Houseofcryptokings

@t_Houseofcryptokings

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Houseofcryptokings

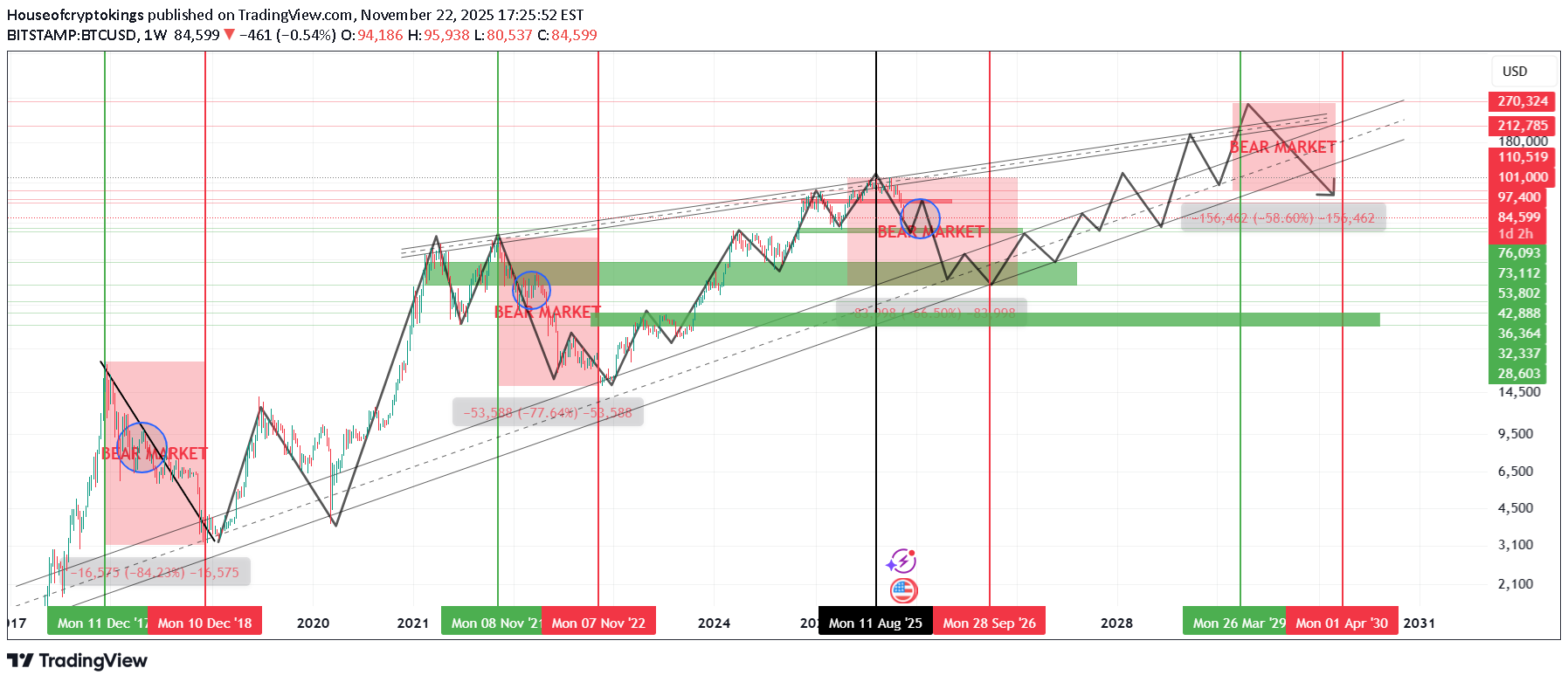

پیشبینی کف بیت کوین در سال 2026: آیا منتظر سقوط تا 40 هزار دلار باشیم؟

Bitcoin Macro Cycle Analysis (2013–2029) | Rising Wedge Breakdown • 2026 Bear Market Targets • Historical % Drops & Next Accumulation Zone Bitcoin historical data strongly follows multi-year macro cycles , where each bull market has been followed by a deep bear market correction: 📉 2nd Cycle (2017–2018) Top: 19,666 (17 Dec 2017) Bottom: 3,122 (15 Dec 2018) Correction: –84.23% 📉 3rd Cycle (2021–2022) Top: 68,997 (8 Nov 2021) Bottom: 15,479 (9 Nov 2022) Correction: –76.64% 📉 4th Cycle (2025–2026 – Ongoing) Top: 126,272 (6 Oct 2025) Rising Wedge + Distribution Phase breakdown confirms bearish structure shift Based on historical cycle behavior and on-chain indicators, Bitcoin has entered the 4th major bear market 📍 Projected Bottom Zone (2026) Primary Support Zone: ➡️ $40,000 – $42,000 – $45,382 (Aligned with Wedge Breakdown + Macro Support) Percentage-Based Targets: –68.16% drop: → ≈ $40,000 –74% historical drop scenario: → ≈ $31,000 (max capitulation zone) 📅 Expected Bottom Window: September – October 2026 → Historically the strongest long-term buying opportunity . 📈 5th Cycle Expectations (2026–2029) Bitcoin has been following a Long-Term Rising Wedge (Bearish Continuation / Reversal Pattern) since 2021. This pattern is expected to fully complete by April 2029 → leading into a new long-term top and then the 5th bear market . ⭐ Why This Analysis Matters Combines **cycle history**, **on-chain metrics**, **pattern analysis**, and **macro support zones** Helps identify high-probability long-term Bitcoin accumulation levels Useful for swing traders, long-term investors, and cycle-based portfolio strategies 🔔 If You Find This Analysis Helpful 👍 Like • 💬 Comment • ⭐ Save It motivates me to share more high-quality Bitcoin cycle research!

Houseofcryptokings

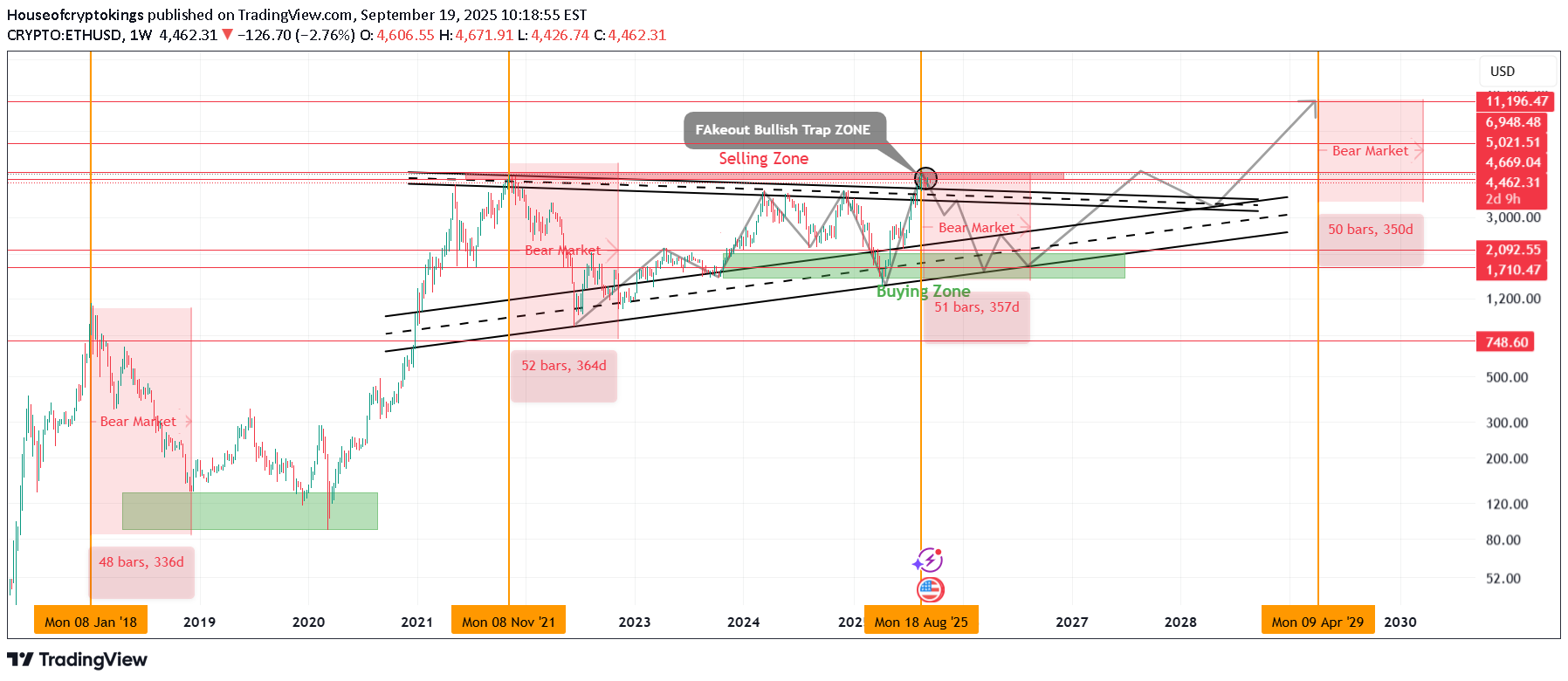

ریزش قریبالوقوع اتریوم (ETH): فرصت فروش کوتاهمدت با اهداف جدید!

🚨 Ethereum (ETHUSD) Market Update – Short-Term Setup 🚨 Ethereum is displaying clear weakness on higher levels, as the recent bounce appears to be a relief move rather than a full trend reversal. The resistance zone between $4074 – $4175 remains crucial — price rejection from this area can offer a high-probability short opportunity. We’re currently holding short positions from $3930, and if ETH extends upward, DCA shorts will activate near $4175 for a better average entry. 📉 Downside targets to watch: 🎯 $3750 🎯 $3636 🎯 $3540 🎯 $3480 Until a confirmed correction forms, avoid aggressive long setups. Market sentiment remains fragile, and bulls may face strong resistance around the upper range. ⚠️ Timeframe: 15-Minute (Scalp / Short-Term Setup) 💡 Tip: Manage risk carefully and trail stops as price moves in your favor. 📊 Follow me on TradingView for more real-time ETH and BTC updates, short-term scalps, and market breakdowns. Your feedback and comments are always welcome!

Houseofcryptokings

تایید صعود بیت کوین: سطوح حیاتی بالای ۱۱۹ هزار دلار و حرکت نوامبر!

Bitcoin is currently trading below a key resistance level of **$114,500**, and a **strong Monday closing on 13 October above this level** is crucial for confirming a short-term bullish recovery. If BTC successfully closes above **$114,500**, the next important resistance will be around **$119,500**. A **Monday closing on 20 October above $119,500** would confirm a temporary bullish structure, giving Bitcoin the strength to test higher levels toward the **$127,600 liquidity zone** in November. Currently, major liquidity is sitting near **$124,600 and $127,600**, which might attract price movement before any major reversal begins. The market has already taken liquidity around **$101,000**, trapping retail sellers — and now, it may move up to grab the **short-side liquidity** before the next larger downtrend begins. ⚠️ **Be patient and stay disciplined. Avoid long positions for now.** Focus on the market’s move toward the top, and prepare for **short positions near the highs** to capture the **2026 bear market** — which is expected to last from **September to November 2026**. 📊 The market often manipulates both sides before showing the real direction. Watch levels carefully and trade with confirmation. 💬 **Follow me on TradingView** for more Bitcoin and Ethereum updates — and comment below which coin you’d like me to analyze next!

Houseofcryptokings

Ethereum Triangle Breakout Trap – Bear Market Focus

Ethereum (ETHUSD) has formed a symmetrical triangle pattern, but an early breakout has already taken place before the structure was fully completed. Historically, such premature breakouts during the end phase of a crypto cycle often hint towards a bearish trend continuation. Looking at past bear market cycles, there is a possibility that Ethereum could enter a deeper corrective phase in 2026, aligning with historical crypto market patterns. The key support zones to watch remain at $3000, $2300, and $1800, which could act as major levels in the upcoming months. On the upside, Ethereum faces strong resistance between $4700 and $4900, where short setups become more favorable. For risk management, a stop loss above $5200 is recommended. Long positions have already been closed, and the focus now shifts towards short opportunities at resistance zones. 📌 This setup provides a clear risk-reward strategy for traders who are closely monitoring ETH price action in relation to cycle completion and historical bear market patterns. 👉 Follow me on TradingView for more crypto market insights, technical analysis, and trading updates. Share your thoughts in the comments – your feedback helps shape future analysis!

Houseofcryptokings

ALGO Technical Analysis: Key Levels to Watch in 2024-2025

Algorand (ALGO) is a promising project known for its efficient management of scalability, security, and decentralization. The long-term success of ALGO depends on broader adoption and leveraging its distinct features in the competitive blockchain market. Currently, ALGOUSD is holding a Weak Support at the $0.119 support level, presenting a potential for significant gains. If this support level holds, we might see a bullish move. However, if this support breaks, the next strong support and bottom lie near $0.086. A bounce is expected from this level due to some upcoming positive events and the potential approval of ETH ETFs. Historically, we have seen altcoin rallies following such approvals. ALGOUSD was listed on June 17, 2019, and experienced a significant rally between March 30, 2020, and November 27, 2021, during the 2021 bull market. According to Bitcoin's historical patterns, a bull market tends to occur every four years. We anticipate increased market volatility in Q4 2024 and Q1 2025, similar to the 2021 bull market for ALGO. Our calculated targets for ALGO's bull run suggest a minimum target of $1.57. If this resistance flips by Q4 2024 or January 2025, we could see a maximum target of $3.44. It's crucial to monitor support and resistance zones to keep the trade active. Remember to exit long positions by April or August 11, 2025, as the bull run and alt season are expected to end during this period. For more analysis like this, follow us on TradingView to stay updated with our latest ideas and take advantage of our insights. Kindly share this idea with your friends and family to maximize profits. Don't forget to comment below and give a like. Thanks!

Houseofcryptokings

TIAUSD: Strong Support at $4.9 - Potential Rally Ahead!

Celestia's TIAUSD token exhibits promising utility within its ecosystem, primarily serving network security through staking, participating in governance decisions, and incentivizing data availability and validation. Moreover, TIA facilitates transaction fees and rewards, ensuring participant compensation for their contributions. Support and Resistance Zones: Currently, TIAUSD holds strong support at $4.9. If this level holds, we could see substantial gains. Should this support break, the next critical support lies near $3.6, a key level from which a bounce is highly probable, given the upcoming significant events and the anticipated approval of Ethereum ETFs. Market Outlook: The approval of Ethereum ETFs is likely to spark a rally in altcoins, including TIAUSD, a relatively new project listed in late 2023. Historically, new projects introduced shortly before a bull market often experience significant rallies. We anticipate notable volatility in Q4 2024 and Q1 2025, presenting an excellent opportunity for TIAUSD to surge. Price Targets: Based on our calculations, the minimum target for TIAUSD during the bull run is $146. If this resistance is flipped by January 2025, we could see a maximum target of $186. Bull markets typically exhibit unexpected price pumps, and we expect similar volatility for TIAUSD. However, monitoring support and resistance zones is crucial to maintain an active trade strategy. Exit Strategy: Traders should aim to exit long positions between March and August 11, 2025, as the bull run and altcoin season are expected to end during this period. Follow us on TradingView for more in-depth analysis and timely updates on TIAUSD and other cryptocurrencies. Share this idea with your friends and family to maximize profits. Comment below and let us know if you found this analysis helpful. Thank you!

Houseofcryptokings

ZILUSD Forecast: Bullish Momentum & Targets for Q4 2024, Q1 2025

ZILUSD currently finds robust support at $0.0136, suggesting favorable conditions for a potential uptrend. The recent retesting and observed volume indicate a promising setup for a bounce. Concurrently, the ETHBTC pairing shows notable growth, poised to potentially flip the 0.6 level, signaling a likely rally in altcoins. Moreover, with ETH's ETF approval nearing, the market anticipates heightened volatility and upward movements in Q4 2024. Historically, such periods have exhibited significant price rises and increased market activity during bull runs. Notably, preparations for market exit around March or November 2025 are advisable as bull runs typically conclude during these times. In historical contexts, ZILUSD has shown resilience and substantial targets during bull runs, with a minimum target projection of around $0.5 in Q4 2024. Breaking the $0.5 resistance could propel prices towards a maximum target of $1.5 by Q1 2025. Since its listing in January 2018 amidst a bear market, ZILUSD underwent significant downtrends until March 2020, followed by a notable uptrend till May 2021's bull run. Subsequently, a downturn from May 2021 to December 2022 led to a consolidation phase until March 2024, marked by recent upward movements. Retesting support at $0.0135 suggests a potential for a substantial uptrend towards Q1 2025 amidst the approaching altcoin season, expecting similar market volatility. Monitoring resistance zones and patterns is essential to maintain active trading strategies. Consider exiting long positions around March or November 2025, aligning with historical market cycles. For more detailed analysis and future trading ideas, follow us on TradingView. Share this idea with your friends and family to maximize profits. Please like, comment, and engage with our posts for more insights. Thanks!

Houseofcryptokings

BTC Update: Key Levels and Market Outlook for Upcoming Weeks.

Bitcoin (BTCUSD) currently holds a strong support level at $55,300. This key level presents a significant opportunity for potential gains. If the support at $55,300 fails, the next critical supports are at $52,000 and $48,500. Given the approaching bull run, we expect a bounce from these levels, particularly in Q4 2024 and Q1 & Q4 2025. As with previous bull runs, we anticipate substantial volatility during this period. Remembering to exit the market around March or November 2025 is crucial, as the bull run is expected to conclude around this time. Based on historical data and calculations, the Minimum target for Bitcoin in this bull run is $253,623. If Bitcoin flips the resistance at $253,623 by February 2025, we could see a maximum target of $275,780. Previous bull runs in 2013, 2017, and early 2021 exhibited unexpected price pumps, and we may witness similar volatility this time. While observing resistance zones, it's essential to keep trades active and plan to exit long positions by March or November 2025. For more detailed analysis and future trading ideas, follow us on TradingView. Share this idea with your friends and family to maximize profits. Please like, comment, and engage with our posts for more insights. Thanks!

Houseofcryptokings

ADA Bull Run Insights: Historical Patterns and Future Projection

In this detailed analysis of Cardano (ADAUSD), we examine the current support level at $0.333, which is proving to be a significant point for potential gains. Should this support hold, ADA could see a substantial increase. However, if it breaks, the next strong support is around $0.24, where a bounce is highly anticipated due to upcoming positive events and the nearing approval of Ethereum ETFs. These events could trigger a rally in altcoins, likely to be observed in Q4 2024. Historically, bull runs have been characterized by high volatility and substantial price rises, which we expect to see again. For the upcoming bull run, Cardano's target is projected to be at least $7, based on historical performance and calculations. If ADA flips the $7 resistance by February 2025, we could see a maximum target of $9.11. Cardano, listed during the September 2017 alt season, yielded a 7322% return and an impressive 15556% return during the 2021 bull run. For 2025, we are anticipating a return of approximately 3750%. ADA is currently forming an uptrend with its maximum resistance projected at $9.11. Historically, bull markets have seen unexpected price pumps, and we can expect similar volatility this time. It is crucial to monitor S&R zones to keep trades active and plan to exit long positions around March or August 2025. For more detailed analysis and future trading ideas, follow us on TradingView. Share this idea with your friends and family to maximize profits. Please like, comment, and engage with our posts for more insights. Thanks!

Houseofcryptokings

Analyzing NMR Bullish Symmetrical Pattern: Breakout Forecast

The NMRUSD pair holds strong support at $11.80, presenting significant potential for a bullish move. If this support level holds, we can expect a notable gain. However, if this support breaks, the next strong support is at $10.66, where a bounce is anticipated due to the proximity of a bull run and the nearing approval of the ETH ETF. We can expect market bullishness in Q4 2024, accompanied by high volatility and substantial rises typical of bull runs. Anticipated Bull Run Targets: Based on historical data and calculations, NMRUSD's minimum target during the bull run is projected at $360. If it can flip the $360 resistance by February 2025, we might see a maximum target of $1000. NMRUSD, listed in 2017, has formed a symmetrical triangle pattern expected to break out during the 2025 bull run. Historically, prices have shown unexpected pumps during bull markets, and similar volatility is expected this time. Strategic Long Position Management: Considering the resistance zones and the potential pattern breakout, it is crucial to maintain active trades while monitoring these levels. Plan to exit long positions around March or November 2025, as the bull run is likely to end during this period. For continuous updates and in-depth analysis, follow us on TradingView to stay ahead with our trading ideas and market insights.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.