MohammadAmin41148

@t_MohammadAmin41148

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

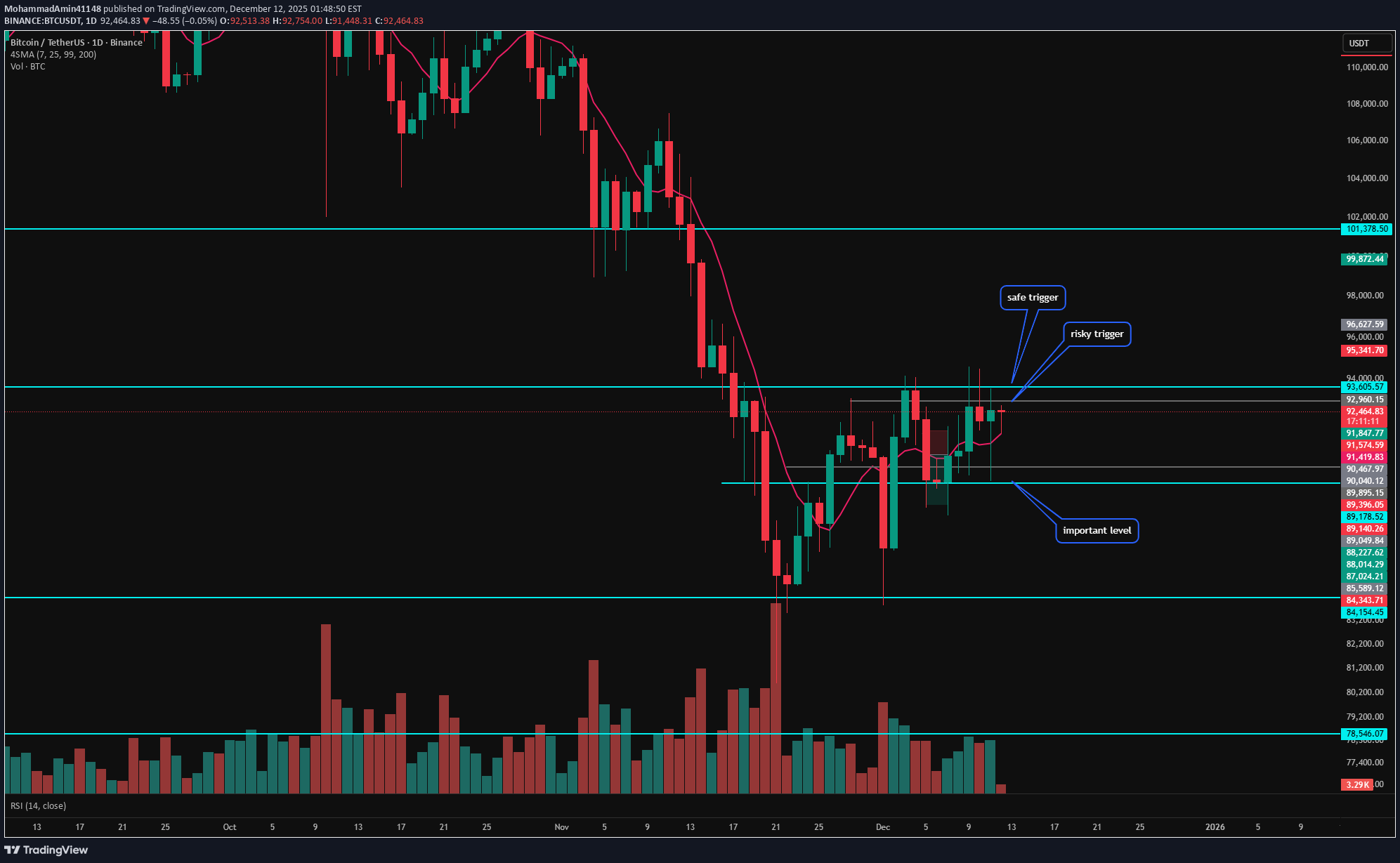

آخرین تلاش خریداران بیت کوین: آیا سطح ۹۳,۶۰۰ شکسته میشود؟

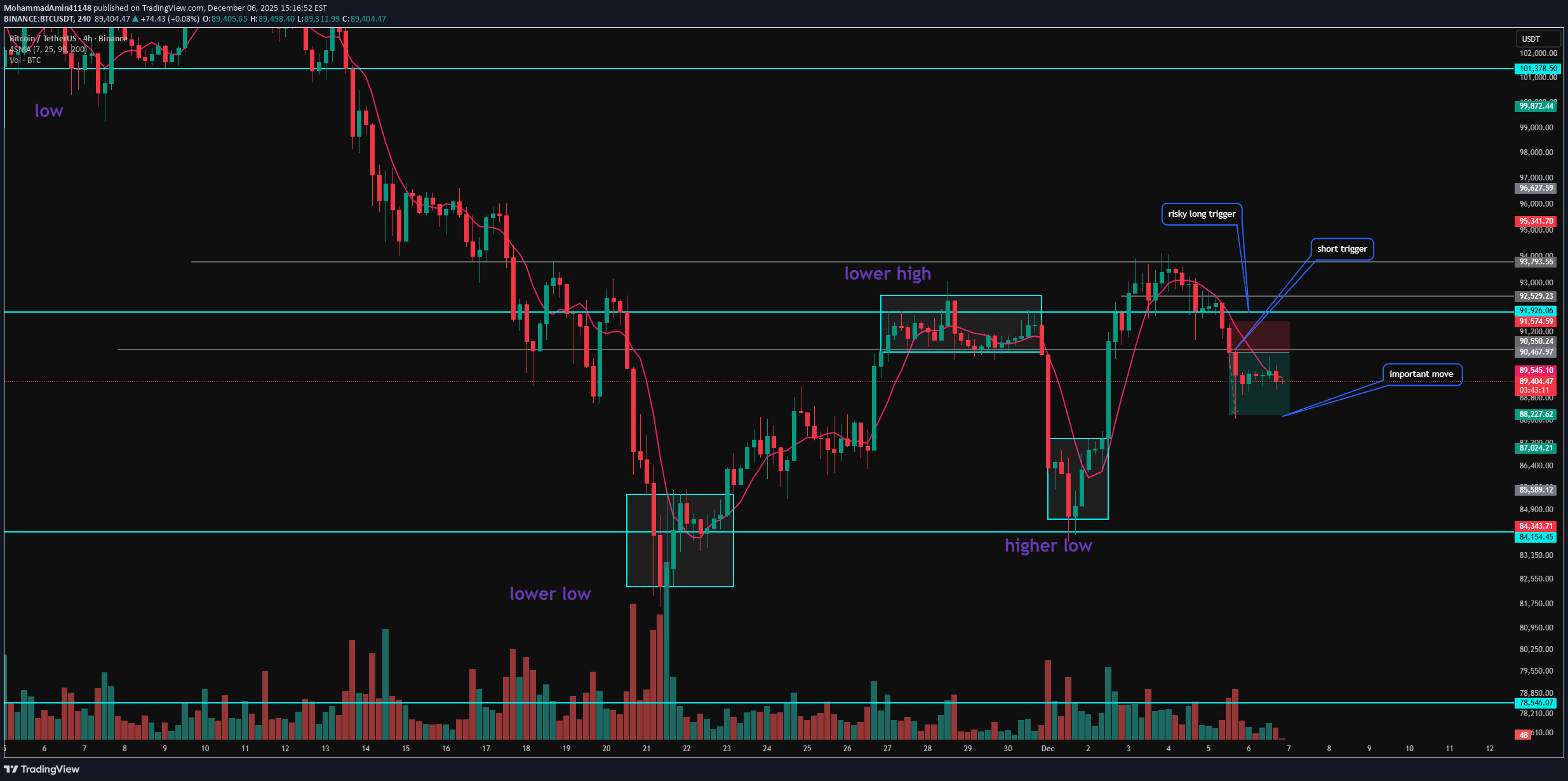

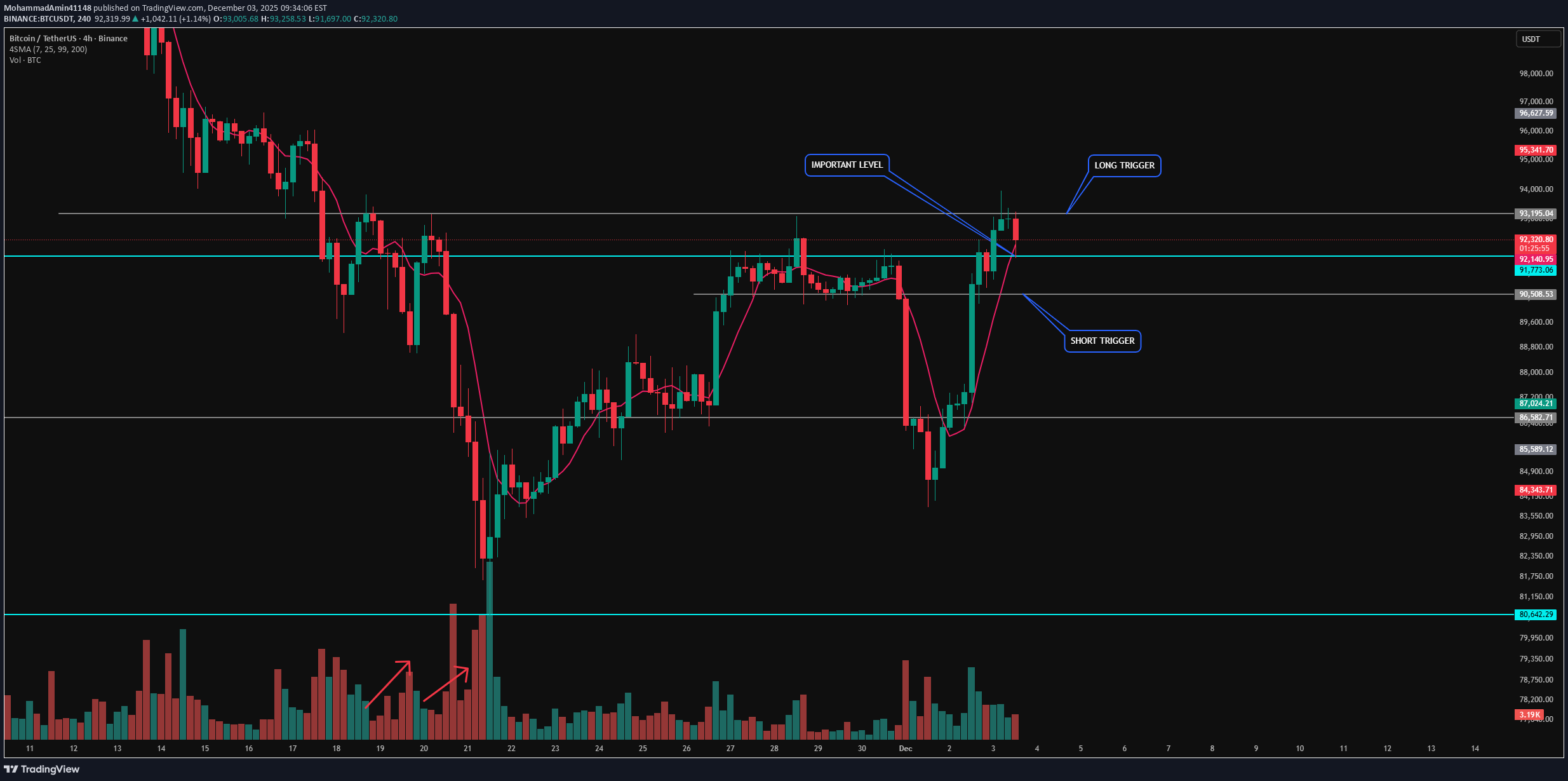

Hello to all my amazing traders! Hope you’re doing great and starting your day strong! 🚀 Today, the Fear & Greed Index is at 29, still in the fear zone. Yesterday we made a small push upward toward the end of the day, and now price is sitting around 92,960 — which is our risky long trigger. Our main long trigger remains 93,600, but if price wants to break that zone, it will most likely break it with a big Marubozu candle. Why? Because there’s a huge amount of sell orders stacked in that region, so if price wants to pass through, it probably will explode through it to liquidate shorts above the zone — meaning we won’t really get a nice 1H candle close to enter comfortably. So this leaves us with two choices: Option 1: Enter at 92,600 Higher chance of getting stopped out, but almost zero chance of missing the move. Option 2: Enter at 93,500 Lower chance of stop-loss compared to option 1, but a much higher chance of missing the breakout. As always, when I say I’ll enter above a certain level, I wait for a 1-hour candle to close above that level before entering — unless the move is clearly a breakout explosion. 🔥 Why I Think This Might Be the Buyers’ Last Push I personally think this attempt might be the last strong effort from buyers. Why? Because if they try again and still fail to break the previous high, then in this secondary uptrend, buyers failed to make higher highs and higher lows — which tells us momentum is weakening. That would strongly suggest our next real breakout is downward, and since that aligns with the primary trend, we can risk a bit more on short setups. Two key levels I’ll trade myself: 📉 Short setups Break of 89,178 If buyers attempt to break 93,600 but fail — in that case, I’ll open shorts on altcoins that have a bearish BTC pair structure. 📈 Long setups If we actually break 93,600, I’ll still take the long — but I’ll probably split my risk: half on Bitcoin, half on a strong altcoin trend, because BTC dominance isn’t showing a clear direction yet. 🎯 Final Note As always — risk management first. This market is still indecisive, and protecting capital is the #1 priority. Thanks for reading my analysis — I’m excited to see your comments! 🚀🔥

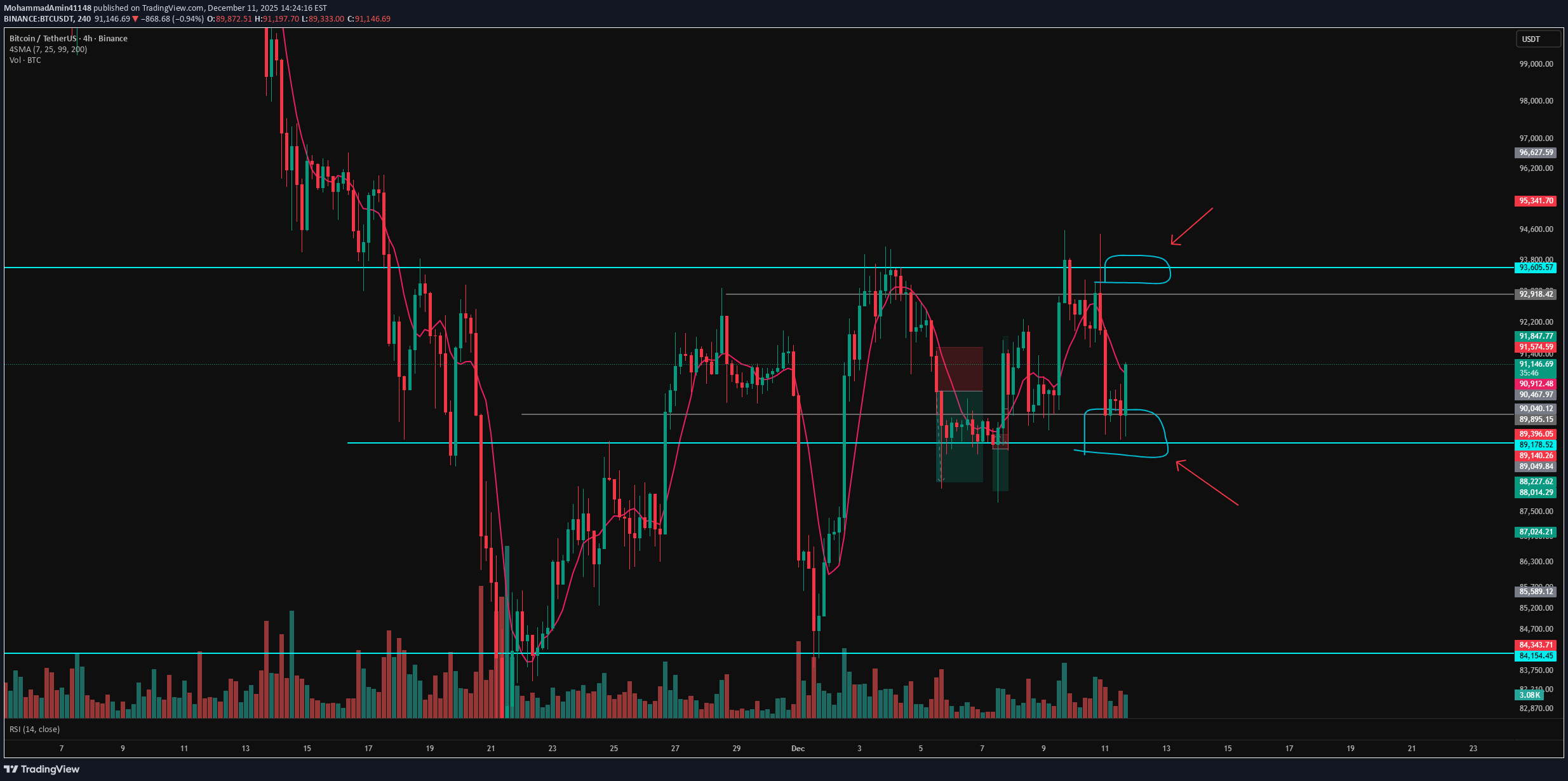

Bitcoin Analysis No Man s Land !

Alright, let’s get into today’s BTC analysis. First thing I want to point out is that the Fear & Greed Index is sitting at 29! Honestly, it’s surprising. We’re basically at the same price we were 15 days ago, so what changed? Did we just get used to this price? Did sentiment shift without price moving? It’s weird — but interesting. 📉 About the 4H Trend Right now, we can’t really talk about a “4H trend” because the market isn’t moving cleanly in 4H or even 1H. How long will this indecision last? Until we either break below 89,000 or break above 93,500. Until then, the only logical timeframe to trade is 15 minutes, or we just stick to the daily timeframe until the market shows its true direction. But PLEASE set alerts on 89,000 and 93,500, because neither of these levels should be passed without a position. 📊 Bitcoin Dominance Talk Now, about BTC dominance: If your strategy — like mine — is momentum-based, I honestly recommend stepping a bit away from Bitcoin trades for now and focusing on altcoins that actually have a clean daily trend. Examples: BAT, AVAX, and similar trending setups. Why? Because if a coin has a trend, risking in the direction of that trend is way easier and more logical than forcing trades on Bitcoin when BTC currently has no real trend. And of course, if Bitcoin’s momentum aligns with your altcoin direction, even better — take the trade with full confidence. 🔚 Final Note Market still hasn’t decided what it wants to do, so my main recommendation remains the same: 👉 Risk management first. Always. Stay sharp and stay profitable 🚀🔥

بیت کوین در مه تردید؛ دو سطح کلیدی برای شکستن این ابهام!

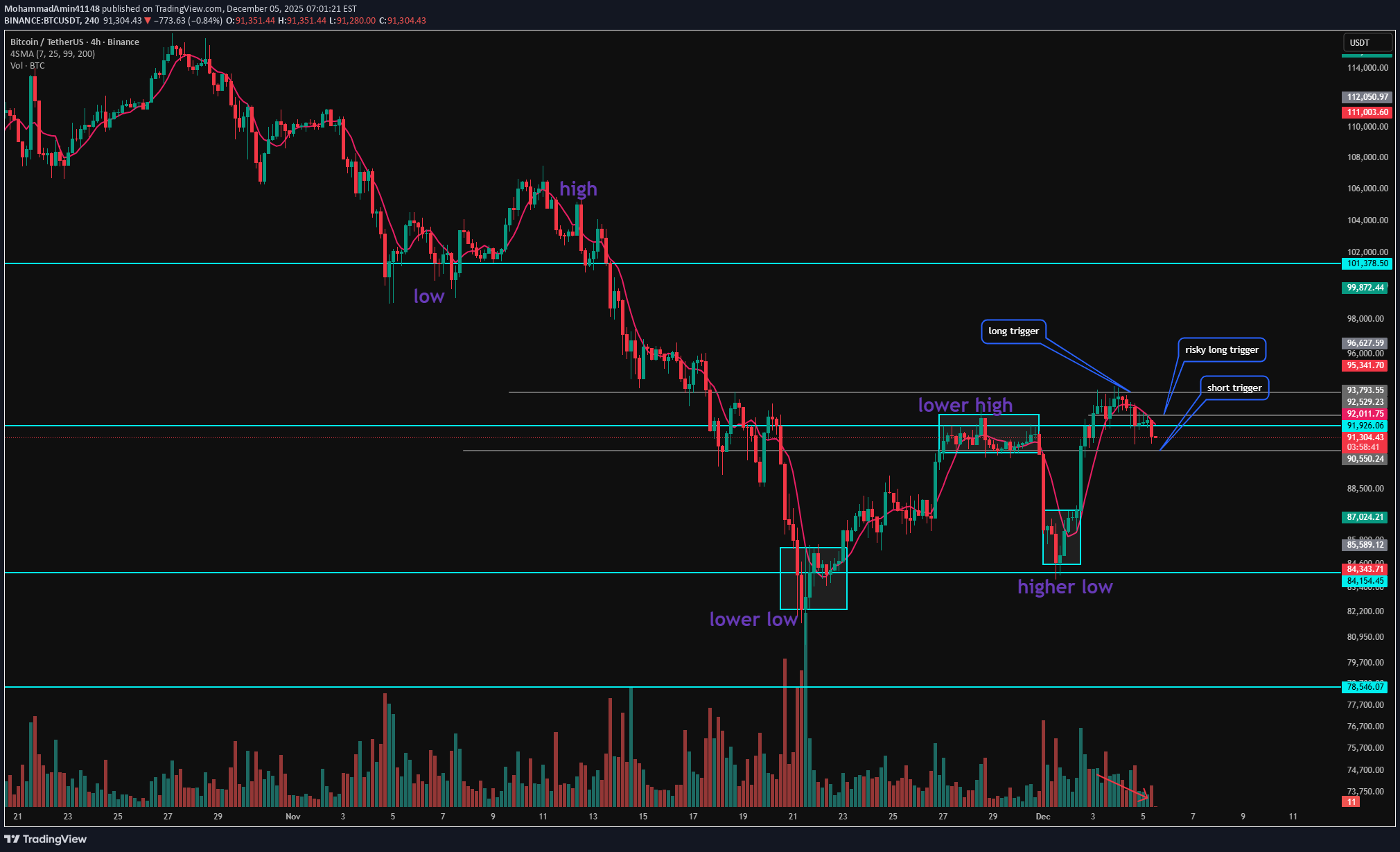

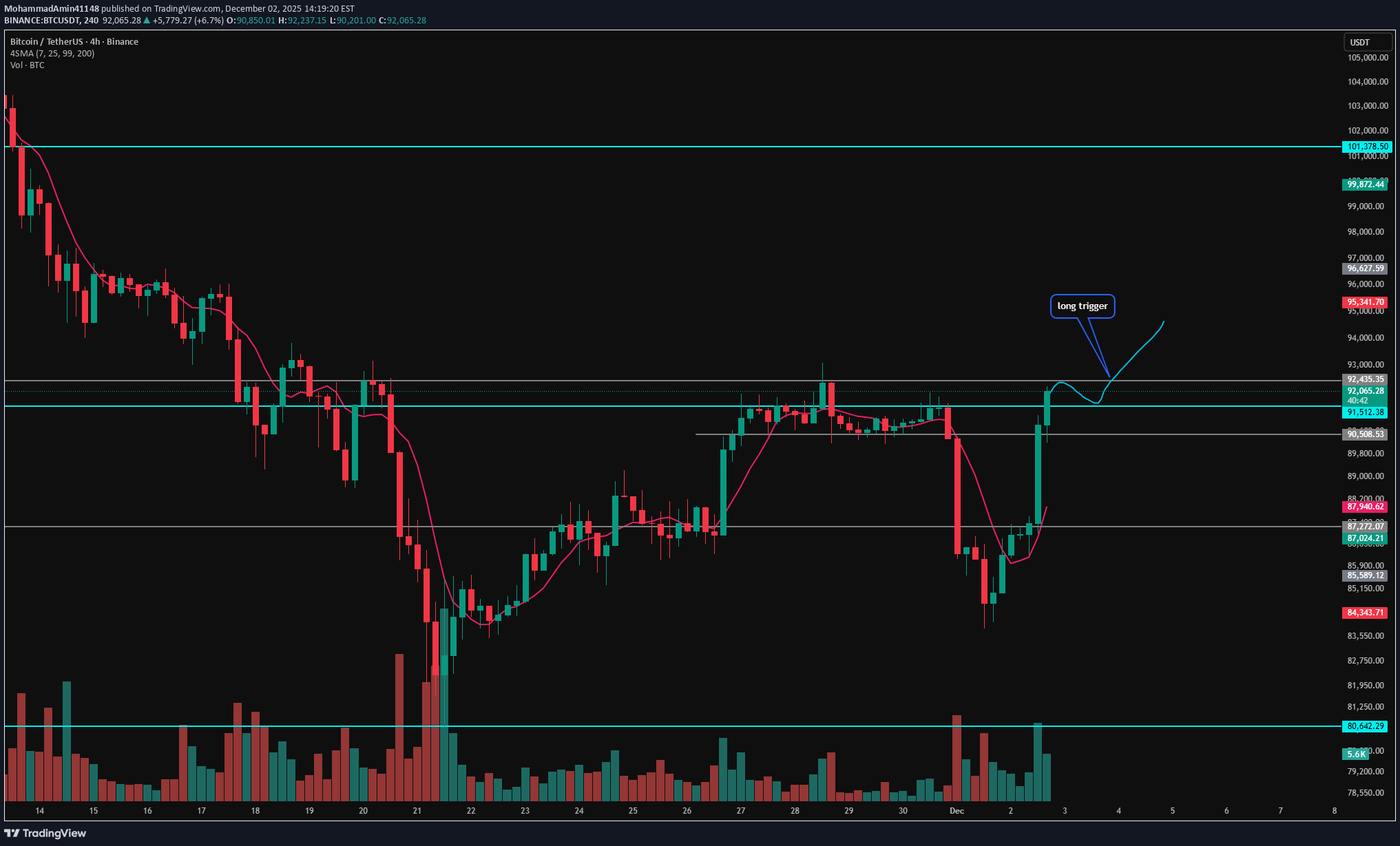

Alright traders, let’s jump into today’s analysis and see what the market is telling us 👇 As you can see, we’re still in that same area I told you about before — we’re inside the secondary trend on the daily timeframe, meaning we’re simply correcting the larger downtrend we already had. On the 4H timeframe, we still can’t call this an uptrend. Why? Because even though we are forming higher lows, buyers still don’t have enough strength to print higher highs — they keep creating equal highs instead. So for now, the 4H trend is unclear ❗️ 🎯 Key Levels That Define Everything There are two major levels that will break this indecision: 93,500 89,100 – 89,800 zone Whichever side breaks first — that’s where I’ll take a position with momentum. Especially the 89,100 level, because that one matches my higher-timeframe bias. 📉 Risky Short Setup I’ve also set a risky short trigger at 92,000. This one needs another clean reaction before entering — but if we get that reaction, it gives us a decent short setup. ⏳ Why Lower Timeframes Matter Right Now? Because on higher timeframes we’ve just reached a support area, and the market needs time to show a proper reaction. That usually takes a while. So right now: ✔️ Most confirmations come from lower timeframes ✔️ We secure profits quickly ✔️ We avoid holding long trades with no clear trend That’s it for today’s analysis ❤️🔥 Make sure to listen to Powell’s speech tonight, and never forget your risk management. Stay profitable and stay sharp! 💰🔥

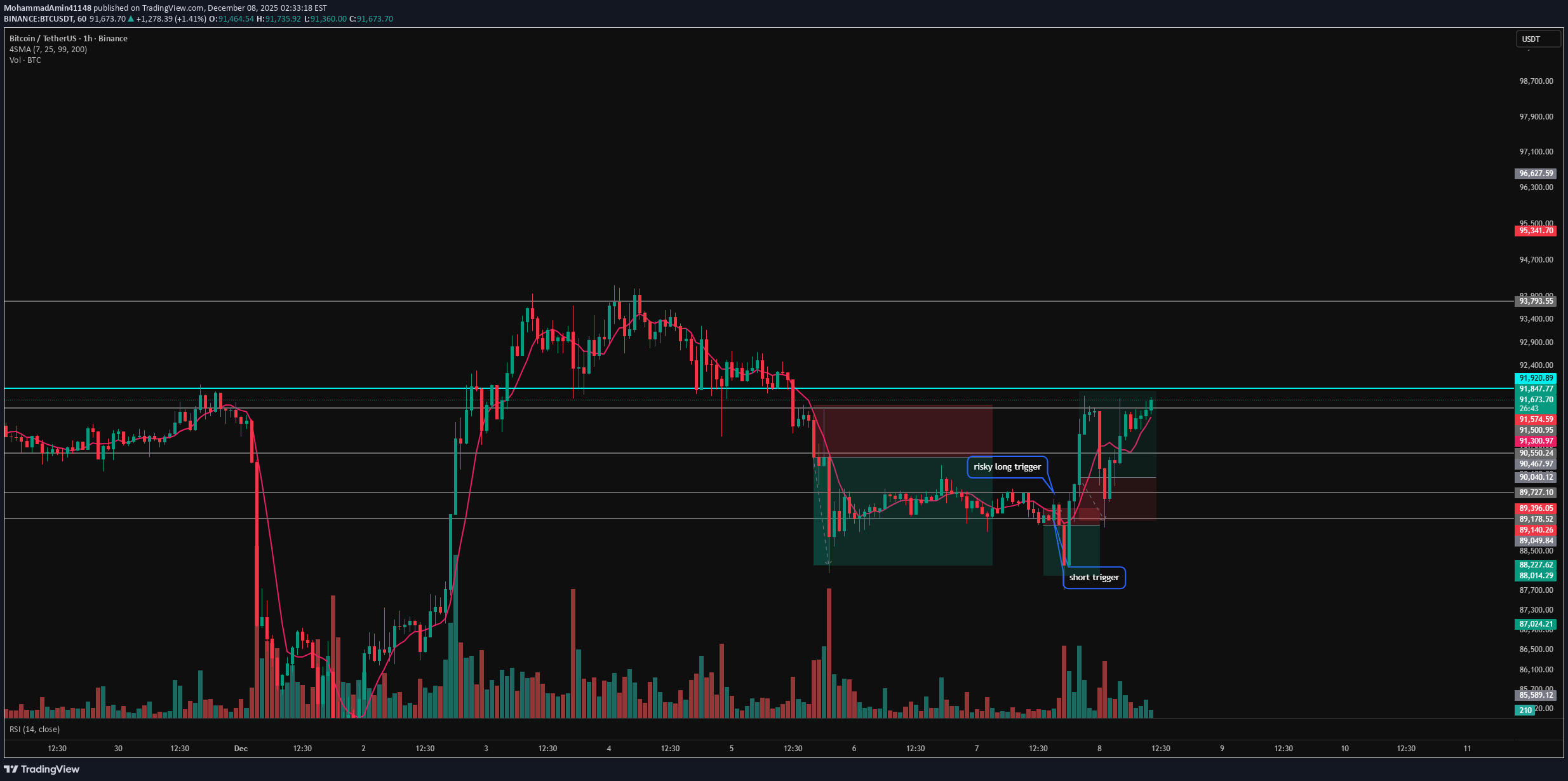

تحلیل بیت کوین امروز: بازار دیروز دیوانه شد! سناریوهای صعودی و نزولی کلیدی

Hey traders! Let’s jump into today’s Bitcoin analysis. Yesterday the market went full crazy mode As I told you before, you could take both long and short positions from the extremes — and I did exactly that. Both directions activated ✔️ First things first, like always, the Fear & Greed Index: 24 — still in the Fear zone. 🔍 Quick Look at the Daily Timeframe I want you to open your daily chart with ZERO indicators. Just look at the structure. The daily trend is still bearish, and right now we are simply in a correction of that bearish trend. According to Dow Theory, if we consider the primary trend as down, then we’re currently in the secondary movement. Keep that in mind — it matters. 🚀 Scenarios & Triggers 📈 Bullish Scenario (LONG) If price wants to move up: 👉 Breaking 92,000 is my main LONG trigger. I will definitely take a long there, especially if the move starts during the US session or if I see clean stepping volume. You can also long from 91,500, just wait for a clean 1-hour candle close. 📉 Bearish Scenario (SHORT) For shorts on Bitcoin itself — honestly, 👉 there’s NOTHING until 89,200. Market structure isn’t giving any short setup yet. Until then: 🔸 either wait 🔸 or look for altcoins that are bearish against BTC — those can give great short setups. 🟢 About Yesterday’s Trades Both trades activated: Short → closed at 2R, solid. Long → almost hit 2R, but because my entry was a bit far, price reversed and hit SL. Totally normal when the market has no clear direction. 🎯 Final Notes Keep the scenarios in mind. Watch the volume. And as always — risk management comes first. Stay profitable 💚🔥

تحلیل بیت کوین پیش از شروع معاملات نیویورک: سطوح کلیدی و سناریوهای پیش رو

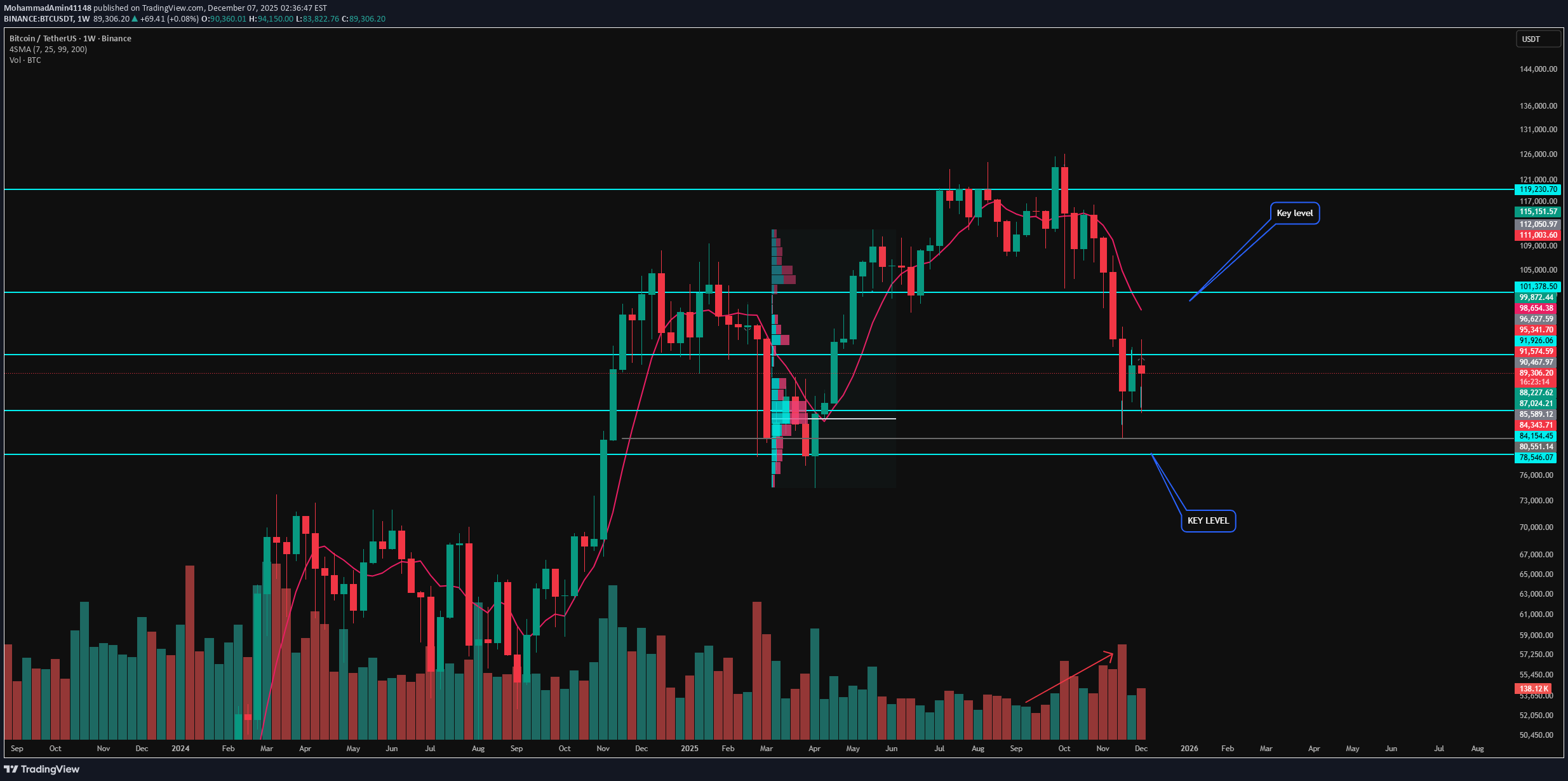

Fear & Greed Index: 22 — still in Fear. 👋 Hello Traders! Let’s dive into today’s Bitcoin analysis. Today’s outlook isn’t very different from yesterday — we simply have more structure, more clarity, and the market has moved deeper into our expected zones. And since I wanted you to have this before the New York session, here we go: 📰 Weekly Outlook — No Clear Signal Yet On the weekly chart, we’re printing something close to a Doji candle. ❓ Does this weekly candle tell us anything significant? ➡️ Not really. The market had a sharp drop, and now it’s simply resting — completely normal. I’ve mentioned in previous weekly scenarios that we might range until the end of the year, and so far the market is following that exact script. But does ranging mean no long or short positions? ❌ Absolutely not. It simply means: Take profits earlier Avoid holding trades for too long Do NOT treat mid-range setups as long-term positions 🎯 Key Higher-Timeframe Levels Two extremely important levels remain: $78,000 $100,000 These are the levels that can confirm a long-term trend shift (up or down). They’re also the “heavyweight” breakout levels — meaning: When you’ve captured several good R/R trades, one of them is worth leaving open in case these levels break. Because if either level breaks, the move could be so sharp that entering afterward becomes nearly impossible. 📉 Lower Timeframe Structure Now let’s zoom in: Sellers are attempting to push price toward $84,000. Two scenarios from here: Scenario A — Strong Sell Continuation If sellers manage to reach $84k, the next short setup becomes straightforward: 📌 Short continuation toward $78,000 (ONLY if momentum remains strong after $84k touches or breaks). ⚠️ Scenario B — Sellers Fail If sellers show weakness and fail to push price to $84k, Bitcoin will likely form a range between $84k – $92k. Inside that box, only short-term trades make sense — no swing positions. 🚀 Bullish Scenario If price returns upward toward $92,000, I will personally open a long position. 🔍 4H Compression Zone — Important! Bitcoin has created a compression structure between: $89,000 and $89,700 This zone is crucial. Break upwards → I will long altcoins with bullish correlation to BTC. Break downwards → I will short BTC or altcoins with bearish correlation to BTC. ⚠️ But only AFTER real volume enters the market. Always track volume — it’s everything in this phase. ✔️ Final Words Thanks for reading today’s analysis! I hope you have a great day full of focus and profits. And remember: 💛 Risk management isn’t optional — it’s your survival tool. Stay safe, stay sharp, and see you in the next update! 🚀📊

تحلیل بیت کوین: ناوبری در ابهام دسامبر و سناریوهای معاملاتی پیش رو

Fear & Greed Index: 21 — still in Fear. 📰 Market Overview As mentioned in my previous analyses, the short entry trigger played out perfectly. I personally opened a short on STX, and the trade has now closed at 2R profit. ✔️ So… what now? To answer that, we need to double-check the trend analysis and evaluate where buyers and sellers currently stand. 📉 Understanding the Current Trend If you’ve been following my earlier posts, you already know how important it is to watch: Candle shapes Volume in bullish vs bearish legs Where buyers actually step in And how strongly they can push the market upward We entered shorts because: The daily structure is still bearish, Sellers still control the larger trend, And the first real signs of buyer weakness appeared — exactly what we waited for. Now we need to analyze this downward leg in detail: ❓ Key Questions to Ask Will this drop reach $84,000, the previous major low? If it reaches that level, will it break? Will this bearish leg be stronger or weaker than the previous one? Or… will we fail early and enter a December range? Your answers to these questions decide your trading plan. 🟦 Scenario 1: December Range (No Man’s Land) If Bitcoin can’t reach $84k and instead starts moving sideways above it, this entire region becomes No Man’s Land — no clear control by buyers or sellers. If that happens, we may spend all of December ranging here. ➡️ Long-term positions would NOT make sense in this scenario. 🔻 Scenario 2: Breakdown Toward $84,000 If price continues downward and reaches $84,000, shorting becomes extremely important — but entering directly at a major support is always tricky. My advice: If you’ve made decent profit recently, 💡 hold one short position without full take-profit, or set your stop to breakeven once your trade hits your desired R:R. Because if $84k breaks, panic can accelerate fast — and we may see some very unusual numbers on the downside. 🎯 Short Entry Plan Right now, the 4H timeframe does not yet have a clean structure for a new short entry. But likely around 1 UTC, U.S. session volume will enter the market, and the structure may become clear enough for a proper short trigger. 🚀 Scenario 3: Bullish Reversal If sellers show weakness and buyers regain control: Long Trigger: $91,900 But I need at least one 1H reaction to form a structure so I can place a reliable stop-loss. No reaction = no long. ✅ Final Notes Thanks for reading my analysis — I appreciate every one of you! Remember: 💛 Risk management is what keeps you alive in the market. If you enjoy these daily updates, feel free to follow — I share exactly what I’m doing in the market every day. Stay safe, stay profitable, and have an amazing trading day! 🚀📊

ضعف خریداران بیت کوین آشکار شد: آیا ریزش بزرگ در راه است؟

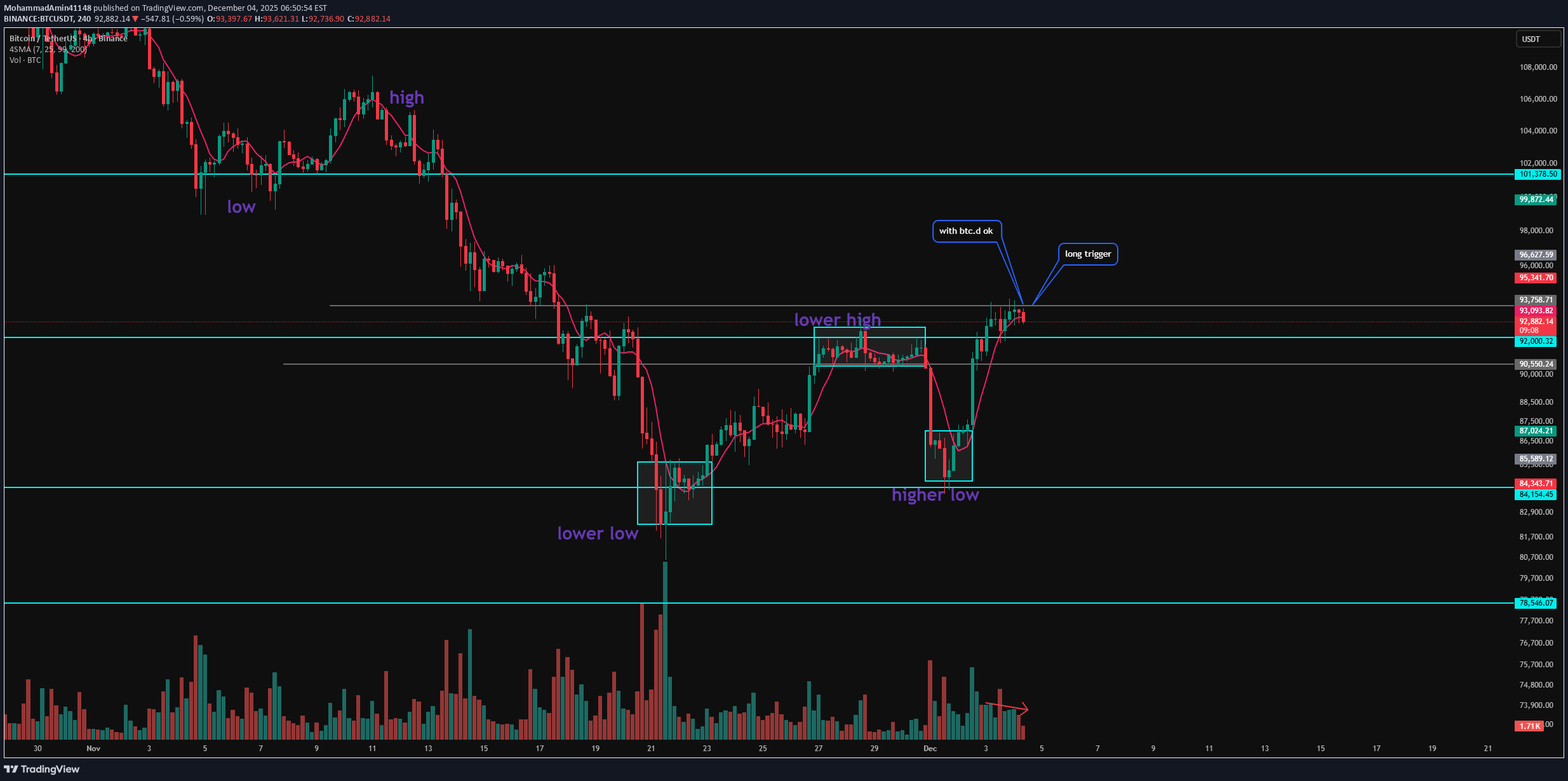

Fear & Greed Index: 25 — still in Fear. 📰 Market Overview As expected, Bitcoin broke below the $92,000 level, which I mentioned was highly probable. Right now, the uptrend is weak, but I don’t believe it’s completely invalidated yet — a confirmed break below $90,500 would seal the deal and flip the structure fully bearish. On the 4H timeframe, we clearly see strong buyer weakness — both in volume and candle size. That’s exactly why we just printed a large red 4H candle. 🎯 So What Should We Do Now? 🔻 My Current Position I personally opened a short on STX, and although I haven’t reached a 2R yet, once I do, I will definitely take profits or even close the entire trade. Why? Because if sellers don’t step in with strength, BTC can easily continue upward. 📉 Short Trigger $90,550 is the clean, confirmed trigger for a short entry. But remember: Bitcoin is in a downward daily structure — lower highs & lower lows are obvious. So any early signs of buyer weakness give us opportunities for short positions. If the next 4H candle fails to reclaim $92,000, the probability of further downside increases significantly. And even if we don’t drop hard, price may stay range-bound in this zone. 📈 Risky Long Scenario If the next candle forms a green engulfing and buyers suddenly return, you can consider a risky long entry above $92,500 — but only if volume supports it. 🧩 About Bitcoin Dominance BTC Dominance is currently ranging, which makes it hard to predict whether Bitcoin or altcoins will drop harder. That’s why I picked a coin (STX) that shows clear bearish correlation with Bitcoin. Since this might be the first leg of a drop, sellers haven’t proven themselves yet — so if you’re already in a trade, take profits quickly. ✅ Final Notes Thanks for reading my analysis! Trade safe, don’t forget risk management, and stay sharp. Good luck! 🚀📉

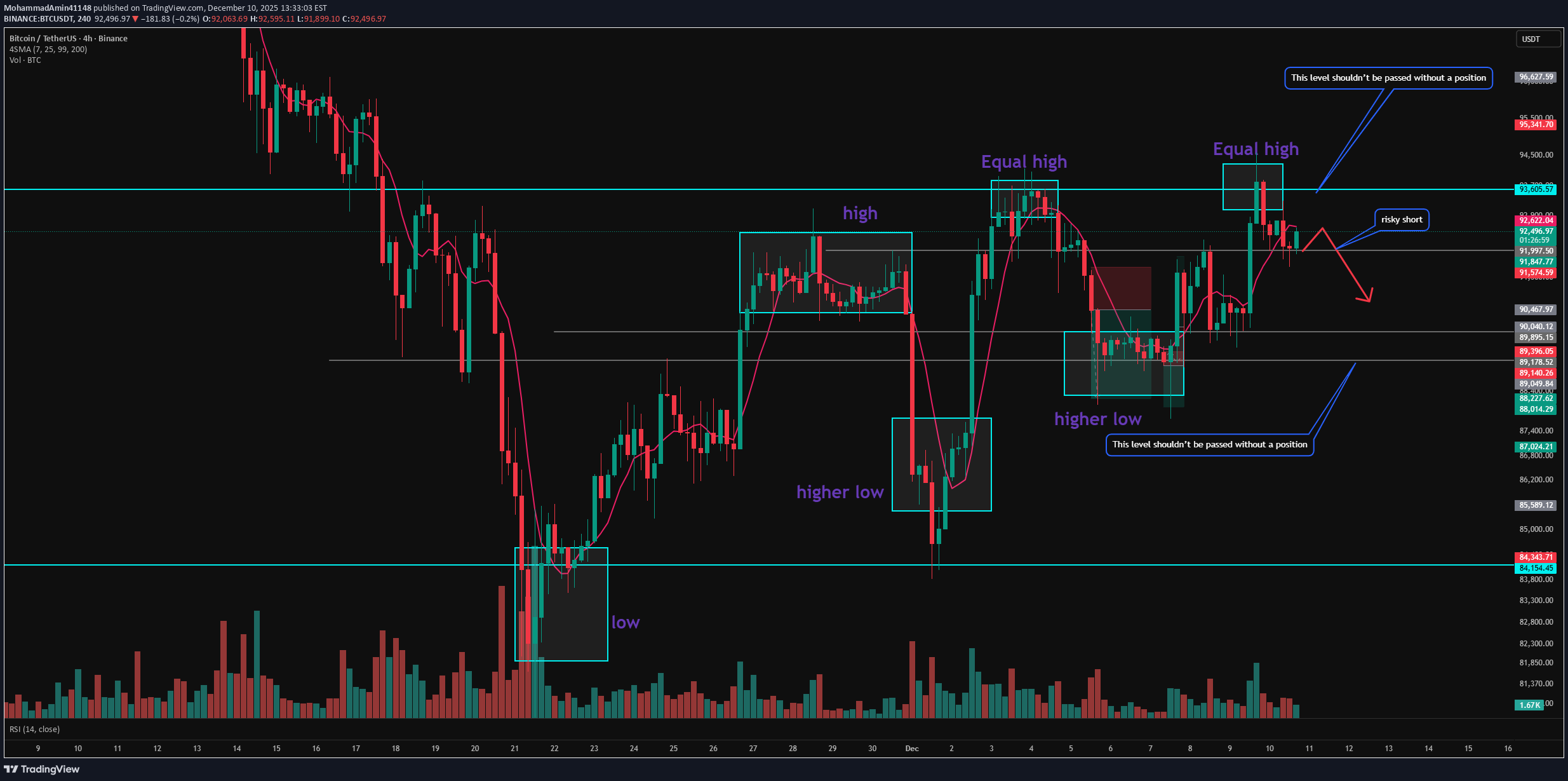

بیت کوین در دوراهی حساس: استراتژی خرید و فروش در سطح 92,000 دلار!

Fear & Greed: 27 — still in Fear. 🔁 Market Structure (Quick Summary) We printed a higher low vs. the previous low and broke the important $92,000 level. From here, longs are actionable, but only with clear structure & confirmation — this isn’t a blind buy. If price fails back under $92k, the picture gets messy and I’ll prefer to step away from spot BTC. 🚀 Bullish Plan Primary long trigger: breakout above 93,758 (preferably a 1-hour close). If you see increasing, stepwise volume on the breakout, you can treat the long as valid earlier. If BTC.D (dominance) is rising, BTC itself is the preferred long — otherwise, favor strong altcoins. Reminder: even after a confirmed break, trade with distrust — this is a short-term setup in a market that’s not yet clearly bullish for higher timeframes. ⚠️ Why the trend isn’t “confirmed” yet On the 4H, we still need to form a higher low above 92k and then break 93,758 to be more confident. After the 92k break we didn’t see a meaningful volume surge, and candle shapes look weak — that reduces conviction. 🔻 Bearish / Caution Scenario If price closes back below $92,000, I can’t clearly choose a side — there’s a lower high and a higher low and that’s ambiguous. In that case I’ll distance from BTC and look for altcoin setups or wait for clearer structure. Key deep support (for a sharp drop): $84,000. If $90,000 is broken and held below, expect range behavior on lower timeframes (1H / 4H). ✂️ Short Trigger (what to watch) I’m not hunting shorts while buyers look strong. If bears take control and we close under 92k with confirming dominance, then I’ll consider shorts — but only with clear 1H structure and tight stop. 🧠 Trading posture & risk management When the higher-timeframe trend is unclear, be sharper on screen time and reduce position size. Good risk-to-reward entries now can fund bigger positions later when the trend is obvious. Always manage risk — don’t forget stop placement and take-profits. ✅ Final take I’ll enter long on a clean break & 1H close above 93,758, or pick the better altcoin if it shows a stronger setup. If price closes below 92k, I’ll step back from BTC and scan altcoins for short or conditional setups. Volume and BTC.D are your co-pilots — trade what they confirm. Hope you found this useful — trade smart and stay disciplined! 💎🚀

تحلیل بیت کوین: لحظات کلیدی تصمیمگیری برای تریدرها!

Hello to all my dear traders! Hope you're doing great. Let’s jump into our beloved Bitcoin! Before anything else, I really hope you pay attention to the points I repeat in almost all of my analyses: Risk management and daily monitoring are the keys to winning. Don’t ignore Bitcoin Dominance. Write down your trades and review them. Trade in the direction of the trend. And if the market—like now—doesn’t have a clear trend, taking too many trades doesn’t make much sense. If you do trade, keep the risk low. Bullish Scenario » As expected, we got a reaction from the top zone on the 1H timeframe. I mentioned you could open a position based on BTC dominance—for example, if you had taken BCHUSDT, you could have already hit a 2R setup. But what’s the situation now? The market has built a nice structure, and we’re just waiting for a long trigger. 📌 My long trigger: A breakout above 93,195. If you see rising volume, you can even take the trigger earlier. 📌 What does rising volume mean? I look for step-by-step / ladder-type volume increases. I’ve shown an example of this structure on the chart—if you see something similar, a long position becomes logical. After the break of 93,195, I personally will be looking for longs—but I will definitely secure partial profits along the way. Range Scenario » If the price falls back below 91,733, the market likely wants to form a multi-week range between roughly 95,000 (top) and 80,000 (bottom). If that happens, I’ll tell you the timeframe where you can open positions with a tight stop-loss and fast take-profits. For now, we should NOT see a 4H candle closing below 91,733, because in my opinion that would kill the current momentum. Bearish Scenario » Very simple: 📌 90,500 is the short trigger. Just pay attention to Bitcoin Dominance, and place your stop-loss above the 15-minute structure high. Make sure you secure profits quickly. If we get one more strong drop, it confirms that we’re likely entering a weekly range, which will help avoid high-risk situations. Final Words » As I told you in previous analyses, this is the first bullish move after a sharp drop, so watch the buyers carefully. Wherever they show weakness, we can take positions against them, but only with confirmation—and our confirmations are automatically provided once our triggers activate. Stay safe, stay healthy, and trade smart. Wish you all the success! 🚀💚

تحلیل بیت کوین: چرا دیروز آپدیت ندادم و فرصت طلایی امروز کجاست؟

Hey traders! Some of you noticed I didn’t post an analysis yesterday — so let me explain why. I promised myself I’d post daily updates here, but yesterday the market had already triggered our short setup from the 90500 level, and price was moving exactly in that direction. At that point, there was no fresh entry, and as I’ve said before: 👉 Until the trend is fully confirmed, holding long-term positions doesn’t make sense — and you MUST secure profits. Plus, to be honest, I had a few personal issues to deal with. But let’s focus on today — because the market gave us something interesting to work with. 🔥 What’s happening today? We got an amazing rejection at 84,000, and price has now climbed all the way back to the critical resistance zone: 91,500 – 92,500. This zone is extremely important — and here’s how to trade it: Scenario A — Long Setup (Most Important) Although this sharp bounce wasn’t predictable by my system, from here on we can ride the move — but only with structure. What we want now: ✅ A clean rejection in the 1H timeframe, ➡️ Something that gives us a proper stop-loss placement, ➡️ And confirms buyers are still in control. After that pullback, I’ll look for a long position either on BTC or altcoins, depending on Bitcoin dominance. ✔️ If 92,500 breaks and the 1H structure forms with a valid stop, 👉 I will definitely take the long. Scenario B — Short Setup Right now? Absolutely nothing. As long as buyers are in control, I won’t touch shorts. If the market wants to drop later, trust me — we will have plenty of opportunities. But this bounce is a very strong signal in favor of longs, and fighting buyer strength here is a bad idea. Thank you for reading my analysis! Stay patient, avoid FOMO, and always trade with proper risk management. Wish you all a profitable day! 🚀💙

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.