Paul_Varcoe

@t_Paul_Varcoe

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Paul_Varcoe

How to start as a trader, and have a good chance of making it.

I have written on this subject before, see my signature. There is more though. If you are starting out, there is a LOT you need to know. I will start with some basics. Some of them you may scoff at, and say I am wrong, but I can assure you I am not. Truly. Read my previous post here: After reading that, you may well think again about trying trading. If the idea of taking a long time (at least 6-8 months for a natural) to learn something bothers you, or you need to make money NOW , then I would advise you that trading is not for you, or not yet, at least. For a start, being impatient is the absolute worst trait you can possibly have. If you still want to continue, then I can help you. You will have to have the patience to read a lot of words. 1. Pick an instrument you want to trade. If you are a stock trader it's different, because you should be trading the stocks that are "in play" that day. Typically I'd recommend the day after results/news came out, rather than the actual day itself, when you are starting out. Why? It's easier to see the way the price is trending, and the trend is your friend. If you are not trading stocks, I would recommend either a share index like SP500 or NASDAQ or FTSE or DJ30, or an FX pair that is NOT EURUSD. Oil and Gold are Ok too. Crypto I would not recommend for a beginner. Reasons: Let's start with Crypto. The big players can pay the exchanges, perfectly legally, to see your orders and stop-loss levels. This is not a personal vendetta against you. They can see the aggregate levels of millions of traders, and thus learn how to trigger bulk stop losses to make money off you directly. This is not legal in the other markets. The same manipulation is still possible, but not to the same extent. Why not EURUSD? It's the biggest and most popular FX pair, so the most big-boy games are played there, see the Crypto explanation above. The banks have access to millions of client positions, so they can see when their clients get squeezed, and they assume (usually correctly) that other banks' clients will be in the same boat. Why the rest? Tight spreads are common (look it up if you don't know what a spread is). Banks exert less control (though still some). Why pick one instrument? because you need to LEARN how it trades. This may seem weird, but each has its own character, and if you trade more than one, you won't notice it. You may be saying "But one pair will only give a few opportunities each day/week, why not trade more than one? This is related to a recurring theme in the way I teach: "Fewer trades, more quality trades, higher confidence trades". If you properly learn the character of one pair, then it's better than guessing in 3-4 pairs. A LOT better for your profits, and that is what counts. Next I am going to say only risk a max of 1% of the account per trade, and again your reaction might be "How am I going to make decent money with tiny risk like that?" Do the maths. If you do four trades a week(yes really just 4 a week), two wins and 2 losses at 2.5R (R is risk reward, so you lose max of 1%, and make 2.5% if you are right, then you will be up 3% in the week. 3% compounded over a year is 330%. Wow. How many hedge funds make that? You won't make as much as 3% a week, probably, but hopefully you can see that this is not too small. When you consider that a loss of 10% will blow most prop firm evaluations (see later), and even a good trader will some day lose 10 in a row just from bad luck, then 1% seems fine. So, we have one instrument and 1%. Next, paper trade first. Make your foolish mistakes on paper. Select a demo account and do not lodge funds with any broker at first. Choose a broker that offers consumer protection. This means that they are authorised/regulated by your country's regulator. Always do this. 2. Let's say you have succeeded at paper trading over a couple of months and you are tempted to start trading your own money. Stop. Lodging $5000 or more and just kicking off is not the way. 90% of new traders lose 90% of their money in the first 90 days of real trading. Instead, look up prop firm evaluation accounts. Also look up how to choose one, as they are not all the same by any means. This will give you the opportunity to trade a $10k account for $100. Your risk is $100 only. Typically, if you make 10% (ie $1000 in this example, then you get a "real" $10k account. Don't buy any more than a $10k account at first. You will learn so much more from this account (where if you lose you lose real money, even if it is only $100), than you did from the paper trading account. Real money = real pressure. You will really want to convert the account, and not blow it. It's pride I know, but it is much more realistic than a demo account. Paper trading is crap, really. Just use it to find the pitfalls of trading and learn the character. More tips in Part 2, but till then, think on this: Pass your $10k evaluation. make another $1000 in real money, keep $500 and pay $500 for a $80k evaluation. Now we're cooking.

Paul_Varcoe

Don't imagine that learning trading will only take a few weeks.

I've been trading since 1987, on and off. You need to be realistic about the time it takes to become profitable. You wouldn't expect to learn a skill in a few weeks of evening classes, so don't expect to become profitable in the same timeframe. Expect a year of study. Good for you if you crack it before then, but be wary of hubris. The market is set up to have many pitfalls for you, and you can make one mistake and be back to square -5 before you can say "WTF happened". If you can make 3-4% 3 months in a row then maybe you know enough to up the size you trade. While you are waiting, try these hints: Don't quit your day job because you had a big win. You have no idea how easy it is to lose what you just made. It's a "learning on the job" process. No matter how much you read or how many YouTube videos you watch, when your money is on the table and your position is going against you, you find out what trading is like. Some say (and I agree) that you aren't really qualified until you have learned your lesson with a stonking loss. Demo accounts teach you nothing. Start small. Or use a prop firm. That way you get the true experience. Protect your capital. Use a stop loss set at the price where you know your initial feel for the market was just wrong. If you think you don't need a stop loss because you are there watching it, then just wait for your first unexpected gap move to learn that one. Have a backstop, at least. People have a habit of running losses, don't be like them. Have the discipline. Don't risk too much on each trade. Great traders can get 10 losses in a row. They know it's part of the game, but that's why they don't put 10% of the account on each trade.... Examples of pitfalls: Spread hours in FX, where you get stopped out 20 pips away from the real market. (50 sometimes) Trading halts in stocks. Unexpected assignment in options. Holding a position over the weekend and a war breaks out. Thanks for listening to my Ted Talk.

Paul_Varcoe

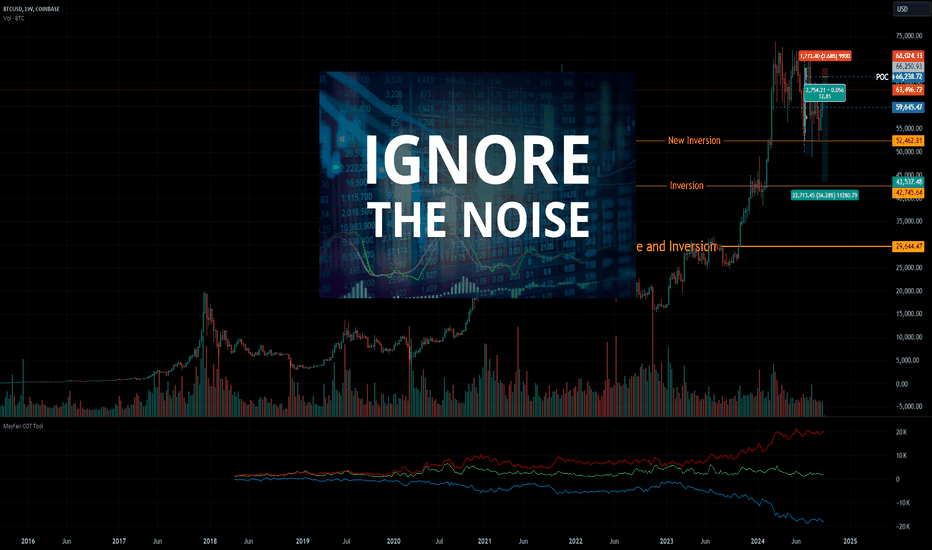

Zoom out in Bitcoin. It's not exponential any longer.

It's all in the picture. Rallies like this need to be driven by the banks and HFs. They didn't accumulate enough before Retail took the price away from them. The banks and HFs have sold it all the way up from 30. They don't lose very often. It's usually best to be aligned the same way as they are. "Buy the Dip?" May as well say "Baaaaa" like a sheep. That is all. Further justification for this view is available in my recent posts and ideas. I'm also pretty active. See signature. Long story short: This stuff is no longer exponential. Stop thinking it's going to $250k. That will take a decade.

Paul_Varcoe

Look for Wyckoff in the right places.

Since my partner Mayfair_Ventures started talking bearish about BTC in March 2021, and also talking about Wyckoff theory, a lot of commentators picked up on it and made Wyckoff more widely known. Most likely they read up on it quickly and got some kind of understanding, but unless you have been using it for a while in anger, as in, making real trading decisions based on it, it's not that easy to use. There is ALWAYS a bigger picture to look at. Also, you rarely get a perfect Wyckoff. One person's spring is another's confirmation that this is a distribution. Like all trading, there is a combination of signs. Take this accumulation from Summer 2021. It only proved it was accumulation when it exited the ranger to the upside. You had to wait for the retest to get a sensible trade. Even then, the overall risk reward was at best mediocre, and no one in the crypto space had the patience to wait almost 7 weeks for it, instead getting rinsed at $50k and likely stopped out. And also remember the narrative was around the Elliott Wave that we'd outlined, because you can't just rely on Wyckoff, or any one thing , if you want a sensible trading strategy. Right now, for a number of sensible logical reasons outlined in the attached posts and videos, I am looking for Wyckoff Distribution. My bias is downward. If you want to know why, look at the other posts, I'm not re-hashing it all again here. The important thing is the pattern I expect to see, involving a significant break of the consolidation structure to the downside and then a retest of the zone. Hmmm.... I spoke in earlier posts about there being a chance of a final upthrust above the ATH, just to sucker the last few in. I think he chances of this are reduced to about 5-10% now, given recent price action. The middle of the consolidation ($66K) seems like the top for now. If it retests and fails, then it may be time to pull the trigger. Please bear in mind that BTC is now a mature instrument, and the days of exponential prices are gone. Good luck, because it's better to be lucky than good, most of the time!

Paul_Varcoe

BTC Update, buy the dip? Is this the last chance?

No. Don't touch it. Please see previous video ideas and normal ideas

Paul_Varcoe

BTC behaves normally for once

Follow up to yesterday's post looking for a change of character (CHOCH) on the shorter timescales, having seen one on the Daily TF.

Paul_Varcoe

BTC Update, first time short? Watch to see why..

BTC Update, first time short? Watch to see why.. This is an update to my earlier piece from earlier this month, where I was saying I had detected a bearish outlook. PLEASE don't just sell it, look at the reasoning, and remember to wait for the Change of Character (CHOCH). It's not here yet. Wisdom: Always wait for confirmation. be happy to miss trades that do not offer confirmation. yes, you can just sell levels, but it's better to be more discerning.

Paul_Varcoe

BTC impulsive or not? FOMO much? WTH should I do? Buy?

BTC impulsive or not? FOMO much? WTH should I do? Buy? There will be loads of you who have followed me for a while. Maybe you think I've been wrong? I know that I didn't start buying till 32k, and I DCA'd down to 21. For the record, I have NEVER shorted Bitcoin. On the way up I sold 28 and 32, so I am long half my BTC allocation from 23 on average. I'm happy with that. Now what? I could sell now for 60% profit (divided by 2). Let's look at the evidence. People are saying this is impulsive. I say: show me an Elliott wave. I have tried to draw one on the weekly, see the chart. I cannot see (even on this large scale) how the fractal wave inside the yellow 2-3 would work. If the yellow wave IS true, then the top looks like 48-ish, which feels like the dampest squib ever. More evidence: The Commitment of Traders (CoT) report story is that the professionals are net shorter than they have ever been. They are not wrong often. You can see the indicator in the chart at the bottom. If you want this indicator go to our website and ask. Personally this a very convincing piece of evidence. Better even than the corrective style of price action. Also. don't forget that Bitcoin is now an institutional instrument, and out of all the big ones it is the easiest to manipulate, see: It's isn't going to make a new high without the big boys being long. They are NOT long. In fact they are still selling. For all those that think it's going to $1,000,000 or some other such borrox, do some maths. There are 19.5m BTC. It needs to go up $962,000, so to get to $1,000,000 a coin, its market cap needs to go up by $18tn. It's not the same as when it went from 1k to 69k. That was an increase of only $1.2tn. It's unimaginable that another 18tn will be invested any time soon. I restate in case you haven't followed me or my partner Mayfair_Ventures : We are BULLISH on Bitcoin. This just isn't the run we want to be involved in. The last of my BTC is for sale at $40,379. I will happily buy them all back sub 25k. My target is actually 21k. I'm waiting for 21K , the CoT to go positive, and for the news to be filled with "Death of Crypto" stories. I am happy with my logic, thanks.

Paul_Varcoe

So is it finally time to go long in Bitcoin?

So is it finally time to go long in Bitcoin? Here at Mayfair we have spent literally years trying to save all of you from getting caught out in Bitcoin. It's at times like these that we have stepped forward and warned you that all that glitters is not gold. Right now Crypto Twitter (Crypto X??) is bullish, like it is every time a breakout seems possible. Wanting to be right is never enough. Let's look back at previous examples, here is one from March: And a few days later: Onward to June: Now, is it finally time? NO! I would recommend not buying here, instead wait for lower prices. Be patient. You can see that the professionals are net short BTC. (You can get the COT tool from our website for free). The Price Action is NOT impulsive. The monthly, weekly and daily stochastics are overbought. But for me the main thing is the psychology aspect. People are not broken and giving up yet. They have to be encouraged to buy BTC here, to fuel the down-move that the professionals are waiting for. The lines on the chart I drew months ago. I still favour a spike above 32k because that would be a new high since August 2022, and that should be enough to trigger some stop-losses from shorts and get a whole new wave of mugs to buy. Then the drop can come. Now, we can be wrong, but we can say with confidence that the next stop is not a new all-time high. I'm saying the same as I have been saying for months. A pop up to 32k+, then back to 21-25k. Personally I think it's 21. My sell order (I am long cash) is still in at 32k+, and I will replace this and my other sale at < 25k. We are BULLISH in BTC long-term, just not from here. I may have mentioned this before, like 100 times. There you go. Take care. My partner's recent stream: https://www.tradingview.com/streams/UMLGqxdKlt/

Paul_Varcoe

Zoom out for goodness sake.

Zoom out for goodness sake. Just look at the weekly chart. Inversion level (my own term) is a level where once it breaks through it tens to stay there for a while and takes more than a couple of attempts to break through. So my bias is short until we get a decent break and a successful retest. Imagine this as a 15m chart. What would you think of it? You would be looking to sell, so why do people feel bullish? FOMO, that's why. I had a guy comment that we are getting higher highs and higher lows, and on a 1H timeframe he is correct. But on the larger (and more significant) timeframes we are seeing a retest of the upside, and that needs to conclude and break through and then retest successfully as support before we can switch bias. ZOOM OUT! Also check out the CoT at the bottom, which shows what the leveraged funds are doing. These people know you and they are selling it to you RIGHT NOW. You think these people are wrong? They are the ones that make consistent money. in a 15m chart when you see price rising and volume falling, what does that mean to you? I am still long on my original DCA. I sold some of it to replace it at lower levels, and if the Crypto Twitter mob get too excited I'll sell some more of it around $32.5k I expect another visit to at least the mid point of the consolidation. Happy to replace my sales in the bottom half somewhere. If you want to go long here, consider your risk-reward ratio first. We are bullish of BTC, just not from here and now.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.