FaithdrivenTrades

@t_FaithdrivenTrades

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

FaithdrivenTrades

Jobs Weakness, Fed Cuts, and Geopolitical Firestorms

What Fired Gold Up Last Friday Last Friday, gold spiked unexpectedly — because Powell’s speech was a bullish shocker. The FOMC hadn’t signaled a shift, inflation was still higher than unemployment… but then Powell dropped that line about employment needing repair, not inflation being the bigger worry. He basically winked, saying a rate cut may be coming, but cautiously. That had markets scrambling—and gold jumped Weekend Headlines That Could Shift the Deck Israel airstrikes in Sanaa, Yemen Israel targeted power plants, a military site near the presidential palace, fuel storage—and amid intensified Houthi attacks, killed at least 2 and injured dozens. Critical infrastructure and geopolitical risk ratchet up. Powell says Fed may need rate cuts—but will proceed carefully Fed chief sees rising job-market risks but wants to act only if necessary. Market now pricing in high odds of rate cuts before year-end. Pentagon planning military deployment in Chicago amid Trump crackdown Thousands of Guard troops could roll in by September, with active-duty forces on the table. Local leaders slam it—no request, no crisis. Has shades of federal overreach, potential market distraction So what does this do to gold? Powell’s dovish tone keeps the bullish bias intact. Employment fragility + potential cuts = gold’s friend. The Middle East strikes inject fresh geopolitical volatility—another tailwind for a haven like gold. Alright, we've got the wind at our back—Powell easing talk + geopolitical flare-up. If you’re riding long, at least set a stop below the recent low. And ask yourself: what’s your exit if the labor data surprises? If it tightens, gold could retract fast. That’s our risk. Stay awake, not dreamy

FaithdrivenTrades

GOLD BULLISH OUTLOOK – Macro Reasons Aligning

I'm still optimistic about Gold heading higher based on the following key macro factors: 🟡 1. USD Weakness Incoming Markets are aggressively pricing in rate cuts by the Fed, with 50bps of easing expected by year-end. A weaker dollar typically supports gold upside. 🟥 2. JPY Under Pressure from Tariffs The U.S. has imposed 25% tariffs on Japanese goods and is now threatening an additional 15%. This weakens the yen, pushing safe-haven demand toward gold instead. 🇬🇧 3. GBP Set for Rate Cuts The Bank of England is on the verge of cutting rates—possibly as early as this month—due to slowing economic momentum and rising risks. This puts pressure on the pound and further supports gold. 🧠 Bias Summary: ✅ Gold supported by global central bank easing cycle ✅ USD, GBP, and JPY macro vulnerabilities boosting demand ✅ Real yields expected to soften = bullish for non-yielding assets like gold

FaithdrivenTrades

XAUUSD & US500 Technical + Fed Commentary

Today’s FOMC event delivered no clear forward guidance on rate cuts — and markets aren’t buying the dovish narrative yet. 🔹 Fed's Mary Daly earlier emphasized patience, saying “we can’t wait forever”, but also acknowledged softening in the labor market. No urgency to cut now. 🔹 The Fed is split — but traders hoping for a preemptive cut may be too early. 🔗 Correlation View: 📍 Gold (XAUUSD) Still respecting the rising channel and reacting off resistance near Monday high and local supply. If FOMC remains neutral and yields don’t fall, we may see a fade down toward support levels around 3,349 or even 3,333 in the coming sessions. 📌 Watch for rejections below 3,380 — could signal lower move ahead. 📍 US500 (S&P Futures) Fibonacci confluence at 6,346 lining up with structural resistance. Bulls need a strong breakout above that to flip sentiment. Otherwise, we're just retracing last week’s downside leg. 🎯 If equities reject and drop → could pressure gold lower too (risk-off + strong dollar). 🧠 Key Takeaway The FOMC is not confirming any cuts just yet. Don’t trade the pivot dream until price confirms it. Let structure guide you.

FaithdrivenTrades

Fed Watch: Soft Labor + Weak Data = Growing Cut Odds

San Francisco Fed President Mary Daly said the U.S. job market is slowing but not dangerously weak. She’s okay with waiting another month to cut interest rates but warned the Fed “can’t wait forever.” She’s still unsure about a September rate cut, but markets took her words as a sign that a cut is likely. Daly also said tariffs aren’t causing long-term inflation problems. At the same time, U.S. data like ISM Services PMI and retail sales showed weak signs in consumer spending and services. Overall, this supports a moderately dovish outlook, meaning the Fed is slowly moving toward cutting rates, possibly in September. Labor market is cooling, but not crashing → softens their tone. Inflation is slowing, but not yet at 2% → keeps them from rushing. Fed speakers (like Daly, Williams) are open to cuts but not in a hurry, still watching data. Markets are pricing in an ~80% chance of a 25bps rate cut in September, not necessarily tomorrow. This meeting (August) is widely expected to be a hold, but the tone will matter more (i.e., will they hint at cutting in September?).

FaithdrivenTrades

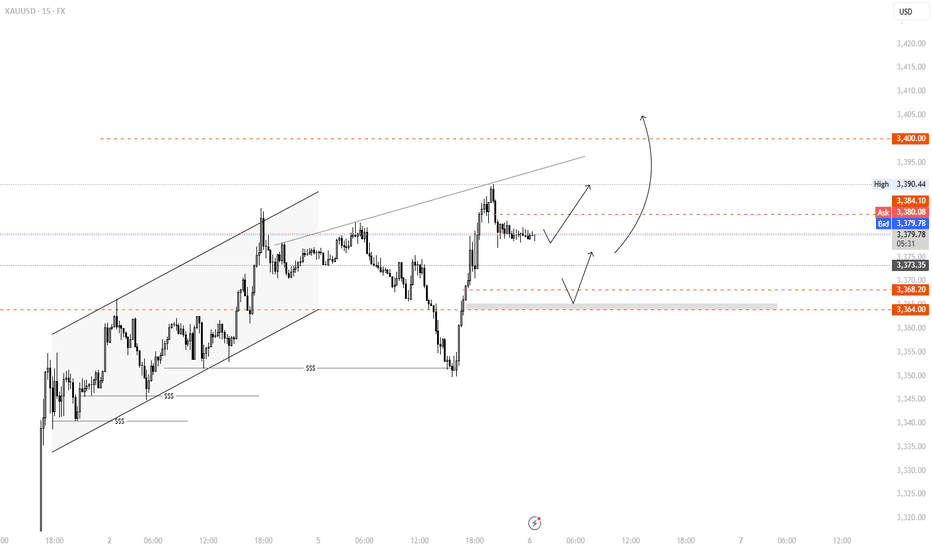

XAUUSD Outlook – Technical Correction Expected Amid Bullish Fund

🧠 Narrative Summary: Gold remains fundamentally supported by: 🇺🇸 US Factory Orders MoM came in at -4.8% (Forecast -4.8%, Previous 8.2%) – a sharp slowdown signaling weaker manufacturing momentum. 🏛️ Markets now price an 80% chance of a 25bps Fed rate cut in September. 🧑💼 Fed Governor Adriana Kugler’s resignation opens the door for a dovish replacement (possibly by Trump). 🔥 Trump reportedly fired the BLS head over “data manipulation” accusations – raising data credibility risks. 📈 COT data shows speculator sentiment above 50%, confirming a bullish stance. ☑️ All signs point to a supportive macro backdrop for Gold. 🧪 My Bias (Short-Term View): Despite the strong bullish macro backdrop, I’m watching for a short-term technical correction today (Tuesday): “Markets often react in advance of data – and after such a strong run, a liquidity grab or pullback could create better entry zones.” 📉 Technical Breakdown: 🔹 15-Min Chart: Price is hovering near point of control/resistance, forming potential distribution. Clean bullish channel, but upside momentum is slowing. 🔹 4H Chart: Price has reached the upper edge of the descending channel. No proper retest on the lower channel → room for liquidity sweep below. RSI nearing overbought zone. 🎯 Trading Plan: Watching for a short-term sell-off / correction during Tuesday’s session. Will reassess based on Wednesday’s ISM Services & Fed speaker lineup. Not chasing highs — waiting for potential re-entry from discounted zones. 📌 Powell Watch: Despite dovish pricing, remember — Powell has held firm for months. One weak report may not be enough to guarantee a cut. “Slow to hire, slow to fire” still equals a balanced labor market.

FaithdrivenTrades

Trump Policy Shock & Fed Cut Buzz Ignite Gold

🔥 Fundamental Drivers 📢 Trump Tariff Announcements (via Truth Social & WH releases): 25% tariffs on Japan and South Korea effective August 1. Targeted retaliatory threats for BRICS-aligned nations. Executive orders signed and trade letters sent. ➡️ Market reads this as risk-off & inflationary = Gold strength. 📉 Goldman Sachs Predicts Early Fed Rate Cuts: Fed terminal rate cut forecast lowered to 3.3-3.25%. Cuts expected to begin as early as September, citing: Softening labor data Weakening inflation trajectory ➡️ Rate cut bets weaken USD = gold demand spikes. 🧊 DXY Reaction: Dollar Index cooled after initial rise — confirms market shift away from USD haven toward gold hedging.

FaithdrivenTrades

Gold’s Last Push

🧠 MACRO OUTLOOK FOR GOLD 1. 📉 Central Bank Rate Sentiment (Macro Risk Bias: Neutral to Bullish Gold) Central BankMeetingProbable MoveCut ProbabilityHold Probability FedJul 30Hold4.7%95.3% ✅ RBAJul 8Cut94% ❗ BoEAug 7Cut80.8% ❗ ECBJul 24Hold9.3%90.7% ✅ BoCJul 30Hold26.5%73.5% ✅ RBNZJul 9Hold16.9%83.1% ✅ ✅ Most majors (Fed, ECB, BoC, RBNZ) are expected to hold — gold-friendly ❗RBA and BoE rate cuts ahead — mildly bullish for gold 2. 💸 FED CUT PROJECTION (Through End of 2025) Jul: 93.3% chance to HOLD Sep: 73.1% chance of CUT Oct: 55.9% chance of CUT Dec: 69.9% chance of CUT 🟡 Progressive rate cuts expected by year-end, favoring a longer-term bullish trend on gold ⚙️ VOLATILITY & IMPLIED RANGE (XAUUSD) Implied Volatility: 14.09% Range EstimateValue 1SD High3355.38 2SD High3385.78 3SD High3414.87 🔺 1SD Low3267.56 2SD Low3237.73 3SD Low3209.36 ✳️ Key Resistance: 3385–3415 🛑 Key Support: 3237–3209 Current price at 3336.6 sits mid-range, slightly bullish 📰 FUNDAMENTAL NEWS REACTION (NFP & GOLD) DateNFP Actual vs ForecastGold Reaction Jul 3144k vs 126k forecast (Hot) 🔥-200 ticks Jun 6139k vs 126k (Hot) 🔥+36, -104 ticks May 2177k vs 138k (Hot) 🔥-105 ticks 🔴 Gold reacted bearishly to strong NFP — Jobs > Forecast = USD strength → Gold weakness 🔍 MARKET FLOWS (MOC) IndexBuySellNet NASDAQ345M-86M+258M ✅ MAG7113M-41M+72M ✅ S&P 5001055M-1041M+13M DOW 30106M-168M-62M ❌ 🟢 Risk-on sentiment visible from large NASDAQ & MAG7 inflows 🟡 Caution on S&P 🔴 DOW weak This supports a mild bearish pressure on gold short-term due to risk appetite. ✅ CONCLUSION (For Gold Traders) 🔻Short-Term Outlook (This Week): Bearish bias due to recent strong NFPs + net equity inflows Rate cuts are delayed (Fed holding in July) Expect gold to retest 1SD/2SD lows around 3267–3237 if USD strength persists 🔺Mid-Term Outlook (Q3-Q4 2025): Dovish tilt from major banks (RBA, BoE, Fed by Sep-Dec) supports long-term gold upside Key upside potential into 3385–3415 area if dollar weakens and yields drop

FaithdrivenTrades

XAUUSD – Bearish Month?

🧭 Fundamental Bias: Bearish (-7/10) – 🔥 NFP beat: 147K vs 110K → Fed cuts unlikely soon – 💵 Dollar & Bond Yields UP – 📈 Risk-on (Stocks ATH) – 🛢️ Oil dropped = easing inflation – 🏛️ No fresh Fed dovish hints – 🕊️ Geopolitics stable for now (Iran/Trump) 📍 Technical View: Price consolidating under supply zone (~3330).

FaithdrivenTrades

XAUUSD: Possible Pullback Before Major Reaction

🟨 XAUUSD: Possible Pullback Before Major Reaction – Eyes on Reversal Zone FaithDrivenTrades | July 2, 2025 Gold continues its bullish climb toward a possible intraday reversal zone (3371–3380). Technicals show a clean sweep of previous liquidity + bullish candle confirmation on H1. However, the broader fundamental backdrop now tilts toward short-term USD strength due to: 🔻 ADP NFP Miss: ADP: 33K vs 99K forecast Indicates weaker labor market, but Gold's reaction muted due to anticipation of Friday’s NFP and mixed inflation fears. 📊 Oil Inventory Surplus: Crude: +3.845M vs -2.7M expected Suggests soft demand → deflationary pressure → less urgency for Fed rate cuts. 📰 Trump Tariff Headlines: Trump announces new 20%-40% tariffs with Vietnam. Short-term USD pressure on trade uncertainty, but market sees longer-term USD safe-haven appeal. 📉 Fed Cuts Still Priced In (Sept, Dec): CME Fed Futures show 2 rate cuts expected → supports bullish gold structure long-term However, dollar’s resilience from ISM rebound + JOLTS adds near-term volatility 🧠 Market Sentiment Summary: Macro: Mixed → USD Strengthening Short-Term Risk: Sentiment cautious, NFP Friday key Bias: Intraday Bearish Correction Possible, bigger trend still bullish

FaithdrivenTrades

Bullish Bias Backed by Macro, Eyes on CHoCH

Fed rate cut expectations, weak DXY, and deficit concerns support bullish bias. Watching for structural shift (CHoCH) to confirm entry zone reaction. 🔹 Markets continue to price in Fed rate cuts starting September, with odds rising after recent dovish tones and political pressure. 🔹 US deficit concerns resurfaced after CBO warned that the Senate tax bill could add $3.3 trillion, weighing on long-term dollar stability. 🔹 Meanwhile, DXY and real yields remain under pressure, weakening the USD and reinforcing gold’s macro support. 🔹 Gold positioning is clean (net longs trimmed), giving room for upside if momentum returns. 🔹 Despite risk-on equity sentiment, underlying safe-haven flow stays active due to lingering Iran-China oil trade tensions and fiscal risks. 🧭 Current structure favors a bullish retracement or reversal setup. Watch for reaction at upper trendline zone for either continuation or rejection setups.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.