MartyBoots

@t_MartyBoots

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

MartyBoots

ARKK: The Calm Before the Innovation Storm -ALTSEASON Is COMING

🚀 ARKK: The Calm Before the Innovation Storm 🌪️ The markets are shifting, and disruption is about to go vertical. ARK Innovation ETF (ARKK) is quietly positioning itself for what could be the most explosive move of this decade. With high-conviction bets in AI, Bitcoin, genomics, and next-gen tech, this isn’t just a fund—it’s a launchpad for exponential growth. This post breaks down exactly why ARKK could go parabolic—and why the smart money is already moving in. 👇 Explosive upside in 2026 ARKK is already up over 24% YTD , showing strong momentum compared to broader markets and signaling early stages of a potential parabolic move . High-conviction concentration in game-changers Top 10 holdings include Tesla, Roku, Zoom, Coinbase, UiPath, Block, Crispr Therapeutics, DraftKings, Shopify, and Exact Sciences. These are leaders in innovation sectors with massive upside potential . Deep exposure to Bitcoin and digital assets Heavy allocation to Coinbase and Block gives indirect exposure to Bitcoin . If BTC breaks into a new cycle high , ARKK stands to benefit significantly. Positioned in exponential growth sectors Focus on AI, genomics, EVs, fintech, robotics, and blockchain , all of which are entering accelerating adoption phases globally. Aggressive smart-money accumulation Cathie Wood’s team continues buying aggressively during dips, reinforcing institutional confidence in the fund’s long-term trajectory. Technical breakout structures forming Ascending triangle and multi-month consolidation breakouts suggest a technical setup primed for explosive upside . Innovation supercycle aligning ARKK's themes are aligned with major global shifts like de-dollarization, decentralized finance, and AI convergence . High beta = massive upside leverage With a beta above 2 , ARKK tends to outperform in bull runs , offering leveraged exposure to innovation without the need for margin. Resurgence of top holdings Names like Coinbase, Tesla, Shopify, and Roku are up 50%–100% YTD , driving ARKK’s NAV growth and fueling bullish sentiment . Long-term vision with short-term catalysts The fund projects 5x returns over the next five years , while Bitcoin halving cycles, tech innovation, and regulatory clarity serve as short-term ignition points . Marty Boots | 17-Year Trader — smash that 👍👍, hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!As you can see this pattern can be explosive when fundamentals allign with patterntradingview.com/news/cointelegraph:56ac5e7b3094b:0-ark-invest-buys-19m-of-jack-dorsey-s-block-as-stock-tumbles-to-73/ Cathy Woods firm ARK has loaded up on 262k shares of Jack Dorseys Block Inc Supporting Bitcoin You are NOT BULLISH ENOUGH

MartyBoots

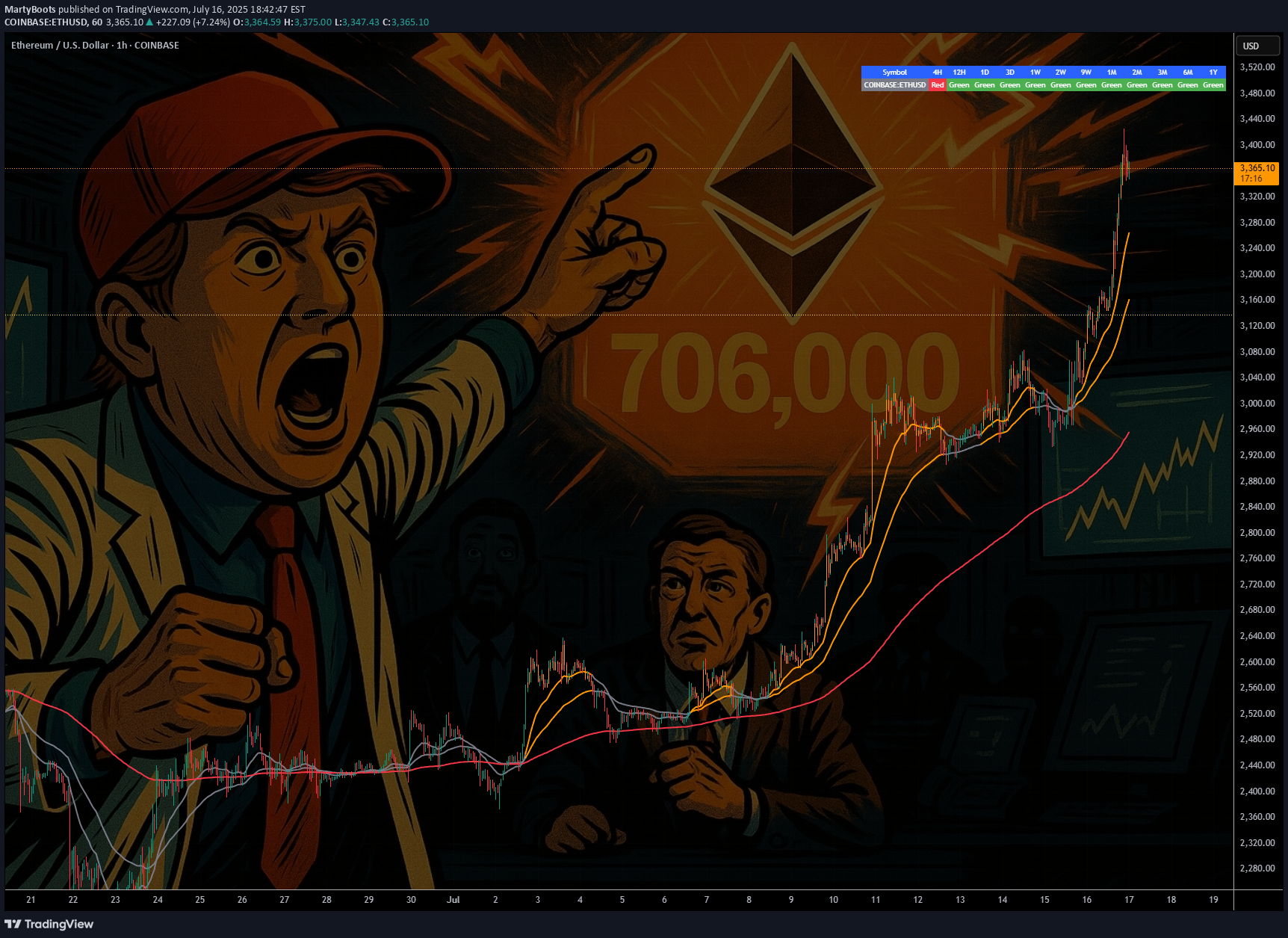

ETH - If You Know ...... You Know whats Coming

BLK $BUIDL tokenized U.S.-Treasury fund launched on ETHUSD in Mar 2024—Wall Street is already settling real dollars on-chain. JPM JPMD stablecoin just went live on Base (an ETHUSD L2), piping wholesale payments from a $4 T balance-sheet straight through ETHUSD rails. ETHUSD isn’t just riding the next crypto cycle—it’s becoming Wall Street’s settlement layer. From BlackRock’s on-chain Treasury fund to JPMorgan’s and soon Bank of America’s dollar tokens, a tidal wave of institutional stable-coin flows is lining up behind ETH. Fewer coins, more real-world volume—if you know, you know what’s coming. BAC CEO says they’ll issue a dollar-backed token the moment regulators nod—another tier-1 bank boarding the Ethereum train. Stablecoin cap has blasted past $230 B , with 80 %+ of all on-chain transfers riding Ethereum (plus BSC) blocks. Corporate settlements via stablecoins grew 25 % YoY in 2024 as multinationals replaced SWIFT with instant on-chain clearing. Daily stablecoin throughput averages $7 B—each hop burning ETH and tightening supply. BCG projects tokenized real-world assets to exceed $16 T by 2030 , with EVM chains as the default plumbing. Over 500 M wallets already interact with stablecoins , a 30 % YoY surge led by emerging-market demand. L2s like ARBUSDT & OPUSDT cut transaction fees 35 % yet still settle back to mainnet—meaning ETH captures the fee stream and the burn. Bottom line: a tidal wave of bank-grade stablecoins + tokenized assets is lining up behind ETH; supply shrinks, demand soars—if you know, you know what’s coming. https://www.tradingview.com/x/CcYueWlq/ quote] Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!This chart was supposed to be shown on the main trading idea Bitcoin bottomed with COVID ETH bottomed with Trump Tariffs BOTH WITH BULLISH STRUCTURAL DEVIATIONS OF LONG TERM CHARTS AND GROWING FUNDAMENTALS DO NOT SLEEP ON ETHtradingview.com/news/cointelegraph:8990a851d094b:0-ethereum-hits-new-multiyear-high-as-tom-lee-s-bitmine-plans-20b-eth-raise/ TOM LEE plans $20 Billion capital raise to buy ETH People and firms will also raise to fron run him . The race is on . You are NOT BULLISH ENOUGH ON ETHPeople and firms will also raise to FRONT run him . The race is on .

MartyBoots

Did Bitcoin Just TOP OUT ??????

BTCUSD has just collided with an 8-year rising trendline that capped the market’s last two cyclical peaks—historically, this level has triggered multi-month corrections and Bear Markets. Triple-test significance : a third touch of a long-term trendline ➜ heightened odds of a reaction; failure to break cleanly often confirms a major top. Watch for confirmation signals —weekly bearish RSI divergence, waning volume, or rejection wicks can validate a reversal scenario. Breakout = regime change : a decisive close and hold above the line flips it to support, opening the door to fresh price discovery and potential parabolic upside. Large Orders at $114k create a visible demand wall in the order book, signalling that whales / institutions are ready to absorb a dip and accumulate at that level. Risk-management alert : consider tightening stops, reducing leverage, or hedging until trendline fate is resolved. The buy pressure has been relentless but this is always worth paying attention to Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!BTC dropped just as expected and now getting closer to my Target Watch for my level of $114600 - 15k

MartyBoots

BITCOIN- MONSTER ORDERS IN THE BOOK -> You Know What This Means

BTCUSD “Monster orders” are exceptionally large buy-limit orders clustered roughly 7 % beneath the current market price. Large buy-limit walls can act like a price magnet—deep liquidity attracts algos and traders hunting fills, often pulling price straight toward the level. Once the wall absorbs the selling pressure, the magnet flips: liquidity dries up, supply thins, and price can rip away from that zone with force. They create a visible demand wall in the order book, signalling that whales / institutions are ready to absorb a dip and accumulate at that level. Price will often wick into this zone to fill the wall, then rebound sharply—treat the 7 % band as potential support or entry. Such walls can act as liquidity traps : market makers may push price down to trigger retail stop-losses before snapping it back up. Confirm that the wall persists as price approaches and that spot + derivatives volume rises; if the wall disappears, it may have been spoofing. Always combine order-book context with trend, momentum and higher-time-frame support for higher-probability trades, Just like the extremely powerful indicators on the chart. 🚀 Marty Boots | 17-Year Trader — smash that 👍, hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!So as you can see my prediction about MONSTER Orders inb the book dropped the price. On top of that we had 50k BTC inflows today alone Its not enough to predict whats going to happen , you need data behind each trade Bitcoin has just hit an 8 year trendline also . BIG levelAS YOU CAN SEE THE ORDERS IN THE BOOK ACTED AS BEAUTIFUL SUPPORT FOR BITCOIN They are still on the book so watch to see if we drop back down into that level Follow me for further updates on Very Important Orderflow data ETH is Mooning also , just like I explained in my other posts - CHECK THEM OUT Also let me know where your top targets are for Bitcoin ???? to help gauge market sentiment Have a great day

MartyBoots

"Ethereum Is The New Bitcoin" - Tom Lee

ETH / Stablecoins Are the ChatGPT of Crypto Stablecoins are exploding in adoption — just like ChatGPT took over AI and Ethereum is the engine driving that revolution. In this post, we break down 10 reasons why Tom Lee is extremely bullish on Ethereum and why it could be the single most important digital asset in the future of finance . If you're sleeping on ETH, this might be your wake-up call. Top 10 Bullish Points from Tom Lee on Ethereum: • Ethereum is the backbone of stablecoins , which Tom Lee compares to the “ChatGPT of crypto” due to their viral adoption and massive utility. • Over 51% of all stablecoins operate on Ethereum , contributing to around 30% of the network’s total fees. • Ethereum network fees could 10x as stablecoin usage grows from $250 billion to $2 trillion. • Ethereum is positioned to lead the tokenization of real-world assets , including stocks and real estate. • ETH could reach $10,000 if asset tokenization becomes a mainstream financial practice. • Ethereum has a regulatory edge in the U.S. , making it the preferred platform for compliant financial innovation. • A $250 million ETH treasury strategy is underway , aiming to use Ethereum as a long-term reserve asset. • Institutions will buy and stake ETH to secure stablecoin networks, making ETH the “next Bitcoin.” • Ethereum dominates the crypto ecosystem , with nearly 60% of activity including DeFi, NFTs, and dApps built on its chain. • HODL ETH for long-term growth , as its utility, demand, and institutional support continue to rise. Conclusion: Ethereum isn’t just a Layer 1 blockchain — it’s becoming the core financial infrastructure for the digital age . As stablecoins expand and institutions enter, ETH could be the most asymmetric opportunity in crypto right now. 📢 Drop a like, leave your thoughts in the comments, and don’t forget to follow for more powerful macro + crypto insights. 👍👍Buy and Sell Orders for Today Buy Orders - $2980 Sell Orders - $2920 Price is in consolidation as showen by the tight orders in the order bookLots of ORDERS below on ETH , The market will likely come for them Sells at $3075 Buys - $2775-$2875

MartyBoots

Why Ethereum’s Will 10×

🚀 Ethereum’s Next 10×: Why bank-grade adoption + the stable-coin avalanche make a moonshot look conservative[]Big banks are building on-chain right now. JPMorgan & Bank of America began 2025 pilots for dollar-backed tokens that settle on Ethereum, while Societe Generale just unveiled its USD CoinVertible stable-coin on main-net.[]Stable-coins already move more money than Visa + Mastercard combined. $27.6 trillion flowed through stable-coins in 2024—most of it routed over Ethereum block-space.[]Ethereum clears four-fifths of that stable-coin volume. More than 80 % of all stable-coin transactions occur on ETH or its L2s, locking in network effects that rivals can’t match.[]ETF wall-of-money is already hitting the gate. 2025 Ethereum ETFs posted a record $743 million month of inflows—the strongest vote of institutional confidence to date.[]ETH supply keeps shrinking while demand spikes. Post-Merge burn has removed roughly 332 k ETH, flipping issuance negative; base-line inflation is now < –1.3 %/yr.[]30 million ETH is locked in staking, slicing liquid float by 25 %. The yield engine tightens supply just as banks and ETFs need inventory.[]Real-world assets are going token-native. Tokenized bond issuance jumped 260 % in 2024 to €3 billion, and virtually every pilot settles on ERC-standards.[]Layer-2 roll-ups slashed average gas fees to <$4. Cheaper block-space makes day-to-day payments viable, driving still more stable-coin throughput (and fee burn).[]User base is exploding toward mass scale. Active ETH wallets hit 127 million—up 22 % YoY—showing that retail, devs, and institutions are onboarding together.[]Energy-efficient PoS removes the last ESG roadblock. With > 99 % less energy use than PoW chains, Ethereum checks the sustainability box that banks and asset managers need for wide-open deployment.Bottom line: when TradFi giants plug directly into Ethereum rails and stable-coins dwarf legacy payment rails, every transfer torches a little more supply. Add the ETF flywheel and a vanishing float, and a 10× move shifts from “moon-boy” to math.OTHER EXAMPLES TSLAtradingview.com/x/FpkHY6aJ/]https://www.tradingview.com/x/FpkHY6aJ/Total 2tradingview.com/x/R4lterQz/]https://www.tradingview.com/x/R4lterQz/MartyBoots here—trading for 17 years, and I would like to hear YOUR take!👉 Can Ethereum really 10× from here? Drop your best argument below, hit the 👍 if you learned something, and smash that Follow to stay in the loop on every crypto deep-dive I post.TSLA Example Compression Before Expansion

MartyBoots

80k BTC On The Move - WHAT It Means

80,000 BTC Wallet Movement (2011 Miner)• Source: 8 wallets containing 10,000 BTC each — mined in 2011, dormant for 14 years• Total Value: Over $8.6 billion USD• Timing: Moved on July 4, 2025 — largest dormant BTC transfer in history• New Addresses: Funds moved to modern SegWit wallets• Probable Owner: Likely a single early miner with 200k+ BTC history Possible Reasons for the Move• Key Rotation: Upgrading to modern wallets for better security• Recovered Access: Private keys may have been recently recovered• Market Strategy: Positioning for profit-taking or major sell-off• Yield Farming: Preparing BTCUSD for use in DeFi/lending platforms• Collateral Use: Possibly for loans, stablecoin leverage, or RWAs• Estate Planning: Legal restructuring or generational wealth setup• OTC Transfer: Could be prepping for off-exchange institutional sale• Psychological Warfare: Could be intended to spook or manipulate the market• Regulatory Response: Aligning with new compliance or tax jurisdiction Market Reaction• BTCUSD Price Dip: Price briefly fell below $108,000 post-move• ETF Context: Movement occurred despite record ETF inflows Key Note: These wallets had not been touched since BTCUSD was worth ~$0.78. Their reactivation adds uncertainty and opportunity in a fragile macro environment.• What to do????: Watch the orderbook to find these large bitcoin moves in case of exchange sellingNear term support & resistance $106000 support$109500 first resistance👍 If this breakdown helped your trading, smash that Like and drop a comment below—let me know what you think will happen with the 80k BTCUSD . 👍Best Reguards MartyBoots, 17-year market traderAs you can see from my post yesterday price hit my resistance point PERFECTLY and rejected not once but TWICE Its a very powerful method of trading I have also posted todays levels if interestedBILLIONAIRE BITCOIN WHALE UPDATEYesterday’s $8 billion transfers were possibly related to address upgrades, moving from 1- addresses to bc1q- addresses.There are no indications that this whale is selling Bitcoin.THE BULL MARKET CONTINUES

MartyBoots

BTCUSD| Bitcoin’s Historic Parabolic Pattern

🔥Parabolic Pattern | Institutional BTCUSD Demand Mirrors Gold ETF Era 🔥 BTCUSD vs SPX vs GOLD The market is whispering something big — and it's not retail noise this time. For the third straight quarter, listed corporations have outpaced ETFs in Bitcoin purchases, a seismic shift that echoes one key moment in history: the launch of the Gold ETF. Companies like MSTR contiune to buy and others are following. Will AAPLMETA and GOOG be next ? Let me know in the comments who you think will be next to buy? Back then, companies rushed to gold as a hedge against inflation and a store of value as fiat cracks widened. Fast forward to now — we're seeing the same institutional footprints in Bitcoin. The buy-the-dip narrative isn't just alive — it's being driven by corporate balance sheets.Rumors are circulating that the U.S. government plans to buy 1 million BTC — a move that would shake the global financial system to its core. If true, this isn’t just bullish — it’s historic. The last time governments got this aggressive with a hard asset was during the Gold Reserve buildup. Bitcoin isn’t just digital gold anymore — it’s becoming sovereign-level collateral. 📈💥💬 Drop your thoughts below. Is this the beginning of the next parabolic era?In this episode, we break down the parabolic pattern forming on the chart, why it may signal the next explosive leg up, and how history is repeating with BTC playing the role of digital gold.📊 Technical breakdown. On-chain behavior. Smart money moves.Don’t blink. Parabolas end in fireworks.I've been trading for 17 years 👍 If you found this useful, drop a like.💬 Got questions or thoughts? Leave a comment below — I always respond and happy to help. 👍Best Regards MartyBootsBuyers have now stepped up to support this market move with large bids at $106k area There is resistance at $110k areaMICRO 3 DRIVE STRUCTURE WITH ORDER FLOW RESISTANCE Todays orders support and resistance shown on chart Resistance - $105000 - $110200Support - $105500 - $106500This is near term suppor and resistance for near future . Bitcoin has a bearish 3 day stop hunt but is likely buys on any dips to go a lot higher

MartyBoots

Bitcoin & Ethereum New Quarter | What To Look For

🎯 New Quarter For BTCUSD & ETHUSD — What To Look ForAs we enter a new quarter, smart money is already positioning.Institutional investors, hedge funds, and asset managers don’t just trade price — they rotate capital based on quarterly performance, risk appetite, and macro expectations. That’s why each quarterly open is a key inflection point across all markets — including crypto.In this video, I break down:• 🧠 How institutional capital rotation impacts Bitcoin and Ethereum • 📈 Key levels to watch as Q3 unfolds • 🔁 What are the likely outcomes • 📊 How to prepare for volatility and new trend formationThis isn’t just another candle — it’s the start of a new chapter in the cycle. If you’re serious about understanding where the money flows next, this video is for you.This is the likely outcomePrice not ready to moon yetStrong candle implying new highs incoming Watch for bearish stop hunt on new quarterThis is a bullish outside bar MartyBoots here , I have been trading for 17 years and sharing my thoughts 👍 Enjoyed the insights? Let me know your thoughts in the comments below — and don’t forget to like this post to support the channel!Todays orders on BTC and ETH were bearish all day but now not so bearish currenly suggesting that there can be an intraday bounce . Bitcoin buy orders sitting at $106000 --- Sell Orders sitting at $108800 ETH buy orders sitting at $2400/2420 --- Sell orders sitting at $2470Tight ranges so far at start of new quarter but will be watching for this to change in the near futureWaiting for those buy orders to flood the marketTodays orders for Bitcoin & ETH BTC lots of sells above price Bullish have some work to do but they are pushing BTC Sells from $107800 - $109300 ETH Sells at $2480 BTC Buys around current price holding this steady uptrendETH Buys at $2420 BTC Needs to break $109300 to have any meaningful breakout

MartyBoots

MACRO 3-Drive Pattern on Bitcoin | Major Reversal Ahead?

Is Bitcoin completing a massive 3-drive structure on the macro chart?Three clear pushes higher, each with fading momentum, are flashing a major reversal signal.This could be the final phase before a long-term shift — are you ready for what’s next?📚 3-Drive Structure Trading Strategy — Full BreakdownThe 3-Drive Pattern is a powerful reversal-based price structure used to spot major turning points in trending markets. It works by identifying three consecutive drives (or pushes) in one direction, typically ending with exhaustion and a high-probability reversal.Each drive forms a new high or low, but with weakening momentum — especially visible using RSI, MACD, or volume divergence.🔍 What is the 3-Drive Pattern? 3 consecutive higher highs (or lower lows) Each drive followed by a shallow pullback Momentum weakens on each push (divergence forms) Fibonacci symmetry often present: - Drive extensions: 127.2%–161.8% - Pullbacks: usually 61.8%📉 Bearish 3-Drive (Reversal from Uptrend):Drive 1: Price makes a higher high with strong momentumDrive 2: Another higher high, weaker strengthDrive 3: Final high with clear divergenceReversal: Entry when price breaks below structure 🎯Entry Criteria: Wait for all 3 drives to form Confirm with divergence on Drive 3 Use a confirmation candle or structure break Stop-loss: just beyond the 3rd drive’s high🎯 Targets: Conservative: Return to Drive 2 base Aggressive: Full trend reversal (50%–100% Fib retracement)🧠 Pro Tips: Best on 4H, 1D, 3D or 1w timeframes Confirm with RSI, MACD, or volume divergence Combine with key S/R or supply-demand zones💡 Summary:The 3-Drive pattern is one of the most reliable reversal structures when combined with divergence and Fibonacci symmetry. It's especially powerful at market exhaustion zones and works best with confirmation-based entries.📈 Ascending Channel & Equal Measured MovesThis Chart identifies ascending channels, a classic bullish price structure where price moves between two parallel upward-sloping trendlines. The lower trendline acts as support, while the upper trendline acts as resistance. Traders often use ascending channels to spot trend continuations or potential breakout opportunities, especially when volume and momentum align with the trend direction.In addition, the Chart highlights equal measured moves (EMMs) — a powerful price action concept where the distance of a previous impulse leg is projected from a pullback or consolidation zone. Equal measured moves often suggest symmetry in market behavior, helping traders forecast potential price targets based on previous swings. This method is commonly used in harmonic structures, breakout strategies, and ABCD patterns.✅ This chart shows: Channel support/resistance in an uptrend Confirm trend strength within the channel Identify price targets using measured move projections Spot breakout or breakdown opportunities at the channel edge🔔 Combine with volume, EMA , or RSI divergence for higher-probability trade setups especially here now as price is at the top of the channel.MICRO 3 DRIVE STRUCTURE WITH ORDER FLOW RESISTANCE Lots of sell into 3 drive structure target .Sell wall at $110k - $111k This is near term action , dips are buys for a lot higher prices

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.