DynamicCapital-FX

@t_DynamicCapital-FX

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

DynamicCapital-FX

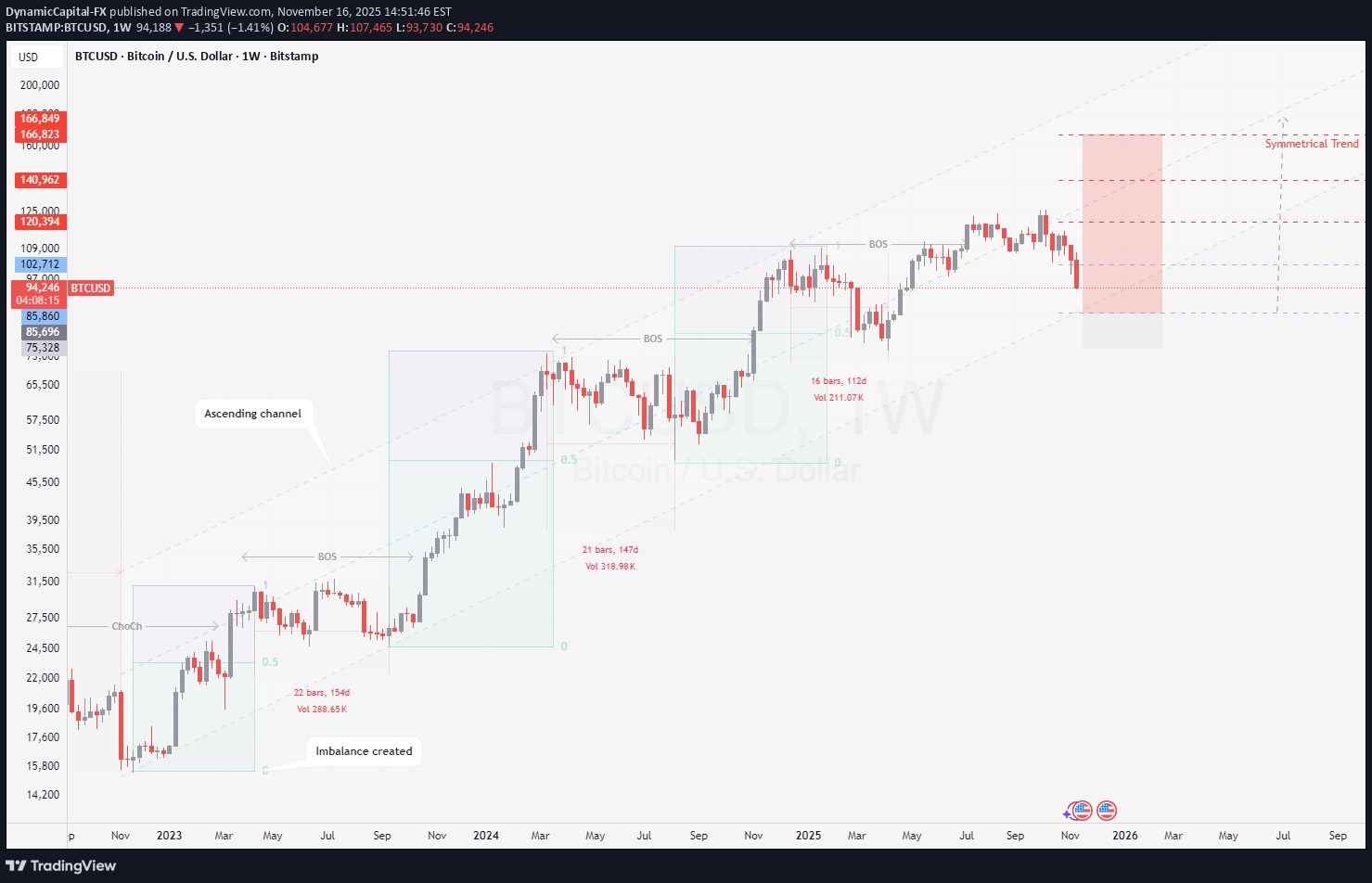

BTCUUSD - Market outlook

There was another round of market chatter about quantum computers cracking Bitcoin this week, the kind of discussion that usually gets going when BTC is on sale and someone tries to tie price uncertainty to pressuring narrative, but this time Adam Back stepped in and shut the whole narrative down with a single explanation that may have took the tension out of the room for some.

DynamicCapital-FX

Gold Sets Record High on Rate-Cut Bets, Haven Demand

Precious metals have extended already impressive year-to-date rallies on expectations of imminent rate cuts and mounting concerns over the Federal Reserve's independence, MUFG analysts say in a note. Lower rates typically boost noninterest bearing bullion's appeal. Investors are also seeking out safe-haven assets amid persistent geopolitical, economic and trade risks, MUFG says. The latest uptick in gold and silver follows Fed Chair Jerome Powell's signal that rates could be lowered this month

DynamicCapital-FX

A New iPhone Is Coming. Should You Upgrade or Just Fix Your Old

This year, your best iPhone upgrade might be a fresh battery, a clean screen and some new software tricks. Plus, the extra cash you get to keep in your pocket.Target reached.

DynamicCapital-FX

XAUUSD - hit lifetime highs

The rally was driven by market expectations of Federal Reserve rate cuts and robust industrial demand. Recent US data showed core PCE inflation rising 2.9% annually in July, the fastest since February, while consumer spending jumped the most in four months, signalling economic resilience. These figures kept September rate cut expectations intact, with Fed Governor Waller backing a 25 bps reduction and further easing in the coming months. On the industrial front, silver demand was further bolstered by China’s expanding solar energy sector," said Axis Securities.

DynamicCapital-FX

Will XRP Break $5 in Q4? Analysts Spot Bullish Setup

XRP is trading near an important support zone, with traders watching for signs of direction. Analysts are weighing two key scenarios: either a continued rebound or a deeper pullback in early September. Market structure, on-chain activity, and regional demand are all being considered as the final quarter of the year approaches.

DynamicCapital-FX

GOLD PRICES RETREAT AS STRONG DOLLAR PREVAILS AND ECONOMIC DATA

Economic Data Impacting the Market On December 12, 2024, the U.S. Bureau of Labor Statistics released important economic data. The Producer Price Index (PPI) rose by 0.4% in November, higher than the expected 0.2%, and showed a 3.0% increase over the year, marking the largest gain since February 2023. Additionally, the core PPI, which excludes food and energy, went up by 0.2% for the month and 3.5% annually. Initial jobless claims for the week ending December 7 reached 242,000, significantly above the expected 220,000, indicating rising unemployment. These mixed signals highlight ongoing inflation pressures alongside a weakening job market. Fed Rate Cut Expectations Shift According to the CME FedWatch Tool, the probability of a rate cut by the Federal Reserve in December has decreased to 96.70% from 97.50% a day ago, signalling changing market expectations.Now active.

DynamicCapital-FX

XAUUSD | Market outlook

Gold prices edged higher on Friday as the November U.S. job growth report indicated a gradual easing of the labor market, supporting expectations for further Federal Reserve rate cuts.

DynamicCapital-FX

XAUUSD | Market outlook

Gold prices were set for their largest weekly drop over three years on Friday. Expectations of less aggressive interest rate cuts by the U.S. Federal Reserve, which strengthened the dollar, drove the drop.Going short.

DynamicCapital-FX

GOLD REACHES NEW HEIGHTS AMID RISING SAFE-HAVEN DEMAND

US economic data Positive news came from the jobless claims, which dropped to 241,000, much lower than expected and down from the revised 260,000 from the previous week. US retail sales also did better than predicted, rising by 0.4% from the month before, compared to an expected 0.3% increase. Nonetheless, positive retail sales and strong jobless claims are unlikely to alter the course of the Fed's monetary policy. ECB rate cut ECB cuts rates as expected and upcoming months will be crucial as the ECB evaluates economic conditions and decides on its future monetary policy approach. US dollar index- The US dollar index showed a minor decline due to profit booking. A break above 104 would confirm a continuation of the bullish trend. Based on the CME FedWatch Tool, the likelihood of a 25 basis point rate cut in November has risen to 92.2%, up from 89.50% just a week ago.Closed.

DynamicCapital-FX

SOLUSDT | Marketoutlook

Summary: • SOL/USD Movement: • Trading within a medium-term descending channel . • Resistance zone: 157.40–162.50 (23.6% Fibonacci & Murrey [+2/8]). A breakout above could lead to further growth toward 175.00 and 185.80 (July highs). • Support zone: If the price falls below 147.60 (central Bollinger Band), it could decline toward 131.25 (38.2% Fibonacci & Murrey [5/8]) and 125.00 (Murrey [4/8]). • Technical Indicators: • Bollinger Bands: Horizontal, signaling consolidation. • Stochastic: Preparing to exit the overbought zone, indicating a potential sell signal. • MACD: Increasing in the positive zone. • Trend Outlook: • With the long-term downtrend intact, further decline in the near future appears more likely.Expected target reached.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.