Technical analysis by GoldMindsFX about Symbol PAXG on 10/22/2025

طلای ۱۹۷۹ در برابر ۲۰۲۵: آیا تاریخ تکرار میشود و طلا سقوط میکند؟

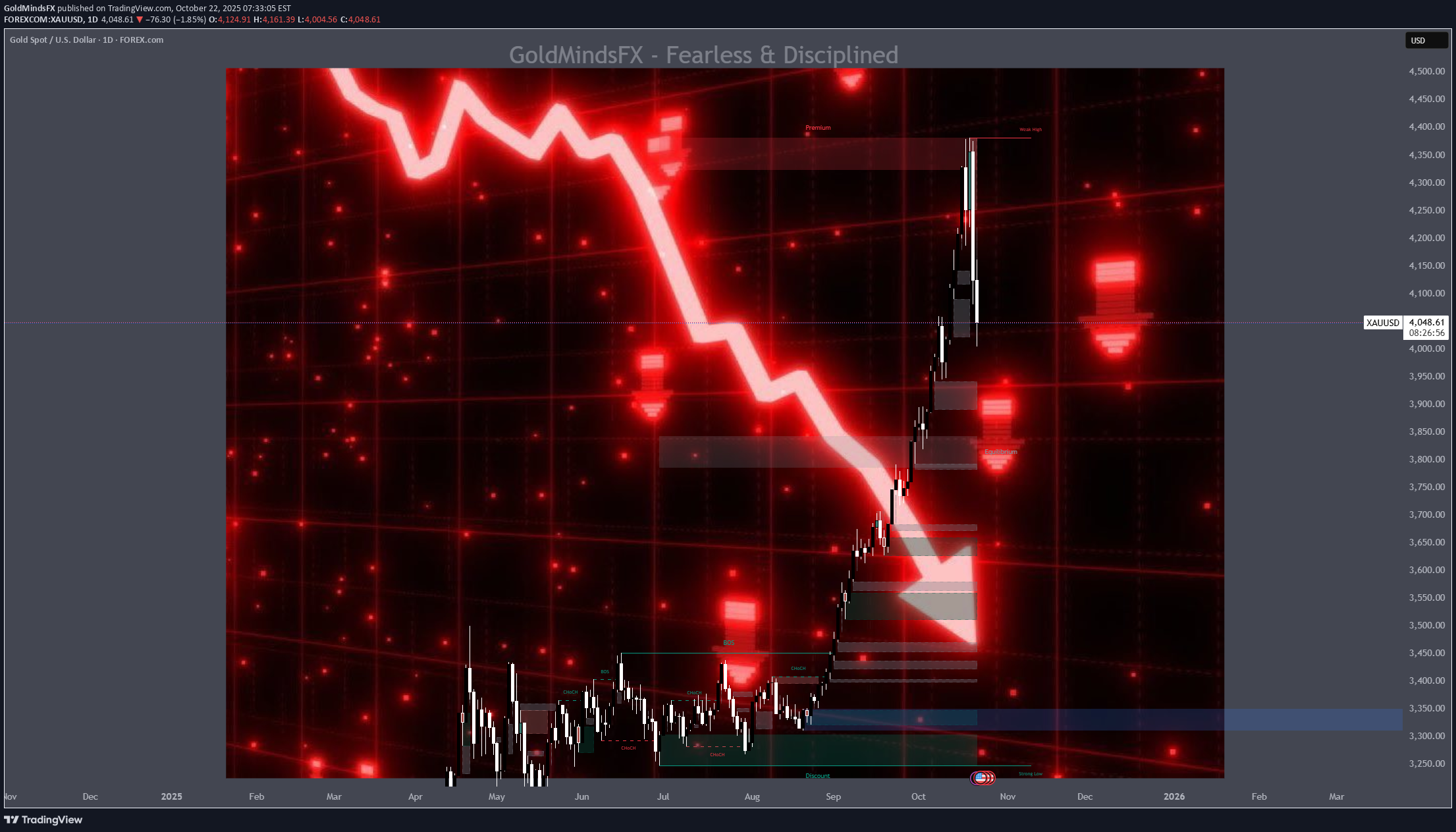

🌕 1. The Echo of 1979 In 1979, the world watched Gold do the impossible. The metal surged from $226 to over $850 per ounce in less than a year, a 275% explosion that turned fear into fortune. The triggers were seismic. 🇮🇷 The Iranian Revolution disrupted global oil flows. 🏛️ The U.S. Embassy hostage crisis fueled geopolitical panic. ⚔️ The Soviet invasion of Afghanistan reignited Cold War fears. 💸 And double-digit inflation in the U.S. shredded faith in the dollar. By early 1980, panic replaced logic. Every newspaper screamed, “Buy Gold before it’s too late!” Then came Paul Volcker’s shock therapy as interest rates jumped above 15% and COMEX doubled margin requirements. Within eight weeks, Gold fell more than 40%, marking the end of one of the most dramatic speculative manias in modern history. 🔁 2. Fast-Forward to 2025: The Parallels Are Uncanny The world of 2025 looks hauntingly similar. 🕰️ 1979 🔮 2025 Iranian Revolution and Cold War tensionsGaza war, U.S.–China decoupling, and regional instability Oil shock and inflation Energy disruptions and persistent post-pandemic inflation Dollar under pressure Record U.S. debt and fiscal erosion Panic buying of Gold Central bank accumulation and retail FOMO Fed under Volcker turns hawkish Fed under Powell trapped between cuts and control By late August 2025, gold sat quietly near $3,415, then erupted into a seven-week vertical rally above $4,300, a mirror image of 1979’s euphoric climb. But just like back then, euphoria was the prelude to exhaustion. ⚠️ 3. The Anatomy of the Current Crash On October 17, 2025, Gold plunged $250 in one day, a shocking 5–6% drop that broke its parabolic structure and sent fear rippling across markets. What triggered it? 🏦 A hawkish shift in the Federal Reserve’s language as officials hinted rate cuts might be delayed. 💰 Real yields surged, breaking the inverse correlation that had fueled gold’s climb. 🏛️ Institutional profit-taking hit record levels, confirmed by rising COMEX open interest and volume. 🗞️ Sentiment flipped overnight as headlines shifted from “Gold to $5000” to “Gold crashes $250.” The move marked the first true break of structure (CHoCH) since the rally began, historically the signal that smart money is quietly exiting. 🔍 4. Lessons from 1980 — The Signs of a Top Before gold crashed in 1980, five clear warning signs appeared. ⚙️ 1979–1980 Signal 💡 2025 Equivalent 🧭 Status Fed turns hawkish Powell signals “pause / higher for longer” ⚠️ Emerging Rising bond yields vs. flat GoldReal yield divergence ✅ Confirmed Parabolic candles Daily range above $100 ✅ Seen Media frenzy “Gold to $5000” hype ✅ Seen Margin hikes and record OIRecord COMEX participation ⚠️ Rising Four out of five signals are already flashing. History teaches that when everyone believes Gold can only rise, it’s often about to fall. 🧭 5. What Smart Traders Should Do Now 🟡 Phase 1 – Immediate Protection (Next 24 Hours) If you’re long, secure 50–75% of gains and protect above $3,950. If you’re short, trail stops to $4,200 and look for targets at $3,950 → $3,800 → $3,600. If you’re flat, stay patient and wait for at least two daily candles of stabilization before acting. 🟠 Phase 2 – Stabilization (Next 3–5 Days) Watch for: 🕯️ Long lower wicks on daily candles show buyer absorption. 📉 Shrinking COMEX volume indicates exhaustion of sellers. 📊 Flat or falling real yields confirming support. 🔵 Phase 3 – Re-evaluation (Next 1–2 Weeks) If gold reclaims $4,000+ with strength and Fed tone softens, a controlled re-rally may begin. If Gold stays below $3,800, the correction likely extends toward $3,500, the same 30–40% retracement seen in 1980. 🧘♀️ 6. Beyond the Chart — Discipline Over Drama When a $250 candle appears, instincts scream, “Do something!” But professionals know the truth: reaction destroys capital, observation preserves it. The coming days are not about prediction but about posture. Stay liquid, track sentiment, watch real yields, and remember that even in 1980, Gold’s crash didn’t end its story — it simply reset the cycle for the next era of accumulation. ✨ History doesn’t repeat, but it rhymes. In 1979, Gold taught us that fear creates bubbles. In 2025, it’s reminding us that even truth needs a pullback before it shines again. If this article helped you today and brought you more clarity: Drop a 🚀 and follow us✅ for more trading ideas and trading psychology. Thank you.