Kriptovole

@t_Kriptovole

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Kriptovole

بیت کوین در چنگال مثلث گسترده: مقصد بعدی ۸۰ هزار دلار یا انفجار بزرگ؟

The chart shows that Bitcoin has formed an expanding triangle formation on the daily time frame. This structure usually develops in the form of waves (A)-(B)-(C)-(D)-(E) and causes the price to make widening oscillations with high volatility. 🔹 Current Situation The price is currently around USD 103,500 and it seems to be moving in the direction of wave (D) followed by wave (C). On the upside, a potential target is the upper trend line near USD 133,000, which is also the resistance for wave (D). 🔹 Possible Scenario •After the (D) wave is completed, the price can be expected to turn down again and create an (E) wave up to the 88,000 – 81,000 USD band. •This move may result in a strong trend break after testing the alt limit of the expanding triangle. •When the (E) wave is completed, the beginning of a new major trend is usually seen. 🔹 Technical Observations •The wave structure of the price is widening, which indicates that the market is in an unstable period and open to manipulation. •Decreasing-increasing imbalances on the volume side may be a signal to pay attention to as the formation approaches its end. •If divergences occur in indicators such as RSI or OBV, it produces a strong signal to confirm the break after the (E) wave. 🔹 Summary The (D) wave of the expanding triangle can be completed in the upward direction, then the 80-85 thousand band can be tested with a final retreat (E) wave. After this level, a sharp break in the direction of the long-term trend can be expected.

Kriptovole

پیشبینی صعودی بیت کوین: آیا اصلاح ABCDE مسیر رسیدن به ۱۱۶ هزار دلار را باز میکند؟

An ABCDE formation similar to a symmetrical triangle structure is formed on the 1-hour chart of Bitcoin. Currently, the chart appears to be in the process of completing wave D. If this structure is technically verified, With the upward movement of the E wave, a rise up to the 116.200 region can be expected. This zone (point E) coincides with the upper band of the formation and can also be a possible reaction sell zone. Therefore, the risk of a sharp pullback (breakdown) after the completion of the triangle after this level should not be ignored. 📍 Critical levels: •Support: 106,150 •Resistance: 116.200 •Formation type: ABCDE correction (Elliott triangle) •Time frame: 1 Hour

Kriptovole

تحلیل بیت کوین: آمادهسازی برای پوزیشن شورت سنگین از سطح ۱۱۴,۹۰۰!

I stated in the previous chart that I did not have any short positions in Bitcoin. Now I will enter a sell order at the 114.900 level and wait. I think there is a possibility of a decline that may deepen to 95,000.

Kriptovole

هشدار جدی بیت کوین: آیا سقوط ناگهانی BTC در راه است؟ تحلیل الگوی "گوه صعودی"

I think that a rising wedge formation is currently forming on the 15-minute chart in Bitcoin. As long as the price does not move above the upper band of the triangle I have drawn, the outlook remains bearish. According to this scenario, I plan to enter two separate orders below, targeting 106.550 and 104.300 levels respectively. I do not currently have any short positions. If the decline I expect occurs and the price finds support from these regions, I expect a recovery to 138,000 with an increase that will start from here. Good luck everyone 🍀

Kriptovole

📉 Due to the voltage between Iran and Israel, the technical analysis I have prepared earlier has greatly lost its validity. Just as in the Covid era, such geopolitical risks can have a black swan effect in financial markets and cause unpredictable price movements. With a strong reaction from this region, a rapid rise to the 2900 band can be experienced .📐 I follow the structure that is formed as a triangular formation. I do not intend to enter any process before this formation is completed or a clear break is realized. In such uncertain periods, protection measures are of great importance.

Kriptovole

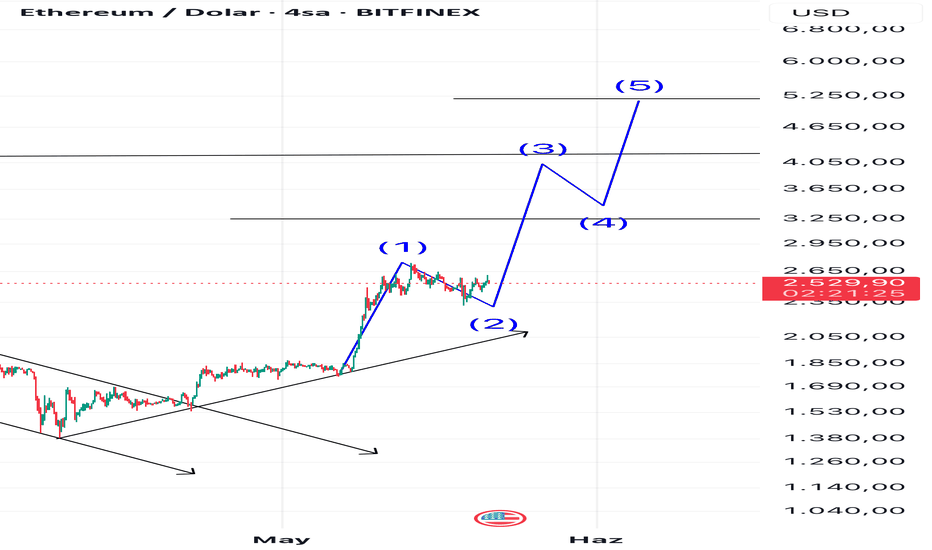

In my previous analysis, I stated that ETH would start a strong upward trend if it provides permanence over $ 1850. This scenario took place and the price continued to accelerate by clinging above this level. As long as this level is above this level, I anticipate that ETH has a potential to rise up to $ 5000 with a 3 -piece impulse wave.

Kriptovole

یک موقعیت معاملاتی فروش استقراضی (Short) در سطح ۹۶۴۰۰ دلار باز شده است. • حد ضرر (Stop Loss): ۹۶۵۰۰ دلار • هدف: سطح ۹۴۷۰۰ دلار. به دلیل نوسانات پایین در آخر هفته، با احتیاط پیش میرویم. این معامله با هدف بهرهمندی از نوسانات کوتاهمدت قیمت انجام شده و مطابق با قوانین مدیریت ریسک برنامهریزی شده است. تحولات را از نزدیک دنبال میکنیم.

Kriptovole

بستهشدنهای روزانه بالاتر از ۱۸۵۰ دلار، پتانسیل این را دارد که اتریوم را ابتدا به ۳۰۰۰ دلار و سپس با قویتر شدن ساختار بازار، در میانمدت تا بلندمدت به سطوح ۵۰۰۰ و ۷۰۰۰ دلار برساند. سطوح حمایت: • اولین حمایت: ۱۷۱۰ دلار • حمایت اصلی: ۱۶۰۰ دلار (اگر قیمت به زیر این سطح برسد، روند نزولی ممکن است آغاز شود) اهداف صعودی: • هدف اول: ۳۰۰۰ دلار • هدف دوم: ۵۰۰۰ دلار • هدف سوم: ۷۰۰۰ دلار

Kriptovole

بیتکوین، با شروع از سطح 109.500، تا سطح 74.500 کاهش یافت و یک ساختار اصلاحی ABC را تشکیل داد. در این ساختار، مشاهده میشود که موج B بیش از حد لازم عمیق شده و یک الگوی اصلاحی رونده به سمت پایین ایجاد شده است. در کوتاهمدت، سطح حمایت اصلی که باید زیر نظر داشت 91.500 است. بستهشدن روزانه بالاتر از سطح 95.800 میتواند منجر به تسریع روند صعودی شود. در این سناریو، منطقه هدف موج C سطوح 111.000 یا 112.000 دلار بود.

Kriptovole

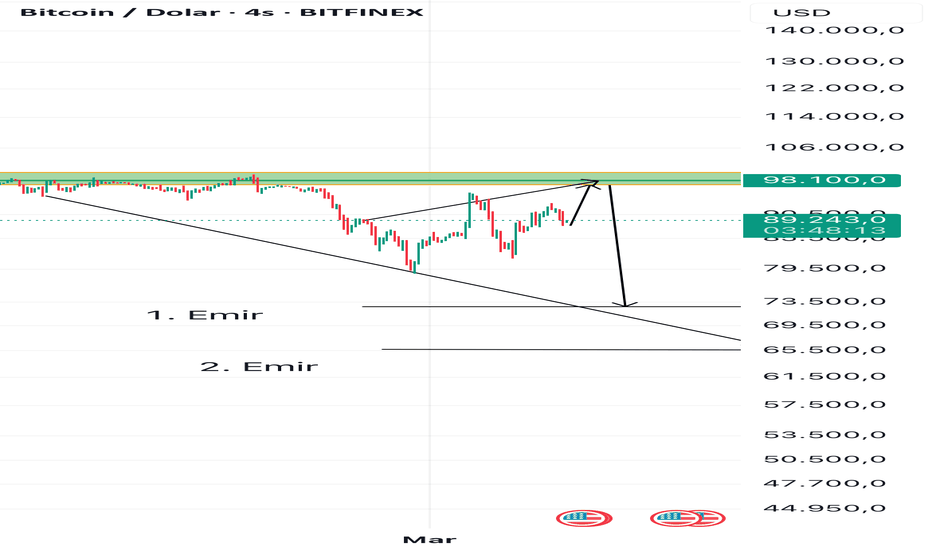

من در حال حاضر با ۸۷ هزار استاپ لاس در معامله هستم. برای اینکه یک صعود سالم داشته باشیم، باید بالای ۱۰۰ هزار باقی بمونیم. در غیر این صورت، قصد دارم دوباره پوزیشنهای فروش (short) را در حدود ۹۷-۹۸ هزار باز کنم. اگر یک سقوط قوی اتفاق بیفته، سفارشات خرید را در محدودههای ۷۲۵۰۰ و ۶۶۰۰۰ ثبت میکنم و منتظر میمونم.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.