MartketsTitan

@t_MartketsTitan

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

تحلیل فارکس هفته آینده: پیشبینی EUR/USD، بیتکوین و شاخصها (۱۷ تا ۲۱ نوامبر)

In this week i talked bout EUR/USD AUD/NZD BTC AUD/USD S&P500 AMZN MSFT Welcome to our weekly market breakdown — get ready for actionable forex insights to guide you through the week ahead. In this episode we cover: 🔍 Major currency pairs and key support/resistance levels 🧲 Trend analysis: where the momentum is shifting and what may be driving it 📆 Economic events to watch (interest rate decisions, inflation releases, central-bank commentary) 🛠️ Trade setups: potential entries, stop-loss zones & profit targets 🎯 Risk management tips: how to approach the week with discipline Whether you’re a day trader, swing trader or simply keen to stay ahead of the curve, you’ll find value in this edition. 🔔 Remember: Markets move fast. Use this analysis as one part of your trading decision process—not the whole. Always perform your own due diligence and manage your risk carefully.

پیشبینی هفتگی بازارهای جهانی: مسیری روشن برای طلا، ارزهای دیجیتال و شاخصها!

This weekly insights has a great possibility for a clear directions for [EURUSD - GBPUSD - BTC - AUDCAD - S&P500]

EUR USD AUD NVDA MSFT AVGO S&P500 BTC XRP Weekly Insights

In this video, we dive into the key market movements and outlooks for major financial instruments over the past week. Highlights include: Analysis of currency pairs: EUR/USD and AUD Trends and technical setups for leading tech stocks: NVDA, MSFT, AAPL, AVGO The S&P 500’s performance and what it suggests about broader market direction Developments in cryptocurrency, with a focus on BTC and XRP Whether you’re a trader, investor, or just interested in macro markets, this video gives you a consolidated, data-driven snapshot of where things stand and what to watch next.

Weekly Insights EUR USD AUD NZD BTC ETH (22nd-25th septemer2025)

Get ready for the week ahead — in this video we break down the technical outlook and key levels for major currencies and markets including EUR/USD, AUD, NZD, as well as S&P 500 and Bitcoin (BTC). We analyze recent price action, highlight important support & resistance zones, and discuss possible scenarios you’ll want to watch from September 22–26, 2025. Whether you trade forex, crypto, or equities, these insights will help you stay informed and better positioned for whatever the markets throw next. If you want, I can give you a more detailed summary (key levels, possible trades, etc.) of the video.

Weekly Insights EUR/USD - BTC - AUD/NZD - NVDA - MSFT

The weekly video, I share my thoughts for the next week. Next week we have a highly important event which is the Federal Reserve interest rate decision. It will strongly affect the EUR/USD, S&P500, and BTC. The common theme is that most of the assets are in the 5th Elliott wave. Good luck to all of us. Markets Titan

AI proves i was right about NVDA

I used Gemini AI to alayze my previous videos and the results was as following: Fundamentally; the price wasat its fair value, and technically; the price was at a reversing point. This is my thoughts and ideas about the stock, do your math before trading. Good luck luck to you all Markets Titan

Weekly insighta EUR/USD S&P500 NVDA META

This video is a weekly insights report from a financial trader on TradingView. I amdiscussing my analysis and predictions for several financial instruments based on technical and fundamental indicators. Key Points: Market Overview: The speaker talks about the impact of recent US unemployment data on the market, which led to a "parabolic" rise in the Euro dollar. Euro Dollar: Based on a technical analysis of an "expanding diagonal" and an old trend line, the speaker believes a false breakout is likely. They plan to avoid trading USD pairs for the next 11 days, waiting for the Fed's interest rate decision. S&P 500: The speaker notes a five-wave Elliot wave pattern with an expanding diagonal. They are waiting for the price to break below a trend line and a red confirmation line before considering a short position. They anticipate a "choppy" market for the coming week. Nvidia: The speaker received "hate comments" for their previous analysis of Nvidia. They stand by their short position, citing a break below the exponential moving average, a "huge" divergence on the monthly chart, and a "shooting star" candle pattern. They note that Nvidia is the heaviest stock in the S&P 500, representing 7.5% of the index. Bitcoin: The speaker points out that Bitcoin's price has crossed and retested two moving averages, which they see as a bearish sign. They will consider a short position if the price breaks below the previous low. They also expect Bitcoin to be stagnant in the coming week while the market waits for the Fed's decision. Call to Action : The video concludes with a plea for viewers to subscribe to the speaker's TradingView channel for more trading insights and short-trade opportunities.

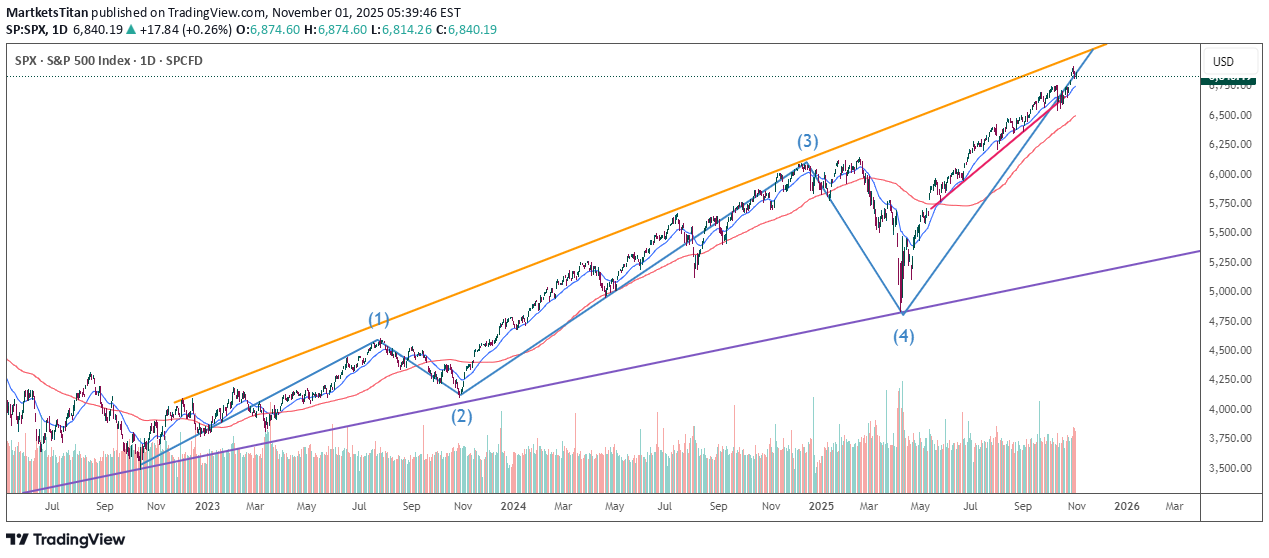

S&P500 THE MOST IMPORTANT ANALYSIS

SPX The S&P500 is in it's 5th wave and about to reverse. In addition to the expanding diagonal. The currenct situation is an economic bubble. Compare it to the S&P500 gold ratio. NVDA is reversing. Markets Titan

NVIDIA Has Some Reversal Signs

NVDA has formed a double top and stochastic oscillator divergance on the dailyt chart. ON the monthly chart it has a it has formed a shooting star candle. Good luck for all of you Markets Titan

ETH Warrning !!!

ETHUSDT The Ethereum is forming an expanding triangle + stochastic divergance. Best wishes to you all Markets Titan

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.