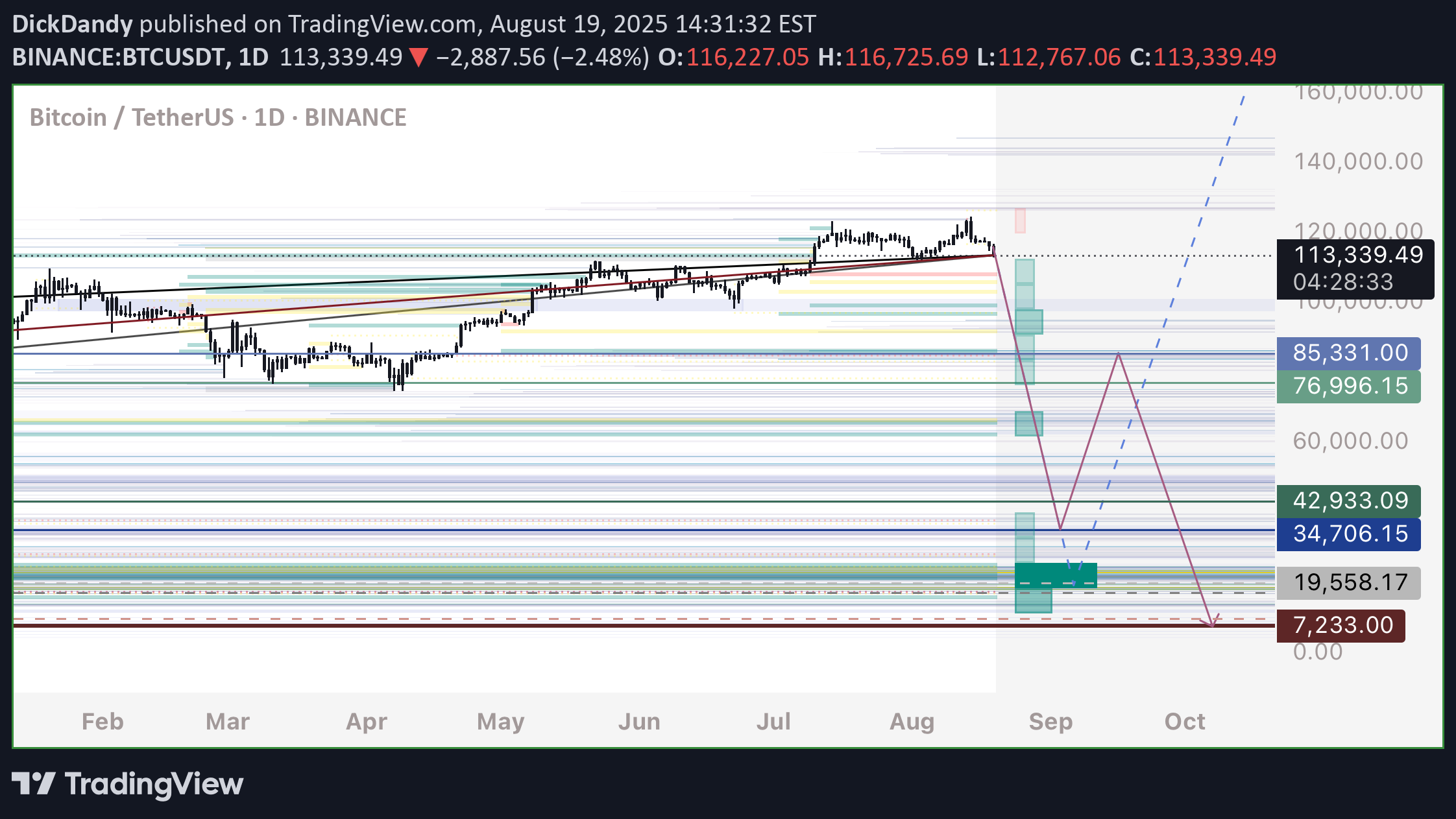

Technical analysis by DickDandy about Symbol BTC: Sell recommendation (8/19/2025)

DickDandy

Prior to Blackrocks ETF traded Bitcoin, Bitcoin was procured on exchanges, many of which that are unregulated. These exchange platforms offer high leveraging capabilities, allowing traders to stake a small portion of their own capital and “borrow” a larger position size, as a consequence, leaving behind their entry a leveraged sell order for the total position size. Bitcoins rise and surge in popularity since beginning of 2023 saw a large influx of traders leveraging long positions and buys. Blackrock wants a piece of the pie and the trading fees associated with those buying and selling Bitcoin. Now here lies the genius plan no one sees coming. Bitcoin has been rising steadily since end 2022 without a significant pullback. Why? Blackrock understands that these exchanges operate with leveraging, and a large percentage of the BTC market cap is leveraging liquidity. There has been a literal chain reaction of explosive nature, of sell orders, building behind Bitcoin as the price steadily moves up. Now Blackrock wouldn’t allow this chain reaction of a shattering selling wick happen too soon - they needed to establish their credibility and acceptance of a safe way to procure Bitcoin. Anytime the price would begin to fall too much, at risk of setting off that chain reaction of leveraged sell orders - Blackrock would initiate enough buys to keep the price stable and attract more and more long positions. Eventually, they will ALLOW the stop loss chain reaction to occur - Bitcoin will wick down to extraordinary lows, around 8,000. They will emphasize the danger of these high leveraging platforms and the volatility risks on BTC, and secure their own monopoly on the procuring and holding of Bitcoin. In essence - they are using the flaws of the leveraging exchanges to do the dirty work for them, as it’s the traders own decisions that will allow the price to drop to such extreme degrees. Microstrategy, another competitor - who leverages its Bitcoin holdings to procure more Bitcoin, will also fail by this event. The security asset being Bitcoin, once the value drops too low, will force Microstrategy into a state of insolvency or bankruptcy. In the end - Blackrock wins Bitcoin.