MockneyScot

@t_MockneyScot

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

MockneyScot

INJECTIVE - 2025 Targets & Areas to Consider TP / SHORT

Subject to a BTC rally to new highs, and a 3-4 week "Alt Season" (IF GIVEN!), these are the levels that should be possible for INJ, confluent with OTHERS reaching 850B, USDT.D 3.3~3.5%. Best Case Scenario at $38 is technically confluent with .705 Fib, M1 supply block and trend resistance from May '24. The timing rhymes with a crypto cycle top around October 17th.

MockneyScot

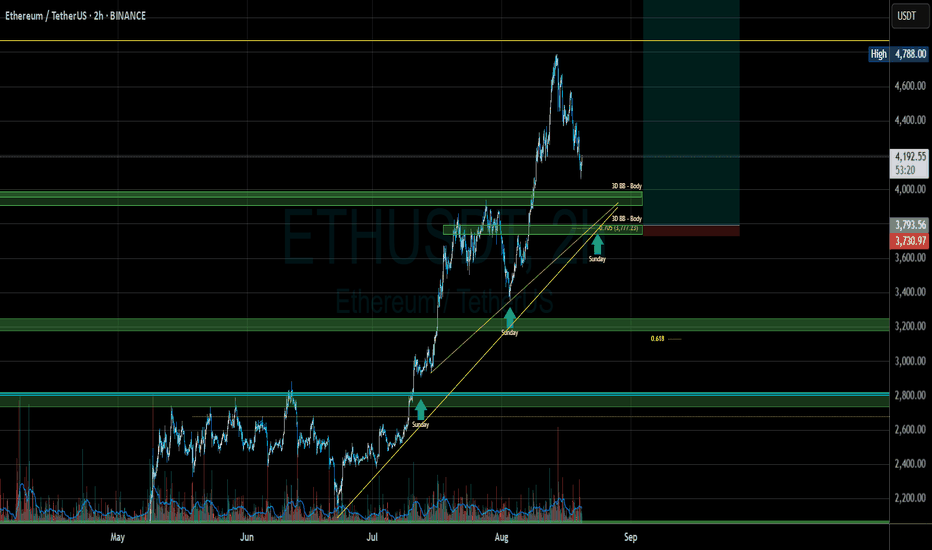

ETH Swing Long with High RR

HTF Swing Long Idea with a high RR and tight invalidation which might play out in the next few days, if we see a slightly deeper correction on BTC (c. 109k), or later on down the road. Confluence around 3.8k with 0.705 FIB (3,777), 3D Breaker Block, and two upward sloping trend lines. There is additional timing confluence for Sunday - which for the past 4 weeks has been a Strong Buy, especially Asia Morning session (GMT +8). Entry: 3,794 SL: 3,720 (-1.95%) TP1: 4,788 (+28%) TP2: 7,400 (+95%) A deeper / longer BTC correction invalidates.

MockneyScot

KASPA Q1 Forecast

This forecast is premised on the timing of the BTC Cycle Low around 20th February. KAS rebounds strongly from HTF demand around 0.05. This low might coincide with a Binance and / or Coinbase listing, or other catalyst in addition to BTC Cycle Low. From the current date (8th Feb), more downside is expected whilst BTC continues to range 90-108k. A deviation below RANGE (87-88K) would result in another severe drop for the Alt Coin market. On the contrary, if BTC breaks out of range to new ATH in February, we can expect an acceleration of this forecast

MockneyScot

MockneyScot

Rotate Within Narratives for Improved ROI

This chart shows TAO priced in FET, both considered "AI projects". Both coins performed well relative to the market, but also against each other (as the chart shows). Retrospective strategy: Portfolio $10k. 25 Oct '23: Buy TAO @ $75. (133 TAO). Current price of FET $0.3. 15 Feb '24: Sell TAO > USD @ $679 = $90,533 15 Feb '24: Buy FET @ 0.68 (133,137 FET) 1 Apr '24: Sell FET > USD @ $3.08 = $410,062 The pattern may or may not repeat, but if the AI narrative heats up again, watch for TAO to lead FET, and then rotate at resistance on the pair chart.

MockneyScot

ENJIN: HTF LONG

ENJ Long at HTF OB 0.269. $2,500, 4x Leverage (LP previous low October '23) TP Target 1: 0.432 (244%): 40% TP Target 2: 0.683 (620%): 50% TP Target 3: 1.72 (2,144%): 100%

MockneyScot

HATHOR. HTF reversal - fractal formed

HTF reversal formed (1D). Entry at $0.057, Target 1.618 Fib in confluence with 2024 peak trend line at $0.27.

MockneyScot

KAS 3 MONTH PLAN

Long until HTF target 0.244. Look for Short Position in that Zone, expect 12 week reversal (-45%) to 0.135 area. Trailing stops below FVG levels until target. Invalidated on corrections below 0.125.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.