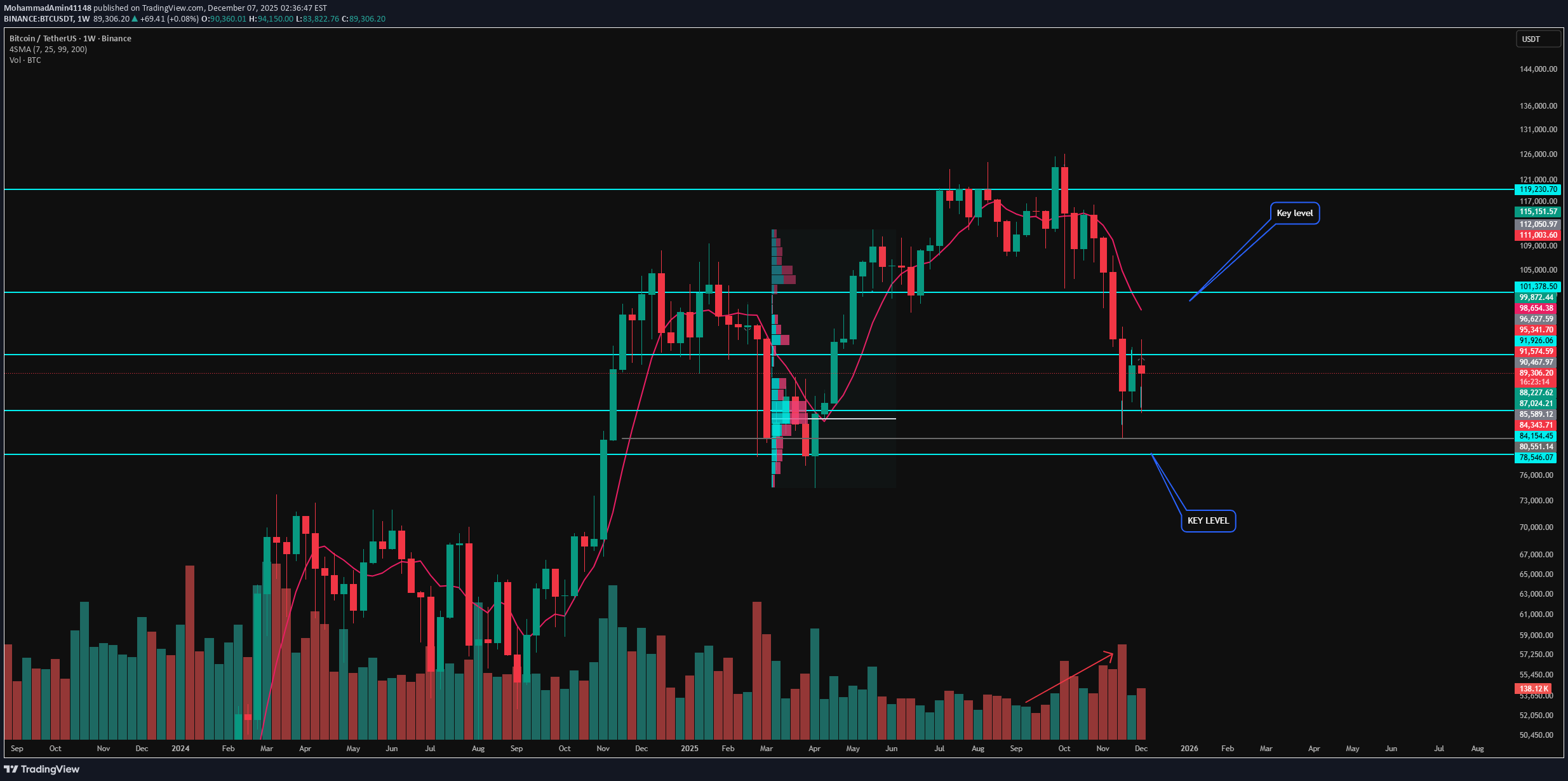

Technical analysis by MohammadAmin41148 about Symbol BTC on 12/7/2025

تحلیل بیت کوین پیش از شروع معاملات نیویورک: سطوح کلیدی و سناریوهای پیش رو

Fear & Greed Index: 22 — still in Fear. 👋 Hello Traders! Let’s dive into today’s Bitcoin analysis. Today’s outlook isn’t very different from yesterday — we simply have more structure, more clarity, and the market has moved deeper into our expected zones. And since I wanted you to have this before the New York session, here we go: 📰 Weekly Outlook — No Clear Signal Yet On the weekly chart, we’re printing something close to a Doji candle. ❓ Does this weekly candle tell us anything significant? ➡️ Not really. The market had a sharp drop, and now it’s simply resting — completely normal. I’ve mentioned in previous weekly scenarios that we might range until the end of the year, and so far the market is following that exact script. But does ranging mean no long or short positions? ❌ Absolutely not. It simply means: Take profits earlier Avoid holding trades for too long Do NOT treat mid-range setups as long-term positions 🎯 Key Higher-Timeframe Levels Two extremely important levels remain: $78,000 $100,000 These are the levels that can confirm a long-term trend shift (up or down). They’re also the “heavyweight” breakout levels — meaning: When you’ve captured several good R/R trades, one of them is worth leaving open in case these levels break. Because if either level breaks, the move could be so sharp that entering afterward becomes nearly impossible. 📉 Lower Timeframe Structure Now let’s zoom in: Sellers are attempting to push price toward $84,000. Two scenarios from here: Scenario A — Strong Sell Continuation If sellers manage to reach $84k, the next short setup becomes straightforward: 📌 Short continuation toward $78,000 (ONLY if momentum remains strong after $84k touches or breaks). ⚠️ Scenario B — Sellers Fail If sellers show weakness and fail to push price to $84k, Bitcoin will likely form a range between $84k – $92k. Inside that box, only short-term trades make sense — no swing positions. 🚀 Bullish Scenario If price returns upward toward $92,000, I will personally open a long position. 🔍 4H Compression Zone — Important! Bitcoin has created a compression structure between: $89,000 and $89,700 This zone is crucial. Break upwards → I will long altcoins with bullish correlation to BTC. Break downwards → I will short BTC or altcoins with bearish correlation to BTC. ⚠️ But only AFTER real volume enters the market. Always track volume — it’s everything in this phase. ✔️ Final Words Thanks for reading today’s analysis! I hope you have a great day full of focus and profits. And remember: 💛 Risk management isn’t optional — it’s your survival tool. Stay safe, stay sharp, and see you in the next update! 🚀📊