Old-School-Crypto

@t_Old-School-Crypto

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Old-School-Crypto

Bitcoin Karar Aşamasında: 150 Binler Mi? 100 Binin Altına Mı?

Btcusdt.p When we look at the course of the BTC over the daily graph, the two formation structures show us that it is in a decision stage at the daily pivot levels. ⬆️ Flag formation and 146500 targeted rise ... ⬇️ 2 Piece Tepe Formation and the possibility of a 99000 -targeted decline ... The daily pivot of 113345 and the average of Kaufman at the 114270 level level (wedge), and if there is permanent, the flag range; If it remains under the pivot and wedge, it will turn to the 2 -hill range Bitcoin.

Old-School-Crypto

ETH için BULLISH SHARK harmonik formasyon ihtimali...

Ethusdt.p After the last ADH, a Bullish Shark (Taurus Shark) is the possibility of a 4 -hour graph with the graphic pattern. If the formation works, the point D within the limits of the formation is expected to take place in the 3525-3150 band. Based on $ 3525 return, formation targets are marked in the green bar. If the Bullish Shark Harmonic Formation works, I will revise the target levels when the D point is clear. I recommend you to evaluate it with the annexed ETH trend analysis I have previously published.

Old-School-Crypto

ETH Trend Analizi

Ethusdt.p When we look at the weekly graph, you can read the long -term trend x -ray on the graph. May 2021 and November 2021 high hills after the broken trend entered the month of the month of the month, with the last decline of the 1400s as a trend bottom by determining a strong upward trend. And by breaking the $ 4877.54 AC in November 2021, this week we were in the new historical summit as $ 4888,49. In the graph, the channel we saw with the red line had experienced a withdrawal twice before the median. Now we see that he is trying to put it on the channel media again. We see that the Median border is in the $ 5214s with weekly Pivot R3 levels. Just above the main rise trend Fibo 1 level $ 5467s ... Ethereum Will the media be able to leave on these values, which are necessary for it to jump on it? Or will he have to withdraw back to gather power by eating rejection from these levels once again? If we assume that it will close the present, this weekly closing at the levels where it is now, Williams %r will tell us some things. If you pay attention, there is a negative incompatibility between price hills and %R (pink wave). While the price hills rise, the descent of %R hills is considered as a strong negative incompatibility and therefore a sign of decrease. Williams has also reached %R saturation limits Ethusdt.p Although its strong appearance and the recently increasing interest of whales, it seems to progress in a route that will gather power with a correction in order to reach $ 10000, which is the expectation of many, to reach the channel ceiling and jump to the upper channel. You can find my opinion on a harmonic formation projection that he is currently in, where this withdrawal may be. I recommend you to review it.

Old-School-Crypto

BNB için BULLISH CYPHER harmonik formasyon ihtimali...

Bnbusdt.p After the new ACT has entered the correction ... For BNB, the target of $ 1000, depending on the course in Bitcoin, a deep correction of the $ 1000 dam with a pattern of the targets appearance. $ 117000 Btcusdt.p If the Bullish BAT Harmonic formation, which I have previously published in the annex, can work the Açonsöz Formation that we observe that BNB may also be in. In this case, a withdrawal is expected up to $ 725.50 under normal conditions. In some cases, the withdrawal of Cypher (Açrarsöz) formation is within acceptable formation limits. Closes under $ 675 invalidate the formation. If the formation works with standard levels, I marked its goals with green bar. I revise the targets according to point D formation.

Old-School-Crypto

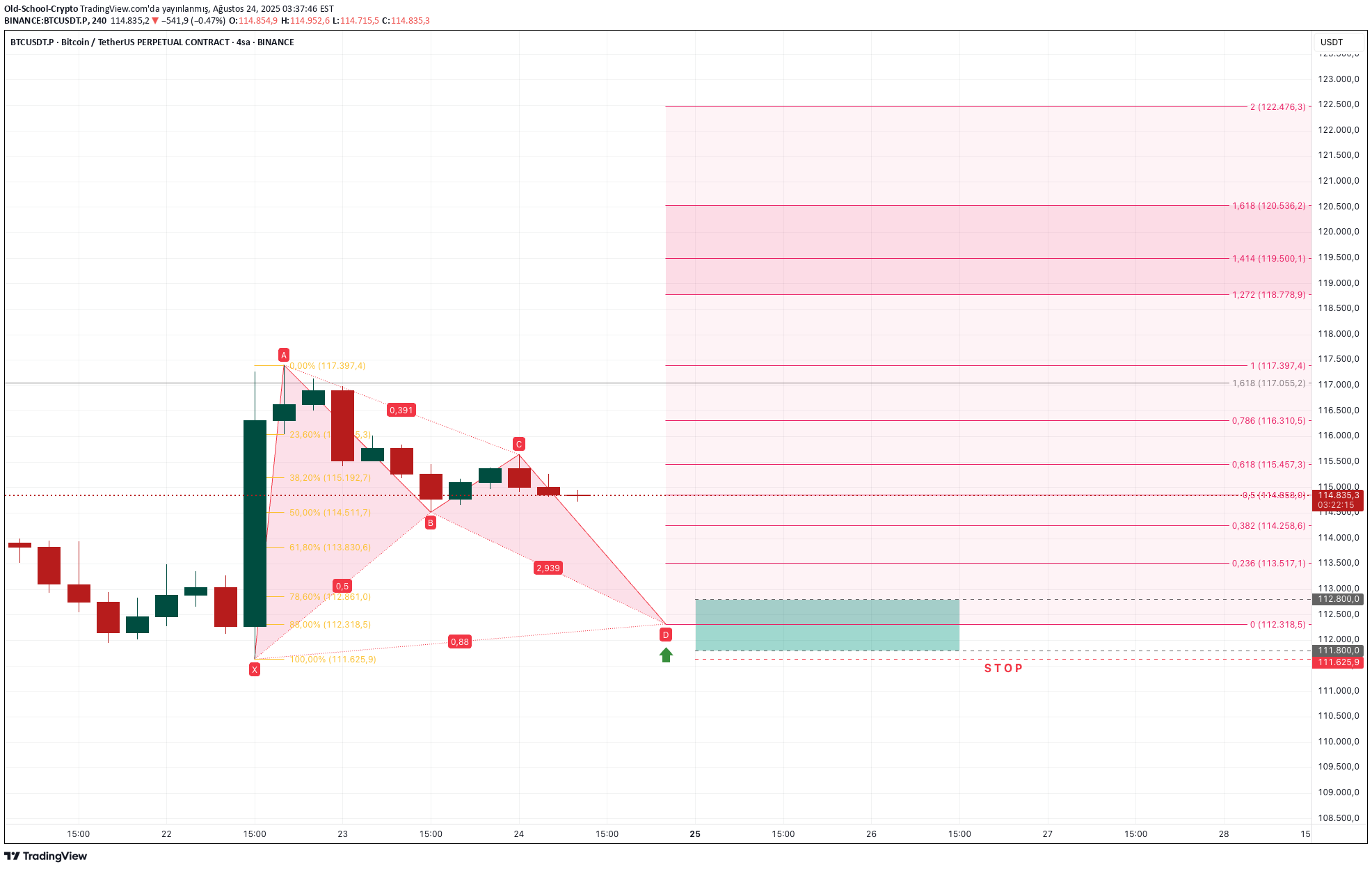

Bitcoin BULLISH BAT Harmonik Formasyon İhtimali

Btcusdt.p After his last hard upward movement, a BULLlish BAT (Taurus bat) is a harmonic formation appearance with the pattern structure he entered. If the formation works, $ 112318.5 level X/A Fibo 88 %Return levels. A return from the 112800-111800 band is expected in line with the flexibility share of the bat formation. And the levels marked in the graphic with their targets red bar ... X If the point is closed below $ 111625,9, the formation will disappear.

Old-School-Crypto

BTC İç İçe Harmonik Formasyonlar İle Düşüşe Mi Baskılanıyor?

Btcusdt.p The month I published before is in the butterfly harmonic formation (red on the graph). As long as this formation continues as a possibility unless it closes on the X hill point ... The pattern formed with price movements offers a bull shark possibility (green in the graph). If the last hill of the BTC has been the c point of the shark harmonic formation, the formation limits for point D are two D. In this sense, the Fibo 0.5 and 0.786 levels of the butterfly formation. "Bitcoin is suppressed by the fall with harmonic formations?" This is the reason I ask. I wanted to present it to your attention.

Old-School-Crypto

BTC - Bitcoin Bearish Kelebek Formasyonu İhtimali

Btcusdt.p The possibility of a bear butterfly harmonic formation on a 4 -hour chart appears ... If he confirms from 23.60 %Fibo level, the possible withdrawal levels and objectives of the formation are in the graph ...

Old-School-Crypto

BTC - Bitcoin 15'likte SHARK Köpekbalığı Ayı Harmonik Formasyonu

Btcusdt.p Bulllish Shark (Shark Bear) Harmonic Formation pattern is read. He hit my eye while scanning. I noticed it a little late, but I wanted to share it. As if he took his confirmation, I marked the target points on the graph if he works as if he took his confirmation ...

Old-School-Crypto

Bitcoin Futures / Kısa Periyotta TOBO İhtimali İçin Seviyeler

Btcusdt.p In short, in the pattern structure that can create a TOBO (Reverse Shoulder-Baş-Somuz) formation. For formation approval, the R1 Pivot support is required in the 15 period of $ 130605. If it returns from the pivot support in $ 112800s, target levels are operated in the graph according to shoulder and head rates ... TP 1 (shoulder): 115400 TP 2 (shoulder): 116250

Old-School-Crypto

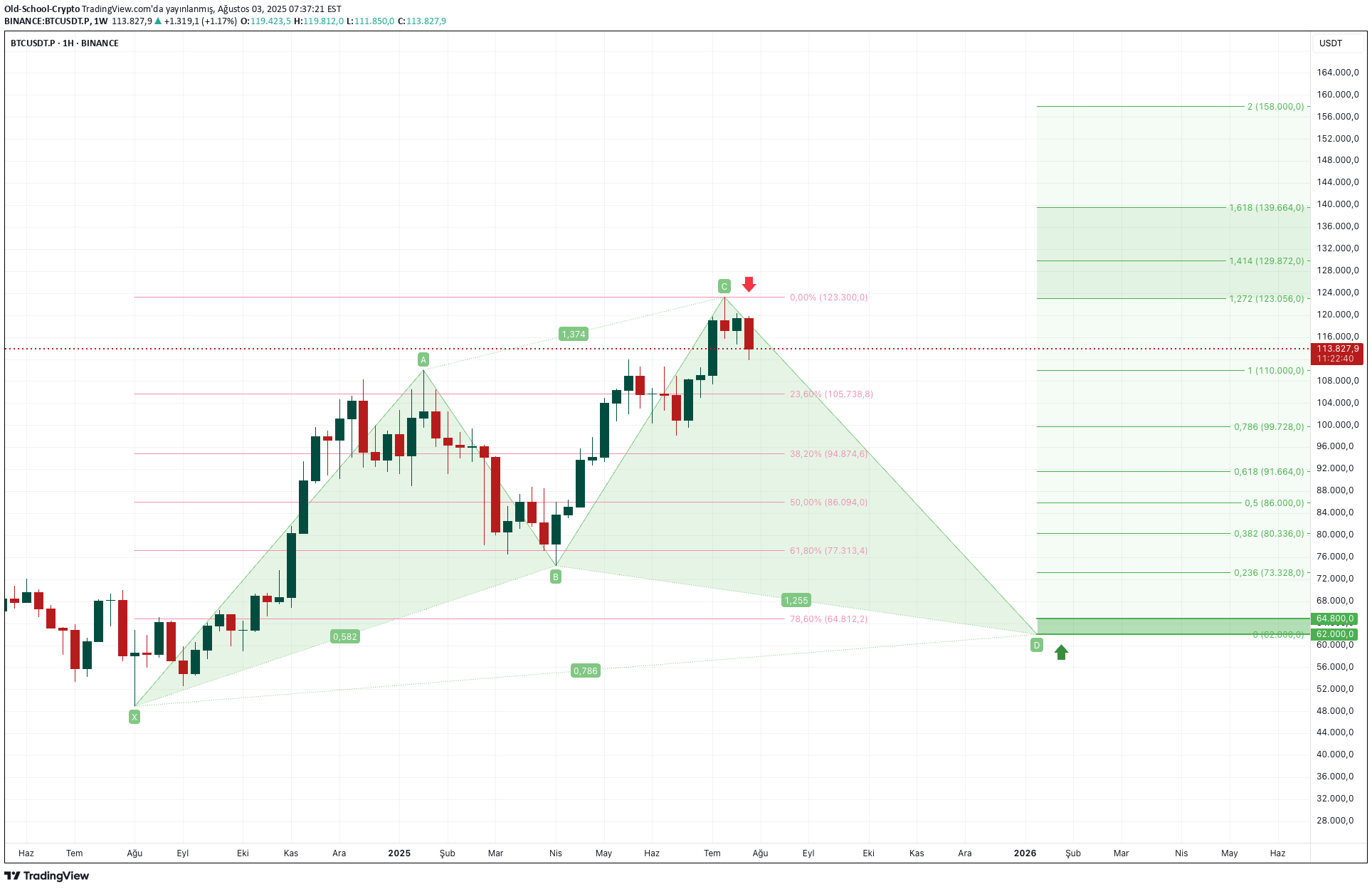

BTC - Bitcoin Bir Açarsöz Formasyonu Kapanında mı?

#Bitcoin Btcusdt.p The current pattern structure on the weekly graph offers a #Bulllishcypher (bull -opened) harmonic formation. If the formation works; It is expected to withdraw to the 68400/62000 band and increase to the target of 135000/150000 after completing the harmonic pattern. In the graph, you can find confirmation levels and formation target levels.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.