EyyJasper

@t_EyyJasper

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

EyyJasper

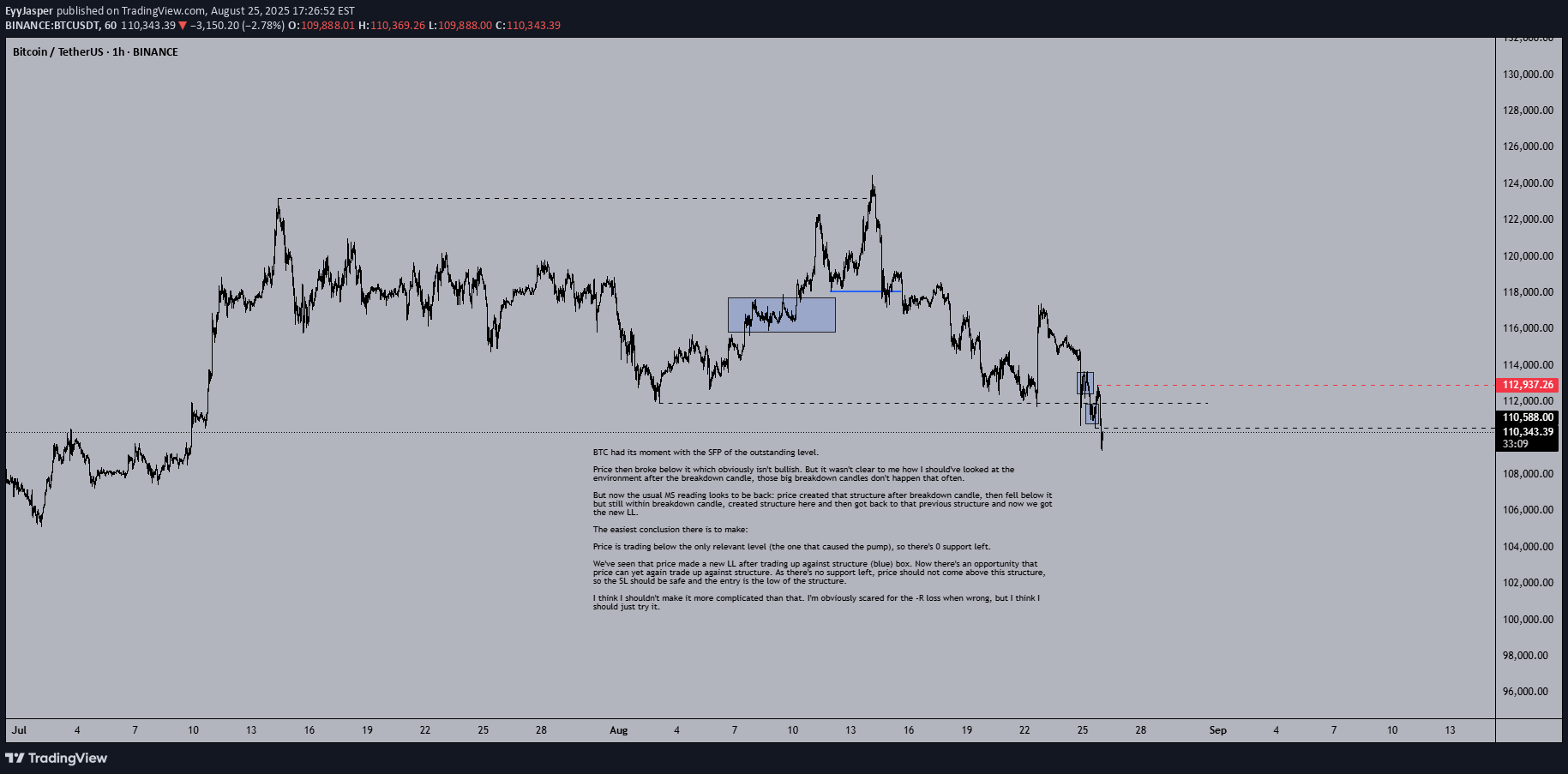

BTC Short Setup

BTC had its moment with the SFP of the outstanding level. Price then broke below it which obviously isn't bullish. But it wasn't clear to me how I should've looked at the environment after the breakdown candle, those big breakdown candles don't happen that often. But now the usual MS reading looks to be back: price created that structure after breakdown candle, then fell below it but still within breakdown candle, created structure here and then got back to that previous structure and now we got the new LL. The easiest conclusion there is to make: Price is trading below the only relevant level (the one that caused the pump), so there's 0 support left. We've seen that price made a new LL after trading up against structure (blue) box. Now there's an opportunity that price can yet again trade up against structure. As there's no support left, price should not come above this structure, so the SL should be safe and the entry is the low of the structure. I think I shouldn't make it more complicated than that. I'm obviously scared for the -R loss when wrong, but I think I should just try it.It hit my entry shortly after posting this idea.Make it make sense -1R.

EyyJasper

BTC Long Setup

15min SFP of the outstanding level (dashed line). Price has with this pump pushed above what was previous resistance, meaning that I think there's now no resistance anymore. So we can probably buy for the HL. Ofcourse I don't know if price pulls back this far. But just looking at the 1H (to not get smoked by 15min TF again) the structure of my entry level should get retested. Maybe it will only retest the top of the structure. Will think about it and update if I'm changing entries.I entered here. I've looked for a bit at the structures on the 1H and the main part of the structure (the thickest) is at the top. So to make sure to not be left out you put the entry at the top of that structure, which I did to which why I'm now in the trade.Price is now creating structure around the entry and thus around the structure of yesterday. After the big 15min pump candle from yesterday price created a 15min wick afterwards. If price now gets below this wick, then price is within ineffiency (pump) + also back in the structure of yesterday. This adds the possibility for a inefficient breakdown candle. If price closes below this wick I'll be closing the trade. For now though all seems fine.Closed for -0.11R. Either I'm wrong or there's going to be a sick short incoming.

EyyJasper

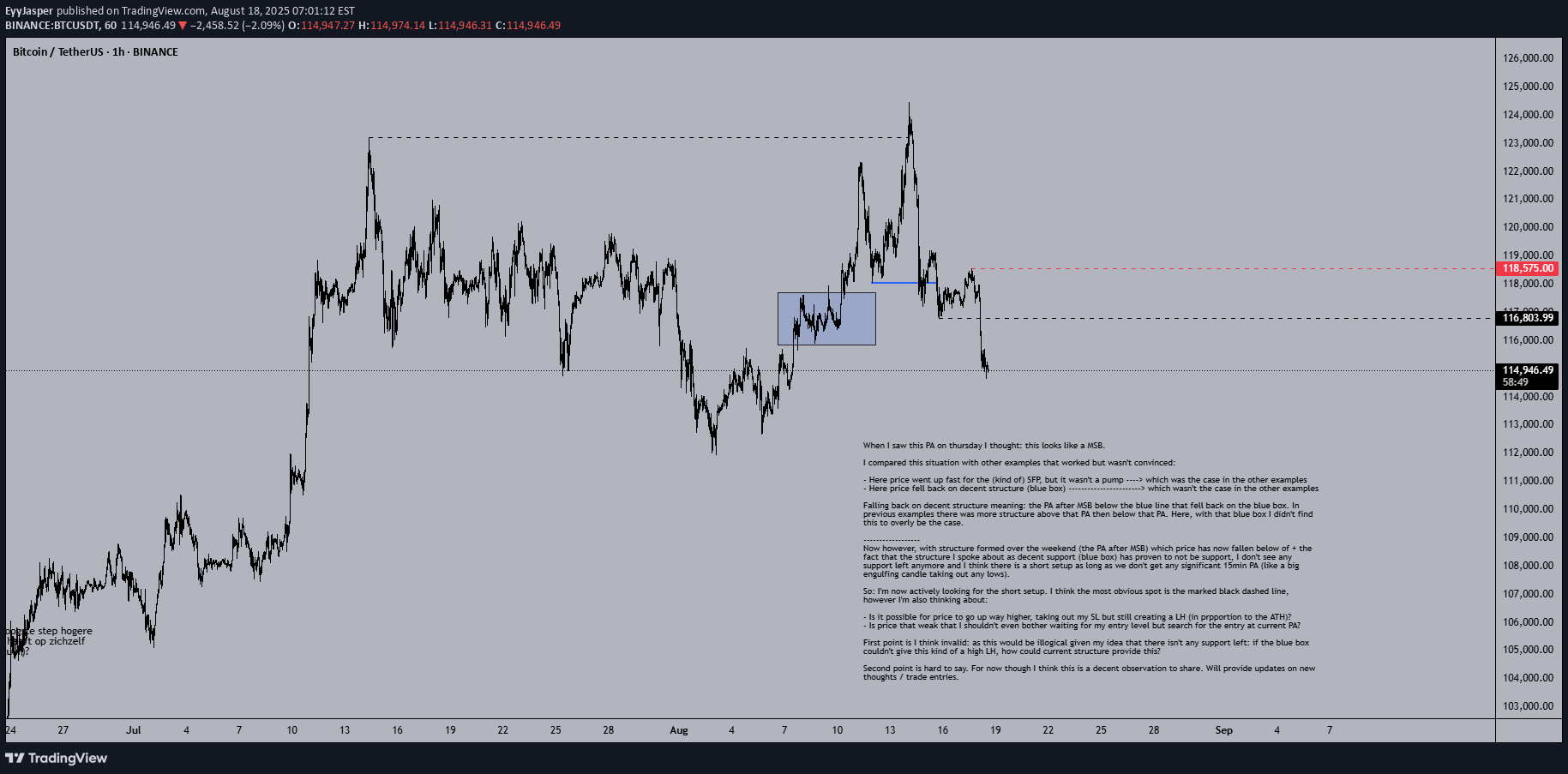

BTC Possible Trend Shift & Short Setup

When I saw this PA on thursday I thought: this looks like a MSB. I compared this situation with other examples that worked but wasn't convinced: - Here price went up fast for the (kind of) SFP, but it wasn't a pump ----> which was the case in the other examples - Here price fell back on decent structure (blue box) -----------------------> which wasn't the case in the other examples Falling back on decent structure meaning: the PA after MSB below the blue line that fell back on the blue box. In previous examples there was more structure above that PA then below that PA. Here, with that blue box I didn't find this to overly be the case. ------------------ Now however, with structure formed over the weekend (the PA after MSB) which price has now fallen below of + the fact that the structure I spoke about as decent support (blue box) has proven to not be support, I don't see any support left anymore and I think there is a short setup as long as we don't get any significant 15min PA (like a big engulfing candle taking out any lows). So: I'm now actively looking for the short setup. I think the most obvious spot is the marked black dashed line, however I'm also thinking about: - Is it possible for price to go up way higher, taking out my SL but still creating a LH (in prpportion to the ATH)? - Is price that weak that I shouldn't even bother waiting for my entry level but search for the entry at current PA? First point is I think invalid: as this would be illogical given my idea that there isn't any support left: if the blue box couldn't give this kind of a high LH, how could current structure provide this? Second point is hard to say. For now though I think this is a decent observation to share. Will provide updates on new thoughts / trade entries.Hmmm, we've got the SFP in this current structure ------> thic could cap price --------> I entered here in current structure. I don't know if price can still go up from here to my entry, but I do know that I think this is a valid short setup so I shouldn't wait for the entry and just suck up the worse R:R.Rookie mistake with this entry: In this case there was only a valid SFP if price would drop below this structure ending the structure. You would then have a new structure with an SFP on top as a fine invalidation for when price pushes above it. I shorted within the structure, anticipating on the drop but we didn't get the drop and the SFP proved to be invalid: it was just another high within the structure. God my perfectionism goes mayhem with this mistake, but hey: lets first see if price will actually even hit my entry and even more important: will this actually be a valid setup? Got 1R on it...Closed here for -0.15R. I think it lacks momentum to break down further as price didn't manage to close below the low of yesterday on the 15min TF. It tried twice, then went back up to the high but wasn't an SFP ----> I think the chances of price pushing up further are high now.It could SFP yesterday's high because there's still lots of structure above the high. If we then get a new LL this SFP is the perfect SL and I will re-enter the trade.

EyyJasper

EyyJasper

BTC HTF HL Could Be In

I can have all my opinions about how this low can't be the HTF HL but who am I to say this? I should keep it in the back of my mind but I shouldn't let it hinder me from entering new trades/investments.I spent too much time speculating on how I think it should look instead of just keeping it simple and just think about how it looks in the moment. It cost me missing the up-move from ~85k-100k.I think of trading vs investing, LTF trades vs HTF trend while I should just scrap the HTF trend as this causes me to go on a speculation trip and I lose track of what's in front of me in the moment.-------------------------------What I think is in front of me right now:Let's start with that MS is king. This up-move is caused by the fact that price got above the structure of 29 March-5 April, without any significant PA. It just got above it and stayed above it and pushed out above it.That's enough evidence to me that I shouldn't necessarily wait for a big SFP, on the 15min TF or 1D. Or that I shouldn't wait for a big 15min engulfing candle. This is just proof as price has pushed all the way back to 100k. Then,The blue box was the resistance and the level below it (95k spike) was the main level. The top of this level was maximal resistance. Here I expected (=speculated) that price would be capped and go back to 74k. I expected price to close above the level but that the new structure formed around the level would provide a short (like a SFP and then a MSB).But this didn't happen. Price pushed above the resistance. So that's how it now is: there's no resistance. Just like in april when price got above the 29 March-5 April structure with main level of structure being the high of 4 April.And then to add: in current structure price has closed above the main level of that structure on the 1D: the high of 12 May. This is good. Also: there's no 15min SFP at the current highs and the MSB failed (price pushed back up).Also: there's a clean level for the long SFP: 12 May low. Conclusion: if price breaks down from here without going back to these highs, price could be capped at the long SFP-level of 100k. And given the (I think) fact that there's no resistance and MS is king, this is the right level to enter the long in spot BTC.So that's what I'm going to do. Might enter the trade too (perps) if price indeed SFP's this level.-----------------------------If price doesn't hold the 100k level, I don't think price can drop further than the 74k low so that's the potential downside (I don't sell spot if there's no short setup) I keep in mind.Price made a new ATH but all PA looks normal to me, just consolidating upwards. Still have my limit orders set.Not the best reaction to the level tbh. 1D candle close above would be welcome.

EyyJasper

BTC MSB Short Setup

I don't think there's much to say here. This is a MSB, even though there's little structure.As there's no structure for resistance the last HL wick just becomes the entry (for the LH).If price manages to get decently above this entry, I'll cut it and take the loss. Most structure has been formed here at the lows, so if price manages to get decently above my entry, it also gets above this structure, thus providing support which could make price jump up pretty quick as there's been little structure formed on the downmove.Full 1R entry with SL red dashed line.Closed for -0.13R

EyyJasper

To be one of the best in trading BTC - BTC HTF HL Hypothesis

Price closed below the support-level on the 1D (red line) ----> price should come back to these lows.Price closed above the resistance-level on the 1D (green line) ----> price should SFP the lows-----------------------------------------I expect (or should I say: hope?) price to do a MSB here, meaning: price coming below all that structure below the green level. This will provide a short setup to the dashed line where the TP and spot limit buy orders are 'rested'.To be one of the best in trading BTC.

EyyJasper

BTC Possible HTF HL Creation 3

BTC Possible HTF Creation 3Inversed chart again... (to minimise full breakdown to 48k fear which messes with my analysis).Price did a MSB which definitely weakens this downtrend (yellow). But what happens now?-------------------------Three possibilities:1Price gets capped here at outstanding 95k level and goes back to 74k level, breaks through it and goes to 48k. This now definitely is a irrational thought as price messed the downtrend up by doing this MSB. Beforehand this might have been also irrational as the big 70k is a closed structure because of the pump through it (this change in PA + followed up up-move makes this a confirmed closed structure; however this is still speculation: needs more sample). Like, if price just kept on downtrending through the inefficiency, then I could see the mega breakdown to 48k happening but now... no.2Price makes a HL instead of going back to 74k level. I don't see this happening as changes in trend usually start with some sort of significant PA at the lows/highs which we IMO didn't get here. I don't think the MSB is enough as the downtrend got initiated with an SFP (strong) and price has yet to deal with the 95k level which IMO is just a really big level if you look at it LTF (though definitely less outstanding as this isn't the last LH anymore. That's the one which now has been broken with the MSB). Just LTF looking at the lowest low it just doesn't make sense to me: nothing significant happened at the lows. The way price went back down and then made a HL instead of an SFP while IMO there was no reason for the HL just doesn't make sense. The 'base' for the higher TF MSB (yellow) is imo weak.3.Price SFP's the lowest low 74k level on the 1D (and even better on the 15min). Why SFP? Well, higher TF moves often just start with an SFP. Either SFP or deviation and I don't see a deviation happening as I think the downmove to 74k would just be weak as there's already the MSB. Weak so no stength to get below the level so simple SFP is what you get. This 'pattern' happens often: downtrend ----> sudden MSB but unexpected as insignificant PA at lows, thus unjustified MSB -----> price gets back to lowest low and creates significant PA (SFP) -----> now the real uptrend starts with a justified bottom.Oct-Dec 2022: SFP within deviationMarch 2023: deviationAugust 2023: deviationJanuary 2024: deviationAugust 2024: SFP

EyyJasper

BTC Short Setup 15min engulfing candle for the LH

BTC Short setup. Not much to say. 15min Engulfing candle for the LH. Invalidation = SL = 1R. Entry = entering ASAP after two 15min downcandles after another below level (so not a specific level)Hopefully I'm right, would be great R:R as the TP is the lowest low around 74k and I don't want to lose 1R.SL changed to top of 16:00-16:15 15min candle. (reducing potential R loss as imo price shouldn't come back up this high anymore after first downmove).No. Leaving the SL as original SL. Might get a retest of the level. If it is a valid setup the wick of an engulfing candle shouldn't get wicked again. Price dropped back in consolidation PA instead of inefficiency so another HH isn't to be expected I think.Closed after 2nd push back up. Engulfing candle definitely not enough it seems like. will update on -r loss.-0.26R.My thought process is/was: There's an SFP at the highest high so we don't need to go back to these highs, therefore I should keep in mind the possible LH (via a LH level) which I thought we got here with the level + 15min engulfing candle.But the correct thought process is: has this SFP from the highest high (so the first SFP of tuesday) broken market structure? Yes ----> you can look for the LH, no ----> you shouldn't look for the LH, price will likely go back to this SFP highest high.

EyyJasper

BTC Possible HTF HL Creation 2

BTC Possible HTF Creation 2 (update from first post): Chart inverted; analysis below as if it weren't an inverted chart:1) Weak highs as there isn't an SFP or some kind of big wick candle;2) Price did break below a significant part of the HL structure but not the full structure (last HL hasn't been broken):- The part it broke down below isn't outstanding enough to produce a big breakdown (my intuition tells me). It isn't a MSB as the last HL is still intact and the structure it did break below I think can't produce a big downmove (which then would create a MSB if it happened but I think would be weak and shortlived, likely to be capped at that outstanding low at 95k).- Price didn't instantly break below structure, it first made a LH (April 10) which weakens the downmove significantly to where my intuition tells me there now can't be a full MSB being formed.------------------------------No significance at highs (no SFP) nor big previous high being hit so no reason for trend shift.Price did break some significant structure but not fully and not fast enough: it first produced a LH before breaking below it. that's key here: if it was a breakdown in one go then price would have broken below the structure very close to the structure making the structure way stronger in resistance and therefore the likelyhood of a real breakdown way higher. That price is consolidating now (so not going fast anymore) is fine: horizontality creates space for a move in either way. But the fact that price didn't break below the structure in one go is the important part which I think cancels out the breakdown.Just looking at it simply, pure intuition. This will never break down as that structure which it broke down below isn't outstanding enough and there is not enough verticality (no strength). I would never short this.---------------------------------------------------------------------------------------And now coming out of the inverted chart: If I would never short this this means I would never buy this at 82k.But the HTF HL, I want to say it as an ego thing: will higly likely be an SFP of the Monday April 7 lowest low and I have put my 100% allocation on it (might take out some to buy the ETH lowest low of June 2022 as these moves would probably go together and ETH is the better investment if you want to make bigger profits)This ego thing is a traders' mistake as you can never be 100% sure in trading so you should never put a limit order on a level in advance, but I'm a young guy and me buying the lowest low of the HTF HL with great potential I could be right is a risk I'm willing to take as the benefit of me being right (having THAT amount of conviction with serious high level analysis backing that conviction) would just prove to me that I'm one of the best in the world in trading BTC, and this mental benefit will flow into daily ordinary life as I would then have proof of this 'status' (forgive me people, I know better but I'm still young and I know having this ego thing now will create a laugh + will make me happy in the future) + gives me more rest to focus on my studies.I accept the traders' mistake as this is a HTF HL environment, not an ordinary area in between.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.