FOREXRSMV

@t_FOREXRSMV

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

FOREXRSMV

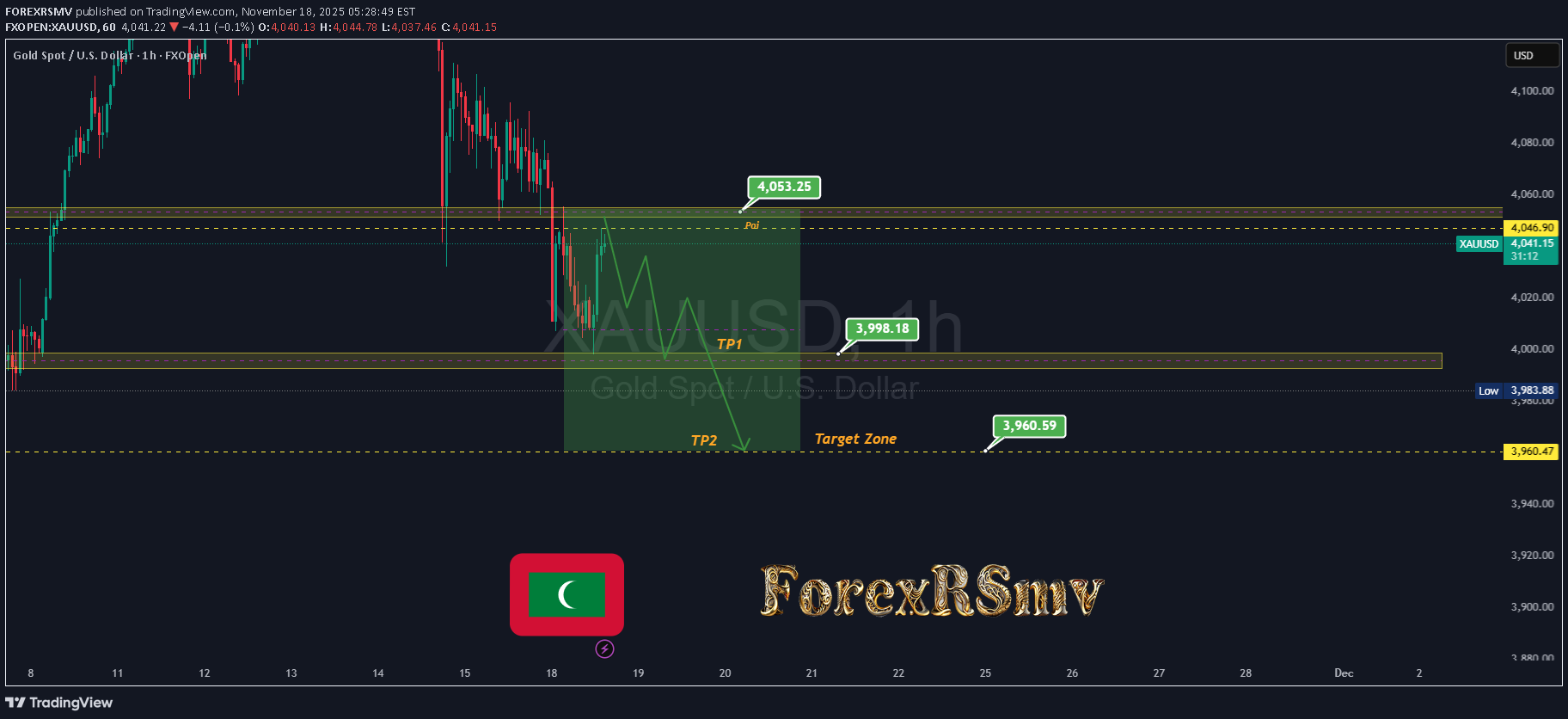

پیشنهاد فروش طلا (XAUUSD): استراتژی دقیق ورود، حد ضرر و اهداف سود احتمالی

XAUUSD SELL Range 4052 4055 Stop Loss (SL 4057): SL at 4057 gives you only a few points of buffer above your entry. That’s quite tight. If price spikes up strongly (momentum surge or a fundamental shock), your SL could be hit quickly. The risk of being stopped out is real, especially if gold breaks upward above that small zone. Take Profit (TP1 3998, TP2 3960): TP1 (3998): This is a decent first target: a drop from ~4055 to ~3998 is a substantial move (~57 points), but not massive in volatile gold. TP2 (3960): More ambitious — this assumes a strong bearish move. For that to happen, you’d likely need a catalyst (for example, strong dollar rally, hawkish Fed, or drop in safe-haven demand). Putting together fundamentals + technicals, here is a possible rationale behind your trade: Mean Reversion from Overbought / Resistance: You may believe gold has run up into a resistance area around 4053–55, and it’s due for a pullback/mean reversion. Macro Risk: Rate Cut Hopes Disappointed / Dollar Strength: If markets start to doubt aggressive rate cuts, real yields could rise, making gold less attractive. A potential dollar bounce could put pressure on gold. Safe-Haven Demand Easing Slightly: If geopolitical risk cools or investors rotate out of gold, there could be a temporary drop. Taking Advantage of Momentum + Technical Structure: You're playing a swing or short-term move where gold re-traces from near-term highs.

FOREXRSMV

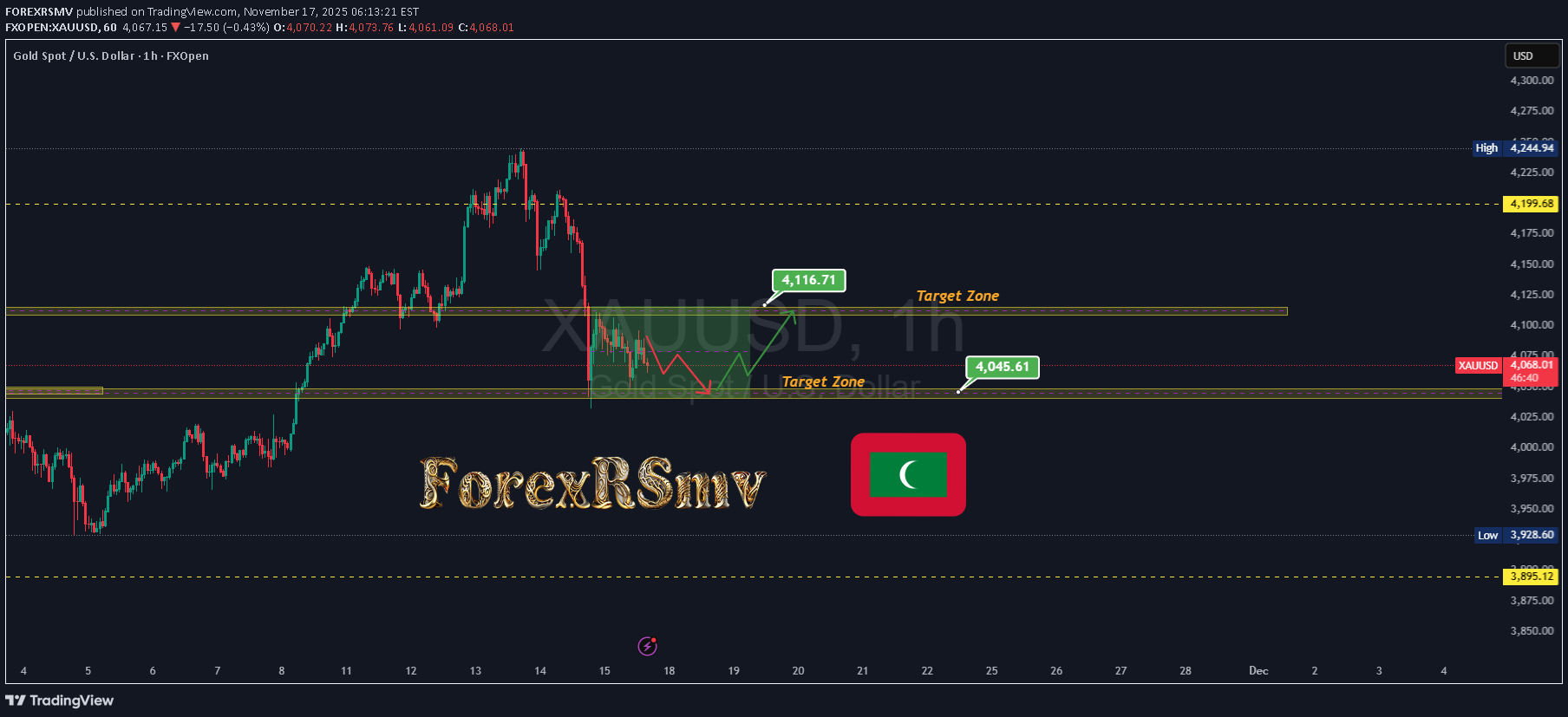

پیشبینی طلا (XAUUSD): منتظر ریزش از مقاومت یا جهش از حمایت؟

XAUUSD Market Analysis Overall Trend: Gold is currently moving in a correction phase after rejecting higher resistance zones. Price is trading within a wide range, creating both sell and buy opportunities. 🔻 Bearish Side (Sell Bias) Key Resistance: 4089 This level is acting as a strong ceiling. Each time price reaches this area, momentum weakens. Sellers are active here because liquidity sits above this zone. Expected Move: If price rejects around 4089, it is likely to drop back toward 4045, the next strong support. 🟩 Bullish Side (Buy Bias) Key Support Zone: 4045 – 4042 This is a major demand zone. Previously, price bounced strongly from this level. Buyers typically wait here for better entry. Expected Move: If price reaches 4045–4042 and holds, a bullish reversal can target 4112, which is the next resistance and liquidity area. 📌 Summary Sell zone: 4089 → Target: 4045 (Market correcting from resistance) Buy zone: 4045–4042 → Target: 4112 (Bullish bounce from strong support)

FOREXRSMV

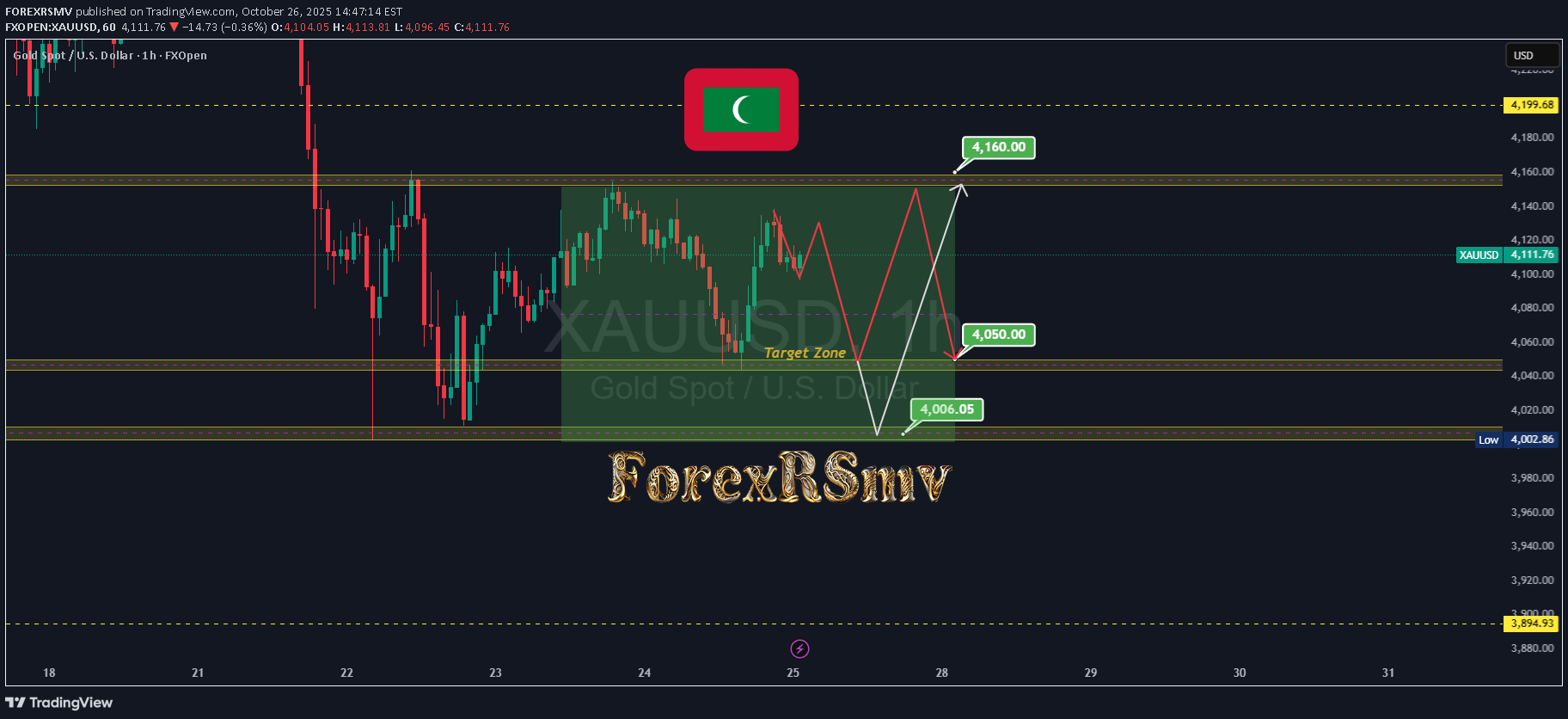

پیشبینی طلا (XAUUSD): استراتژی فروش در محدوده 4160-4018 و نقاط ورود کلیدی

Market Context Gold price (XAUUSD) will move sideways (consolidate) between 4160 and 4018 until November 6, 2025. This means price is stuck in a range not trending strongly up or down and traders are waiting for a breakout (a strong move beyond one side of the range) to decide the next big direction. 📌🔽▶️ Sell Scenario (Your main plan) If the price goes up to 4122 -4125, you plan to open a sell position. You expect the price to drop from there toward your take-profit levels. Entry: 4122–4125 TP1: 4050 the first support area (where price may bounce). TP2: 4018 next key support and the lower end of the range. Logic: You believe sellers will take control again once price fails to stay above 4125. If price breaks below 4050 and stays under it, that confirms a bearish breakout, so you’ll hold the sell to your second target (4018). 🔼🇲🇻 Buy Scenario (Backup plan) If the price fails to break below 4050 and instead bounces back up, it means buyers are still defending that support zone. Then you’ll switch your plan: Buy Entry: near 4050 Target: 4122–4160 (the upper side of the consolidation) Logic: You expect the range to continue, with price moving back up from the bottom of the zone. ⁉️▶️👀 Risk Management You should place a stop-loss above 4133 when selling, or below 4018 when buying, to protect your trade if price breaks out against you. The breakout direction (either above 4160 or below 4018) will decide the next major move , so after the breakout, you’ll follow that direction.

FOREXRSMV

برنامه معاملاتی طلا (XAUUSD): استراتژی دقیق فروش و خرید با نقاط ورود و خروج مشخص

🟡 XAUUSD Trading Plan 📉 Sell Setup Sell Zone: 4125 - 4085 Main Range: 4082 – 4158 Condition: If price breaks below 4082, bearish momentum is expected. Next Target: 4058 (continuation level) ✅ Summary: Look for short opportunities between 4125–4085. A confirmed break below 4082 may extend the drop toward 4058. 📈 Buy Setup Buy Zone: Near 4059 (support area) Target: 4199 Condition: If price tests and holds 4059 support, expect bullish reversal toward 4199. ✅ Summary: Wait for price to test 4059 — if it shows support or bullish confirmation, target 4199 for rebound.

FOREXRSMV

تحلیل طلای جهانی (XAUUSD): دامنه مقاومت 3955 و سناریوهای احتمالی خرید و فروش

XAUUSD Technical Outlook: Gold is currently testing the 3950–3955 resistance zone. A rejection from this level could trigger a corrective decline toward the 3895 support area. Bearish scenario: Failure to break above 3955 may lead to a pullback toward 3895. Bullish scenario: A confirmed breakout above 3955 will likely extend the upside move toward 3975. Trade idea: If price corrects to 3895, look for buy opportunities targeting 3975. Signal Vision XAUUSD Update: If 3950–3955 fails to break, gold may drop to 3895 for correction. If 3955 breaks, price can rise to 3975. From 3895 zone, a buy setup is possible targeting 3975.

FOREXRSMV

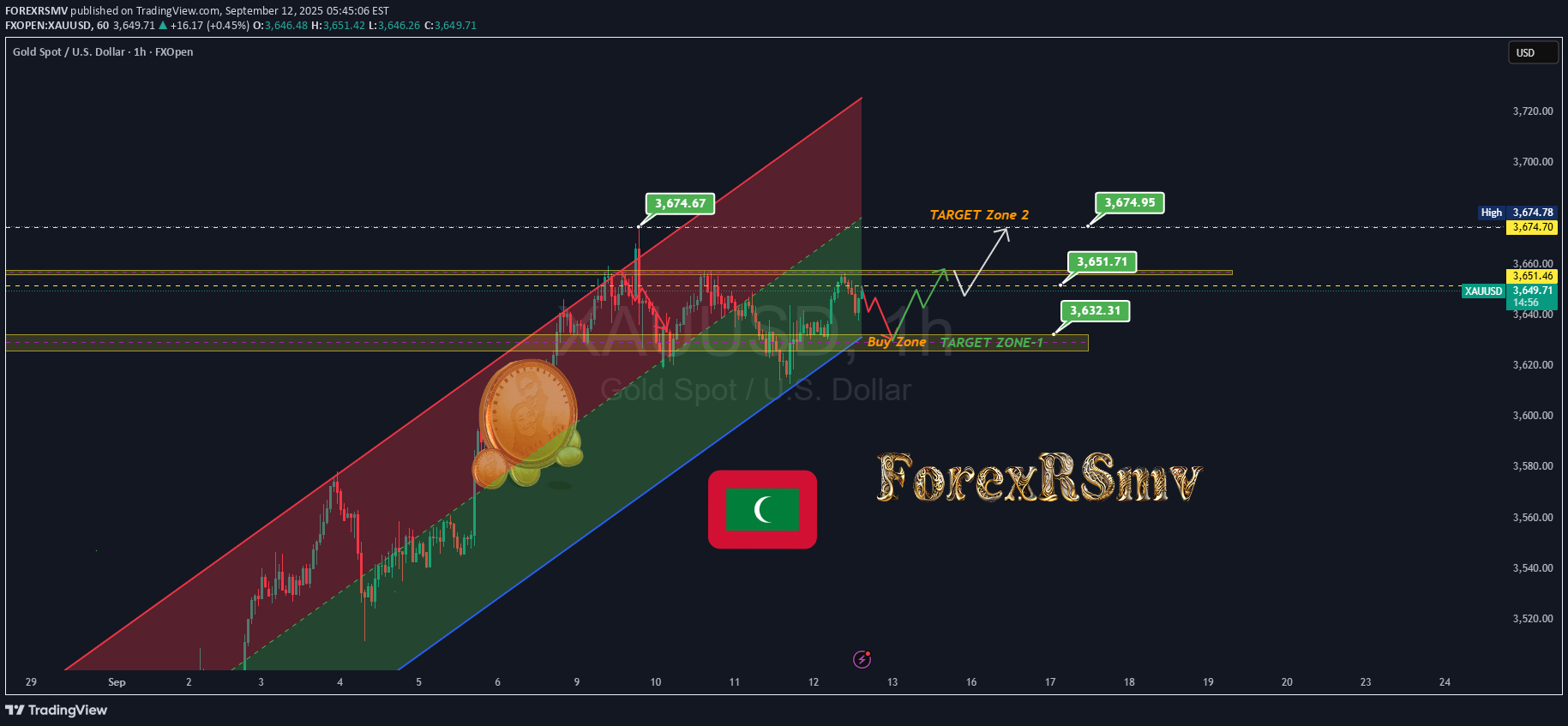

XAUUSD IDEA

XAUUSD Trading Signals After the Fed cut, Gold recovered strongly, breaking the downtrend resistance. Demand remains high, but MM may still retest liquidity at 3674–3668 before pushing higher. 🟢 Buy Setup Buy above 3685 on consolidation Or buy from 3674–3668 zone (retest support) SL: 3660 TP1: 3700 TP2: 3710 🔴 Sell Setup (Short-term / Countertrend) Sell from 3685–3700 if rejection / false breakout SL: 3708 TP1: 3674 TP2: 3668 If, during the Asian/Pacific session, gold consolidates without a pullback and closes above 3685, the market may continue to rise towards the specified target. However, if the market lacks potential (after the weekend), then MM may test 3674 - 3668 before the price returns to growth towards the target of 3700.

FOREXRSMV

XAUUSD IDEA

XAUUSD Sell Setup Sell Zone: 3665 – 3663 Stop Loss (SL): 3667 Take Profit (TP): TP1: 3652 TP2: 3628 Resistance Rejection: Price is struggling to stay above the 3665–3667 zone, showing signs of weakness after a minor retracement. This zone acts as an intraday resistance, and sellers are likely to step in here. Trend Pressure: Gold is under short-term bearish pressure as buyers failed to hold higher levels. This indicates possible continuation toward the next support levels. Targets: 3652 First support area, good for partial profits. 3628 A stronger support zone, aligning with deeper bearish continuation if momentum extends. 🌍 Market Context: The US Dollar is showing short-term recovery, which usually weighs on gold prices. Traders are cautious ahead of key economic events (Fed policy / data releases), making resistance zones good opportunities for tactical sells. Overall, sentiment favors a pullback in gold as long as it trades below 3667.

FOREXRSMV

XAUUSD IDEA

🪙 XAUUSD Update Gold is holding strong near $3650, eyeing its 4th straight weekly gain 🚀. 📊 Key drivers: Fed rate cut bets (92% chance of 25bp cut on Sept 17) Geopolitical tensions & new US tariffs on 🇮🇳 India & 🇨🇳 China Weak US economy keeps safe-haven demand high 📉 Support: 3638 / 3630 📈 Resistance: 3649 / 3657 🎯 Outlook: Liquidity grab likely at 3638 before bounce 🔄 If gold ranges 3649–3657 ➡️ a close above 3657 could trigger another bullish wave 📈 📢 XAUUSD Trade Signals 🔻 Sell Setup Entry: 3647 – 3650 SL: 3653 TP: 3640 Reasoning: Price is near resistance. If gold tests this area (3647–3650) but fails to break higher, we expect sellers to step in for a short-term pullback toward 3640. 🔼 Buy Setup Entries: 3636 – 3632 SL: 3628 Targets: TP1: 3648 TP2: 3656 TP3: 3662 TP4: 3674 Reasoning: This zone (3636–3632) is a strong support/liquidity area. If price dips into this region and holds above 3628, buyers are expected to regain control. From here, we look for a bullish continuation toward higher levels. ⚖️ Plan Summary: If price rejects resistance → short-term sell. If price corrects into support → buy the dip for continuation higher.

FOREXRSMV

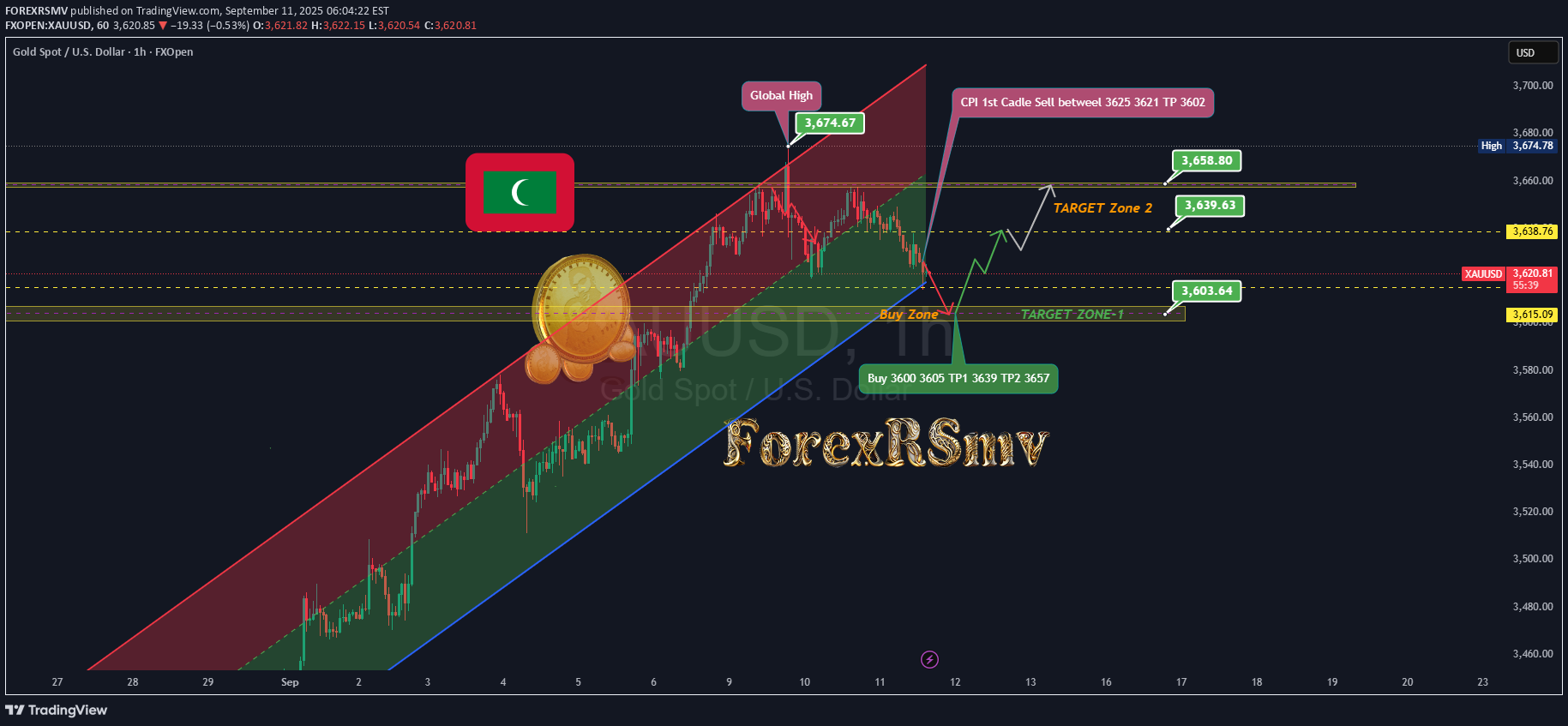

XUUSD IDEA

Gold is consolidating ahead of key U.S. inflation data (CPI), trading near $3,650 and testing short-term support. Despite the intraday correction, the broader bullish structure remains intact as the market holds below the recent record high of $3,675. CPI Outlook: Higher-than-expected CPI: Likely to strengthen the dollar, weigh on gold, and reduce expectations for Fed easing. Lower-than-expected CPI: Could trigger fresh highs in gold, reinforcing expectations of aggressive rate cuts. Currently, markets are pricing a 92% probability of a 25 bps rate cut and an 8% chance of a 50 bps cut at the September 17 meeting. Technical Picture: Gold is consolidating within a bullish trend. The $3,620 zone is critical holding above it would confirm buyer strength, while a breakdown could extend the correction toward the $3,607–3,600 imbalance zone before renewed upside momentum. Resistance: 3,638, 3,649, 3,657 Support: 3,620, 3,607, 3,600 Trading Signals (XAU/USD): 🟢 Buy Zone: 3,600 – 3,605 | TP1: 3,639 | TP2: 3,658 🔴 Sell Zone: 3,625 – 3,621 | TP: 3,603

FOREXRSMV

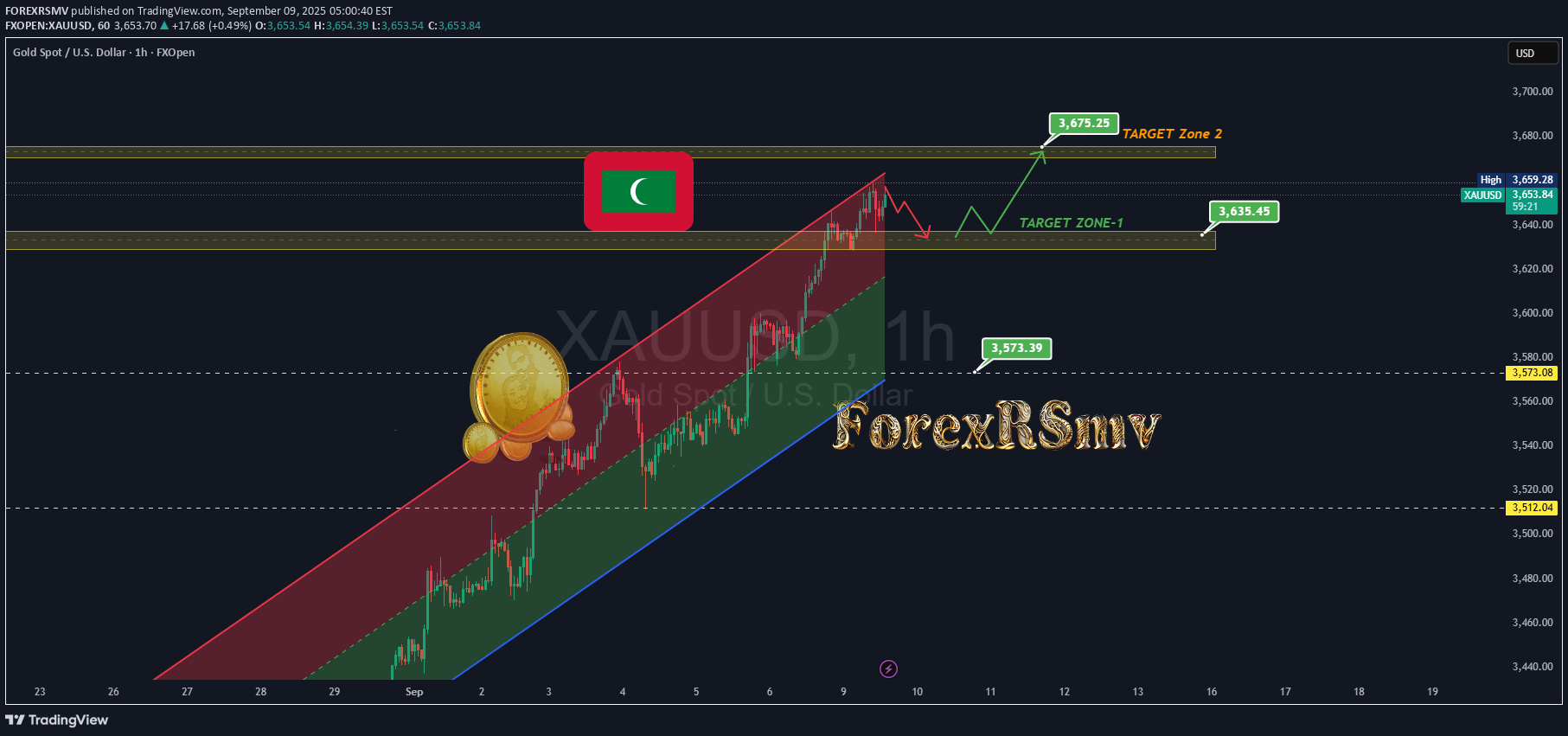

XAUUSD IDEA

XAUUSD Price is expected to drop from the 3658–3655 zone towards 3635. From that support zone, we anticipate a bullish reversal, targeting the 3675 zone. 3658 – 3655 Zone supply/resistance zone Expect selling pressure here. Place a down arrow showing the expected drop. 3635 Zone Highlight this as a demand/support zone Show price reaching here with a bounce arrow pointing upward. 3675 Zone Sell from supply Target support Buy from support Target resistance ************************************ XAU/USD Trade Plan Sell Setup Entry Zone: 3658 – 3655 Target: 3635 SL: 3665 ********************************* Buy Setup (Reversal) Entry Zone: 3635 Target: 3675 SL: 3628

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.