiencies — Strength: 8/10 Management has guided 46–47% GM for FQ4 (tariff headwind embedded). Mix shift to Services + component deflation support FY26 margin resilience. 📱 iPhone 17 Product Cycle — Strength: 8/10 (↑ from 7.5) Early sell-through outpacing prior gen in the U.S. and China within first days; the iPhone 17 (incl. “Air”) is the incremental driver restoring unit momentum. 🥽 Vision Pro & Hardware Diversification — Strength: 7/10 Next-gen devices + Apple Intelligence tie-ins create optionality; still niche near-term but adds ecosystem gravity. 💵 Capital Returns — Strength: 7/10 $110 B buyback authorization remains a floor; watch cadence vs. stock at ATHs and post-print cash deployment commentary. 🌏 Supply Chain & Trade Policy — Strength: 6.5/10 China exposure/tariffs remain a swing factor; Apple has been absorbing some costs rather than pushing through prices on key models. ⚖️ Regulatory & Antitrust Pressures — Strength: 6/10 DMA compliance and global app store cases could trim Services take-rate; monitor any remedial changes called out on the call. 📈 Macro & Rates — Strength: 5/10 “Higher for longer” limits multiple expansion; any disinflation/soft-landing upside would expand P/E support. 🥊 Smartphone Competition — Strength: 5/10 Android OEM velocity still high in EM; Apple’s cycle needs sustained switcher share to outrun. 💼 Earnings Set-Up: FQ4 reporting Thu Oct 30 2025 📅 Consensus into print: • Revenue: ~$101–104 B (TipRanks ref: $102.2 B) • EPS: ~$1.74–$1.82 (TipRanks ref: $1.78) • Gross Margin guide: 46–47% (company indication) • Services: watch for >$100 B annualized pace confirmation • Implied move: options pricing ~±4% 🎧 Watch items on the call: Apple Intelligence activation/MAUs, iPhone 17 channel inventory, China mix, Services take-rate headwinds (EU), GM puts/takes (tariffs), cap-return cadence. 🎯 Street Positioning & Targets 🔼 Loop Capital: Buy, PT $315 (Oct 20/21 2025). 📊 General take: Many houses remain Overweight; focus turning to 2026 EPS power and AI monetization path. 🧭 Tactical View 0–3 Months 📈 Into/after print: Choppy but constructive. Chasing at ATHs is risky; prefer buy-on-weakness zones near $248–255 with stop discipline. A bullish guide/Services beat could sustain a breakout; a light AI engagement update or China wobble likely gets faded back into the mid-$250s. ⚠️ Risk-case: Regulatory headline or guide below mid-single-digit growth could quickly compress P/E and retest the $240s. 🚀 Bull-case: Clean beat/raise + AI usage KPIs → re-rate toward $290–300 into holiday. 🏁 Quick Milestone Recap 🥇 $4 Trillion Market Cap achieved on Oct 28–29 2025, making Apple the third public company (after Nvidia, Microsoft) to reach the level; iPhone 17 momentum and Services strength cited across coverage.🚀 Apple Outlook (Oct 2025 – Q1 2026) 🍏 Hit $4 T market cap, third company ever to reach the milestone. 🤖 Apple Intelligence & AI rollout driving next growth wave. 📱 iPhone 17 cycle strong, fueling demand recovery. 💡 Services segment on track for >$100 B annual run-rate. 📊 Gross margins guided at 46–47%, resilient vs. tariffs. 🥽 Expanding Vision Pro & AR/VR hardware ecosystem. 💵 $110 B buyback and dividends underpin valuation floor. 🌏 Supply-chain shift to India & Vietnam continues. ⚖️ Regulatory pressures in EU/US remain medium-term risk. 🧭 Base case: Buy-on-dips near $250 → target $290-300 if AI metrics beat.let me know your thoughts on the above in the comments section 🔥🏧🚀🎁Please hit the like button and 🎁Leave a comment to support our team!TSLA path to 550/650 USD Breakout Still PendingTSLA Catalysts Ranking: September 2025 update and Path ForwardGold next week: Key S/R Levels and Outlook for TradersGold Bull Market Update and Outlook Q4 2025 / Q1 2026

ProjectSyndicate

طلا سقوط کرد: آیا اصلاح قیمت تا ۳۵۰۰ دلار ادامه دارد؟

🟡 Where We Are Right now After ripping to fresh records, gold snapped hard — WSJ logged the steepest one-day loss in years last week and a follow-through weekly drop as longs unwound. Analysts across Kitco and others frame this as a technical/positioning correction after a parabolic run, with a fight around the $4k handle and scope to probe $3,750 → $3,500 if selling persists. Sentiment/flows flipped: GLD and other gold ETFs saw notable outflows into the selloff after heavy YTD inflows. That flow reversal is consistent with a near-term correction phase. 🔻 Why the Market Is Correcting Now 1️⃣ Positioning & Froth Unwinds The rally attracted outsized speculative length; once momentum cracked, forced de-risking kicked in. WSJ called out “long unwind” dynamics; Kitco says the correction could persist for months as near-term drivers fade. 2️⃣ $4k Failed on First Retest; Technical Break Triggered Stops Kitco flagged a “fight for $4k” with downside risk if that shelf gives. Once sub-4k prints hit, systematic sellers likely accelerated. 3️⃣ Flow Flip in ETFs After massive 2025 inflows, GLD posted a sharp daily outflow during the drop — classic late-cycle reversal behavior for a momentum move. 4️⃣ Macro Balance Less Supportive at the Margin Even with long-term tailwinds (deficits/geopolitics), the recent leg higher ran ahead of fundamentals. Kitco and others note easing physical tightness and cooling central-bank buying pace compared with earlier in the year, removing a key prop for spot. ⚙️ Near-Term Levels That Matter (Tactical) $4,000 → Battle zone. Regaining and holding above turns near-term tone neutral. $3,750 → First meaningful downside target; aligns with multiple analysts’ “healthy pullback” zone. $3,500 → Deeper correction magnet if flows/positioning continue to bleed; widely discussed as a plausible washout level. 🔮 4–8 Week Catalyst Map (What Can Push Price) 🏛️ Macro / Policy Treasury Quarterly Refunding (Nov 5): Mix/size guidance can sway the long-end, USD, and real yields — key for gold. A heavier bill tilt (and steady coupons) is less threatening than a surprise coupon ramp. Fed Communication Cadence: With the Oct 28–29 FOMC just occurred, watch minutes (Nov 19) + any guidance shifts. A less-dovish tone or firmer real yields = near-term headwind; growth scares or easing bias = support. US Data Prints: CPI/PCE, NFP, ISM — anything that re-prices the path of real rates. (Direction of real yields remains the single most important macro input.) 💰 Flows & Positioning ETF Flows (GLD/IAU): Continued outflows would confirm distribution; a turn back to net inflows often leads price inflections. COT Positioning: If spec length compresses materially, downside fuel diminishes — setting up a cleaner base. (Track weekly CFTC updates.) 🪙 Physical / Seasonal India Demand (festive/wedding season) and China retail demand can stabilize spot if discounts narrow and premiums re-emerge, but Kitco notes near-term tightness has eased versus the squeeze earlier in the rally. 📈 Base Case Outlook (Next 4–8 Weeks) Trend: We’re in a bull-market correction — momentum currently with sellers — inside a bigger, intact secular uptrend. WSJ + Kitco both frame it as a technical consolidation after a near-vertical ascent. Range Expectation: $3,500–$4,100 with whipsaws around $4k. The market likely tests $3,750 and could overshoot to $3,500 on negative macro surprises or persistent outflows before attempting a higher-low base. Bull Re-acceleration Triggers: (a) USD/real-yield rollover post-Refunding/Fed minutes (b) A visible reversal in ETF flows (c) Stabilization in Asia physical premiums (d) Fresh geopolitical shocks Bear Extension Risks: (a) Firmer real yields / stronger USD (b) Deeper ETF outflows and CTA/systematic supply (c) Evidence of slower central-bank demand than H1 (d) Soft physical uptake into dips ⚔️ Trade / Hedge Tactics If Underweight/Flat: Stagger bids $3,760 → $3,520, scale size smaller into weakness; insist on confirmation (stops above prior day’s high) before adding. If Long From Higher: Respect $3,750 — below it, tighten or partially hedge (short miners, long USD vs. FX beta, or buy short-dated puts) targeting $3,500 as a potential flush. If Momentum Trader: Let $4,000 decide regime. Sustained reclaims with rising on-balance volume/ETF creations = green light for a bounce to $4,080–$4,150; failure = fade rallies into $3,950–$3,980. 🧭 What I’m Watching Day-to-Day 1️⃣ Treasury refunding headlines (Nov 5) and term-premium reaction. 2️⃣ Fed minutes (Nov 19) and any shift in balance-of-risks language. 3️⃣ GLD/IAU flow tape (creations/redemptions). 4️⃣ Kitco/WSJ desk color on physical tightness and dealer inventories.🚨 GOLD MARKET CORRECTION: THE BULL PAUSES BUT NOT DEAD 🚨 💰 Gold peaked at $4,380, now sliding — momentum shifted to bears. 📉 Broke $4,000, spot near $3,920 — correction phase confirmed. 🔥 Overheated positioning + ETF outflows triggered the unwind. ⚙️ Next support: $3,750 → $3,500 key psychological zones. 🏦 Macro catalysts: Treasury refunding (Nov 5) & Fed minutes (Nov 19). 💵 Rising real yields / USD strength adding short-term pressure. 📊 ETF + COT flows will signal when washout ends. 🌏 India/China demand could stabilize spot in coming weeks. 🧭 Range view: $3,500–$4,100 over next 4–8 weeks. 🚀 Big picture: Still a bull market correction — reload zone coming soon.BREAK BELOW 3950/3960 USD EXPOSES FURTHER DOWNSIDE TARGETS TP1 3900 USD TP2 3850 USD. TP1 HIT ALREADY.

ProjectSyndicate

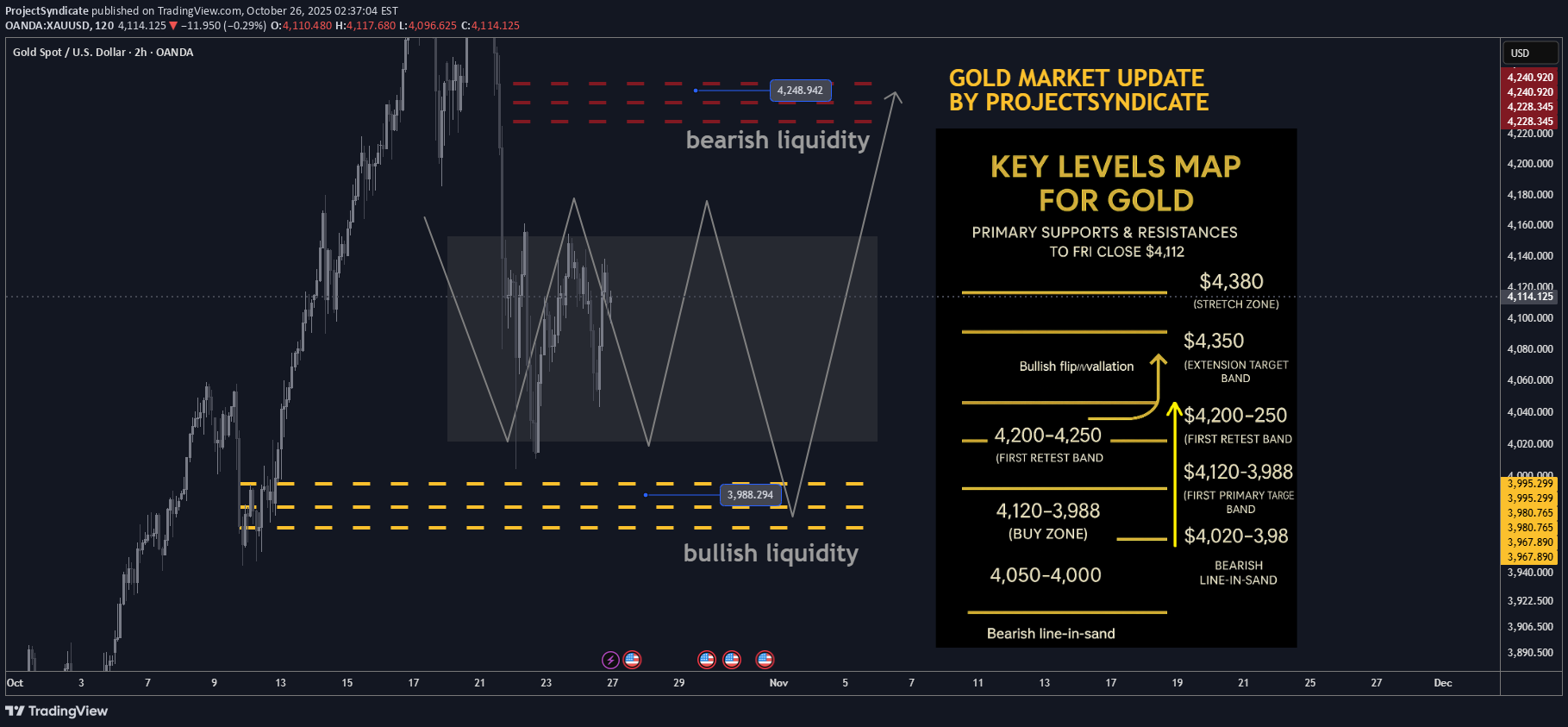

پیشبینی طلای هفته آینده: سطوح حیاتی حمایت و مقاومت برای معاملهگران

🔥 GOLD WEEKLY SNAPSHOT — BY PROJECTSYNDICATE 🏆 High/Close: $4,380 → ~$4,112 — lower close within range; momentum cooled but holding the $4,000 handle. 📈 Trend: Uptrend intact > $4,000; oversold into $4.1k—setup favors reflex bounce. 🛡 Supports: $4,120–$4,080 → $4,020–$3,988 (bullish liquidity) → $4,000/3,980 must hold. 🚧 Resistances: $4,200 / $4,250 (bearish liquidity) / $4,300 → stretch $4,350–$4,380. 🧭 Bias next week: Buy-the-dip $4,020–$3,988; momentum regain above $4,200 targets $4,250 → $4,300–$4,350. Invalidation < $3,980 risks a deeper flush to $3,950. 🌍 Macro tailwinds: • Policy: Easing real yields supportive on dips. • FX: Softer USD tone = constructive backdrop. • Flows: Central-bank buying + tactical ETF interest underpin $4k. • Geopolitics: Trade/tariff & regional tensions keep safety bids alive. 🎯 Street view: Select houses still float $5,000/oz by 2026 on policy easing & reserve-diversification narratives. ________________________________________ 🔝 Key Resistance Zones • $4,200–$4,230 immediate supply from the weekly close • $4,250 bearish liquidity / primary target • $4,300–$4,350 extension band • $4,380 prior spike high / stretch 🛡 Support Zones • $4,120–$4,080 first retest band below close • $4,020–$3,988 buy zone (bullish liquidity) • $4,000 / $3,980 must-hold shelf ________________________________________ ⚖️ Base Case Scenario Expect pullbacks into $4,120–$4,080 and $4,020–$3,988 to attract buyers, rotating price back toward $4,200 then $4,250. Acceptance above $4,250 invites a drive into $4,300–$4,350. 🚀 Breakout Trigger A sustained push/acceptance > ~$4,250 unlocks $4,300 → $4,350, with room toward $4,380 if momentum persists. 💡 Market Drivers • Real-yield drift lower (supportive carry backdrop) • USD softness aiding metals • Ongoing CB accumulation; ETF flows stabilizing on dips • Headline risk (trade/geopolitics) sustaining safe-haven demand 🔓 Bull / Bear Trigger Lines • Bullish above: $4,020–$4,100 (buyers defend pullbacks) • Bearish below: $3,980 (risk expands; threatens $3,950) 🧭 Strategy Buy low from bullish liquidity (~$3,988) with a target at $4,250; oversold conditions favor a strong bounce. Add on strength above $4,200 toward $4,300–$4,350. Keep risk tight below $3,980–$4,000 to invalidate.🎁Please hit the like button and 🎁Leave a comment to support our team!let me know your thoughts on the above in the comments section 🔥🏧🚀Gold Bull Market Outlook And Targets: 5000 USD/7500 USD1️⃣ High/Close: $4,380 → $4,112 — momentum cooled but trend intact. 2️⃣ Trend: Still bullish above $4,000; oversold = bounce setup. 3️⃣ Supports: $4,120–$4,080 → $4,020–$3,988 💪 4️⃣ Resistances: $4,200 / $4,250 / $4,300–$4,350 🚧 5️⃣ Bias: Buy dips near $4,020–$3,988 → target $4,250–$4,350. 6️⃣ Invalidation: < $3,980 = bearish risk ⚠️ 7️⃣ Macro tailwinds: Soft USD, lower yields, CB buying 🌍 8️⃣ Breakout: > $4,250 opens $4,300–$4,380 🚀 9️⃣ Street view: $5,000/oz by 2026 still on table 🎯 🔟 Strategy: Accumulate dips ➕ hold above $4,000 🧭

ProjectSyndicate

پیشبینی ریاضیاتی دقیق: کف بعدی بیت کوین کجاست؟ (احتمال ۹۵ هزار دلار)

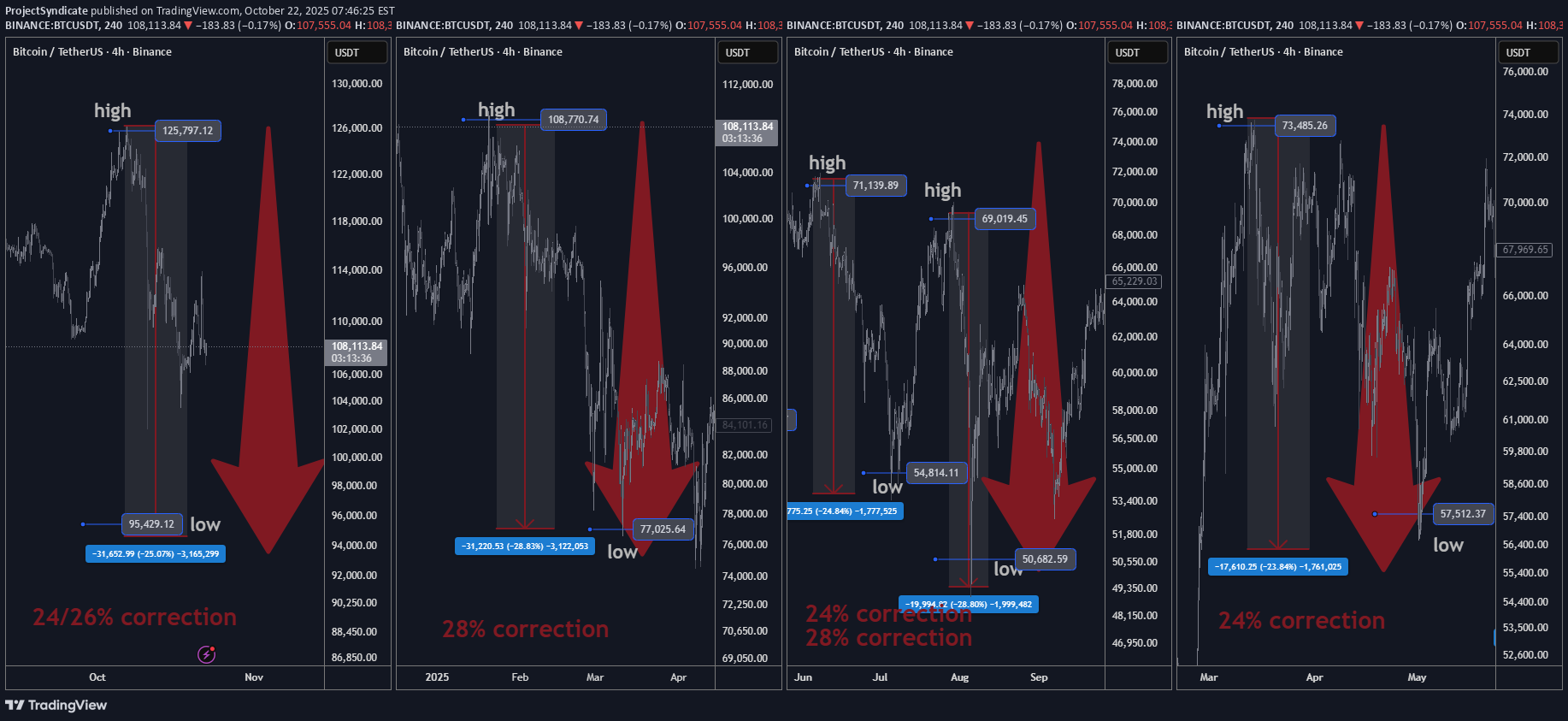

Bitcoin has repeatedly corrected ~mid-20% during the last 12–24 months. Using this empirical drawdown profile, a base-case correction of ~25% from a recent $126,000 high implies a **probable correction low near $94,500–$95,000. This is a high probability forecast based on real math and stats, not science fiction. No expanding triangles, Elliott Wave counts, Wolfe and Dragon patterns. Bitcoin does not trade by the textbook. This is real world TA by a pro trader. Tactical view: Expect a final flush toward ~$95k, then a reversal/bounce if market structure and liquidity conditions confirm. Confidence: VERY HIGH —pattern consistency is notable, but crypto remains headline- and liquidity-sensitive. Use disciplined risk controls. 🧠 2) Recent Corrections (Past 12–24 Months) #High → Low% Drawdown 1$72,000 → $54,00025% 2$108,000 → $76,00028% 3$70,000 → $50,00028% 4$74,000 → $56,00024% Empirical mean drawdown: (25+28+28+24)÷4 = 26.25%. We’ll use 25% as the base-case assumption (conservative vs. the 26.25% mean). ✅ Projection for the Current Correction Reference high: $126,000 Base-case (25%) low: $126,000 × (1 − 0.25) = $94,500 Empirical-mean (26.25%) low: $126,000 × (1 − 0.2625) = $92,925 Projected buy-zone: $92.9k – $95k, centered near $95k. 🎯let me know your thoughts on the above in the comments section 🔥🏧🚀🎁Please hit the like button and 🎁Leave a comment to support our team!Massive Bitcoin Whale Initiates Whopping $122,000,000 BTC Short dailyhodl.com/2025/10/21/massive-bitcoin-whale-initiates-whopping-122000000-btc-short/No BTC won't reverse at 100k, because someone told you so on X or TikTokpro traders don't use MACD RSI and other useless garbage crossovers EW etc forget about trading bitcoin by the book not going to work you will blow up your accountmy previous analysis belowBitcoin September 2025 Outlook: a/b/c price fractal structureUS govt Shutdown Impact on GOLD/BTC/SPX/NDX Overviewbreak below 100k incomingGold next week: Key S/R Levels and Outlook for Tradersit's not an alt coin season now. it's not bitcoin season now. it's bear season now. figure it out already.Gold Bull Market Update and Outlook Q4 2025 / Q1 2026where the moon boys at?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.