JosWilliam_

@t_JosWilliam_

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

JosWilliam_

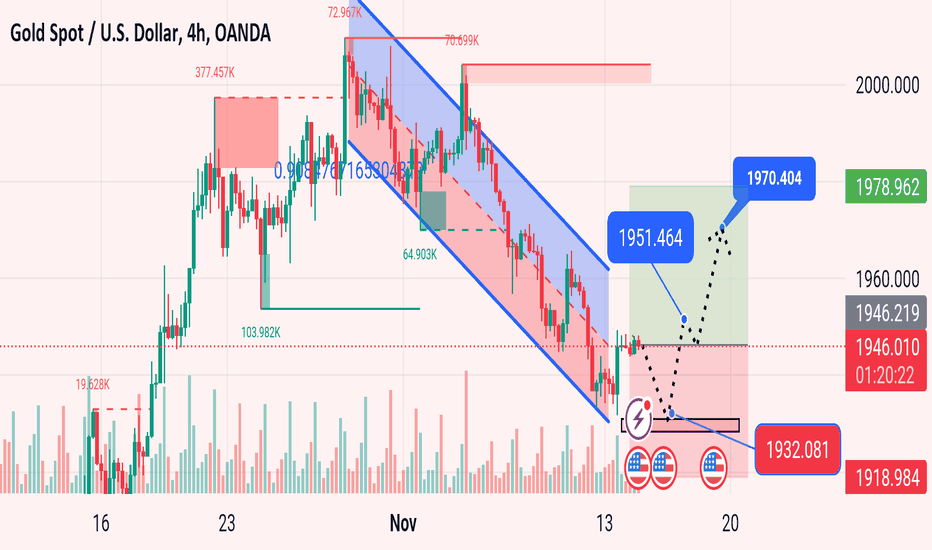

XAUUSD CONFIRM UPCOMING BIG BLAST FOR CPI🔥

XAUUSD CONFIRM UPCOMING BIG BLAST FOR CPI🔥 Gold price is holding the rebound from in three-week low of $1,932 early Tuesday, as risk sentiment remains in a weak spot in the lead-up to the top-tier economic data from the US. Amidst a cautious market mood, the United States Dollar (USD) is attempting a comeback even as the US Treasury bond yields trade listlessly. Will Gold price rebound on US Consumer Price Index data? The Asian equities pared gains while the US S&P 500 futures trade modestly flat, as traders refrain from placing any fresh bets on riskier assets ahead of the all-important US Consumer Price Index (CPI) data due later in the day. Additionally, renewed concerns over China’s slowdown keep investors on the edge. These factors have led to a revival in the demand for the safe-haven US Dollar, capping the renewed upside in the Gold price. GOLD BUY FROM 1945 TARGET 1970 🔥

JosWilliam_

GOLD UPCOMING BIG BLAST FOR TODAY 🔥

GOLD UPCOMING BIG BLAST FOR TODAY 🔥 Gold price (XAU/USD) has fallen to around $1,940 and it is exposed to more downside amid multiple headwinds. The precious metal loses shine due to no significant escalation in Middle East tensions, hawkish messages from Federal Reserve (Fed) Chair Jerome Powell and his colleagues, and uncertainty ahead of the US Consumer Price Index (CPI) data for October, which will be published on Tuesday. The appeal for Gold diminished significantly after Jerome Powell said he was less confident that the current interest rate policy is sufficiently restrictive to get inflation under control. Further action in the US Dollar, bond markets and the Gold price will be guided by US inflation data, which will dictate whether more interest rate hikes are needed. GOLD SELL : 1938 TP : 1930 TP : 1920 TP : 1910

JosWilliam_

XAUUSD NEXT BIG BLAST FOR UPCOMING WEEK

XAUUSD NEXT BIG BLAST FOR UPCOMING WEEK XAU/USD prices are testing towards the downside on Friday, edging towards $1,930 after yesterday's hawkish comments from Federal Reserve (Fed) Chairman Jerome Powell, who suggested that the Fed may not have achieved suitably restrictive monetary policy to contain inflation. Alongside Fed head Powell, several Fed policymakers hit newswires this week suggesting that rates may not be high enough to sufficiently cap inflation towards the Fed's 2% target looking forward. The hawkish stance completely eviscerated the broad-market narrative that the Fed was not only done with rate hikes, but would be heading into a rate-cut cycle soon.

JosWilliam_

BTCUSD NEXT MOVE AND UPCOMING BLAST 👿🔥

BTCUSD NEXT MOVE AND UPCOMING BLAST 👿🔥 Bitcoin (BTC) price, on the daily time frame, showcases not one but multiple sell signals. To add to its woes, on-chain metrics are also showing profit-taking en masse. While the rally prompted by the potential ETF approval has propelled BTC so far, the lack thereof could also knock the pioneer crypto lower.

JosWilliam_

XAUUSD NEXT CONFIRM MOVE IN SELL 💯

XAUUSD NEXT CONFIRM MOVE IN SELL 💯 The US Dollar maintained its positive tone throughout the first half of the day but changed course after the American opening. As a result, XAU/USD bounced from a fresh weekly low of $1,944.71 to trade above the $1,960 mark. Financial markets maintain cautious optimism amid hopes central banks are done with monetary tightening, despite policymakers insisting on keeping the door open for additional rate hikes. Richmond Federal Reserve Bank President Thomas Barkin delivered some encouraging words on Thursday, as he said the economy is “remarkably” healthy, noting real progress on inflation. He also added that the job is not yet done, as inflation remains high. Finally, he said that any downturn might be less severe than in past recessions and that the labor market is now more balanced XAUUSD SELL : 1953 TP : 1947 TP : 1940 TP : 1932

JosWilliam_

XAUUSD NEXT CONFIRM MOVE FOR TODAY 100% CONFIRM ANALYSIS

XAUUSD NEXT CONFIRM MOVE FOR TODAY 100% CONFIRM ANALYSIS Gold price (XAU/USD) falls further as upside risks of Middle East tensions ease. The precious metal remains on the backfoot as market participants expect conflicts to remain contained between Israel and Palestine. Along with fading Middle East conflicts, caution over the interest rate outlook from the Federal Reserve (Fed) has dampened appeal for the Gold. Investors are waiting for Federal Reserve Chairman Jerome Powell’s guidance on the monetary policy meeting in December and the outlook on the economy. Fed Powell is expected to maintain the stance of keeping current interest rates higher for a longer period as cracks appear in the US job market that could restrict inflation expectations. Jerome Powell could warn for more rate hikes in case progress in inflation returns to 2% slows. XAUUSD SELL : 1952 TP. : 1944 TP. : 1936 TP. : 1930 SL. : 1962

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.