DickDandy

@t_DickDandy

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

DickDandy

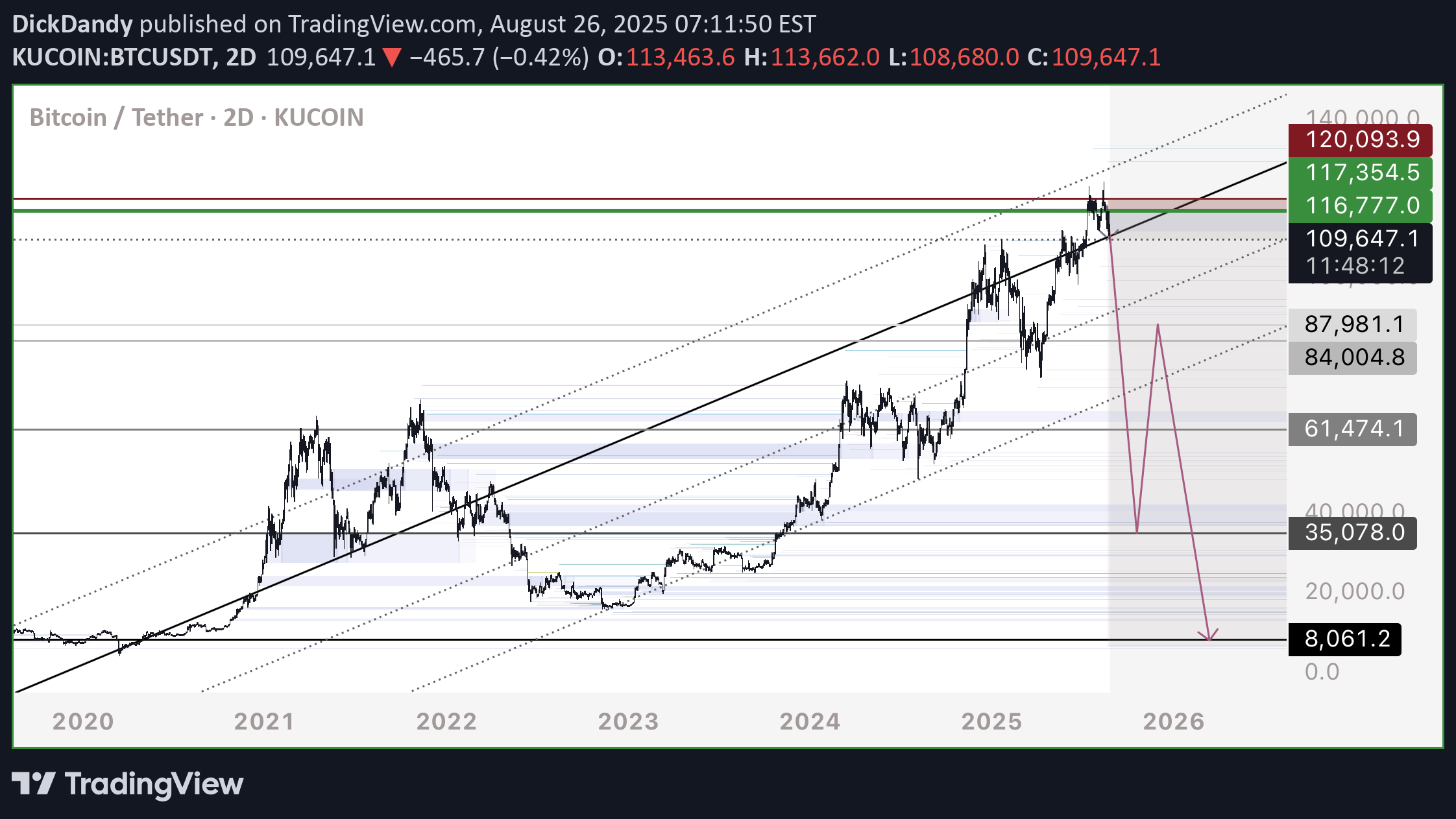

This whole upwards movement since 2023 has been a retest of a bearish breakdown. The major trendline shown takes Bitcoin to 7,400-8,000 region. Traders who discredit the possibility of this will certainly be baited and trapped. Bitcoin will drop aggressively, triggering all of the long stop loss orders one after the next - leveraged sell limit orders that only fill when price passes. This will generate an insanely fast drop to these uber lows. Traders will take their losses, or their gains - trying to catch the bottom, certain price won’t drop below 100,000 - the 80,000 - then 60,000. They will not be able to fathom how a drop of such magnitude is possible - or where it’s going to, because they don’t take into consideration the power of stop loss orders and the sheer amount of leveraging in Bitcoins market cap. Microstrategy - who leverages their assets to produce more of the asset - will likely be challenged with insolvency when the price shows this type of volatility. The safety of exchange platforms will be called into question - the legalities of leveraging challenged by regulations. Blackrock will secure their monopoly on Bitcoins buying and selling through their own ETF structure. Open your eyes. Don’t get trapped or fooled. This whole move has been a big, intentional set up and my posts explain in detail why, how, what, and when.

DickDandy

ETH (like Bitcoin) has risen only to retest a bearish breakdown on the HTF. This whole upwards movement is one big set up - to trap liquidity in longs and absorb it all from the chart. My initial call is marked here with original entry. Second entry can be 4,420 region. Short to my targets marked on chart. Don’t be a sucker and get trapped by this. Happy trading

DickDandy

I see often times analysts using horizontal support and resistance on Bitcoin. I wanted to demonstrate the proper way of using support resistance on Bitcoin - and show how the channels are ascending from left to right. Not only can this be repeated on high time frames - by duplicating the line with the same degree of angle, and placing it at any location - it can also be applied to smaller and smaller time frames, and the price respects these angles very well. Due to the liquidation wicks and absorptions that occur, price will move above and below the correct line - but the correct line serves as a volume support line that’s again, ascending from left to right. Try this out on your charts - and see how reliable it is. Ascending angles - not horizontals.

DickDandy

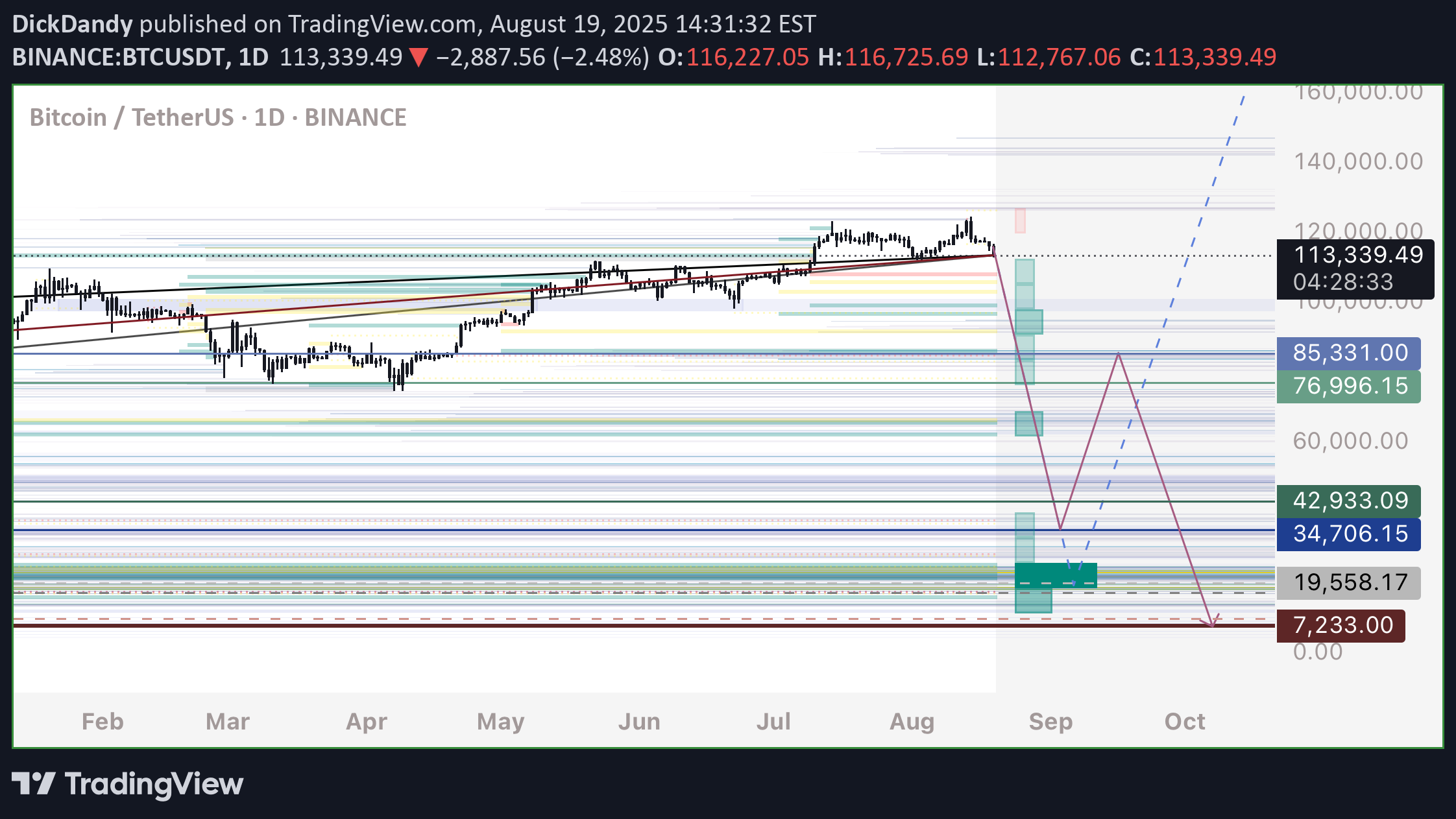

Anyone who didn’t take this trade at top entry may enter at the lower level here. Entry - 110,500-111,000 Stop Loss - 113,000 (High Risk) to 120,000 (Low Risk) Targets: 1) 81,000 2) 61,000 3) 36,000 4) 9,000 Personally I will time any crypto related trades with this pathway. Everything will drop and rise with bitcoins movement. Happy trading. Disclaimer - this is not financial advice and outlines my personal trade plan only

DickDandy

I’m sending an update to this short idea because as we progress we can start narrowing down which pathway is the most likely. I expect this move to occur very quickly, and I hope that afterwards we understand why it’s important to be preemptive with predicting the potential movements and corrective patterns. My most likely / personal trade: 110,000 to 34,700-35,000 35,000 to 81,000 81,000 to 8,000 My Strategy: I will be closing 50-75% of my short at 45,000 to 40,000 I will watch for a rise from that 35,000 level to confirm the swing long - and if I see intention for that to play out (we could also go straight to 8,000) - I will open a hedge long position and add to it accordingly I know many of you think I’m crazy or a troll - but my confidence is very high we will see this occur.

DickDandy

Per my BTC analysis, I expect the market to crash very hard and quickly, timed with the US dollar bearish retest on major weekly breakdown. Entry in green, targets marked and path shown. ETH fell below this major series of bearish trendlines, targets marked by analyzing liquidity and volume profile levels.

DickDandy

We secured the top entry around 117,000 - successfully snagging that top price. Currently Bitcoin has fallen below this key trendline channel. Adjusted trading path possibilities: Scenario 1: Short - 110,000 to 34,700-35,000 Long - 35,000 to 82,000 Short - 82,000 to 7,300-9,000 Scenario 2: Short - 110,000 to 43,000 Long - 43,000 to 74,000 Short - 74,000 to 7,300-9,000 Scenario 3: Short - 110,000 to 7,300-8,000 Suggestion: Watch for interactions at these bounce levels, consider hedging with longs at those Long ranges (remain short for main position) on ETH (correspondence with BTC price timing). Let’s see how this progresses. All the best.

DickDandy

Updated details for this BTC short below, with a lower entry than first plan. DISCLAIMER - This is my personal trade only and I’m not advising you what to do with your money. Trading is risky and please use your own discretion and risk practices. Fundamental analysis of this trade can be found on my prior posts. Entry Range - 116,700 to 117,000 Stop Loss - 120,000 Target 1 - 88,000 Target 2 - 61,500 Target 3 - 35,000 Target 4 - 8,000 God speed. Let the dump begin.

DickDandy

BTC has been following my analysis of predicting a potential crash here. We can use DXY to anticipate when a significant liquidity grab / flash crash will occur. Since DXY is retesting a major breakdown on the weekly - monthly, it would be wise to watch for volatility today on Bitcoins price, noting these liquidity regions if we are about to enter a bull run ranging out 3-5 years. Targets and potential corrective patterns marked on this chart. Happy trading.

DickDandy

Prior to Blackrocks ETF traded Bitcoin, Bitcoin was procured on exchanges, many of which that are unregulated. These exchange platforms offer high leveraging capabilities, allowing traders to stake a small portion of their own capital and “borrow” a larger position size, as a consequence, leaving behind their entry a leveraged sell order for the total position size. Bitcoins rise and surge in popularity since beginning of 2023 saw a large influx of traders leveraging long positions and buys. Blackrock wants a piece of the pie and the trading fees associated with those buying and selling Bitcoin. Now here lies the genius plan no one sees coming. Bitcoin has been rising steadily since end 2022 without a significant pullback. Why? Blackrock understands that these exchanges operate with leveraging, and a large percentage of the BTC market cap is leveraging liquidity. There has been a literal chain reaction of explosive nature, of sell orders, building behind Bitcoin as the price steadily moves up. Now Blackrock wouldn’t allow this chain reaction of a shattering selling wick happen too soon - they needed to establish their credibility and acceptance of a safe way to procure Bitcoin. Anytime the price would begin to fall too much, at risk of setting off that chain reaction of leveraged sell orders - Blackrock would initiate enough buys to keep the price stable and attract more and more long positions. Eventually, they will ALLOW the stop loss chain reaction to occur - Bitcoin will wick down to extraordinary lows, around 8,000. They will emphasize the danger of these high leveraging platforms and the volatility risks on BTC, and secure their own monopoly on the procuring and holding of Bitcoin. In essence - they are using the flaws of the leveraging exchanges to do the dirty work for them, as it’s the traders own decisions that will allow the price to drop to such extreme degrees. Microstrategy, another competitor - who leverages its Bitcoin holdings to procure more Bitcoin, will also fail by this event. The security asset being Bitcoin, once the value drops too low, will force Microstrategy into a state of insolvency or bankruptcy. In the end - Blackrock wins Bitcoin.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.