Mike-BTD

@t_Mike-BTD

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Mike-BTD

NEAR Protocol (NEAR) – TA Update

NEAR is at a critical decision point. Price has formed a short-term higher low and is pushing back into a key resistance / prior supply zone. This area has repeatedly capped price in the past, so how NEAR behaves here matters. Momentum is recovering from oversold conditions, pointing to seller exhaustion rather than strong buyer control just yet. For this to become meaningful, price needs to reclaim and hold above this zone, which would confirm a short-term CHoCH and shift structure to neutral. The volume profile shows a low-volume pocket above current price. If NEAR can hold this reclaim, there’s room for a sharp move into the next high-volume area. A rejection here likely sends price back to retest recent demand. This is the level that decides whether this move is just a bounce or the start of something bigger. Watching closely.

Mike-BTD

آیا ساختار قیمت، بازگشت (ریورسال) دیپبوک را تایید میکند؟ (تحلیل تکنیکال)

DeepBook is starting to show early signs of stabilization after a prolonged downtrend. Price has broken out of the descending channel and is now holding above prior lows. The recent consolidation looks constructive, with dips being absorbed quickly rather than sold aggressively. This area is acting like a base. If price can reclaim and hold above the nearby supply zone, it would signal a meaningful shift in structure and open the door for a stronger relief move. Failure to hold this level keeps the broader range in play, but as long as demand holds, risk-to-reward is improving. Watching for confirmation, not chasing.

Mike-BTD

Pyth needs to show us a bit of strength.

PYTH is still in a broader downtrend, but selling pressure is clearly fading. Price has compressed into a tight base, showing signs of absorption rather than panic selling. Momentum is curling up from oversold, and recent lows aren’t getting follow-through. That often happens before a relief move. The key test is a reclaim of short-term averages. If that happens, the next challenge sits at the prior range highs above. Lose the base, and the trend continues lower. This is a patience zone, not a breakout yet, but no longer one to ignore.

Mike-BTD

Kaito has a lot to prove.

KAITO is still trading within a broader downtrend, sitting below its descending trendline and short-term averages. Price has started to stabilize near recent lows, suggesting sellers are losing momentum rather than pressing lower. The main area to watch is the highlighted horizontal level. This zone previously acted as support and has now flipped into resistance, lining up with a heavy volume area. A reclaim and hold above it would be the first sign of a potential relief move back into higher ranges. Momentum has cooled even as price pushed lower, showing a clear loss of downside strength near oversold conditions. While this alone doesn’t signal a trend reversal, it does point to growing balance between buyers and sellers. Key scenarios: Hold above resistance - opens the door for a relief rally Rejection - keeps the downtrend intact Breakdown from the base - continuation into lower demand KAITO is approaching a decision point. Let price confirm the next move before committing.

Mike-BTD

QNT = stable before a big move.

Quant is sitting at a major point of interest after a long compression. Price is pressing into a well-defined demand zone that’s been defended multiple times. Downside momentum is fading, with each push lower showing less follow-through. That often signals seller exhaustion, not expansion. Above price sits a clear volume and resistance stack. A reclaim of the mid-range could open a cleaner path higher, while a loss of this floor is the line in the sand. This is a decision zone. Patience and confirmation matter here. What’s your bias on QNT?

Mike-BTD

BTC still ranging...are you ready for decision time?

Bitcoin is stabilizing after the sharp selloff, with price holding above key demand and reclaiming short-term trend support. That shift suggests sell pressure is fading and buyers are starting to step in, even if the move is still corrective for now. General momentum indications are quietly improving, showing downside exhaustion and early signs of a potential relief move. The market is no longer accelerating lower, which often happens before a range expansion. The key level to watch is the prior breakdown zone overhead. Acceptance above it would open room for a move into higher resistance, while rejection keeps BTC stuck in range with the lower demand zone as the line in the sand. Structure is calming, and the next expansion is getting closer.

Mike-BTD

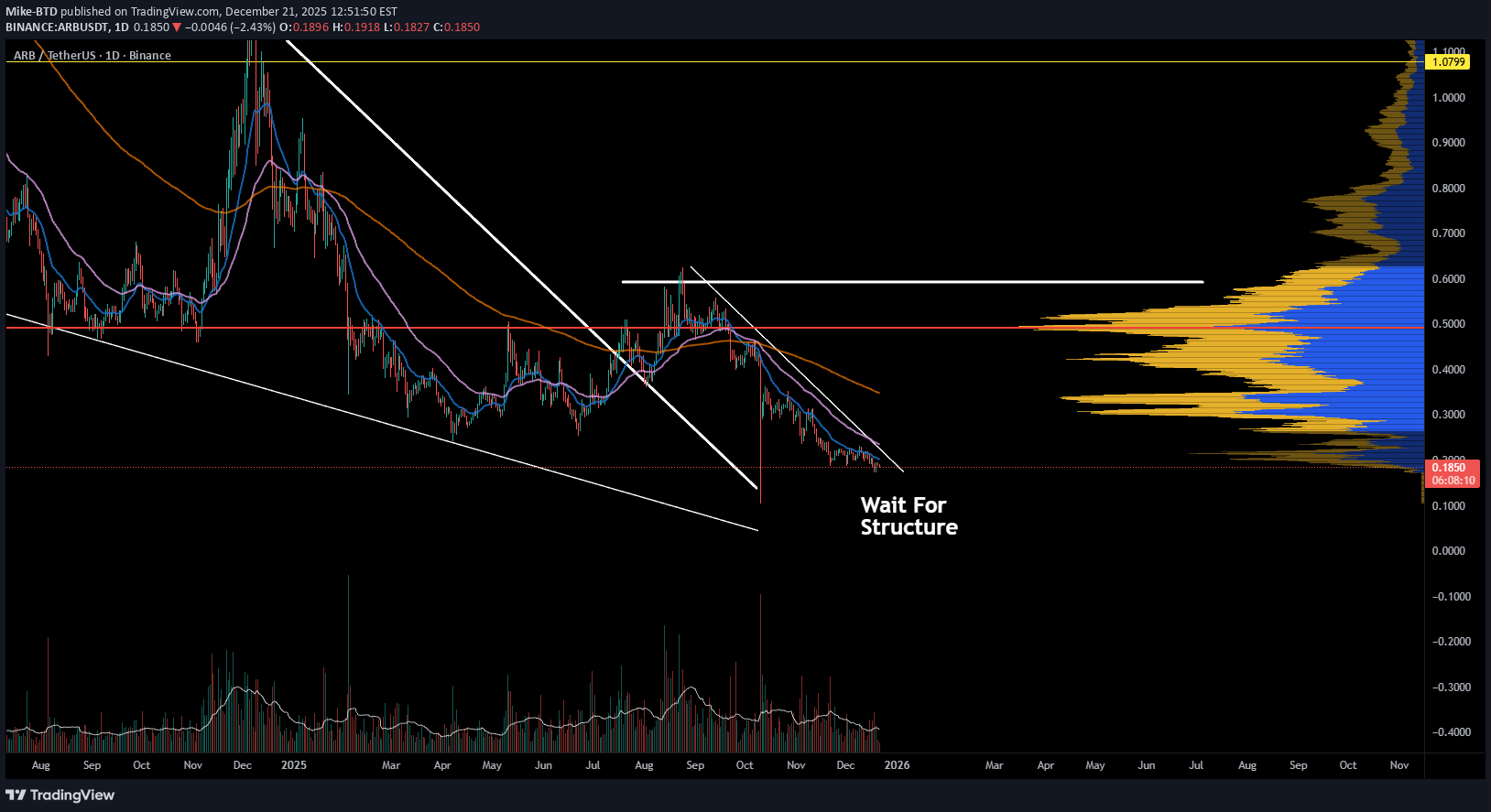

ARB showing no signs of support... Yet.

ARB is still trading within a well-defined daily downtrend, with price respecting the descending channel and holding below key moving averages. Structure remains bearish for now, so the broader trend hasn’t shifted. Momentum, however, is telling a different story. Oscillators are heavily compressed and starting to flatten, pointing to seller exhaustion rather than aggressive continuation. Volume is also fading, suggesting downside pressure is losing strength. This doesn’t mean reversal yet. Any bounce from here is still corrective unless ARB can reclaim short-term structure and hold it. Patience matters here. Let price show its hand, then trade the confirmation.

Mike-BTD

BNB sliding into support... waiting for the signal

BNB remains below key moving averages, keeping the short-term bias heavy. Price is compressing after the range breakdown, signaling indecision rather than strength. The volume profile shows a major demand zone much lower, lining up with long-term support. If current levels fail, that area is where buyers are likely to defend. Upside needs a clean reclaim of range resistance to flip momentum. Until then, rallies look corrective and downside risk remains. Watching this level closely.

Mike-BTD

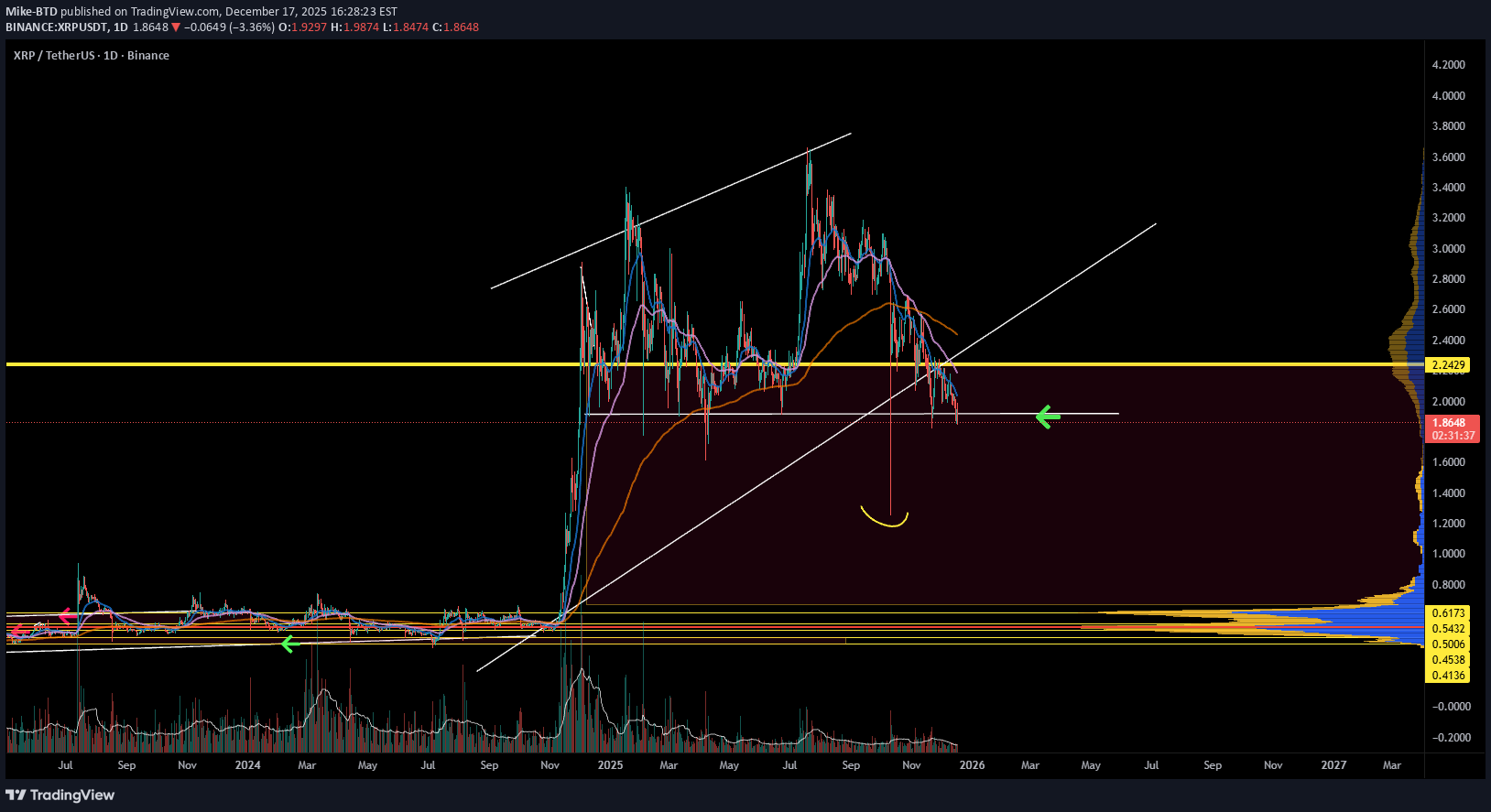

XRP bottom of the range or else....

XRP is pulling back into a key decision area after losing momentum near the top of the trend. Price is now sitting on a major support level that has acted as a pivot multiple times in the past. Momentum has cooled and selling pressure appears to be slowing, but this level needs to hold to avoid a deeper move into lower value. From a structure standpoint, the broader trend is still intact, making this zone important for buyers to defend. If support holds, there’s room for a relief move back toward the upper range. If it fails, price likely searches for liquidity lower before finding balance. This area will tell the story. Watching how price reacts here. What’s your take on XRP right now?

Mike-BTD

The bears are almost done

ETH is holding a major high-timeframe support zone and sellers are losing momentum. Downside pressure is fading, with bullish divergence starting to show across momentum. Volume is declining into support, suggesting absorption rather than aggressive selling. If ETH can reclaim the nearby range level, there’s room toward the next high-volume area above. Lose this level, and price likely revisits lower demand. This is a key decision zone for ETH. What’s your bias here?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.