Technical analysis by FOREXRSMV about Symbol PAXG on 9/11/2025

FOREXRSMV

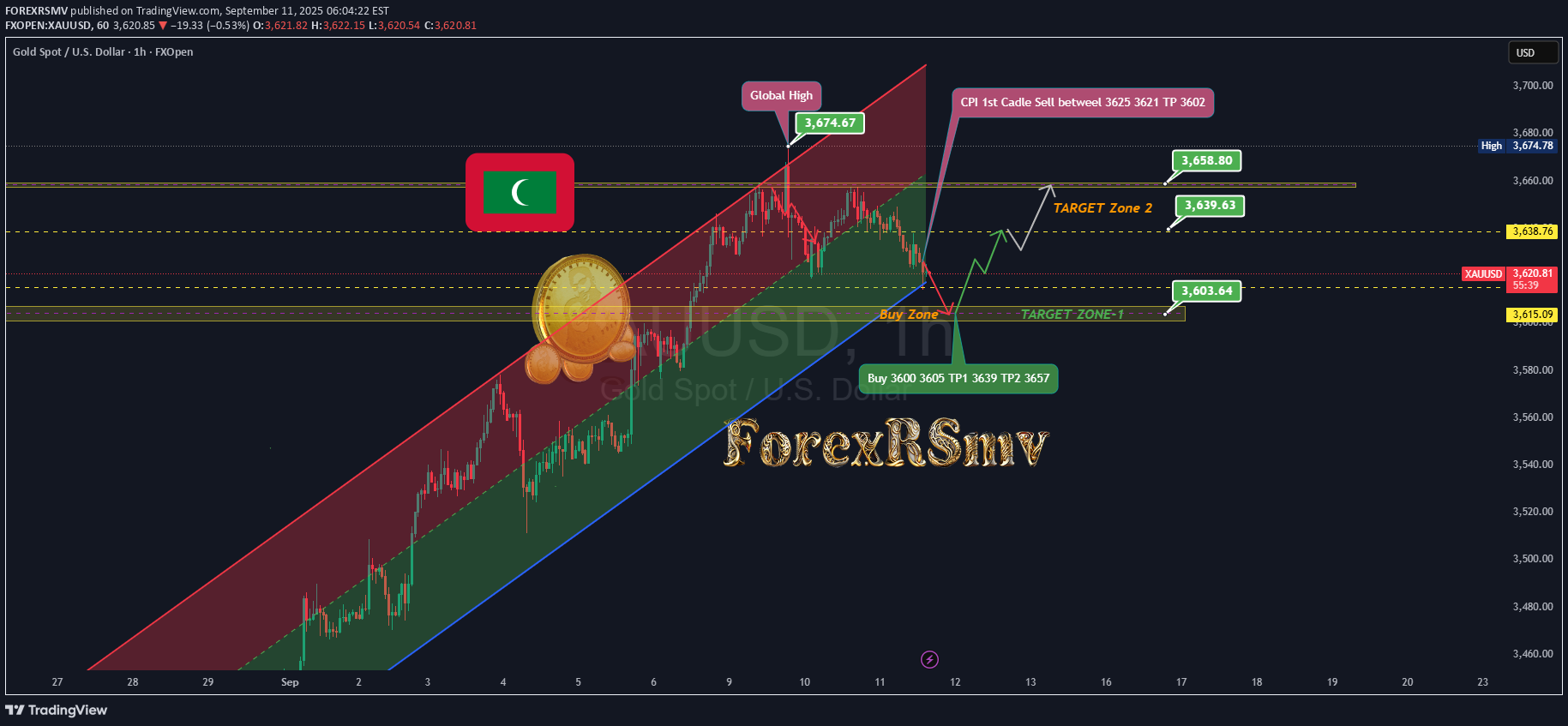

XUUSD IDEA

Gold is consolidating ahead of key U.S. inflation data (CPI), trading near $3,650 and testing short-term support. Despite the intraday correction, the broader bullish structure remains intact as the market holds below the recent record high of $3,675. CPI Outlook: Higher-than-expected CPI: Likely to strengthen the dollar, weigh on gold, and reduce expectations for Fed easing. Lower-than-expected CPI: Could trigger fresh highs in gold, reinforcing expectations of aggressive rate cuts. Currently, markets are pricing a 92% probability of a 25 bps rate cut and an 8% chance of a 50 bps cut at the September 17 meeting. Technical Picture: Gold is consolidating within a bullish trend. The $3,620 zone is critical holding above it would confirm buyer strength, while a breakdown could extend the correction toward the $3,607–3,600 imbalance zone before renewed upside momentum. Resistance: 3,638, 3,649, 3,657 Support: 3,620, 3,607, 3,600 Trading Signals (XAU/USD): 🟢 Buy Zone: 3,600 – 3,605 | TP1: 3,639 | TP2: 3,658 🔴 Sell Zone: 3,625 – 3,621 | TP: 3,603