Mark804

@t_Mark804

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

Mark804

From a technical perspective, the commodity has been struggling to capitalize on the recent strength beyond the $3,380-3,385 region. Moreover, mixed oscillators on the daily chart warrant caution for the XAU/USD bulls. That said, this week's bounce from the 200-period Simple Moving Average (SMA) on the 4-hour chart backs the case for a further appreciating move. Some follow-through buying beyond the $3,400 mark will reaffirm the constructive outlook and lift the Gold price to the $3,420-3,422 intermediate hurdle en route to the $3,434-3,435 supply zone. A strength move beyond the latter would set the stage for a move towards retesting the all-time peak, around the $3,500 psychological mark touched in April. On the flip side, any corrective pullback might continue to find decent support near the $3,350 area. This is closely followed by the 200-period SMA on the 4-hour chart, which, if broken decisively, might prompt some technical selling and drag the Gold price to the $3,315 intermediate support en route to the $3,300 round figure. Acceptance below the latter would expose the $3,268 region, or a one-month low touched last week.

Mark804

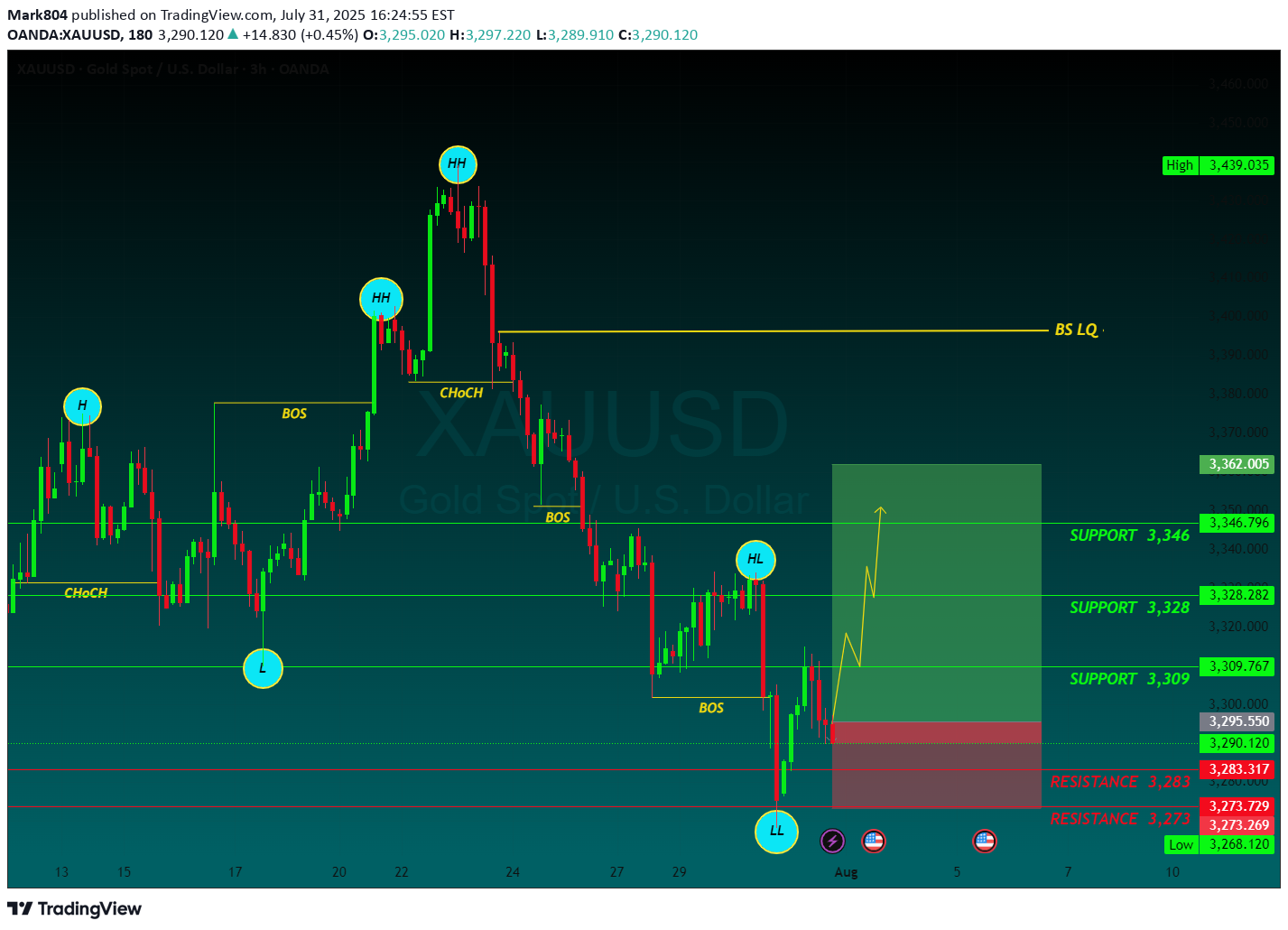

Gold maintains its daily gains around $3,300 After retreating markedly on Wednesday, Gold rebounds moderately and remains positive at about $3,300 per troy ounce on Thursday. The precious metal’s rebound comes in response to the daily retracement in US yields across the curve and the so far irresolute price action in the Greenback The US Federal Reserve kept its benchmark interest rate unchanged for the fifth consecutive meeting, in a range of 4.25% to 4.5%, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs. The decision, however, met opposition from Fed Governors Michelle Bowman and Christopher Waller. This was the first time since 1993 that two governors had dissented on a rate decision. In the accompanying monetary policy statement, the committee had a more optimistic view and noted that the economy continued to expand at a solid pace. Adding to this, Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September. This comes on top of the upbeat US macro data, and lifted the US Dollar to a two-month high. Automatic Data Processing reported that private payrolls in the US rose by 104,000 jobs in July, following a revised 23,000 fall recorded in the previous month. Adding to this, the Advance US Gross Domestic Product (GDP) report published by the US Commerce Department showed that the economy expanded at a 3.0% annualized pace during the second quarter after contracting by 0.5% in the previous quarter SUPPORT 3,346 SUPPORT 3,328 SUPPORT 3,309 RESISTANCE 3,283 RESISTANCE 3,273

Mark804

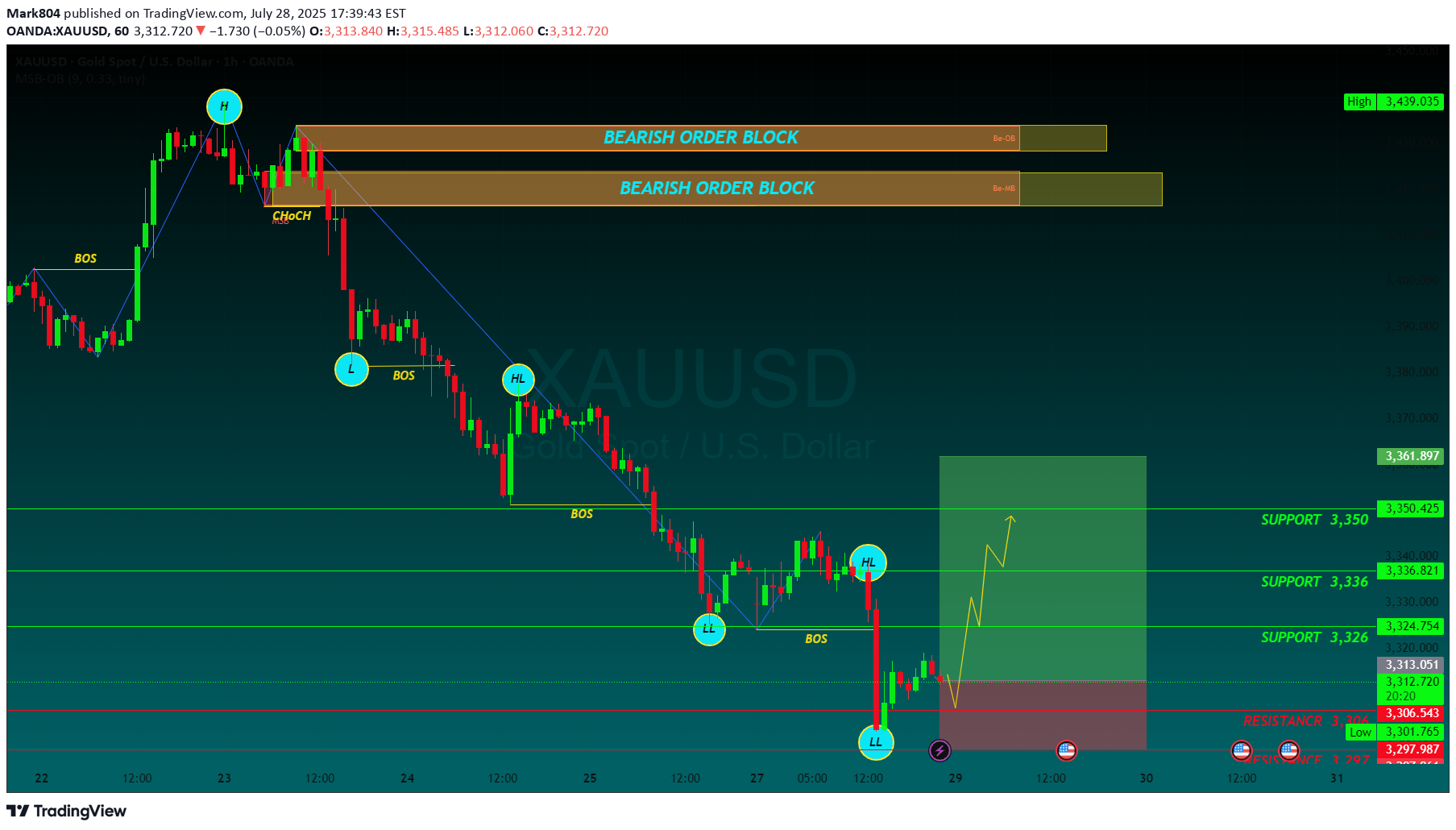

In the XAU/USD 2025 Forecast, FXStreet analyst Eren Sengezer suggests Gold’s 2025 outlook depends on Federal Reserve (Fed) policy, Donald Trump’s decisions and geopolitics. A bearish scenario could unfold if geopolitical tensions ease, inflation remains persistent and United States-China trade tensions weaken China’s economy, reducing Gold demand. A hawkish Fed could also pressure prices. On the bullish side, continued global policy easing, a recovering Chinese economy or escalating geopolitical conflicts could boost safe-haven flows into Gold, supporting its resilience and pushing prices higher. Gold's technical outlook suggests weakening bullish momentum, with the RSI at its lowest since February and XAU/USD. Key support lies at $2,530-$2,500, with further declines potentially targeting $2,400 and $2,300. On the upside, resistance at $2,900 could limit gains, with additional barriers at $3,000-$3,020 and $3,130 if Gold attempts a new record high. SUPPORT 3,326 SUPPORT 3,336 SUPPORT 3,350 RESISTANCE 3,306 RESISTANCE 3297

Mark804

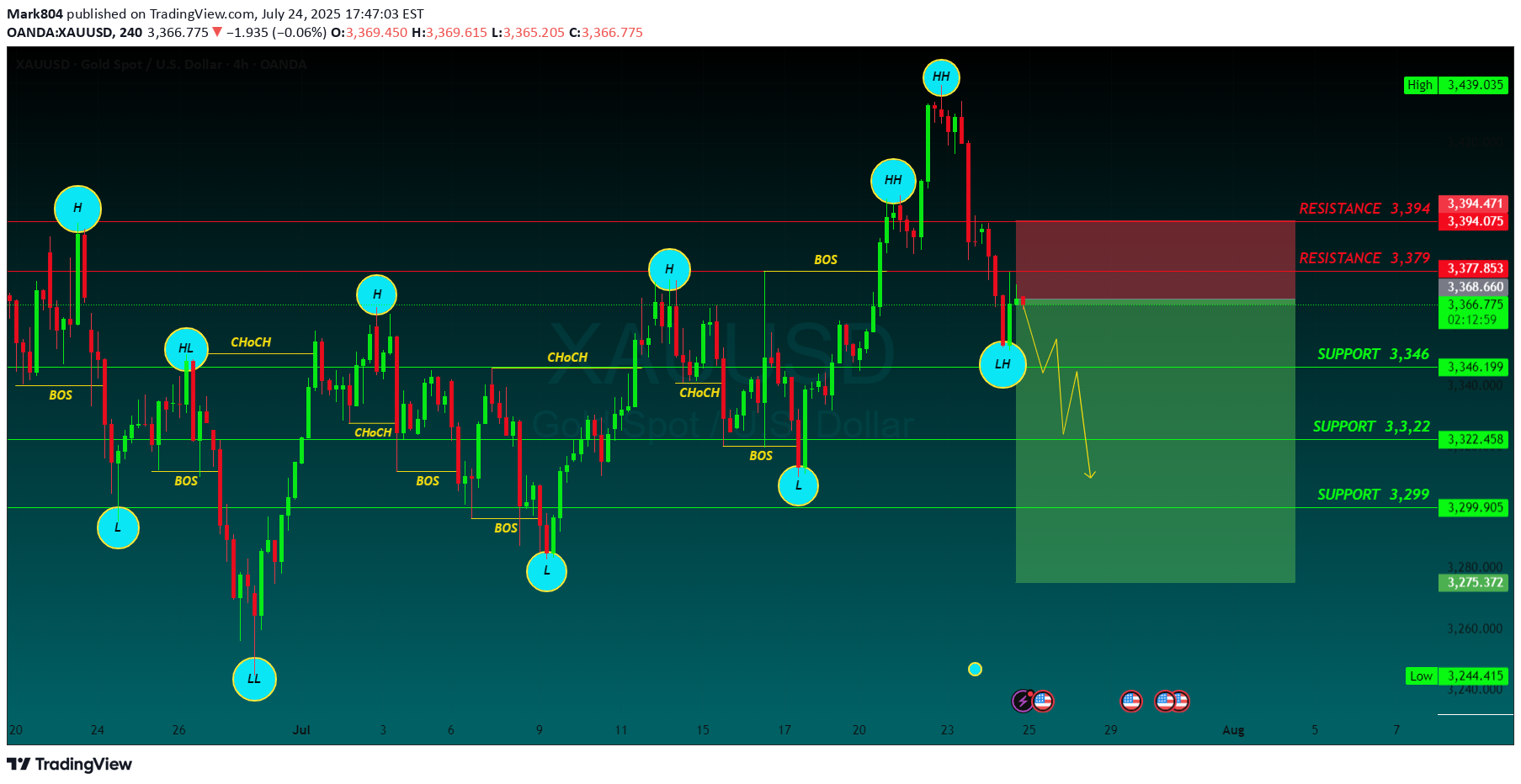

Gold price bears retain control amid fading safe-haven demand, rebounding USD US President Donald Trump announced late Tuesday that his administration had reached a trade deal with Japan. Furthermore, reports that the US and the European Union are heading towards a 15% trade deal boost investors' confidence and weigh on the safe-haven Gold price for the second straight day on Thursday. The markets do not expect an interest rate cut from the US Federal Reserve in July despite Trump's continuous push for lower borrowing costs. In fact, Trump has been attacking Fed Chair Jerome Powell personally over his stance on holding rates and repeatedly calling for the central bank chief's resignation. Moreover, Fed Governor Chris Waller and Trump appointee Vice Chair for Supervision Michelle Bowman have advocated a rate reduction as soon as the next policy meeting on July 30. This keeps the US Dollar depressed near a two-and-a-half-week low and could offer some support to the non-yielding yellow metal. Traders now look forward to the release of flash PMIs, which would provide a fresh insight into the global economic health and influence the safe-haven commodity. Apart from this, the crucial European Central Bank policy decision might infuse some volatility in the markets and drive the XAU/USD pair. Meanwhile, the US economic docket features Weekly Initial Jobless Claims and New Home Sales data, which, in turn, would drive the USD and contribute to producing short-term trading opportunities around the commodity. Nevertheless, the fundamental backdrop warrants caution for aggressive traders. SUPPORT 3,346 SUPPORT 3,322 SUPPORT 3,399 RESISTANCE 3,394 RESISTANCE 3,3791 support hit 100 pips done Gold sell 280 pips running BOOOOOM Check my work

Mark804

Gold price remains confined in a multi-week-old range as bulls seem reluctant Gold price attracts some safe-haven flows amid persistent trade-related uncertainties. Mixed Fed rate cut cues keep the USD depressed and further benefit the XAU/USD pair. The range-bound price action warrants some caution before placing fresh bullish bets. In the Forex market, Gold functions as a currency. The particularity of Gold is that it is traded against the United States Dollar (USD), with the internationally accepted code for gold being XAU. Known as a safe-haven asset, Gold is expected to appreciate in periods of market volatility and economic uncertainty. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government. Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. The United States is the country that holds the biggest resources of Gold in the world. 1 SUPPORT 3,323 2 SUPPORT 3,323 3 SUPPORT 3,295 1 RESISTANCE 3,370 2 RESISTANCE 3,393

Mark804

Gold defends 50-day SMA ahead of US PPI inflation data Gold price attempts a tepid bounce early Wednesday as focus shifts to trade updates and US PPI data. The US Dollar retreats alongside Treasury bond yields even as risk-off flows persist. Gold price needs to crack the 50-day SMA support at $3,323; daily RSI reclaims midline. As observed on the daily chart, Gold price is stuck between two key barriers, with the 21-day Simple Moving Average (SMA) support-turned-resistance at $3,335 checking the upside. On the other hand, the 50-day SMA at $3,323 cushions the downside. The 14-day Relative Strength Index (RSI) is sitting just above the midline, currently near 50.50, suggesting that buyers could retain control. Acceptance above the 21-day SMA is critical to sustaining the renewed upside, above which the 23.6% Fibonacci Retracement (Fibo) level of the April record rally at $3377 will be put to the test once again. Further north, the $3,400 round level will challenge bearish commitments. In contrast, rejection at the 21-day SMA could attack the 50-day SMA support. Sellers must find a strong foothold below the 50-day SMA on daily closing basis. The next healthy support levels are located at the 38.2% Fibo level of the same rally at $3,297 and the July low of $3,283. TP 1 3,349 TP 2 3,371 TP 3 3,390 RESISTANCE 3,317

Mark804

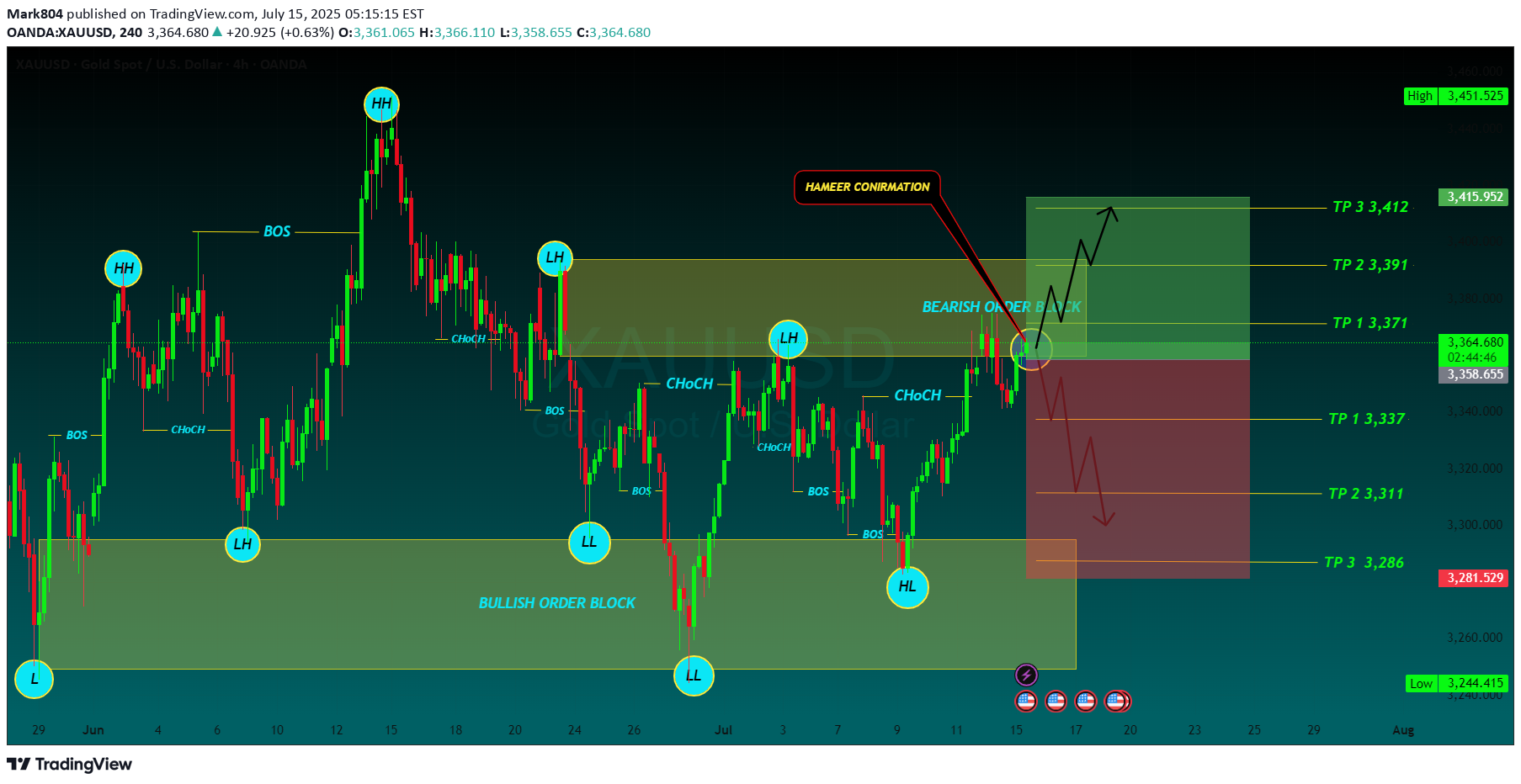

Gold price moves closer to three-week peak amid modest USD downtick Gold price regains positive traction amid a modest USD pullback from a multi-week high. Persistent trade-related uncertainties also lend support to the safe-haven precious metal. Reduced Fed rate cut bets might cap the commodity ahead of the critical US CPI repo Fundamental Overview Amid US President Donald Trump’s fresh tariff threats announced late Monday and his latest criticism of Federal Reserve Chairman Jerome Powell, Gold traders resorted to profit-taking after the bright metal hit a three-week high of $3,375 while bracing for the US inflation report for June. Trump threatened to impose 100% tariffs on Russia if President Vladimir Putin does not agree to a deal to end his invasion of Ukraine in 50 days, per Bloomberg. Meanwhile, the US President renewed his attacks on Powell, noting that “interest rates should be at 1% or lower, rather than the 4.25% to 4.50% range the Fed has kept the key rate at so far this year.” Markets now price in 50 basis points of Fed interest rate cuts by year-end, with the first reduction foreseen in September. However, it remains to be seen if these expectations hold ground following the US CPI data publication. Economists are expecting the US annual CPI and core CPI to accelerate 2.7% and 3% in June, reflecting the tariff impact feeding through prices. Meanwhile, the monthly CPI and core CPI inflation figures are set to rise to 0.3% in the same period. Hotter-than-expected US CPI monthly or annual readings could reinforce the Fed’s patient outlook, pushing back against expectations of two Fed rate cuts this year. This scenario could help the US Dollar (USD) extend its recovery at the expense of the non-yielding Gold price. Alternatively, if the data come in below forecasts, it could provide a fresh tailwind to the Gold price on renewed bets that the Fed will remain on track for two rate cuts. BAY TP TP 1 3,371 TP 2 3,391 TP 3 3,412 SELL PT TP 1 3,337 TP 2 3,311 TP 3 3,286

Mark804

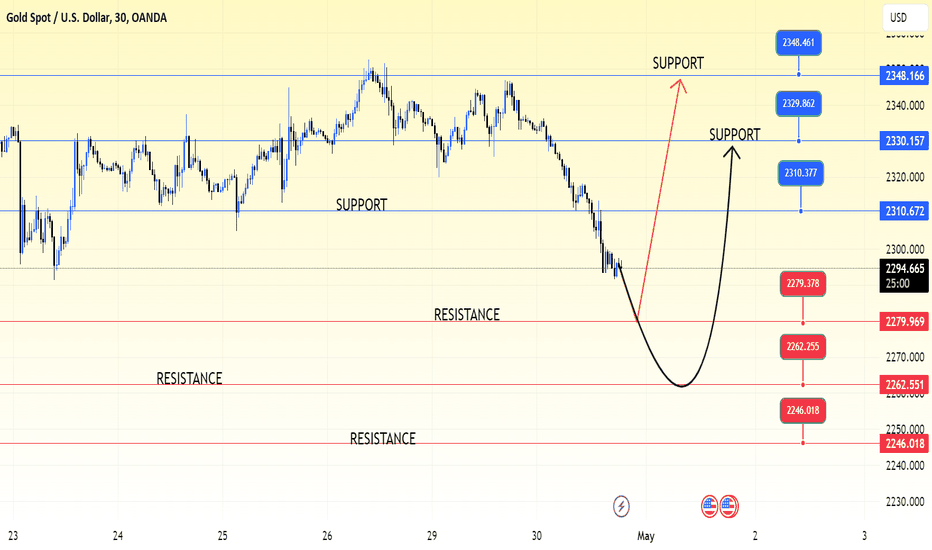

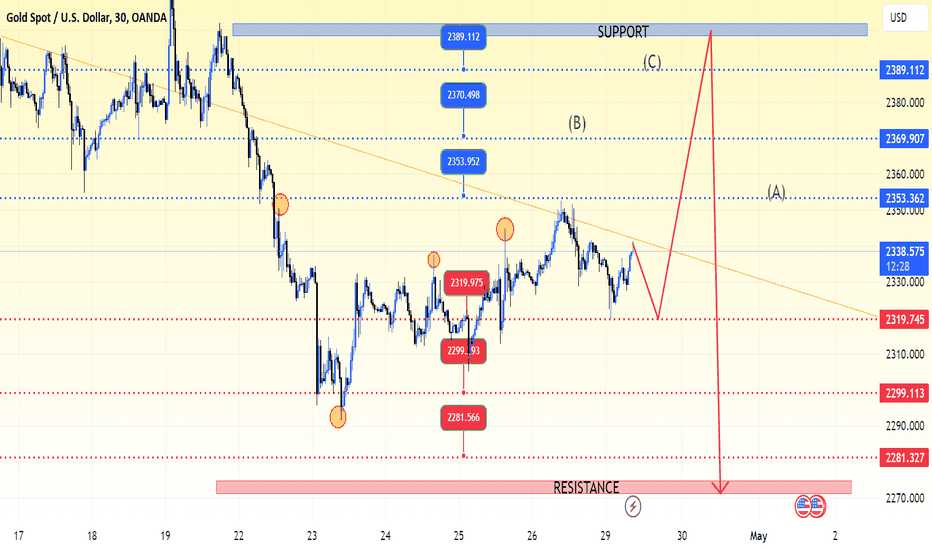

Gold Price: Current Pricing, Prices Chart & Rate Graph\Gold has been considered a highly valuable commodity for millennia and the gold price is widely followed in financial markets around the world. Mostly quoted in US Dollars (XAU/USD), gold price tends to increase as stocks and bonds decline. The metal holds its value well, making it a reliable safe-haven. It's traded constantly based on the intra-day spot rate. Improve your technical analysis of live gold prices with the real-time XAU/USD chart, and read our latest gold news, expert analysis and gold price forecast.gold now buy 2296tp1 2300tp2 2304tp3 2308tp4 2312tp5 2316tp6 2330gold buyxauusdgold confirm chartgold signalxauusdgold buyfollow my signal

Mark804

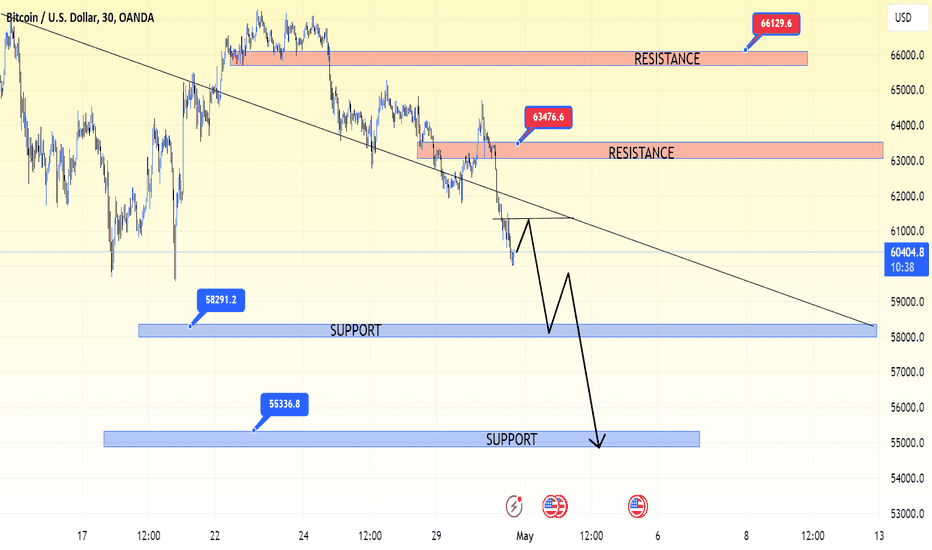

Bitcoin (BTC) is recognised as the world's first truly digitalised digital currency (also known as a cryptocurrency). The Bitcoin price is prone to volatile swings; making it historically popular for traders to speculate on. Follow the live Bitcoin price using the real-time chart, and read the latest Bitcoin news and forecasts to plan your trades using fundamental and technical analysis.confirm signal

Mark804

Gold Price: Current Pricing, Prices Chart & Rate GraphGold has been considered a highly valuable commodity for millennia and the gold price is widely followed in financial markets around the world. Mostly quoted in US Dollars (XAU/USD), gold price tends to increase as stocks and bonds decline. The metal holds its value well, making it a reliable safe-haven. It's traded constantly based on the intra-day spot rate. Improve your technical analysis of live gold prices with the real-time XAU/USD chart, and read our latest gold news, expert analysis and gold price forecast.gold now 2339tp1 2343tp2 2347tp3 2351tp4 2355tp5 2360gold buytp1 hit 40 pips donegold buy 50 pips doneconfirm my signalxauusdfollow my chartgold buy confirm signalxauusd buy

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.