GoldMindsFX

@t_GoldMindsFX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

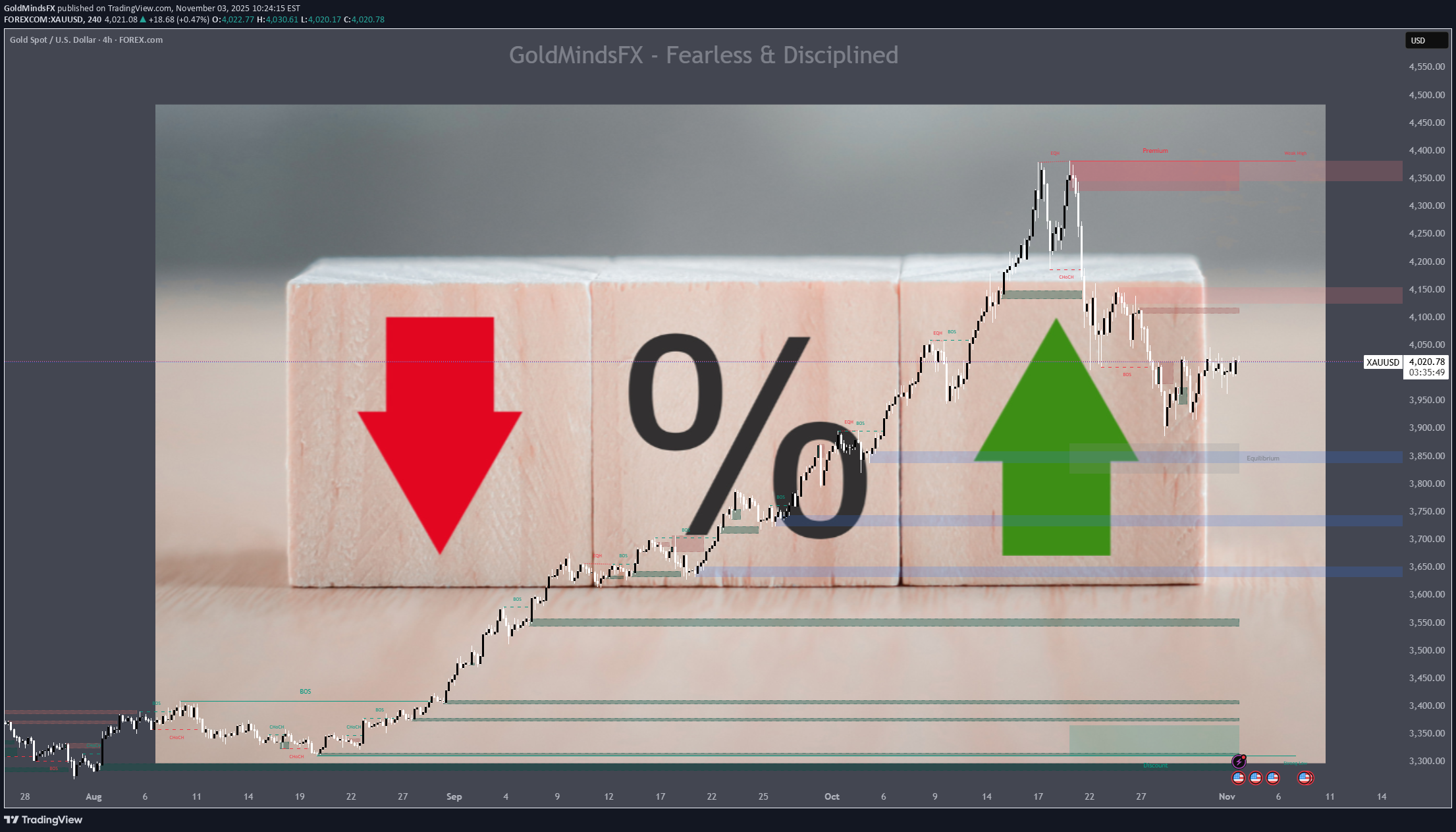

تناقض طلای نوامبر: قدرت مورد انتظار در برابر سردرگمی جهت بازار

🍂 November typically brings seasonal bullish moves for Gold; demands from India and China, central bank interest, and safe-haven flows as the year winds down. ⭐But November 2025 opens with hesitation, not momentum. October closed with fresh all-time highs, followed by a sharp end-month correction that broke short-term structure. Now, Gold begins November range-bound, lacking both clarity and fundamental conviction. Contributing to this indecision is the U.S. government shutdown, which has delayed critical economic data. Without jobs reports or inflation metrics, the Fed has no updated visibility and traders are left without macro confirmation to support directional conviction. While shutdowns often support Gold as a safe haven, the current blackout has instead amplified uncertainty. 🔹 This first week already carries weight: ISM Manufacturing PMI on Monday (negative for Dollar as of recent release) and ADP Employment on Wednesday; two of the few confirmed releases still standing despite the shutdown. They could offer short-term directional clues if volatility aligns with structure, but just as easily trigger reactive spikes that fade within hours. Either way, the message is the same let structure confirm before conviction takes over. Until that changes, structure not sentiment is the only valid guide. 📚 November’s Setups in Disguise Gold is trading November more in anticipation. Because the market isn’t lost, but simply waiting for structure to confirm direction. Our metal is moving between defined zones, reacting level to level, not to headlines or speculation. For now, price is holding inside a decision area, no breakout yet and that telling us to be patient. Here’s the paradox: → If Gold begins to rally this month, the whispers of an early Fed pivot will return. Risk appetite expands, and momentum traders chase continuation. → If it sells off, those same expectations get priced out. The safe-haven flows unwind, and bearish narratives resurface. → But if Gold simply stays trapped in a wide, reactive range both buyers and sellers become liquidity for one another if they do not pay attention. And that’s the part most traders miss. November is a preparation month. Volatility without confirmation is dangerous. → Read the structure, not the headlines. → Trade the reaction, not the assumption. → Focus on your system, not the noise. Clarity will come, but maybe not in the first week. ⚖️ The Mindset Shift This Market Demands Beware this not the Gold environment we were trading even two months ago. We’ve entered a phase where volatility has changed: one-minute candles can travel 200+ pips, and price can sweep both sides of structure in minutes. Volumes in a day can exceed 2000+ pips. 🔹 Think in wider zones, not narrow scalps. High timeframe levels — like H1/30M and H4 — are providing more stability in these volatile conditions. Entries defined there, confirmed on M15 or M5, are showing better follow-through. 🔹 Consider reducing your lot sizes. Not as a rule, but as a response to the increased range and unpredictability. What worked with older volatility may now lead to outsized losses in the blink of an eye. 🔹 Let go of urgency. This isn’t about catching every move. In fact, the best setups in this market come from not chasing, but letting structure unfold first. 1 good setup/day is more than enough. 🔹 Trade with the trend first — countertrend only with caution. The current volatility makes every retracement look like opportunity, but most reversals are just liquidity sweeps. Until structure confirms a real shift, fading moves is riskier than riding them. XAUUSD has changed pace again. And the traders who are adapting ,without needing to predict ,are the ones who’ll stay in profit in this cycle. This November isn’t a month for bold predictions, so let’s trade what’s real, adjust often, and survive cleanly into December, with capital and clarity intact. If this article gave you clarity for the weeks ahead, drop a 🚀 and follow us ✅for Trading Psychology articles and daily ideas.

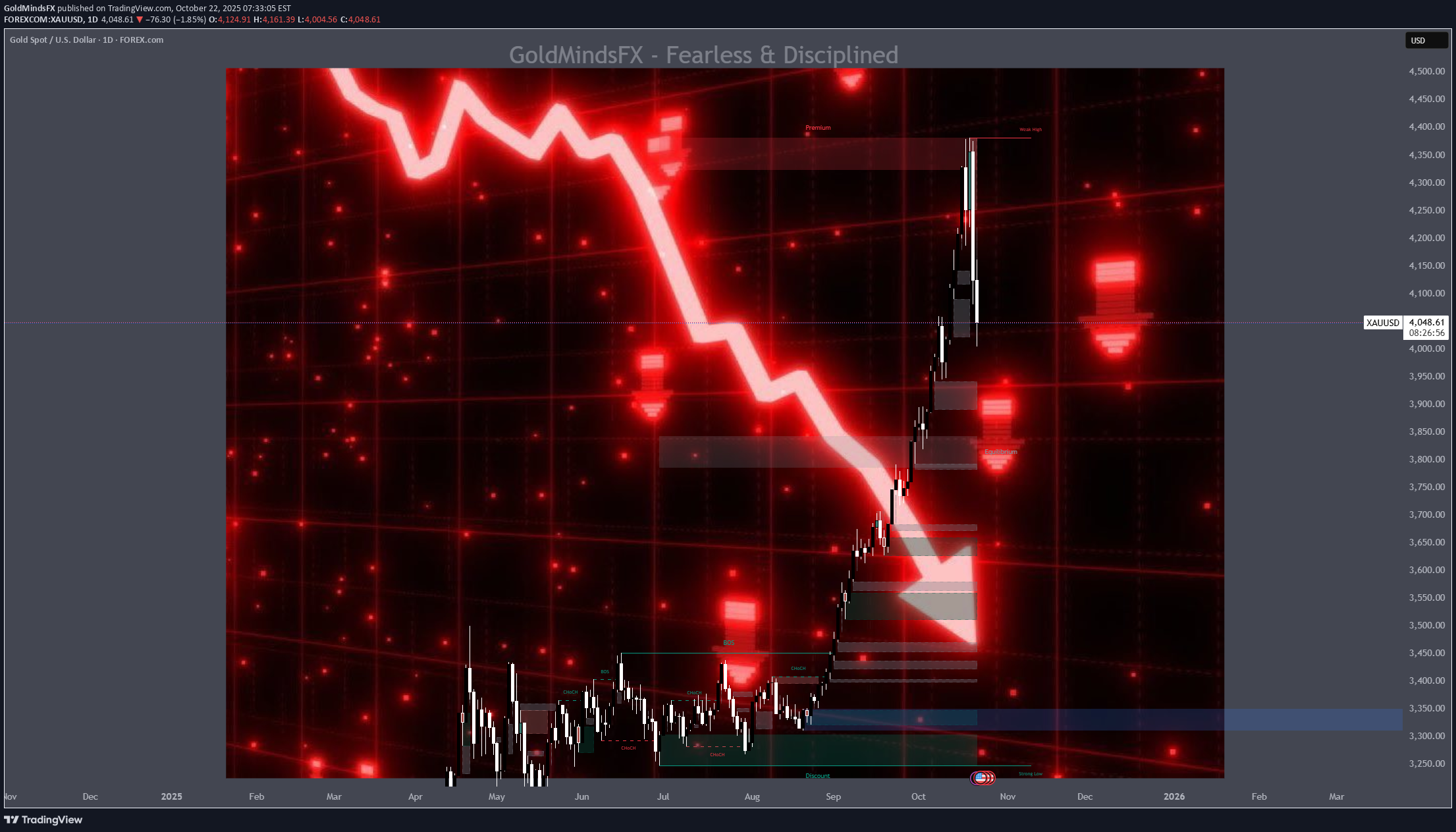

طلای ۱۹۷۹ در برابر ۲۰۲۵: آیا تاریخ تکرار میشود و طلا سقوط میکند؟

🌕 1. The Echo of 1979 In 1979, the world watched Gold do the impossible. The metal surged from $226 to over $850 per ounce in less than a year, a 275% explosion that turned fear into fortune. The triggers were seismic. 🇮🇷 The Iranian Revolution disrupted global oil flows. 🏛️ The U.S. Embassy hostage crisis fueled geopolitical panic. ⚔️ The Soviet invasion of Afghanistan reignited Cold War fears. 💸 And double-digit inflation in the U.S. shredded faith in the dollar. By early 1980, panic replaced logic. Every newspaper screamed, “Buy Gold before it’s too late!” Then came Paul Volcker’s shock therapy as interest rates jumped above 15% and COMEX doubled margin requirements. Within eight weeks, Gold fell more than 40%, marking the end of one of the most dramatic speculative manias in modern history. 🔁 2. Fast-Forward to 2025: The Parallels Are Uncanny The world of 2025 looks hauntingly similar. 🕰️ 1979 🔮 2025 Iranian Revolution and Cold War tensionsGaza war, U.S.–China decoupling, and regional instability Oil shock and inflation Energy disruptions and persistent post-pandemic inflation Dollar under pressure Record U.S. debt and fiscal erosion Panic buying of Gold Central bank accumulation and retail FOMO Fed under Volcker turns hawkish Fed under Powell trapped between cuts and control By late August 2025, gold sat quietly near $3,415, then erupted into a seven-week vertical rally above $4,300, a mirror image of 1979’s euphoric climb. But just like back then, euphoria was the prelude to exhaustion. ⚠️ 3. The Anatomy of the Current Crash On October 17, 2025, Gold plunged $250 in one day, a shocking 5–6% drop that broke its parabolic structure and sent fear rippling across markets. What triggered it? 🏦 A hawkish shift in the Federal Reserve’s language as officials hinted rate cuts might be delayed. 💰 Real yields surged, breaking the inverse correlation that had fueled gold’s climb. 🏛️ Institutional profit-taking hit record levels, confirmed by rising COMEX open interest and volume. 🗞️ Sentiment flipped overnight as headlines shifted from “Gold to $5000” to “Gold crashes $250.” The move marked the first true break of structure (CHoCH) since the rally began, historically the signal that smart money is quietly exiting. 🔍 4. Lessons from 1980 — The Signs of a Top Before gold crashed in 1980, five clear warning signs appeared. ⚙️ 1979–1980 Signal 💡 2025 Equivalent 🧭 Status Fed turns hawkish Powell signals “pause / higher for longer” ⚠️ Emerging Rising bond yields vs. flat GoldReal yield divergence ✅ Confirmed Parabolic candles Daily range above $100 ✅ Seen Media frenzy “Gold to $5000” hype ✅ Seen Margin hikes and record OIRecord COMEX participation ⚠️ Rising Four out of five signals are already flashing. History teaches that when everyone believes Gold can only rise, it’s often about to fall. 🧭 5. What Smart Traders Should Do Now 🟡 Phase 1 – Immediate Protection (Next 24 Hours) If you’re long, secure 50–75% of gains and protect above $3,950. If you’re short, trail stops to $4,200 and look for targets at $3,950 → $3,800 → $3,600. If you’re flat, stay patient and wait for at least two daily candles of stabilization before acting. 🟠 Phase 2 – Stabilization (Next 3–5 Days) Watch for: 🕯️ Long lower wicks on daily candles show buyer absorption. 📉 Shrinking COMEX volume indicates exhaustion of sellers. 📊 Flat or falling real yields confirming support. 🔵 Phase 3 – Re-evaluation (Next 1–2 Weeks) If gold reclaims $4,000+ with strength and Fed tone softens, a controlled re-rally may begin. If Gold stays below $3,800, the correction likely extends toward $3,500, the same 30–40% retracement seen in 1980. 🧘♀️ 6. Beyond the Chart — Discipline Over Drama When a $250 candle appears, instincts scream, “Do something!” But professionals know the truth: reaction destroys capital, observation preserves it. The coming days are not about prediction but about posture. Stay liquid, track sentiment, watch real yields, and remember that even in 1980, Gold’s crash didn’t end its story — it simply reset the cycle for the next era of accumulation. ✨ History doesn’t repeat, but it rhymes. In 1979, Gold taught us that fear creates bubbles. In 2025, it’s reminding us that even truth needs a pullback before it shines again. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.

Hack Gold. Win Fast. Inside XAUUSD trading secrets.

⚡ If you just chose Gold to trade, listen up. This market doesn’t forgive. It’s fast, brutal, violent, yet equally rewarding. But if you don’t know what you are doing, it will chew you up and spit you out before you even finish your first coffee. Here are 5 Hacks to help you every single day instead of the same Mistakes that keep new traders in losses, frustrated, and blaming “manipulation” instead of fixing their own game: 🔔1. Trading Blind With Zero Knowledge Everyone wants quick cash, and most traders do not want to study. If you don’t know about liquidity, order blocks, or imbalances, you are just guessing. And Gold punishes guesses. Copying random signals online won’t save you. You need a system, discipline, and screen time. Period. 🔥HACK 1: Learn the game before you risk the money. Demo, daily chart study & repeat hundreds of times. If you treat this like a casino, you will always leave broke. ✨2. Pretending Risk Management Is Optional This one kills more accounts than anything else. No stop loss, no take profit, just “I’ll close it when it comes back.” And then the market doesn’t come back. Sometimes ever. Gold can drop 300 pips in minutes, and if you are sitting unprotected, you will blow up faster than you can blink. 🔥HACK 2: Risk max 0.3 per trade. Place your SL. Place your TP or watch profits like a hawk. And if you don’t know where to place them, you are not ready to trade real money. Find real premium help, not fake flashy plastic scams. 💥3. Loading the Gun With Too Many Trades Gold moves fast. One wrong click, and if you are stacked with five positions, you are done. I have seen traders open buys, sells, hedges, all at once, thinking they are “diversified.” No. You are just multiplying risk. A 1% move against you and XAUUSD can wipe your entire account if you are over-leveraged. 🔥 HACK 3: Stick to one clean setup, manage the size, and stop spraying bullets like you are in an arcade game. 🔴4. FOMO Buying Tops (and Selling Bottoms) Gold hits a new high. Like yesterday. Traders scream “To the moon!” You panic and click Buy. Two minutes later, your drawdown hits rock bottom. Happens all the time. FOMO is the fastest way to donate your money to smarter traders. 🔥HACK 4: Plan your trades before the price gets there. If you were not ready before the move, you missed it. Accept it. The market is not closing tomorrow or ever. 😡5. Revenge Trading Like a Maniac You take a loss. Then your brain screams: “I’ll get it back!” So you double the next position. Then triple. Guess what? XAUUSD is so volatile that it will run over your feelings and leave you in depression. You are not getting your money back, just gaining more anxiety and daily stress. 🔥HACK 5: Close the platform. Step away. One good trade tomorrow is worth more than five revenge trades today. 🖊️Homework: Memorize your hacks, stick them on a post-it by your screen, in your wallet, and read them as many times as needed; learn them like a mantra. Daily. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.

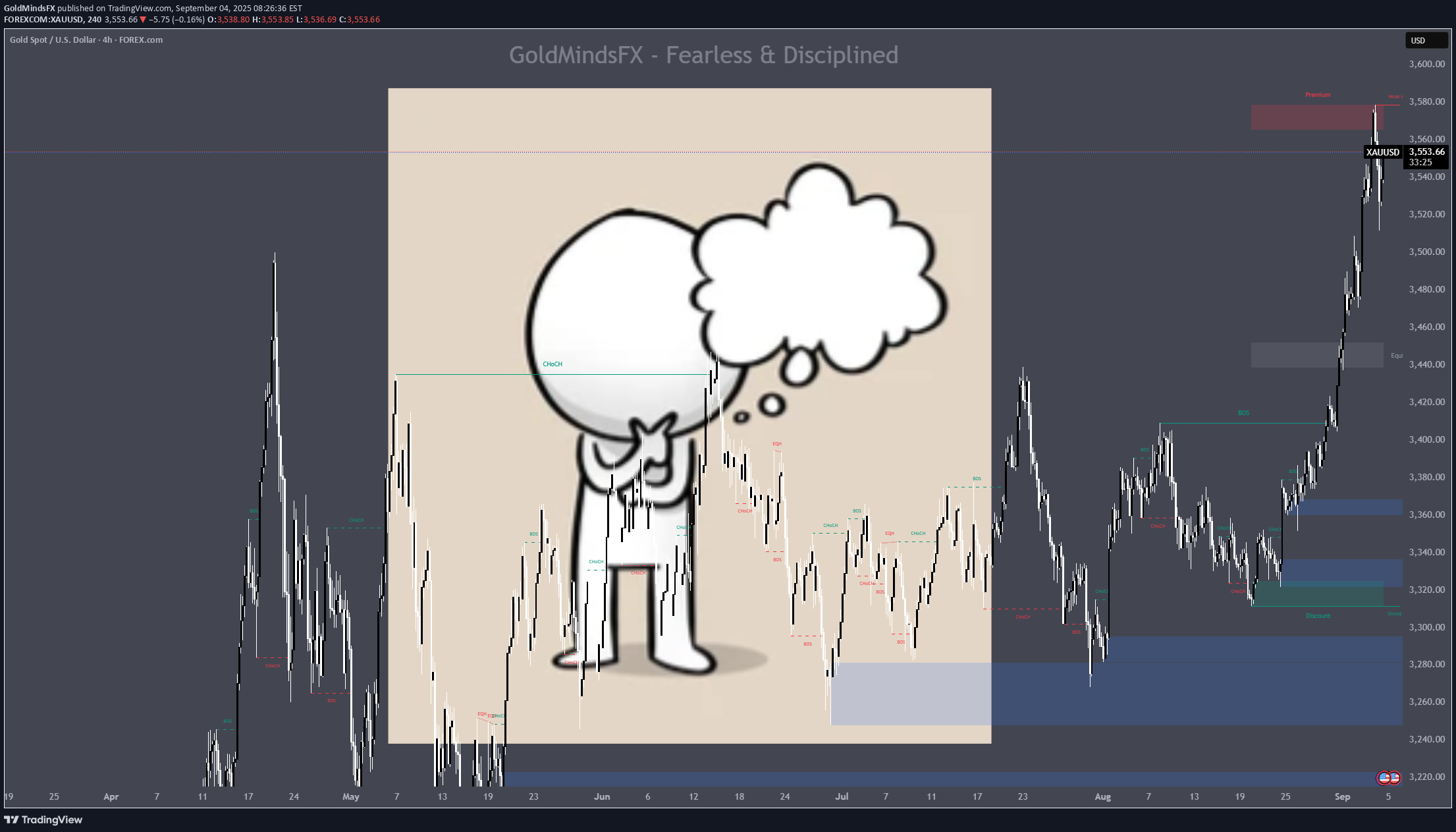

Money, Time and Emotions – The Trio before Balance in Trading

Gurus love to tell traders: “You just need to find your balance.” But to be honest, balance doesn’t exist when Gold just ripped through your stop loss for the second time today, and you do a sneak charts check on your phone while pretending to work. For sure, you are not calm or zen. At least in the first 2 years... more like frustrated, scattered, and asking yourself if this whole thing is even worth it. But you’re not broken. Just carrying the wrong kind of weight, and it usually shows up in three ways combined. ⏳ The Time Pressure Trading doesn’t fail because you cannot read the charts when you put a bit of an effort into it. But your life is already so full. Work, family, bills, endless noise, and you’re trying to squeeze trading into the cracks for the sake of a better financial outcome. So you start chasing candles and force trades into the tiny windows you’ve got. Plus stare at the screen longer, hoping focus & hidden entries will magically appear. But Gold does not bend to your schedule. And that mismatch wrecks your decisions. 🔑Shift: Don’t out-stare the chart. Get rid of some stress levels by: Set alerts near the key reaction zones. Create focus slots. Let price knock on your door by doing homework in advance. 💰 The Money Illusion Every trader has tried it: opening a tiny 200 USD account and hoping it’ll explode into freedom. But pressure makes that account heavier than it really is. Instead of freedom, you get fear. So your clarity goes away. And suddenly every single candle feels like it’s deciding your future. So in the end, that little account gets blown several times. 🔑Shift: Lower the stakes. Trade smaller than you think you should. ALWAYS. Track everything, especially your state of mind, keep a journal, and do not be ashamed to put down some thoughts. The game isn’t about miracles, but making repetition boringly consistent like gym reps. 🐺 The Lone Wolf Spiral The hardest part isn’t the losses but the silence that surrounds when you choose trading. When you do it alone, every mistake feels like proof that you are bad at this in the beginning. Every win feels like dumb luck, or it blinds you further more. There’s no feedback loop, no outside voice to ground you. And that silence eats at you until you are second-guessing everything you do. 🔑Shift: Find real traders to connect with. Not 15 channels and 10 Discords, they will eat your time alive. Not fake hype. Actual humans who talk about process, not just profits. The right community cuts through the spiral faster than any indicator ever will. One group that gives you a direction and you can learn from, or gives you the secrets to the ropes ‘til you catch them. 🧭 And The Good News Is... Stress doesn’t mean you’re doomed. It just means the game is heavy in the wrong places: your time, your money, your isolation. And all three are fixable in time with patience and the right support. Balance isn’t about meditating after a loss, even though that can be good too:) Start building a structure in your daily trading schedule bit by bit. And by putting systems around your weak spots. About letting caring trading mentors who guide you well, in your life, instead of doing all of the thinking by yourself. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.

XAUUSD – Should You Trade the Red News… or Let Them Trade You?

🌟The Hype vs. Reality Every NFP Friday, you’ll see traders flexing $500 to $5,000+ in one candle. But the reality check is that 95% of accounts are blown by spreads, slippage, and whipsaws. News looks like payday, but for the market, it is traps set both ways for retail traders. Why Gold + Red USD News Is a Dangerous Mix XAUUSD reacts harder with momentum than any other Forex pair. NFP, CPI, FOMC, PCE — every release creates engineered chaos. Typical pattern: spike one way → sweep stops the other way → only then trend resumes. Example: NFP prints strong, Gold dumps 100+ pips, sweeps liquidity, then rips 350+ pips bullish with the higher-timeframe trend. 🔴When You Shouldn’t Touch It (Beginners) If you’re still learning structure, stay flat. Here’s why: • Spreads jump 10–30 pips instantly. • SLs get slipped or completely ignored. • First candle is pure manipulation. • Emotions peak → revenge trades blow the account. • Best move: study the reaction and wait for a safe entry, repeat 100+ times X more. 🟢When You Can Consider It (Intermediate Traders) For traders with experience 1year+ on the charts: • Before the release: position based on HTF bias, with very small risk. • After the release: wait for the spike to finish, then take structure-backed entries. Example: CPI prints weak, Gold jumps → once the fakeout clears and structure reclaims, you trade the continuation. 🖊️The Truth Nobody Likes to Hear News doesn’t set the trend; instead, it likes to accelerate the story the chart was already telling. If you can’t trade Gold without news, why would you dream of lying to yourself that an Unemployment Claims would make you instantly rich? Final Note: Trading XAUUSD over Red folder news is not proving catching the spikes. You need to show by sitting put, waiting for the dust to settle, that you trade with structure. Beginners should grab some popcorn, watch it, and study for a while. Intermediate traders can use news as fuel. But if you dive in blind, remember XAUUSD doesn’t care about your trade; most likely, it will feed on it while you are volunteering as liquidity. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.

All Time High, again?!Gold Keeps Climbing & Traders Keep Selling

🚀Gold printed a new all-time high. Last Friday, now Monday and today. You sell. You lose. The minute it pulls back, you try again. Same story on repeat. Thousands of beginner traders are caught in this loop right now. Sell → Stop Loss → Frustration → Sell again because now for sure it will reverse, because it has to... wake up and stop this loop. I. The Mental Bias – Why ATHs Trigger Dumb Decisions The human brain hates “expensive”. Expensive feels wrong to buy, so you try to sell it, forgetting that expensive can get even higher in price. We are wired to hunt bargains, not pay premiums, but Gold at ATH doesn’t follow shopping logic. “I missed the buy, so I’ll catch the drop” is Ego trading, not strategy. People confuse exhaustion candles with reversals. ATHs are not automatic sell signals; they are liquidity traps. Your brain wants to be right, not profitable. II. Why GOLD is Different – It Doesn’t Behave Like Forex Pairs Gold = Safe Haven. It attracts massive capital in global political & economic uncertainty. When XAUUSD breaks ATH, it often does so to induce sellers, not reverse. It will breathe, drop 100 pips, trap more shorts, and rally again. This is by design, due to the fact that the market runs on pain and liquidity. III. So What Should You Actually Do? • Stop shorting just because it’s “too high”. Learn to wait or buy pullbacks. • Don’t trade out of regret. Trade from a solid plan. • Use bias on different time frames from high to low, structural zones and key levels. • Align with HTF bias. Intraday trades should flow with the structure. • Gold gives pullbacks, if you miss them, wait, don’t chase reversals until the fire in price action settles with solid confirmations. 🌟Conclusion to follow: It’s not Gold that destroys accounts, but panic, ego, lack of patience and the absence of structure. XAUUSD isn’t your enemy, but as always your emotions are. Until you learn to keep them in check, trade less and …. Survive ATH season by following the structure and leave moods & fake hopes out of the market. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.

XAUUSD Liquidity Addiction: Why Your Brain Wants to Get Swept

💫There’s a cruel irony in trading: the cleaner a level looks, the more dangerous it usually is. ATHs, equal highs, perfect lows, and round numbers shine like neon signs saying “enter here.” And your brain, wired for safety and clarity, feels drawn to them like a moth to light. The problem? In SMC, those are not safe zones. They’re bait. 1. The Brain Craves Clarity The human mind hates uncertainty. When a chart looks messy, hesitation dominates. But on the show of perfect symmetry, you relax because you see something clear. That relaxation is a dopamine hit, and you get addicted to it. But in the markets, the very thing that calms you down is what sets you up. 2. Trap in Action You’ve seen it before. Price builds a flawless high, traders lean in heavy with sells, certain it can’t go higher — and then Gold rips into new ATHs. The sweep takes them out in minutes. What hurts most isn’t the loss itself, it’s the betrayal. You were so sure and felt safe. And that’s the point: the moment of peak confidence is the moment of maximum exposure. 3. Psychological Addiction This cycle is repetitive for your brain, giving it a fake feeling of safety. Every “almost win,” every daily plan that looked perfect, every friend who caught that one clean breakout — it all trains you to crave the next hit of certainty. You’re not hooked on trading itself but on the illusion of control. The market doesn’t have to be smarter than you. It just has to let your brain do the 'work', then they take a piece of your account with your SL being hit. 📋 Takeaways 1. Spot the bait, don’t buy/sell it → If it looks too perfect, don’t ask “what am I benefiting?” but ask “WHO’s benefiting from this?” 2. Don’t trade the sweep itself → Wait for the reaction & confirmation after liquidity is taken. 3. Flip the perspective → Ask where the trap is being set, not where the bait is shining. 4. Patience is a position → Sweeps only work because traders can’t sit still. 🔑Liquidity does not hunt you. It waits for you to walk in. The moment you stop chasing certainty and start chasing context — structure, reactions, and intent — the game changes. The 'traps' and 'baits' are in plain sight, so they cannot fool you so often. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.

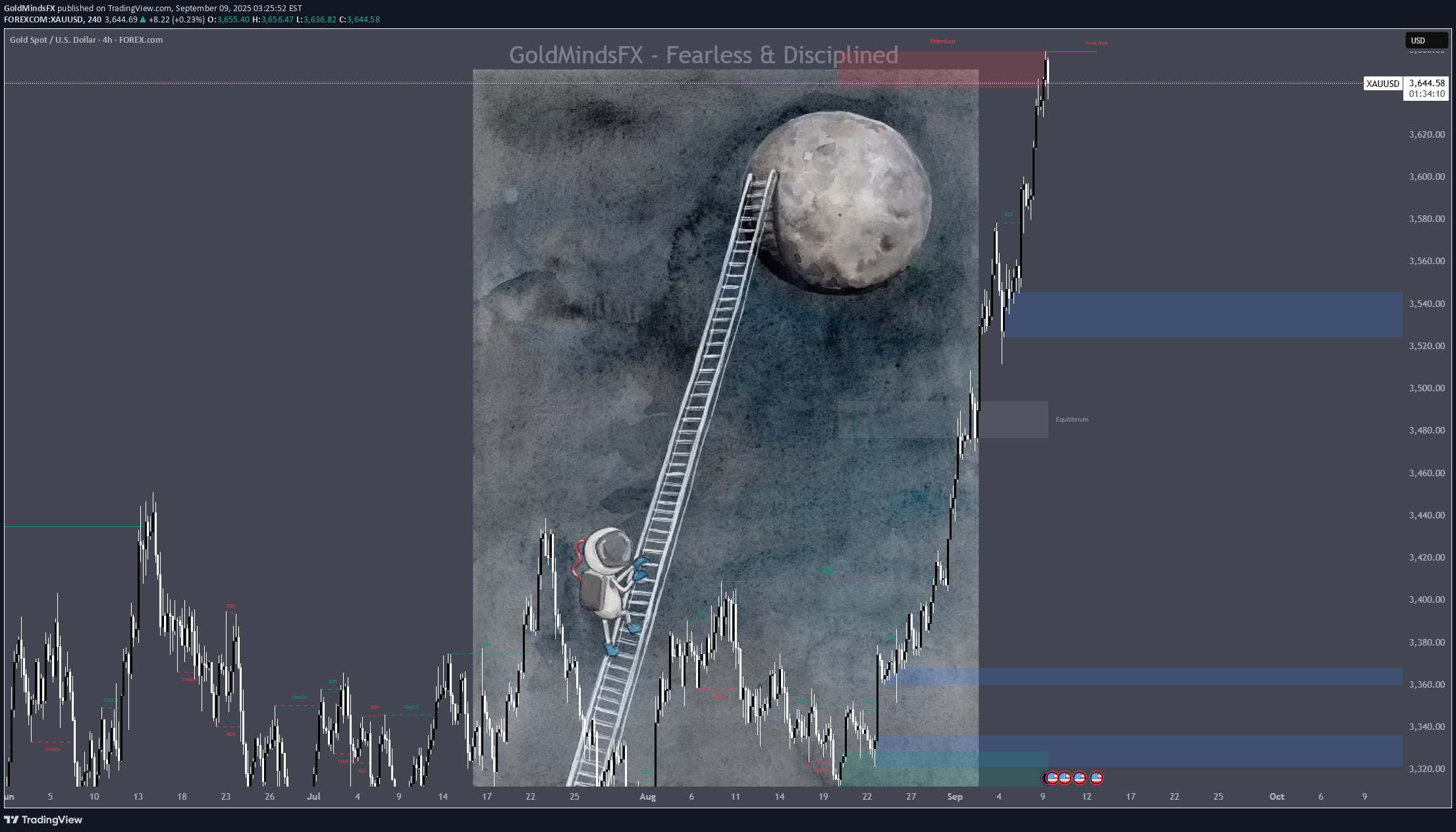

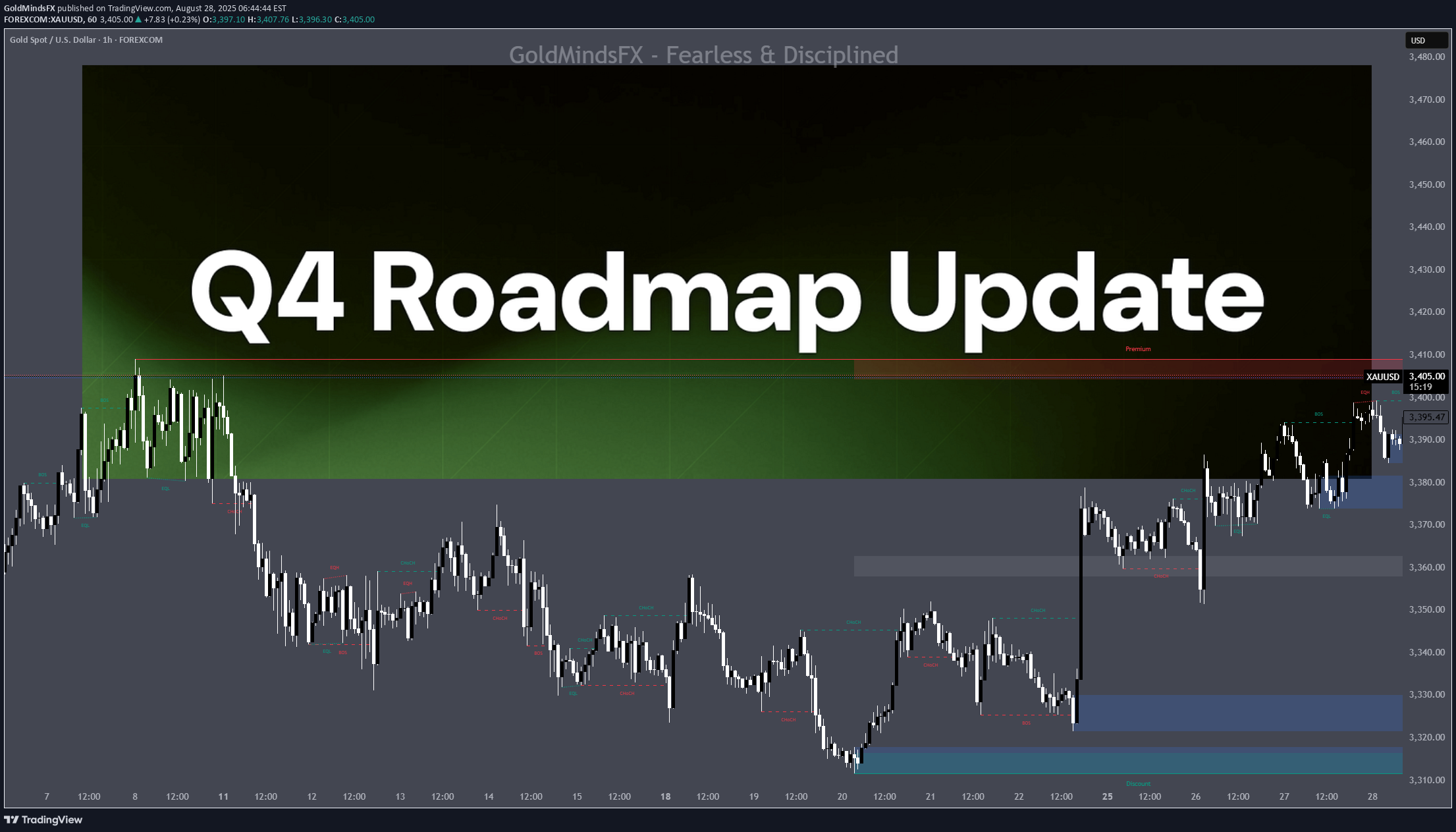

XAUUSD Q4 is Coming; September Reset for Gold Traders

Summer is leaving its mark already. For some, it’s the heat of missed trades. For others, it’s the frustration of chop: false breaks, liquidity traps, the kind of price action that tests your patience more than your strategy. Another batch of traders comes back refreshed from their holidays... But every year, like clockwork, September arrives. And this month is different. It’s the reset button. Liquidity returns as big players come back from summer. Volumes rise. Market makers shift gears. What looked like a bit of chaotic moves in July and August begin to make sense in September, because the context changes. 1️⃣ Why September Matters Think of it as the gateway to Q4. It’s not just “another month”, but the bridge between the summer ranges and the final push of the year. • Institutions reposition. • Central banks set the tone for year-end. • Physical demand from India and China accelerates into festivals and holidays. This is when the market stops drifting and starts building direction. 2️⃣ Q4: The Final Act October to December is rarely quiet. It’s when portfolios get rebalanced, reports closed, and big narratives find their conclusion. For Gold, Q4 often means: • Volatility with a purpose. Not just random spikes, but moves that make a mark. • Trends that can define the whole year. One or two big swings can make all the difference. • Liquidity sweeps early, momentum later. September often tests both sides before revealing the path. 3️⃣ The Psychology of the Season This is where traders win or lose more in their minds than on their charts. • Patience over FOMO. September rewards those who wait for clarity. • Confidence over ego. Don’t chase every move to “make up” for the passed summer. • Preparation over reaction. Mark your levels, define your risk, and let the market come to you and your reaction zones. It’s not about catching the first candle of the move. It’s about being ready for the real trend when it reveals itself. 4️⃣ How to Prepare • Treat September as a filtering month. Don’t overtrade; study how XAUUSD reacts around key liquidity pools. • When October–November come, be ready to scale into clean moves. • In December, remember that thinner liquidity can still hide powerful setups — but choose them carefully. ✨ A Note for Serious Traders The edge isn’t in chasing signals, it’s in building structure and a sure plan with a few great trades/week. Every trader stepping into Q4 should have: • A clear bias based on higher timeframes, then move to the lower ones. • Defined key levels & reaction zones marked in advance. Do your homework on the charts. • Discipline to avoid impulsive trades and wait for price to come to the plan. That’s how you survive September and thrive in Q4. Outlooks and daily bias updates — when done properly — bring in good/great results and fewer SL. Let's get ready for XAUUSD fall trading! If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology.

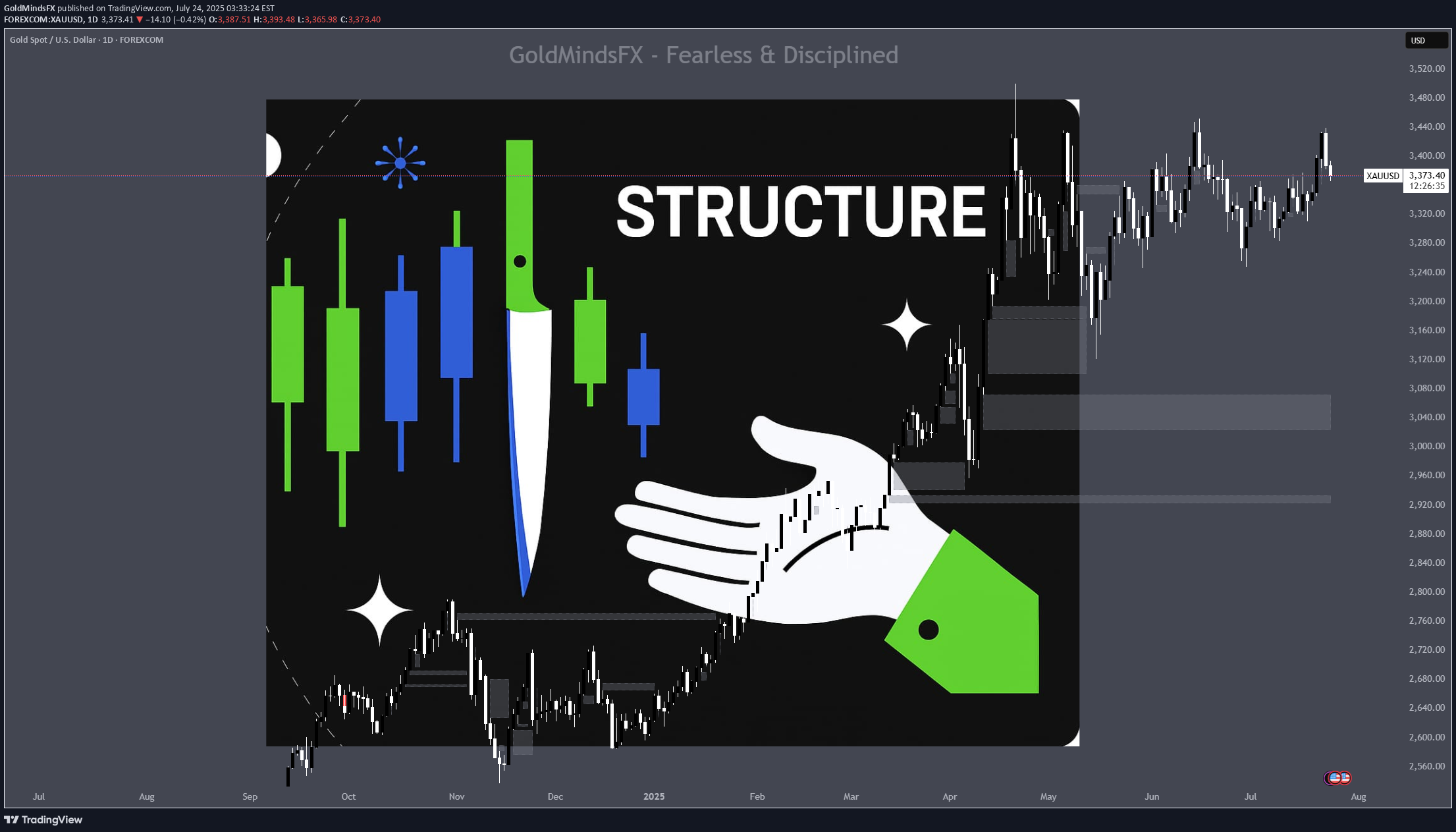

The Myth of Gold Reversals – Why Traders Keep Catching the Knife

Gold is a master of deception. It shows a clean wick into a zone, but reacts just enough to pull in early buyers or sellers — then rips straight through their stops like they weren’t even there. The reversal looked real and the candles seemed perfect. But the move? It was never meant for them. This isn’t bad luck, but traders who survive aren’t trying to guess, they are the ones reading the reaction after the trap. Let’s break down how these traps happen — and how Smart Money actually operates when XAUUSD is loading a real move. 🟥 Sell Trap – The "Instant Short" Mistake Price pushes up into a clear reaction zone — maybe an OB, maybe an imbalance, a FVG, or a gap. Structure looks stretched. Traders recognize a premium zone and decide it’s time to short. The trap? Jumping in immediately on the touch, with no confirmation. This is where Gold loves to trap sellers. No M15 CHoCH/ BOS on M5 or real liquidity swept. Just a blind move and hope. Price often pulls slightly higher — sweeping internal liquidity, triggering SLs — then shows a real rejection. 📌 Here’s what needs to happen before selling: • First: look for a liquidity sweep (equal highs or engineered inducement) • Then: price must shift — CHoCH or BOS on M15 or M5 • Finally: confirmation via bearish engulf, imbalance fill, or break + retest • For experts: M1 can offer refined sniper triggers with minimal drawdown 💡 If none of this appears, it’s not a setup — it’s a trap. 🟩 Buy Trap – The "Wick Bounce" Illusion Price taps a demand zone — again, a refined OB or imbalance, liquidity zone. A long bullish wick forms. Some candles pause. It looks like a reversal. But there’s no shift.Just hovering. Many jump in long the second they see the wick. And then price breaks straight through. 📌 Here’s how to flip this trap into a real buy: • Let price sweep liquidity below the zone — signs of a purge - true wick bounce • Watch for a CHoCH or BOS on M15, M5, or even M1 • Look for a strong bullish engulf from the reactive level • Confirm via imbalance fill or price reclaiming broken structure 📍 If all that happens — the trap becomes your entry. If not? Stand down. 📊 What Smart Traders Actually Do Differently They don’t chase wicks. And never enter just because price tapped a line. IT IS ALL ABOUT READING STRUCTURE AND PRICE ACTION. Here’s how: • Mark the highest probability reaction zones — above and below current price; • Set alerts, not blind entries; • Wait for price to come into their zone and then watch what it does there; • Look for confirmation: CHoCHs, BOS, engulfing candles, FVG fills, clean rejections; • And always keep one eye on the news — because Gold reacts fast and violently when volatility hits. • Repeat this work daily until they learn how to recognize signs faster and more secure. That’s the difference between chasing the reversal… and trading the move after the trap. Because in this game, patience isn’t just a virtue — it’s survival. And Gold? Well, XAUUSD has no mercy for those in a hurry and not studying its moves day by day, month after month and so on. Learn structure and price action even if you join any channel for help if you are serious about trading this amazing metal. If this lesson helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology.

GOLD - The One That Survived All Ages - Trading Psychology

Summer light reading between trades💫From Ancient Gods to modern banks — Gold never needed marketing to be priceless.Gold was never invented.It was found, worshipped, stolen, buried, and bled for.Long before charts, before forex pairs, before brokers — it was power.So if you're wondering why this metal moves the world?Let’s take it back — way back.But before we dive into history, here’s why traders are addicted to XAUUSD:It’s fast. Ruthless. Liquid. It can deliver a week’s profit in one candle — or wipe you out in seconds.If you understand structure, it will reward you like nothing else.If you’re lazy, impulsive, or just guessing?It’ll humble you fast and without mercy. The Discovery – Gold Before Currency • Gold was first discovered in Paleolithic caves (~40,000 B.C.), admired purely for its beauty. • Ancient Egyptians called it “The flesh of the Gods” — Pharaohs were buried with it, because in their mind, you couldn’t enter the afterlife without gold. • No value was assigned — it simply was value. Empire Fuel – Gold as the Engine of War • The Roman Empire used Gold Coins (Aureus) to expand its reach. • Spain and Portugal built fleets just to steal it from the Americas. • Entire wars were started and sustained by it — Gold wasn’t a luxury; it was national survival.Gold & the Banks – Trust in a Metal • 1816: The UK made Gold its official standard. • By the early 1900s, most major economies followed — every currency was tied to the physical rulling metal . • Why? Because you can’t print trust. But you can weigh it. • Even today, central banks don’t hoard crypto or tech stocks — they hoard Gold, quietly, relentlessly. Collapse, Rebirth, and Chaos – The Modern Era of Gold • 1971: U.S. President Nixon kills the gold standard.➤ Until then, every dollar had to be backed by real gold in U.S. vaults.➤ After that? Dollars became promises, not assets. • Welcome to the fiat era — where money has no anchor, just hope. • Gold, no longer “money,” became something more powerful:➤ The panic button, the global fallback, the last honest asset when everything else crumbles. • And crumble it did:🔹 2008: Banks collapse — Gold soars.🔹 2020: Global lockdown — It explodes.🔹 2022–2024: War, inflation, debt ceilings, de-dollarization — Gold reclaims the throne.When fear wins, this metal doesn’t blink. It rises. From Ancient Tombs to 2025 – Gold’s Unshakable Throne • Today, you stare at candlesticks.You mark order blocks, gaps, and key level zones.But beneath that technical setup is a story written in blood, empire, and survival. • Gold has outlived Kings. Outlasted currencies. Outsmarted every attempt to replace it.You can crash a stock. You can ban a coin.But you can’t cancel this number 1. • And now? It’s 2025.The world is uncertain. Digital assets are volatile.And Gold is still the most traded, most hoarded, most feared asset on Earth. • You’re not here by accident. You chose to trade this beast — not because it’s easy, but because you know what it means to master chaos.So you’re not trading a metal.You’re trading a legacy, so pay respect.Every setup is a whisper from history — and every move on Gold is just the past repeating itself…Only this time, the empire isn’t outside.It’s YOU.And your chart is your battlefield. So make an effort and study XAUUSD before trading it.If this lesson helped you today and brought you more clarity:Drop a 🚀 and follow us✅ for more published ideas.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.