Technical analysis by FOREXRSMV about Symbol PAXG on 11/18/2025

FOREXRSMV

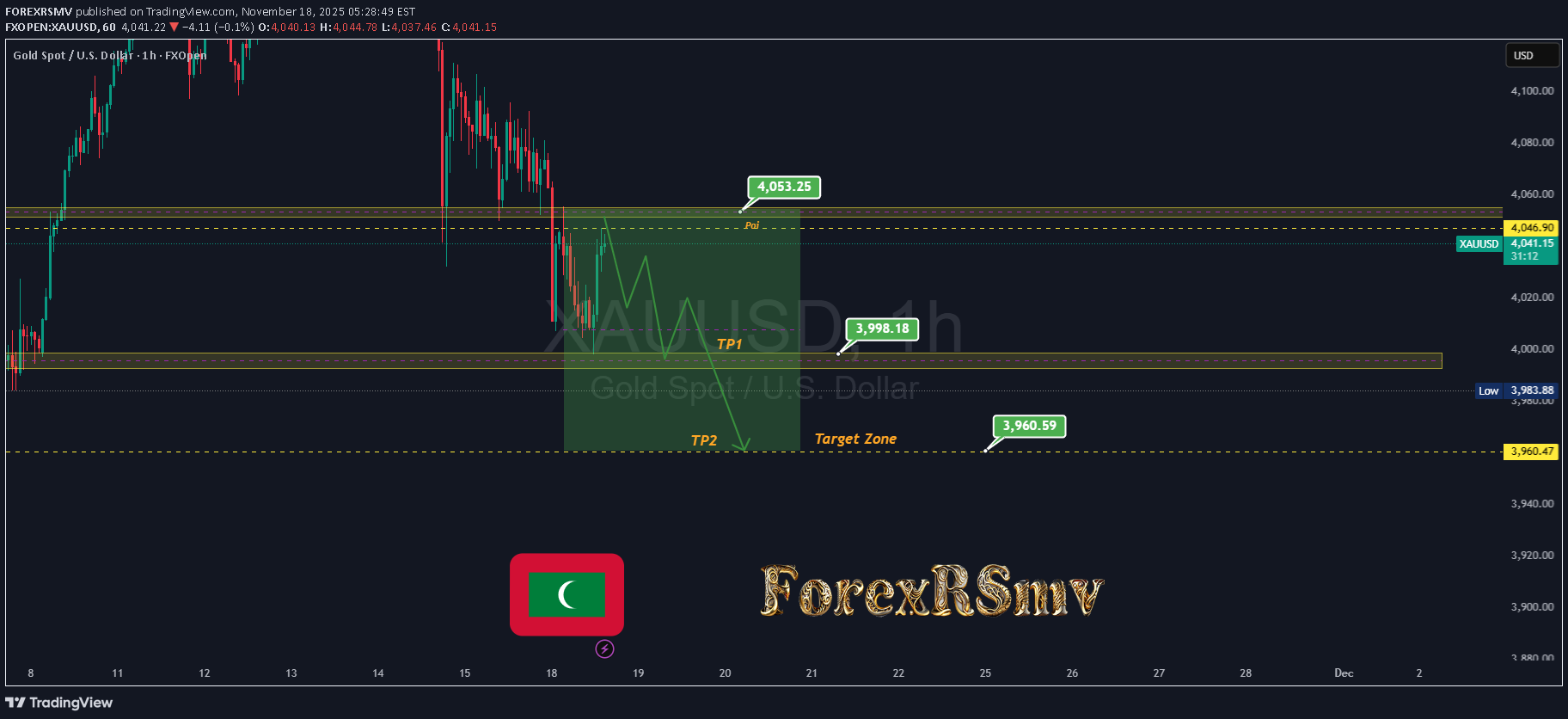

پیشنهاد فروش طلا (XAUUSD): استراتژی دقیق ورود، حد ضرر و اهداف سود احتمالی

XAUUSD SELL Range 4052 4055 Stop Loss (SL 4057): SL at 4057 gives you only a few points of buffer above your entry. That’s quite tight. If price spikes up strongly (momentum surge or a fundamental shock), your SL could be hit quickly. The risk of being stopped out is real, especially if gold breaks upward above that small zone. Take Profit (TP1 3998, TP2 3960): TP1 (3998): This is a decent first target: a drop from ~4055 to ~3998 is a substantial move (~57 points), but not massive in volatile gold. TP2 (3960): More ambitious — this assumes a strong bearish move. For that to happen, you’d likely need a catalyst (for example, strong dollar rally, hawkish Fed, or drop in safe-haven demand). Putting together fundamentals + technicals, here is a possible rationale behind your trade: Mean Reversion from Overbought / Resistance: You may believe gold has run up into a resistance area around 4053–55, and it’s due for a pullback/mean reversion. Macro Risk: Rate Cut Hopes Disappointed / Dollar Strength: If markets start to doubt aggressive rate cuts, real yields could rise, making gold less attractive. A potential dollar bounce could put pressure on gold. Safe-Haven Demand Easing Slightly: If geopolitical risk cools or investors rotate out of gold, there could be a temporary drop. Taking Advantage of Momentum + Technical Structure: You're playing a swing or short-term move where gold re-traces from near-term highs.