Technical analysis by GoldMindsFX about Symbol PAXG on 11/3/2025

تناقض طلای نوامبر: قدرت مورد انتظار در برابر سردرگمی جهت بازار

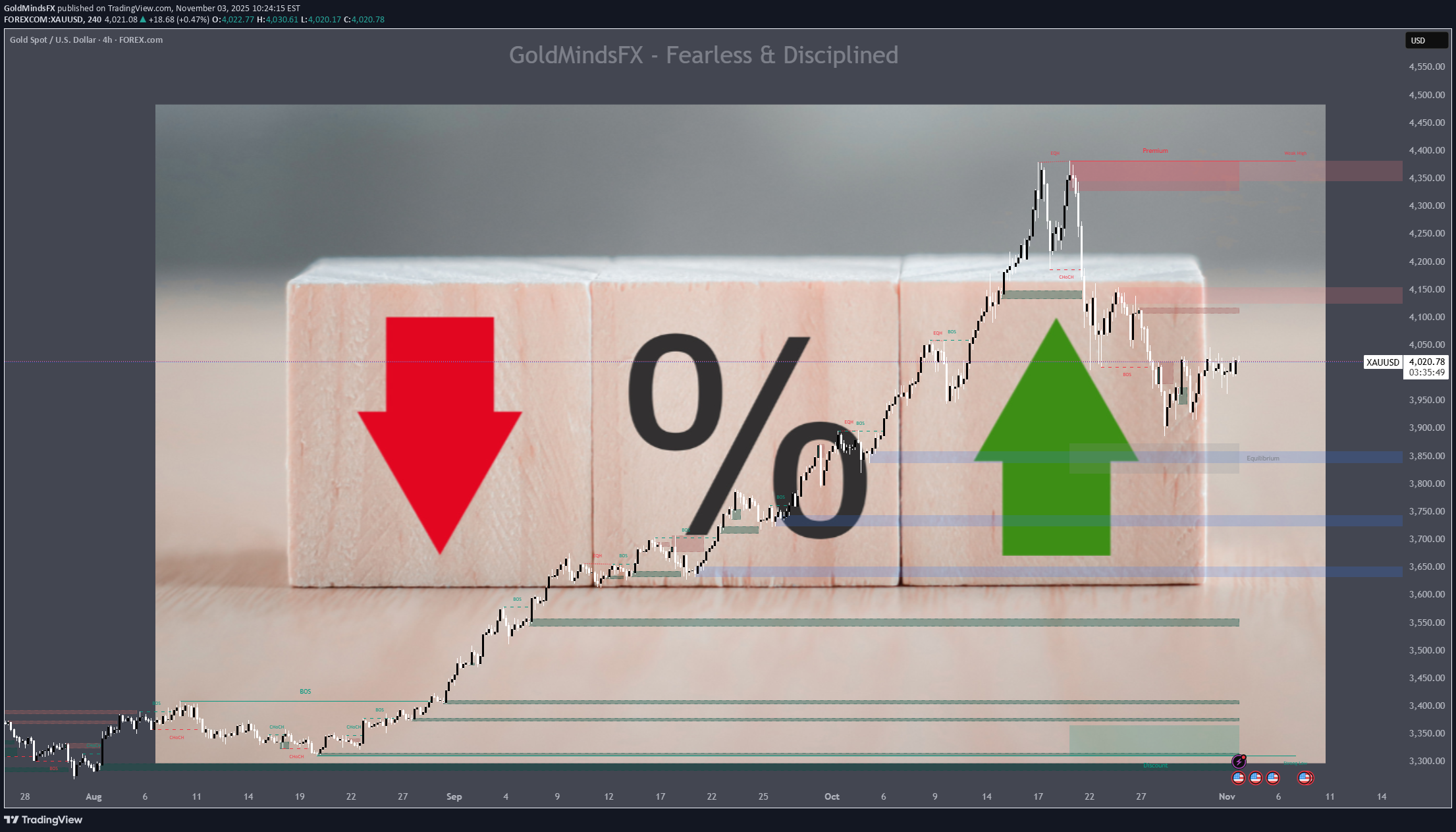

🍂 November typically brings seasonal bullish moves for Gold; demands from India and China, central bank interest, and safe-haven flows as the year winds down. ⭐But November 2025 opens with hesitation, not momentum. October closed with fresh all-time highs, followed by a sharp end-month correction that broke short-term structure. Now, Gold begins November range-bound, lacking both clarity and fundamental conviction. Contributing to this indecision is the U.S. government shutdown, which has delayed critical economic data. Without jobs reports or inflation metrics, the Fed has no updated visibility and traders are left without macro confirmation to support directional conviction. While shutdowns often support Gold as a safe haven, the current blackout has instead amplified uncertainty. 🔹 This first week already carries weight: ISM Manufacturing PMI on Monday (negative for Dollar as of recent release) and ADP Employment on Wednesday; two of the few confirmed releases still standing despite the shutdown. They could offer short-term directional clues if volatility aligns with structure, but just as easily trigger reactive spikes that fade within hours. Either way, the message is the same let structure confirm before conviction takes over. Until that changes, structure not sentiment is the only valid guide. 📚 November’s Setups in Disguise Gold is trading November more in anticipation. Because the market isn’t lost, but simply waiting for structure to confirm direction. Our metal is moving between defined zones, reacting level to level, not to headlines or speculation. For now, price is holding inside a decision area, no breakout yet and that telling us to be patient. Here’s the paradox: → If Gold begins to rally this month, the whispers of an early Fed pivot will return. Risk appetite expands, and momentum traders chase continuation. → If it sells off, those same expectations get priced out. The safe-haven flows unwind, and bearish narratives resurface. → But if Gold simply stays trapped in a wide, reactive range both buyers and sellers become liquidity for one another if they do not pay attention. And that’s the part most traders miss. November is a preparation month. Volatility without confirmation is dangerous. → Read the structure, not the headlines. → Trade the reaction, not the assumption. → Focus on your system, not the noise. Clarity will come, but maybe not in the first week. ⚖️ The Mindset Shift This Market Demands Beware this not the Gold environment we were trading even two months ago. We’ve entered a phase where volatility has changed: one-minute candles can travel 200+ pips, and price can sweep both sides of structure in minutes. Volumes in a day can exceed 2000+ pips. 🔹 Think in wider zones, not narrow scalps. High timeframe levels — like H1/30M and H4 — are providing more stability in these volatile conditions. Entries defined there, confirmed on M15 or M5, are showing better follow-through. 🔹 Consider reducing your lot sizes. Not as a rule, but as a response to the increased range and unpredictability. What worked with older volatility may now lead to outsized losses in the blink of an eye. 🔹 Let go of urgency. This isn’t about catching every move. In fact, the best setups in this market come from not chasing, but letting structure unfold first. 1 good setup/day is more than enough. 🔹 Trade with the trend first — countertrend only with caution. The current volatility makes every retracement look like opportunity, but most reversals are just liquidity sweeps. Until structure confirms a real shift, fading moves is riskier than riding them. XAUUSD has changed pace again. And the traders who are adapting ,without needing to predict ,are the ones who’ll stay in profit in this cycle. This November isn’t a month for bold predictions, so let’s trade what’s real, adjust often, and survive cleanly into December, with capital and clarity intact. If this article gave you clarity for the weeks ahead, drop a 🚀 and follow us ✅for Trading Psychology articles and daily ideas.