DatTong

@t_DatTong

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

DatTong

تحلیل طلای جهانی (XAUUSD): قیمتها در مسیر بعدی صعودی یا نزولی؟

Fundamental approach: - Trade Talks and Gold Sentiment: Gold experienced a sharp correction after reaching record highs, primarily due to improving risk sentiment as optimism grew around US-China trade negotiations. Reports indicate that both nations have reached a preliminary framework agreement on export controls and tariffs, which is expected to ease geopolitical tensions and reduce demand for safe-haven assets, such as gold. - Other Pressures: Fed Policy and the US Dollar: The gold market is also reacting to expectations of a Fed rate cut. While a rate cut typically supports gold, the move is largely priced into the market. Recent steadiness in the US dollar, as well as the possibility of a less dovish stance from the Fed, has added further pressure. With traders focusing on upcoming policy signals and macroeconomic data, a "cut and pause" approach from the Fed could prompt continued profit-taking in gold. - Outlook: As long as US-China relations remain stable and central banks, especially the Fed, avoid surprising markets with additional dovish measures, XAUUSD may remain under pressure. Technical approach: - XAUUSD significantly declined to the support area of 3890-3950. The price is between both EMAs, indicating a shift to sideways movement. - If XAUUSD breaches the support area, the price may decline to the next support level at 3720, which is confluenced with the 61.8% Fibonacci Extension. - Conversely, remaining above the support area may prompt a retest of the next resistance at 4054. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

صعود انفجاری US500: آیا رسیدن به مرز روانی 7000 قطعی است؟

Fundamental approach: - The US500 advanced this week, propelled by strong earnings momentum from tech giants and robust performance in select sectors. Among top movers, Qualcomm rose over 11% following upbeat earnings guidance, while Alphabet and Tesla also rallied ahead of their highly anticipated quarterly results. W.R. Berkley Corporation and Welltower Inc. were notable gainers, reflecting sector rotation and risk-on flows in the index. - Earnings from the 'Magnificent Seven', including Microsoft, Alphabet, and Meta, drove sentiment, with over 86% of S&P 500 companies reporting results above consensus expectations so far this quarter. Tesla's performance was mixed, while Amazon is set to announce slightly lower profits, but the broader group is still outpacing the rest of the market in earnings growth. - Tech earnings and the upcoming FOMC decision are key catalysts that may influence future US500 moves. Broad sector participation and ongoing AI investment could sustain upward momentum if macroeconomic conditions remain supportive. Technical approach: - US500 created a new all-time high this week after breaching the key level at around 6765. The index showed an urgency in moving upward, creating a gap that remains unfilled. US500 is well above the diverging EMAs, indicating a strong upward momentum. However, the index is approaching the upper bound of the ascending channel, which may limit the price movement. - If the current gap remains unfilled, the US500 may continue to move upward and test the psychological resistance at 7000. - On the contrary, rejecting the channel's upper bound may prompt a correction and fill the gap around 6790, retesting the broken level at 6765. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

آینده طلا: ریزش کوتاهمدت یا صعود بلندمدت؟ (تحلیل XAUUSD)

Fundamental approach: - Gold prices traded lower this week after setting fresh record highs earlier in Oct, pressured by profit-taking and cautious sentiment ahead of delayed US inflation data. - Geopolitical uncertainty and expectations of further Fed easing continued to support underlying demand for safe havens in the longer term. - US President Trump'sTrump's new sanctions on Russia and export restrictions toward China, alongside the prolonged US government shutdown, reinforced demand early in the week. At the same time, stabilization in trade rhetoric and rising yields curbed momentum later. - However, a stronger US dollar and rising Treasury yields amid improved global risk appetite and optimism around an upcoming US. China dialogue also reduced safe-haven demand in the short term, especially with today's CPI, which is expected to rise. Technical approach: - Gold consolidated within the range of 4054-4113. The price is below the converging EMAs, indicating that a bearish momentum persists. - If the XAUUSD breaches the support at 4054, the price may decline further toward the next support level at 3950. - On the contrary, remaining above 4054 may prompt a retest of the upper range at 4143, confluenced with the EMA21. Analysis by: Dat Tong, Senior Financial Markets Strategist at ExnessThe Sep US CPI, released today after a delay due to the government shutdown, showed inflation rising 0.3% MoM and 3.0% YoY, slightly below expectations of 0.4% and 3.1% respectively. Core CPI, which excludes volatile food and energy components, increased 0.2% on the month and 3.0% annually, signaling a moderation from Aug's 3.1% reading. This cooler-than-expected report eased market concerns about persistent inflation, reigniting expectations that the Fed will proceed with a 0.25% rate cut at its 29 Oct meeting, with futures pricing almost full probability of a second cut in Dec. The moderation in underlying prices indicates declining pressure from shelter and goods costs, aligning with the Fed’s recent dovish tone. For XAUUSD, the softer CPI initially supported bullish sentiment as lower inflation and a more accommodative Fed reduce real yields and the opportunity cost of holding non-yielding assets. That's why the market found support right at 4050 and an engulfing candle, and may retest 4143. This falls into a very classical trading setup of range breakout. Look for a breakout trading setup within the range I provided.

DatTong

طلا در اوج تاریخی؛ آیا سقوط در راه است یا فتح قلههای جدید؟

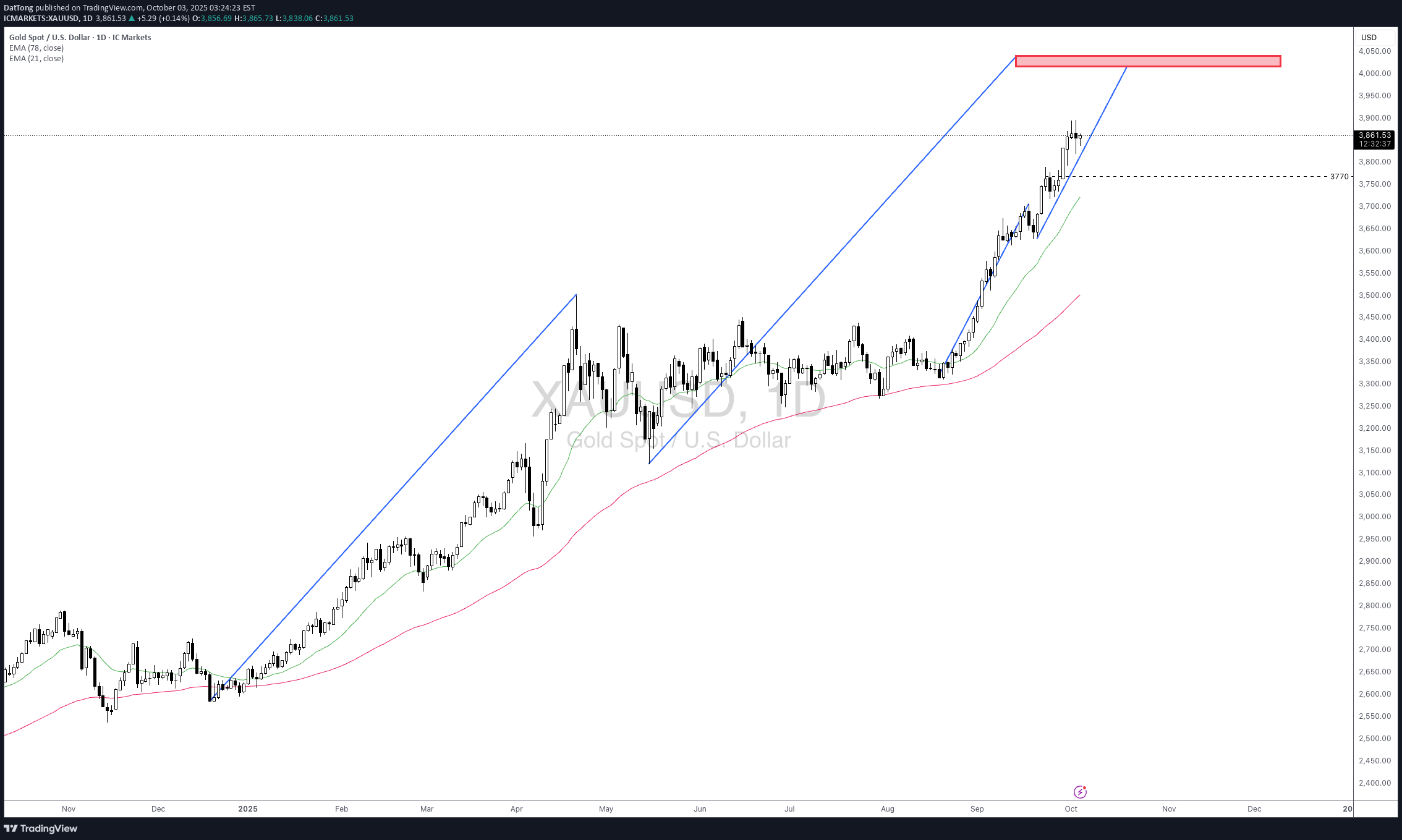

Fundamental approach: - Gold climbed this week on safe-haven bids as the US government shutdown froze key data releases, amplifying uncertainty and driving a bid for defensives. - Softer ADP private payrolls and an ISM manufacturing print that remains in contraction supported bullion near record highs, with a softer dollar and easing Treasury yields boosting the appeal of non‑yielding assets. - Multiple independent outlets pointed to shutdown‑driven risk aversion, higher odds of Fed easing after weak ADP, and lingering geopolitical and policy risks as catalysts for stronger bullion demand. Technical approach: - Technically, XAUUSD is hovering near all‑time highs with no clear reversal signal; price holds well above key EMAs, underscoring strong upside momentum. - A clean breakout to new highs could open the door toward the confluence area of 4015-4045, where substantial profit-taking may emerge. - Failure to clear the peak increases the risk of a pullback toward support around 3770, where buyers may reassess the trend's strength. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

تعطیلی دولت آمریکا چطور قیمت بیت کوین را بالا نگه میدارد؟

Fundamental approach: - Bitcoin prices this week have been driven by renewed risk appetite and positive spot ETF inflows, with sentiment supported by the US government shutdown’s data blackout and expectations of further Fed easing as labor market signals soften. The institutional demand narrative strengthened as US spot ETFs returned to inflows, with assets under management remaining elevated, thereby bolstering dip-buying interest. - Drivers included a modest uptick in the ISM manufacturing PMI, which is still in contraction, and ADP private payrolls showing job losses, reinforcing the view that looser policy could persist and liquidity conditions may remain supportive for the crypto beta. The shutdown has curtailed government data releases, prompting markets to rely on private indicators and amplifying sensitivity to risk sentiment and ETF flow headlines throughout the week. - Bitcoin prices could sustain momentum if ETF inflows remain positive and macro uncertainty keeps rate-cut expectations intact, though volatility may rise with limited official data. Technical approach: - BTCUSD broke the triangle pattern and rose higher, positioning itself above both EMAs, indicating an upward momentum. - If BTCUSD remains above 117000, the price may retest the previous swing high at around 123000. - On the contrary, closing below 117,000 may prompt BTCUSD to retest the broken triangle pattern and the area between both EMAs. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

ETH this week: stabilization after liquidations and ETF flows in

Fundamental approach - ETH prices slipped this week amid a broad crypto pullback following a weekend wave of leveraged liquidations and profit-taking, even as prior spot ETF inflows and easing Fed policy supported risk appetite earlier in the week. Sentiment was volatile as traders digested mixed ETF flow signals and macro easing after the Fed's rate cut. - The main impacting factors included a reported $1.5B in crypto long liquidations, which are pressuring majors. ETH prices posted their weakest two-day stretch since late Aug as risk unwound into Monday's session. Offsetting factors were mid-Sep net inflows into US spot ETH ETFs, led by BlackRock's product, and growing anticipation for Dec's Fusaka upgrade aimed at scaling Layer 2 data capacity. - In the near term, ETH could stabilize if ETF flows remain favorable and macro conditions stay supportive; however, further deleveraging and data-sensitive risk sentiment could keep swings elevated. Upcoming catalysts include continued daily ETF flow prints, developer communications around the Fusaka timeline, and features that may influence medium-term adoption. Technical approach: - ETHUSD is forming a lower high and lower low pattern within the defined range of 4080-4756. The price is awaiting a clear breakout to determine the upcoming trend. - If ETHUSD breaks below the support at 4080, EMA78, and the descending channel's lower bound, the price may retest the following support at 3384. - On the contrary, closing above 4260 may help ETH prices gain momentum to retest the descending channel's upper bound. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

Will BTCUSD Confirm a Double-Top Pattern?

Fundamental approach: - Bitcoin prices declined amid a risk-off tone and sizeable spot ETF outflows following last week's post-record pullback and liquidation-driven volatility. - Selling pressure was reinforced by Tue's sharp net redemptions from US spot Bitcoin ETFs (about $523M), alongside broader crypto weakness early in the week; traders also positioned around macro risk with attention on policy signals from Jackson Hole. - Concurrently, recent rotations toward ETH products contrasted with BTC's softer demand profile in Aug, adding relative headwinds. - Ahead, BTC could remain sensitive to ETF flow trends and Fed communication. The persistent outflows and cautious risk sentiment may cap rebounds, while a flow stabilization could restore bid momentum. Technical approach: - BTCUSD broke the ascending trendline and was between both EMAs. The price is testing EMA78, which is in confluence with support at 112000. - If BTCUSD breaches the support below 112000 and the neckline of the double-top pattern, the price may plunge to the following support at 106200. - On the contrary, a close above 115000 may prompt a further retest of the broken descending trendline. Analysis by: Dat Tong, Senior Financial Markets Strategist at ExnessIt's a wrong label with "Long" while it should be "Short", plz help to take note.

DatTong

Will Gold Make a New High Amid Prospect of Sep Fed Rate Cut?

Fundamental approach: - Gold gained this week, supported by renewed trade tensions following new US tariffs on major partners and rising expectations of a Fed rate cut in Sep. - Safe-haven demand strengthened after weak US NFP data heightened concerns about economic growth and reinforced market bets on monetary easing, while US President Trump's tariff announcements drove risk aversion. - Comments from Fed officials signaled openness to policy adjustments, keeping investors focused on future rate moves even as the US dollar softened and global equities stabilized. - XAUUSD could remain resilient if upcoming US labor and inflation data continue to disappoint. Technical approach: - XAUUSD fluctuates within a broad range. The price is forming a big Triangle Formation, awaiting an apparent breakout to determine the next movement. - If XAUUSD breaches above the Triangle Pattern and the resistance at 3433, the price may continue to advance with the measured target at 3600. - On the contrary, closing below support at 3560 may prompt XAUUSD to continue range-bound movement by retesting support at 3273. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

Will Upcoming Data Determine the Next Gold's Direction?

Macro approach: - Gold retreated this week, reversing early gains to trade near four-week lows amid renewed US dollar strength and caution ahead of the Fed's policy decision. - The retreat was mainly pressured by stronger-than-expected US economic data and a tentative revival in risk appetite, offsetting pockets of safe-haven demand. - Key drivers included robust US GDP growth for 2Q, a bounce in consumer confidence, and the Fed's steady rates with a more hawkish tone, suggesting cuts may be further out. - Meanwhile, recent US-EU and US-China trade deals eased some global uncertainty, damping gold's appeal as a hedge. - Market participants also eyed the labor market's continued cooling, but resilient consumer spending further buoyed the dollar. - Gold may remain volatile, with potential upside if upcoming US PCE inflation and NFP reports disappoint expectations. Any escalation in trade tensions or signals of Fed policy easing could renew support for gold prices. Technical approach: - XAUUSD fluctuated within the range of 3285-3560, which is below the broken ascending trendline. The price between the two EMAs awaits an apparent breakout to determine the next trend. - If XAUUSD breaks below the support at 3273, confluence with EMA78, the price may plunge to retest the following support at 3167. - On the contrary, remaining above the support at 3273 may lead XAUUSD to retest the resistance at around 3560. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

DatTong

Will The Emerging Uncertainties Support Gold Ahead?

Macro approach: - XAUUSD advanced this week, supported by broad-based US dollar weakness and reviving safe-haven demand amid rising global trade tensions. The yellow metal briefly reached a five-week high as investors sought safety following headlines of escalating US tariffs and uncertainty over the Fed’s policy direction. - Gold may remain well-supported if risk aversion persists, with upcoming global PMIs and further US trade developments set to guide market direction. Additional Fed commentary and central bank actions could trigger new volatility for XAUUSD throughout the week. Technical approach: - XAUUSD remains above both the EMA21 and EMA78, reflecting ongoing bullish momentum. The recent price action shows consolidation below the resistance at 3430 after rejecting the swing high. In contrast, higher lows have formed above the ascending trendline and the support at 3285. - If XAUUSD stays above the support at 3560, it may extend towards the previous swing high at around 3430 and open for another record high. - On the contrary, if the price drops below the support at 3560 and the ascending trendline, it may retreat toward the following support at 3165. Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.