Technical analysis by ProjectSyndicate about Symbol PAXG: Buy recommendation (6/19/2025)

ProjectSyndicate

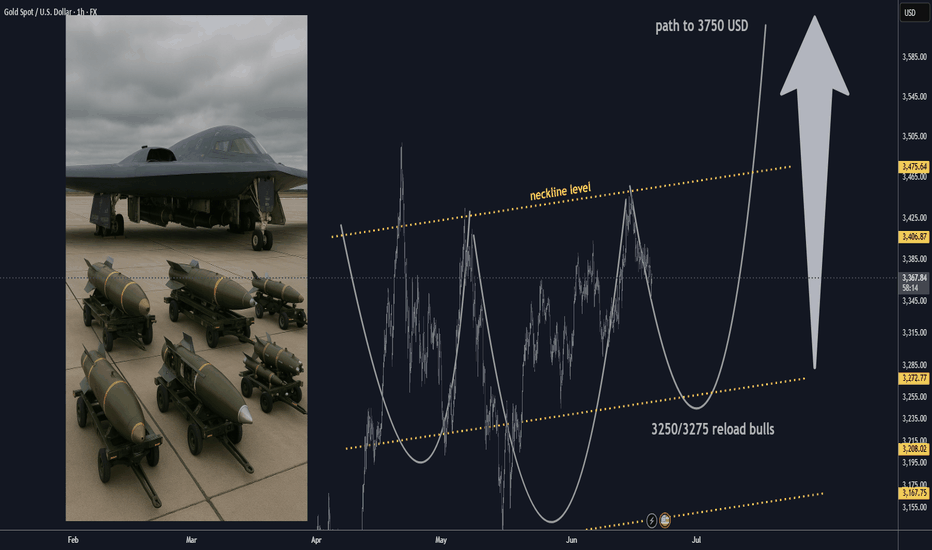

🏆 Gold Market Mid-Term Update (June 19, 2025) 📊 Price & Technical Outlook Current Spot Price: ~$3,365 Technical Setup Inverted H&S pattern forming/completed on higher timeframes — confirms bullish reversal structure. Reload (buy) zone: $3,250–$3,275 (ideal accumulation range for bulls if price pulls back). Swing trade setup: Entry: $3,250–$3,275 (reload zone) Take Profit (TP): $3,750 Support: Major at $3,250–$3,275 (break below = reassess bullish bias). Resistance: $3,450–$3,500 ; next major resistance: $3,600, then $3,750. Price consolidating above $3,250–$3,350 is technically healthy — maintaining bullish structure. 🏆 Bull Market Overview The pullback appears complete; uptrend resumes amid strong macro/geopolitical drivers (inflation, rates, safe haven flows). Key Levels: $3,000 (macro support), $3,250 (bulls must defend), $3,500 (breakout zone), $3,750 (swing TP). Short-term dips = buying opportunities — “Buy the Dip” remains favored as long as support holds. Upside targets: Immediate: $3,600 Swing target: $3,750 Summary: Gold remains in a bullish mid-term structure, with the inverted H&S pattern pointing to higher prices ahead. Bulls look to reload at $3,250–$3,275, targeting $3,750 for swing trades. As long as $3,180–$3,200 holds, buying dips is the play. A sustained breakout above $3,400–$3,600 opens the door for new all-time highs.🚨 Market Alert: Israel-Iran Conflict Impact Forecast 📈 🔴 Worst-Case Scenario: Regional War + U.S. Military Involvement 🚢 Oil (Brent): Soars to $150–$200+ if Strait of Hormuz closes 🥇 Gold: Skyrockets to $4,500–$5,000 (safe-haven rush) ₿ Bitcoin: Initial volatility; settles at $80k–$100k 📉 SPX: Crashes to 4,000–4,500 💻 NDX: Drops sharply to 15,000–16,000 🟠 Base-Case Scenario: Protracted Tension, No Major Disruption 🛢 Oil: Stabilizes at elevated $75–$95, occasional spikes 🥇 Gold: Moves higher, trading $3,500–$3,800 ₿ Bitcoin: Trades steady, $90k–$110k range 📊 SPX: Pullback moderate, around 5,200–5,500 💻 NDX: Moderately lower, 18,000–19,000 range 🟢 Best-Case Scenario: Diplomatic De-Escalation 🌊 Oil: Eases down to $65–$75 🥇 Gold: Mild decline, holds at $3,300–$3,500 ₿ Bitcoin: Positive sentiment, lifts to $100k–$120k 📈 SPX: Slight dip; stays strong near 5,800–6,200 💻 NDX: Minor correction, remains high at 20,000–22,000still expecting a pullback into early next week I'd say we bottom out on Tuesday/Wednesday next weekForex and Gold Market Highlights June 21 2025AI Algo Systems vs. Manual Trading: Which Delivers Real Results?GOLD H4 Accumulation Fractal Target is 4 000 USDGold Bull Markets: Long-Term Overview & Current Market UpdateGold Market Update: Stuck in summer time range / Seasonality